Abstract

Climate change is expected to increase the frequency and intensity of natural disasters. Adaptation investments are required in order to limit the projected increase in natural disaster risks. Adaptation measures can reduce risk partially or completely eliminate risk. The literature on behavioural economics suggests that individuals rarely undertake measures that limit risk partially, while they may place a considerable value on measures that reduce risk to zero. This is studied for a case of adaptation to climate change and its effects on flood risk in the Netherlands. In particular, we examine whether households are willing to invest in elevating newly built structures when this is framed as eliminating flood risk. The results indicate that a majority of homeowners (52%) is willing to make a substantial investment of €10,000 to elevate a new house to a level that is safe to flooding. Differences between willingness to pay (WTP) for flood insurance and WTP for risk elimination through elevation indicate that individuals place a considerable value on the latter adaptation option. This study estimates that the “safety premium” which individuals place on risk elimination is approximately between €35 and €45 per month. The existence of a safety premium has important implications for the design of climate change adaptation policies. The decision to invest in elevating homes is significantly correlated with the expected negative effects of climate change, perceptions of flood risks, individual risk attitudes, and living close to a main river.

Similar content being viewed by others

1 Introduction

Climate change is projected to increase flood risks in low-lying coastal regions as a result of more frequent extreme river discharges and sea level rise (IPCC 2007, 2011). This is especially problematic for a low-lying country like the Netherlands, since about 53% of the total population of 16.7 million live and two third of the national income is earned in areas below sea or river water level. The Netherlands is a delta and is at risk from storm surges of the North Sea and peak discharges of the rivers, Rhine, Meuse, and Scheldt (Middelkoop et al. 2001; Aerts et al. 2006; Ward et al. 2008). The risk of potential flood damage may be amplified by a combination of future climate change and socio-economic developments, notably economic growth and urban expansion in locations vulnerable to flooding (Aerts et al. 2008a; Bouwer et al. 2010; te Linde et al. 2011; Klijn et al. 2011). Additional climate change adaptation strategies are, therefore, needed to be able to limit the projected increase in flood risks.

At present, most adaptation measures that are being planned or have been undertaken focus on limiting the probability of flooding by investing in flood protection infrastructure (Deltacommissie 2008). Aerts et al. (2008b) show that a combination of water management strategies, such as raising dikes and flood proofing structures, is likely to be more effective in reducing the likelihood of suffering extreme damage than only heightening dikes. Furthermore, research on flood insurance and the effect of flood insurance on building codes and flood proofing measures indicate that preventive actions undertaken by households (also referred to as mitigation measures) may be an effective means to limit residual flood risk, which is the flood risk remaining after investing in dike infrastructure (Kreibich et al. 2005; Thieken et al. 2006). It is sometimes argued that flood insurance may stimulate the undertaking of such mitigation measures, for instance, through rewarding policyholders with premium discounts or increased levels of coverage (Kleindorfer and Kunreuther 1999; Botzen and van den Bergh 2008; Botzen et al. 2009a). However, flood insurance is not available in the Netherlands at present, which implies that it cannot be used as an instrument to encourage investments in damage mitigation (Botzen et al. 2010). Alternative water management strategies, including flood mitigation measures, are being investigated in the Netherlands. For example, a recently executed study “Attention for Safety” proposes to raise all newly built homes in the Netherlands to several metres above sea level as a viable long run strategy to accommodate rising flood risk (Aerts et al. 2008a). This strategy is proposed as a complementary strategy to traditional dike reinforcements, and is predominantly geared toward lowering potential flood damages. In contrast to mitigation through insurance that limits residual risk, elevating homes almost completely eliminates the residual flood risk of newly built homes.

Experience in the USA, however, indicates that homeowners rarely undertake damage mitigation voluntarily (Kunreuther et al. 2011). In view of this, a relevant question is whether households would be willing to pay for elevating newly built houses. This is examined in this paper using a survey among 473 homeowners in the river delta of the Netherlands. In particular, it is analyzed how many homeowners are willing to invest in elevating a new house which is framed as a measure that eliminates risk, and how this decision relates to perceptions of respondents about the impacts of climate change and risk of flooding as well as household characteristics. The literature on behavioural economics indicates that individuals may place a considerable value on measures that reduce risk to zero levels instead of only limiting risk partially, which has been called the certainty effect (Tversky and Kahneman 1981, 1986; Schmidt 1998). The existence of such a certainty effect would have important implications for adaptation policy since it means that individuals would generally favour adaptation measures that are framed toward obtaining zero risk. This paper provides estimates of a ‘certainty premium’ associated with adaptation options by comparing the results of this survey on demand for elevation with another economic valuation study in which we examined the willingness of homeowners to purchase flood insurance and to invest in measures that reduces risk partially, such as purchasing sandbags or water barriers to avoid low inundation floods. Botzen and van den Bergh (2012) discuss the willingness of homeowners to purchase flood insurance in detail. This comparison provides insights into the premium individuals are willing to pay to forgo flood risk completely, instead of limiting its damage. This provides an indication of the monetary valuation of the prevention of the welfare loss caused by the emotional stress of floods and flood-related health and mortality risks. The main objective of this paper is to estimate individual demand for an elevated house in the Netherlands, and whether or not individuals place a safety premium on adaptation measures that are framed as eliminating risks.

