Abstract

This paper examines a transfer pricing problem between two divisions of a decentralized firm. The selling division is privately informed about its own costs and produces a good that is sold both externally in an intermediate market and internally within the firm. Unlike most previous work, we focus on dual transfer pricing systems that allow the selling division to be credited for an amount that differs from the amount charged to the buying division. We identify conditions under which efficient decentralized trade and external price setting incentives can be provided with a properly chosen set of dual transfer prices that do not rely on direct communication. Instead, the optimal dual transfer prices will depend only on public information about the market price charged by the upstream division in the external market, which indirectly communicates information about production costs to the downstream division. For a variety of well-known demand functions, the optimal transfer prices will be linear functions of the market price. Our main results hold when the upstream division faces multiple internal buyers or faces a binding capacity constraint.

Similar content being viewed by others

Notes

Lambert (2001, pp. 65–67), for example, provides a short survey of the transfer pricing literature in accounting and suggests “future work should also more fully explore the use of dual prices (i.e., transfer pricing systems where the price credited to the upstream division need not be the same as the price charged to the downstream division). Dual pricing would seem to eliminate the problems induced by the ‘zero sum’ nature of conventional transfer pricing mechanisms”.

Surveys indicate that between 30 and 45 % of responding firms adopt a market-based approach for valuing intra-company transactions. Often market prices are adjusted for internal transactions to account for various “market imperfections,” such as cost differences, that can be avoided by intra-company trade (e.g., Price Waterhouse 1984; Maher et al. 2004; Merchant and Van der Stede 2012). Emmanuel and Mehafdi (1994) provide a rigorous comparison of various transfer pricing studies and report that 4.4–31.0 % of firms using a market-based approach use adjusted market prices for internal pricing.

Eccles (1983) reports on a case in which dual transfer pricing is used to promote internal trade in the presence of excess capacity. In the reported case, the selling division receives the market price for the transferred product.

Baldenius et al. (2004) study the properties of zero-sum market-based transfer prices when income tax rates differ across divisions.

Christensen and Demski (1998) use an adverse selection model to study the efficiency of linear compensation contracts when the divisions engage in ancillary trade in addition to other independent activities. They indicate in footnote 9 that dual transfer prices based on costs and revenues can restore the second-best solution. Slof (1999) also uses an adverse selection model but focuses on pure intra-company trade to show that dual transfer prices conditioned on costs and revenues can induce the second-best solution when the structure of compensation contracts and communication are restricted. In both papers, there is no external market for the intermediate good, so external price setting incentives are not an issue.

Due to aggregation of financial information in cost accounting systems, \(R(q_{d},\theta _{d})\) would generally not be observable by headquarters or contractible unless the downstream division’s operations were particularly simple.

\({\varPi }_{u}\) represents the upstream division’s incremental profit from selling the intermediate good externally and to the downstream division. \({\varPi }_{d}\) represents the downstream division’s incremental profit from the purchase and use of the intermediate good as an input to its production process. Our results do not change if either division engages in additional profit generating activities.

The difference between total divisional profits and total firm profit, \((t_{u}(p_{u})-t_{d}(p_{u}))\cdot q_{d}\), is allocated to a corporate holding account.

We define the elasticity, \(\eta (p)\), of a demand function, Q(p), such that the elasticity will be positive for downward sloping demand curves, i.e., \(\eta (p)=-p\cdot Q^{\prime }(p)/Q(p)\,\ge\,0\) if \(Q^{\prime }(p)<0\).

For instance, if headquarters uses the market price as a zero-sum transfer price, i.e., \(t_{d}(p_{u})=t_{u}(p_{u})=p_{u}\), the upstream division will set the market price, \(p_{u}\), as a weighted average of the internal and external monopoly prices (Baldenius and Reichelstein 2006).

If neither transfer price depends on \(p_{u}\), internal profit will not depend on \(p_{u}\), and the upstream division will choose the efficient external price, \(p_{u}^{*}\). A zero sum, standard cost-based transfer price such as \(t_{d}=t_{u}=E[c(\theta _{c})]\) is an example.

Our modeling setup allows for the optimal transfer prices to be zero-sum, i.e., \(t_d(p_u )=t_u(p_u )\) for all \(p_u\).

