Abstract

The classic capital tax policy externality is studied in the presence of a social security program where both the benefits and taxes depend on wages in an overlapping generations economy with many countries and mobile capital. We study the response and welfare implications of a coordinated capital tax rate increase across countries competing for the mobile tax base on the initial generations, the transition, and the steady state. The tax increase is initially completely capitalized, but some of the burden is shifted to labor on the transition path and in the steady state. Several new welfare effects are uncovered including an effect involving the parameters of the social security program. Sufficient conditions are provided so that all current and future generations are better off from the reform. However, social security may reduce the gain to capital tax reform.

Similar content being viewed by others

Notes

See Zodrow and Mieszkowski (1986), Wilson (1986), Mintz and Tulkens (1986), and Wildasin (1989) for the early research. See Wilson (1999) and Wilson and Wildasin (2004) for surveys of the literature. One classic result is that competition among governments for a mobile tax base like capital may lead to such a tax being set too low, which would put downward pressure on public spending. Another classic result is that a coordinated increase in the capital tax rate across all governments competing for the base would increase public spending and improve welfare.

See Social Security Programs Throughout the World at www.ssa.gov for a description of the features of social security programs by country.

Cremer et al. (2008) also use a version of the Feldstein model to study social security. They examine the program in a closed, partial equilibrium economy where the interest rate and the growth rate are both fixed at zero, and there is a fixed distribution of wages based on productivity for each type of agent. Their focus is on the relationship between the number of myopic agents and the structure and size of the program. They also do not address policy externality issues.

See Social Security Programs Throughout the World at www.ssa.gov.

Some benefits may be lump sum relative to the person receiving the transfer even if they are determined by the earnings of the main beneficiary. In many programs, a survivor may receive a benefit after the main beneficiary passes away. This transfer would be lump sum relative to the recipient. As another example, some programs pay a benefit to the spouse of the main beneficiary that is dependent on the latter’s earnings history, not the recipient’s, e.g., US.

This is related to the research on consumer myopia and the hyperbolic discounting literature. For the early research on models of consumer myopia and dynamic inconsistency see Strotz (1956) and Phelps and Pollack (1968). For empirical evidence of myopia. see Thaler (1981, 1990) and Campbell and Mankiw (1990, 1991), for example. And for research on hyperbolic discounting, see Laibson (1997) and Harris and Laibson (2001).

We have not included cash bequests. Bequeathing behavior is very complicated and there are many motives for such transfers. Changes in intrafamily transfers will not offset changes in the local capital tax policy under any motive including pure altruism since that policy causes distortions across firms, not consumers. In addition, there are theoretical objections and considerable empirical evidence against the pure altruism model. See the discussion in Chap. 11 in Batina and Ihori (2000).

It is straightforward to show that if the cross partial derivative U 12 is nonnegative, consumption is a normal good. It follows immediately that savings is increasing in first period income and decreasing in second period income. This certainly follows for the additively separable case.

The income variables I 1 and I 2 are defined in the same way for the two types.

Following the literature, we use the ex post utility function of the spender in the social welfare function, rather than the ex ante function. In a strong sense, the ex ante function causes the saving problem for spenders to begin with. Use of the ex post function allows the government to appropriately address the policy problem and calculate the correct policy response. See the discussion in Cremer et al. (2008).

Estimates of the user cost elasticity by Caballero et al. (1995) using US data range from 0.01 to 2.0 depending on the industry. Hassett and Hubbard (2002) give a range of 0.5 to 1.0. Schaller (2006) estimates the long run user cost elasticity for equipment to be well above one in magnitude and essentially zero for structures using Canadian time series data and cointegration techniques. If θε<1, (1−θε)−1>1.

One issue that has arisen in the public goods literature is whether the second-best social cost of the public good is greater than or less than one in magnitude since this may have implications for the level of the public good relative to the first-best case. It is possible for the right-hand side of (9a) to be less than one in magnitude in our model if (γ−β/1+r)<θε. It is also possible that the right- hand side is equal to one, as well. I am indebted to an anonymous referee for this observation.

The analysis in this section is positive. In the normative welfare analysis of the reform in the next section, terms in dγ t /dτ drop out of the formula when use is made of the optimal policy rules in Proposition 1 and the envelope theorem is applied.

See Bernheim (1981) for this method of writing the response as a combination of short and long run adjustments. The first term captures the long run adjustment while the second term in λ 1 captures the short run adjustment. As time proceeds the emphasis shifts from the short run to the long run term.

