Abstract

In this paper, I investigate whether instead of strengthening home-based production, government R&D-subsidies can induce R&D-intensive firms to locate production abroad. Investigating firm-level data on Swedish MNEs, however, I find no evidence of such relocation. R&D subsidies rather tend to encourage export production at the expense of foreign production. The theory presented suggests that this is consistent with technology transfer costs, which outweigh trade costs for physical goods.

Similar content being viewed by others

Notes

According to OECD, annual programs transfer some US $50 billion from public budgets to the enterprise sector. “Public Support to Industrial R&D Efforts,” available at http://www1.oecd.org/dsti/sti/prod/intro-21.htm. OECD (1996).

The car producers VOLVO and SAAB are owned by the US firms FORD and GM with global car producing capabilities. In the empirical analysis conducted below (1965–1998), VOLVO and SAAB were Swedish-owned firms.

Indeed, MNEs often dominate R&D activities in their home countries. For example, in 1965, ten MNEs accounted for 75 % of the business R&D expenditures in Sweden. In 1994, this share had risen to 90 % (Jakobsson 1999). In 2004, 22 Swedish and 12 foreign multinationals accounted for 70% of all aggregate R&D expenditures in Sweden (ITPS 2007). Indeed, the ability to add the services of their firm-specific assets into additional production facilities at low costs is often put forward as a key ingredient in explaining the existence of MNEs (see Dunning 1977 and Markusen 1995).

In this vein, Blomstrom (2000) argues that Sweden as a country lost market shares in international markets when large Swedish MNEs increased their share of world markets. At the same time, generous government subsidies to R&D were granted. Technology policies may then have increased an on-going process leading MNEs to utilize assets abroad instead of domestically. While subsidy policies may have served to increase the rents of Swedish firms, the externalities associated with high-tech production in Sweden may not have materialized.

Teece (1977) provides strong evidence of the existence of such technology transfer costs.

When government agencies support the development of a product, financing is provided at the development stage often years before actual production takes place. The government could, in principle, write a contract conditioning payments in the development phase on the location production. Such practice seems rare, however. Conditions for the location of production appear not to be attached to government support in Sweden.

See Cheng (1984).

I model the costs of transferring the new technology to a foreign affiliate in a very simple way. Markusen (2002) uses a more general model to show how firms with knowledge-capital intensive production risk asset dissipating when producing abroad and how this affects the choice between foreign production and exporting. Agency problems affecting the mode to serve a foreign market are also extensively discussed in Barba Navaretti and Venables (2004).

The assumption of a quadratic transfer cost is not essential. What is important is that the transfer cost influences the level of R&D, x.

In the Appendix, it is shown that the latter assumption guarantees that the second-order condition for the firm’s maximization is fulfilled.

These conditions are necessary to guarantee that production is profitable.

Comparing marginal costs, note that Δc = c E − c A , which can be written as Δc = t + θ(x A − x E ).

A decrease in η ∗ is indicated by a minus sign, an increase in η ∗ by a plus sign.

The countries included are: Belgium, France, Italy, the Netherlands, Germany, Luxemburg, UK, Norway, Ireland, Denmark, Spain, Portugal, Greece, Finland, Austria, Switzerland, USA, Canada, Japan, Australia and New Zealand. The last two countries are combined into one single country observation.

Ideally, one would like to find a direct measure of technology transfer costs. A measure using the age of the affiliates should reflect that such costs are lower in more experienced firms but, admittedly, this is not an exact measure. It is very hard to find alternatives, however. One alternative, which has been suggested, is to try measures of royalty payments from the affiliates back to the parents as a proxy for technology transfer costs. However, there are reasons to believe this to be a biased measure. First, it is not clear how royalties would reflect the cost of transferring technology. As a part of the firm’s internal pricing system, they could equally well just reflect profit flows from the affiliates. Moreover, there is a great variety in the way firms use transfer pricing. Many firms with high R&D intensities do not even use transfer- or royalty payments for technology. And for firms which do use such payments, there are reasons to believe that they would distort such prices or payments to avoid taxes, or other costs created by government policies.

The firm-specific effects pick up the variation in the AGE variable, rendering this variable insignificant. This may be so because for firms remaining in the sample, age-differences between firms are roughly constant over time.

Large subsidies were recorded in 1965 for group 4 (Machinery n.e.c.; Office, accounting and computing machinery; Instruments Electrical machinery; Electronic equipment).

These regressions investigate the location decision for firm i country j at time t. In the present paper, the overall location decision of firm i in time t is examined. Results are available on request.

Within Swedish MNEs, the bulk of R&D takes place at home, although there is an increasing share of foreign R&D, which might indicate that R&D for developing new products and technologies is to a larger extent carried out abroad.