The transfer prices in Lemma 1 can be interpreted as the transfer prices that headquarters would choose if it observed \((\theta _{u},\theta _{d})\) and delegated the external pricing and internal quantity decisions to the upstream and downstream divisions, respectively.

The arbitrary constant, A, can be used as an additional instrument to shift the upstream division’s expected profit without influencing the upstream division’s pricing decision. An arbitrary lump-sum payment, S, could also be incorporated into the downstream division’s total transfer payment.

If the downstream demand function equals \(Q_{d}(t_{d},\theta _{d})=J_{d}(\theta _{d})\cdot \overline{Q}_{d}(t_{d})\), then the elasticity function, \(\eta _{d}(t_{d},\theta _{d})=-t_{d}\cdot \overline{Q}_{d}^{\prime }(t_{d})/\overline{Q}_{d}(t_{d})=\overline{\eta }_{d}(t_{d})\), does not depend on \(\theta _{d}\). The same argument holds for \(Q_{u}(p_{u},\theta _{u})\). Note that \(\overline{\eta }_{u}(p_{u})\) is simply the elasticity function of the demand function \(Q_{u}(p_{u},\theta _{u})\). That is, \(\eta _{u}(p_{u},\theta _{u})=-p_{u}\cdot Q_{u}^{\prime }(p_{u},\theta _{u})/Q_{u}(p_{u},\theta _{u})=-p_{u}\cdot \overline{Q}_{u}^{\prime }(p_{u})/ \overline{Q}_{u}(p_{u})=\overline{\eta }_{u}(p_{u})\) for all \(\theta _{u}.\)

Specifically, we assume in our discussion of multiple external competitors that rivals in the external market do not observe the firm’s transfer pricing policies, so that the transfer prices cannot be used to strategically influence interactions among market participants [see Narayanan and Smith (2013) for a more detailed discussion of the strategic impact of firms’ accounting choices].

See footnote 21.

As a technical note, the demand functions in (20) have the limiting form \(Q_{i}(p_{i},\theta _{i})=J_{i}(\theta _{i})\cdot e^{-k_{i}\cdot p_{i}}\) for \(i=d,u\) and \(p_{d}=t_{d}\), which implies that the conditions on the demand functions in Proposition 2 include the case in which one or both demand functions take this form [see Eq. (57) in the "Appendix" for technical details]. If both demand functions take this exponential form, the optimal dual transfer prices exhibit simple additive discounts to the market price, i.e., \(t_{d}(p_{u})=p_{u}-1/k_{u}\) and \(t_{u}(p_{u})=p_{u}-1/k_{u}+1/k_{d}\). Consistent with the discussion that follows, we get in this case that \(t_{u}(p_{u})=p_{u}\) if \(k_{u}=k_{d}\) and \(t_{d}(p_{u})=t_{u}(p_{u})=p_{u}\) if \(k_{u}=k_{d}\rightarrow \infty\).

In the limiting case in which demand in both markets becomes perfectly elastic, i.e., when \(\eta _{u}=\eta _{d}\rightarrow \infty\), the transfer prices converge to the zero-sum market price, \(t_{d}(p_{u})=t_{u}(p_{u})=p_{u}\). If \(\eta _{u}\rightarrow \infty\) but \(\eta _{d}\) is finite, i.e., the upstream external market is perfectly competitive but internal demand is downward sloping, the transfer prices do not converge to \(p_{u}\) because a zero-sum transfer price equal to \(p_{u}\) would induce the upstream division to shut out the external market (where marginal profits are zero) and set the external price to the internal monopoly price to maximize its profits from internal trade. However, first best can be achieved in this case with a zero-sum price equal to the verifiable common market price (rather than a price chosen by the upstream division). In the limiting case in which only demand in the downstream market becomes perfectly elastic, i.e., when \(\eta _{d}\rightarrow \infty\), both transfer prices converge to a zero-sum transfer price that is equal in equilibrium to the upstream division’s marginal cost, i.e., \(t_{d}(p_{u})=t_{u}(p_{u})=p_{u}\left( 1-\frac{1}{\eta _{u}}\right)\).

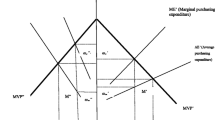

The external monopoly quantity, \(Q_{u}^{m}\), is the quantity associated with the first-best external monopoly price, \(p_u^*\). The internal monopoly price is the transfer price the upstream division would set for internal trade if the transfer price were zero sum and the upstream division could choose it freely. The internal monopoly quantity, \(Q_{d}^{m}\), is the internal quantity associated with the internal monopoly price.

