Abstract

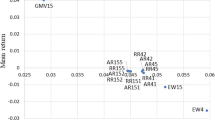

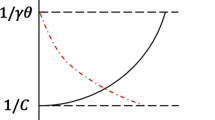

We examine the robust mean-VaR portfolio optimization problem when a parametric approach is used for estimating VaR. A robust optimization formulation is used to accommodate estimation risk, and we obtain an analytic solution when there is a risk-free asset and short-selling is allowed. This renders the model computationally tractable. Further, to avoid the conservatism of robust optimal portfolios, we suggest an adjusted robust optimization approach. Empirically, we evaluate the out-of-sample performance of the new approach, the robustness of obtained solutions and level of conservatism of the resulting portfolios. The empirical results highlight some benefits of our approach.

Similar content being viewed by others

Notes

VaR optimization models trade off the VaR risk measure against return or more generally utility function e.g., mean-VaR portfolio selection while VaR minimization model is purely VaR risk minimization.

To make sure they do not have any special distribution, we let skewness and kurtosis randomly chosen in \([-0.5, 0.5]\) and [2, 4], respectively.

Note that \(VaR _{\alpha }(x) = -r^Tx+F^{-1}(\alpha )\Vert \varSigma ^\frac{1}{2}x\Vert \) and mean return of portfolio is \(r^Tx\)

L is the matrix in the Cholesky decomposition of \(\varSigma,\) i.e., \(\varSigma = LL^T\)

The means and covariance matrix of asset returns are available at http://people.brunel.ac.uk/%7Emastjjb/je$$b/orlib/portinfo.html.

References

Abad P, Benito S, López C (2014) A comprehensive review of value at risk methodologies. Span Rev Financ Econ 12(1):15–32

Alexander GJ, Baptista AM (2002) Economic implications of using a mean-VaR model for portfolio selection: a comparison with mean-variance analysis. J Econ Dyn Control 26(7–8):1159–1193

Alizadeh F, Goldfarb D (2003) Second-order cone programming. Math Program 95(1):3–51

Basak S, Shapiro A (2001) Value-at-risk-based risk management: optimal policies and asset prices. Rev Financ Stud 14(2):371–405

Beck A, Ben-Tal A (2009) Duality in robust optimization: primal worst equals dual best. Oper Res Lett 37(1):1–6

Ben-Tal A, Nemirovski A (2001) Lectures on modern convex optimization: analysis, algorithms, and engineering applications. MPS-SIAM series on optimization. Philadelphia

Benati S, Rizzi R (2007) A mixed integer linear programming formulation of the optimal mean/value-at-risk portfolio problem. Eur J Oper Res 176(1):423–434

Best MJ, Grauer RR (1991) Sensitivity analysis for mean-variance portfolio problems. Manag Sci 37(8):980–989

Brinkmann U (2007) Robuste asset allocation. Ph.D. thesis, Universität Bremen, Bremen

Ceria S, Stubbs RA (2006) Incorporating estimation errors into portfolio selection: Robust portfolio construction. Journal of Asset Management 7(2):109–127

Chopra VK, Ziemba WT (1993) The effect of errors in means, variances, and covariances on optimal portfolio choice. J Portf Manag 19(2):6–11

Consiglio A, Lotfi S, Zenios S (2016) Portfolio diversification in the sovereign CDS market. Working Paper No. 16-06, The Wharton Financial Institutions Center, University of Pennsylvania, Philadelphia, PA, USA

DeMiguel V, Nogales FJ (2009) Portfolio selection with robust estimation. Oper Res 57(3):560–577

Gaivoronski AA, Pflug G (2005) Value-at-risk in portfolio optimization: properties and computational approach. J Risk 7(2):1–31

Goldfarb D, Iyengar G (2003) Robust portfolio selection problems. Math Oper Res 28(1):1–38

Grant M, Boyd S (2013) CVX: Matlab software for disciplined convex programming, version 2.0 beta. http://cvxr.com/cvx

Jobson JD, Korkie BM (1981) Performance hypothesis testing with the Sharpe and Treynor measures. J Financ 36(4):889–908

Kamdem JS (2005) Value-at-risk and expected shortfall for linear portfolios with elliptically distributed risk factors. Int J Theor Appl Financ 08(05):537–551

Lotfi S, Zenios S (2016) Equivalence of robust VaR and CVaR optimization under ambiguity. Working Paper No. 16-03, The Wharton Financial Institutions Center, University of Pennsylvania, Philadelphia, PA, USA

Memmel C (2003) Performance hypothesis testing with the Sharpe ratio. Financ Lett 1(1):21–23

Mulvey JM, Vanderbei RJ, Zenios SA (1995) Robust optimization of large-scale systems. Oper Res 43(2):264–281

Paç AB, Pınar MÇ (2014) Robust portfolio choice with CVaR and VaR under distribution and mean return ambiguity. Top 22(3):875–891

Pınar MÇ (2013) Static and dynamic var constrained portfolios with application to delegated portfolio management. Optimization 62(11):1419–1432

Pınar MÇ (2016) On robust mean-variance portfolios. Optimization 65(5):1039–1048

Santos A (2010) The out-of-sample performance of robust portfolio optimization. Braz Rev Financ 8(May):1–29

Schottle K, Werner R (2009) Robustness properties of mean-variance portfolios. Optimization 58(6):641–663

Acknowledgements

The authors would like to thank anonymous referees for their constructive comments which led to significant improvement on the early draft of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lotfi, S., Salahi, M. & Mehrdoust, F. Adjusted robust mean-value-at-risk model: less conservative robust portfolios. Optim Eng 18, 467–497 (2017). https://doi.org/10.1007/s11081-016-9340-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11081-016-9340-3

Keywords

- Mean-value-at-risk

- Estimation error

- Solution robustness

- Structure robustness

- Robust optimization

- Conservatism