Abstract

We consider markets consisting of a set of indivisible items, and buyers that have sharp multi-unit demand. This means that each buyer \(i\) wants a specific number \(d_i\) of items; a bundle of size less than \(d_i\) has no value. We consider the objective of setting prices and allocations in order to maximize the total revenue of the market maker. The pricing problem with sharp multi-unit demand buyers has a number of properties that the unit-demand model does not possess, and is an important question in algorithmic pricing. We consider the problem of computing a revenue maximizing solution for two solution concepts: competitive equilibrium and envy-free pricing. For unrestricted valuations, these problems are NP-complete; we focus on a realistic special case of “correlated values” where each buyer \(i\) has a valuation \(v_iq_j\) for item \(j\), where \(v_i\) and \(q_j\) are positive quantities associated with buyer \(i\) and item \(j\) respectively. We present a polynomial time algorithm to solve the revenue-maximizing competitive equilibrium problem. For envy-free pricing, if the demand of each buyer is bounded by a constant, a revenue maximizing solution can be found efficiently; the general demand case is shown to be NP-hard.

Similar content being viewed by others

Notes

This phenomenon does occur in our real life. For example, in most travel packages offered by travel agencies, they could lose money for some specific programs; but their overall net profit could always be positive.

By the nature of the solution concepts considered in the paper, it can be assumed without loss of generality that \(i\) will not get more than \(d_i\) items.

References

Ausubel Lawrence M, Cramton Peter (1996) Demand revelation and inefficiency in multi-unit auctions, vol 98. University of Maryland, Mimeo

Balcan MF, Blum A (2006) Approximation algorithms and online mechanisms for item pricing. In: Proceedings of the 7th ACM Conference on Electronic Commerce, pp. 29–35

Balcan MF, Blum A, Mansour Y (2008) Item pricing for revenue maximization. In: Proceedings of the 9th ACM conference on Electronic commerce, pp. 50–59

Bezjian-Avery Alexa, Calder Bobby, Iacobucci Dawn (1998) New media interactive advertising vs. traditional advertising. J Advert Res 38:23–32

Bilò V, Flammini M, Monaco G (2013) Approximating the revenue maximization problem with sharp demands. arXiv preprint arXiv:1312.3892

Briest P (2008) Uniform budgets and the envy-free pricing problem. Automata, languages and programming. Springer, Berlin, pp 808–819

Briest P, Krysta P (2006) Single-minded unlimited supply pricing on sparse instances. In: Proceedings of the 17th annual ACM-SIAM symposium on Discrete algorithm, pp. 1093–1102

Cantillon E, Pesendorfer M (2013) Combination bidding in multi-unit auctions. The London School of Economics and Political Science, London

Chen N, Deng X (2014) Envy-free pricing in multi-item markets. ACM Trans Algorithms 10(2):7

Chen N, Ghosh A, Vassilvitskii S (2011) Optimal envy-free pricing with metric substitutability. SIAM J Comput 40(3):623–645

Cheung M, Swamy C (2008) Approximation algorithms for single-minded envy-free profit-maximization problems with limited supply. In: IEEE 49th Annual IEEE Symposium on Foundations of Computer Science, 2008. FOCS’08, pp. 35–44

Demange G, Gale D, Sotomayor M (1986) Multi-item auctions. J Polit Econ 94(4):863–872

Deng X, Goldberg P, Sun Y, Tang B, Zhang J (2013) Pricing ad slots with consecutive multi-unit demand. Algorithmic game theory. Springer, Berlin, pp 255–266

Deng X, Sun Y, Yin M, Zhou Y (2010) Mechanism design for multi-slot ads auction in sponsored search markets. Frontiers in algorithmics. Springer, Berlin, pp 11–22

Edelman B, Ostrovsky M, Schwarz M (2005) Internet advertising and the generalized second price auction: selling billions of dollars worth of keywords. Technical report, National Bureau of Economic Research

