Abstract

The objective o this study is to empirically measure the performance of Dutch university’s technology transfer. Dutch universities are ranked high on research output but there is scarce evidence about the commercialization of research-based innovation. We present a novel approach to measure the performance of university technology transfer using meta data analysis. We use data on research output as meta-data to estimates the potential for technology transfer, and data about the actual technology transfer projects as measured by patents, license agreements and spin-offs. We tested our model for Dutch universities and validated it using data from private and state universities in the US. Our results suggest that most Dutch research universities have poor performance while technical Dutch universities and academic medical center perform well. We pilot-tested our model for selected US universities and the result confirm the validity of our approach. Our approach contributes to the literature on university technology transfer by adding a novel approach for measuring performance of university technology transfer while taking into account university research as the potential for technology transfer.

Similar content being viewed by others

1 Introduction

In the last few decades, the economies of developed countries have become increasingly knowledge dependent (Brinkley and Lee 2006). Knowledge has become an essential element of the production of products and services, and is nowadays the key engine of productivity and long-term economic growth (Acs and Audretsch 2010; Agrawal 2001; Ndonzuau et al. 2002). Therefore, economies in the Western world are becoming increasingly dependent on knowledge producers. A substantial amount of knowledge is produced at universities and research centers (Löfsten and Lindelöf 2002). However, for economies to benefit from this knowledge, the results of research need to be transferred from the university to society. This specific form of knowledge valorization is known as university technology transfer.

Forthcoming, knowledge producers such as universities and research centers are gaining an increasingly prominent role in Western economies (Vinig and Rijsbergen 2010). The results of university research need to be successfully ‘transferred’ from the university to commercial application in order for society to benefit though (Agrawal 2001). This process is also known as technology transfer, or valorization, and has been defined as the transfer of the results of research from universities to the commercial sector’ by Bremer (1999).

Universities are not equally successful in commercializing their knowledge. In the United States, a number of universities have demonstrated considerable success in their valorization activities (Carlsson and Fridh 2002). The Association of University Technology Managers (AUTM) has shown that the number of patents granted to U.S. universities on an annual basis has risen from less than 300 in 1980 to 3,278 in 2005, while licensing of these patents to existing firms has increased fourfold since 1991. Moreover, the revenue generated through these licensing activities in the U.S. increased from almost $160 million in 1991 to $1.4 billion in 2005, a year in which 628 university spin-offs were launched as well. This marks a global phenomenon, with vast increases in patenting, licensing, and spinoff formation observable across Canada, Australia, and Europe (Wright et al. 2007). Technologies that have been transferred from research to industry have resulted in some of the most innovative companies of the past decades, including Genentech Inc., Plastic Logic, and Google. It therefore comes as no surprise that technology transfer is generally recognized as an immensely valuable process, improving local economic development, generating novel products and services, and generally enhancing the quality of life through various spill-over effects (Shane 2004).

Unfortunately, no such description can be given regarding the technology transfer process in the Netherlands. Indeed, the very few studies performed that assess the output of the Dutch universities’ valorization activities were unable to provide clear answers regarding their performance, mostly due a lack of obtained data (Bakker 2010). Nevertheless, quantifying the commercial output generated via the technology transfer activities of universities relative to their research output is an important measure for the success and effectiveness of this very process. Especially since commercialization is becoming a more prominent aspect of a universities’ objectives and many of its activities are funded with public money, shedding more light on the direct commercial output is much needed to acquire a full understanding of the valorization activities of a university and its relative success (Ndonzuau et al. 2002).

2 University technology transfer

The rapid increase in university technology transfer has attracted attention in the academic literature (Rothaermel et al. 2007; Carlsson and Fridh 2002; Jensen and Thursby 2002; Di Gregorio and Shane 2003; Baldini 2006; Anderson et al. 2007; Thursby and Thrusby 2007). This emerging literature is interdisciplinary, with contributions from scholars in many disciplines, such as economics, sociology, political science, public administration, engineering, and in several fields within management, such as strategy, entrepreneurship, human resource management, and technology and innovation management. There is also some international evidence for this phenomenon. Due to the complexity of the issues raised by the rise of technology transfer at universities, many authors have employed qualitative methods to address key research questions.

