Abstract

Although theory suggests its importance, empirical evidence on the relation between exogenous termination risk and contracted compensation packages is limited. This study takes a different approach by exploring determinants of contracted annual compensation and severance packages for city managers. Results indicate that managers exposed to greater exogenous political risk— i.e., those employed by municipalities where voters are more likely to recall elected officials—are 6 %–11 % more likely to receive severance, and receive, on average, 12 %–24 % more severance pay, but do not receive more annual compensation. Additional analyses suggest that the relation between contracted municipal severance and political risk primarily exists in states without restrictions on voters’ ability to file recalls and in municipalities with strong public sector unions. Findings also suggest that municipalities with greater expected agency problems between managers and citizens offer significantly more contracted annual compensation and severance pay.

Similar content being viewed by others

Notes

For example, Bushman et al. (2010) show that the likelihood of CEO turnover is increasing in idiosyncratic risk but decreasing in systematic risk.

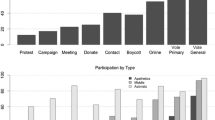

We use three measures of political risk, which are described in greater detail within Section 3.3: Recall provision, which is an indicator set to one if the city has a provision that allows voters to recall elected officials; Recall attempts, which is an indicator set to one if voters initiated any recall attempts against council members or the mayor during the prior five years; and % incumbent lost, which is the ratio of the number of incumbents losing reelection to the number of incumbents running for election.

Note that these studies investigate termination that is linked to poor performance. Nevertheless, we believe that the implications apply to our setting, in which termination is caused by exogenous factors.

Prior research does find that severance is negatively related to takeover risk (Rau and Xu 2013).

For example, Mortensen (1978) finds a relationship between severance and the uncertainty of the arrival of alternative job opportunities. Booth and Chatterji (1989) find that severance is positively related to uncertainty in the return of firm-specific human capital investment when such uncertainty is related to the risk of involuntary dismissal. Suedekum and Ruehmann (2003) theoretically show that severance pay provides job security and consequently fosters firm-specific investments in human capital.

Although the ICMA still collects data from municipalities, they no longer release the data to outsiders due to recent sensitivities surrounding city manager compensation. We also searched publicly available data for municipalities but were unable to successfully obtain a systematic, reliable dataset.

All inferences are qualitatively similar if we only include one observation per municipality.

We express severance in terms of weeks rather than dollars of salary because the dollar amount reflects both the magnitude of severance and differences in salary levels (Rusticus 2006). Thus, specifications would not discern between determinants of salary and determinants of severance. Inferences are qualitatively similar if we substitute the dollar amount of severance.

The minimum and maximum severance weeks are identical for 80 % of the sample.

City councils are important in the appointment of city managers. In 97 % of our sample, city managers are appointed either by councils alone or jointly by councils and mayors. As a result, we expect that council member turnover effectively captures the threat of involuntary termination facing city managers.

For municipalities that are in the sample twice, we observe differences between the contracts during the two years.

Prior research in the private sector measures agency issues via a measure of excess compensation. Untabulated results employ a model that measures excess salary and examines whether excess salary relates to annual compensation and severance. The results indicate that managers who receive excess salary have significantly higher severance pay, consistent with rent extraction. Because excess salary can also measure manager talent, we test (and find) that excess salaries are positively associated with inefficient municipalities, using a measure of administrative overhead. Because this analysis results in a smaller, different sample, we do not tabulate the results for consistency.

We separately include prior government experience and current job tenure rather than use a measure of total government experience. Untabulated specifications that combine these variables offer qualitatively similar insights. In addition, note that Prior government experience is not analogous to an inside CEO. A city manager with experience in the local government management profession can be an outsider to the municipality because his previous experience is in a different city.

Yermack (2006) finds that higher severance is paid to CEOs further away from retirement.

We analyze Severance weeks with an OLS rather than a Tobit model because the variable cannot assume a negative value. Thus, the observed zero values reflect a decision not to offer severance, rather than censoring. However, we also utilize a Tobit model as a specification test, with qualitatively similar results.

We cluster standard errors on state rather than on city because the sample contains multiple observations for each state but at most two observations per city. For robustness, we also cluster standard errors on city, and find results consistent with those presented.

