Abstract

We study whether and how financial reporting concerns are priced by insurers that sell Directors’ and Officers’ (D&O) insurance to public firms. As D&O insurers typically assume the liabilities arising from shareholder litigation, the premiums they charge for D&O coverage reflect their assessment of a company’s litigation risk. Using a sample of public firms in the 2001–2004 Tillinghast D&O insurance surveys, we document that firms with lower earnings quality or prior accounting restatements pay higher premiums after controlling for other factors impacting litigation risk. In addition, insurers’ concerns about financial reporting are most evident for firms with restatements that are not revenue or expense related, are greater in the period following the passage of the Sarbanes–Oxley Act of 2002, and are greater for firms with financial reporting problems that linger. Our results are consistent with past restatements being viewed as evidence of chronic problems with a firm’s financial statements. By analyzing archival data, we can also quantify the effects of other determinants of D&O premiums (such as business risk, corporate governance, etc.) identified by Baker and Griffith (Univ Chic Law Rev 74(2):487–544, 2007a) through interviews regarding the D&O underwriting process.

Similar content being viewed by others

Notes

Chen et al. (2012) appear to challenge this finding by showing that firms with accounting irregularities do experience a significant decrease in earnings response coefficients for up to 3 years after restatement announcements.

Such static regression models have been the subject of recent criticism in the finance literature. They have been shown to be econometrically unreliable in contexts such as merger and acquisition prediction and bankruptcy prediction (Shumway 2001).

Field et al. (2005) document that results of their study change significantly when frivolous lawsuits are dropped from the lawsuit sample.

The study is framed as an assessment of whether financial reporting concerns affect litigation risk. However, we acknowledge that what we actually test is whether these concerns impact D&O insurers’ perception of litigation risk. To the extent that the D&O insurance market does not exhibit accurate pricing of litigation risk, the original assessment may not be valid. However, the recent legal literature has recognized the promise of D&O insurance premiums as a litigation risk proxy. For example, Baker and Griffith (2007a) state that “D&O premiums are the only place to look” if one wants to find “the annualized present value of shareholder litigation risk for any particular corporation.”

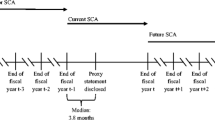

Though D&O insurance policies are typically written on a “claims made” basis (excluding claims made and reported after the policy expires), claims related to restatements are typically protected by other provisions. For example, the “notice of circumstances” provision allows the insured to give notice to the insurer to lock in insurance coverage under the current policy for restatements that may not ripen into an actual claim for months or even years. As a result, future D&O policies need not cover these restatements even if claims are made in future periods.

Claims pertaining to insider trading are normally excluded from D&O insurance coverage.

U.S. law allows indemnification against most claims. However, defense costs in certain shareholder derivative lawsuits where the D&Os are sued by shareholders on behalf of the firm are not indemnifiable. Additionally, firms may be unable to bear the costs due to financial distress.

Core (2000) argues that the insurance application is structured to enable the insurer to obtain full information about the applicant’s risk factors at negligible cost.

“The buyer’s perception of D&O realities and latest trends,” speech by Philip Norton, Arthur J. Gallagher & Co., Tillinghast Executive Seminar, 2004.

A few studies have examined the demand for D&O coverage using non-U.S. data (O’Sullivan 1997; Core 1997; Boyer 2004, 2005) and U.S. data (Kaltchev 2006). Chung and Wynn (2008) report that greater D&O insurance coverage is associated with lower earnings conservatism. Chung et al. (2008) use excess D&O liability insurance coverage for Canadian firms as a proxy for managerial opportunism and find a positive association between excess D&O coverage and audit fees for local firms but no significant relation between the two for firms cross-listed in the U.S. None of the above studies focuses on D&O pricing.

Chalmers et al. (2002) is the only study that we are aware of examining the D&O insurance premium using proprietary U.S. data. However, their sample consists of only 72 IPO firms, and the focus of the study is whether the insurance coverage chosen reflects managerial opportunism and is related to post-IPO performance. They do not consider financial reporting in their analysis of D&O premiums.

PricewaterhouseCoopers (2003) reports that the settlement costs rose another 53 % in 2003.