The remainder of this paper is structured as follows. Section 2 discusses the recently proposed water management strategy to elevate newly built homes above potential water levels. Section 3 examines insights from behavioural economics regarding self-protecting behaviour against natural hazards. Section 4 presents the survey and analyses the obtained data. Section 5 concludes.

2 Elevating buildings as a sustainable long run water management strategy

The Netherlands is one of the most densely populated countries in the world with 395 inhabitants per km² and about 16.7 million inhabitants. Roughly half of the Netherlands (the Western part) is below sea level and about 9 million people live in these areas, which are protected by dikes. Also, alongside the Rhine and Meuse rivers there are areas that lie lower than average river water levels. The roots of this situation are historical. Many low-lying parts (which are often called ‘polders’) have been reclaimed from former lakes. Also, subsidence of land induced by agricultural practice is one of the processes that cause increased exposure to floods in already low-lying areas. This situation is further exacerbated by sea level rise.

The low-lying areas in the Netherlands are protected by a system of dikes and embankments along the main rivers and coastal areas. The country is divided into 53 so-called ‘dike-ring’ areas which are geographical units that have their own closed flood protection system that consists of dikes, dams, and sluices. A dike-ring area should be protected against floods by a system of primary embankments, and each dike-ring has been designed such that it meets a safety norm. These safety norms are based on potential high flood levels with a certain probability and have been derived from extrapolations based on historical data. Safety norms have been determined with the use of cost-benefit analysis and vary throughout the country (van Dantzig 1956). Figure 1 shows the different dike-ring areas in the Netherlands and their safety norm, which is either 1/10,000, 1/4,000, 1/2,000 or 1/1,250.

Safety standards of dike-ring areas in the Netherlands. Source: TAW (2000)

So far, investments by the Dutch government have been mainly targeted toward new flood defence infrastructure, such as dikes and storm surge barriers (Kabat et al. 2005). Heightening dikes is effective in terms of its costs and benefits, where the benefits refer to reducing the frequency of flooding (Janssen and Jorissen 1997; Aerts et al. 2008a). However, it is increasingly recognized that only raising dikes is insufficient to realize a sustainable situation in the long run, because heightening dikes merely reduces the probability a flood occurs, while the potential damage of a flood continues to increase. The latter trend is due to two reasons. First, most polder areas in the Netherlands are below mean sea level and can in fact be considered as a bathtub. A higher dike lowers the probability of a flood, but also results in higher maximum floodwater levels and resulting damage may be potentially higher if it fails. This is especially problematic because future water levels during floods are expected to increase as a result of climate change (Klijn et al. 2011). Second, heightening dikes increases feelings of safety among households and investors, which stimulates further economic and urban development in vulnerable areas (Vis et al. 2003). The latter has been called the “levee effect” (Anderson and Kjar 2008). As an illustration, it is projected that between 500,000 and 1,500,000 new houses will be built in the next 30 to 40 years in the Netherlands (MNP 2007). These developments together with economic growth are projected to increase potential flood damage at a constant price level with a factor 6 to 7 in the coming 80 years (Aerts et al. 2008a). It is, therefore, questionable whether only raising dikes will be sufficient to cope with increasing flood risks, or whether additional adaptation measures should address new spatial planning policies that limit development in flood plains and new building codes that make houses less vulnerable to flooding (e.g. Aerts et al. 2008a; Olsthoorn et al. 2008; Klijn et al. 2011). Investing in a variety of measures that lower both the probability and damage of floods may be more effective to increase resilience to climate change (Botzen and van den Bergh 2009a).

Aerts et al. (2008a) examined several long-term strategies to cope with the combined effects of climate change and socio-economic developments on flood risk in the Netherlands. In order to reduce flood damage, the study proposes to elevate new urban areas with sand from the North Sea to 5 m above sea level. Elevating new buildings to such a high level would imply that they do not suffer from any damage during floods in almost all areas in the Netherlands (Aerts et al. 2008a). Given that the Netherlands is a very densely populated country more efficient use of space through ‘multi functional land use’ relieves pressure on land. Building new houses on elevated grounds does not only almost completely eliminate the flood risk of these houses, but potentially realizes additional benefits. For example, in elevated areas, infrastructure, such as pipelines, powergrids and even railroads can be constructed at lower costs by first developing infrastructure above ground and next covering the infrastructure with a layer of sand, on top of which new buildings and residential areas can be developed. Another benefit is that new flood protection for existing buildings can be created through elevating new neighbourhoods around low-lying city centres and connecting these higher grounds with dikes. These new dike-rings around old city centres may protect cities once the existing coastal protection fails during a storm surge. It is noted that living in such elevated areas is not very much different from living in low-lying areas, since whole streets or neighbourhoods would be elevated, so that accessibility, for example, for elderly people, is not impaired.

In order to elevate 1 million new houses in the coming decades about 40 million m3 sand per year should be excavated at the cost of approximately €0.4–1.6 billion per year (Aerts et al. 2008a). The nominal €/$ exchange rate is 0.716 in 2011 (OECD 2011). This also includes the price of adjusting the infrastructure of these new urban areas, such as roads, pipelines, and rail infrastructure. Recent studies show that there is enough sand in the North Sea to meet this demand for sand (van der Meulen et al. 2007). The costs of elevating an individual new house with a surface of 150 m2 to 5 m above sea level have been estimated as €9,000 up to €12,000, depending on the exact amount of sand needed and its price. These costs are quite substantial in an absolute sense but, are only a small percentage of the price of a new house, which is approximately €220,000 on average in 2008 prices. To assess the feasibility of the adaptation strategy to elevate new homes, it is important to know whether or not households are willing to pay costs of this magnitude. This study is the first in its kind that examines this for the Netherlands.

