Abstract

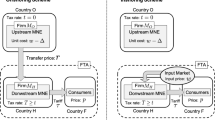

We examine the optimal rules of origin (ROO) in a free trade area/agreement (FTA) by employing a stylized three-country partial equilibrium model of an international duopoly. We incorporate compliance costs of the ROO into the model. In particular, compliance costs are higher for a firm located in a non-member country of the FTA than for a firm (an internal firm) located in an FTA member country, whereas marginal production costs are lower for the former. The FTA member countries set the optimal level of ROO to maximize their joint welfare. An importing country within the FTA imposes tariffs on imports that do not comply with the ROO. We show that the optimal ROO may have a protectionist bias in the sense that they are set for only the internal firm to comply. ROO may also cause low utilization of FTAs when they are set such that even the internal firm does not comply with them. These cases arise depending on parameter values.

Similar content being viewed by others

Notes

Basically, there are three criteria of the ROO to check whether a “substantial transformation” of goods is done within the FTA (Falvey and Reed 1998): changes in tariff classification (CTC), value-added content (VC), or specific production process (SP). The CTC criterion requires that imported intermediate inputs be transformed into products with different tariff classifications within the FTA. The VC criterion specifies a minimum percentage of value that should be added within the FTA. Finally, the SP criterion specifies certain production or processing that should be conducted within the FTA.

Anson et al. (2005) find that in the case of the NAFTA, the average compliance costs are around 6 % in ad valorem equivalent. As a related issue, there exists considerable empirical literature on the compliance costs of taxation. See, for example, Andreoni et al. (1998), Tran-Nam et al. (2000), and Mathieu et al. (2010).

Rosellón (2000) also analyze the effects of ROO on the intermediate-good market and welfare.

In addition, they assume perfect competition, which is also different from our model setting.

For example, the production of the good requires the establishment of a large-scale plant, but the supply of land may be extremely limited in country A. Or, as the wage rate is so high, labor costs may become very expensive in country A.

Although we do not explicitly model how firm E complies with the ROO, one can consider, for example, that firm E conducts part of its production process at a plant in country B. Actually, external firms can be eligible for preferential trade if they conduct export-platform foreign direct investment (FDI) (Ekholm et al. 2007) to an FTA member country, as demonstrated by Motta and Norman (1996). That is, an external firm sets up a plant in a member of an FTA and exports goods to the other members of the FTA from the internal plant. Baltagi et al. (2008) provide empirical evidence to support the export-platform FDI to members of European RTAs.

For example, firm E may initially use intermediate inputs imported cheaply from country C and assemble them at the plant in country B. To comply with the ROO, however, it needs to purchase a certain percentage of inputs from suppliers in country B. As firm E has to make an arm’s-length transaction with local suppliers, it incurs higher costs to comply with the ROO.

In this paper’s model setting, country A has no incentive to form an FTA with country B as far as the industry in question is concerned. However, we implicitly assume that there is another industry, outside the scope of this paper, in which country A gains from an FTA with country B.

In the subsequent analysis of welfare, we exclude ε to simplify calculations.

11 Here, the trade barrier for firm I is given by ϕ and that for firm E is given by t.

We thank an anymous referee for suggesting this illustration.

We thank an anonymous referee for pointing out this important issue.

References

Andreoni J, Erard B, Feinstein J (1998) Tax compliance. J Econ Lit 36:818–860

Anson J, Cadot O, Estevadeordal A, de Melo J, Suwa-Eisenmann A, Tumurchudur B (2005) Rules of origin in North-South preferential trading arrangements with an application to NAFTA. Rev Int Econ 13:501–517

Augier P, Gasiorek M, Lai Tong C (2005) The impact of rules of origin on trade flows. Econ Policy 20:567–624

Baltagi BH, Egger P, Pfaffermayr M (2008) Estimating regional trade agreement effects on FDI in an interdependent world. J Econometrics 145:194–208