Elbassioni K, Raman R, Ray S, Sitters R (2009) On profit-maximizing pricing for the highway and tollbooth problems. Algorithmic game theory. Springer, Berlin, pp 275–286

Engelbrecht-Wiggans Richard, Kahn Charles M (1998) Multi-unit auctions with uniform prices. Econ Theory 12(2):227–258

Feldman M, Fiat A, Leonardi S, Sankowski P (2012) Revenue maximizing envy-free multi-unit auctions with budgets. In: Proceedings of the 13th ACM Conference on Electronic Commerce, pp. 532–549

Fiat A, Wingarten A (2009) Envy, multi envy, and revenue maximization. Internet and network economics. Springer, Berlin, pp 498–504

Ghosh A, Nazerzadeh H, Sundararajan M (2007) Computing optimal bundles for sponsored search. Internet and network economics. Springer, Berlin

Grandoni F, Rothvoß T (2011) Pricing on paths: a ptas for the highway problem. In Proceedings of the Twenty-Second Annual ACM-SIAM Symposium on Discrete Algorithms, pp. 675–684

Gul Faruk, Stacchetti Ennio (1999) Walrasian equilibrium with gross substitutes. J Econ Theory 87(1):95–124

Guruswami V, Hartline JD, Karlin AR, Kempe D, Kenyon C, McSherry F (2005) On profit-maximizing envy-free pricing. In: Proceedings of the 16th annual ACM-SIAM symposium on Discrete algorithms, pp. 1164–1173. Society for Industrial and Applied Mathematics

Hartline J, Yan Q (2011) Envy, truth, and profit. In: Proceedings of the 12th ACM conference on electronic commerce, pp. 243–252

Hartline JD, Vladlen K (2005) Near-optimal pricing in near-linear time. Algorithms and data structures. Springer, Berlin, pp 422–431

Hatfield JW (2009) Strategy-proof, efficient, and nonbossy quota allocations. Soc Choice Welf 33(3):505–515

Krysta P, Ventre C (2010) Combinatorial auctions with verification are tractable. Algorithms-ESA 2010. Springer, Berlin, pp 39–50

Mas-Colell A, Whinston MD, Green JR et al (1995) Microeconomic theory, vol 1. Oxford University Press, New York

Nisan N, Bayer J, Chandra D, Franji T, Gardner R, Matias Y, Rhodes N, Seltzer M, Tom D, Varian H et al (2009) Googles auction for tv ads. Automata, languages and programming. Springer, Berlin

Rosenkrans Ginger (2009) The creativeness and effectiveness of online interactive rich media advertising. J Interact Advert 9(2):18–31

Shapley Lloyd S, Shubik Martin (1971) The assignment game i: the core. Int J Game Theory 1(1):111–130

Varian HR (2007) Position auctions. Int J Ind Organ 25(6):1163–1178

Acknowledgments

The authors thanks anonymous referees for their constructive review comments, helping to improve the readability of the paper. Ning Chen’s research was supported by the AcRF Tier 2 Grant of Singapore (No. MOE2012-T2-2-071). Xiaotie Deng was supported by Shanghai Jiaotong University with a 985 Project Grant and by an NSFC Grant No. 61173011. Paul W. Goldberg was supported by EPSRC Grant EP/G069239/1 “Efficient Decentralised Approaches in Algorithmic Game Theory” and EPSRC grant EP/K01000X/1 “Efficient Algorithms for Mechanism Design Without Monetary Transfer. Jinshan Zhang was supported by EPSRC Grant EP/K01000X/1 “Efficient Algorithms for Mechanism Design Without Monetary Transfer.

Author information

Authors and Affiliations

Corresponding author

Appendix: Hardness for general valuations

Appendix: Hardness for general valuations

Theorem 5.1

It is NP-complete to determine the existence of a competitive equilibrium for general valuations in the sharp demand model (even when all demands are 3, and valuations are 0/1).

