Abstract

This paper presents a mathematical model for analyzing long-term infrastructure investment decisions in a deregulated electricity market, such as the case in the United States. The interdependence between different decision entities in the system is captured in a network-based stochastic multi-agent optimization model, where new entrants of investors compete among themselves and with existing generators for natural resources, transmission capacities, and demand markets. To overcome computational challenges involved in stochastic multi-agent optimization problems, we have developed a solution method by combining stochastic decomposition and variational inequalities, which converts the original problem to many smaller problems that can be solved more easily.

Similar content being viewed by others

Notes

Any node in the power grid can be an access point as long as there is supporting transmission infrastructure.

For a small example illustrating these flow conservation constraints, please refer to Appendix 1.

Note that since the wholesale prices depend on the production quantities, chain rule of differentiation should be used while taking derivatives to arrive at the VI.

Symmetric assumption and separable investment cost are not required in our model and algorithm.

For the same scenario-dependent problems, PATH, a general-purpose optimization solver for complementarity problems, was unable to obtain solutions.

In this example, ISO is allowed to make short term revenues from transmission services. But eventually, this revenue will be used for transmission investment so that ISO keeps long term profit neutral.

References

Abrell J, Kunz F (2015) Integrating intermittent renewable wind generation - a stochastic multi-market electricity model for the european electricity market. Networks and Spatial Economics 15:117–147

Abrell J, Weigt H (2012) Combining energy networks. Networks and Spatial Economics 12:377–401

Bar-Gera H (2010) Traffic assignment by paired alternative segments. Transportation Research Part B 44:1022–1046

Birge JR, Louveaux F (2011) Introduction to stochastic programming. Springer

Bushnell JB, Mansur ET, Saravia C (2007) Vertical Arrangements, Market Structure, and Competition An Analysis of Restructured US Electricity Markets. Technical Report, National Bureau of Economic Research

CalISO (2013). About us. http://www.caiso.com/about/Pages/default.aspx

Chen C, Fan Y (2012) Bioethanol supply chain system planning under supply and demand uncertainties. Transportation Research Part E: Logistics and Transportation Review 48:150–164

Conejo AJ, Carrión M, Morales JM (2010) Decision making under uncertainty in electricity markets, vol 1. Springer

Cournot AA, Fisher I (1897) Researches into the Mathematical Principles of the Theory of Wealth, Macmillan Co.

Csercsik D (2015) Competition and cooperation in a bidding model of electrical energy trade. Networks and Spatial Economics:1–31. doi:10.1007/s11067-015-9310-x

Day CJ, Hobbs B, Pang JS (2002) Oligopolistic competition in power networks: a conjectured supply function approach. IEEE Transactions on Power Systems 17:597–607

Do Chung B, Yao T, Xie C, Thorsen A (2011) Robust optimization model for a dynamic network design problem under demand uncertainty. Networks and Spatial Economics 11:371–389

Fan Y, Liu C (2010) Solving stochastic transportation network protection problems using the progressive hedging-based method. Networks and Spatial Economics 10:193–208

Genc TS, Reynolds SS, Sen S (2007) Dynamic oligopolistic games under uncertainty: A stochastic programming approach. J Econ Dyn Control 31:55–80

Hamdouch Y, Qiang QP, Ghoudi K (2016) A closed-loop supply chain equilibrium model with random and price-sensitive demand and return. Networks and Spatial Economics:1–45. doi:10.1007/s11067-016-9333-y

Hearn DW, Yildirim MB (2002) A toll pricing framework for traffic assignment problems with elastic demand. Springer

Hobbs B, Metzler C, Pang JS (2000) Strategic gaming analysis for electric power systems: an mpec approach. IEEE Transactions on Power Systems 15:638–645. doi:10.1109/59.867153

Hobbs B, Drayton G, Fisher E, Lise W (2008) Improved transmission representations in oligopolistic market models: quadratic losses, phase shifters, and dc lines. IEEE Transactions on Power Systems 23:1018–1029

Hobbs B, Pang JS (2007) Nash-cournot equilibria in electric power markets with piecewise linear demand functions and joint constraints. Oper Res 55:113–127

