Abstract

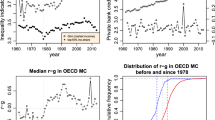

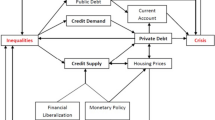

Recent literature presented arguments linking income inequality to the financial crash of 2007–2008. One proposed channel is expected to work through bank credit. I analyze the relationship between income inequality and bank credit in a panel cointegration framework and find that they have a long-run dependency relationship. Results show that income inequality contributed to the increase of bank credit in developed economies after the Second World War.

Similar content being viewed by others

References

Anselman, C., Krämer, H.M.: Income inequality and top incomes: some recent empirical developments with a focus on Germany. Int. Rev. Appl. Econ. 29(6), 770–786 (2015)

Alvaredo, F., Atkinson, A.B., Piketty, T., Saez, E., Zucman, G.: The World Top Incomes Database. http://g-mond.parisschoolofeconomics.eu/topincomes. Accessed 7th of March (2016)

Banerjee, A, Carrion-i-Silvestre, J.: Cointegration in panel data with breaks and cross-section dependence. University of Birmingham Department of Economics discussion paper no. 11–25 (2011)

Bolt, J., van Zanden, J.L.: The Maddison project: collaborative research on historical national accounts. Econ. Hist. Rev. 67(3), 627–651 (2014)

Bordo, M.D., Meissner, C.M.: Does inequality lead to a financial crisis?. J. Int. Money Finance 31, 2147–2161 (2012)

Borio, C., White, W.W.: Whither money and financial stability? The implications of evolving policy regimes. In: Monetary Policy and Uncertainty: Adapting to a Changing Economy: a Symposium Federal Reserve Bank of Kansas City, pp. 131–211 (2003)

Debacker, J., Heim, B., Panousi, V., Ramnath, S., Vidangos, I.: Rising inequality: transitory or persistent? New evidence from a panel of U.S. tax returns. Brooking Papers Econ. Act. Spring 2013, 67–122 (2013)

Dembiermont, C., Drehmann, M., Muksakunratana, M.: How much does the private sector really borrow - a new database for total credit to the private non-financial sector. BIS Quart. Rev. March (2013)

D’Onofrio, A., Murro, P.: Local banking development and income distribution across Italian provinces. CASMEF working paper no. 7 (2013)

Emirmahmutoglu, F., Kose, N.: Testing for Granger causality in heterogeneous mixed panels. Econ. Modelling 28, 870–876 (2011)

Fisher, R.A.: Statistical Methods for Research Workers, 4th edn. Oliver and Boyd, Edinburgh (1932)

Fitoussi, J.-P., Saraceno, F.: Europe: how deep is a crisis? Policy responses and structural factors behind diverging performances. J. Globalization Dev. 1(1) (2010)

Frank, R.H.: Positional externalities cause large and preventable welfare losses. Am. Econ. Rev. 95(2), 137–141 (2005)

Herzer, D., Vollmer, S.: Rising top incomes do not raise the tide. J. Policy Model 35(4), 504–519 (2013)

Iacoviello, M.: Household debt and income inequality, 1963–2003. J. Money Credit Bank 40(5), 929–965 (2008)

Im, K., Pesaran, H., Shin, Y.: Testing for unit roots in heterogeneous panels. J. Econom. 115(1), 53–74 (2003)

Jorda, O., Schularick, M., Taylor, A.: Betting the house. J. Int. Econ. (2016). forthcoming

Jäntti, M., Jenkins, S.P.: The impact of macroeconomic conditions on income inequality. J. Econ. Inequal. 8(2), 221–240 (2010)

Kalliovirta, L., Malinen, T: Nonlinearity and cross-country dependence of income inequality. ECINEQ working paper no. 2015 – 358 (2015)

Kirschenmann, K., Malinen, T., Nyberg, H.: The risk of financial crises: does it involve real or financial factors? ECINEQ working paper no. 336 (2015)

Klein, M.: Inequality and household debt: a panel cointegration analysis. Empirica 43, 391–412 (2015)

Kumhof, M., Lebarz, C., Ranciere, R., Richter, A.W., Throckmorton, N.A.: Income inequality and current account balances. IMF working paper no 12/08 (2012)

Kumhof, M., Ranciere, R., Winant, P.: Inequality, leverage and crises. Am. Econ. Rev. 105(3), 1217–1245 (2015)

Leigh, A.: How closely do top income shares track other measures of inequality?. Econ. J. 117, 619–33 (2007)

Maddala, G., Wu, S.: A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 61(special issue), 631–652 (1999)

Malinen, T.: Inequality, savings and consumption: a reconsideration of the relationship in cointegrated panels. Appl. Econ. Quar. 59(3), 235–251 (2013)

Malinen, T.: Estimating the long-run relationship between income inequality and economic development. Empir. Econ. 42(1), 209–33 (2012)

Mark, N, Ogaki, M., Sul, D.: Dynamic seemingly unrelated cointegrating regressions. Rev. Econ. Studies 72(3), 797–820 (2005)

Mendoza, E.G., Terrones, M.: An anatomy of credit booms: evidence from the macro aggregates and microdata. NBER working paper 14049 (2008)

Mocan, H.N.: Structural employment, cyclical employment and income inequality. Rev. Econ. Stat. 81(1), 122–134 (1999)

Parker, S.: Opening a can of worms: the pittfalls of time-series regression analyses of income inequality. Appl. Econ. 32(2), 221–230 (2000)

Pesaran, H.: A simple panel unit root test in the presence of cross section dependence. J. Appl. Econom. 22(2), 265–315 (2007)

Phillips, P.C., Sul, D.: Dynamic panel estimation and homogeneity testing under cross section dependence. Econom. J. 6, 217–259 (2003)

Rajan, R.G.: Fault Lines: How Hidden Fractures Still Threaten the World Economy. Princeton University Press, Princeton (2010)

Roine, J., Vlachos, J., Waldenström, D.: The long-run determinants of inequality: what can we learn from top income data. J. Pub. Econ. 93, 974–988 (2009)

Rossanan, R., Seater, J.J.: Temporal aggregation and economic time series. J. Bus. Econ. Stat. 13, 441–451 (1995)

Schularik, M., Taylor, A.M.: Credit booms gone bust: monetary policy, leverage cycles and financial crises, 1870–2008. Am. Econ. Rev. 102(2), 1029–1061 (2012)

Stiglitz, J.E.: Joseph Stiglitz and why inequality is at the root of the recession. Next Left website posted 9 of January (2009)

Stockhammer, E.: Rising inequality as a cause of the present crisis. Camb. J. Econ. 39(3), 867–870 (2013)

White, H., Granger, C.W.: Consideration of trends in time series. J. Time Series Econom. 3, 1–38 (2010)

Özgür, G., Ertürk, K.A.: Endogenous money in the age of financial liberalization. Rev. Pol. Econ. 25(2), 327–347 (2013)

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Malinen, T. Does income inequality contribute to credit cycles?. J Econ Inequal 14, 309–325 (2016). https://doi.org/10.1007/s10888-016-9334-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10888-016-9334-6