Abstract

This paper examines how an input supplier’s monopoly power affects exporters’ choice between compliance and noncompliance with rules of origin (ROO) in a free trade area (FTA). When the regional input supplier has monopoly power, the number of compliers largely affects the input price. This is because to meet ROO, exporters must use a certain ratio of the input originated within the area. In such a case, each exporter has an incentive to choose noncompliance with ROO if the rival exporter complies. Because this incentive yields strategic substitution between symmetric exporters, the coexistence of the complier and the non-complier appears in equilibrium. Our model consists of three final-good producers (one in an importing country and two in an exporting country) and one input supplier, which is in the importing country and has monopoly power. We show that within the range of parameter values for which some exporters comply with ROO, the content rate affects the output of the final-good producer in the importing country and the country’s welfare in a U-shaped fashion. The content rate levels that allow the coexistence of the complier and the non-complier minimize welfare.

Similar content being viewed by others

Notes

Rosellón (2000) also considers the choice of an exporter. However, his purpose is to examine the dynamic effects of ROO on the input market and labor income. Additionally, there are other works that consider different issues of ROO. Although Mizuno and Takauchi (2013) consider exporter choice, they focus on the production cost uncertainty of meeting ROO. Ishikawa et al. (2007) omit the input market, focus on the final good, and assume the price-discrimination behavior of firms that produce a final-good originating outside of the FTA.

Because firm L and the two exporting firms supply final goods to the same country’s market, the price discrimination of firm l is possibly against the competition policy of the importing country. We assume that firm l cannot discriminate in its price among final-good producers.

The value of (14) is always lesser than 7/10.

f 2(⋅) ≥ f 1(⋅) for all θ in [0, 1].

References

Anson J, Cadot O, Estevadeordal A, de Melo J, Suwa-Eisenmann A, Tumurchudur B (2005) Rules of origin in North–south preferential trading arrangements with an application to NAFTA. Rev Int Econ 13:501–517

Demidova S, Krishna K (2008) Firm heterogeneity and firm behavior with conditional policies. Econ Lett 98:122–128

Falvey R, Reed G (1998) Economic effects on rules of origin. Weltwirtshaftliches Archiv (Rev W Econ) 134(2):209–229

Falvey R, Reed G (2002) Rules of origin as commercial policy instruments. Int Econ Rev 43:393–407

Hayakawa K, Hiratsuka D, Shiino K, Sukegawa S (2009) Who uses free trade agreements? ERIA-DP-2009-22

Ishikawa J, Mukunoki H, Mizoguchi Y (2007) Economic integration and rules of origin under international oligopoly. Int Econ Rev 48:185–210

James W (2006) Rules of origin in emerging Asia-Pacific preferential trade agreements: will PTAs promote trade and development? Asia-Pacific Research and Training Network on Trade Working Paper Series, No. 19

Ju J, Krishna K (2005) Firm behavior and market access in a free trade area with rules of origin. Can J Econ 38:290–308

Krishna K, Krueger AO (1995) Implementing free trade areas: rules of origin and hidden protection. In: Deardorff AV et al (eds) New directions in trade theory. University of Michigan Press, Ann Arbor, pp 149–187

Krueger AO (1999) Free trade agreements as protectionist devices: rules of origin. In: Melvin J et al (eds) Trade, theory and econometrics: essays in honor of John Chipman. Routledge, London, pp 91–102

Lahiri S, Ono Y (1998) Foreign direct investment local content requirement, and profit taxation. Econ J 108:444–457

Lahiri S, Ono Y (2003) Export-oriented foreign direct investment and local content requirement. Pac Econ Rev 8:1–14

Lopez-de-Silanes F, Markusen JR, Rutherford TF (1996) Trade policy subtleties with multinational firms. Eur Econ Rev 40:1605–1627

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71:1695–1725

Mizuno T, Takauchi K (2013) Rules of origin and uncertain cost of compliance. MPRA Paper No. 44431

Mukherjee A, Ray A (2007) Strategic outsourcing and R&D in a vertical structure. Manch Sch 75(3):297–310