The internal monopoly price is the price the upstream division would charge for internal transfers if the transfer price were zero-sum and the upstream division could set it freely.

Baldenius and Reichelstein (2006, footnote 3) point out that first best can also be achieved in this case with a different mechanism that allows the downstream division to make a take-it-or-leave it offer, since the downstream division could perfectly infer upstream cost from the external price, \(p_{u}\).

References

Alles, M., & Datar, S. (1998). Strategic transfer pricing. Management Science, 44(4), 451–461.

Amershi, A., & Cheng, P. (1990). Intrafirm resource allocation: The economics of transfer pricing and cost allocation in accounting. Contemporary Accounting Research, 7(1), 61–99.

Anctil, R., & Dutta, S. (1999). Negotiated transfer pricing and divisional vs. firm-wide performance evaluation. The Accounting Review, 74(1), 87–104.

Arya, A., & Mittendorf, B. (2008). Pricing internal trade to get a leg up on external rivals. Journal of Economics & Management Strategy, 17(3), 709–731.

Baldenius, T., & Reichelstein, S. (2006). External and internal pricing in multidivisional firms. Journal of Accounting Research, 44(1), 1–28.

Baldenius, T., Reichelstein, S., & Sahay, S. (1999). Negotiated versus cost-based transfer pricing. Review of Accounting Studies, 4(2), 67–91.

Baldenius, T., Melumad, N., & Reichelstein, S. (2004). Integrating managerial and tax objectives in transfer pricing. The Accounting Review, 79(3), 591–615.

Christensen, J., & Demski, J. S. (1998). Profit allocation under ancillary trade. Journal of Accounting Research, 36(1), 71–89.

Cook, P. (1955). Decentralization and the transfer-price problem. Journal of Business, 28(2), 87–94.

Dikolli, S., & Vaysman, I. (2006). Information technology, organizational design, and transfer pricing. Journal of Accounting and Economics, 41(1–2), 203–236.

Dutta, S., & Reichelstein, S. (2010). Decentralized capacity management and internal pricing. Review of Accounting Studies, 15(3), 442–478.

Eccles, R. (1983). Control with fairness in transfer pricing. Harvard Business Review, 61(6), 149–161.

Eccles, R., & White, H. (1988). Price authority in inter-profit center transactions. American Journal of Sociology, 94, S17–S51.

Edlin, A. S., & Reichelstein, S. (1995). Specific investment under negotiated transfer pricing: An efficiency result. The Accounting Review, 70(2), 275–291.

Eldenburg, L. G., & Wolcott, S. K. (2005). Cost management: Measuring, monitoring, and motivating performance (1st ed.). Hoboken, NJ: Wiley.

Emmanuel, C., & Mehafdi, M. (1994). Transfer pricing. London: Academic Press.

Göx, R. (2000). Strategic transfer pricing, absorption costing, and observability. Management Accounting Research, 11(3), 327–348.

Harris, M., Kriebel, C., & Raviv, A. (1982). Asymmetric information, incentives and intrafirm resource allocation. Management Science, 28(6), 604–620.

Hirshleifer, J. (1956). On the economics of transfer pricing. Journal of Business, 29(3), 172–184.

Hirshleifer, J. (1957). Economics of the divisionalized firm. Journal of Business, 30, 96–108.

Holmstrom, B., & Tirole, J. (1991). Transfer pricing and organizational form. Journal of Law, Economics, & Organization, 7(2), 201–228.

Johnson, N. (2006). Divisional performance measurement and transfer pricing for intangible assets. Review of Accounting Studies, 11(2–3), 339–365.

Kanodia, C. (1979). Risk sharing and transfer price systems under uncertainty. Journal of Accounting Research, 17(1), 74–98.

Lambert, R. (2001). Contracting theory and accounting. Journal of Accounting and Economics, 32(1–3), 3–87.

Maher, M. W., Lanen, W. N., & Rajan, M. V. (2004). Fundamentals of cost accounting (1st ed.). New York: McGraw-Hill/Irwin.

Merchant, K., & Van der Stede, W. (2012). Management control systems: Performance measurement, evaluation and incentives (3rd ed.). London: Financial Times/Prentice-Hall.