2.1 Measuring technology transfer performance

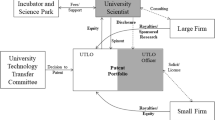

The term ‘technology transfer’ is broad and not easily measurable (Agrawal 2001). The technology transfer process (Fig. 1), includes different stockholders (Table 1), and the performance is measured by monetary income generated by the university. Using income from technology transfer however, does not measure real performance as it does not provide nor is it based on the potential for technology transfer based on university research. High dollar income from technology transfer may be low or moderate performance if the potential is higher than what is represented by the Dollar income.

The technology transfer process. Source: Siegel et al. (2007)

Bremer (1999), defines technology transfer as the transfer of the results of research from universities to the commercial sector. There are varieties of means to transfer research results from universities to society. The traditional form is by publishing research results the commercial forms are by licensing, patenting or spin-offs. Bongers et al. (2003) identified 10 other channels to transfer knowledge from university to the commercial sector.

For a long time universities have operated as ivory towers disconnected from practice and society (Ndonzuau et al. 2002) with research and teaching being core activities without any concern to commercialization. In the 1980s entrepreneurial activities were first stimulated by legislative changes, such as the Bayh–Dole Act in the USA (Morgan et al. 2001; Siegel et al. 2007; Litan et al. 2007). The Bayh–Dole Act made it possible for universities to claim the legal rights of inventions made by faculty personnel. In Europe, similar legislative changes were made in the 1990s which stimulated universities to commercialize knowledge (Baldini 2006; Rasmussen et al. 2006; Siegel et al. 2007).

2.2 Technology transfer office (TTO)

The majority of universities in the Western world have incorporated technology transfer in the university objectives, besides the traditional goals of education and research (Rasmussen et al. 2006). To assist and simulate technology transfer, the majority of universities have established technology transfer offices (TTOs). These offices facilitate the process of commercial knowledge transfer from university to industry (Siegel et al. 2007). TTOs are primarily responsible for the protection of university created IP, and the management of the commercialization process (Markman et al. 2005).

In recent years, Western universities have become increasingly entrepreneurial and are becoming network organizations (Butera 2000; Rothaermel et al. 2007). The move from a traditional to a more entrepreneurial university is difficult and has been criticized by numerous researchers. The main criticism is the loss of integrity and independence of universities (Goldfarb and Henrekson 2003). Furthermore, the ambiguous relationship of scientists to money and other cultural factors hinder the process of technology transfer (Ndonzuau et al. 2002). However, some researchers see benefits in a more entrepreneurial university. Baldini (2006) showed that technology transfer activities and scientific excellence are mutually reinforcing, and shows benefits from technology transfer activities for university, industry and society.

Despite the fact that nearly all universities carry out technology transfer activities, the distribution of successful commercialization activities is highly skewed among universities (Di Gregorio and Shane 2003; Litan et al. 2007). Most of the TTOs are not even making money out of their commercialization activities (Rasmussen et al. 2006). An interesting question is why some universities are more successful in commercializing knowledge than others. Several authors have tried to answer this question for commercialization activities in general (Goldfarb and Henrekson 2003; Rasmussen et al. 2006; Litan et al. 2007), or for specific forms of commercialization such as patenting (Siegel et al. 2007), licensing (Shane 2004; Siegel et al. 2007) or spin-offs (Wright et al. 2007; Link and Scott 2005; Gras et al. 2008).

Some studies focused on institutions that facilitate commercialization and entrepreneurship, such as TTOs (Rogers et al. 2000; Wright et al. 2007), science parks (Löfsten and Lindelöf 2002) and incubators. Siegel et al. (2007) to evaluate and explain the relative productivity of US university TTOs, and reported that organizational practices explain a significant percentage of the variations in performance. Thursby and Thursby (2007) reported that growth in licensing and patenting by universities reflects an increase in the willingness of professors to patent, not a fundamental shift from basic to applied research. Di Gregorio and Shane (2003) concluded that the two key determinants of the rate of formation of university-based start-ups are faculty quality and the ability of the university and inventor(s) to assume equity in a start-up in lieu of licensing royalty fees.

