Abstract

We formulate a model of vertical differentiation to evaluate the welfare effects of removing a low quality product from the market. The mechanism through which a welfare improvement might arise is simple: Once the low quality low cost alternative is banned, entry into the high quality segment becomes more likely. This in turn may lead to a significant reduction in the price of the high quality product. We find that such a ban might improve consumer as well as aggregate welfare when consumers value the higher quality more, the marginal cost of producing high quality is lower, the price of low quality is higher, and the price sensitivity for high quality is not too high. The key feature of our model is that it allows elastic demands by individual consumers.

Similar content being viewed by others

Notes

See Allenby (2003) for a historic account of the events that led to the ban in 1999.

We believe that this certainty regarding quality is a good fit for our motivating example as well as goods that can be categorized easily, such as those subject to standards regulations.

The prior categorization of quality can be due to historical factors, due to the limited or discrete nature of vertical differentiation, or due to legal or regulatory restrictions.

A detailed derivation of the bivariate distribution of consumer types and the following demand functions is given in the Appendix.

The correlation coefficient between the two elements of the bivariate vector is given by \(\rho =\frac {\lambda _{L}}{\sqrt {(\lambda _{H}+\lambda _{L})^{2}+{\lambda _{L}^{2}}}}\).

Specifically, \(E(s_{L})=\frac {\lambda _{H} \lambda _{L}}{\lambda _{H}+\lambda _{L}}\), and E(s H )=λ H +E(s L ).

The demand for the low quality product can be computed similarly as

If we were to assume an alternative cost function with increasing marginal costs, the equilibrium price would have been a function of the price of the low quality variant.

Formally, \(\frac {\partial \pi ^{\ast }(A, \alpha , N)}{\partial N}=-\frac { (2N-1) e^{(A-k\alpha -\frac {1}{N})}}{N^{4}\alpha }<0\) for N≥1.

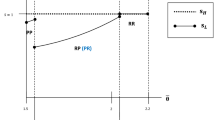

It turns out that z is a convenient function of these three parameters. Changes in z have a very clear interpretation in terms of the changes in these parameters. The value of z decreases as the marginal cost of producing the high quality variant approaches the price of the low quality variant and/or as the price elasticity of the high quality decreases.

See the Appendix for the proof.

When F is lower than this maximum value, the pre-ban monopolist’s profit would also increase. However, since there are two active firms after the ban, their total gain in profits will be the double of that of the monopolist.

References

Allenby M.C. (2003) “The European Union Ban on Conventional Cages for Laying Hens: History and Prospects”. Journal of Applied Animal Welfare Science 6(2):103–121

Andersen L.M. (2010). “Animal Welfare and Eggs -Cheap Talk or Money on the Counter?, FOI Working Papers, University of Copenhagen. Available at http://okonomi.foi.dk/workingpapers/WPpdf/WP2010/WP6_animal_welfare_eggs.pdf

Bockstael N.E. (1984) “The Welfare Implications of Minimum Quality Standards”. American Journal of Agricultural Economics 66:466–471

Crampes C., Hollander A. (1995) “Duopoly and Quality Standards, ”. European Economic Review 39:71–82

Griffith R., Nesheim L. (2008). Household Willingness to Pay for Organic Products, CEPR Discussion Paper No. DP6905. Available at SSRN: http://ssrn.com/abstract=1240215

Leland H.E. (1979) “Quacks, Lemons, and Licensing: A Theory of Minimum Quality Standards, ”. Journal of Political Economy 87:1328–1346

Ronnen U. (1991) “Minimum Quality Standards, Fixed Costs, and Competition, ”. RAND Journal of Economics 22:490–504

Shaked A., Sutton J. (1982) “Relaxing Price Competition through Product Differentiation, ”. Review of Economic Studies 49:3–13

Valletti T.M. (2000) Minimum Quality Standards Under Cournot Competition. Journal of Regulatory Economics 18(3):235–245

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank Izak Atiyas, Kevin Hasker, Eren Inci, and seminar participants at Bilkent University and EARIE 2010 for their useful comments. All remaining errors are our own.