This is demonstrated in the Appendix in Batina (2009).

References

Batina, R. G. (2009). Local capital tax competition and coordinated tax reform in an overlapping generations economy. Regional Science and Urban Economics, 39, 472–478.

Batina, R. G., & Ihori, T. (2000). Consumption taxation policy and the taxation of capital income. Oxford: Oxford University Press.

Beltrametti, L., & Bonatti, L. (2003). Does international coordination of pension policies boost capital accumulation? Journal of Public Economics, 88, 113–129.

Bernheim, B. D. (1981). A note on dynamic tax incidence. Quarterly Journal of Economics, 96, 705–723.

Caballero, R., Engel, E., & Haltiwanger, J. (1995). Plant-level adjustment and aggregate investment dynamics. Brookings Papers on Economic Activity, 2, 1–54.

Campbell, J., & Mankiw, N. G. (1990). Permanent income, current income, and consumption. Journal of Business and Economic Statistics, 8, 265–279.

Campbell, J., & Mankiw, N. G. (1991). The response of consumption to income: a cross country investigation. European Economic Review, 35, 723–767.

Casarico, A. (2000). Pension systems in integrated capital markets. Topics in Economic Analysis and Policy, 1, 1–17.

Cremer, H., De Donder, P., Maldonado, D., & Pestieau, P. (2008). Designing a linear pension scheme with forced savings and wage heterogeneity. International Tax and Public Finance, 15, 547–562.

Feldstein, M. (1985). The optimal level of social security benefits. Quarterly Journal of Economics, 100, 303–320.

Harris, C., & Laibson, D. (2001). Dynamic choices of hyperbolic consumers. Econometrica, 69, 935–957.

Hassett, K. A., & Hubbard, R. G. (2002). Tax policy and business investment. In A. Auerbach & M. Feldstein (Eds.), Handbook of public economics (Vol. 3, pp. 1293–1343). Amsterdam: North-Holland.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. Quarterly Journal of Economics, 62, 443–478.

Mankiw, N. G. (2000). The savers-spenders theory of fiscal policy. American Economic Review, 90, 120–125.

Mintz, J., & Tulkens, H. (1986). Commodity tax competition between member states of a federation: equilibrium and efficiency. Journal of Public Economics, 29, 492–508.

Pemberton, J. (1999). Social security: national policies with international implications. Economic Journal, 109, 492–508.

Pemberton, J. (2000). National and international privatization of pensions. European Economic Review, 44, 1873–1896.

Phelps, E., & Pollack, R. (1968). On second-best national saving and game-equilibrium growth. Review of Economic Studies, 35, 185–199.

Pestieau, P., Piaser, G., & Sato, M., (2006). PAYG pension systems with capital mobility. International Tax and Public Finance 13, 587–599.

Schaller, H. (2006). Estimating the long run user cost elasticity. Journal of Monetary Economics, 53, 725–736.

Strotz, R. (1956). Myopia and inconsistency in dynamic utility maximization. Review of Economic Studies, 23, 165–180.

Thaler, R. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8, 201–207.

Thaler, R. (1990). Saving, fungibility, and mental accounts. Journal of Economic Perspectives, 4, 193–205.

Wildasin, D. (1989). Interjurisdictional capital mobility: fiscal externality and a corrective subsidy. Journal of Urban Economics, 25, 193–212.

Wilson, J. D. (1986). A theory of interregional tax competition. Journal of Urban Economics, 19, 296–315.

Wilson, J. D. (1999). Theories of tax competition. National Tax Journal, 52, 269–304.

Wilson, J. D., & Wildasin, D. (2004). Capital tax competition: bane or boon. Journal of Public Economics, 88, 1065–1091.

Zodrow, G., & Mieszkowski, P. (1986). Pigou, Tiebout, property taxation, and the underprovision of local public goods. Journal of Urban Economics, 19, 356–370.

Social security programs throughout the world (2004). Europe, Social Security Administration USA, Office of Policy, publications 13-11801, 13-11802, 13-11803.