The authors also found that a royalty distribution formula that is more favorable to faculty members reduces start-up formation, a finding that is confirmed by Markman et al. (2005). Di Gregorio and Shane attributed this finding to the higher opportunity cost associated with launching a new firm, relative to licensing the technology to an existing firm. Other studies have focused on agents involved in technology transfer, such as academic scientists. These authors assessed the antecedents and consequences of faculty involvement in university technology transfer, such as their propensity to patent, disclose inventions, co-author with industry scientists, and form university-based start-ups. A paper by Jensen and Thursby (2002) demonstrated that inventor involvement in university technology transfer potentially attenuates the deleterious effects of informational asymmetries that naturally arise in technological diffusion from universities to firms.

The most common commercialization strategy used by TTO’s is licensing; an official agreement in which the legal rights to utilize and invention for commercial purposes are sold by the licensor, the university in this case, to a licensee, usually an established company, in return for revenues (Bray and Lee 2000). The total revenue is composed of an upfront fee upon establishment of the agreement and continuous annual royalty payments of which the amount is determined be the commercial success of the technology (Bray and Lee 2000). Cases in which the licensee is a new entrepreneurial company formed around a specific technological innovation are also referred to as university spin-offs (Shane 2004). Instead of ongoing royalty payments derived from a licensing agreements, universities often take an equity stake in a spin-off (Shane 2004). The revenue generated by an equity stake results from selling the shares at an IPO or at an acquisition (Bray and Lee 2000). Both technology transfer mechanisms thus differ in their commercial potential, and the total revenue generated by a TTO is the total of these combined assets.

2.3 Technology transfer performance

Given the widespread activity of the TTO’s of most universities in Western society, one would expect to observe successful commercialization distributed roughly equally amongst the different universities. However, the opposite is true; the distribution of successful technology transfer resulting in economically viable returns is ‘highly skewed among universities’ (Vinig and Rijsbergen 2010). Rasmussen et al. (2006) noted that a substantial number of the universities that have established TTOs have not succeeded in generating significant amounts of revenues. In fact, only the universities with the highest academic track record have received multi-million dollar revenue streams as part of their technology transfer activities (Rasmussen et al. 2006). In the case of The Netherlands, no multimillion corporate has yet been observed that started out as a spinoff from university research in the Netherlands so far.

Measuring the performance of technology transfer is based on the income generated from these activities. MIT for example, reports a cash income of $147.5 million, royalties amounting to $54.09 million, and equity cash-ins of $2.75 million, with a total of 694 invention disclosures, 305 patent applications, 81 license agreements, and 16 spin-off companies started in fiscal year 2012 (MIT 2012).

Bray and Lee (2000) analyzed the revenue generated by the TTOs of several universities in the U.S. and compared the financial returns of equity positions in spin-off companies to licensing fees. The license deals that were analyzed consisted of a license fee ranging between $10,000 and $250,000 and an annual income based on royalties averaging $63,382 in 1996 (Bray and Lee 2000). However, the average value of the equity that was sold in the 16 spin-off companies included in their research was $1,384,242, indicating that even despite a failure rate of 50 %, taking an equity position is still more profitable than a licensing deal (Bray and Lee 2000).

None of these performance measurements based on income does measure the real performance based on the potential. Does the $147.5 in the case of MIT above represent 100, 50 or 10 % of the potential for technology transfer in MIT?

In this study we consider the potential for technology transfer based on research output in terms of publications as well as the actual technology transfer based on number of patents, spin-offs and license agreements for measuring the performance of university technology transfer of Dutch universities based on their potential.

Considering that virtually all technology transfer output is a result of academic research, together with the fact that annual publications are perhaps an more readily available representation (annual publications are the most accurate representation) available to measure academic research, makes academic output an acceptable indicator of (a good indicator for), university’s potential for technology transfer. That said, it would probably be more accurate for future research to take only the annual publications into account that fall into the domains of technology transfer output’s most common categories: medicine, engineering and natural sciences.

3 Methodology

3.1 Sample

Dutch universities rank high on research output in all international rankings. Considering the limited research on the technology transfer offices of Dutch universities so far, it seems that the concept is still at a relatively early stage. The TTOs of most universities have been established within the last decade, and little is known about the actual performance of TTOs in terms of their quantifiable output. The majority of available literature on the topic of technology transfer is based on TTOs and universities in the United States. It does not follow that the reported successes of a number of these TTOs also translates to TTOs in the Netherlands. In order to account for this gap in knowledge regarding the performance and output of Dutch TTOs, this research investigated the technology transfer output of a selected number of Dutch universities and their associated technology transfer offices. The selection TTOs and university research institutes is based on Elsevier’s selection of the ‘most enterprising universities in the Netherlands’ for 2011, a ranking that classified research universities on a number of metric related to valorization (Elsevier 2011). The following universities are included in our study.

