Abstract

We study the welfare ranking of an emission tax and emissions trading when firms self-report their emissions to the regulator and may be noncompliant. We allow for the subjective probabilities of auditing and, using conventional assumptions, find that an emission tax produces a higher level of welfare than emissions trading under noncompliance. The main driver of the result is that the compliance pattern of the firms affects the marginal compliance cost (price of emissions) in the case of permits, thus affecting the level of emissions and welfare. The result also holds when enforcement and sanctioning costs are taken into account and differs from the result found by Montero (J Public Econ 85:435–454, 2002). We also show that the ranking may be reversed if these costs are taken into account and the regulator must audit at least one firm. We also analyze the welfare ranking when the expected penalties depend on relative violations.

Similar content being viewed by others

Notes

Montero’s model is used in Rohling and Ohndorf (2012) to analyze the effect of fiscal cushioning in the choice between emissions trading and emission tax. They found evidence in favor of emissions trading.

For example, a firm may think that its choice of violation affects the chance for the firm to belong to the set of audited firms. This is something like speeding on the motorway; the probability of the police stopping you is essentially subjective and may depend on how much over the limit you are speeding.

From page 91.

As Hatcher (2012) explains, expected penalties may depend on the relative violations, since penalties in addition to probabilities may depend on the relative violations.

Throughout we assume that the firms must self-report their emissions to the regulator. For example, in the EU ETS, self-reporting is carried out during accredited inspections and compliance checks by the competent authority.

We assume throughout the paper that the regulator can commit to the monitoring scheme and that the firms regard the scheme credible. See Franckx (2002) for an analysis of the case where the regulator cannot commit to the auditing probability it sets.

Relative violations are discussed in Sect. 3.

These assumptions are similar to the ones made in Van Egteren and Weber (1996) and Malik (2002). Sandmo (2002) thinks that it is more realistic to allow the auditing probability to depend on the level of violation. Also, among many others, Harford (1978) and Rousseau and Proost (2005, 2009) assume that the auditing probability is increasing in violations.

Sandmo (2002) sees \(m_i'(v_i)>0\) and \(m_i''(v_i)>0\) as ”natural” assumptions. If we allowed \(m_i''(v_i)\ge 0\), we should also analyze corner solutions. However, we are only interested in interior solutions.

Perhaps because firm’s subjective auditing probability depends on parameters that are characteristic to that firm such as its stakeholders or its geographical distance to the regulator.

This follows from the concavity of the benefit function: Assume that firm \(i\) is compliant when there are \(n-k\) compliant firms and noncompliant when there are \(n-(k+1)\) compliant firms. The other firms’ behavior between compliance and noncompliance is fixed. Then

$$\begin{aligned} \pi _i'(e_i^h)=p_{n-k}>p_{n-(k+1)}=\pi _i'\left( e_i^d\right) , \end{aligned}$$where the last equation follows after summing Eqs. (3) and (4). The (strict) concavity of the benefit function \(\pi \) implies then that \(e_i^h<e_i^d\).

The result in the lemma has also been observed, for example, in Sandmo (2002).

The strict convexity of \(D\) is not actually needed for the main results.

Note that the argument of function \(D\) is not the total initial allocation, but the total actual emissions at price \(p\).

A similar argument is also given in the analysis made by Arguedas et al. (2010) in the case of investing in abatement technology.

We could let the enforcement costs depend continuously and smoothly on the level of auditing, namely we could let the enforcement costs be a function \(\mathcal {E}(a^j)\) with \(\mathcal {E}'(a^j)>0\), where \(a^j\in [0,1)\) is the proportion of firms audited. The discrete choice is more intuitive, though.

Stranlund (2007) has analyzed enforcement and sanctioning costs in an emissions trading model but uses an objective auditing probability. Also, Stranlund and Moffitt (2014) include these costs in their analysis on hybrid policies and noncompliance, but they too use an objective auditing probability.

The penalty function is given. Of course, at least the unit penalty can also be chosen by the regulator (as well as many other factors). We abstract away from these possibilities.

Numerical analysis may be useful in this case.

References

Arguedas, C., Camacho, E., & Zofío, J. L. (2010). Environmental policy instruments: Technology adoption incentives with imperfect compliance. Environmental and Resource Economics, 47, 261–274.