D&O insurance policies typically include a “fraud exclusion” that relates to claims involving intentional fraudulent acts or personal enrichment. This can appear to reduce the effect of financial reporting concerns on D&O insurance pricing. However, in practice, such exclusion has not had such an impact for three reasons. First, proving fraud is a challenge as the plaintiff must establish intent. Second, there is a presumption of innocence on the part of the directors and officers until fraud is proved under the “final adjudication” condition. Meanwhile, the insurance company has to continue to indemnify the directors and officers. Finally, most shareholder litigation ends in settlement without any admissions of fraud or guilt, with D&O insurers being the ones footing the bill. See Baker and Griffith (2007b) and Mathias et al. (2000) for detailed discussions on the issue.

As Core (2000) argues, weak corporate governance is not necessarily bad for shareholders. As a counter-example, shareholders can maximize share value by imposing loose constraints on a talented manager and sue her if she makes bad choices.

Core (2000) uses another variable, the percentage of share votes controlled by inside directors for his sample of Canadian companies. He finds support for a negative (positive) relation between premiums and percentage of shareholdings (percentage of voting power) due to incentive alignment (entrenchment). In our sample of U.S. companies, we do not find a significant difference between these two variables since, unlike Canadian firms, our sample firms typically have only one class of shares.

Bailey (2005), who was the lead counsel for the D&O insurance companies in the various Enron related lawsuits, states that prior to 2000 it was difficult to identify a settlement of more than $100 million. However, he lists at least 27 settlements larger than this amount since then. Settlements of securities cases are about 20 % higher in cases involving large companies where the lead plaintiff is an institutional investor (Early and Kastelic 2004).

While the D&O coverage purchased might seem to be affected by cost (i.e., the D&O premiums charged), Core (2000) argues that the premium does not affect the firm’s choice of the limit, which depends instead on marginal costs and benefits of coverage. We have followed the prior literature on D&O insurance (Core 2000; Chalmers et al. 2002) and not modeled it as a simultaneous equations system.

We require the firms to be repeat respondents included in both the 2001 and 2002 (or 2003 and 2004) Tillinghast surveys. This is because the data on “prior claims” is only available for 2002 and 2004, and we can reconstruct such data for the 2001 and 2003 observations only for firms included in the two consecutive years mentioned above.

While the validity of our results hinges on the accuracy of our matching algorithm, we believe that any matching error would not lead to systematic bias in the results and would only introduce noise that biases against finding a significant association between accounting and litigation risk.

We exclude the financial firms in computing the accrual-based accounting quality measures, to be consistent with prior literature.

In an alternative specification, we also examine the impact of prior-year restatements on D&O premium, conditional on the firm’s history of restatements. Specifically, we add to Model 3 of Table 6 the following two variables: (1) restatement_ history , an indicator variable that equals one if a firm has at least one restatement in year -2 or year -3 (with the year prior to the D&O policy effective date being year -1) and zero otherwise, and (2) restatement*restatement_ history . Untabulated results show that the coefficient on restatement*restatement_ history is significantly positive, suggesting that the D&O premium is even higher for firms with a history of repeat restatements.

46.7 % of the firm-year observations with prior restatements involve revenue or expense recognition issues.

Model 2 is based on a slightly smaller sample, as some firms only have the primary insurance layer in their D&O policies.

We obtain the bankruptcy and default information from multiple sources including Bankruptcy Data Source, Bankruptcy Yearbook and Almanac, Moody’s Corporate Default Risk Service, and Lynn Lopucki’s Bankruptcy Research Database. We supplement the collected bankruptcy data by Compustat and CRSP databases as follows. Footnote information (AFTNT33, AFTNT34, and AFTNT35) in Compustat provides the month, year, and reasons of deletion of a firm. Code 2 under AFTNT35 denotes bankruptcy under Chapter 11, while Code 3 indicates bankruptcy under Chapter 7. The delisting code in CRSP, a three-digit number that provides the reasons of delisting, denotes liquidation if it is a value between 400 and 499.

References

Abbott, L. J., Parker, S. G., Peters, F., & Raghunandan, K. (2003). The association between audit committee characteristics and audit fees. Auditing: A Journal of Practice & Theory, 22(2), 17–32.

Aboody, D., Hughes, J., & Liu, J. (2005). Earnings quality, insider trading, and cost of capital. Journal of Accounting Research, 43(5), 651–673.

Agrawal, A., & Chadha, S. (2005). Corporate governance and accounting scandals. Journal of Law and Economics, 48(2), 371–406.