3 Self-protecting behaviour against natural hazards

Individuals are accustomed to taking actions that limit the probability or expected consequences of risks in daily life – witness the wearing of seatbelts, the purchase of insurance against risks such as fire or theft, and the use of sunscreen to block UV radiation. Furthermore, individuals have several options to limit the impact of natural disasters. For example, the consequences of floods can be reduced with various measures that limit damage, such as installing water barriers, adapting buildings to flooding by placing costly installations such as for central heating or the electrical system on higher floors, building with water-proof materials, and replacing furniture above potential water levels. Natural disasters can often be characterized as low-probability, high-impact events. It is commonly observed that many individuals insufficiently prepare themselves for such low-probability risks and do not invest in measures that limit risks (Kunreuther 1978, 1996; Lamond et al. 2009).

Behavioural economics can clarify why many people fail to protect themselves against low-probability natural disasters. Several explanations for such behaviour have been put forward. Individuals can regard investments in natural disaster risk reduction as providing a low return on their money. This is especially true for individuals with short time horizons and high discount rates. Upfront investments costs of damage mitigation measures then loom large compared with future gains of reduced risks. It has been observed that people often have high short run discount rates and make short sighted decisions steered toward immediate returns (e.g. Frederick et al. 2002).

Individual decisions to invest in climate change adaptation measures are further influenced by perceptions of risk and climate change impacts (Grothmann and Pat 2005). Individual perceptions of natural hazard risks may deviate considerably from expert judgment of risk (Slovic 1987; Botzen et al. 2009b). Studies concerning low-probability disasters often find that individuals underestimate the probability of a disaster causing damage and, therefore, decide not to spend money on reducing the risk (Camerer and Kunreuther 1989). This processing of probabilities poses some difficulties when applying the traditional expected utility framework of individual decision making under risk (von Neumann and Morgenstern 1947). This assumes that individuals correctly assess the likelihoods of adverse events and that they process probabilities linearly. The descriptive failure of expected utility theory in explaining individual behaviour under risk is well documented, and several alternative theories have been developed of which prospect theory is the most important (Camerer 1998; Starmer 2000). Prospect theory of individual decision making under risk provides a theoretical basis for weighting of probabilities by individuals (Kahneman and Tversky 1979). Under this theory, individual risk attitudes depend on probability transformations as well as on the value individuals place on losses. Probability transformations are captured by a probability-weighting function, which models the weight that individuals place on specific probabilities in their decision making about protecting against a particular risk. Prospect theory indicates that individuals either ignore low probability risk or excessively focus on low probabilities and overweigh them (Tversky and Kahneman 1992; Etchart-Vincent 2004; Laury et al. 2009).

Few adaptation measures will be undertaken if many individuals ignore the low probabilities associated with natural hazards. An explanation for the observed neglect of low-probability risk is that individuals may unconsciously adopt a certain probability threshold p * below which they do not worry about the consequences of disasters. Disasters with a probability p < p * may be ignored, which implies that cost-benefit analysis for protection are not undertaken, and mitigation measures are not implemented even if they are cost-effective. Another explanation refers to individuals’ bounded rationality or limited cognitive abilities to understand probabilities of risk they face (Conlisk 1996). Individuals who do not know the actual probability of a natural hazard may not take actions to limit risk if acquiring knowledge about the probability involves considerable search costs (Kunreuther and Pauly 2004).

Individual demand for reductions in natural hazard risk depends on the current probability of the natural hazard and the size of the reduction in the probability. Individuals’ subjective valuations of probabilities of losses are often nonlinear (Etchart-Vincent 2004, 2009), which implies that similar reductions in probability can be valued differently depending on the size of the current probability, as is captured by the probability weighting function in prospect theory. An extreme kind of this nonlinearity has been often observed in choices that involve risky and certain outcomes, where individuals appear to place a disproportional large value on certain (risk free) outcomes (Tversky and Kahneman 1981, 1986; Schmidt 1998). This is defined as the certainty effect, which implies that a reduction in the probability of a natural disaster, for instance, from 0.02 to 0.01, is valued less than a reduction from 0.01 to zero. The existence of a certainty effect implies that individuals generally favour measures that eliminate natural hazard risk completely, instead of only limiting its probability. An explanation for the certainty effect in the natural hazard domain is that eliminating a risk instead of reducing its probability implies that fears for mortality because of the hazard are substantially reduced, which is highly valued by individuals. This is supported by risk perception research showing that individual risk perceptions and their willingness to take action to reduce risk are high if a risk is associated with feelings of dread, for example, due to associations with lethality (Slovic et al. 2004). Therefore, designing adaptation measures in a way that risks are eliminated and framing these strategies as such is likely to increase their demand by individuals.

