Abstract

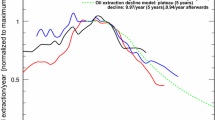

A theoretical model of conventional oil production has been developed. The model does not assume Hubbert’s bell curve, an asymmetric bell curve, or a reserve-to-production ratio method is correct, and does not use oil production data as an input. The theoretical model is in close agreement with actual production data until the 1979 oil crisis, with an R 2 value of greater than 0.98. Whilst the theoretical model indicates that an ideal production curve is slightly asymmetric, which differs from Hubbert’s curve, the ideal model compares well with the Hubbert model, with R 2 values in excess of 0.95. Amending the theoretical model to take into account the 1979 oil crisis, and assuming the ultimately recoverable resources are in the range of 2–3 trillion barrels, the amended model predicts conventional oil production to peak between 2010 and 2025. The amended model, for the case when the ultimately recoverable resources is 2.2 trillion barrels, indicates that oil production peaks in 2013.

Similar content being viewed by others

Abbreviations

- [C d(t)]:

-

The cumulative discoveries for the world as a function of time (TL)

- [C p(t)]:

-

The cumulative production for the world as a function of time (TL)

- [\(C_{{\rm p}_{l}}(t)\)]:

-

The cumulative production for the reservoir l as a function of time (TL)

- [\(C_{{\rm p}_{l_{i}}}(t)\)]:

-

The cumulative production for the ith well in reservoir l (TL)

- [k(t)]:

-

The technology function

- [p(t)]:

-

The expected discovery percentage function

- [P′(t)]:

-

The production function as used in Brandt (2007) (b/year)

- [\( P_{l_i}(t)\)]:

-

The production in the ith well of reservoir l (TL/year)

- [\( Pr_{l_i}(t)\)]:

-

The pressure in the ith well of reservoir l as a function of time (Pa)

- [R 2]:

-

The coefficent of determination

- [w l (t)]:

-

The number of wells in operation for the reservoir l as a function of time

- [y d(t)]:

-

The yearly discoveries function (TL/year)

- [b t]:

-

The slope constant for the technology function(year−1)

- [\( k_{1_{l_i}}\)]:

-

The proportionality constant relating production to pressure, in the ith well (TL/Pa.year)

- [\( k_{2_{l_i}} \)]:

-

The proportionality constant relating pressure to remaining reserves (Pa/TL)

- [\( k_{{\rm p}_{l_i}} \)]:

-

The proportionality constant relating the production to the remaining reserves (year−1)

- [k w]:

-

The proportionality constant in the wells model

- [\( k_{{\rm w}_{l}} \)]:

-

The proportionality constant for reservoir l in the wells model

- [P 0]:

-

The initial production of the wells in all reservoirs (TL/year)

- [\( P_{0_{l}} \)]:

-

The initial production of the wells in reservoir l (TL/year)

- [\( P_{0_{l_i}} \)]:

-

The initial production from the ith well in reservoir l (TL/year)

- [r dec]:

-

The rate of decrease, as used by Brandt (2007) (year−1)

- [r inc]:

-

The rate of increase, as used by Brandt (2007) (year−1)

- [Δr]:

-

The difference between the rate of increase and rate of decrease, as used by Brandt (2007) (year−1)

- [t]:

-

Time (year)

- [t l ]:

-

The year the lth reservoir is found (year)

- [\( t_{l_i} \)]:

-

The year the ith well comes on-line in reservoir l (year)

- [T peak]:

-

The Peak year for the production curve as used in Brandt (2007) (year)

- [T start]:

-

The start year for the production curve as used in Brandt (2007) (year)

- [t t]:

-

The year the technology function reaches 0.5 (year)

- [URR]:

-

The Ultimate Recoverable Resources (TL)

- [URR l ]:

-

The Ultimately Recoverable Resources for the reservoir l (TL)

- [\( w_{l_{\rm T}} \)]:

-

The total number of wells for reservoir l, if cumulative production were infinite

- [\( w_{l_{{\rm T}_{\rm act}}} \)]:

-

The total number of wells for reservoir l given the cumulative production is finite