Research Universities | Technical Universities | Academic Medical Centers |

|---|---|---|

Leiden University | Delft University of Technology | Leiden University Medical Center |

Radboud University | University of Twente | Utrecht University Medical Center |

Utrecht University | Eindhoven University of Technology | University of Groningen Medical Center |

University of Groningen | Erasmus University Medical Center | |

University of Amsterdam | University of Amsterdam Academic Medical Center | |

Vrij Universieteit Amsterdam | Vrije Universiteit Amsterdan Medical Center | |

Wageningen University |

3.2 Data collection

We used the annual reports of university’s technology transfer in the period 2006–2011, data from the online resources and data from the Central Statistical Bureau (CBS). The annual reports provide a complete overview of the university’s valorization activities. The annual reports were therefore investigated to provide insights into the annual number of patent applications, licensing agreements, the formation of university spin-off companies, and the financial revenue generated through these activities. This data was subsequently used to construct an overview of the TTO output per university. However, in many cases the annual reports and institute websites did not provide full disclosure of these numbers, causing the obtainable data from annual reports regarding TTO output to be incomplete. To fill in these gaps and to acquire a more complete picture of TTO output for each of the included research institutes, inquiries and repeated follow-up inquiries were made to the respective institutes per email, phone and semi-structured interviews with TTO personnel. This resulted in the obtainment of additional data for a number of research institutes.

Our approach to measuring performance includes analysis of the potential using meta data from which we can infer the potential of university technology transfer. By doing so, a valorization score was established that allowed for the categorization of the performance output according to a uniform metric.

The assumption we make is that research output in terms of published articles in academic journals provides a good proxy for the potential of valorization. These data is also included in the year report of all Dutch universities. We assume that from the total number of the publication, a certain percentage describe innovative research which results in a potential technology, knowledge that can be commercialized. Therefore we can estimate the potential for technology transfer. The actual performance of university technology transfer can therefore be measured against the potential.

3.3 Calculating technology transfer performance

We developed our model using the assumption that research output provides a good estimation of the potential for the university’s technology transfer. We used the values of 1, 2 and 3 % of the total journal publications (TJP), to represent the potential for technology transfer, potential valorization projects (PVP in %). For example, if an institute published 1,500 scientific papers in a year and 1 % is used as the valorization potential percentage, then it represent a potential of 15 valorization project (PVP). The valorization performance score (PER), is then calculated by dividing the actual valorization projects (AVP) output by the PVP. The AVP, was retrieved from the yearly report and it includes patents, spin-offs and license agreements. The technology transfer performance (PER), is calculated as:

where

Using this approach we normalize university technology transfer based on the maximum estimated potential for technology transfer based on research output. In a case when all potential technology transfer is utilized AVP = PVP we get the value of 1. Value of PER => 1 represents good technology transfer performance by which all potential valorization has been utilized. Lower than 1 score represent less than optimal (0.6–0.9), or weak performance (0–0.5). Score of higher than 1 captures all additional valorization performance in case the innovation from research was not published in academic article. This may be the case for innovations for which the university decides to apply for patent. In such cases the scientists is asked to wait with publication after applying for patent in order not to disclose the innovation in public domain.

The annual number of granted patent applications measures the patenting output. This serves as an indicator of an institutes’ intention to commercialize its research results. Nevertheless, patent output cannot serve as a perfect measurement of an institutes’ valorization performance since a number of inventions with commercial applications are likely not to be patented or even patentable, for a variety of reasons (Baldini 2006). License output is measured by the annual number of license agreements a TTO makes with external companies in return for royalty income. Spin-off formation is measured by the annual number of spin-off based on the university’s IP in which the university has equity stake that are founded (Shane 2004). Financial income is measured as all annual income or loss reported by a TTO to be the result of royalty income from license agreements, the value estimated from current equity or derived from selling equity at an IPO, and the costs of filing for patents.

We calculated the performance of Dutch universities and validated them by calculating performance of university technology transfer of selected US university (Private and state university) using data from the AUTM technology transfer survey.