It might be argued that there is a sample selection bias present since purely exporting firms are absent in the RIIE sample. However, there also seems to be an export-bias for R&D-intensive firms in other studies. In Brainard (1997), where trade data from the US Bureau of Census and FDI data from the Bureau of Economic Analysis are combined, it is found that when levels of affiliate production and exports are regressed separately against R&D intensity; both increase in R&D, but the elasticity of exports is about two and half times larger. While R&D intensity is not used as a regressor when explaining the variation in the affiliate share of foreign sales, these elasticities implicitly suggest a negative correlation.

References

Barba Navaretti G, Venables A (2004) Multinational firms in the world economy. Princeton University Press, Princeton

Blomstrom M (2000) Internationalization and growth: evidence from sweden. Swed Econ Policy Rev 7(1):185–201

Brainard LS (1997) An empirical assessment of the proximity-concentration trade-off between multinational sales and trade. Am Econ Rev 87:520–544

Brander JA (1995) Strategic trade policy. In: Grossman and Rogoff (eds) Handbook of international economics, vol 3. Elsevier, Amsterdam

Cheng L (1984) International competition in R&D and technological leadership. J Int Econ 17:15–40

Dick A (1993) Strategic trade policy and welfare: the empirical consequences of cross-ownership. J Int Econ 35:227–249

Dunning JH (1977) Trade, location of economic activities and the MNE: a search for an eclectic approach. In: Hesselborn P-O, Ohlin B, Wijkman P-M (eds) The international allocation of economic activity. MacMillan, London, pp 395–418

Flam H (1994) EC members fighting about surplus: VERs, FDI and Japanese cars. J Int Econ 36:117–131

Haaland J, Kind H (2008) R&D policies, trade and process innovation. J Int Econ 74(1):170–187

Horstmann I, Markusen JR (1992) Endogenous market structures in international trade (natura facit saltum). J Int Econ 32:109–129

ITPS (2007) Forskning och utvecklingi internationella företag. S2007:006

Jakobsson U (1999) Storföretagen och den ekomiska tillvä xten. In: Calmfors L, Persson M (eds) Tillväxt och ekonomisk politik, pp 329–356

Leahy D, Neary P (1996) International R&D rivalry and industrial strategy without government commitment. Rev Int Econ 4:322–338

Leahy D, Neary P (2009) Multilateral subsidy games. In: Econ Theory, vol 41, no 1, pp 41–66, Springer

Markusen JR (1995) The boundaries of multinational enterprises and the theory of international trade. J Econ Perspect 9:169–189

Markusen JR (2002) Multinational firms and the theory of international trade. MIT, Cambridge

Norbäck P-J (2001) Multinational firms, technology and location. J Int Econ 54:449–469

OECD (1996) Public support to Industry, 1989–1993. Report by the Industry Committee Council at Ministerial level. [OECD/GD(96)82], Paris

OECD (1997) Economic outlook no. 61: annual data. OECD, Issy les Moulineaux

Ravenscraft D, Scherer F (1982) The lag structure of returns to research and development. Appl Econ 14:603–620

Sanna-Randaccio F (2002) The impact of foreign direct investment on the home and host countries with endogenous R&D. Rev Int Econ 10(2):278–298

SCB (1965, 1970) Industristatistiken

Smith A (1987) Strategic investments, multinational corporations and trade policy. In: European Economic Review, vol 31, nos 1–2, pp 89–96, Elsevier

Swedenborg B (1982) Swedish industry abroad. An analysis of driving-forces and effects. IUI, Stockholm

Teece DJ (1977) Technology transfer by multinational firms: the resource cost of transferring technological know-how. Econ J 87:242–261

Author information

Authors and Affiliations

Corresponding author

Additional information

I want to thank Susana Aparicio for helpful data assistance and Statistics Sweden for providing additional data.

Appendix

Appendix

First, the statements in Lemmas 1 and 2 are proved, then Table 3 is derived. A simulation of the model is also provided. Finally, second-order conditions are shown.

A.1 Proof of Lemmas 1 and 2

In Table 7, I provide most expressions needed for this appendix. These can be derived noting that Π h from Table 2 can be written as follows:

The first entries in the first row in Table 7 proves Lemma 1. To prove Lemma 2, define the difference in variable profits as \(\triangle \Pi =\Pi _{E}-\Pi _{A}\). It is easily seen that τ = ∞ (infinite transfer costs) implies \(\tfrac{\partial \triangle \Pi }{\partial \eta }>0\), whereas τ = 1 (no transfer costs) implies \(\tfrac{\partial \triangle \Pi }{\partial \eta }<0.\) It follows that \(\tfrac{\partial \triangle \Pi }{\partial \eta }\) must be monotonically increasing in τ. Then, define τ ∗ such that \(\tfrac{\partial \triangle \Pi ((\tau ^{\ast },\mathbf{z})}{ \partial \eta }=0\). Hence, if there is a η = η ∗ such that \( \triangle \Pi (\eta ^{\ast },\mathbf{z})=0\Leftrightarrow \Pi _{E}\left( \eta ^{\ast },\mathbf{z}\right) =\Pi _{A}\left( \eta ^{\ast },\mathbf{z} \right) ,\) where z is the vector of exogenous variables, it follows that Π E < Π A for η > η ∗ and τ < τ ∗ , whereas Π E > Π A for η > η ∗ and τ > τ ∗ .

