Abstract

Using a simple two-group model of the private provision of public goods, this paper investigates the endogenous formation of within-group cooperation. We show that the equilibrium outcomes may result in a prisoners’ dilemma, depending on the characteristics of between-group externalities. If between-group externalities are strongly positive (negative), within-group cooperation does not occur in either group, which leads to Pareto-inferior (superior) outcomes for all agents. On the other hand, if between-group externalities are weakly positive or negative, each group chooses to cooperate within a group in providing public goods, but it may reduce utility of both group members. Our simple framework is applicable to a wide variety of socio-economic problems such as an arms race, advertising competition, transboundary pollution, and antiterrorism measures.

Similar content being viewed by others

Notes

For an empirical study of foreign aid including the public-good nature of the aid and strategic interaction among donor countries, see Mascarenhas and Sandler (2006).

In the field of anthropology, Kitchen and Beehner (2007) review the relationship between inter-group interaction and intra-group cooperation among non-human primates. For various types and properties of strategic interactions and cooperative behaviors in providing global public goods, see Cornes and Sandler (1996), Sandler (1997), and Barrett (2007).

Buchholz et al. (1998) considers how the benefits from a joint increase in the supply of public good by a subgroup of agents are restricted by offsetting-reactions of the non-cooperating agents. Assuming more general utility functions, they show that the profitability of partial cooperation depends on the induced relative income effects with respect to the demand of non-cooperating agents for the private and the public good. In contrast, our paper assumes Cobb-Douglas utility, which has unitary income elasticity, but considers various types of BGEs as a sources of unprofitable cooperation in a two-group model with endogenous formation of within-group cooperation.

Sandler and Siqueira (2006) construct a game theoretic model in which two target countries independently choose proactive or defensive counterterrorism measures and examine the efficacy of governmental counterterrorism.

In Appendix B, we investigate the case of more than two agents in each group.

In Appendix C, we investigate the case where the group-specific public good can be produced through weakest-ling or best-shot technologies.

The utility function implies that the marginal propensity to consume public goods is \(1/2\), which seems high. Although the utility specification seems somewhat ad hoc, it enables us to derive intelligible theoretical results concerning the relation between within-group cooperation and BGEs. In addition, our main results are qualitatively unchanged if we assume the other types of utility functions. In Appendix, we investigate a Cobb-Douglas and quasi-linear utility functions.

Throughout the paper, we mean that \(i\ne j\) (and \(k\ne l\)) when we use \(i\) and \(j\) (and \(k\) and \(l\)) at the same time.

In Appendix D, we consider simply the case of cooperation across group boundaries.

Furthermore, we can solve the coordination issue regarding multiple Nash equilibria by using the concept of risk dominance, as defined by Harsanyi and Selten (1988). If we apply this concept, tedious calculations indicate that \(\gamma <-0.7002\) is sufficient to assure that equilibrium \((N, N)\) is the risk-dominant equilibrium in the former situation. Likewise, \(\gamma <0.7144\) is sufficient to ensure that equilibrium \((C, C)\) is the risk-dominant equilibrium in the latter situation.

References

Baik, K. H., & Lee, S. (2000). Two-stage rent-seeking contests with carryovers. Public Choice, 103, 285–296.

Baik, K. H. (2008). Contests with group-specific public-good prizes. Social Choice and Welfare, 30, 103–117.

Barrett, S. (2007). Why to cooperate. The incentive to supply global public goods. Oxford: Oxford University Press.

Bergstrom, T., Blume, L., & Varian, V. (1986). On the private provision of public good. Journal of Public Economics, 35, 53–73.

Bornstein, G., & Ben-Yossef, M. (1994). Cooperation in intergroup and single-group social dilemmas. Journal of Experimental Social Psychology, 30, 52–67.

Bornstein, G., Gneezy, U., & Nagel, R. (2002). The dffect of intergroup competition on group coordination: An experimental study. Games and Economic Behavior, 41, 1–25.

Bruce, N. (1990). Defense expenditures by countries in allied and adversarial relationships. Defense Economics, 1, 179–195.

Buchholz, W., Haslbeck, C., & Sandler, T. (1998). When does partial co-operation pay? FinanzArchiv, 55, 1–20.

