Abstract

This paper uses a multi-factor pricing model with time-varying risk exposures and premia to examine whether the 2003–2006 period has been characterized, as often claimed by a number of commentators and policymakers, by a substantial mispricing of publicly traded real estate assets (REITs). The estimation approach relies on Bayesian methods to model the latent process followed by risk exposures and idiosynchratic volatility. Our application to monthly, 1979–2009 U.S. data for stock, bond, and REIT returns shows that both market and real consumption growth risks are priced throughout the sample by the cross-section of asset returns. There is weak evidence at best of structural mispricing of REIT valuations during the 2003–2006 sample.

Similar content being viewed by others

Notes

A few commentators have used the term “bubble” to refer to such a state of large and ever growing over-pricing, followed by a sudden decline, between 2007 and 2009. See e.g., Shiller (2009). In our paper we will refrain from using the technical notion of bubble as this would require the adoption of specific pricing frameworks and testing methodologies (see e.g., Scott 1990) that are less general than the ones we pursue in our paper.

See Jacquier and Polson (2010) for a review of applications of Bayesian econometrics in finance.

Of course, we do not mean to deny the fact that at the micro-economic level, poor lending practices in the U.S. residential housing sector may have decreased the quality of existing mortgage pools during 2003–2006. Our goal is to assess whether such biases have generated empirical evidence of systematic, aggregate misspricing in REIT portfolios that are widely diversified across properties and types of properties.

Other, frequentist approaches have been pursued in the literature. For instance, Ling and Naranjo (1997a) use nonlinear multivariate techniques to estimate a system of equations with cross- and within-equation restrictions. This fixed-coefficient method eliminates the generated regressors problems, although the risk sensitivities and risk premia are constrained to be constant. In our paper we remove this restriction by adopting a Bayesian estimation approach. That real estate abnormal performances may be spuriously due to unspanned time-variation in risk exposures has been known since Glascock (1991).

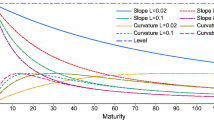

The conditional beta of the jth mimicking portfolio on the jth economic factor may change as \(\mathbf {B}_{t}\) and \(\mathbf {V}_{t}\) change over time. However, such mimicking portfolios are typically adjusted to have constant factor betas by combining them with T-bills so that the combined portfolio has a beta equal to the time-series average of the betas that are produced by the constrained optimization. We provide additional details on our Bayesian implementation of this procedure in the Appendix.

For instance, in classical MLE framework it would be hard to separately identify the stochastic shifts represented by the variables \(\kappa _{1ij,t}\) and \(\kappa _{2i,t}\) from the continuous shocks in \(\eta _{ij,t}\) and \(\upsilon _{i,t}\). In a Bayesian framework, proposing plausible priors informed by economic principles greatly helps to deal with these issues.

These priors are commonly referred to as uninformative or “flat”. The Appendix summarizes results obtained using more informative priors and show that these have a negligible impact on our findings for the questions of interest.

When these decomposition tests are implemented using the estimation outputs obtained from our BTVBSV framework, drawing from the joint posterior densities of the factor loadings \(\beta _{ij,t|t-1}\) and the implied risk premia \(\lambda _{j,t}, i=1,...,N\), \(j=1,...,K\), and \(t=1,...,T\), and holding the instruments fixed over time, it is possible to compute VR1 and VR2 in correspondence to each of such draws.

The fact that in Eq. 1 the risk factors are assumed to be orthogonal does not imply that their time-varying total risk compensations (\(\lambda _{j,t}\beta _{ij,t|t-1}\) for \(j=1,...,K\)) should be orthogonal.

Data for a longer 1972:01–2010:12 are in fact available. However, in a portion of our estimation experiments, we use a 8-year, 1972:01–1979:12 period to compute the priors that investors were likely to hold as of the beginning of 1980.

An alternative approach to improve the precision of security-specific beta estimates is to use the shrinkage technique proposed by Vasicek (1973). This method uses the cross-sectional mean and variance of betas as prior information and, as recently shown by Cosemans et al. (2011), may be profitably extended to time-varying beta frameworks.