A.2 Proof of Proposition 3

I show only the proof for a small subsidy. Below, I provide a simulation illustrating that results also extend beyond infinitesimal subsidies.

Using the equality \(\Pi _{E}\left( \eta ^{\ast },\mathbf{z}\right) =\Pi _{A}\left( \eta ^{\ast },\mathbf{z}\right) \), implicit differentiation yields:

where Eq. 18 is used to determine the signs in Table 3. Inserting the appropriate expressions from Table 7 in Eq. 18 yields these signs. Inspecting Table 7, it can be shown that there exists a \(\hat{\tau}\), such that \(\tau > \hat{\tau}\) implies \(\tfrac{\partial \left( \Pi _{E}-\Pi _{A}\right) }{ \partial \sigma }>0\), a \(\tilde{\tau}\) such that \(\tau >\tilde{\tau}\) implies \(\tfrac{\partial \left( \Pi _{E}-\Pi _{A}\right) }{\partial \eta }>0\) and that \(\hat{\tau}>\tilde{\tau}>0\) holds. Setting \(\tau ^{\ast }=\hat{\tau} \) completes the proof of Proposition 3.

A.2.1 A simulation with non-infinitesimal R&D-subsidies

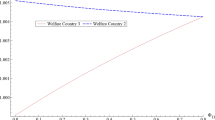

Here, I present a simulation showing that the results also extend into subsidies which are not infinitesimal. Figure 1 shows how large the trade cost must be for the firm to be indifferent between affiliate- and export production. More formally, I define this critical trade cost, t ∗ , where \(\Pi _{E}\left( t^{\ast },\mathbf{z}\right) =\Pi _{A}\left( t^{\ast },\mathbf{z}\right) \). In Fig. 1, t ∗ , is plotted against the transfer cost, τ, and the return to R&D, η. Other parameter values are A = s = 5, σ = 0.5, θ = 0.2 and G = 1. Figure 1 is easily interpreted: If trade costs are above the surface t ∗ , “tariff-jumping” occurs and the firm chooses FDI. Conversely, if trade cost are below t ∗ , export production takes place. Note that when transfer costs τ are high (low) and the return to R&D η is high, exports (FDI) are chosen, as predicted by the theory in Section 2.

In Fig. 2, I make the following experiment. Suppose that the R&D subsidy is originally set at σ = 0.5, generating the critical trade cost \( \left. t^{\ast }(\tau ,\eta )\right\vert _{\sigma ={\kern.8pt} 0.5}\) shown in Fig. 1, where once more t ∗ is level of the trade cost such that the firm is indifferent between the two location strategies. Figure 2 then shows the effect on the location decision of an increase in the R&D subsidy from σ = 0.5 to σ = 3. Calculating \(\left. t^{\ast }(\tau ,\eta )\right\vert _{\sigma =3}\), it follows that the firm chooses affiliate production whenever \(\left. t^{\ast }(\tau ,\eta )\right\vert _{\sigma =3}<\left. t^{\ast }(\tau ,\eta )\right\vert _{\sigma =0.5}\) and export production, whenever the opposite holds. As predicted from the theory, it can be seen that when transfer costs are absent or low, FDI is chosen. However, once the return to R&D η is sufficiently increased for positive transfer costs, exports are preferred. This is also the case for higher transfer costs, irrespective of the return to R&D.

A.3 Appendix: second-order conditions

In this appendix, we check the firm’s second-order conditions for the maximization of Π h . For having a well-posed maximization problem, the Hessian, defined in (19), must be negative definite:

where, for example, \(\Pi _{h,q_{h},x_{h}}=\frac{\partial ^{2}\Pi _{h}}{ \partial q_{h}\partial x_{h}}\). This, in turn, requires that \(\left\vert Q_{h}\right\vert >0,\Pi _{h,q_{h},q_{h}}<0\) and \(\Pi _{h,x_{h},x_{h}}<0\). I can show that this will hold if \(\frac{\eta }{\tau }<2\), since:

Rights and permissions

About this article

Cite this article

Norbäck, PJ. Subsidizing Away Exports? A Note on R&D-policy Towards Multinational Firms. J Ind Compet Trade 11, 25–42 (2011). https://doi.org/10.1007/s10842-009-0061-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-009-0061-6