We calculate the economic significance of the impact of Recall provisions and Recall attempts on the unlogged dependent variable and the average amount of severance offered, or e0.226 = 25 %; and e0.438 = 55 %, respectively.

Our evidence can also suggest that longer-serving bureaucrats are well-connected and have greater power to negotiate better employment contract terms.

Note that retention of vacation and sick pay following termination differs from severance pay. While severance is paid only if the manager is terminated, the retention of vacation and sick pay is guaranteed regardless of the reason for the manager’s departure.

We separately consider state recall laws and public sector union strength because the correlation between the two is low (0.07).

For example, Florida Statutes Section 100.361 stipulates: “The grounds for removal of elected municipal officials shall, for the purposes of this act, be limited to the following and must be contained in the petition: (1) Malfeasance; (2) Misfeasance; (3) Neglect of duty; (4) Drunkenness; (5) Incompetence; (6) Permanent inability to perform official duties; and (7) Conviction of a felony involving moral turpitude.” Except for the “incompetence” category, which can be construed broadly, all categories reflect egregious, criminal, or medical, rather than political, reasons for recall. Language in the other nine state laws is similar.

This conjecture cannot be tested because data are not available for council members’ political affiliations.

References

Baber, W., & Gore, A. (2008). Consequences of GAAP disclosure regulation: evidence from municipal debt issues. The Accounting Review, 83(3), 565–591.

Baber, W., Gore, A., Rich, K., & Zhang, J. (2013). Accounting restatements, governance, and municipal debt financing. Journal of Accounting and Economics, 56(2–3), 212–227.

Banker, R., & Datar, S. (1989). Sensitivity, precision and linear aggregation of signals for performance evaluation. Journal of Accounting Research, 27(1), 21–39.

Bebchuk, L. A. (2003). The case for shareholder access to the ballot. Business Lawyer, 59, 43–66.

Blodgett, T. (1998). City government that works. Austin: Texas City Management Association [TCMA], 1st edition.

Booth, A., & Chatterji, M. (1989). Redundancy payments and firm-specific training. Econometrica, 56, 505–521.

Bushman, R., & Smith, A. (2001). Financial accounting information and corporate governance. Journal of Accounting and Economics, 32(1–3), 237–333.

Bushman, R., Dai, Z., & Wang, X. (2010). Risk and CEO turnover. Journal of Financial Economics, 96, 381–398.

Cai, J., Garner, J., & Walkling, R. (2009). Electing directors. Journal of Finance, 64(5), 2389–2421.

Chakraborty, A., Sheikh, S., & Subramanian, N. (2007). Termination risk and managerial risk taking. Journal of Corporate Finance, 13, 170–188.

Core, J., & Guay, W. (2010). Is CEO pay too high and are incentives too low? A wealth-based contracting framework. Academy of Management Perspectives, 24(1), 5–19.

Datar, S., Lambert, R., & Kulp, S. (2001). Balancing performance measures. Journal of Accounting Research, 39(1), 75–92.

Eiman, M. (2013). Severance pay a key factor in Lemoore manager hiring. The Sentinel, August 2, 2013.

Evans, J., & Patton, J. (1983). An economic analysis of participation in the municipal finance officers association certificate of conformance program. Journal of Accounting and Economics, 5, 151–175.

Fee, C., & Hadlock, C. (2004). Management turnover across the corporate hierarchy. Journal of Accounting and Economics, 37, 3–38.

Feltham, G., & Xie, J. (1994). Performance measure congruity and diversity in multi-task principal/agent relations. The Accounting Review, 69(3), 429–453.

Gillan, S., Hartzell, J., & Parrino, R. (2009). Explicit versus implicit contracts: evidence from CEO employment agreements. Journal of Finance, 64(4), 1629–1655.

Gore, A. (2009). Why do cities hoard cash? Determinants and implications of municipal cash holdings. The Accounting Review, 84(1), 183–207.

Governmental Accounting Standards Board (GASB) (2006). GASB white paper: why governmental accounting and financial reporting is - and should be - different . CT: Norwalk.http://www.gasb.org/white_paper_mar_2006.html

Green, J. (2013) Jumbo severance packages for top CEOs are growing, Bloomberg Business Week, June 6, 2013.