Data on size- and industry-sorted portfolios are available from Ken French’s web site at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

Approximated returns from this formula are correlated with actual, Baa rating bracket returns (from Bloomberg) over recent years (2005–2010), with a correlation in excess of 0.8.

Data on 1-month T-bill, 10-year and 5-year government bond yields are from FREDII® at the Federal Reserve Bank of St. Louis.

The trailing, 12-month dividend yield on all stocks traded on the NYSE, AMEX, and Nasdaq (computed from CRSP data) is also used as an instrument in some of the exercises. However, it is not used as priced factor because it only relates to stock cash distributions and differs from REITs’ cap rates.

1993 is also the date of an important tax reform Act that has entitled REITs to look through pension funds and count the number of participants with the result of favoring institutional investment without jeopardizing the trust’s tax-favored status. As a result, in the 1990s the REIT market expanded considerably and became much more dominated by institutional investors (see e.g., Ling and Ryngaert 1997b).

Note that pinning down the “statistical significance” of coefficients (betas or lambdas) on the basis of 90 % credibility intervals represents a rather stringent criterion because the Bayesian posterior density will reflect not only the uncertainty on the individual coefficient but also the overall uncertainty on the entire model (e.g., the uncertainty on structural instability of all the coefficients), see e.g., the discussion in Uno et al. (2005).

However, should we interpret the term premium to be a business cycle indicator—in the sense that a higher (lower) term premium signals an improvement (deterioration) of business cycle conditions, see e.g. Estrella and Hardouvelis (1991)—then a negative exposure of REITs to this factor may be puzzling.

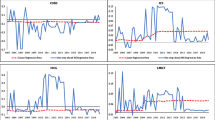

In Fig. 3, we report posterior beta results only for 4 factors out of 7. Complete results are available from the Authors upon request.

Plots are available from the Authors upon request. However, risk premia are sufficiently variable over time that in this case plots are not particularly revealing, especially because the size of the 90 % confidence bands is rather volatile.

Large differences in results derived from means vs. quantiles of the posterior densities of the risk premia coefficients are possible because the posterior densities have a highly-non normal, asymmetric shape.

The difference between the sum of these contributions and the 3.44 % estimate, comes from the estimated \(\lambda _{0}\).

We thank Peter Schotman for drawing our attention on these residual issues and concerns.

Unreported results for the case in which the factors and not their mimicking portfolios are employed reveal much higher VR1 ratios. For instance, in the case of size-sorted portfolios, \(VR1\) always exceeds 70 % and it averages close to 87 %, which is impressive. For REIT portfolios we obtain VR1 statistics around 50 % which are similar to ones reported in Table 3.

As explained in section “Decomposition Tests”, these ratios may exceed 100 % because \(Var\left [P\left (\sum _{j=1}^{7}\lambda _{j,t}\beta _{ij,t|t-1}|\mathbf {Z}_{t-1}\right )\right ]\) will also reflect the contribution of covariance terms between factor terms. In fact, in Table 3 the only two contributions exceeding 100 % are obtained in the presence of sizably negative covariance contributions.

Interestingly, for a comparable sample, also Peterson and Hsieh (1997) report large and statistically significant negative alphas (hence, over-pricing) of mortgage REITs, although in a linear factor model that is based on a 5-factor extension of the classical Fama–French framework.

The two perspectives are logically consistent because under-pricing the risk exposures of an asset implies that the asset will be over-priced and will fail to yield adequate rates of capital gain over time.

More generally, out of 20 portfolios, in 5 cases we find \(\beta _{i0,t}\)s with a posterior median that is uniformly positive over our entire sample period (this occurs for non durables, energy, telecommunication, health, and utility stocks), although there are other 9 portfolios (durables, high tech, retail, size deciles 1–6 stocks) for which the posterior means of the abnormal returns are negative. In the remaining 6 cases, the mean \(\beta _{i0,t}\) changes sign over time.