Mukherjee A, Broll U, Mukherjee S (2008) Unionized labor market and licensing by a monopolist. J Econ 93:59–79

Mukherjee A, Broll U, Mukherjee S (2009) The welfare effects of entry: the role of the input market. J Econ 98:189–201

Rosellón J (2000) The economics of rules of origin. J Int Trade Econ Dev 9:397–425

Takauchi K (2010) The effects of strategic subsidies under FTA with ROO. Asia Pac J Account Econ 17(1):57–72

Takauchi K (2011) Rules of origin and international R&D rivalry. Econ Bull 31(3):2319–2332

WTO (2002) Rules of origin regimes in regional trade agreements. WT/REG/W/45

Acknowledgments

The various valuable comments and suggestions from the anonymous referee are highly appreciated. I would like to thank Takashi Kamihigashi, Tomohiro Kuroda, Noriaki Matsushima, and Eiichi Miyagawa for their helpful comments. I also thank Younsub Chun, Jota Ishikawa, Seiichi Katayama, Tomomichi Mizuno, and the participants in seminars at a number of universities and conferences, including the 68th Japan Society of International Economics (Chuo University) and the International Young Economists’ Conference (Osaka University) for their comments. Of course, any remaining errors are my own responsibility.

Author information

Authors and Affiliations

Corresponding author

Appendix: proofs

Appendix: proofs

Proof of proposition 1

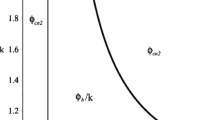

Let us consider exporter 1. Comparing (NC, NC) and (C, NC), the following indifference condition holds: \( \pi_1^E\left( {NC,NC} \right)=\pi_1^E\left( {C,NC} \right) \) is equivalent to \( \gamma ={{{4\theta \left( {1+3\theta } \right)}} \left/ {{\left( {51-38\theta +39{\theta^2}} \right)}} \right.}\equiv {f_1}\left( \theta \right) \), where γ ≡ τ/a. Similarly, comparing (NC, C) and (C, C), the following indifference condition holds: \( \pi_1^E\left( {NC,C} \right)=\pi_1^E\left( {C,C} \right) \) is equivalent to \( \gamma ={{{4\theta \left( {1+2\theta -{\theta^2}+4{\theta^3}} \right)}} \left/ {{\left( {3-4\theta +4{\theta^2}} \right)\left( {17-14\theta +17{\theta^2}} \right)}} \right.}\equiv {f_2}\left( \theta \right) \). Note that the exporters are symmetric; subsequently, f 1(θ) and f 2(θ) are valid for exporter 2. That is, f 1(θ) corresponds to exporter 2’s (NC, NC) and (NC, C) cases, and f 2(θ) corresponds to exporter 2’s (C, NC) and (C, C) cases. Thus, \( \gamma \geq {f_1}\left( \theta \right)\Leftrightarrow \pi_1^E\left( {C,NC} \right)\geq \pi_1^E\left( {NC,NC} \right) \), \( \gamma \leq {f_1}\left( \theta \right)\Leftrightarrow \pi_1^E\left( {NC,NC} \right)\geq \pi_1^E\left( {C,NC} \right) \), \( \gamma \geq {f_2}\left( \theta \right)\Leftrightarrow \pi_1^E\left( {C,C} \right)\geq \pi_1^E\left( {NC,C} \right) \), and \( \gamma \leq {f_2}\left( \theta \right)\Leftrightarrow \pi_1^E\left( {NC,C} \right)\geq \pi_1^E\left( {C,C} \right) \). Further, \( \gamma \geq {f_1}\left( \theta \right)\Leftrightarrow \pi_2^E\left( {NC,C} \right)\geq \pi_2^E\left( {NC,NC} \right) \), \( \gamma \leq {f_1}\left( \theta \right)\Leftrightarrow \pi_2^E\left( {NC,NC} \right)\geq \pi_2^E\left( {NC,C} \right) \), \( \gamma \geq {f_2}\left( \theta \right)\Leftrightarrow \pi_2^E\left( {C,C} \right)\geq \pi_2^E\left( {C,NC} \right) \), and \( \gamma \leq {f_2}\left( \theta \right)\Leftrightarrow \pi_2^E\left( {C,NC} \right)\geq \pi_2^E\left( {C,C} \right) \). For all θ in (0, 1], C becomes a dominant strategy for all exporters if γ ≥ f 2(θ). Next, for all θ in (0, 1], NC becomes a dominant strategy for all exporters if γ ≤ f 1(θ). Finally, for all θ in (0, 1], (C, NC) and (NC, C) are the equilibrium if f 2(θ) ≥ γ ≥ f 1(θ). Q.E.D.