Cadot O, de Melo J (2008) Why OECD countries should reform rules of origin? World Bank Res Obser 23:77–105

Chang YM, Xiao R (2013) Free trade areas, the limit of rules of origin, and optimal tariff reductions under international oligopoly: A welfare analysis. J Int Trade & Econ Dev 22:694–728

Ekholm K, Forslid R, Markusen JR (2007) Export-platform foreign direct investment. J Eur Econ Assoc 5:776–795

Estevadeordal A, Freund C, Ornelas E (2008) Does regionalism affect trade liberalization toward nonmembers? Q J Econ 123:1531–1575

Falvey R, Reed G (1998) Economic effects of rules of origin. Weltwirtschaftliches Archiv 134:209–229

Falvey R, Reed G (2002) Rules of origin as commercial policy instruments. Int Econ Rev 43:393–407

Freund C (2010) Third-country effects of regional trade agreements. World Econ 33:1589–1605

Hayakawa K, Hiratsuka D, Shiino K, Sukegawa S (2013) Who uses free trade agreements? Asian Econ J 27:245–264

Ishikawa J, Mukuniki H, Mizoguchi Y (2007) Economic integration and rules of origin under international oligopoly. Int Econ Rev 48:185–210

James WE (2008) Rules of origin in emerging Asia-Pacific preferential trade agreements: Will PTAs promote trade and development? In: Asia-Pacific Research and Training Network on Trade (ed) Trade facilitation beyond the multilateral trade negotiations: regional practices, customs valuation and other emerging issues. United Nations ESCAP, Bangkok, pp 137–162

Ju J, Krishna K (2005) Firm behaviour and market access in a Free Trade Area with Rules of Origin. Can J Econ 38:290–308

Krishna K, Krueger AO (1995) Implementing free trade agreements: Rules of origin and hidden protection. In: Deardorff AV, Levinsohn J, Stern RM (eds) New directions in trade theory. University of Michigan Press, Ann Arbor, pp 149–187

Krueger AO (1999) Free trade agreements as protectionist devices: rules of origin. In: Melvin JR, Moore JC, Riezman R (eds) Trade, theory and econometrics: essays in honor of John Chipman. Routledge Press, London, pp 91–101

Lopez-de-Silanes F, Markusen JR, Rutherford TF (1996) Trade policy subtleties with multinational firms. Eur Econ Rev 40:1605–1627

Mathieu L, Waddams Price C, Antwi F (2010) The distribution of UK personal income tax compliance costs. Appl Econ 42:351–368

Motta M, Norman G (1996) Does economic integration cause foreign direct investment? Int Econ Rev 37:757–783

Rosellón J (2000) The economics of rules of origin. J Int Trade & Econ Dev 9:397–425

Takauchi K (2011) Rules of origin and international R&D rivalry. Econ Bull 31:2319–2332

Takauchi K (2014) Rules of origin and strategic choice of compliance. J Ind Compet Trade 14:287–302

Tran-Nam B, Evans C, Walpole M, Ritchie K (2000) Tax compliance costs: research methodology and empirical evidence from Australia. National Tax J 53:229–252

Acknowledgments

We thank Jota Ishikawa, Hiroshi Mukunoki, Kazuhiro Takauchi, Binh Tran-Nam, two anonymous referees, and participants of the 4th Spring Meeting of the Japan Society of International Economics, the Fall 2014 Meeting of the Japanese Economic Association, the 3rd HITS-MJT Seminar on International Economy and Industry, and Kobe International Conference on “Fragmentation, Time Zones, and their Dynamic Consequences” for their helpful comments and suggestions on earlier versions of the paper. Jinji acknowledges financial support from the Japan Society for the Promotion of Science under the Grant-in-Aid for Scientific Research (B) No. 23330087 and (C) No. 24530246. The authors are solely responsible for any remaining errors.