For the sake of comparison, the methods described in section “Standard Estimation Approach” are augmented by a GARCH(1,1) model for shocks to the linear factor model to match the presence of a stochastic volatility component in the BTVSVM implementation. Complete results from a 60-month rolling window Fama–MacBeth strategy are available upon request.

Also in this case we employ uninformative priors.

In order to gain a rough idea of how well the chain mixes in our algorithm we follow Primiceri (2005) and check the autocorrelation function of the draws.

In any event, the qualitative results and insights from Table 2 were intact, and the only important change was that the 90 % credibility intervals become tighter. Both real consumption growth and market risks re-assert themselves as important drivers of the cross section of U.S. returns.

References

Ang, A., & Chen, J. (2007). CAPM over the long run: 1926–2001. Journal of Empirical Finance, 14(1), 1–40.

Ang, A., Liu, J., Schwarz, K. (2010). Using stocks or portfolios in tests of factor models. Working paper. New York: Columbia University.

Campbell, J.Y., & Cochrane, J.H. (1999). By force of habit: a consumption-based explanation of aggregate stock market behavior. Journal of Political Economy, 107, 205–251.

Carter, C., & Kohn, R. (1994). On the Gibbs sampling for state-space models. Biometrika, 81, 541–553.

Chan, K.C., Henderhott, P., Sanders, A.B. (1990). Risk and return on real estate: evidence from equity REITS. Real Estate Economics, 18(4), 431–452.

Chen, N.-F., Roll, R., Ross, S. (1986). Economic forces and the stock market. Journal of Business, 59, 383–403.

Clayton, J., & MacKinnon, G. (2003). The relative importance of stock, bond and real estate factors in explaining REIT returns. Journal of Real Estate Finance and Economics, 27, 39–60.

Cochrane, J. (2005). Asset pricing. Princeton, NJ: Princeton University Press.

Coleman, M., LaCour–Little, M., Vandell, K. (2008). Subprime lending and the housing bubble: tail wags dog? Journal of Housing Economics, 17, 272–290.

Cosemans, M., Frehen, R., Schotman, P., Bauer, R. (2011). Estimating security betas using prior information based on firm fundamentals. Working paper. University of Maastricht.

Devaney, M. (2001). Time varying risk premia for real estate investment trusts: a GARCH-M model. Quarterly Review of Economics and Finance, 41, 335–346.

Dittmar, R.F. (2002). Nonlinear pricing kernels, kurtosis preference, and evidence from the cross section of equity returns. Journal of Finance, 57, 369–403.

Estrella, A., & Hardouvelis, G.A. (1991). The term structure as predictor of real economic activity. Journal of Finance, 46, 555–576.

Fama, E., & MacBeth, J. (1973). Risk, return and equilibrium: empirical tests. Journal of Political Economy, 81, 607–636.

Fama, E., & French, K.R. (1989). Business conditions and expected returns on stocks and bonds. Journal of Financial Economics, 81, 607–636.

Ferson, W., & Harvey, C.R. (1991). The variation of economic risk premiums. Journal of Political Economy, 99, 385–415.

Ferson, W., & Korajczyk, R. (1995). Do arbitrage pricing models explain the predictability of stock returns? Journal of Business, 68, 309–349.

Gerlach, R., Carter, C., Kohn, R. (2000). Efficient Bayesian inference for dynamic mixture models. Journal of the American Statistical Association, 95, 819–828.

Geweke, J., & Zhou, G. (1996). Measuring the pricing error of the arbitrage pricing theory. Review of Financial Studies, 9, 557–587.

Giordani, P., & Kohn, R. (2008). Efficient Bayesian inference for multiple change-point and mixture innovation models. Journal of Business and Economic Statistics, 26(1), 66–77.

Glascock, J. (1991). Market conditions, risk, and real estate portfolio returns: some empirical evidence. Journal of Real Estate Finance and Economics, 4, 367–373.

Guidolin, M., & Tam, Y.-M. (2010). A yield spread perspective on the great financial crisis: break-point test evidence. Working paper. Federal Reserve Bank of St. Louis.

