Abstract

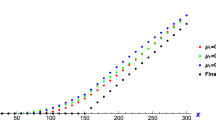

This paper proposes a new approximation method for pricing barrier options with discrete monitoring under stochastic volatility environment. In particular, the integration-by-parts formula and the duality formula in Malliavin calculus are effectively applied in pricing barrier options with discrete monitoring. To the best of our knowledge, this paper is the first one that shows an analytical approximation for pricing discrete barrier options with stochastic volatility models. Furthermore, it provides numerical examples for pricing double barrier call options with discrete monitoring under Heston and λ-SABR models.

Similar content being viewed by others

References

Ben Arous, G., & Laurence, P. (2009). Second order expansion for implied volatility in two factor local stochastic volatility models and applications to the dynamic λ-SABR model (Preprint).

Baudoin, F. (2009). Stochastic Taylor expansions and heat Kernel asymptotics. Preprint, Department of Mathematics, Purdue University.

Fink J. (2003) An examination of the effectiveness of static hedging in the presence of stochastic volatility. Journal of Futures Markets 23(9): 859–890

Fournié E., Lasry J.-M., Lebuchoux J., Lions P.-L., Touzi N. (1999) Applications of Malliavin calculus to Monte-Carlo methods in finance. Finance Stoch 3(4): 391–412

Fusai G., Abrahams D., Sgarra C. (2006) An exact analytical solution for discrete barrier options. Finance Stoch. 10(1): 1–26

Gatheral, J., Hsu, E. P., Laurence, P., Ouyang, C., & Wang, T.-H. (2009). Asymptotics of implied volatility in local volatility models. Forthcoming in Mathematical Finance.

Malliavin P., Thalmaier A. (2006) Stochastic calculus of variations in mathematical finance. Springer, Berlin

Malliavin P. (1997) Stochastic Analysis. Springer, New York

Shiraya, K., Takahashi, A., & Toda, M. (2009). Pricing barrier and average options under stochastic volatility environment. Preprint, CARF-F-176, Graduate School of Economics, University of Tokyo. Forthcoming in “The Journal of Computational Finance”.

Siopacha M., Teichmann J. (2011) Weak and strong Taylor methods for numerical solutions of stochastic differential equations. Quantitative Finance 11(4): 517–528

Takahashi A. (1999) An asymptotic expansion approach to pricing contingent claims. Asia-Pacific Financial Markets 6: 115–151

Takahashi, A. (2009). On an asymptotic expansion approach to numerical problems in finance. Selected papers on probability and statistics, Series 2 (Vol. 227 pp. 199–217). American Mathematical Society.

Takahashi, A., Takehara, K., & Toda. M. (2009). Computation in an asymptotic expansion method. Working paper, CARF-F-149, The University of Tokyo.

Takahashi, A., & Yamada, T. (2009). An asymptotic expansion with push-down of Malliavin weights (Preprint).

Takahashi A., Yoshida N. (2004) An asymptotic expansion scheme for optimal investment problems. Statistical Inference for Stochastic Processes 7: 153–188

Watanabe, S. (1983). Malliavin’s calculus in terms of generalized Wiener functionals. Lecture notes in control and information science (Vol. 49). Berlin: Springer

Watanabe S. (1984) Lectures on stochastic differential equations and Malliavin calculus. Springer, Berlin

Author information

Authors and Affiliations

Corresponding author

Additional information

This research is supported by CARF (Center for Advanced Research in Finance), Graduate School of Economics, the University of Tokyo.

All the contents expressed in this research are solely those of the authors and do not represent the view of Mitsubishi UFJ Trust Investment Technology Institute Co., Ltd.(MTEC), Mizuho-DL Financial Technology Co., Ltd. or any other institutions. The authors are not responsible or liable in any manner for any losses and/or damages caused by the use of any contents in this research.

Rights and permissions

About this article

Cite this article

Shiraya, K., Takahashi, A. & Yamada, T. Pricing Discrete Barrier Options Under Stochastic Volatility. Asia-Pac Financ Markets 19, 205–232 (2012). https://doi.org/10.1007/s10690-011-9147-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-011-9147-3