Conflict of interests

The authors declare that they have no conflict of interest

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

Proof of Proposition 1

In stage 3, each firm chooses compliance, C, or non-compliance, N. Thus, the game in stage 3 can be represented by the normal form game shown in Table 1.

Firms’ best responses can be found in the following way. First, for firm I, Eqs. 11 and 17 yield

Thus, \(\pi ^{I}_{cc} \geq \pi ^{I}_{nc}\) holds if and only if ϕ≤t. Moreover, from Eqs. 4 and 15, we have

which implies that \(\pi ^{I}_{nn} \geq \pi ^{I}_{cn}\) holds if and only if ϕ≥t. Second, for firm E, Eqs. 11 and 15 yield

Thus, \(\pi ^{E}_{cc} \geq \pi ^{E}_{cn}\) holds if and only if ϕ≤t/k. Similarly, from Eqs. 4 and 17, it follows that

yielding that \(\pi ^{E}_{nn} \geq \pi ^{E}_{nc}\) if and only if ϕ≥t/k.

Then, when 0≤ϕ<t/k, C is the dominant strategy for both firms; hence, {C,C} is a unique NE as long as ε>0 is sufficiently small. When t/k≤ϕ<t, C is still the dominant strategy for firm I, and N is the dominant strategy for firm E in the presence of ε>0. Thus, {C,N} is a unique NE. Finally, when t≤ϕ, N becomes the dominant strategy for both firms in the presence of ε>0. Thus, {N,N} is a unique NE. □

Appendix B

Proof of Lemma 5

(i) For 5/2<α≤43/14, ϕ c n =t holds for ϕ c n =ϕ b =(2a−c)/8, and t=t b =(2a−c)/8, and ϕ c n =t/k holds for ϕ c n =ϕ c n2=(a+4c)/(11k−4) and t=t c n (ϕ c n2)=(a+4c)k/(11k−4). Comparing joint welfare of the FTA members in these cases, Eqs. 27 and 30 yield

It can be shown that the term within the curly brackets on the RHS of Eq. 41 is negative if Eq. 32 holds, which implies that \(W^{AB}_{cn}(\phi _{b}) > W^{AB}_{cn}(\phi _{cn2})\). Otherwise, the this term is non-negative; hence, \(W^{AB}_{cn}(\phi _{b}) \leq W^{AB}_{cn}(\phi _{cn2})\) holds. As the RHS of Eq. 32 becomes one when α=3 and a complex number for α<3, ϕ c n =ϕ b =(2a−c)/8 never holds for α≤3.

(ii) For 43/14<α, ϕ c n =t holds when ϕ c n =ϕ b =(2a−c)/8 for α≤13/2 and ϕ c n =ϕ c n1=(a+4c)/7 for 13/2<α. On the other hand, ϕ c n =t/k holds when ϕ c n =ϕ b /k=(2a−c)/8k for 43/14<α<13/2 and k<4(2α−1)/(14α−43), and ϕ c n =ϕ c n2=(a+4c)/(11k−4) for k≥4(2α−1)/(14α−43). Note that 4(2α−1)/(14α−43)=1 holds at α=13/2. Thus, for 43/14<α≤13/2, we compare joint welfare of the FTA members at ϕ c n =ϕ b =(2a−c)/8 and ϕ c n =ϕ b /k=(2a−c)/8k. From Eqs. 27 and 31, we have

Since 3(2α−1)/(26α−45)<1 holds for α>5/2, it follows that \(W^{AB}_{cn}(\phi _{b}) < W^{AB}_{cn}(\phi _{b}/k)\); hence, ϕ c n =ϕ b =(2a−c)/8 does not hold. Moreover, a comparison of joint welfare of countries A and B under ϕ c n =ϕ b =(2a−c)/8 and ϕ c n =ϕ b /k=(2a−c)/8k has been made in Eq. 41. However, it is shown that

holds for all α∈(43/14,13/2). Thus, \(W^{AB}_{cn}(\phi _{b}) < W^{AB}_{cn}(\phi _{cn2})\) holds. It follows that ϕ c n =ϕ b =(2a−c)/8 is never optimal in this case. Finally, for 13/2<α, comparing joint welfare of countries A and B under ϕ c n =ϕ c n1=(a+4c)/7 and ϕ c n =ϕ c n2=(a+4c)/(11k−4), Eqs. 26 and 30 yield