Hu X, Ralph D, Ralph EK, Bardsley P, Ferris MC (2004) Electricity generation with looped transmission networks: Bidding to an ISO. Department of Applied Economics, University of Cambridge

IEA (2006) Wind Energy Annual Report. Technical Report. International Energy Association

Jofre A, Wets R (2014) Variational convergence of bifunctions: Motivating applications. SIAM J Optim. (to appear)

Kagiannas AG, Askounis DT, Psarras J (2004) Power generation planning: a survey from monopoly to competition. Int J Electr Power Energy Syst 26:413–421

Kazempour SJ, Conejo AJ (2012) Strategic generation investment under uncertainty via benders decomposition. IEEE Transactions on Power Systems 27:424–432

Kazempour SJ, Conejo AJ, Ruiz C (2013) Generation investment equilibria with strategic producers—part i: Formulation. IEEE Transactions on Power Systems 28:2613–2622

LeBlanc LJ, Morlok EK, Pierskalla WP (1975) An efficient approach to solving the road network equilibrium traffic assignment problem. Transp Res 9:309–318

Leuthold FU, Weigt H, Von Hirschhausen C (2012) A large-scale spatial optimization model of the european electricity market. Networks and spatial economics 12:75–107

Li M, Gabriel SA, Shim Y, Azarm S (2011) Interval uncertainty-based robust optimization for convex and non-convex quadratic programs with applications in network infrastructure planning. Networks and Spatial Economics 11:159–191

Liu Z, Nagurney A (2009) An integrated electric power supply chain and fuel market network framework: Theoretical modeling with empirical analysis for new england. Naval Research Logistics 56:600–624

Liu Z, Nagurney A (2011) Supply chain outsourcing under exchange rate risk and competition. Omega 39:539–549

Liu C, Fan Y, Ordóñez F (2009) A two-stage stochastic programming model for transportation network protection. Comput Oper Res 36:1582–1590

Løkketangen A., Woodruff D (1996) Progressive hedging and tabu search applied to mixed integer (0, 1) multistage stochastic programming. J Heuristics 2:111–128

Louveaux F (1986) Discrete stochastic location models. Ann Oper Res 6:21–34

Matsypura D, Nagurney A, Liu Z (2007) Modeling of electric power supply chain networks with fuel suppliers via variational inequalities. International Journal of Emerging Electric Power Systems 8

Melese Y, Heijnen P, Stikkelman R, Herder P (2016) An approach for integrating valuable flexibility during conceptual design of networks. Networks and Spatial Economics:1–25

Metzler C, Hobbs B, Pang JS (2003) Nash-cournot equilibria in power markets on a linearized dc network with arbitrage: Formulations and properties. Networks and Spatial Economics 3:123–150

Mulvey JM, Vladimirou H (1991) Applying the progressive hedging algorithm to stochastic generalized networks. Ann Oper Res 31:399–424

Mulvey JM, Vladimirou H (1992) Stochastic network programming for financial planning problems. Manage Sci 38:1642–1664. doi:10.1287/mnsc.38.11.1642

Murphy FH, Smeers Y (2005) Generation capacity expansion in imperfectly competitive restructured electricity markets. Oper Res 53:646–661

Murphy FH, Sherali HD, Soyster AL (1982) A mathematical-programming approach for determining oligopolistic market equilibrium. Math Program 24:92–106

Nagurney A (2006) On the relationship between supply chain and transportation network equilibria: A supernetwork equivalence with computations. Transportation Research Part E-Logistics and Transportation Review 42:293–316

Nagurney A, Matsypura D (2007) A supply chain network perspective for electric power generation, supply, transmission, and consumption. Springer, pp 3–27

Pineau PO, Murto P (2003) An oligopolistic investment model of the finnish electricity market. Ann Oper Res 121:123–148

Ralph D, Smeers Y (2006) Epecs as models for electricity markets. In: Power Systems Conference and Exposition. PSCE’06. 2006 IEEE PES. IEEE, pp 74–80

Rinaldi SM, Peerenboom JP, Kelly TK (2001) Identifying, understanding, and analyzing critical infrastructure interdependencies. IEEE Control Syst 21:11–25