Appendix

Appendix

1.1 A–1 Derivation of the Distribution of Consumer Tastes and the Demand Functions

In this section we are first going to derive the joint distribution of consumer tastes for the two quality levels and then the demand functions. Let us start with a bivariate exponential distribution with independent components for s H and s L . Its density function is given by the product of two exponential densities

In the second step, we need to incorporate the vertical differentiation nature of the products into the joint distribution of tastes; namely that for each consumer the draw of s H should be greater than the draw of s L . In order to add the condition that s H ≥ s L , we have to make sure that the joint density function is still a valid probability density function and as such integrates to 1. Formally, we need to find a constant k that satisfies

Solving the equation yields \(k=\frac {(\lambda _{H}+\lambda _{L})}{{\lambda _{H}^{2}}\lambda _{L}}\). Thus we arrive at the joint distribution of the tastes for the two quality variants, which is provided in the text:

Note that the bivariate distribution no longer has independent components for an individual consumer. If a consumer draws a high s L , her draw for s H must be even higher. Alternatively, if the realization for the taste for high quality is low, the realization of the low quality taste must be even lower. The expected qualities of the two products are given by

and λ H = E(s H −s L ).

Let us next derive the demand functions for the products given the distribution of consumer tastes. In order to calculate the proportion of consumers who choose the high quality variant, one needs to find the region on the support of the bivariate random vector [s H , s L ] that gives

Using the indirect utility function, the set of consumers who choose to buy the high quality variant is given by the region

And the set of consumers who choose to buy the low quality variant will then be given by

The aggregate demand functions for the two quality variants can then be obtained by calculating the expected value of individual demands over the corresponding regions of [s H , s L ]. Formally,

It is clear that since \(\lim _{s_{H} \to \infty }e^{s_{H}}=\infty \), the second integral is only defined when λ H is less than one. A similar condition is required in the derivation of the aggregate demand for the low quality product. Once we assume that 0≤λ H < 1 and 0≤λ L < 1, the demand functions will be well defined. The rest of the derivation follows straightforward integration and gives

where \(A^{C}=\delta -\beta p_{L}(1-\frac {1}{\lambda _{H}})+\ln (\tfrac { \lambda _{H}+\lambda _{L}}{(\lambda _{H}+\lambda _{L}-\lambda _{H}\lambda _{L})(1-\lambda _{H})})\), and \(\alpha ^{C}=\tfrac {\beta }{\lambda _{H}}\).

The demand for the low quality product can be computed similarly as

1.2 A–2 Proof of Lemma 1

The difference between pre and after ban profit functions for an equal number of firms is given by

The denominator and the first two terms on the numerator are clearly positive. Since k ≥ p L and λ H < 1, the term inside the parentheses is also positive .

1.3 A–3 Proof of Proposition 1

Denoting the number of firms before the ban by N and that after the ban by N+M, the price change can be computed as

The sign of this term is positive when N < λ H (N+M).

Next, consider change in the price differential as the number of active firms prior to the ban increases. Namely,

which clearly is negative whenever \(\frac {N}{N+M}<\lambda _{H}<\sqrt {\lambda _{H}}\). Thus, as N increases the price differential before and after the ban becomes smaller.

1.4 A–4 Proof of Proposition 2

Let γ(z, λ H ) denote the ratio of CS C(1) and CS B(2), which is given by

It is easy to verify that the derivative of γ(z, λ H ) with respect to λ H is given by

with \(\psi =1+\frac {z}{\lambda _{H}}\). It is also easy to verify that ψe −ψ is log-concave, and hence has a unique maximum at ψ = 1. Thus, the smallest value of the term in the brackets is obtained at ψ = 1 and is given by 0.632. Since \(e^{z+\frac {1}{2}}>0\) for all z, we have that \(\frac {\partial }{\partial \lambda _{H}}\gamma (z, \lambda _{H})<0\). Thus, γ(z, λ H ) is decreasing in λ H ∈ [0, 1).

Note that \(\gamma (z, 0)=e^{z+\frac {1}{2}}>1\) and \(\gamma (z, 1)=e^{-\frac {1}{2 }}<1\). There exists a \(\tilde {\lambda }_{H}(z)\) which solves \(\gamma (z, \tilde {\lambda }_{H}(z))=1\). Furthermore, for all \(\lambda _{H}>\tilde {\lambda }_{H}(z)\), we have γ(z, λ H )<1 and hence CS B(2)>CS C(1). ■

1.5 A–5 Proof of Proposition 3

We can compute \(\frac {\partial }{\partial z}\tilde {\lambda }(z)\) by differentiating \(\gamma (z, \tilde {\lambda }(z))=1\) with respect to z and solving for \(\frac {\partial }{\partial z}\tilde {\lambda }(z)\) which is given by

with \(\psi =1+\frac {z}{\lambda _{H}}\). We have shown earlier that 1−ψe −ψ>0 for all ψ. The numerator has the same sign as 1−e −ψ which is positive whenever ψ > 0, or equivalently as long as z > −λ H . Thus, \(\tilde {\lambda }_{H}(z)\) increases with z as long as 0≤λ H < 1 and z > −λ H .