Acknowledgements

The author would like to thank Toshihiro Ihori and Gilad Aharonovitz for their helpful comments, and Laci Graciano for help in preparing the manuscript. Thanks are also due to the editor Jay Wilson and several helpful reviewers. The usual caveat applies.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Proposition 1: optimal second-best policy rules

Writing out the social welfare function of (6),

First, consider the optimal policy rule of the GTA. It chooses an infinite sequence {τ t ,g t } t to maximize the social welfare function subject to a sequence of budget constraints given by (7), taking as given the policy sequence of the other agency, the policy sequences of all other countries, and the sequence of interest rates. The first-order conditions for the optimal policy sequence at time t are given by

where λ t is the Lagrange multiplier for its budget constraint at time t. Combine conditions to obtain

Use u 1=b(1+r)u 2, \(u^{*}_{1} = b(1+r^{*})u^{*}_{2}\), and the definition of Φ to rewrite (A.1) as (9a).

The SSA chooses the infinite sequence {γ t ,β t } t to maximize the same social welfare function subject to its budget constraint, (8), taking as given the policy sequence of the GTA, the policy sequences of all other countries, and the sequence of interest rates. The first-order conditions for an interior solution are

where μ is the Lagrange multiplier for the social security constraint. Combine these conditions to obtain (9b), \(\phi u_{1} +(1-\phi)u^{*}_{1} = (\phi u_{2} + (1-\phi) u^{*}_{2})\).

Appendix B: Proposition 2: response to the capital tax policy reform

2.1 B.1 Preliminary results

Let  . This can also be written as

. This can also be written as  , by using S

2=−βR(1−S

1). If Δ>0, then the steady state equilibrium is stable when it exists. Let D=ϕS

r

−(1+n)K

r

>0. Thus,

, by using S

2=−βR(1−S

1). If Δ>0, then the steady state equilibrium is stable when it exists. Let D=ϕS

r

−(1+n)K

r

>0. Thus,  . If

. If

then ds/dw>0. Furthermore, when α>0, it follows that γ>β/(1+n), from the social security budget constraint. Thus, 1+βR−γ<1+βR−β/(1+n), or

If (B.1) is satisfied, then S 1>βR[1+βR−β/(1+n)]−1, from (B.2). It then follows that \(\phi [\beta R - [1 +\beta R - \tilde{\beta}(1+n)]S_{1}] < 0\). Hence, D>Δ.

2.2 B.2 Initial response

Equations (3) and (8) for t=1 determine (r 1,γ 1). Equation (3) implies that dr 1/dτ=−1 and w 1 is unaffected by the reform. It follows from this and (8) that dγ 1/dτ=0. To see this, consider the social security budget in the first period, (1+n)γ 1 W(r 1+τ 1)=α 1+β 1 w 0. The right-hand side is fixed and the d(r 1+τ 1)/dτ 1=0. It follows immediately that dγ 1/dτ=0. The young at t=1 face (4) for t=1 and (8) for t=2. Differentiate this system and solve to obtain the following:

where we have used dr 1/dτ=−1. Note that 0<ϕS r /D<1 since K r <0. The wage rate in the second period, W(r 2+δ+τ 2), responds according to

where we have used W r =−k.

2.3 B.3 Steady state response

Substitute the steady state social security budget for the payroll tax rate into the equilibrium condition to obtain,

To derive the steady state responses, totally differentiate this last equation to obtain

Since Δ<D, it follows that dr 2/dτ<dr/dτ<0. The response of the payroll tax rate is

Under (B.1), dγ/dτ<dγ 2/dτ. To see this, compare (B.4) with (B.6) after using (B.3) and (B.5). The local wage W(r+δ+τ) responds to the reform according to

Since D>Δ, dw/dτ<dw 2/dτ.

2.4 B.4 Transition response

Substitute the social security constraint into the equilibrium condition for the payroll tax to get

This is a second-order difference equation. Differentiate

Divide by D and rewrite using the lag operator, L, where Lx t =x t−1,

where A 1=kϕ[S 1+βS 2]/D=ϕk((1+βR)S 1−βR)/D, A 2=kϕβS 1/(1+n)D, and A 3=[ϕS r −Δ]/D. Following Bernheim (1981), the A i are evaluated at the initial steady state equilibrium, and hence constant. If A 1<1 in the absence of social security, then the equilibrium is locally stable. If A 1<β/γ(1+n) (< or =) 1 in the presence of the social security program, then the equilibrium will be stable. The roots to this second-order equation are given by