Cheikbossian, G. (2008). Heterogeneous groups and rent-seeking for public goods. European Journal of Political Economy, 24, 133–150.

Cornes, R. (1993). Dyke maintenance and other stories: Some neglected types of public goods. Quarterly Journal of Economics, 107, 259–271.

Cornes, R., & Sandler, T. (1996). The theory of externalities, public goods, and club goods. Cambridge: Cambridge University Press.

Cornes, R., & Hartley, R. (2007). Weak links, good shots and other public good games: Building on BBV. Journal of Public Economics, 91, 1684–1707.

Harsanyi, J. C., & Selten, R. (1988). A game theory of equilibrium selection in games. Cambridge, MA: MIT Press.

Ihori, T. (2001). Defense expenditures and allied cooperation. Journal of Conflict Resolution, 44, 854–867.

Ihori, T. (2004). Arms races and economic growth. Defense and Peace Economics, 15, 27–38.

Kitchen, D. M., & Beehner, J. C. (2007). Factors affecting individual participation in group-level aggression among non-human primates. Behaviour, 144, 1551–1581.

Mascarenhas, R., & Sandler, T. (2006). Do donors cooperatively fund foreign aid? Review of International Organization, 1, 337–357.

Niou, E. M., & Tan, G. (2005). External threat and collective action. Economic Inquiry, 43, 519–530.

Reuben, E., & Tyran, J. R. (2010). Everyone is a winner: Promoting cooperation through all-can-win intergroup competition. European Journal of Political Economy, 26, 25–35.

Salant, S. W., Switzer, S., & Reynolds, R. J. (1983). Losses from horizontal merger: The effects of an exogenous change in industry structure on Cournot-Nash equilibrium. Quarterly Journal of Economics, 98, 185–199.

Sandler, T. (1997). Global challenges. Cambridge, UK: Cambridge University Press.

Sandler, T., & Siqueira, K. (2006). Global terrorism: Deterrence versus pre-emption. Canadian Journal of Economics, 39, 1370–1387.

Tan, J. H. W., & Bolle, F. (2007). Team competition and the public goods game. Economics Letters, 96, 133–139.

Torsvik, G. (2005). Foreign economic aid; should donors cooperate? Journal of Development Economics, 77, 503–515.

Warr, P. (1983). The private provision of a public good is independent of the distribution of income. Economics Letters, 13, 207–211.

Acknowledgments

We would like to thank Amihai Glazer, Satomi Kobayashi, and two anonymous referees for helpful comments and suggestions. This work was supported by Special Research Aid in Osaka University of Economics, 2010–2011.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Quasi-linear and cobb-douglas utilities

First, we consider a case of quasi-linear utility function that is often used in the literature of private provision of public goods. The utility function is \(U_{ik}=x_i+\beta \sqrt{H_i}\), where \(\beta >0\) is the preference parameter. We focus on the symmetric equilibrium (\(F_i=F\), \(y_{ik}=y\), \(\gamma _i=\gamma \) for all \(i\in \{A, B\}\) and \(k\in \{1,2\}\)) and assume \(F=0\). We then obtain each agent’s contributions at second-stage equilibrium given by

where superscript CN refers to the case in which members of group A cooperate but those of group B do not. Note that \(\gamma \ge 1/4\), then \(g_{Bk}^\mathrm{CN}=0\), implying that cooperation in group \(i\) makes group \(j\) non-contributor due to positive externalities. Also note that the individual contributions approach to infinity as \(\gamma \rightarrow -1\), implying agents spend their all income on contributions to public goods when BGEs are strongly negative. Here, we assume that the income \(y\) is large enough such that the agents consume non-negative amount of private goods except in the case of \(\gamma =-1\).

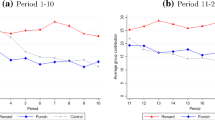

From the above equilibrium contributions, we can derive the equilibrium utilities. Then, we have \(U_{ik}^\mathrm{CC}-U_{ik}^\mathrm{NN}=[\beta ^2(1+4\gamma )]/[8(1+\gamma )]\gtreqless 0\) when \(\gamma \gtreqless -1/4\), which implies that the situation \((C,C)\) Pareto-dominates \((N,N)\) when \(\gamma >-1/4\). Then, comparing the equilibrium utilities in each case, we find that the strategy Not Cooperate is the dominant strategy for \(\gamma <-1/2\), and Cooperate is the dominant strategy for \(-1/2\le \gamma <0.42\). In addition, we find that Cooperate is the best reply for another group’s Not Cooperate and Not Cooperate is the best reply for another group’s Cooperate when \(\gamma \ge 0.42\). These results are illustrated in Fig. 2. We find from the figure that SPNE is Pareto inferior only if \(-0.5\le \gamma < -0.25\).