Proof of proposition 2

First, \( {\pi^L}\left( {NC,NC} \right)={\pi^L}\left( {C,C} \right) \) is equivalent to \( {\tau \left/ {a} \right.}={{{-4\theta \left( {1-\theta } \right)}} \left/ {{\left( {3-4\theta +4{\theta^2}} \right)}} \right.}\equiv {q_1}\left( \theta \right) \). q 1(θ) is nonpositive for all θ in [0, 1], and \( {\pi^L}\left( {NC,NC} \right) > {\pi^L}\left( {C,C} \right) \) if γ > q 1(θ). \( {\pi^L}\left( {NC,NC} \right)\geq {\pi^L}\left( {C,C} \right) \) for all \( \left( {\theta, \gamma } \right)\in \left[ {0,1} \right]\times \left[ {0,{\tau^{\max }}} \right] \). Next, \( {\pi^L}\left( {NC,NC} \right)={\pi^L}\left( {C,NC} \right) \) is equivalent to \( {\tau \left/ {a} \right.}={{{-4\theta \left( {-1+\theta } \right)}} \left/ {{\left( {-3+\theta } \right)\left( {1+\theta } \right)}} \right.}\equiv {q_2}\left( \theta \right) \). q 2(θ) is non-positive for all θ in [0, 1], and \( {\pi^L}\left( {NC,NC} \right) > {\pi^L}\left( {C,NC} \right) \) if γ > q 2(θ). \( {\pi^L}\left( {NC,NC} \right)\geq {\pi^L}\left( {C,NC} \right) \) for all \( \left( {\theta, \gamma } \right)\in \left[ {0,1} \right]\times \left[ {0,{\tau^{\max }}} \right] \). Finally, \( {\pi^L}\left( {C,NC} \right)={\pi^L}\left( {C,C} \right) \) is equivalent to \( {\tau \left/ {a} \right.}={{{-4\theta \left( {-3+3\theta -2{\theta^2}+2{\theta^3}} \right)}} \left/ {{\left( {3-4\theta +4{\theta^2}} \right)\left( {3-6\theta +7{\theta^2}} \right)}} \right.}\equiv {q_3}\left( \theta \right) \). q 3(θ) is nonpositive for all θ in [0, 1], and \( {\pi^L}\left( {C,NC} \right) > {\pi^L}\left( {C,C} \right) \) if γ > q 3(θ). \( {\pi^L}\left( {C,NC} \right)\geq {\pi^L}\left( {C,C} \right) \) for all \( \left( {\theta, \gamma } \right)\in \left[ {0,1} \right]\times \left[ {0,{\tau^{\max }}} \right] \). Therefore, \( {\pi^L}\left( {NC,NC} \right)\geq {\pi^L}\left( {C,NC} \right)={\pi^L}\left( {NC,C} \right)\geq {\pi^L}\left( {C,C} \right) \) for all \( \left( {\theta, \gamma } \right)\in \left[ {0,1} \right]\times \left[ {0,{\tau^{\max }}} \right] \). Q.E.D.