Guidolin, M., Ravazzolo, F., Tortora, A.D. (2010). A Bayesian multi-factor model of instability in prices and quantities of risk in U.S. financial markets. Working paper. Federal Reserve Bank of St. Louis.

Hendershott, P., Hendershott, R., Shilling, J. (2010). The mortgage finance bubble: causes and corrections. Journal of Housing Research, 19, 1–16.

Jacquier, E., & Paulson, N. (2010). Bayesian econometrics in finance. In J. Geweke, G. Koop, H.K. van Dijk (Eds.), Handbook of Bayesian econometrics. UK: Oxford University Press.

Jostova, G., & Philipov, A. (2005). Bayesian analysis of stochastic betas. Journal of Financial and Quantitative Analysis, 40(4), 747–778.

Karolyi, G.A., & Sanders, A. (1998). The variation of economic risk premiums in real estate returns. Journal of Real Estate Finance and Economics, 17(3), 245–262.

Kleibergen, F. (2010). Reality checks for and of factor pricing. Working paper. University of Amsterdam.

Kim, S., Shepard, N., Chib, S. (1998). Stochastic volatility: likelihood inference and comparison with ARCH models. Review of Economic Studies, 65, 361–393.

Lai, R.N., & Van Order, R. (2010). Momentum and house price growth in the United States: anatomy of a bubble. Real Estate Economics, 38, 753–773.

Lewellen, J., Nagel, S., Shanken, J. (2010). A skeptical appraisal of asset pricing tests. Journal of Financial Economics, 96, 175–194.

Lin, C., Rahman, Y.H., Yung, K. (2009). Investor sentiment and REIT returns. Journal of Real Estate Finance and Economics, 39, 450–471.

Ling, D.C., & Naranjo, A. (1997a). Economic risk factors and commercial real estate returns. Journal of Real Estate Finance and Economics, 15(3), 283–307.

Ling, D.C., & Ryngaert, M. (1997b). Valuation uncertainty, institutional involvement, and the underpricing of IPOs: the case of REITs. Journal of Financial Economics, 43, 433–456.

Liu, C.H., & Mei, J. (1992). The predictability of returns on equity REITs and their co-movement with other assets. Journal of Real Estate Finance and Economics, 5, 401–418.

Ouysse, R., & Kohn, R. (2010). Bayesian variable selection and model averaging in the arbitrage pricing theory model. Computational Statistics and Data Analysis, 54(12), 3249–3268.

Pavlov, A.D., & Wachter, S. (2011). Subprime lending and real estate prices. Real Estate Economics, 39(1), 1–17.

Perez–Quiros, G., & Timmermann, A. (2000). Firm size and cyclical variations in stock returns. Journal of Finance, 55, 1229–1262.

Peterson, J., & Hsieh, C.-H. (1997). Do common risk factors in the returns on stocks and bonds explain returns on REITs? Real Estate Economics, 25, 321–345.

Primiceri, G. (2005). Time varying structural vector autoregressions and monetary policy. Review of Economic Studies, 72, 821–852.

Ravazzolo, F., Paap, R., van Dijk, D., Franses, P.H. (2007). Bayesian model averaging in the presence of structural breaks. In D. Rapach & M. Wohar (Eds.), Forecasting in the presence of structural breaks and uncertainty, frontiers of economics and globalization. New York: Elsevier.

Scott, L.O. (1990). Do prices reflect market fundamentals in real estate markets? Journal of Real Estate Finance and Economics, 3, 5–23.

Serrano, C., & Hoesli, M. (2007). Forecasting EREIT returns. Journal of Real Estate Portfolio Management, 13, 293–310.

Shanken, J. (1992). On the estimation of beta pricing models. Review of Financial Studies, 5, 1–34.

Shiller, R. (1979). The volatility of long-term interest rates and expectations models of the term structure. Journal of Political Economy, 87, 1190–1219.

Shiller, R. (2009). The subprime solution. Princeton: Princeton University Press.

Tanner, M.A., & Wong, W.H. (1987). The calculation of posterior distributions by data augmentation. Journal of the American Statistical Association, 82, 528–550.