Milgrom, P., & Segal, I. (2002). Envelope theorems for arbitrary choice sets. Econometrica, 70(2), 583–601.

Narayanan, V., & Smith, M. (2013). Competition and cost accounting. Foundations and Trends in Accounting, 7(3), 131–195.

Pfeiffer, T., Schiller, U., & Wagner, J. (2011). Cost-based transfer pricing. Review of Accounting Studies, 16(2), 219–246.

Ronen, J., & Balachandran, K. (1988). An approach to transfer pricing under uncertainty. Journal of Accounting Research, 26(2), 300–314.

Ronen, J., & McKinney G., III (1970). Transfer pricing for divisional autonomy. Journal of Accounting Research, 8(1), 99–112.

Sahay, S. (2003). Transfer pricing based on actual cost. Journal of Management Accounting Research, 15(1), 177–192.

Slof, E. J. (1999). Transfer prices and incentive contracts in vertically-integrated divisionalized companies. European Accounting Review, 8(2), 265–286.

Vaysman, I. (1996). A model of cost-based transfer pricing. Review of Accounting Studies, 1(1), 73–108.

Vaysman, I. (1998). A model of negotiated transfer pricing. Journal of Accounting and Economics, 25(3), 349–384.

Price Waterhouse. (1984). Transfer pricing practices of American industry. New York: Price Waterhouse.

Acknowledgments

We thank seminar participants at University of California Berkeley, Arizona State University, Santa Clara University, George Washington University, University of Illinois, New York University Summer Accounting Conference, Duke/University of North Carolina Fall Camp, Brigham Young University, Utah State University, The Ohio State University, University of Colorado, Boulder, University of Oregon, University of Washington, the European Accounting Association Meeting, and the European Institute for Advanced Studies in Management Workshop on Accounting and Economics for helpful comments and suggestions. We are particularly grateful to Stefan Reichelstein and two anonymous referees for detailed comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs

Appendix: Proofs

Proof of Lemma 1

As outlined in the text, the transfer prices in (11) and (12) achieve first best. Now, we prove necessity. Since first best requires \(t_{d}(p_{u})=c(\theta _{c})\) for all \(\theta _{c}\), Assumption 1 ensures uniqueness of \(t_{d}(p_{u})=p_{u}+Q_{u}(p_{u})/Q_{u}^{ \prime }(p_{u})\).

Now we show the uniqueness of \(t_{u}(p_{u})\) up to a constant, A. The upstream profit from internal trade, \({\varPi }_{u}^{int}(t_{d})=(t_{u}-c(\theta _{c}))\cdot Q_{d}(t_{d})\), must be locally maximized where \(t_{d}=c(\theta _{c})\) for all values of \(\theta _{c}\), or the upstream division would have an incentive to distort \(p_{u}\) away from \(p_{u}^{*}\).

Consider an alternative upstream transfer pricing function with an added term, \(D(t_{d}(p_{u}))\) [since each possible value of \(c(\theta _c)\) yields a unique value of \(p_{u}^{*}\), we can always write \(t_{u}\) as a function of \(t_{d}\)].

The associated upstream profit from internal trade is given by:

If \(D(t_{d})\) is not constant, we will show that there is some \(c(\theta _{c})\) for which \({\varPi }_{u}^{int}(t_{d})\) is not maximized at \(t_{d}=c(\theta _{c})\).

Assume that \(D(t_{d})\) is not constant. Then there are some values \(a\ne b\) within the range \((\underline{c},\overline{c})\) such that \(D(b)>D(a)\). W.l.o.g., assume that \(b>a\). Denoting the slope of the secant line between D(a) and D(b) as \(S=(D(b)-D(a))/(b-a)>0\), we can divide the interval [a, b] into n equal subintervals. At least one of these subintervals \([a^{\prime },b^{\prime }]\) must satisfy \(D(b^{\prime })-D(a^{\prime })\ge [D(b)-D(a)]/n\).

Now consider the case where the realization of \(\theta _{c}\) is such that \(c(\theta _{c})=a^{\prime },\)

where the last equality holds because \(n(b^{\prime }-c(\theta _{c}))=(b-a)\). Since \(Q_{d}\) is continuous over the compact interval [a, b], it is uniformly continuous by the Heine–Cantor theorem. Since \(Q_{d}(b^{\prime })-Q_{d}(c(\theta _{c}))<0\) goes to zero uniformly as n becomes large and S does not (because it is constant), it will always be possible to pick a large enough n (and a corresponding \(a^{\prime }\) and \(c(\theta _{c})=a^{\prime }\)) such that the quantity in the brackets will be strictly positive.