4 Willingness of households to invest in elevating houses

4.1 Survey method

The willingness to invest in elevation of new houses was asked in an extensive online survey that also inquired about the demand for flood insurance among homeowners in the Netherlands. Botzen et al. (2008) give a full description of the survey. The structure of the survey is as follows. The questionnaire opens with questions on the experience of the respondent with flooding and knowledge about the causes of flooding. In addition, several questions are included on the potential consequences of climate change and perceptions of flood risks. Subsequently, a part elicits demand for flood insurance. This is followed by the question on the willingness to invest in elevation. It is explicitly explained that elevating a house would completely eliminate flood risks and, therefore, implies that respondents do not need any flood insurance (see Botzen et al. 2008 for an overview of the questions). In practice, a very small probability of failure of the elevation structure may exist, depending on the applied elevation method, such as when individual buildings are elevated with sand which may wash away during floods. This failure probability is negligible, or even zero, if entire neighbourhoods are elevated to very high levels, as has been proposed by Aerts et al. (2008a). Therefore, this failure probability may be ignored and the survey asked respondents to imagine that elevation would completely eliminate flood risk. The pre-test of the survey revealed that respondents did not protest against this scenario. The respondents are requested to imagine that they are going to buy a new house in 2015 and asked whether they are willing to spend €10,000 to elevate their new house to a level safe against flooding. Elevating houses by sand is not possible in areas with very wet grounds, while such areas pose no problem for elevation with poles. Therefore, we decided to ask respondents whether they are willing to pay this amount for a house on poles instead of a house elevated by sand, so the question is applicable to the living areas of all respondents. Respondents were only informed about the average costs of elevation (€10,000) since the objective of this study is not derive a complete demand curve – as in some contingent valuation studies – but to estimate the average demand for a best estimate of the costs. The questionnaire concludes with the usual socio-demographic questions.

A potential caveat of the survey method is that it is hypothetical in the sense that the respondents who are asked whether or not they are willing to make an investment in elevating a house do not actually have to incur these costs in practice. A reason for this is that personal constraints, such as income, may not be considered as constraints at the time the survey is answered. These views are contradicted by evidence of laboratory and field experiments that reveal similar patterns of behaviour in settings in which a real or hypothetical payment was involved (Mitchell and Carson 1989). Moreover, respondents may answer dishonestly and overstate or understate their true demand for elevation. However, theoretical evidence and experimental studies suggest that strategic behaviour is limited in practice, due to strong counter-strategic behaviour motives, such as altruism and honesty (Mitchell and Carson 1989).

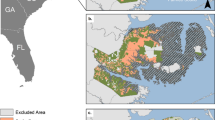

Three pretests (n = 88) were conducted using face-to-face interviews to test the questionnaire and a final pretest (n = 30) was performed to test the online survey. The survey was administered over the Internet using Sawtooth CBC software (www.sawtoothsoftware.com). Respondents were selected from the consumer panel of Multiscope and contacted by e-mail (www.multiscope.nl). The selection of respondents may result in sample selection bias if the probability of an individual agreeing to participate in the survey is related to the construct under investigation (willingness to invest in an elevated house). Therefore, the invitation e-mail did not specify the topic of the survey, in order to prevent selection bias. Another potential source of bias of the survey results may arise if the sample is not representative and only reflects a certain subgroup of the population. This bias has been minimized in our study by carefully selecting the sample of survey respondents. The sample was set up to be representative for the population of Dutch citizens who own a house until an age of 60 years. The sample consists of random draws of panel members who live in the river delta in the Netherlands and includes only homeowners. Reducing flood risk through elevation is more applicable to homeowners because tenants do not bear the (full) cost of flood damage. The resulting total number of completed questionnaires is 473. Figure 2 depicts the location of the respondents to the survey on a map of the Netherlands.

4.2 Sample characteristics

The average age of the respondents is 46 years. The proportion of respondents who are older than 60 years is about 15%, while this is 22% in the actual Dutch population. Fewer older individuals are represented in the Internet sample, because seniors are generally less active on the Internet than younger people. We do not regard this as troublesome in this application, since it concerns buying a new house in the year 2015. This scenario is likely to be less applicable to older homeowners who may be less willing to move, and are likely to stay in their current house or move to an elderly home instead. Furthermore, the increased flood risk posed by climate change is less applicable to older respondents, since it will take several decades before these risks materialize. Our sample has slightly more male (59%) than female respondents and 45% of the respondents have at least one child. About 39% have a bachelor’s or master’s degree as their highest education level. The average after-tax household income is the answer category “between €2501 and €3000 per month”. This is close to the average after-tax income of a household that owns a house in the Netherlands, namely €3025 per month (Statistics Netherlands 2008).

4.3 Willingness to invest in elevation

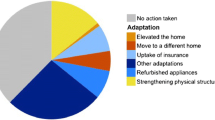

The answers indicate that slightly more than half of the respondents (52%) are willing to purchase an elevated house so that flood risks are eliminated, despite the substantial cost of €10,000. These results suggest that this mitigation measure could be very promising. This provides an excellent basis for undertaking future research on the feasibility and return of elevating newly built structures. Results of the parallel survey (Botzen et al. 2009a) indicate that about 68% of homeowners are willing to invest in sandbags for €15 that can be used as a water barrier during floods, in exchange for a discount on their flood insurance premium (Botzen et al. 2009a). Hence, the proportion of homeowners who are willing to invest in elevation is not that much smaller than the proportion who are willing to invest in water barriers, despite the much higher costs of elevation (€10,000 compared with €15). This suggests that individuals regard a mitigation measure that is framed as completely eliminating flood risk as very attractive. This is consistent with findings in behavioural economics that individuals place a considerable value on reducing small probability risk to a probability of zero, which is the so-called certainty effect (see Section 3). Recent theories in individual decision-making under risk, such as prospect theory, indicate that individuals can place a large value on reducing low-probability, high-impact risks, which is consistent with the survey results (Botzen and van den Bergh 2009b).