Rockafellar R (1976) Augmented lagrangians and applications of the proximal point algorithm in convex programming. Math Oper Res 1:97–116

Rockafellar RT, Wets RJB (1991) Scenarios and policy aggregation in optimization under uncertainty. Math Oper Res 16:119–147

Ventosa M, Denis R, Redondo C (2002) Expansion planning in electricity markets. two different approaches. In: Proceeding of 14th PSCC, Sevilla, pp 24–28

Waston J, Woodruff D (2010) Progressive hedging innovations for a class of stochastic mixed-integer resource allocation problems. CMS 8:355–370

Willems B, Rumiantseva I, Weigt H (2009) Cournot versus supply functions: What does the data tell us? Energy Econ 31:38–47

Wogrin S, Centeno E, Barquin J (2011) Generation capacity expansion in liberalized electricity markets: A stochastic mpec approach. IEEE Transactions on Power Systems 26:2526–2532

Wogrin S, Hobbs B, Ralph D, Centeno E, Barquín J (2013) O electricity markets under perfect and oligopolistic competition. Math Program B 140:295–322

Acknowledgments

This work is partially supported by the Sustainable Transportation Energy Pathways (STEPS) program and the National Transportation Center on Sustainability (NTCS) at University of California, Davis (UC Davis). The authors are grateful to Prof. Roger Wets at UC Davis and Mr. Obadiah Bartholomy at the Sacramento Municipal Utility District (SMUD) for helpful discussion.

Author information

Authors and Affiliations

Corresponding author

Appendices

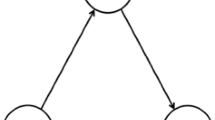

Appendix 1: Small Example Illustrating Flow Conservation Constraint (3b)–(3e)

1.1 Network Structure

1.2 OD and Path Information

1.3 Network Flow

1.4 Incidence Matrix

Appendix 2: Subroutine Pseudocode

Appendix 3: Data for Example 2

Appendix 4: Calculation of \(\protect \frac {\partial \rho _{k^{\prime }}}{\partial {g_{i}^{j}}}\)

\({\partial \rho _{k^{\prime }}}/{\partial {g_{i}^{j}}}\) can be computed from the ISO’s optimization problem (3a), where ρ is the dual variables of constraint (3a) and g is parameters. \({\partial \rho _{k^{\prime }}}/{\partial {g_{i}^{j}}}\) is essentially the derivative of dual variables with respect to right-hand side constants. We use the standard notations for convex optimization with linear constraints:

where f(x) is a convex function and \(\boldsymbol {x} \in \mathbb {R}^{n}, \boldsymbol {\lambda }, \boldsymbol {b} \in \mathbb {R}^{m}\), to illustrate the calculating process and our goal is to calculate the Jacobian matrix J λ (b).

Lagrangian of problem (18b) is \(\mathcal {L} = f(\boldsymbol {x}) - \boldsymbol {\lambda }^{T}(A\boldsymbol {x}-\boldsymbol {b})\). The optimality conditions of problem (18b) is:

Take implicit derivatives of Eq. (4) with respect to b :

The unknown variables in Eq. 20a are two Jacobian matrices, J x (b) and J λ (b). The total number of equations is equal to the total number of variables in Eq. 20a, which is n m + m 2. Therefore, as long as these equations are consistent and independent, J λ (b) can be calculated uniquely. Clearly, if function f(x) is in quadratic form of x, \(\nabla ^{2}_{\boldsymbol {x}} f(\boldsymbol {x})\) then only involves constants, in which case J λ (b) can be computed analytically. For general form of f(x), one can solve J λ (b) numerically; one can take an initial guess of b based on historical data and then solve (20a) and Algorithm 2 iteratively until J λ (b) converged.

Rights and permissions

About this article

Cite this article

Guo, Z., Fan, Y. A Stochastic Multi-agent Optimization Model for Energy Infrastructure Planning under Uncertainty in An Oligopolistic Market. Netw Spat Econ 17, 581–609 (2017). https://doi.org/10.1007/s11067-016-9336-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11067-016-9336-8