Second, we consider a Cobb-Douglas utility function and investigate how the preference for public goods affects the endogenous determination of within-group cooperation. Here the utility of each agent is given by \(U^{ik}= \left( x_{ik} \right) ^{1-\alpha } \left( H_i\right) ^\alpha \), where \(\alpha \in (0,1)\) is the preference parameter. Higher values of \(\alpha \) mean that the public goods are more valuable for agents. The case of \(\alpha =0.5\) corresponds to (2). We focus on a symmetric equilibrium and assume \(F=0\). We then obtain each agent’s contributions at second-stage equilibrium given by

Note that if \(\gamma \ge 1/[2(1-\alpha )]\), then \(g_{Bk}^\mathrm{CN}=0\). By a procedure similar to Proposition 2, we obtain Fig. 3. In the figure, the dotted curve PP represents the parameter range that satisfies \(U_{ik}^\mathrm{CC}=U_{ik}^\mathrm{NN}\). The area to the left (right) side of curve PP is one where \(U_{ik}^\mathrm{CC}<U_{ik}^\mathrm{NN}\) (\(U_{ik}^\mathrm{CC}>U_{ik}^\mathrm{NN}\)) holds. We see that, as the preference for public good \(\alpha \) increases, within-group cooperation is more likely in both groups. We find that prisoners’ dilemma situations are more likely to occur for larger \(\alpha \) when \(\gamma \) negative, while they are more likely to occur for smaller \(\alpha \) when \(\gamma \) is strongly positive.

Appendix 2: Group size

Here, we consider a case where each group has more than two agents. Consider each group \(i\in \{A,B\}\) consists of \(n\) agents. We only focus on the symmetric equilibrium and assume \(F=0\). In addition, we do not investigate the case of partial cooperation within group in which some agents cooperate but the rest do not.

When group \(i\) chooses Not Cooperate, then its reaction function at the second stage is given by \(g_{ik}^N=(y-\gamma G_j)/(n+1)\). When group \(i\) chooses Cooperate, then it’s reaction function at the second stage is given by \(g_{ik}^C=(n y-\gamma G_j)/(2 n)\). These function characterizes the equilibrium amount of individual contributions of four cases NN, CN, NC, and CC:

When \(\gamma \ge 2/n\), \(g_{Bk}^\mathrm{CN}=0\) holds in \((C,N)\) equilibrium, which implies that cooperation in group \(i\) is more likely to result in \(g_{jk}=0\) in group \(j\) as the number of agents in each group increases. Fig. 4 illustrates the Nash equilibrium of cooperation stage and Pareto-inferior situations. The dotted curve PP represents the parameter range that satisfies \(U_{ik}^\mathrm{CC}=U_{ik}^\mathrm{NN}\) and the area to the left (right) side of the curve is one where \(U_{ik}^\mathrm{CC}<U_{ik}^\mathrm{NN}\) (\(U_{ik}^\mathrm{CC}>U_{ik}^\mathrm{NN}\)) holds. The figure shows that the Nash equilibrium may lead to Pareto-inferior outcome when BGEs are moderately negative. However, when \(\gamma \) is positive, the Nash equilibrium never lead to Pareto inferior outcome as long as \(n\ge 3\).

As the group sizes increase, a cooperation in group \(i\) is more likely to make group \(j\) non-contributor under positive BGEs. In the corner-solution case, the agents in group \(i\) can cooperate without fear of the negative reaction taken by the agents in group \(j\) and members in group \(j\) do not have an incentive to cooperate. This is the reason why \((N,C)\) and \((C,N)\) are the Nash equilibria. If we consider the case where group size differs between the two group, the larger group is more likely to have an incentive to cooperate compared to the smaller group. Cooperation in one group may induce negative reactions from another group, but the reactions are smaller if they are taken by a smaller group.