The rest of the claims in the proposition follows by straightforward differentiation. We know that \(\frac {d\tilde {\lambda }_{H}}{dz}>0\). Since by definition \(\frac {dz}{dk}>0\), and \(\frac {dz}{dp_{L}}<0\), by the chain rule we have \(\frac {d\tilde {\lambda }_{H}}{dk}>0\), and \(\frac {d\tilde {\lambda }_{H} }{dp_{L}}<0\). >0. Finally, \(\frac {dz}{d\beta }=k-p_{L}\). Therefore, \( \frac {d\tilde {\lambda }_{H}}{d\beta }>0\) for k > p L , \(\frac {d\tilde {\lambda }_{H}}{d\beta }<0\) for k < p L and \(\frac {d\tilde {\lambda }_{H}}{d\beta }=0\) otherwise.

1.6 A–6 Proof of Proposition 4

Comparison of before and after ban welfare is a complicated issue. Given that what we want to do is to highlight the possibility of having a duopoly after the ban, and a monopoly before the ban, we will set the fixed entry cost so that the total industry profit is zero after the ban. This is the least likely case that would result in a welfare gain.

Note that the after ban equilibrium profit when two firms enter is given by

Thus, the critical fixed cost which allows two firms to enter is simply given by the zero profit condition as

In this case, the welfare after ban is simply equal to the consumer surplus. The welfare difference before and after the ban is then

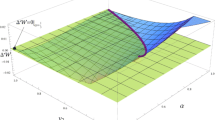

It is straightforward though cumbersome to verify that ΔW = w 0 w 1(z, λ H ) where

and

with z = β(k−p L ). Given that w 0>0 for all relevant parameter values, the sign of ΔW is the same as the sign of w 1(z, λ H ).

First note that

with \(\psi =1+\frac {z}{\lambda _{H}}\) as defined above. Once again, since ψe −ψ is logconcave, it is uniquely maximized at ψ = 1. Therefore, \( \frac {\partial w_{1}(z, \lambda _{H})}{\partial \lambda _{H}}\) is minimized at ψ = 1, and min[4(1 − 2ψe −ψ)] ≈ 1.057>0. Consequently, \(\frac {\partial w_{1}(z, \lambda _{H})}{\partial \lambda _{H}}>0\), for all λ H and z.

We have \(w_{1}(z, 0)=5e^{-z-\frac {1}{2}}-4<0\) for all z > 0. On the other hand, we have w 1(z, 1)≈0.090e −z>0. Therefore, there exists a \( \hat {\lambda }_{H}(z)\), such that \(w_{1}(z, \hat {\lambda }_{H}(z))=0\). For \( \lambda _{H}>\hat {\lambda }_{H}(z)\), we have w 1(z, λ H )>0 and therefore ΔW > 0 whenever \(\lambda _{H}>\hat {\lambda }_{H}(z)\). ■

1.7 A–7 Proof of Proposition 5

Totally differentiating w 1(z, λ H )=0 we obtain

Since we have shown earlier that \(\frac {\partial w_{1}(z, \lambda _{H})}{ \partial \lambda _{H}}>0\),

Straightforward differentiation yields

whenever z > 0. Therefore, we have \(\frac {d\hat {\lambda }_{H}(z)}{dz}>0\).

The remaining claims follow by a straightforward application of the chain rule.

1.8 A–8 Welfare Change with Shaked-Sutton Vertical Differentiation Model

The well known Shaked and Sutton (1982) preferences specify a utility function

from the consumption of one unit of quality v where 𝜃 denotes the individual taste for quality which is distributed uniformly across the population of consumers within [0, 1] and p denotes the unit price of the vertically differentiated variant in consideration. Unlike our model, all consumers consume either 1 or 0 units of a good.

There are initially two qualities of the good, high ( s H ) and low ( s L ), with s H >s L >0. The low quality product is produced competitively at marginal cost c and is available at a price of p L = c. In addition to the fixed costs of F the high quality product costs k per unit to produce. All consumers with 𝜃 high enough will prefer the high quality product. The indifferent consumer is given by

All consumers with 1 ≥ 𝜃 ≥ 𝜃 HL prefer the high quality over the low quality version. Thus the demand for high quality becomes

Similarly, all consumers who value the low quality more than the high quality while receiving a positive utility will buy the low quality product, leading to a demand for low quality of

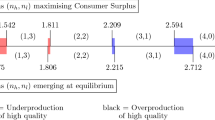

In order to analyze the welfare effects of a ban on low quality, we need to consider three possible scenarios: i) monopoly producer of high quality facing competition from the low quality fringe, ii) duopoly producers of high quality facing competition from the low quality fringe, and iii) duopoly producers of high quality with no low quality substitute (post-ban scenario). Ultimately, our aim is to characterize a situation where a second firm enters the high quality segment after a ban on low quality, whereas this firm does not find it profitable to enter if low quality is not banned.

