Abstract

Billings and Jennings (2011) develop a new measure of stock price sensitivity to earnings called anticipated information content (AIC). The main difference between an AIC and an earnings response coefficient (ERC) is that AICs measure expected rather than actual sensitivity. I evaluate the AIC’s potential usefulness in future research, and conclude that AICs have several disadvantages relative to ERCs but might be useful in rare circumstances. Estimates of AICs contain considerable measurement error and fail a primary test of construct validity when left uncorrected. I outline a method for correcting two of the three sources of measurement error, which can be used by researchers interested in pursuing work on AICs. The method may have uses beyond computing AICs because it yields a prediction of the unsigned change in stock price during a scheduled event window.

Similar content being viewed by others

Notes

The ERC is not subject to the same inconsistency. Even if researchers could perfectly measure the components of an ERC (earnings surprise and change in market value), ERCs still would vary across firms. For example, firms with more persistent earnings still would have higher ERCs because the market would assign a higher capitalization rate to the perfectly measured earnings surprise for the current quarter.

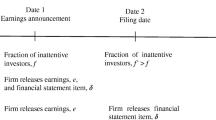

The authors state: “Does a negative reporting event reduce investors’ anticipated responsiveness to a firm’s earnings news in the next quarter? The frequent measurability along with the firm- and quarter-specific nature of the AIC allows researchers to address this question without waiting until the next earnings release…” (emphasis added) (p. 5–6).

A researcher might want to measure sensitivity one or 2 days before the window in a study comparing predicted to actual return-earnings sensitivity. However, the authors discourage this: “We expect our [AIC] metric to behave distinctly from traditional return-earnings relation metrics, including the [ERC]. The AIC does not capture the anticipated sign of the impending earnings news, nor can its scale compare to that of the ERC. Given these distinctions (as well as others discussed in the next section), we do not use the AIC to predict the ERC” (p. 3).

All results shown below are easily derivable and implementable using actual risk neutral probabilities.

References

Billings, M. B., & Jennings, R. (2011). The option market’s anticipation of information content in earnings announcements. Review of Accounting Studies, 16(3). doi:10.1007/s11142-011-9156-5.

Chevis, G. M., & Sommers, G. A. (2007). Using market reaction to infer persistence of earnings surprises. Baylor University Working Paper. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1013350.

Cox, J. C., Ross, S. A., & Rubinstein, M. (1979). Option pricing: A simplified approach. Journal of Financial Economics, 7(3), 229–263.

Hull, J., & White, A. (1987). The pricing of options on assets with stochastic volatilities. The Journal of Finance, 42(2), 281–300.

Patell, J. M., & Wolfson, M. A. (1981). The ex ante and ex post price effects of quarterly earnings announcements reflected in option and stock prices. Journal of Accounting Research, 19(2), 434–458.

Acknowledgments

Thanks to two anonymous reviewers for helping to frame some of my thoughts for discussion.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Burks, J.J. Discussion of: The option market’s anticipation of information content in earnings announcements. Rev Account Stud 16, 620–629 (2011). https://doi.org/10.1007/s11142-011-9145-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-011-9145-8

Keywords

- Stock options

- Earnings announcements

- Implied volatility

- Anticipated information content

- Return-earnings relation

- Earnings response coefficients