Abstract

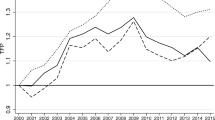

This paper assesses and tests the response of banks operating in financial centers to the financial crisis by investigating the actual productivity change and its components—pure efficiency change, scale efficiency change and technological change (innovation). The heterogeneity in the organizational form and size of banks has been represented with the Aggregated Malmquist Productivity Index (Zelenyuk in Eur J Oper Res 174:1076–1086, 2006) and the bootstrap techniques (Simar and Wilson in Eur J Oper Res 115:459–471, 1999) extended to this index. Our findings indicate that both branch and subsidiary banks respond to the financial crisis with productivity improvements and, in both cases, this improvement is driven primarily by a positive technical change. However, the branch banks outperform the subsidiary banks. In addition, for the three categories of big, medium and small banks, we find a positive productivity reaction to the crisis, driven by a technical change. However, because small banks not only respond to the financial crisis with improvements in the technical change but also in the scale efficiency change, they appear to reach a higher productivity growth, compared with larger banks, as a response to the financial crisis.

Similar content being viewed by others

Notes

In the Luxembourg financial center, only four banks operated throughout 1995–2010, six banks disappeared over time, and three banks entered between 2006 and 2007.

In the untabulated estimation, we have conducted all of the analyses restricting the sample to include only foreign subsidiary banks and obtained results similar to those with the full sample.

As noted by Guarda and Roubah (2009).

The only exception is in the scale efficiency change for the years 1999–2000 (the consolidation boom period).

References

Berger AN, Buch CB, DeLong G, DeYoung R (2004) Exporting financial institutions management via foreign direct investment mergers and acquisitions. J Int Money Finance 23:333–366

Brealey RA, Kaplanis EC (1996) The determination of foreign banking location. J Int Money Finance 15:577–597

Burgstaller J, Cocca TD (2011) Efficiency in private banking: evidence from Switzerland and Liechtenstein. Financ Mark Portf Manag 25:75–93

Caves D, Christensen L, Diewert E (1982) The economic theory of index numbers and the measurement of input, output, and productivity. Econometrica 50:1393–1414

Clare A, Gulamhussen MA, Pinheiro C (2013) What factors cause foreign banks to stay in London? J Int Money Finance 32:739–761

Clark AJ, Siems TF (2002) X-efficiency in Banking: looking beyond the balance sheet. J Money Credit Bank 34:987–1013

Curi C, Lozano-Vivas (2013) Productivity of foreign bank: evidence from a financial center. In: Pasiouras F (ed) Efficiency and productivity growth: modelling in the financial services industry. Wiley Ch 5, pp 95–121. ISBN: 978-1-119-96752-1

Curi C, Guarda P, Zelenyuk V (2011) Changes in bank specialization: comparing foreign subsidiaries and branches in Luxembourg. Banque Centrale du Luxembourg Working Paper, 67

Curi C, Guarda P, Lozano-Vivas A, Zelenyuk V (2013) Is foreign-bank efficiency in financial centers driven by home or host country characteristics? J Prod Anal 40(3):367–385

Curi C, Guarda P, Lozano-Vivas A, Zelenyuk V (2014) Foreign bank diversification and efficiency prior to and during the financial crisis: Does one business model fit all? BEMPS 18-Bozen Economics and Management Paper Series

Damanpour F (1991) Global banking: developments in the market structure and activities of foreign banks in the United States. Columbia J World Bus 26(3):58–69

Färe R, Grosskopf S, Norris M, Zhang Z (1994) Productivity growth, technical progress, and efficiency change in industrialized countries. Am Econ Rev 84(1):66–83

Färe R, Primont D (1995) Multi-output production and duality: theory and applications. Kluwer Academic Publishers, Boston

Färe R, Zelenyuk V (2003) On aggregate Farrell efficiency scores. Eur J Oper Res 146(3):615–620

Farrell MJ (1957) The measurement of productive efficiency. J R Stat Soc Ser A 120:253–281

Fisher A, Molyneux P (1996) A note on the determinants of foreign bank activity in London between 1980 and 1989. Appl Financ Econ 6(3):271–277

Fixler D, Zieschang K (1992) User costs, shadow prices, and the real output of banks. In: Griliches Z (ed) Output measurement in the service sectors. University of Chicago Press, Chicago

