Abstract

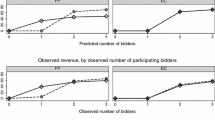

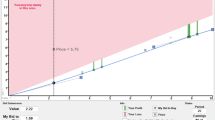

We analyze the implications of different pricing rules in discrete clock auctions. The two most common pricing rules are highest-rejected bid (HRB) and lowest-accepted bid (LAB). Under HRB, the winners pay the lowest price that clears the market; under LAB, the winners pay the highest price that clears the market. In theory, both the HRB and LAB auctions maximize revenues and are fully efficient in our setting. Our experimental results indicate that the LAB auction achieves higher revenues. This revenue result may explain the frequent use of LAB pricing. On the other hand, HRB is successful in eliciting true values of the bidders both theoretically and experimentally.

Similar content being viewed by others

References

Ausubel, L. M., & Cramton, P. (2004). Auctioning many divisible goods. Journal of the European Economic Association, 2, 480–493.

Ausubel, L. M., & Cramton, P. (2010). Virtual power plant auctions. Utilities Policy, 18, 201–208.

Ausubel, L. M., Cramton, P., Filiz-Ozbay, E., Higgins, N., Ozbay, E. Y., & Stocking, A. (2009). Common value auctions with liquidity needs: an experimental test of a troubled assets reverse auction. Working Paper, University of Maryland.

Cooper, D. J., & Fang, H. (2008). Understanding overbidding in second price auctions: an experimental study. Economic Journal, 118, 1572–1595.

Coppinger, V., Smith, V. L., & Titus, J. A. (1980). Incentives and behavior in English, Dutch, and sealed-bid auctions. Economic Inquiry, 18, 1–22.

Cox, J. C., Roberson, B., & Smith, V. L. (1982). Theory and behavior of single object auctions. Research in Experimental Economics, 2, 1–43.

Cox, J. C., Smith, V. L., & Walker, J. (1988). Theory and individual behavior of first-price auctions. Journal of Risk and Uncertainty, 1, 61–99.

Cramton, P., Dinkin, S., & Wilson, R. (2010). Auctioning rough diamonds: a competitive sales process for BHP Billiton’s Ekati diamonds. Working Paper, University of Maryland.

Cramton, P., & Sujarittanonta, P. (2010). Pricing rule in a clock auction. Decision Analysis, 7, 40–57.

Crawford, V., & Iriberri, N. (2007). Level-k auctions: can a nonequilibrium model of strategic thinking explain the winner’s curse and overbidding in private value auctions? Econometrica, 75(6), 1721–1770.

Delgado, M. R., Schotter, A., Ozbay, E. Y., & Phelps, E. A. (2008). Understanding overbidding: using the neural circuitry of reward to design economic auctions. Science, 321, 1849–1852.

Engelbrecht-Wiggans, R., & Katok, E. (2007). Regret in auctions: theory and evidence. Economic Theory, 33, 81–101.

Filiz-Ozbay, E., & Ozbay, E. Y. (2007). Auctions with anticipated regret: theory and experiment. American Economic Review, 97, 1407–1418.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Goeree, J. K., Holt, C. A., & Palfrey, T. R. (2002). Quantal response equilibrium and overbidding in private-value auctions. Journal of Economic Theory, 104, 247–272.

Goeree, J. K., Offerman, T., & Sloof, R. (2009). Demand reduction and preemptive bidding in multi-unit license auctions. Working Paper.

Harstad, R. M. (2000). Dominant strategy adoption and bidders’ experience with pricing rules. Experimental Economics, 3, 261–280.

Kagel, J. H. (1995). Auctions: a survey of experimental research. In A. E. Roth & J. H. Kagel (Eds.), Handbook of experimental economics. Princeton: Princeton University Press.

Kagel, J. H., & Levin, D. (1993). Independent private value auctions: bidder behaviour in first-, second-, and third-price auctions with varying numbers of bidders. Economic Journal, 103, 868–879.

Kagel, J. H., & Levin, D. (2001). Behavior in multi-unit demand auctions: experiments with uniform price and dynamic Vickrey auctions. Econometrica, 69, 413–454.

Kagel, J. H., & Levin, D. (2008). Auctions: a survey of experimental research, 1995–2008. In A. E. Roth & J. H. Kagel (Eds.), Handbook of experimental economics (Vol. 2). Princeton: Princeton University Press.

Kagel, J. H., Harstad, R. M., & Levin, D. (1987). Information impact and allocation rules in auctions with affiliated private values: a laboratory study. Econometrica, 55(6), 1275–1304.

Lange, A., & Ratan, A. (2009). Multi-dimensional reference-dependent preferences in sealed-bid auctions: how (most) laboratory experiments differ from the field. Working Paper, University of Maryland.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank our colleagues, Lawrence M. Ausubel and Daniel R. Vincent, for helpful discussions. We thank the National Science Foundation for support.

Electronic Supplementary Material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Cramton, P., Filiz-Ozbay, E., Ozbay, E.Y. et al. Discrete clock auctions: an experimental study. Exp Econ 15, 309–322 (2012). https://doi.org/10.1007/s10683-011-9301-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-011-9301-9