Scenario 1: Monopoly producer of high quality plus a low quality fringe

Given that the price of low quality equals its marginal cost, the monopolist producer of high quality has the profit function

The maximization of monopoly profits leads to the following monopoly price and profit:

The above profit function gives an upper limit on the available range of fixed costs, namely:

The total surplus in this scenario is given by the sum of consumers surpluses of those purchasing high and low quality and the profit of the monopolist. After simple algebraic manipulations, the welfare in this scenario can be written as

Scenario 2: Duopoly producers of high quality plus a low quality fringe

Now imagine the case, where high quality is produced by two firms that compete in quantities. Let us start by writing the inverse demand for high quality, such that the quantity competition game becomes easier to present. Denoting the outputs of the two firms q 1 and q 2, it is easy to show that the inverse demand function becomes

leading to the profit function

Solving the first-order-conditions simultaneously, we arrive at the Cournot-equilibrium quantities of \({q_{1}^{c}}={q_{2}^{c}}=\frac {1}{3}\frac {s_{H}-s_{L}+c-k}{s_{H}-s_{L}}\) and equilibrium profits of \({{\Pi }_{1}^{c}}={{\Pi }_{2}^{c}}=\frac {1}{9}\frac {(s_{H}-s_{L}+c-k)^{2}}{s_{H}-s_{L}}-F\).

In order for there to be no entry without a ban of low quality, fixed costs must be high enough to deem said entry unprofitable. This condition provides us with a lower limit on the available range of fixed costs, namely:

Naturally, F m>F c.

This equilibrium is valid under certain parameter restrictions. Namely, at the equilibrium prices of the high and low quality products, there should some consumers who still prefer to buy the low quality product. This requires \(d_{L}({p_{H}^{c}}, c;s_{H}, s_{L})>0\) or equivalently

Define \(\tau ^{2}=\frac {s_{H}}{s_{H}-s_{L}}>1\), ρ H = s H −k and ρ L = s L −c. Note that ρ H >ρ L so that high quality product is sold in equilibrium as well. Using these new variables, we can rewrite the condition for positive sales of the low quality product as

Scenario 3: Duopoly producers of high quality with no low quality substitute

Let us now consider the post-ban market scenario. The low quality product is no longer available, and this means that the demand for high quality needs to be derived again. The consumer who is indifferent between purchasing one unit of the high quality product and making no purchase at all is identified by

All consumers who have draws of 𝜃 that are higher than 𝜃 H will demand the high quality product, leading to a demand for high quality of

Similar to the previous scenario, we have two Cournot duopolists competing in quantities. Omitting the trivial intermediate steps, one arrives at the post-ban equilibrium quantities of \({q_{1}^{b}}={q_{2}^{b}}=\frac {1}{3}\frac {s_{H}-k}{s_{H}}\) and equilibrium profits of \({{\Pi }_{1}^{b}}={{\Pi }_{2}^{b}}=\frac {1}{9}\frac {(s_{H}-k)^{2}}{s_{H}}-F\).

For the ban to induce the entry of a second firm, the equilibrium duopoly profit needs to be positive. This gives us another upper limit on F, namely: \(F<F^{b}=\frac {1}{9}\frac {(s_{H}-k)^{2}}{s_{H}}\).

We claim that for parameter values where with two firms supplying the high quality product and the demand for low quality product is positive prior to a ban, we have F c < F b. Note that with the notation we introduced above we have

Thus, F b>F c whenever \(\frac {\rho _{H}}{\tau }>\rho _{H}-\rho _{L}\), or equivalently

Recall the condition in (7) which insures that low quality product has positive sales when two firms supply the high quality product. Comparing the right hand sides of (8) and (7), we have that

Therefore, F c < F b for the range of parameters that support the equilibria we are interested in.