References

Aleklett, K., 2004, International Energy Agency accepts Peak Oil: ASPO website, http://www.peakoil.net/uhdsg/weo2004/TheUppsalaCode.html (11/27/07)

Arps J.J. (1945) Analysis of decline curves. Trans. AIME. 160:228–247

Bakhtiari A. M. S. (2004) World oil production capacity model suggests output peak by 2006–07. Oil Gas J 102(16):18–20

Bardi U. (2005) The mineral economy: A model for the shape of oil production curves. Energy Policy 33(1):53–61

Bauquis P. (2003) Reappraisal of energy supply-demand in 2050 shows big role for fossil fuels, nuclear but not for nonnuclear renewables. Oil Gas J. 101(7):20–29

BP, 2006, Statistical Review of World Energy 2006

Brandt, A. R., 2007, Testing Hubbert. Energy Policy, v. 35, no. 5, p. 3074–3088

CAPP, 2006, Statistical Handbook: Canadian Association of Petroleum Producers website, http://www.capp.ca/default.asp?V_DOC_ID=1071 (01/18/08)

Deffeyes K.S. (2002) World’s oil production peak reckoned in near future. Oil Gas J. 100(46):46–48

DeGolyer and MacNaughton Inc., 2006, 20th Century Petroleum Statistics 2005 edition

EIA, 2007, Distribution and Production of Oil and Gas Wells by State: EIA website, www.eia.doe.gov/pub/oil_gas/petrosystems/petrosysog.html (08/24/07)

Linden H.R. (1998) Flaws seen in resource models behind crisis forecasts for oil supply, price. Oil Gas J. 96(52):33–37

Mohr S.H., Evans G.M. (2007) Mathematical model forecasts year conventional oil will peak. Oil and Gas Journal 105(17):45–50

Moritis G. (2005) Venezuela plans Orinoco expansions. Oil Gas J. 103(43):54–56

Reynolds D.B. (1999) The mineral economy: How prices and costs can falsely signal decreasing scarcity. Ecol. Econ. 31(1):155–166

Wells P. R. A. (2005a) Oil supply challenges – 1: The non-OPEC decline. Oil Gas J. 103(7):20–28

Wells P. R. A. (2005b) Oil supply challenges – 2: What can OPEC deliver? Oil Gas J. 103(9):20–30

Williams B. (2003) Heavy hydrocarbons playing key role in peak-oil debate, future energy supply. Oil Gas J. 101(29):20–27

Wood, J. H., Long, G. R., and Morehouse, D. F., 2004, Long-Term World Oil Supply Scenarios: EIA website, www.eia.doe.gov/pub/oil_gas/petrosystems/petrosysog.html (08/24/07)

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: The Rate Difference

The rate difference, Δr, as defined by (Brandt, 2007) is

where the rate of increase r inc and rate of decrease r dec are determined by fitting Equation (A.1) to the production data (Brandt, 2007).

where P′(t) is production in (barrels/year) and T peak is the year the production peaks (year) and r inc and r dec are the rate constants (year−1) and T start is the year production was 1 barrel a year Brandt (2007). In calculating the rate difference of the theoretical model equation (A.1) was altered to

where P(40) is the production of oil estimated by the theoretical model in the year 1900. Using Equation (A.2) the rate difference for the pessimistic case was 0.0184 (years−1), optimistic case was 0.0179 (years−1), and the ideal case was 0.0217 (years−1).

Appendix B: Coefficient of Determination

The coefficient of determination, R 2, was used to measure the accuracy of the discovery model to the data.

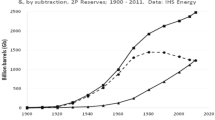

For the pessimistic case URR = 2 trillion barrels and for the optimistic case URR = 3 trillion barrels. For the ideal case, the URR was a variable. The best fit was found by varying b t, t t (and URR for ideal case) to obtain the highest R 2 value. The constants are shown in Table B.1. The actual data for the pessimistic and optimistic cases was truncated to the year 1966, as the optimists claim that oil reserves found in the past will grow.