3.4 Results

3.4.1 Total journal publications (TJP)

To obtain the required data on both the research and the commercial output for the 2006–2011 period, the annual reports of the related research institutes or the TTO itself, if available, were studied. This approach was required since none of the TTO websites provided a full description of its commercial output. Nevertheless, the majority of annual reports could be accessed through the websites of the research institutes. In case an annual report was not available for a specific year, the information services were contacted. The annual reports were able to provide a complete picture of the annual number of scientific publications for each university. Table 1 shows an overview of the number of scientific publications for all included research institutes.

3.4.2 Actual valorization projects (AVP)

A similar analysis of the universities’ annual reports was used to assess the commercial output of each TTO in terms of patent applications, license agreements, and spin-off formation. However, the majority of annual reports showed only an incomplete picture of this commercial output, and some annual reports did not include any information regarding this at all. Remarkably enough, even the different annual reports of the same university displayed a large extent of inconsistency in their disclosure on technology transfer output. For example, the 2009 and 2011 reports of one university might include a concise description of the number of patent applications and spin-offs formed by its TTO, while the 2010 report of the same university does not include any information on these numbers at all. These observations alone indicate that there is indeed a lack of structured guidelines on measuring and reporting TTO results in the Netherlands, a preliminary result that is significant in itself already. In case annual reports did not include complete information on the three quantified metrics of this study, the technology transfer offices themselves were contacted via email or phone. In a number of cases this resulted in additional data. The commercial output of the research institutes is displayed in Table 2 by the number of patents (P), license agreements (L) and spin-offs (S) Table 3.

4 University technology transfer performance: valorization score

Table 4 displays the expected number of successful valorization attempts based on the estimation that 1, 2, or 3 % of all scientific publications in a given year represent innovation with commercialization potential. The actual number of successful valorization projects is based on the total number of patent applications, license agreements, and spin-offs, and is shown in Table 5 based on the information disclosed in the annual reports or after follow-up. The university technology transfer performance—valorization scores are reported in Table 6.

From our sample of Dutch universities four scored a valorization score higher than 1.0 in at least 1 year between 2006 and 2011 and the number of valorization score higher than 1.0 in 13 instances in total. It has to be noted however, that a score of >1.0 was only reached when assuming a valorization potential percentage of 1 %.

Of the four research institutes that reported a complete dataset with a calculated valorization score above 1.0, three are technical universities and one is a medical center. Even though it seems to be expected that these specific institutes scored a positive valorization score, given that the research conducted in these institutes is more innovative by nature and the stock of available technology significantly larger, it further illustrates that regular universities in the Netherlands are currently far behind when it comes to their technology transfer performance.

The results of our calculation (Table 6), demonstrate that under the assumption that only 1 % of the research represent potential for technology transfer, only technical universities and one academic medical center perform well. All research university demonstrate poor technology transfer performance.

To put the valorization scores of the selected Dutch institutes in a more meaningful perspective, four United States universities—two private universities with a reputation of having high commercial outputs and two state universities without such reputation, were analyzed regarding their technology transfer performance using the same model we used for Dutch universities. Their research output was determined indirectly through the ARWU university rankings. The commercial output was available in the annual reports or the website of the TTOs Table 7.

Based on these results, it is clear that the universities renowned for their technology transfer performance are indeed substantially more successful than their Dutch counterparts, indicating that their TTOs are more effective. Stanford and MIT are universities with a budget many times the size of that of any Dutch research institute, and their superior valorization output is therefore to be expected. Still, it acknowledges the preconception that these type of universities are more effective in their technology transfer processes. This situation seems different for the state universities, as both Iowa State University and Mississippi State University show lower valorization scores. This is congruent with research indicating an overall poor performance of TTOs worldwide and a highly skewed distribution of overall performance amongst universities (Vinig and Rijsbergen 2010; Rasmussen et al. 2006).

5 Discussion

We present a novel approach to estimate the actual performance of university technology transfer based on the potential for technology transfer. The current literature on the performance of technology transfer uses monetary value only by calculating revenues from patents, license agreement and equity positions in spin-offs. This however does not provide proper performance measure, as it does not include or based on the potential for technology transfer and how much of the potential has been realized. Using revenue by itself does not measure real performance as it does not provide nor is it based on the potential for valorization. High dollar income from technology transfer may be low or moderate performance if the potential is higher than what is represented by the Dollar income.