Finally, post-ban total surplus can be shown to amount to

Welfare Comparisons

The difference between post-and-pre-ban total surpluses can now be written as

Let us now determine the possible range of values of fixed costs of production. For there to be an entry of a second firm into the high quality segment only after the ban on low quality, it has to be that F c < F < F b. In other words, fixed costs have to be large enough to prevent the entry of a second firm without a ban on low quality, but low enough to allow entry in case of a ban. From (9) it is clear that the change in welfare is decreasing in F. As a second firm enters the high quality segment, additional fixed costs are realized. Let us set the fixed costs to the lowest allowed value, namely let F = F c. This way, we are considering a situation most favorable for a welfare improving ban, while reducing the parameter space by one. Note that unlike our approach in the paper, which considers the least likely scenario for a welfare improvement after the ban, we consider here the most likely scenario for a welfare improvement.

Evaluating (9) at \(F=F^{c}=\frac {1}{9}\frac {(s_{H}-s_{L}+c-k)^{2}}{s_{H}-s_{L}}\) we arrive at

Notice that (10) is quadratic in k, and one can furthemore show that it is strictly concave. Finding its maximizer and evaluating (10) at this critical value (\(k^{*}=\frac {(35c+3s_{H}-3s_{L})s_{H}}{3s_{H}+32s_{L}}>0\)) we find the maximum value of the welfare difference as

which is clearly negative for all allowed parameter values. It is therefore not possible, even when one restricts certain parameters to maximize the net welfare gain under a ban, to achieve a welfare improving ban on low quality using the Shaked and Sutton (1982) preferences.

1.9 A–9 An Alternative Representation of Consumer Tastes

Motivated by the comments of the reviewers we show that heterogeneity in consumer tastes for quality can be modeled using a univariate distribution of consumer tastes and the following utility function:

where 𝜃 > 0 denotes consumer types and s is the quality level of the product.

We are going to show that this formulation leads to aggregate demand functions for the two qualities that are one-to-one transformations of those derived from our formulation of consumer tastes. Consequently, all of the results of our paper can be arrived at with this alternative formulation. Simply put, starting from two different micro foundations one will reach the same conclusions regarding the welfare effects of product ban.

Maximization of (12) with respect to a budget constraint leads to the following demand function for the vertically differentiated good

where p denotes the unit price, and a corresponding indirect utility function of

Let the distribution of consumer types be given by a univariate exponential density function

In order to find the proportion of consumers who prefer the high quality variant, one needs to find the region on the support of the random variable 𝜃 such that

where s H >s L indicating the quality difference between the alternatives. Given the indirect utility function in (14), the set of consumers who choose to buy the high quality variant is given by the region

The demand functions for the two quality variants can then be obtained by calculating the expected value of the demand in (13) over the corresponding region of 𝜃. Formally, the demand for the high quality product is

In order for the aggregate demand for high quality to be well-defined, it is necessary that s H < 1 which we impose in the remainder of this analysis. This in turn implies that s L < s H < 1 which insures the demand for low quality product is well-defined as well and is given by

On the other hand, when the low quality is banned all consumers will purchase the high quality product. The corresponding aggregate demand function is given by

Comparing \(\hat {d}_{H}^{C}(p_{H}, p_{L})\) and \(\hat {d}_{L}^{C}(p_{H}, p_{L})\) to the demand functions derived from our formulation, it can be seen that for \([\lambda _{1}=\frac {s_{H}-s_{L}}{1-s_{L}}, \lambda _{2}=\frac {s_{L}(s_{H}-s_{L})}{{s_{L}^{2}}-2s_{L}+s_{H}}]\) the two systems are equivalent. Furthermore, this equivalence of demands carries out to the case where the low quality product is banned, that is using the same reparametrization, the demand function for high quality product in the paper reduces to \(\hat {d}_{H}^{B}(p_{H})\). Since the aggregate demand functions are simple reparameterizations of one another, all the welfare results in the paper can be attained with either formulation. Also note that the reparameterization does not depend on additional conditions.

The reason we prefer our formulation with a bivariate distribution of tastes for high and low quality is its property that allows the tastes for quality to be uncorrelated across individuals. In other words, with our formulation there are consumers who value the high quality product much more than the low quality, and others who value the high quality just a bit more than the low quality, such that the ratio s H /s L varies across consumers. With the above formulation where consumer tastes follow a univariate distribution, all consumers compare the two qualities in an identical manner (i.e. s H /s L is the same for all). Even though the choice of micro foundations makes no difference in terms of the results obtained in the paper, we feel that our formulation of consumer preferences presents a more realistic picture.

Rights and permissions

About this article

Cite this article

Doganoglu, T., Inceoglu, F. Product Bans May Benefit Consumers: Implications from a New Model Of Vertical Product Differentiation. J Ind Compet Trade 15, 155–180 (2015). https://doi.org/10.1007/s10842-014-0179-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-014-0179-z