Proof of proposition 3

(1) Differentiating y(C, C) and z j (C, C) with respect to θ, we have \( \left( {{{{\partial y}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,C} \right)={{{3a\left( {2\theta -1} \right)}} \left/ {{b{{{\left( {3-4\theta +4{\theta^2}} \right)}}^2}}} \right.} \) and \( \left( {\partial {{z}_{j}}/\partial \theta } \right)\left( {C,C} \right) = {{{a\left( {1 - 8\theta + 4{{\theta }^{2}}} \right)}} \left/ {{2b{{{\left( {3 - 4\theta + 4{{\theta }^{2}}} \right)}}^{2}}}} \right.} \). Thus, \( \left( {{{{\partial y}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,C} \right)\geq \left( < \right)\;0 \) if θ ≥ (<)1/2, and \( y\left( {C,C} \right)\left| {_{{\theta ={1 \left/ {2} \right.}}}} \right.=0 \). From the numerator of (∂z j /∂θ), \( 1-8\theta +4{\theta^2}\geq 0 \) if \( \theta \leq \left( {{1 \left/ {2} \right.}} \right)\left( {2-\sqrt{3}} \right) \). Thus, \( \left( {{{{\partial {z_j}}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,C} \right)\geq \left( < \right)\;0 \) if \( \theta \leq \left( > \right)\;\left( {{1 \left/ {2} \right.}} \right)\left( {2-\sqrt{3}} \right)\simeq 0.133975 \). (2) Differentiating y(C, NC), z 1(C, NC), and z 2(C, NC) with respect to θ, we have \( \left( {\partial y/\partial \theta } \right)\left( {C,NC} \right) = {{{\left( {a + \tau } \right)\left( {{{\theta }^{2}} + 6\theta - 3} \right)}} \left/ {{2b{{{\left( {3 - 2\theta + 3{{\theta }^{2}}} \right)}}^{2}}}} \right.} \), \( \left( {{{{\partial {z_1}}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,NC} \right)={{{\left( {a+\tau } \right)\left( {3{\theta^2}-6\theta -1} \right)}} \left/ {{2b{{{\left( {3-2\theta +3{\theta^2}} \right)}}^2}}} \right.} < 0 \), and \( \left( {{{{\partial {z_2}}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,NC} \right)={{{\left( {a+\tau } \right)\left( {1-{\theta^2}} \right)}} \left/ {{b{{{\left( {3-2\theta +3{\theta^2}} \right)}}^2}}} \right.}\geq 0 \). Here, \( \left( {{{{\partial y}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,NC} \right)=\left( {{{{\partial y}} \left/ {{\partial \theta }} \right.}} \right)\left( {NC,C} \right) \), \( \left( {{{{\partial {z_1}}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,NC} \right)=\left( {{{{\partial {z_2}}} \left/ {{\partial \theta }} \right.}} \right)\left( {NC,C} \right) \), and \( \left( {{{{\partial {z_2}}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,NC} \right)=\left( {{{{\partial {z_1}}} \left/ {{\partial \theta }} \right.}} \right)\left( {NC,C} \right) \). From the numerator of ∂y/∂θ, \( {\theta^2}+6\theta -3\geq 0 \) if \( \theta \geq 2\sqrt{3}-3 \). Thus, \( \left( {{{{\partial y}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,NC} \right)\geq \left( < \right)\;0 \) if \( \theta \geq \left( < \right)\;2\sqrt{3}-3\simeq 0.464102 \). Further, \( y\left( {C,NC} \right)\left| {_{{\theta =2\sqrt{3}-3}}} \right.={{{3\left( {a+\tau } \right)\left( {7-4\sqrt{3}} \right)}} \left/ {{8b\left( {9-5\sqrt{3}} \right)}} \right.} > 0 \). Since \( \left( {{{{\partial {\pi^L}}} \left/ {{\partial \theta }} \right.}} \right)\left( { \cdot } \right)=2by\left( { \cdot } \right)\left( {{{{\partial y}} \left/ {{\partial \theta }} \right.}} \right)\left( { \cdot } \right) \) and \( \left( {{{{\partial \pi_j^E}} \left/ {{\partial \theta }} \right.}} \right)\left( { \cdot } \right)=2b{z_j}\left( { \cdot } \right)\left( {{{{\partial {z_j}}} \left/ {{\partial \theta }} \right.}} \right)\left( { \cdot } \right) \), \( \mathrm{sign}\left\{ {\left( {{{{\partial {\pi^L}}} \left/ {{\partial \theta }} \right.}} \right)\left( { \cdot } \right)} \right\}=\mathrm{sign}\left\{ {\left( {{{{\partial y}} \left/ {{\partial \theta }} \right.}} \right)\left( { \cdot } \right)} \right\} \) and \( \mathrm{sign}\left\{ {\left( {{{{\partial \pi_j^E}} \left/ {{\partial \theta }} \right.}} \right)\left( { \cdot } \right)} \right\}=\mathrm{sign}\left\{ {\left( {{{{\partial {z_j}}} \left/ {{\partial \theta }} \right.}} \right)\left( { \cdot } \right)} \right\} \). Q.E.D.