The finding that many homeowners are voluntarily willing to invest in reducing risk is in contrast to practical experience in the USA, where few individuals invest in measures that limit damage, such as the strengthening of roofs with the objective to limit wind damage (Kunreuther 2009). The elevation measure examined in this study may be very attractive to individuals, because it completely eliminates risk, instead of only reducing part of the damage. Individuals may place a premium on the elimination of the total risk compared with just reducing the potential damage, for example, because of the stress and anxiety associated with flooding. Information on such a ‘safety premium’ is very valuable for cost-benefit analyses of investments in flood risk reduction, but such premiums are currently not included in the measurement of benefits of flood protection because of a lack of empirical estimates (Kind et al. 2008). As an illustration of the size of this ‘safety premium’, the monthly payments for elevation financed with a mortgage may be compared with the average monthly household willingness to pay (WTP) for flood insurance. The WTP for flood insurance indicates the value individuals place on reducing their financial exposure to flooding, while WTP for elevation can be seen as the value placed on eliminating the emotional stress and mortality risk associated with floods in addition to eliminating potential damage. Suppose that the costs of elevation are financed with an annuity mortgage at the average home mortgage interest rate during the time of the survey of 5% (Statistics Netherlands 2008). In that case, the monthly payment for a mortgage with duration of 20 and 30 years is, respectively, €55 and €67. The average monthly WTP for flood insurance estimated by Botzen and van den Bergh (2012) is approximately €21 based on estimates of a choice model under current climate and socio-economic conditions. The comparison between WTP for insurance and WTP for elevation indeed indicates that many homeowners place a considerable premium on eliminating flood risk completely compared with only financial compensation for damage. This “safety premium” is approximately between €35 and €45 per month. It arises due to a certainty effect that is related to lower stress and mortality (dread) risks due to elevation. Moreover, according to Stewart and Stewart (2001), the certainty effect implies that individuals place a lower value on insurance compared with elimination of risk, because insurers may be unwilling or unable to pay large claims that arise due to natural disasters, which results in uncertainty about actual compensations received by policyholders. This uncertainty is resolved by the elevation measure.

4.4 Factors determining the willingness to invest in elevation

It is useful to examine how the investment decision relates to characteristics of the respondent, expected climate change impacts and perceptions of flood risks. Information about this will allow policy makers to target relevant groups of individuals or households, namely those who will be potentially most interested in investing in elevation. In particular, the government could provide information or subsidies to stimulate elevation of newly built houses or require elevation with building codes. The correlation coefficients of the decision to invest in elevating homes and other variables are shown in Table 1 and will be discussed in detail below.

4.5 Expected impacts of climate change

Perceptions of risk are found to be an important determinant of individual decision making under risk (Slovic 2000). We examine whether respondents who expect climate change to have considerable consequences for the Netherlands are more likely to invest in the elevation measure. This is analyzed by relating the answers to the question regarding willingness to elevate one’s house with a variable that represents the expectations of the respondent about the negative effects of climate change in the Netherlands. The variable has six categories, namely “very small”, “small”, “not small/not large”, “large”, “very large” and “don’t know” (coded as missing). Figure 3 shows the answers to the question about the size of these climatic effects. The majority of the respondents expect the negative effects to be large or very large (62%), while about 14% expect the negative effects to be small or very small. This suggests that most respondents regard climate change as worrisome. The answers to this question relate positively and significantly (at the 5% level) with the decisions to invest in elevation of a new house, as indicated by the correlation statistic shown in Table 1. Only 31% and 46% of the respondents who expect the negative impacts of climate change to be very small and small, respectively, are willing to invest in elevation, while this is 60% if respondents expect very large negative effects of climate change. In other words, the larger homeowners perceive the negative effects of climate change, the greater is the probability they are willing to invest in reducing flood risk.

4.6 Respondents’ perceptions of flood risk and geographical characteristics

Individual perceptions of the flood risk also relate with the decision to invest in elevated homes. In particular, homeowners are more likely to invest in elevating homes the larger they perceive their risk of flooding. Three variables are included that represent perception of flood risk by individuals. The first is based on a question that asks respondents to estimate their probability of flooding on a qualitative scale, with the answer categories “I do not have any flood risk”, “very low”, “low”, “not low/not high”, “high”, “very high”, ”don’t know” (coded as missing). The correlation coefficient of this variable in relation with the decision to invest in elevating houses is positive. About 47% of respondents who answered the first three lowest categories of perceived flood risks are willing to invest in elevation, while this is about 67% for the respondents who expect that they have a high or very high flood risk. The two other variables representing perceptions of flood risk are obtained from a question that asks respondents to rate their flood risk compared with an average resident in the Netherlands, with the answer options “equal to average”, “higher than average”, and “lower than average”. The correlation coefficients indicate that the probability of investing in elevating a house is higher for homeowners who state that they have a higher flood risk than an average resident, and lower for homeowners who indicate that they have a lower flood risk than an average resident. As an illustration of the importance of this effect, 46% of the respondents who expect that they have a lower than average flood risk are willing to invest in elevation, while this is 63% among the respondents who expect that they have a higher than average flood risk. The three correlations sketch a consistent picture.