Uno, H., Lu, T., Wei, L.J. (2005). The optimal confidence region for a random parameter. Biometrika, 92, 957–964.

Vasicek, O. (1973). A note on using cross-sectional information in Bayesian estimation of security betas. Journal of Finance, 28, 1233–1239.

Acknowledgments

We thank Peter Schotman (a discussant), one anonymous referee, and participants to the 2011 Maastricht-NUS-MIT Symposium for comments and encouragement. Massimo Guidolin acknowledges support from the Center for Analysis of Investment Risk. Andrea Donato Tortora acknowledges support from the Marie Curie Early Stage Training Programme. The views expressed in this paper are our own and do not necessarily reflect those of Norges Bank.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The assumption of \(\boldsymbol {\epsilon } _{t}\equiv (\epsilon _{1,t},\epsilon _{2,t},...,\epsilon _{N,t})^{\prime }\sim N(0,\mathbf {I}_{N})\) in Eq. 5 allows to estimate independently parameters for each asset \(i=1,...,N\). For the sake of brevity, we rewrite the model in Eq. 5 for each i as

where the subscript i has been omitted, \(\mathbf {\epsilon }_{t}\sim N(0,1), (\boldsymbol {\eta } _{t},\upsilon _{t})^{\prime }\sim N(0,\mathbf {Q})\) with \(\mathbf {Q}\) a diagonal matrix characterized by the parameters \(q_{0}^{2}, q_{1}^{2},...,q_{K}^{2}, q_{\upsilon }^{2}\), and \(\boldsymbol {\kappa }_{t}\equiv (\kappa _{0,t},...,\kappa _{K,t},k_{2,t})^{\prime }\) is a \((K+2)\times 1\) vector of unobserved uncorrelated 0/1 processes with \(\Pr [\kappa _{j,t}=1]=\pi _{j}\) for \(j=0,...,K\) and \(\Pr [k_{2,t}=1]=\pi _{2k}\). The model parameters are the structural break probabilities \(\mathbf {\pi }\equiv (\pi _{0},...,\pi _{K},\pi _{2})^{\prime }\) and the vector of variances of the break magnitude \(\mathbf {q}^{2}\equiv (q_{0}^{2},q_{1}^{2},...,q_{K}^{2},q_{\upsilon }^{2})\). They are collected in a \((2(K+2)\times 1)\ \text {vector}\ \boldsymbol {\theta } \equiv (\mathbf {\pi }^{\prime },(\mathbf {q}^{2})^{\prime })^{\prime }\).

Independent conjugate priors are used to ease posterior simulation. Priors could differ across assets \(i=1,...,N\). For the break probability we assume simple Beta distributions,

where the hyperparameters \(a_{j}\) and \(b_{j} (j=0,...K)\) reflect prior beliefs about the occurrence of breaks. For the variance parameters the inverted Gamma-2 prior is chosen,

where \(\nu _{j}\) expresses the strength of the prior mean.

For posterior simulation we run the Gibbs sampler in combination with the data augmentation technique by Tanner and Wong (1987). The latent variables \( B=\left \{ \beta _{t}\right \} _{t=1}^{T}\), \(R=\left \{ \sigma _{t}^{2}\right \} _{t=1}^{T},\) and \(\mathcal {K}=\left \{\kappa _{t}\right \} _{t=1}^{T}\) are simulated alongside the model parameters, \(\boldsymbol {\theta } \). Define \(x=\left \{ x_{t}\right \} _{t=1}^{T}\) and \( f=\left \{ \left \{ f_{j,t}\right \} _{j=1}^{K}\right \} _{t=1}^{T}=\left \{ f_{t}\right \} _{t=1}^{T}\), the complete data likelihood function is given by

Combining prior and likelihood, we obtain the posterior density \(p(\theta ,B,\mathcal {K},R|x,f) \propto p(\theta ) p(x,B,\mathcal {K},R|\theta ,f)\). Defining \(\mathcal {K}_{\beta }=\left \{ \kappa _{0,t},...,\kappa _{K,t}\right \} _{t=1}^{T}\) and \(\mathcal {K}_{\sigma }=\left \{ k_{2t}\right \} _{t=1}^{T}\), the sampling scheme consists of the iterative steps:

-

1.