Harford, J. (1999). Corporate cash reserves and acquisitions. Journal of Finance, 54, 1969–1997.

Hartzell, J. (2001). The impact of the likelihood of turnover on executive compensation. Working paper, The University of Texas at Austin.

Holmstrom, B. (1979). Moral hazard and observability. Bell Journal of Economics, 10(1), 74–91.

Ichniowski, C., Freeman, R., & Lauer, H. (1989). Collective bargaining laws, threat effects, and the determination of police compensation. Journal of Labor Economics, 7(2), 191–209.

Inderst, R., & Mueller, H. (2005). CEO compensation and strategy inertia. Working paper, New York University.

Indjejikian, R. (1999). Performance evaluation and compensation research: an agency perspective. Accounting Horizons, 13(2), 147–157.

Jensen, M. (1986). The agency cost of free cash flow, corporate finance, and takeovers. American Economic Review, 76, 323–329.

Kempf, A., Ruenzi, S., & Thiele, T. (2009). Employment risk, compensation incentives and managerial risk taking: evidence form the mutual fund industry. Journal of Financial Economics, 92(1), 92–108.

Kodrzycki, Y. (1998). The effects of employer-provided severance benefits on reemployment outcomes. New England Economic Review, Nov/Dec. 41–68.

Moe, T. (2005). Political control and the power of the agent. Journal of Law, Economics, and Organization, 22(1), 1–29.

Mortensen, D. (1978). Specific capital and labor turnover. The Bell Journal of Economics, 572–586.

Murphy, K. (1999). Executive compensation. Handbook of Labor Economics (eds C. David and A. Orley), Vol. 3, North-Holland.

Pendergast, C. (1999). The provision of incentives in firms. Journal of Economic Literature, 37, 7–63.

Rau, P., & Xu, J. (2013). How do ex-ante severance pay contracts fit into optimal incentive schemes? Journal of Accounting Research, 51(3), 631–671.

Renner, T., & DeSantis, V. (1994). City manager turnover: the impact of formal authority and electoral change. State and Local Government Review, 26(2), 104–111.

Ruhm, C. (1990). Do earnings increase with job seniority? Review of Economics and Statistics, 72, 143–147.

Rusticus, T. (2006). Executive severance agreements. Ph.D. Dissertation, the University of Pennsylvania Wharton School.

Suedekum, J., & Ruehmann, P. (2003). Severance payments and firm-specific human capital. Labour, 17(1), 47–62.

Topel, R. (1991). Specific capital, mobility, and wages: wages rise with job seniority. Journal of Political Economy, 99, 145–175.

U.S. Census Bureau 2010. https://www.census.gov/popest/data/historical/2000s/vintage_2002/

Yermack, D. (2006). Golden handshakes: separation pay for retired and dismissed CEOs. Journal of Accounting and Economics, 41, 237–256.

Zhang, J. (2009). Compensation and accounting information: the case of city managers. Ph.D. Dissertation, The George Washington University.

Zimmerman, J. (1977). The municipal accounting maze: an analysis of political incentives. Journal of Accounting Research, 15, 107–144.

Acknowledgments

We thank Yuan Ji for her exceptional research assistance. We are grateful to an anonymous referee, Bill Baber, Masako Darrough, Chris Jones, Bjorn Jorgensen, Fred Lindahl, Barry Marks, Sandeep Nabar, Scott Richardson (Editor), Tjomme Rusticus, and Karen Sedatole for comments and advice. Workshop participants at American University, Boston University, Colorado State University, George Mason University, George Washington University, National University of Singapore, Oklahoma State University, University of Colorado at Boulder, University of Wisconsin – Milwaukee, U.S. Securities and Exchange Commission and the American Accounting Association Government and Nonprofit section midyear and annual meetings offered useful suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

The Securities and Exchange Commission, as a matter of policy, disclaims responsibility for any private publication or statement by any of its employees. The views expressed herein are those of the author and do not necessarily reflect the views of the Commission or of the author’s colleagues on the staff of the Commission.

Rights and permissions

About this article

Cite this article

Compton, Y.L., Gore, A.K. & Kulp, S.L. Compensation design and political risk: the case of city managers. Rev Account Stud 22, 109–140 (2017). https://doi.org/10.1007/s11142-016-9379-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-016-9379-6