Guarda P, Rouabah A (2006) Measuring banking output and productivity: a user cost approach to Luxembourg data. In: Bandyopadhyay PK, Gupta GS (eds) Measuring productivity in services: new dimensions. Icfai University Press, Hyderabad

Guarda P, Roubah A (2007) Banking output and price indicators from quarterly reporting data. Banque Centrale du Luxembourg Working Paper, 27

Guarda P, Roubah A (2009) Bank productivity and efficiency in Luxembourg: Malmquist indices from a parametric output distance function. In: Balling M, Gnan E, Lierman F, Schoder JP (eds) Productivity in the Financial Services Sector. SUERF, The European Money and Finance Forum, pp 151–166

Henderson V, Kuncoro A, Turner M (1995) Industrial development in cities. J Polit Econ 103:1067–1090

Hryckiewicz A, Kowalewski O (2011) Why do foreign banks withdraw from other countries? Int Finance 14(1):67–102

Johnson AL, Ruggiero J (2011) Nonparametric measurement of productivity and efficiency in education. Ann Oper Res. doi:10.1007/s10479-011-0880-9

Kwan SH (2006) The X-efficiency of commercial banks in Hong Kong. J Bank Finance 30:1127–1147

Lozano-Vivas A, Pasiouras F (2010) The impact of non-traditional activities on the estimation of bank efficiency: international evidence. J Bank Finance 34:1436–1449

Nishimizu M, Page JM (1982) Total factor productivity growth, technological progress and technical efficiency change: dimensions of productivity change in Yugoslavia, 1965–1978. Econ J 92(368):920–936

Rime B, Stiroh KJ (2003) The performance of universal banks: evidence from Switzerland. J Bank Finance 27:2121–2150

Sealey CW Jr, Lindley JT (1977) Inputs, outputs, and the theory of production and cost at depository financial institutions. J Finance 32:1251–1266

Seth R, Nolle D, Mohanty SK (1998) Do banks follow their customers abroad? Financ Mark Inst Instrum 7(4):1–25

Simar L, Wilson PW (1999) Estimating and bootstrapping Malmquist indices. Eur J Oper Res 115:459–471

Simar L, Wilson PW (2008) Statistical inference in nonparametric frontier models: recent developments and perspectives. In: Fried HO, Knox Lovell CA, Schmidt SS (eds) The measurement of productive efficiency and productivity growth. Oxford University Press, New York

Simar L, Zelenyuk V (2007) Statistical inference for aggregates of Farrell-type efficiencies. J Appl Econom 22:1367–1394

Sufian F, Majid MZA (2007) Deregulation, consolidation and banks efficiency in Singapore: evidence from an event study window approach and Tobit analysis. Int Rev Econ 54(2):261–283

The Economist (2013) Storm survivors. 16 Feb 2013

Tschoegl AE (2000) International banking centers, geography, and foreign banks. Financ Mark Inst Instrum 9(1):1–32

Wheelock DC, Wilson PW (1999) Technical progress, inefficiency, and productivity change in US banking, 1984–1993. J Money Credit Bank 31(2):212–234

Zelenyuk V (2006) Aggregation of Malmquist productivity indexes. Eur J Oper Res 174:1076–1086

Zofio JL (2007) Malmquist productivity index decompositions: a unifying framework. Appl Econ 39(18):2371–2387

Acknowledgments

The authors are grateful for the comments received from Subal C. Kumbhakar, Robin C. Sickles and all participants in the Conference in Memory of Lennart Hjalmarsson, Gothenburg, December 7–8, 2012. We would like to thank two anonymous referees and Valentin Zelenyuk for their valuable comments. Claudia Curi gratefully acknowledges the financial support from the Luxembourg Fonds National de la Recherche (through the PERFILUX project), the Central Bank of Luxembourg, where this research first took shape, and the Faculty of Economics and Management, Free University of Bozen-Bolzano (through the TECHBANK project). Ana Lozano-Vivas gratefully acknowledges the financial support from the Spanish Ministry of Economy and Competitiveness (project ECO2011-26996). Any remaining errors are solely our responsibility.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Curi, C., Lozano-Vivas, A. Financial center productivity and innovation prior to and during the financial crisis. J Prod Anal 43, 351–365 (2015). https://doi.org/10.1007/s11123-015-0434-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-015-0434-2

Keywords

- Financial center

- Bank productivity

- Innovation

- Data envelopment analysis

- Aggregated Malmquist Productivity Index

- Sensitivity analysis

- Financial crisis