Draw \(\mathcal {K}_{\beta }\) conditional on \(R,\mathcal {K}_{\sigma },\boldsymbol {\theta } \), x and f.

-

2.

Draw B conditional on \(R,\mathcal {K},\boldsymbol {\theta } \), x and f.

-

3.

Draw \(\mathcal {K}_{\sigma }\) conditional on \(B,\mathcal {K}_{\beta },\boldsymbol {\theta } \), x and f.

-

4.

Draw R conditional on \(B,\mathcal {K},\boldsymbol {\theta } \) , x and f.

-

5.

Draw \(\boldsymbol {\theta } \) conditional on \(B,\mathcal {K}\), x and f.

The first step applies the efficient sampling algorithm of Gerlach et al. (2000), the main advantage being drawing \(\kappa _{j,t}\) without conditioning on the states \(\beta _{j,t}\), as Carter and Kohn (1994) instead do. The conditional posterior density for \(\kappa _{\beta ,t}\), \(t=1,..,T\) unconditional on B is:

Gerlach et al. (2000) show how to evaluate the first two terms while the last one is obtained from the prior. When \(\mathcal {K}_{\beta ,t}\) and \(\beta _{j,t}\) are highly dependent, the sampler of Carter and Kohn (1994) breaks down completely: the higher the correlation (dependence), the bigger the efficiency gain. The latent process for the betas is estimated by means of the forward-backward algorithm of Carter and Kohn (1994). \(\mathcal {K}_{\sigma }\) and R are drawn in the same way as \(\mathcal {K}_{\beta }\) and B. To do so we follow Kim et al. (1998) and approximate the log of a \(\chi ^{2}(1)\) distribution by means of a mixture of seven normals. In each iteration of the Gibbs sampler we simulate a component of the mixture distribution in order to get a conditional linear state space model for \(\ln (\sigma _{t}^{2})\). Finally, \(\boldsymbol {\theta } \) is easily sampled as we use conjugate priors. We use a burn-in period of 1,000 and draw 5,000 observations storing every other of them to simulate the posterior distributions of parameters and latent variables. The resulting autocorrelations of the draws are very low.Footnote 32

To estimate the cross section in Eq. 6 at each time t and for each draw of \(B_{t|t-1}=(\beta _{1,t|t-1},...,\beta _{N,t|t-1})\) where each \(\beta _{j,t|t-1}\) is a \(((K+1)\times 1)\) vector and N is the total number of assets, we use natural conjugate priors. In particular, \(p(\lambda ,\sigma ^{2})=p(\lambda |\sigma ^{2})\times p(\sigma ^{2})\) where

Combining them with the data likelihood we obtain a joint posterior density with convenient analytical form. The resulting marginal posterior distributions are

with

where

where \(B=\left \{ B_{t|t-1}\right \} _{t=2}^{T}\), \(\overline {\nu }=\underline {\nu }+N,\) and \(\hat {\lambda }\) is the OLS estimate. Results were obtained under two different sets of priors. In the former case priors were weak informative (\(\underline {\nu }=0\) and \(\underline {V}^{-1}=0\)) and exploit the well known Jeffreys’ prior while in the latter case we impose some prior information. In more detail, we opted for a small amount of strength (\(\underline {\nu }=5\)) supporting a prior view for premiums with zero mean and standard deviation equal to a twelfth of the maximum absolute return observed in the sample. When informative priors were used, we recorded a striking reduction in the variability of the estimated posterior distributions for the risk premia relative to the baseline case.Footnote 33 Finally, the prior residual variance is centered at about 10, a value that appears in the higher range of the maximum likelihood estimates.

Rights and permissions

About this article

Cite this article

Guidolin, M., Ravazzolo, F. & Tortora, A.D. Myths and Facts about the Alleged Over-Pricing of U.S. Real Estate. J Real Estate Finan Econ 49, 477–523 (2014). https://doi.org/10.1007/s11146-013-9404-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-013-9404-5