Next, a variable was constructed that represents respondents who live within 5 km to a main river. This has been done with the use of Geographical Information Systems (GIS), which are related to the respondents’ zip codes. The correlation coefficient shows that homeowners who live close to a main river are more likely to invest in elevating houses, possibly because they are more aware of the risk of flooding in their living area. In particular, 59% of homeowners who live close to a main river are willing to invest in elevating homes, while this is only 46% for homeowners who live further away from a main river.

4.7 Risk attitudes: willingness to purchase flood insurance

Risk averse individuals generally have a positive willingness to pay value for insurance against the residual risk of flooding (e.g., Botzen and van den Bergh 2009b). It seems likely that individuals who are willing to pay for financial coverage against flood damage by insurance are also more likely to invest in elevating homes, than individuals not interested in buying flood insurance. A question has been included in the survey that asks whether respondents are willing to pay for flood insurance under the current flood probability. A dummy variable that represents respondents who answered “yes” to that question correlates positively to the decision to invest in elevating homes. In particular, 63% of homeowners who are willing to pay for flood insurance are also willing to spend €10,000 for elevating their new home. This percentage is only 48% for homeowners who are not willing to purchase flood insurance.

4.8 Socio-economic characteristics

Finally, we examine whether the decision to invest in elevation is related to socio-economic characteristics of the respondent, such as the value of the current house, home contents, age, income, and education. A positive correlation coefficient can be observed for income, but this is only significant at the 10% level (two-tailed test). The other correlations are not statistically significant and are, therefore, not reported. In conclusion, perceptions of flood risks, expected effects of climate, risk attitudes and geographical characteristics are more important determinants in the decision to invest in elevating houses than socio-economic characteristics of the respondent.

5 Conclusions

Climate change may have catastrophic consequences for flood risk in the Netherlands. Socio-economic developments and resulting urban developments are an additional factor of increasing potential flood damage. Most water management investments are currently targeted at controlling flood probabilities through dike reinforcement and heightening. Here it was suggested to examine additional investments in adaptation measures by individuals that lower potential flood damage. A problem with limiting damage by ‘flood proofing’ of houses is that individuals rarely voluntary invest in measures that limit their exposure to natural hazards. Recent studies have suggested that elevating structures may be a good strategy to limit impacts of floods since it would almost completely eliminate the flood risk of elevated houses. An advantage of this strategy is that it may be regarded as very attractive by individuals who place a considerable value on reducing risk to zero, which has been suggested by the certainty effect. This paper has reported the results of a survey that examined the willingness of Dutch homeowners to invest in elevating newly built houses, and whether individuals are willing to pay a premium for eliminating risk instead of only reducing its financial consequences through insurance. This study is the first in its kind that examines this topic, and delivers three main conclusions.

First, the results indicate that a considerable proportion of Dutch homeowners (52%) are willing to invest in elevating their house which has been framed in the survey as a measure that eliminates flood risks. This suggests that this water management strategy holds promise to limit potential flood damage.

Second, a comparison of an indicator of the willingness to pay (WTP) for elevation and WTP for flood insurance indicates that individuals place a considerable premium on eliminating the risk completely, instead of purchasing only financial protection against the risk or investing in measures that only partly reduce damage. A reason for this may be the negative welfare effects of emotional stress and anxiety associated with floods. In addition, the removal of mortality risk and associated dread feelings related to flood risk results in an increased attractiveness of elevation as an adaptation measure. The existence of this ‘certainty premium’ implies that cost-benefit analyses of measures that eliminate natural hazard risk will understate benefits of such measures if the premium is ignored, which is at present the policy practice in the Netherlands. Moreover, it implies that framing or communicating adaptation measures in terms of their potential to eliminate risks is likely to increase their attractiveness to individuals compared with framing measures as reducing risks.

Third, both psychological factors and actual risk levels influence the demand for elevation and the associated ‘safety premium’. This follows from an analysis of individual heterogeneity in demand for elevation which is examined by estimating correlations between demand and perceptions of climate change and flood risk, risk attitudes, and geographical and socio-economic characteristics. Estimated correlations indicate that the decision to invest in elevation of a house is positively related to the size of the expected negative effects of climate change and the perception of flood risks by the respondent. Moreover, homeowners who are willing to purchase flood insurance against the residual risk of flooding and homeowners living close to a main river are more likely to invest in elevating houses.

Elevating buildings in order to limit flood damage would represent a major shift in Dutch flood risk management, which currently focuses on lowering the flood probability to an acceptable (positive) level. Often measures focussed on limiting flood damage are based on investments at the household level, which requires a participatory approach toward flood risk management involving governments and citizens. An understanding of household attitudes toward, and values of, risk reduction measures is fundamental to achieve effective protection against flooding. Future research should focus on assessing how elevation of structures can be precisely organized as a cost-effective, complementary activity to current water management policies in limiting climate change induced flood risks. In addition, the potential benefits of elevating new homes in terms of preventing flood damage may be examined in more detail with the use of ‘catastrophe models’. The results of this study provide a basis for further research, as it shows that willingness of homeowners to make a substantial investment to elevate homes is sufficiently large. Translating these findings to climate change adaptation research in general, the existence of a certainty effect indicates the usefulness of exploring adaptation measures that eliminate natural disaster risk instead of only reducing risks.