Using revenue instead of the number of patents, licenses and spin-off may also give an acceptable representation of university technology transfer as it is not uncommon for a single license or spin-off IPO to generate the majority of a university’s revenue.

Our model solves this limitation and therefore provides a comprehensive measure of university technology transfer performance based on the actual potential measured in terms of research output.

We tested our approach for Dutch universities and the results confirm the validity of our approach. Out of all universities in our sample the ones that have high technology transfer performance (PER > 1) are the three technical universities and one academic medical center which is inline with the Elsevier ranking of the most enterprising universities in The Netherlands. We then tested our approach using data from private and state universities in the US. The result confirms the validity of our approach—our calculation shows that MIT and Stanford have PER > 1 and the two state universities have PER < 1.

Dutch universities have high score of academic performance measured by research output. However the technology transfer performance for eleven of the ‘most enterprising’ Dutch universities is poor. With the exception of Dutch technical universities and academic medical center, all Dutch research universities fail to translate their high research output into successful technology transfer and commercialization.

By adding the university’s potential for technology transfer when calculating performance we provide an important parameters for universities and TTO’s for developing and improving their technology transfer strategy.

Given the importance of technology transfer performance for driving growth and innovation in a knowledge economy, our approach offers a way to evaluate actual technology transfer performance of universities, taking into consideration the potential for technology transfer.

Future refinements of our study may use research publications only from hard sciences such as physical sciences, engineering and natural sciences. Further, future studies may compare the relative efficacy of other measures such as research funding, patents, income from technology transfer or develop a measure that is a weighted composite of two or more measures.

Additional development of the model can be by including research funding—Dollar spent by the university on research in our model. Adding this parameter to our model can further refine the measure for technology transfer potential and provide more accurate measurement of university’s potential and therefor of the university’s performance.

6 Limitation of this study

A limitation of this study is that there is still a significant inconsistency in the reports and disclosure of information regarding the actual commercialization performance of the universities in our study. The data on actual commercialization (patents + license + spin-offs), could be retrieved only for 42 out of the 66 datasets and was not complete for all years in our sample. Other limitation is that we do not capture technology transfer that is done through student’s spin-offs. Students created startups do not represent university IP as students are not university employees therefore their projects’s IP is not owned by the university. Fortunately, the lack of transparency by universities seems to become more widely acknowledged. The European Commission has indicated the need to ‘generate more and better data on commercialization’ as the task with the absolute highest priority in order to complete the implementation of a composite index for knowledge transfer that can be used across all universities in Europe to provide a much required overall view for improving technology transfer (Finne et al. 2011).

References

Acs, Z. J., & Audretsch, D. B. (2010). Knowledge spillover entrepreneurship. Handbook of Entrepreneurship Research. Springer Media

Agrawal, A. (2001). University-to-industry knowledge transfer: Literature review and unanswered questions. International Journal of Management Reviews, 3(4), 285–302.

Anderson, T. R., Daim, T. U., & Lavoie, F. F. (2007). Measuring the efficiency of university technology transfer. Technovation, 27(5), 306–318.

Bakker, R. (2010). University technology transfer: Does the TTO model work?. Master thesis, Faculty of Economics and Business, Uva.

Baldini, N. (2006). University patenting and licensing activity: A review of the literature. Research Evaluation, 15(3), 197–207.

Bongers, F., den Hertog, P., Vandeberg, R., & Segers, J. (2003). Towards measurable cooperation, exploring the possibilities for measuring knowledge transfer between public knowledge institutes and firms and organizations. Utrecht, October: Report to the Advisory Council for Science and Technology Policy.

Bray, M. J., & Lee, J. N. (2000). University revenues from technology transfer: Licensing fees vs. equity positions. Journal of Business Venturing, 15, 385–392.

Bremer, H. W. (1999) University technology transfer evolution and revolution. Washington, DC: Council on Governmental Relations. http://www.cogr.edu

Brinkley, I., & Lee, N. (2006). The knowledge economy in Europe. London: The Work Foundation.

Butera, F. (2000). Adapting the pattern of university organization to the needs of the knowledge economy. European Journal of Education, 35(4), 403–419.