Edlin, A. S., & Shannon, C. (1998). Strict monotonicity in comparative statics. Journal of Economic Theory, 81, 201–219.

Franckx, L. (2002). The use of ambient inspections in environmental monitoring and enforcement when the inspection agency cannot commit itself to announced inspection probabilities. Journal of Environmental Economics and Management, 43, 71–92.

Harford, J. D. (1978). Firm behavior under imperfectly enforceable pollution standards and taxes. Journal of Environmental Economics and Management, 5, 26–43.

Hatcher, A. (2005). Non-compliance and the quota price in an ITQ fishery. Journal of Environmental Economics and Management, 49, 427–436.

Hatcher, A. (2012). Market power and compliance with output quotas. Resource and Energy Economics, 34, 255–269.

Heyes, A. G. (1998). Making things stick: Enforcement and compliance. Oxford Review of Economic Policy, 14, 50–63.

Keeler, A. G. (1991). Noncompliant firms in transferable discharge permit markets: Some extensions. Journal of Environmental Economics and Management, 21, 180–189.

Macho-Stadler, I., & Pérez-Castrillo, D. (2006). Optimal enforcement policy and firms’ emissions and compliance with environmental taxes. Journal of Environmental Economics and Management, 51, 110–131.

Malik, A. S. (1990). Markets for pollution control when firms are noncompliant. Journal of Environmental Economics and Management, 18, 97–106.

Malik, A. S. (1992). Enforcement costs and the choice of policy instruments for controlling pollution. Economic Inquiry, 30, 714–721.

Malik, A. S. (2002). Further results on permit markets with market power and cheating. Journal of Environmental Economics and Management, 44, 371–390.

Milgrom, P., & Shannon, C. (1994). Monotone comparative statics. Econometrica, 62, 157–180.

Montero, J.-P. (2002). Prices versus quantities with incomplete enforcement. Journal of Public Economics, 85, 435–454.

Polinsky, A. M., & Shavell, S. (1992). Enforcement costs and the optimal magnitude and probability of fines. Journal of Law and Economics, 35, 133–148.

Rousseau, S., & Proost, S. (2005). Comparing environmental policy instruments in the presence of imperfect compliance—A case study. Environmental and Resource Economics, 32, 337–365.

Rousseau, S., & Proost, S. (2009). The relative efficiency of market-based environmental policy instruments with imperfect compliance. International Tax and Public Finance, 16, 25–42.

Rohling, M., & Ohndorf, M. (2012). Prices vs. quantites with fiscal cushioning. Resource and Energy Economics, 34, 169–187.

Sandmo, A. (2002). Efficient environmental policy with imperfect compliance. Environmental and Resource Economics, 23, 85–103.

Stranlund, J. K., & Dhanda, K. K. (1999). Endogenuous monitoring and enforcement of a transferable emissions permit system. Journal of Environmental Economics and Management, 38, 267–282.

Stranlund, J. K. (2007). The regulatory choice of noncompliance in emissions trading programs. Environmental and Resource Economics, 38, 99–117.

Stranlund, J. K., Chávez, C. A., & Villena, M. G. (2009). The optimal pricing of pollution when enforcement is costly. Journal of Environmental Economics and Management, 58, 183–191.

Stranlund, J. K., & Moffitt, J. L. (2014). Enforcement and price controls in emissions trading. Journal of Environmental Economics and Management, 67, 20–38.

Van Egteren, H., & Weber, M. (1996). Marketable permits, market power and cheating. Journal of Environmental Economics and Management, 30, 161–173.

Villegas-Palacio, C., & Coria, J. (2010). On the interaction between imperfect compliance and technology adoption: Taxes versus tradable emissions permits. Journal of Regulatory Economics, 38, 274–291.

Acknowledgments

The author thanks Markku Ollikainen, Essi Eerola, Anastasios Xepapadeas, Arun Malik, and Nils-Henrik von der Fehr for their helpful comments. Financial support from the OP-Pohjola Group Research Foundation is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Lemma 1

Fix \(k =0,\ldots ,n-1\) and define a function \(F :\mathbb {R}_+ \rightarrow \mathbb {R}\) with

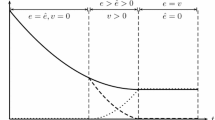

The function \(F\) is strictly decreasing in \(p\) since emission reports and actual emissions are strictly decreasing in \(p\). Since \(p_{n-k}\) is the equilibrium price with \(k\) noncompliant firms, we have \(F(p_{n-k})=0\).

