Abstract

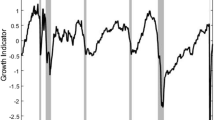

In this paper we develop a portfolio selection theory under regime switching means and volatilities. We use log mean-variance as the portfolio selection criteria and, as a result, the theory is made substantially easier to implement than other existing theories. Moreover, the estimated regimes are easy to interpret as one of the regimes corresponds to the business cycle turning points. Finally, we conduct an asset allocation simulation and obtain reasonable results by introducing an idea of switching volatility targets.

Similar content being viewed by others

References

Ang A., Bekaert G. (2002) International asset allocation with regime shifts. Review of Financial Studies 15: 1137–1187

Breiman, L. (1961). Optimal gambling systems for favorable games. In Proceedings of the 4th Berkeley symposium on mathematical statistics and probability (Vol. I, pp. 65–78).

Campbell J. Y., Viceira L. M. (2002) Strategic asset allocation: Portfolio choice for long-term investors. Oxford University Press, Oxford

Cover T. M., Thomas J. A. (1991) Elements of information theory. Wiley, New York

Cox J. C., Ingersoll J. E., Ross S. A. (1985) A theory of the term structure of interest rates. Econometrica 53: 385–408

Dempster A. P., Laird N. M., Rubin D. B. (1977) Maximum likelihood from incomplete data via the EM algorithm. Journal of the Royal Statistical Society Series B 39: 1–38

Diebold F. X., Lee J., Weinbach G. C. (1994) Regime switching with time-varying transition probabilities. In: Hargreaves C. (eds) Nonstationary time series analysis and cointegration. Oxford University Press, Oxford, pp 283–302

Elliott R. J. (1994) Exact adaptive filters for Markov chains observed in Gaussian noise. Automatica 30: 1399–1408

Elliott R. J., Aggoun L., Moore J. B. (1995) Hidden Markov models: Estimation and control. Springer, New York

Elliott R. J., van der Hoek J. (1997) An application of hidden Markov models to asset allocation problems. Finance and Stochastics 1: 229–238

Filardo A. J. (1994) Business-cycle phases and their transitional dynamics. Journal of Business and Economic Statistics 12: 299–308

Hamilton J. D. (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57: 357–384

Hamilton J. D. (1990) Analysis of time series subject to changes in regime. Journal of Econometrics 45: 39–70

Hamilton J. D. (1994) Time series analysis. Princeton University Press, Princeton

Kelly J. L. (1956) A new interpretation of information rate. Bell System Technical Journal 35: 917–926

Kim C.-J. (1993) Dynamic linear models with Markov-switching. Journal of Econometrics 60: 1–22

Konno H., Pliska S., Suzuki K. (1993) Optimal portfolio with asymptotic criteria. Annals of Operations Research 45: 187–204

Krolzig, H. (1997). Markov-switching vector autoregressions: Modelling, statistical inference, and application to business cycle analysis. Lecture Notes in Economics and Mathematical Systems (Vol. 454). Berlin: Springer.

Layton A. P., Katsuura M. (2001) Comparison of regime switching, probit and logit models in dating and forecasting US business cycles. International Journal of Forecasting 17: 403–417

Luenberger D. G. (1993) A preference foundation for log mean-variance criteria in portfolio choice problems. Journal of Economic Dynamics and Control 17: 887–906

Maheu J. M., McCurdy T. H. (2000) Indentifying bull and bear markets in stock returns. Journal of Business and Economic Statistics 18: 100–112

Merton R. C. (1969) Lifetime portfolio selection under uncertainty: The continuous-time case. Review of Economics and Statistics 51: 247–257

Merton R. C. (1971) Optimum consumption and portfolio rules in a continuous-time model. Journal of Economic Theory 3: 373–413

Mizrach B., Watkins J. (1999) A Markov switching cookbook. In: Rothman P. (eds) Nonlinear time series analysis of economic and financial data. Kluwer, Boston

Perez-Quiros G., Timmermann A. (1998) Variations in the mean and volatility of stock returns around turning points of the business cycle. In: Knight J., Satchell S. (eds) Forecasting volatility in the financial markets. Butterworth-Heinemann, Oxford

Psaradakis Z., Sola M. (1998) Finite-sample properties of the maximum likelihood estimator in autoregressive models with Markov switching. Journal of Econometrics 86: 369–386

Schaller H., van Norden S. (1997) Regime switching in stock market returns. Applied Financial Economics 7: 177–191

Thorp, E. O. (1971). Portfolio choice and the Kelly criterion. In Proceedings of the 1971 Business and Economics Section of the American Statistical Association (pp. 215–224).

Timmermann A. (2000) Moments of Markov switching models. Journal of Econometrics 96: 75–111

Author information

Authors and Affiliations

Corresponding author

Additional information

Authors are grateful to R.J. Elliott and two referees for many suggestions and comments for improving the earlier draft.

Rights and permissions

About this article

Cite this article

Ishijima, H., Uchida, M. The Regime Switching Portfolios. Asia-Pac Financ Markets 18, 167–189 (2011). https://doi.org/10.1007/s10690-010-9129-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-010-9129-x