Abstract

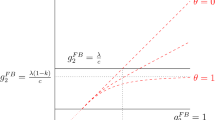

This paper studies how Oates’ trade-off between centralized and decentralized public good provision is affected by changes in households’ mobility. We show that an increase in household mobility favors centralization. This results from two effects. First, mobility increases competition between jurisdictions in the decentralized régime, resulting in lower levels of public good provision. Second, while tyranny of the majority creates a gap between social welfare in different jurisdictions in the centralized régime, mobility allows agents to move to the majority jurisdiction, raising average social welfare. Our main result is obtained in a baseline model where jurisdictions first choose taxes, and households move in response to tax levels. We show that the result is robust to changes in the objective function and the strategic variable of local governments.

Similar content being viewed by others

Notes

Eurostat: Migration and migrant population statistics, October 2011.

Dustmann et al. (2010) report that the share of immigrants from accession countries as a proportion of the UK working-age population increased from 0.01 to 1.3 % by the beginning of 2009.

Notice, however, that this effect of mobility on public good provision only arises when jurisdictions take into account the effect of their choice of tax/public good packages on mobility. Hence, in order to capture this effect, we construct a sequential model where jurisdictions choose their tax/public good package in the first stage, and households move in the second stage.

In our earlier work (Bloch and Zenginobuz 2006, 2007), we analyzed the Tiebout equilibria of the same model of public good provision with spillovers, but did not restrict attention to symmetric equilibria. Notice also that the same independence result obtains if, instead of considering a model of simultaneous mobility and taxation decisions, we analyzed a model of “slow” migration where agents choose their jurisdiction before jurisdictions choose taxation levels (Mitsui and Sato (2001) and Hoel (2004)). In that case, as in the Tiebout model, at a symmetric equilibrium, \( n_{1}=n_{2}=1\), and the equilibrium choice of jurisdictions \(g^{*}\) is independent of \(\lambda \).

Jehiel and Scotchmer (2001) also adopt this refinement to abstract from coordination failures.

When the two jurisdictions are of equal size, we break ties by assuming that jurisdiction 1 holds the majority.

By contrast, Besley and Coate (2003) implicitly assume that the technology of public good provision involves diseconomies of scale, so that the majority jurisdiction optimally chooses to provide positive amounts of public goods in both jurisdictions.

References

Arzaghi, M., & Henderson, J. V. (2005). Why countries are fiscally decentralizing. Journal of Public Economics, 89, 1157–1189.

Besley, T., & Coate, S. (2003). Centralized versus decentralized provision of local public goods: A political economy approach. Journal of Public Economics, 87, 2611–2637.

Bergstrom, T., Blume, L., & Varian, H. (1986). On the private provision of public goods. Journal of Public Economics, 29, 25–49.

Bloch, F., & Zenginobuz, Ü. (2006). Tiebout equilibria in local public good economies with spillovers. Journal of Public Economics, 90, 1745–1763.

Bloch, F., & Zenginobuz, Ü. (2007). The effect of spillovers on the provision of local public goods. Review of Economic Design, 11(3), 199–216.

Boadway, R. (1982). On the method of taxation and the provision of local public goods: Comment. American Economic Review, 72, 846–851.

Boadway, R., & Tremblay, J.-F. (2011). Reassessment of the Tiebout model. Journal of Public Economics, 11–12, 1063–1078.

Brueckner, J. K. (2004). Fiscal decentralization with distortionary taxation: Tiebout vs. tax competition. International Tax and Public Finance, 11, 133–153.

Caplan, A. J., Cornes, R. C., & Silva, E. C. D. (2000). Pure public goods and income redistribution in a federation with decentralized leadership and imperfect labor mobility. Journal of Public Economics, 77, 265–284.

Carraro, C., & Siniscalco, D. (1993). Strategies for the international protection of the environment. Journal of Public Economics, 52, 309–328.

Dustmann, C., Frattini, T., & Halls, C. (2010). Assessing the fiscal costs and benefits of A8 migration to UK. Fiscal Studies, 31, 1–41.

Epple, D., & Nechyba, T. (2004). Fiscal decentralization. In J. V. Henderson & J.-F. Thisse (Eds.), Handbook of regional and urban economics vol 4—cities and geography. North Holland: Elsevier.

Hoel, M. (2004). Interregional interactions and population mobility. Journal of Economic Behaviour and Organization, 55, 419–433.