Proof of Proposition 1

Part (i) Follows from Lemma 1.

Part (ii) If headquarters does not know upstream elasticity, \(\eta _{u}(p_{u},\theta _{u})\), then the downstream transfer price cannot be set such that \(c(\theta _{c})\) can be inferred from \(p_{u}^{*}\). That is, it is not possible to set the downstream price such that \(t_{d}(p_{u}^{*}(c(\theta _{c}),\theta _{u}))=c(\theta _{c})=p_{u}^{*}(c(\theta _{c}),\theta _{u})\cdot [1-\eta _{u}(p_{u}^{*}(c(\theta _{c}),\theta _{u}),\theta _{u})]\) for all \((\theta _{u},\theta _{c})\).

If headquarters does not know downstream elasticity, the upstream external price will not be set at the first-best level. Specifically, condition (10) shows that the upstream division will choose \(\hat{p_{u}}=p_{u}^{*}\) when

For a given realization of \(c(\theta _{c})\), all of the terms in the expression above are known to headquarters except for the demand elasticity term, \(\dfrac{\partial Q_{d}(t_{d},\theta )/\partial t_{d}}{ Q_{d}(t_{d},\theta )}\), which is random and unobserved by headquarters. Equation (41) will hold for all values of \(\theta\) if and only if \(\partial t_{u}(p_{u}^{*})/\partial p_{u}=0\) and \(\partial t_{d}(p_{u}^{*})/\partial p_{u}=0\), but part (iii) of Proposition 1 shows that \(\partial t_{d}(p_{u}^{*})/\partial p_{u}=0\) is not part of the optimal solution. Therefore the upstream price will not be set to the first-best level.

Part (iii) To show that \(t_{d}(p_{u})\) must be a function of \(p_{u}\), we consider the linear transfer prices, \(t_{i}(p_{u})=\alpha _{i}\cdot p_{u}+\delta _{i}\) for \(i=u,d\), and show that the first-order conditions for optimality are not met when \(\alpha _{u}=\alpha _{d}=0\) and that it is not optimal to set \(\alpha _{u}\ne 0\) when \(\alpha _{d}=0\). Therefore it cannot be optimal to set a downstream transfer price that does not depend on \(p_{u}\). Note that using linear transfer prices is without loss of generality, since we are simply showing that the downstream transfer price cannot be constant.

The firm’s problem is:

subject to:

The associated first-order conditions are:

Let \(\alpha _{u}=\alpha _{d}=0\). Then the transfer prices are constant, and \(\hat{p}_{u}=p_{u}^{*}\), which implies that \(Q_{u}(\cdot )+(p_{u}-c(\theta _{c}))\cdot Q_{u}^{\prime }(\cdot )=0\). Furthermore, \(\alpha _{d}=0\) implies \(\partial Q_{d}/\partial \hat{p}_{u}=0\). Then (47) and (48) are satisfied, and (45) and (46) reduce to:

Solving (43) gives the downstream division’s first-order condition: \(R_{q}(q_{d},\theta )=\alpha _{d}\hat{p}_{u}+\delta _{d}\). Using the implicit function theorem, we get \(\dfrac{\partial Q_{d}}{\partial \alpha _{d}}=\dfrac{\hat{p}_{u}}{R_{qq}}\) and \(\dfrac{\partial Q_{d}}{ \partial \delta _{d}}=\dfrac{1}{R_{qq}}\). Since \(\alpha _{d}=0\) implies \(R_{q}=\delta _{d}\), we can rewrite:

where we use that \(R(\cdot )\) (by assumption) and \(Q_{d}(\cdot )\) (since \(t_{d}\) does not depend on \(\hat{p}_{u}\)) are independent of \(c(\theta _{c})\). Since both equations cannot be fulfilled simultaneously for all \(\theta\), one or both transfer prices must depend on \(p_u\).