Ashbaugh-Skaife, H., Collins, D. W., Kinney, W. R., Jr, & LaFond, R. (2008). The effect of SOX internal control deficiencies and their remediation on accrual quality. The Accounting Review, 83(1), 217–250.

Baginski, S. P., Hassell, J. M., & Kimbrough, M. D. (2002). The effect of legal environment on voluntary disclosure: Evidence from management earnings forecasts issued in U.S. and Canadian markets. The Accounting Review, 77(1), 25–50.

Bailey, D. A. (2002). Size of D&O settlements exploding. Available at http://library.findlaw.com/2002/Nov/1/130753.html.

Bailey, D. A. (2005). D&O liability in post-Enron era. International Journal of Disclosure and Governance, 2(2), 159–176.

Baker, T., & Griffith, S. J. (2007a). Predicting corporate governance risk: Evidence from the Directors’ & Officers’ liability insurance market. The University of Chicago Law Review, 74(2), 487–544.

Baker, T., & Griffith, S. J. (2007b). The missing monitor in corporate governance: The Directors’ & Officers’ liability insurer. Georgetown Law Journal, 95(6), 1795–1842.

Black, B., Cheffins, B., & Klausner, M. (2003). Outside director liability. SSRN working paper. Available at http://papers.ssrn.com/abstractid=382422.

Boyer, M. (2004). Is the demand for corporate insurance a habit? Evidence from Directors’ and Officers’ insurance. HEC Montreal CIRANO working paper. Available at http://www.cirano.qc.ca/pdf/publication/2004s-33.pdf.

Boyer, M. (2005). Directors’ and Officers’ insurance and shareholder protection. HEC Montreal CIRANO working paper. Available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=886504.

Brown, S., Hillegeist, S. A., & Lo, K. (2005). Management forecasts and litigation risk. SSRN working paper. Available at http://papers.ssrn.com/abstract_id=709161.

Burks, J. J. (2011). Are investors confused by restatements after Sarbanes–Oxley? The Accounting Review, 86(2), 507–539.

Cao, Z., & Narayanamoorthy, G. (2011). The effect of litigation risk on management earnings forecasts. Contemporary Accounting Research, 28(1), 125–173.

Carcello, J. V., Neal, T. L., Palmrose, Z.-V., & Scholz, S. (2011). CEO involvement in selecting board members, audit committee effectiveness, and restatements. Contemporary Accounting Research, 28(2), 396–430.

Chalmers, J. M. R., Dann, L. Y., & Harford, J. (2002). Managerial opportunism? Evidence from Directors’ and Officers’ insurance purchases. Journal of Finance, 57(2), 609–636.

Chen, X., Cheng, Q., & Lo, A. K. (2012). Is the decline in the information content of earnings following restatements temporary? Working paper, 2012 American Accounting Association Annual Meeting. Available at http://aaahq.org/AM2012/display.cfm?Filename=SubID%5F1993%2Epdf&MIMEType=application%2Fpdf.

Chung, H. H., & Wynn, J. P. (2008). Managerial legal liability coverage and earnings conservatism. Journal of Accounting and Economics, 46(1), 135–153.

Chung, H. H., Wynn, J. P., & Yi, H. (2008). Managerial opportunism, legal liability rule, and audit pricing. Working paper, Arizona State University. Available at http://aaahq.org/meetings/AUD2009/ManagerialOpportunism.pdf.

Core, J. E. (1997). On the corporate demand for Directors’ and Officers’ insurance. The Journal of Risk and Insurance, 64(1), 63–87.

Core, J. E. (2000). The Directors’ and Officers’ insurance premium: An outside assessment of the quality of corporate governance. Journal of Law Economics and Organization, 16(2), 449–477.

DeAngelo, L. (1981). Auditor size and audit quality. Journal of Accounting and Economics, 3(3), 183–199.

Dechow, P., & Dichev, I. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77(Supplement), 35–59.

Dechow, P. M., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2–3), 344–401.

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1996). Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC. Contemporary Accounting Research, 13(1), 1–36.

DeFond, M. L., & Jiambalvo, J. (1991). Incidence and circumstances of accounting errors. The Accounting Review, 66(3), 643–655.

Desai, H., Hogan, C., & Wilkins, M. (2006). The reputational penalty for aggressive accounting: Earnings restatements and management turnover. The Accounting Review, 81(1), 83–112.