Hoel, M., & Shapiro, P. (2003). Population mobility and transboundary environmental problems. Journal of Public Economics, 87, 1013–1024.

Hoel, M., & Shapiro, P. (2004). Transboundary environmental problems with mobile but heterogeneous populations. Environmental and Resource Economics, 27, 265–271.

Janeba, E., & Wilson, J. D. (2011). Optimal fiscal federalism in the presence of tax competition. Journal of Public Economics, 11–12, 1302–1311.

Jehiel, P., & Scotchmer, S. (2001). Constitutional rules of exclusion in jurisdiction formation. Review of Economic Studies, 68, 393–413.

Koethenbuerger, M. (2008). Revisiting the ’decentralization theorem’—on the role of externalities. Journal of Urban Economics, 64, 116–122.

Koethenbuerger, M. (2012). ‘Competition for migrants in a federation: Tax or transfer competition? CESifo Working Paper No. 3709, Category 1: Public Finance.

Lockwood, B. (2002). Distributive politics and the benefits of decentralization. Review of Economic Studies, 69, 313–338.

Lockwood, B. (2008). Voting, lobbying and the decentralization theorem. Economics and Politics, 20, 416–431.

Mansoorian, A., & Myers, G. M. (1993). Attachment to home and efficient purchases of population in a fiscal externality economy. Journal of Public Economics, 52, 117–132.

Mansoorian, A., & Myers, G. M. (1997). On the consequences of government objectives for economies with mobile populations. Journal of Public Economics, 63, 265–281.

Mitsui, K., & Sato, M. (2001). Ex ante free mobility, ex post immobility and time inconsistency in a federal system. Journal of Public Economics, 82, 445–460.

Naoto, A., & Silva, E. C. D. (2008). Correlated pollutants, interregional redistribution and labor attachment in a federation. Environmental and Resource Economics, 41, 111–131.

Oates, W. (1972). Fiscal federalism. New York: Harcourt Brace.

Ray, D., & Vohra, R. (2001). Coalitional power and public goods. Journal of Political Economy, 109, 1355–84.

Rodríguez-Pose, A., & Ezcurra, R. (2011). Is fiscal decentralization harmful for economic growth? Evidence from the OECD countries. Journal of Economic Geography, 11, 619–643.

Tiebout, C. (1956). A pure theory of local public expenditures. Journal of Political Economy, 64, 416–424.

Wellisch, D. (1993). On the decentralized provision of public goods with spillovers in the presence of household mobility. Regional Science and Urban Economics, 23, 667–680.

Wellisch, D. (1994). Interregional spillovers in the presence of perfect and imperfect household mobility. Journal of Public Economics, 55, 167–184.

Wellisch, D. (1995). Can household mobility solve basic environmental problems? International Tax and Public Finance, 2, 245–260.

Wildasin, D. E. (1988). Nash equilibria in models of fiscal competition. Journal of Public Economics, 35, 229–240.

Wildasin, D. E. (1991). Some rudimentary ’duopolity’ theory. Regional Science and Urban Economics, 21, 393–421.

Wildasin, D. E. (2006). Global competition for mobile resources: Implications for equity, efficiency and political economy. CESifo Economic Studies, 52, 61–110.

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to Robin Boadway, Marie-Laure Breuillé, Sam Bucovetsky, Nicolas Gravel, Hideo Konishi, Ben Lockwood and participants in the Workshop on Fiscal Federalism in Lyons (November 2010), PET 11 at Bloomington, and in the seminars at the Universities of Uppsala, Otago, Catolica Lisbon, Bilkent, Bern and Paris Dauphine for helpful suggestions. The comments by two anonymous referees and the editor greatly improved the exposition of the paper. Ünal Zenginobuz acknowledges partial support from Bogazici University Research Fund, Project No. 6048.

Appendix

Appendix

Proof of Proposition 1: We first prove that \( (\tau ^*, \tau ^*)\) is a pure strategy Nash equilibrium of the taxation game. Suppose that jurisdiction \(2\) chooses \(\tau ^*\). Using Eq. (8), we compute the marginal effect of an increase in \(\tau _1\) on \( n_1\):

Notice that the denominator is always positive as \( (U_g(G,1-\tau _1)-U_g(G,1-\tau ^*))(\tau ^*-\tau _1) >0\). Next, we compute the derivative of the resident’s utility with respect to an increase in taxes:

Developing, we find that the sign of \(\frac{\partial U_1}{\partial \tau _1}\) is the same as the sign of

If \(\tau _1 < \tau ^*\), this expression is positive and \(\frac{ \partial U_1}{\partial \tau _1} > 0\). If \(\tau _1 > \tau ^*\), the expression is negative and \(\frac{\partial U_1}{\partial \tau _1 }< 0\), showing that \( \tau _1 = \tau ^*\) is a best response to \(\tau _2 = \tau ^*\).