Thus, if

then \(W^{AB}_{cn}(\phi _{cn1})> W^{AB}_{cn}(\phi _{cn2})\) holds. However, since (11α−12)/(25α−54)<1 holds for α>3, \(W^{AB}_{cn}(\phi _{cn1})< W^{AB}_{cn}(\phi _{cn2})\) holds in the relevant range of the parameter values. □

Appendix C

Proof of Proposition 2

(i) From Eqs. 20 and 30, we have

Then, it can be shown that, if Eq. 37 holds, the term within the curly brackets on the RHS of Eq. 42 is negative and, hence, it follows that \(W^{AB}_{cn}(\phi _{cn2})<W^{AB}_{nn}(t_{b})\). In Eq. 37, 28α 2−108α+87=0 when \(\alpha =(27+2\sqrt {30})/14 \approx 2.71\) and 28α 2−108α+87<0 for \(\alpha < (27+2\sqrt {30})/14\). Thus, Eq. 37 does not hold for \(\alpha \leq (27+2\sqrt {30})/14\). From Eqs. 20 and 27, we have

Thus, \(W^{AB}_{cn}(\phi _{b})< W^{AB}_{nn}(t_{b})\) always holds for α>5/2.

(ii) For 43/14<α≤9/2, from Lemma 5, ϕ c n =ϕ c n2 if Eq. 34 holds, and ϕ c n =ϕ b /k if Eq. 33 holds. Equations 20 and 31 yield

It can be shown that if Eq. 38 holds, it follows that \(W^{AB}_{cn}(\phi _{b}/k)>W^{AB}_{nn}(t_{b})\). On the other hand, Eqs. 20 and 30 yield

Thus, if Eq. 39 holds, it follows that \(W^{AB}_{cn}(\phi _{cn2})>W^{AB}_{nn}(t_{b})\). Note that for 43/14<α<9/2, 4(2α−1)/(14α−43) is monotonically decreasing, and the RHS of both Eqs. 38 and 39 is monotonically increasing, and all three take the same value at \(\alpha =(323+16\sqrt {205})/126 \approx 4.38\).

(iii) For α>9/2, from Lemma 5, regime CN has two possible optimal ROO solutions: ϕ c n =ϕ b /k and ϕ c n =ϕ c n2. Equations 30 and 36 yield

Thus, if Eq. 40 holds, it follows that \(W^{AB}_{cn}(\phi _{cn2})>W^{AB}_{cc}(\phi _{cc}=0)\). Note that the RHS of Eq. 40 becomes \((8+\sqrt {15})/7 \approx 1.70\) at α=9/2 and is increasing for α>9/2. Moreover, Eqs. 31 and 36 yield

Thus, if

holds, it follows that \(W^{AB}_{cn}(\phi _{b}/k) \geq W^{AB}_{cc}(\phi _{cc}=0)\). Note that the RHS of Eq. 44 becomes \(1+\sqrt {1152}/48 \approx 1.71\) at α=9/2, and it is increasing for α>9/2. On the other hand, from Lemma 5, if Eq. 34 holds, then ϕ c n =ϕ c n2. Note that the RHS of Eq. 34 becomes 4(2α−1)/(14α−43)=1.6 at α=9/2 and is decreasing for α>9/2. □

Rights and permissions

About this article

Cite this article

Jinji, N., Mizoguchi, Y. Optimal Rules of Origin with Asymmetric Compliance Costs under International Duopoly. J Ind Compet Trade 16, 1–24 (2016). https://doi.org/10.1007/s10842-015-0202-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-015-0202-z