Abstract

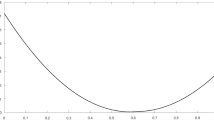

This paper derives the optimal debt ratio and consumption strategies for an economy during the financial crisis. Taking into account the impact of labor market condition during the financial crisis, the production rate function is stochastic and affected by the government fiscal policy and unanticipated shocks. The objective is to maximize the total expected discounted utility of consumption in the infinite time horizon. Using dynamic programming principle, the value function is a solution of Hamilton–Jacobi–Bellman (HJB) equation. The subsolution-supersolution method is used to verify the existence of classical solutions of the HJB equation. The explicit solution of the value function is derived, and the corresponding optimal debt ratio and consumption strategies are obtained. An example is provided to illustrate the methodologies and some interesting economic insights.

Similar content being viewed by others

References

Stein, J.L.: Stochastic Optimal Control and the U.S. Financial Debt Crisis. Springer, New York (2012)

Koo, H.K.: Consumption and portfolio selection with labor income: a continuous time approach. Math. Financ. 8, 49–65 (1998)

Branson, W.: Macroeconomic Theory and Policy. Harper and Row Publishers, New York (1972)

Jarrow, R.A.: Financial crises and economic growth. Q. Rev. Econ. Financ. 54, 194–207 (2014)

Fleming, W.H., Soner, H.M.: Controlled Markov Processes and Viscosity Solutions. Springer, New York (1992)

Pang, T.: Stochastic portfolio optimization with log utility. Int. J. Theor. Appl. Financ. 9(6), 869–887 (2006)

Song, Q., Yin, G., Zhu, C.: Utility maximization of an indivisible market with transaction costs. SIAM J. Control Optim. 50(2), 629–651 (2012)

Björk, T., Murgoci, A., Zhou, X.Y.: Mean-variance portfolio optimization with state-dependent risk aversion. Math. Financ. 24, 1–24 (2014)

Karatzas, I., Lehoczky, J., Shreve, S.: Optimal portfolio and consumption decisions for a “small investor” on a finite horizon. SIAM J. Control Optim. 25, 1557–1586 (1987)

Kuwana, Y.: Certainty equivalence and logarithmic utilities in consumption/investment problems. Math. Financ. 5(4), 297–309 (1995)

Zhang, X., Siu, T.K., Meng, Q.: Portfolio selection in the Enlarged Markovian regime-switching market. SIAM J. Control Optim. 48(5), 3368–3388 (2010)

Barro, R.J.: On the determination of the public debt. J. Polit. Econ. 87(5), 940–971 (1979)

Adam, K.: Government debt and optimal monetary and fiscal policy. Eur. Econ. Rev. 55(1), 57–74 (2011)

Pontryagin, L.S.: Optimal processes of regulation. Uspekhi Mat. Nauk 14, 3–20 (1959)

Bellman, R.: Dynamic Programming. Princeton University Press, Princeton (2010)

Yong, J., Zhou, X.Y.: Stochastic Controls: Hamiltonian Systems and HJB Equations. Springer, New York (1999)

Song, Q., Zhang, Q.: An optimal pairs-trading rule. Automatica 49(10), 3007–3014 (2003)

Wei, J., Yang, H., Wang, R.: Classical and impulse control for the optimization of dividend and proportional reinsurance policies with regime switching. J. Optim. Theory Appl. 142(2), 358–377 (2010)

Yao, D., Yang, H., Wang, R.: Optimal dividend and capital injection problem in the dual model with proportional and fixed transaction costs. Eur. J. Oper. Res. 211, 568–576 (2011)

Yang, H., Yin, G.: Ruin probability for a model under Markovian switching regime. In: Lai, T.L., Yang, H., Yung, S.P. (eds.) Probability, Finance and Insurance, pp. 206–217. World Scientific, River Edge (2004)

Siu, T.K.: A BSDE approach to optimal investment of an insurer with hidden regime switching. Stoch. Anal. Appl. 31(1), 1–18 (2013)

Zhou, X.Y., Yin, G.: Markowitz mean-variance portfolio selectionwith regime switching: a continuous-time model. SIAM J. Control Optim. 42, 1466–1482 (2003)

Fleming, W.H., Pang, T.: An application of stochastic control theory to financial economics. SIAM J. Control Optim. 43(2), 502–531 (2004)

Pao, C.V.: Nonlinear Parabolic and Elliptic Equations. Plenum Press, New York (1992)

Øksendal, B.: Stochastic Differential Equations: An Introduction with Applications. Springer, Berlin (2003)

Vasicek, O.: An equilibrium characterisation of the term structure. J. Financ. Econ. 5(2), 177–188 (1977)

Cox, J.C., Ingersoll, J.E., Ross, S.A.: A theory of the term structure of interest rates. Econometrica 53, 385–407 (1985)

Chen, L.: Stochastic mean and stochastic volatility—a three-factor model of the term structure of interest rates and its application to the pricing of interest rate derivatives. Financ. Mark. Inst. Instrum. 5, 1–8 (1996)

Luenberger, D.G.: Investment Science, 2nd edn. Oxford University Press, New York (2013)

Elton, E.J., Gruber, M.J., Brown, S.J., Goetzmann, W.N.: Modern Portfolio Theory and Investment Analysis, 8th edn. Wiley, Hoboken (2009)

Yin, G., Zhu, C.: Hybrid Switching Diffusions: Properties and Applications. Springer, New York (2010)

Jin, Z., Yang, H., Yin, G.: Numerical methods for optimal dividend payment and investment strategies of regime-switching jump diffusion models with capital injections. Automatica 49(8), 2317–2329 (2013)

Acknowledgments

The research of Zhuo Jin was supported by the Early Career Research Grant of University of Melbourne and The Fundamental Research Funds for the Central Universities in China.

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by David G. Luenberger.

Rights and permissions

About this article

Cite this article

Jin, Z. Optimal Debt Ratio and Consumption Strategies in Financial Crisis. J Optim Theory Appl 166, 1029–1050 (2015). https://doi.org/10.1007/s10957-014-0629-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-014-0629-0