Appendix 3: Weakest-link and best-shot public goods

Here, we consider the cases of weakest-link and best-shot group-specific public goods. Following Cornes (1993) and Cornes and Sandler (1996), we consider the following public-goods composition (or aggregator) function:

where \(\rho \rightarrow -\infty \) corresponds to the weakest-ling public goods (i.e., \(G_i=\min [g_{i1}, g_{i2}]\)) and \(\rho \rightarrow \infty \) corresponds to the best-shot public goods (i.e., \(G_i=\max [g_{i1}, g_{i2}]\)). The case of \(\rho =1\) implies the simple summation technology analyzed in the main body of our paper. We focuses on a symmetric equilibrium.

First, we characterize the second-stage equilibria in the case of weakest-link public goods. Utility of agent \(ik\) is given by (2), where \(G_i\) is given by (18). As is well known, contributing to weakest-link public good yields a continuum of Nash equilibria, in which all agents’ contributions are matched each other. We employ the method of selecting unique Nash equilibrium studied by Cornes and Hartley (2007): an unique Nash equilibrium as the limit of equilibria when \(\rho \rightarrow -\infty \).

In the case where no-cooperation arises in group \(i\), the first-order condition of the utility maximization of member \(k\) in group \(i\) yields \((dU_{ik})/(dg_{ik})=-F-G_i-\gamma G_j+(y-g_{ik})g_{ik}^{-1+\rho }G_i^{1-\rho }=0\). Because \(g_{ik}=g_{il}=g_i\), we have the following reaction function:

Because weakest-link public goods means \(\rho \rightarrow -\infty \), we have

In the case where cooperation arises in group \(i\), the first-oder condition of the joint-utility maximization is given by \([d(U_{i1}+U_{i2})]/(dg_{ik})=-F+2^{1/\rho }(y-2g_i^C)-\gamma G_j=0\). As \(\rho \rightarrow -\infty \), the reaction function leads to

From (19) and (20), we characterizes the equilibrium for four cases as follows.

The equilibrium in Case CN where members of group A cooperate while those of group B do not can be characterized by:

The equilibrium in Case NC can be obtained by substituting A for B in the above equations. The equilibrium in Case CC can be characterized by:

Therefore, we have \(U_{Ak}^\mathrm{CC}-U_{Ak}^\mathrm{NC}=\frac{\left[ F+(1+\gamma )y \right] ^2}{2(2+\gamma )^2(3-\gamma ^2)^2}(2-4\gamma ^2+\gamma ^4)\gtreqless 0\) for \(|\gamma |\lesseqgtr \sqrt{2-\sqrt{2}}\approx 0.77\) and \(U_{Ak}^\mathrm{CN}-U_{Ak}^\mathrm{NN}=\frac{\left[ F+(1+\gamma )y \right] ^2}{4(3+2\gamma )^2(3-\gamma ^2)^2}(9-24\gamma ^2+8\gamma ^4)\gtreqless 0\) for \(|\gamma |\lesseqgtr \sqrt{3(2-\sqrt{2})}/2 \approx 0.66\). These conditions imply that the strategy Cooperate is the dominant strategy for \(-0.66\le \gamma <0.66\) and the strategy Not Cooperate is the dominant strategy for \(\gamma <-0.77\) and \(\gamma \ge 0.77\). When \(0.66<|\gamma |<0.77\), \((N,N)\) and \((C,C)\) are both Nash equilibria in the cooperation stage. In addition, we have \(U_{ik}^\mathrm{CC}-U_{ik}^\mathrm{NN}=\frac{ \left[ F+(1+\gamma )y \right] ^2}{(2+\gamma )^2 (3+2\gamma )^2}\left( 1+4\gamma +2\gamma ^2\right) \gtreqless 0\) for \(\gamma \gtreqless (\sqrt{2}-2)/2\approx -0.29\). Therefore, the situation \((C, C)\) Pareto-dominates \((N, N)\) when \(\gamma > -0.29\). Notice that these conditions are equivalent to those in the case of simple summation public goods studied in the main body. Therefore, Fig. 1 also illustrates the results in the case of weakest-link group-specific public goods.