Proof

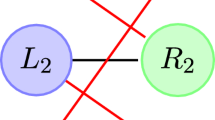

We reduce from exact cover by 3-sets (X3C): Given a ground set \(A=\{a_1,\ldots ,a_{3n}\}\) and a collection of subsets \(S_1,\ldots ,S_m\subset A\) where \(|S_i|=3\) for each \(i\), we are asked whether there are \(n\) subsets that cover all elements in \(A\). Given an instance of X3C, we construct a market with \(3n+3\) items and \(9n+m+1\) buyers as follows. Every element in \(A\) corresponds to an item; further, we introduce another three items \(B=\{b_1,b_2,b_3\}\). We use index \(j\) to denote one item. For each subset \(S_i\), there is a buyer with value \(v_{ij}=1\) if \(j\in S_i\) and \(v_{ij}=0\) otherwise; further, for every possible subset \(\{x,y,z\}\) where \(x\in A\) and \(y,z\in B\), there is a buyer with value \(v_{ij}=1\) if \(j\in \{x,y,z\}\) and \(v_{ij}=0\) otherwise; finally, there is a buyer with value \(v_{ij}=1\) if \(j\in B\) and \(v_{ij}=0\) otherwise. The demand of every buyer is 3.

We claim that there is a positive answer to the X3C instance if and only if there is a competitive equilibrium in the constructed market. Assume that there is \(T\in \{S_1,\ldots ,S_m\}\) with \(|T|=n\) that covers all elements in \(A\). Then we allocate items in \(A\) to the buyers in \(T\) and allocate \(B\) to the buyer who desires \(B\), and set all prices to be 1. It can be seen that this defines a competitive equilibrium.

On the other hand, assume that there is a competitive equilibrium \((\mathbf {p},\mathbf {X})\). We first claim that all the items in \(B\) must be allocated (Cl). Suppose the claim C1 is not true, there are two cases: Case 1, there is only one unallocated items, since if the items in \(B\) are allocated, either two items are allocated to some buyer or all three items are allocated (because there only exist buyers who desire two items in \(B\) or three items in \(B\)). W.l.o.g. suppose \(b_1\) and \(b_2\) together with some \(x\in A\) are allocated to a buyer and \(b_3\) is unallocated, then we know \(p_{b_1}+p_{b_2}+p_x\le 3\). If \(p_x=3\), it holds that \(p_{b_1}=p_{b_2}=0\), then buyer who values \(B\) will not be envy-free. If \(p_x<3\), then we either have \(p_{b_1}+p_x<3\) or \(p_{b_2}+p_x<3\). W.l.o.g. suppose \(p_{b_1}+p_x<3\), then the buyer who values the set \(\{b_1,x,b_3\}\) will not be envy-free. Case 2: all three items in \(B\) would be unallocated, contradicting envy-freeness of the buyer who values \(B\). Second, we claim all the items are allocated (C2). Otherwise, by C1, there must exist an item \(a_j\in A\) that is not allocated to any buyer. Then we have \(p_{a_{j}}=0\). Consider the buyers who desire subsets \(\{a_j,b_1,b_2\}, \{a_j,b_1,b_3\}, \{a_j,b_2,b_3\}\). They do not win since \(a_j\) is not sold. Due to envy-freeness, we have

This implies that \(p_{b_1}+p_{b_2}+p_{b_3}\ge 4.5\). Hence, the buyer who desires \(B\) cannot afford the price of \(B\) and at least one item in \(B\), say \(b_1\), is not allocated out, which contradicts with C1.

Now since all items in \(A\) are allocated out, because of the construction of the market, we have to allocate all items in \(A\) to \(n\) buyers and allocate \(B\) to one buyer; the former gives a solution to the X3C instance. \(\square \)

Rights and permissions

About this article

Cite this article

Chen, N., Deng, X., Goldberg, P.W. et al. On revenue maximization with sharp multi-unit demands. J Comb Optim 31, 1174–1205 (2016). https://doi.org/10.1007/s10878-014-9817-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10878-014-9817-y