We evaluate the difference \(F(p_{n-k})-F(p_{n-(k+1)})\) as follows.

where the inequality follows from the definition of noncompliant behavior, that is, from the inequality \(\hat{e}_i(p)<e_i^h(p)\) for any \(p\) and for any noncompliant firm, and the last equality follows from the market clearing condition for \(k+1\) noncompliant firms.

Now we show that \(p_{n-k}>p_{n-(k+1)}\) by contradiction. Assume that \(p_{n-k}\le p_{n-(k+1)}\) holds. If \(p_{n-k}=p_{n-(k+1)}\), then \(F(p_{n-k})=F(p_{n-(k+1)})\), contradicting (39), and if \(p_{n-k}<p_{n-(k+1)}\), then \(F(p_{n-k})>F(p_{n-(k+1)})\), since \(F\) is strictly decreasing, which again contradicts (39). To conclude, the assumption \(p_{n-k}\le p_{n-(k+1)}\) leads to a contradiction implying that the inequality \(p_{n-k}> p_{n-(k+1)}\) holds.

1.2 Proof of Lemma 3

If \(v_i=0\), we have from Eq. (28) that \(S'_i(0)\frac{1}{e_i }=p+\lambda \ge p\). We give a proof for the other direction by showing that \(v_i>0\) implies that \(S'_i(0)\frac{1}{e_i }<p\). When \(v_i>0\), we have \(\lambda _i=0\). Therefore equality

holds. Using the strict convexity of \(S_i\) and the inequality \(e_i>\hat{e}_i\), we obtain

1.3 Proof of Lemma 4

Part (i). (We assume differentiability where ever necessary.) We first use Theorem 5 (Topkis’s Theorem) in Milgrom and Shannon (1994) to show that the actual and reported emissions are nonincreasing in the permit price. The objective function \(\Pi _i^p\) is supermodular in \((e_i,\hat{e}_i)\) and satisfies increasing differences in \((e_i,\hat{e}_i;-p)\), since

Therefore, \(\mathop {\text {argmax}}_{(e_i,\hat{e}_i) \in X} \Pi _i^p(e_i,\hat{e}_i;-p)\), where \(X\) is the feasible set \(\{ (e_i,\hat{e}_i) \in \mathbb {R}^2 \ | \ e_i>0, \hat{e}_i>0, e_i-\hat{e}_i\ge 0 \}\), is nondecreasing in \(-p\) or equivalently nonincreasing in \(p\). In particular,

Now we show that the reported emissions of a noncompliant firm are strictly decreasing in the permit price. We do this by applying the aggregation method described in Milgrom and Shannon (1994) together with Strict Monotonicity Theorem 1 (SMT1) in Edlin and Shannon (1998). Define

where \(\hat{e}_i \in \mathbb {R}_{++}\). The function \(K_i\) has increasing marginal returns (that is, \(\frac{\partial K_i}{\partial \hat{e}_i}\) is increasing in \(-p\)), since

by (44). Let \(-p'>-p^*\) (the other case is derived similarly) and define

From the beginning of the proof, we know that \(\hat{e}_i'\ge \hat{e}_i^*\), which can be strengthened to \(\hat{e}_i'> \hat{e}_i^*\) by (46) and by SMT1. In other words, we have that \(p'<p^*\) implies \(\hat{e}_i'> \hat{e}_i^*\), as desired.

Part (ii). We can use the same reasoning as in the proof of Lemma 1, since the reported emissions (and the actual) are strictly decreasing in the permit price.

1.4 Proof of Lemma 5

A noncompliant firm chooses its emissions and reported emissions such that

The term in the brackets is positive, since \(e_i^d>\hat{e}_i\). When the firm is compliant, equation \(\pi _i'(e_i^h)=t\) holds. Since \(\pi _i''<0\), we have \(e_i^d>e_i^h\).

Rights and permissions

About this article

Cite this article

Lappi, P. The welfare ranking of prices and quantities under noncompliance. Int Tax Public Finance 23, 269–288 (2016). https://doi.org/10.1007/s10797-015-9356-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-015-9356-1