If only the upstream transfer price depends on \(p_{u}\), then Condition 10 reduces to:

Since the upstream division will only set the external price efficiently if the equality above holds and since an inefficient external price provides no benefit to the firm when \(t_{d}\) does not depend on \(p_{u},\,\frac{\partial t_{u}(p_{u})}{\partial p_{u}}=0\) will always be optimal if \(t_{d}\) does not depend on \(p_{u}\). Since one or both transfer prices must depend on \(p_{u}\), it will always be optimal for \(t_{d}\) to depend on \(p_{u}\).

Proof of Proposition 2

By Lemma 1, \(t_{d}(p_{u})=p_{u}+Q_{u}(p_{u})/Q_{u}^{\prime }(p_{u})\). Therefore \(t_{d}(p_{u})\) is linear in \(p_{u}\) if and only if \(Q_{u}/Q_{u}^{\prime }\) is linear.

The upstream transfer price, \(t_{u}(t_{d}(p_{u}))\), only depends on \(p_{u}\) through the downstream transfer price, \(t_{d}(p_{u})\). Thus, if \(t_{d}(p_{u})\) is linear in \(p_{u}\), then \(t_{u}(t_{d}(p_{u}))\) will be linear in \(p_{u}\) if and only if it is linear in \(t_{d}\), that is, if \(t_{u}(t_{d}(p_{u}))=\alpha \cdot t_{d}+\beta\). For first best to hold, the upstream transfer price must be set such that the upstream division’s profit from internal trade, \({\varPi }_{u}^{int}=(t_{u}(t_{d})-c(\theta _{c}))\cdot Q_{d}(t_{d})\), is maximized when \(t_{d}=c(\theta _{c})\) for all \(c(\theta _{c})\) (as outlined in the text). Thus \(t_{u}(t_{d}(p_{u}))\) must be such that the derivative of \({\varPi }_{u}^{int}\) with respect to \(t_{d}\) is equal to zero when \(t_{d}=c(\theta _{c})\). Writing this first-order condition as:

substituting \(t_{u}(t_{d})=\alpha \cdot t_{d}+\beta\) and \(t_{d}=c(\theta _{c})\) into (54), and solving gives:

Thus a linear upstream transfer price will be optimal only if \(Q_{d}/Q_{d}^{\prime }\) is linear.

We have shown that for both transfer prices to be linear, \(Q_{d}/Q_{d}^{\prime }\) and \(Q_{u}/Q_{u}^{\prime }\) must be linear. The general solutions to the differential equation \(F(x)/F^{\prime }(x)=\gamma x+\delta\) are given by:

Plugging (56) into Lemma 1 yields the form in Proposition 2. (57) is a limiting form of (56) as \(\gamma \rightarrow 0\).

Proof of Corollary 1

Follows directly from Proposition 2.

Proof of Corollary 2

Follows from Proposition 1.

Proof of Proposition 3

Proof follows the same argument as for the unconstrained case in Sect. 3.

Proof of Lemma 2

We derive conditions for which the upstream division’s profit function (32), i.e.,

is decreasing in \(p_{u}\) for \(p_{u}>p_{u}^{c}\) and increasing in \(p_{u}\) for \(p_{u}<p_{u}^{c}\).

Calculating the derivative,

noting that \((p_{u}-c(\theta _{c}))\cdot Q_{u}^{\prime }+Q_{u}\le 0\) if \(p_{u}\ge p_{u}^{c}\), and simple algebra yields (34).

Proof of Corollary 3

Follows directly from Proposition 1.

Proof of Proposition 4

Noting from the Envelope Theorem that \(E_{\theta _{d}}[\int _{t_{d}(p_{u})}^{\infty }Q_{d}(s,\theta _{d})\;ds]=E_{\theta _{d}}\left[ {R}(\cdot )-t_{d}(p_{u})\cdot Q_{d}(\cdot )\right]\), we can restate the upstream division’s expected profit from the internal transaction as in (14), that is:

The upstream division will maximize its profits from internal trade by setting \(p_{u}\) to make the downstream division’s transfer price equal to \(c(\theta _{c})\) (which induces the downstream division to choose the optimal internal trade quantity). Noting that \(t_{d}(p_{u}^{*})=c(\theta _{c})\) proves the result.

Rights and permissions

About this article

Cite this article

Johnson, E., Johnson, N.B. & Pfeiffer, T. Dual transfer pricing with internal and external trade. Rev Account Stud 21, 140–164 (2016). https://doi.org/10.1007/s11142-015-9343-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-015-9343-x