Carlsson, B., & Fridh, A. (2002). Technology transfer in United States universities: A suvey and statistical analysis. Journal of Evolutionary Economics, 12, 199–232.

Elsevier Magazine. (2011). Retrieved from www.elsevier.nl

Finne, K., Day, A., Piccaluga, A., Spithoven, A., Walter, P., & Wellen, D. (2011). A composite indicator for knowledge transfer. Report from the European Commission’s Expert Group on knowledge transfer indicators.

Goldfarb, B., & Henrekson, M. (2003). Bottom-up versus top-down policies towards the commercialization of university intellectual property. Research Policy, 32(4), 639–658.

Gras, J. M. G., Lapera, D. R. G., Solves, I. M., Jover, A. J. V., & Azuar, J. S. (2008). An empirical approach to the organisational determinants of spin-off creation in European universities. International Entrepreneurship and Management Journal, 4(2), 187–198.

Gregorio, D. D., & Shane, S. (2003). Why do some universities generate more start-ups than others? Research Policy, 32, 209–227.

Jensen, R., & Thursby, M. (2002). Proofs and prototypes for sale: The tale of university licensing. American Economic Review, 91(1), 240–260.

Link, N. A., & Scott, J. T. (2005). Opening the ivory tower’s door: An analysis of the deter- minants of the formation of U.S. university spin-off companies. Research Policy, 34, 1106–1112.

Litan, R. E., Mitchell, L., & Reedy, E. J. (2007). Commercializing university innovations: A better way. Cambridge, MA: National Bureau of Economic Research.

Löfsten, H., & Lindelöf, P. (2002). Science parks and the growth of new technology-based firms: Academic-industry links, innovations and markets. Research Policy, 31, 859–876.

Markman, G. D., Phan, P. H., Balkin, D. B., & Gianiodis, P. T. (2005). Entrepreneurshipand university-based technology transfer. Journal of Business Venturing, 20(2), 241–263.

Massachusetts Institute of Technology TLO (2012). Office Statistics 2006-2011. http://web.mit.edu/tlo/www/about/office_statistics.html. Accessed 20 Mar 2013.

Morgan, R. P., Kruytbosch, C., & Kannankutty, N. (2001). Patenting and invention activity of U.S. scientists and engineers in the academic sector: comparisons with industry. Journal of Technology Transfer, 26(1–2), 173–183.

Ndonzuau, F. N., Pirnay, F., & Surlemont, B. (2002). A stage model of academic spin-off creation. Technovation, 22, 281–289.

Rasmussen, E., Moen, O., & Gulbrandsen, M. (2006). Initiatives to promote commercialization of university knowledge. Technovation, 26(4), 518–533.

Rogers, E. M., Yin, Y., & Hoffmann, J. (2000). Assessing the effectiveness of technology transfer offices at U.S. research institutes. Journal of the Association of University Technology Managers, 12, 47–80.

Rothaermel, F. T., Agung, S. D., & Jiang, L. (2007). University entrepreneurship: A taxonomy of the literature. Industrial and Corporate Change, 16, 691–791.

Shane, S. (2004). Academic entrepreneurship: University spin-offs and wealth creation. Cheltenham: Edward Elgar Publishing.

Siegel, D. S., Veugelers, R., & Wright, M. (2007). Technology transfer offices and commercialization of university intellecutal property: performance and policy implications. Oxford Review of Economic Policy, 23(4), 640–660.

Thursby, J. G., & Thrusby, M. C. (2007). University licensing. Oxford Review of Economic Policy, 23(4), 620–639.

Vinig, G.T., Rijsbergen D. (2010). University technology transfer—Comparative study of US, Europe and Australian universities. In A. Malach-Pines & M. Ozbilgin (Eds.), Handbook of research on high-tech entrepreneurship (pp. 179–209). Elgar Publishing. ISBN:978-1-84720-949-8.

Wright, M., Siegel, D. S., & Lockett, A. (2007). The rise of entrepreneurial activity at universities: Organizational and societal implications. Industrial and Corporate Change, 16(4), 489–504.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Vinig, T., Lips, D. Measuring the performance of university technology transfer using meta data approach: the case of Dutch universities. J Technol Transf 40, 1034–1049 (2015). https://doi.org/10.1007/s10961-014-9389-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-014-9389-0