Proof of proposition 4

First, comparing (15) with (16), we obtain

This yields the following equations:

where \( B\equiv -8281-168\theta +26504{\theta^2}-47904{\theta^3}+19184{\theta^4} < 0 \). Since γ 2 < 0 for all θ in [0, 1], we can omit γ 2. W(NC, NC) > W(C, C) if γ < γ 1 and W(NC, NC) < W(C, C) if γ > γ 1. Since γ 1 > τ max for all θ in [0, 1], W(NC, NC) > W(C, C). Second, comparing (16) with (17), we obtain

Solving W(C, C) = W(C, NC) with respect to τ, we obtain

where \( D\equiv 819-1572\theta +1538{\theta^2}-708{\theta^3}+99{\theta^4} > 0\;and\;\mathrm{F}\equiv 114705-680724\theta +1996874{\theta^2}-3698236{\theta^3}+4594521{\theta^4}-3950392{\theta^5}+2254340{\theta^6}-792944{\theta^7}+106128{\theta^8} \). Since γ 4 < 0 for all θ in [0, 1], we can omit γ 4. On the other hand, γ 3 > 0.7 > τ max and γ 3 is strictly increasing with respect to θ. This implies that W(C, C) > W(C, NC) if γ < γ 3. Thus, \( W\left( {C,C} \right)>W\left( {C,NC} \right)\left( {=W\left( {NC,C} \right)} \right) \). Q.E.D.

Proof of proposition 5

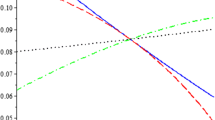

Differentiating (16) and (17) with respect to θ, we obtain

From (A.1), the meaning root of \( -14+61\theta -90{\theta^2}+44{\theta^3}+8{\theta^4}=0 \) is θ = 1/2. Thus, \( \left( {{{{\partial W}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,C} \right)\leq \left( > \right)\ 0 \) if θ ≤ (>)1/2. From the denominator of (A.2), we solve the inequality \( \left( {17+5\theta -27{\theta^2}+31{\theta^3}-18{\theta^4}} \right)\;{\tau^2}+2\left( {5+13\theta -27{\theta^2}+23{\theta^3}-6{\theta^4}} \right)\;a\tau +\left( {-7+21\theta -27{\theta^2}+15{\theta^3}+6{\theta^4}} \right)\ {a^2}\geq 0 \) with respect to τ and obtain τ ≤ − a or a × g −1(θ) ≤ τ. Thus, we obtain \( \left( {{{{\partial W}} \left/ {{\partial \theta }} \right.}} \right)\left( {C,NC} \right)=\left( {{{{\partial W}} \left/ {{\partial \theta }} \right.}} \right)\left( {NC,C} \right)\leq \left( > \right)\ 0 \) if θ ≤ (>) g (γ), where \( {g^{-1 }}\left( \theta \right)\equiv {{{\left( {-7+21\theta -27{\theta^2}+15{\theta^3}+6{\theta^4}} \right)}} \left/ {{\left( {-17-5\theta +27{\theta^2}-31{\theta^3}+18{\theta^4}} \right)}} \right.} \). Q.E.D.

Rights and permissions

About this article

Cite this article

Takauchi, K. Rules of Origin and Strategic Choice of Compliance. J Ind Compet Trade 14, 287–302 (2014). https://doi.org/10.1007/s10842-013-0159-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-013-0159-8