Second, we consider a case of best-shot group-specific public goods. In each group \(i\in \{A,B\}\), each agent \(k\in \{1,2\}\) contributes to their group-specific public goods represented by \(G_i=\max [g_{ik}, g_{il}]\). The utilities are given by (2). We focus on a symmetric equilibrium and assume \(F=0\) for simplicity.

It is well known that, in the case of best-shot public goods, there are two equilibria in which one agent becomes sole-contributor and another becomes non-contributor. Since we focus on a symmetric equilibrium, we assume that each agent becomes sole-contributor with probability \(1/2\) and non-contributor with probability \(1/2\) if they choose Not Cooperate at the first stage.

When group \(i\) chooses Not Cooperate at the first stage, one agent in group \(i\) would be a contributor and her reaction function is given by \(\hat{g}_{ik}=(y/2)-(\gamma /2)G_j\). The other agent in group \(i\) would be a non-contributor and contributes nothing. Therefore, \(G_i=\max [\hat{g}_{ik},0]=(y/2)-(\gamma /2)G_j\) holds when the group \(i\) chooses Not Cooperate. The expected utilities are given by the sum of \(1/2\) utilities when he would be a sole-contributor and \(1/2\) utilities when he would be a non-contributor. On the other hand, when group \(i\) chooses Cooperate at the first stage, the group would choose its contribution and transfer between the agents so as to maximize the sum of the agents’ utilities. In this case, group \(i\)’s reaction function against group \(j\) is given by \({g}_{ik}=G_{i}=y-(\gamma /2)G_j\) and the equilibrium utilities are the same among cooperating agents.

Using these reaction functions, we obtain the equilibrium amount of group-specific public goods given gy

Obviously, the equilibrium contribution of one agent in each group is given by the above, but that of another is zero. Notice that if \(\gamma < 1-\sqrt{3}\approx -0.73\), one agent in non-cooperating group \(i\) will spend all income on contribution (a corner-solution arises) when he facing with cooperation by another group \(j\) because the non-negative condition of \(H_i\) is binding due to strong BGEs.

Given that \(U_{ik}^\mathrm{CC}\gtreqless U_{ik}^\mathrm{NN}\) for \(\gamma \gtreqless -1/2\), we can illustrate Fig. 5 for the case of best-shot public goods. The figure shows that when \(\gamma >0.86\) and \(\gamma <-0.5\), the Nash equilibrium choices of cooperation result in Pareto-inferior outcomes. In the best-shot case, Cooperate is a dominant strategy for negative BGEs, therefore Prisoners’ dilemma situations are more likely to occur compared to the case of summation public goods.

Appendix 4: Cooperation across group boundaries

Here, we examine simply whether agents have a unilateral incentive to cooperate across group boundaries. We consider the case wherein agents A1 and B1 cooperate with each other and agents A2 and B2 do not. In this case, agents A1 and B1 choose \(g_{A1}\) and \(g_{B1}\) so as to maximize joint payoffs \(U_{A1}+U_{B1}\), given \(g_{A2}\) and \(g_{B2}\). Agent A2 (B2) independently chooses \(g_{A2}\) (\(g_{B2}\)) so as to maximize his/her own payoff \(U_{A2}\) (\(U_{B2}\)). The setting of the model is the same as in the main body, but we only focus on symmetric equilibrium. Then, we obtain the equilibrium utility of agents A1 and B1 as

Thus, we have

This shows that agents have incentives for unilaterally cooperating with an agent in its rival group if \(\gamma <0\), but they have no such incentives if \(\gamma >0\). The intuition is straightforward: if BGEs are positive, agents A2 and B2 can free ride on increases in the amount of public goods that are brought about by cooperation between agents A1 and B1. On the other hand, if BGEs are negative, agents A1 and B1 cooperatively reduce their contributions, which will induce agents A2 and B2 to increase their contributions. In this case, the cooperation can serve as a commitment to reduce their contribution to the group-specific public good and enables A1 and B1 to free ride on A2 and B2. Therefore, interestingly, A1 and B1 benefit from cooperating across group boundaries even if the two groups have an adversarial relationship with each other.

Rights and permissions

About this article

Cite this article

Hattori, K. Within-group cooperation and between-group externalities in the provision of public goods. Int Tax Public Finance 22, 252–273 (2015). https://doi.org/10.1007/s10797-014-9308-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-014-9308-1