References

Aerts JCJH, Renssen H, Ward PJ, de Moel H, Odada E, Goosse H (2006) Sensitivity of global river discharges under Holocene and future climate conditions. Geophys Res Lett 33(19):L19401

Aerts JCJH, Sprong TA, Bannink B (eds) (2008a) Aandacht voor veiligheid. VU University Press, Amsterdam

Aerts JCJH, Botzen WJW, van der Veen A, Krywkow J, Werners S (2008b) Dealing with uncertainty in flood management through diversification. Ecol Soc 13(1):41

Anderson W, Kjar SA (2008) Hurricane Katrina and the levees: taxation, calculation, and the matrix of capital. Int J Soc Econ 35(8):569–578

Botzen WJW, van den Bergh JCJM (2008) Insurance against climate change and flooding in the Netherlands: present, future and comparison with other countries. Risk Anal 28(2):413–426

Botzen WJW, van den Bergh JCJM (2009a) Managing natural disaster risk in a changing climate. Environ Hazards 8:209–225

Botzen WJW, van den Bergh JCJM (2009b) Bounded rationality, climate risks and insurance: is there a market for natural disasters? Land Econ 85(2):266–279

Botzen WJW, van den Bergh, JCJM (2012) Monetary valuation of insurance against flood risk under climate change. Int Econ Rev (in press)

Botzen WJW, van den Bergh JCJM, Aerts JCJH (2008) Report on a survey about perceptions of flood risk, willingness to pay for flood insurance, and willingness to undertake mitigation measures: explanation of the survey instrument. VU University Amsterdam. http://ivm45.ivm.vu.nl/adaptation/project/files/File/NCIP/Botzen%20vdBergh%0Aerts-Report%20Survey%20perc%20flood%20risk.pdf

Botzen WJW, Aerts JCJH, van den Bergh JCJM (2009a) Willingness of homeowners to mitigate climate risk through insurance. Ecol Econ 68(8–9):2265–2277

Botzen WJW, Aerts JCJH, van den Bergh JCJM (2009b) Individual flood risk perceptions and their relations with socio-economic and objective risk factors. Water Resour Res 45:W10440

Botzen WJW, van den Bergh JCJM, Bouwer LM (2010) Climate change and increased risk for the insurance sector: a global perspective and an assessment for the Netherlands. Nat Hazards 52(3):577–598

Bouwer LM, Bubeck P, Aerts JCJH (2010) Changes in future flood risk due to climate and development in a Dutch polder area. Global Environ Chang 20:463–471

Camerer C (1998) Bounded rationality in individual decision making. Exp Econ 1(2):163–183

Camerer CF, Kunreuther HC (1989) Decision processes for low probability events: policy implications. J Pol Anal Manag 8(4):565–592

Conlisk J (1996) Why bounded rationality? J Econ Lit 34:669–700

Deltacommissie (2008) Samen werken met water: Een land dat leeft, bouwt aan zijn toekomst. Bevindingen van de Deltacommissie 2008. ISBN 978-90-9023484-7

Etchart-Vincent N (2004) Is probability weighting sensitive to the magnitude of consequences? An experimental investigation on losses. J Risk Uncertainty 28(3):217–235

Etchart-Vincent N (2009) Probability weighting and the ‘level’ and ‘spacing’ of outcomes: an experimental study over losses. J Risk Uncertainty 39:45–63

Frederick S, Loewenstein G, O’Donoghue T (2002) Time discounting and time preference: a critical review. J Econ Lit 40(2):351–401

Grothmann T, Pat A (2005) Adaptive capacity and human cognition: the process of individual adaptation to climate change. Global Environ Chang 15:199–213

IPCC (2007) In: Solomon S et al (eds) Climate change 2007: the physical science basis. Contribution of working group I to the fourth assessment report of the intergovernmental panel on climate change. Cambridge University Press, Cambridge and New York

IPCC (2011) Special report on managing the risks of extreme events and disasters to advance climate change adaptation. In press: http://www.ipcc-wg2.gov/SREX/

Janssen JPFM, Jorissen RE (1997) Flood management in the Netherlands: Recent development and research needs. In: Casale R, Havno K, Samuels P (eds) Ribamod, river basin modelling, management and flood mitigation, concerted action, pp 89–104

Kabat P, van Vierssen W, Veraart J, Vellinga P, Aerts J (2005) Climate proofing the Netherlands. Nature 438(7066):283–284

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–291

Kind J, Gauderis J, van Velzen E., Silva W (2008) Waterveiligheid 21e eeuw: Kengetallen Kosten-batenanalyse. Rapport WD 2008.044. Ministerie van Verkeer en Waterstaat, Den Haag

Kleindorfer PR, Kunreuther HC (1999) The complementary roles of mitigation and insurance in managing catastrophic risks. Risk Anal 19(4):727–738

Klijn F, de Bruijn KM, Knoop J, Kwadijk J (2011) Assessment of the Netherlands’ flood risk management policy under climate change. Ambio. doi:10.1007/s13280-011-0193-x

Kreibich H, Thieken AH, Petrow T, Müller M, Merz B (2005) Flood loss reduction of private households due to building precautionary measures: lessons learned from the Elbe flood in August 2002. Nat Hazards Earth Syst Sci 5(1):117–126

Kunreuther HC (1978) Disaster insurance protection: public policy lessons. Wiley & Sons, New York

Kunreuther HC (1996) Mitigating disaster losses through insurance. J Risk Uncertainty 12(2–3):171–187