Appendix C: Determining the Constants

The method to determine valid estimates for the constants \(k_{\rm w},\, w_{l_{\rm T}},\) and P 0 in the reservoir production model is given in this section. The best data found is unfortunately state based rather than reservoir based data from EIA (2007). The production model was used with several cycles to model the production as a function of time, and the number of wells as a function of cumulative production for various states as shown in Figs. C.1–C.4.

Note our model assumes that no wells are shut down, and instead exponentially decay and although are still on-line, are in reality producing no significant quantity of oil. This is the reason for the poor fit of the well model for Nevada and South Dakota. Now observe that there is only one sensible option for the \(w_{l_{\rm T}}\) constants, since these values need to match the actual total wells. The k w values and P 0 values determine the rate of increase in the wells model and are determined by trial and error so that the wells model and production model fit the data as accurately as possible. Whilst the values used produce reasonably accurate results, we need to check that the initial production values P 0 correspond to the actual initial production. Unfortunately the initial production for all the wells is not known; however, the number of wells as a function of size and time is known (EIA 2007) and the model’s predictions were compared with the actual data for the four states, as shown in Figs. C.5–C.8 (Note that the size of the wells from EIA, 2007 is explained in Table C.1).

The Figs. C.5–C.8 indicate a reasonable fit and hence the initial well productions P 0 can be assumed to be reasonable estimates. The constants k w, P 0, and \(w_{l_{\rm T}}\) used in the state models are shown in Table C.2.

Now if we ignore the outlier of 32 for South Dakota, the average for k w is 10.7 and this value is assumed to be constant in the world model; including the outlier the average becomes 12. By plotting w T vs. URR l /P 0 we obtained the linear relation \(w_{l_{\rm T}} = 0.072 URR_{l}/P_0\) which is shown in Fig. C.9. The linear relationship is expected, as increasing the size of the reservoir would increase the total number of wells needed. Equally if we have two reservoirs of the same size we could either have a small number of wells with a large initial production P 0 or a large number of wells with a small initial production P 0. Hence the linear relationship between \(w_{l_{\rm T}}\) and URR l /P 0 was expected.

The value for P 0 appears to have a great deal of variability. However, by analyzing the other U.S. state wells sizes from EIA (2007), we observe that Alaska along with Federal Pacific and Federal Gulf, have abnormally large wells compared to the rest of the U.S., we hence considered the Alaskan well production data as an outlier and ignored the data. Taking the initial production from Nevada, South Dakota, and Alabama, we obtain an average of 18.3 ML/year, which places it in category 16 in the EIA sizes. Hence we assumed that the values of the constants were P 0 = 18.3 ML/year, k w = 10.7, and \(w_{l_{\rm T}}=0.072 URR_{l}/P_0.\)

Appendix D: Amended Model

The amended model \(C_{{\rm p}_{\rm mod}}(t)\) is determined from the method explained in Mohr and Evans (2007), and formally is:

Now f 1(t), f 2(t), and f 3(t) are small polynomials fitted to the production data using least squares method, and formally are:

the f 4(t) is a 3rd degree polynomial. The polynomial was determined by the literature method explained generally in Mohr and Evans (2007). Specifically f 4(t) is the 3rd degree polynomial such that the following equations are solved:

where t 0 ≈ 138 and p(t) is a polynomial to replicate the long-term historic trend and is p(t) = −0.004t 2 + 1.5t−104.6. With the list of equations solved, we obtain t 1 = 153.5, t 2 = 162, and f 4(t) = −0.0012t 3 + 0.51t 2 − 73.4t + 3515.6 for the ideal case. For the pessimistic case it was t 1 = 147.2, t 2 = 153.6, and f 4(t) = −0.0041t 3 + 1.77t 2 − 256.2t + 12353.8. t 1 = 177.8, t 2 = 196.4, and f 4(t) = −0.00009t 3 + 0.036t 2 − 4.3t + 178.8 for the optimistic case.

Rights and permissions

About this article

Cite this article

Mohr, S.H., Evans, G.M. Peak Oil: Testing Hubbert’s Curve via Theoretical Modeling. Nat Resour Res 17, 1–11 (2008). https://doi.org/10.1007/s11053-008-9059-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11053-008-9059-8