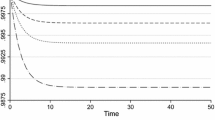

If \(A_{1}^{2} - 4A_{2} > 0\), the roots are real, which is the case we will pursue. It is straightforward to show that the stable root is given by \(\lambda_{1} = (1/2)[A_{1} + (A_{1}^{2} - 4 A_{2})^{1/2}]\). If Δ>0, then λ 1<1. This is easy to confirm by expanding λ 1. Since 1+βR−β/(1+n)<1+βR, it follows that S 1>βR/(1+βR) by (B.1) so that A 1>0. Therefore, 0<λ 1. The stable solution to the difference equation is given by

or,

for t=2,…, where we have used (B.3) and (B.5). Clearly, the response converges to the steady state response, dr/dτ. Thus,

Since dw t /dτ=−k(1+dr t /dτ), we also have the result that

The response of the payroll tax rate on the transition path is

from the social security budget constraint. Since γ>β/(1+n) for α>0, and 1+dr t /dτ>1+dr t−1/dτ, by (B.7), this response is positive, dγ t /dτ>0. Furthermore, if A 1<β/(1+n)γ<1, then dγ 2/dτ>dγ/dτ. The response of the payroll tax rate converges to the steady state response and we have the result, dγ 2/dτ>⋯>dγ t /dτ>⋯>dγ/dτ>0. When α=0, we obtain, dγ 2/dτ>⋯>dγ t /dτ>⋯>dγ/dτ=0.

Appendix C: Proposition 3: welfare effects of the coordinated capital tax reform

3.1 C.1 Initial generations

The per capita sum of the utility of the agents alive in the first period of the reform is

where we have appended the first two social security budget constraints since they affect utility in the first period of the economy. The Lagrange multipliers are μ t . Substitute the GTA’s budget constraint for g 1 and g 2 into (C.1). Differentiate (C.1) and use the definitions of θ and ε, dr 1/dτ=−1, ϕs 0=(1+n)k 1, and the policy rules of Proposition 1 to obtain the effect of the reform on social welfare for the initial generations,

evaluated at the initial steady state. The initial old spender is better off because of the spending effect that occurs in the first period of the reform, \(\theta\varepsilon U ^{*\,0}_{4} > 0\). The initial old saver is better off if the positive spending effect outweighs the negative interest rate effect, which occurs if \(\theta\varepsilon m ^{0}_{2} > s/k = (1+n)/\phi\). The initial young spender is better off if

where \(R^{*}m^{*\,1}_{2} =(U^{*\,1}_{4}/U^{*\,1}_{2})(U^{*\,1}_{2}/U^{*\,1}_{1})\). A sufficient condition is that the current spending effect outweigh the social security effect on wages, \(\theta\varepsilon m^{*\,1}_{1} > \gamma_{1} -\beta_{2}/{(1+n)}\).

The initial young saver is better off under the reform if

Sufficient conditions for this to be satisfied are \(\theta\varepsilon m ^{1}_{1} > \gamma_{1} - \beta_{2}/(1+ n)\) and \(\theta\varepsilon m ^{1}_{2} > s/k = (1+n)/ \phi\).

3.2 C.2 Welfare effects on the transition path

Define Ω t in the same manner as Ω 1 in (C.1). It is then straightforward to derive the following result, by using the same steps,

The old spender on the transition path is unambiguously better off since they only experience the current spending effect, \(-\theta\varepsilon U^{*\,t-1}_{4}(dr_{t}/d \tau) > 0\). The old saver is better off if the spending effect outweighs the interest rate effect, \(\theta\varepsilon U^{t-1} _{4} >{(1+ n)U^{t-1} _{2}/\phi}\), or \(\theta\varepsilon m^{t-1} _{2} >(1+ n)/ \phi\). The welfare of the young saver improves if \((1+n)U^{t}_{2} < \phi U^{t}_{4}\theta\varepsilon\), or

and, \(- (U^{t}_{3}\theta\varepsilon +U^{t}_{1})(dr_{t}/d\tau) > U^{t}_{1}(\gamma - \beta /(1+r))\), or

The young spender’s welfare improves if \(-(U^{*\,t} _{3}\theta\varepsilon +U^{*\,t} _{1})( dr_{t}/d \tau) > {U^{*\,t} _{1}(\gamma - \beta /(1+ r))}\), or

3.3 C.3 Steady state welfare effects

The steady state welfare results can be easily derived by letting t go to infinity in conditions (C.2)–(C.4).

Rights and permissions

About this article

Cite this article

Batina, R.G. Capital tax competition and social security. Int Tax Public Finance 19, 819–843 (2012). https://doi.org/10.1007/s10797-011-9209-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-011-9209-5