Dopuch, N., & Simunic, D. (1980). The nature of competition in the auditing profession: A descriptive and normative view. In Regulation and the accounting profession, 34(2): 283–289. Belmont, CA: Lifetime Learning Publications.

Dye, R. (1993). Auditing standards, legal liability, and auditor wealth. Journal of Political Economy, 101(5), 887–914.

Early, M., & Kastelic, F. (2004). What’s really going on in D&O insurance: Taking a look at capacity, claims and carriers. Tillinghast executive D&O seminar: D&O liability—What’s wrong with this picture? New York.

Ettredge, M., Huang, Y., & Zhang, W. (2011). Restatement disclosures and management earnings forecasts. SSRN working paper. Available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1764524.

Fama, E. F., & French, K. R. (1997). Industry costs of equity. Journal of Financial Economics, 43(2), 153–193.

Farber, D. (2005). Restoring trust after fraud: Does corporate governance matter? The Accounting Review, 80(2), 539–561.

Field, L., Lowry, M., & Shu, S. (2005). Does disclosure deter or trigger litigation? Journal of Accounting & Economics, 39(3), 487–507.

Files, R., Sharp, N. Y., & Thompson, A. (2011). Why do firms restate repeatedly? SSRN working paper. Available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1748822.

Francis, J., LaFond, R., Olsson, P., & Schipper, K. (2004). Costs of equity and earnings attributes. The Accounting Review, 79(4), 967–1010.

Francis, J., LaFond, R., Olsson, P., & Schipper, K. (2005). The market pricing of earnings quality. Journal of Accounting and Economics, 39(2), 295–327.

Francis, J., Philbrick, D., & Schipper, K. (1994). Shareholder litigation and corporate disclosures. Journal of Accounting Research, 32(2), 137–164.

Jensen, M. C. (1993). Modern industrial revolution, exit, and the failure of internal control systems. Journal of Finance, 48(3), 831–880.

Johnson, M. F., Kasznik, R., & Nelson, K. K. (2001). The impact of securities litigation reform on the disclosure of forward-looking information by high technology firms. Journal of Accounting Research, 39(2), 297–326.

Johnson, M. F., Nelson, K. K., & Pritchard, A. C. (2007). Do the merits matter more? The impact of the Private Securities Litigation Reform Act. Journal of Law Economics and Organization, 23(3), 627–652.

Jones, C. L. (1998). The association of earnings management with current returns, current market values, future returns, executive compensation and the likelihood of being a target of 10b-5 litigation. Dissertation, Stanford University.

Kaltchev, G. D. (2006). Dynamic panel models with directors’ and officers’ liability insurance data. Panel Data Econometrics, 274, 351–360.

Karpoff, J., Lee, D., & Martin, G. (2008). The costs to firms of cooking the books. Journal of Financial and Quantitative Analysis, 43(3), 581–612.

Kim, I. Y. (2006). Directors’ and Officers’ insurance and opportunism in accounting choice. Working paper, Duke University. Available at http://www.efmaefm.org/efma2006/papers/764024_full.pdf.

Kinney, W. R., Jr, & McDaniel, L. S. (1989). Characteristics of firms correcting previously reported quarterly earnings. Journal of Accounting and Economics, 11(1), 71–93.

Knepper, W. E., & Bailey, D. A. (1998). Liability of corporate Officers & Directors (6th ed.). Charlottesville, VA: Lexis Law Pub.

Kothari, S. P., Leone, A. J., & Wasley, C. E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163–197.

Lazer, R., Livnat, J., & Tan, C. E. L. 2004. Restatements and accruals after auditor changes. Working paper, New York University.

Lys, T., & Watts, R. (1994). Lawsuits against auditors under the Security Acts. Journal of Accounting Research, 32(Supplement), 65–93.

Mathias, J. H., Neumeier, M. M., & Burgdoerfer, J. J. (2000). Directors and officers liability: Prevention, insurance, and indemnification. New York: American Lawyer Media Law Journal Press.

O’Sullivan, N. (1997). Insuring the agents: The role of Directors’ and Officers’ insurance in corporate governance. Journal of Risk and Insurance, 64(3), 545–556.

Palmrose, Z.-V. (1988). An analysis of auditor litigation and audit service quality. The Accounting Review, 63(1), 55–73.

Palmrose, Z.-V., Richardson, V. J., & Scholz, S. (2004). Determinants of market reactions to restatement announcements. Journal of Accounting and Economics, 37(1), 1–32.