Kunreuther HC (2009) Reducing losses from catastrophic risks through long-term insurance and mitigation. Soc Res 75(3):819–854

Kunreuther HC, Pauly MV (2004) Neglecting disasters: why don’t people insure against large losses? J Risk Uncertainty 28(1):5–21

Kunreuther HC, Michel-Kerjan EO, Doherty NA, Grace MF, Klein RW, Pauly MV (2011) At war with the weather: managing large-scale risks in a new era of catastrophes. MIT, Cambridge

Lamond JE, Proverbs DG, Hammond FN (2009) Accessibility of flood risk insurance in the UK: Confusion, competition and complacency. J Risk Res 12(6):825–841

Laury SK, Morgen-McInnes M, Swarthout JT (2009) Insurance decisions for low-probability losses. J Risk Uncertainty 39:17–44

Middelkoop H, Daamen K, Gellens D, Grabs W, Kwadijk JCJ, Lang H, Parmet BWAH, Schädler B, Schulla J, Wilke K (2001) Impact of climate change on hydrological regimes and water resources management in the Rhine basin. Clim Chang 49(1–2):105–128

Mitchell RC, Carson RT (1989) Using surveys to value public goods: The contingent valuation method. Resources for the Future, Wahington

MNP (2007) Nederland later: tweede duurzaamheidsverkenning, deel fysieke leefomgeving Nederland. Milieu- en Natuurplanbureau (MNP), Bilthoven http://www.mnp.nl/nl/publicaties/2007/Duurzaamheidsverkenning2Nederlandlater.html. Cited 10 Dec 2010

OECD (2011) Statistics: exchange rates. Organisation for Economic Co-operation and Development (OECD). www.oecd.org. Cited 4 Jan 2012

Olsthoorn X, van der Werff P, Bouwer LM, Huitema D (2008) Neo-Atlantis: the Netherlands under a five-meter sea level rise. Clim Chang 91(1–2):103–122

Schmidt U (1998) A measurement of the certainty effect. J Math Psychol 42(1):32–47

Slovic P (1987) Perception of risk. Science 236(4799):280–285

Slovic P (2000) Perceptions of risk. Earthscan, London

Slovic P, Finucane ML, Peters E, MacGregor DG (2004) Risk as analysis and risk as feelings: some thoughts about affect, reason, risk, and rationality. Risk Anal 24(2):311–322

Starmer C (2000) Developments in non-expected utility theory: the hunt for a descriptive theory of choice under risk. J Econ Lit 38(2):332–382

Statistics Netherlands (2008) StatLine database. Centraal Bureau voor de Statistiek (CBS). www.cbs.nl. Cited 9 Jan 2012

Stewart RE, Stewart BD (2001) The loss of the certainty effect. Risk Manag Insur Rev 4(2):29–49

te Linde A, Bubeck P, Dekkers JEC, de Moel H, Aerts JCJH (2011) Future flood risk estimates along the river Rhine. Nat Hazards Earth Syst Sci 11:459–473

Technical Advisory Committee for Flood Defense (TAW) (2000) From probability of exceedance to probability of flooding: Towards a new safety approach. Technische Adviescommissie voor de Waterkeringen, Dienst Weg- en Waterbouwkunde (DWW) Rijkswaterstaat, Delft

Thieken AH, Petrow T, Kreibich H, Merz B (2006) Insurability and mitigation of flood losses in private households in Germany. Risk Anal 26(2):383–395

Tversky A, Kahneman D (1981) The framing of decisions and the psychology of choice. Science 211(4481):453–458

Tversky A, Kahneman D (1986) Rational choice and the framing of decisions. J Bus 59(4):251–278

Tversky A, Kahneman D (1992) Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncertainty 5(4):297–323

van Dantzig D (1956) Economic decision problems for flood prevention. Econometrica 24(3):276–287

van der Meulen MJ, van der Spek AJF, de Lange G, Gruijters SHLL, van Gessel SF, Nguyen BL, Maljers D, Schokker J, Mulder JPM, van der Krogt RAA (2007) Regional sediment deficits in the Dutch lowlands: implications for long-term land-use options. J Soil Sediments 7(1):9–16

Vis M, Klijn F, de Bruijn KM, van Buuren M (2003) Resilience strategies for flood risk management in the Netherlands. Int J River Basin Manag 1(1):33–40

von Neumann J, Morgenstern O (1947) The theory of games and economic behavior, 2nd edn. Princeton University Press, Princeton

Ward PJ, Renssen H, Aerts JCJH, van Balen RT, Vandenberghe J (2008) Strong increases in flood frequency and discharge of the River Meuse over the late Holocene: Impacts of long-term anthropogenic land use change and climate variability. Hydrol Earth Syst Sc 12(1):159–175

Acknowledgements

We thank our colleagues at the Institute for Environmental Studies (IVM) for constructive comments on the questionnaire. This research project was carried out as part of the Dutch National Research Program ‘Climate Changes Spatial Planning’ (www.klimaatvoorruimte.nl) and has been partly funded by a Veni grant of the Netherlands Organisation for Scientific Research (NWO).

Open Access

This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Botzen, W.J.W., Aerts, J.C.J.H. & van den Bergh, J.C.J.M. Individual preferences for reducing flood risk to near zero through elevation. Mitig Adapt Strateg Glob Change 18, 229–244 (2013). https://doi.org/10.1007/s11027-012-9359-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11027-012-9359-5