To show that there cannot be any other symmetric equilibrium, we compute \( \frac{\partial U_1}{\partial \tau _1}\) along the diagonal when \(\tau _1=\tau _2 = \tau \):

The only point at which \(\frac{\partial U_1}{\partial \tau _1}=0\) is the point \(\tau _1 = \tau _2 = \tau ^*\).

Proof of Proposition 2: We first verify that \((\tau ^{**}, \tau ^{**})\) is a pure strategy Nash equilibrium of the taxation game. As \(U(\tau ^{**}, 1-\tau ^{**}) > U(\tau , 1-\tau )\) for any \(\tau \ne \tau ^*\), if the other jurisdiction charges \(\tau ^*\), any deviation to another tax rate \(\tau \) induces a migration out of the jurisdiction, resulting in a utility

Hence, when the other jurisdiction chooses tax rate \(\tau ^{**}\), any deviation to \(\tau \ne \tau ^{**}\) results in a loss of utility.

We now verify that \((\tau ^{**}, \tau ^{**})\) is the unique symmetric Nash equilibrium. To this end, compute first:

showing that the only tax level at which \(\frac{\partial U_1}{ \partial \tau _1}\) is equal to zero along the diagonal is \(\tau _1=\tau _2 = \tau ^{**}\).

Proof of Proposition 3: We first show that \((\hat{\tau }, \hat{\tau })\) is a pure strategy Nash equilibrium of the taxation game. Suppose that jurisdiction \(2\) chooses \(\tau _2 = \hat{\tau }\).

Consider first a strategy \(\tau _1 \le \underline{\tau }\), namely a choice \( \tau _1\) so low that \(U_1 < U_2\) and \(n_1 < 1\). We show that this choice is dominated by choosing \(\tau _1 = \hat{\tau }\). Different cases have to be distinguished. First suppose that \(\alpha \hat{\tau } < \tau _1\). Then

where the last inequality is obtained because \(\tau _1 < \hat{\tau } < \tau ^*\), so any increase in the tax rate increases \(\tau + v(1- \tau )\).

Next, suppose that \(\tau _1 \le \alpha \hat{\tau }\). Notice that, as \(U_1 < U_2\), \(\phi (\tau _1) < \phi (\hat{\tau })\) so that

proving that choosing \(\tau _1\) is dominated by choosing \(\hat{\tau } \).

Next consider values of \(\tau _1 > \underline{\tau }\). Compute

and

so that \(\frac{\partial U_1}{\partial \tau _1}\) is of the same sign as:

If \(\underline{\tau } < \tau _1 < \hat{\tau }\), \(n_1 > 1\), \(v^{\prime }(1-\tau _1) < v^{\prime }(1-\hat{\tau })\) and \([2 \lambda - (1-\alpha ) \hat{ \tau } + \alpha (\tau _1 - \hat{\tau })]< [2 - \lambda - (1-\alpha ) \hat{\tau }]\) , so that \(A >0\) and \(\frac{\partial U_1}{\partial \tau _1} > 0\). On the other hand, if \(\tau _1 > \hat{\tau }\), \(n_1 < 1\), \(v^{\prime }(1-\tau _1) > v^{\prime }(1- \hat{\tau })\) and \([2 \lambda - (1-\alpha ) \hat{\tau } + \alpha (\tau _1 - \hat{\tau })]> [2 - \lambda - (1-\alpha ) \hat{\tau }]\), so that \(A <0 \) and \(\frac{\partial U_1}{\partial \tau _1} <0\). Hence, \(U_1\) attains its maximum at \(\tau _1 = \hat{\tau }\).

In order to prove that there is no other symmetric equilibrium in the game, we compute

Hence, along the diagonal, \(\frac{\partial U_1}{\partial \tau _1}=0\) if and only if \(\tau = \hat{\tau }\).

Rights and permissions

About this article

Cite this article

Bloch, F., Zenginobuz, Ü. Oates’ decentralization theorem with imperfect household mobility. Int Tax Public Finance 22, 353–375 (2015). https://doi.org/10.1007/s10797-014-9311-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-014-9311-6