Palmrose, Z.-V., & Scholz, S. (2004). The circumstances and legal consequences of non-GAAP reporting: Evidence from restatements. Contemporary Accounting Research, 21(1), 139–180.

PricewaterhouseCoopers. (2002). PricewaterhouseCoopers LLP 2002 securities litigation study. Available at http://10b5.pwc.com/pdf/2002_study_final.pdf.

PricewaterhouseCoopers. (2003). PricewaterhouseCoopers LLP 2003 securities litigation study. Available at http://10b5.pwc.com/pdf/2002_study_final.pdf.

Rogers, J. L., & Stocken, P. C. (2005). Credibility of management forecasts. The Accounting Review, 80(4), 1233–1260.

Romano, R. (1991). The shareholder suit: Litigation without foundation? Journal of Law Economics and Organization, 7(1), 55–87.

Romano, R. (2001). Less is more: Making institutional investor activism a valuable mechanism of corporate governance. Yale Journal on Regulation, 18(2), 174–251.

Ronen, J. (2002). Post-Enron reform: Financial statement insurance, and GAAP re-visited. Stanford Journal of Law, Business and Finance, 8(1), 1–30.

Scholz, S. (2008). The changing nature and consequences of public company financial restatements. The Department of Treasury, April, 1–54.

Sennetti, J. T., & Turner, J. L. 1999. Post-audit restatement risk and brand-name audits. Working paper, Nova Southeastern University.

Shumway, T. (2001). Forecasting bankruptcy more accurately: A simple hazard model. Journal of Business, 74(1), 101–124.

Skinner, D. J. (1996). Why is stockholder litigation tied to accounting and disclosure problems? Unpublished manuscript, University of Michigan.

Skinner, D. J. (1997). Earnings disclosures and stockholder lawsuits. Journal of Accounting and Economics, 23(3), 249–282.

Srinivasan, S. (2005). Consequences of financial reporting failure for outside directors: Evidence from accounting restatements and audit committee members. Journal of Accounting Research, 43(2), 291–334.

Tillinghast. (2002). Directors and Officers liability survey. Available at http://www.towersperrin.com/tillinghast/publications/reports/Directors_and_Officers_2002/DO_summary2002a.pdf.

Tillinghast. (2005). Directors and Officers liability survey. Available at http://www.towersperrin.com/tillinghast/publications/reports/2005_DO/DO_2005_Exec_Sum.pdf.

Wahlen, J. M. (2004). Discussion of “The circumstances and legal consequences of non-GAAP reporting: Evidence from restatements”. Contemporary Accounting Research, 21(1), 181–190.

Wilson, W. M. (2008). An empirical analysis of the decline in the information content of earnings following restatements. The Accounting Review, 83(2), 519–548.

Acknowledgments

We thank Tillinghast–Towers Perrin for providing the insurance data. We would like to thank several industry participants who have shared their valuable time with us. In particular, we thank Elissa Sirovatka of Tillinghast, David Allan of General Reinsurance Corporation, Dan Bailey of Bailey Cavalieri LLC, Michael Early and Frank Kastelic of the Chicago Underwriting Group, Lori Fuchs of Honeywell, Phil Norton of Arthur J. Gallagher and Co., and Paul Van Zuiden of Risk Management and Insurance Consulting LLC. We acknowledge helpful comments from Stephen Penman (Editor), two anonymous reviewers, Rashad Abdel-khalik, Tom Baker, Paul Beck, Andy Bauer, Michael Donahoe, Todd Green, Dongkuk Lim, Brian Mittendorf, Scott Richardson, Roberta Romano, Theo Sougiannis, Shyam Sunder, Jake Thomas, Anne Thomson, Albert Tsang, Peter Wysocki, Frank Zhang, and seminar and conference participants at the 2012 American Accounting Association Western Region Meeting, Yale School of Management, the University of Connecticut School of Law, the University of Illinois at Urbana-Champaign and the University of Washington Tacoma. Any errors are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cao, Z., Narayanamoorthy, G.S. Accounting and litigation risk: evidence from Directors’ and Officers’ insurance pricing. Rev Account Stud 19, 1–42 (2014). https://doi.org/10.1007/s11142-013-9249-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-013-9249-4

Keywords

- Financial reporting quality

- Accounting restatements

- Directors’ and Officers’ insurance

- Litigation risk

- D&O

- Corporate governance