Abstract

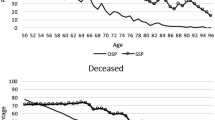

Because of the important role that survival expectations play in individual decision making, we investigate the extent to which individual responses to survival probability questions are informative about actual mortality. In contrast to earlier studies, which relied on the Health and Retirement Study (HRS) of US individuals aged 50 and over, we combine household survey data on subjective survival probabilities with administrative data on actual mortality for Dutch respondents aged 25 and over. Our main finding is that in our sample, individual life expectancies (measured as subjective survival probabilities) do predict actual mortality even when we control for a large set of health indicators. Our results further suggest that, on average, women underestimate their remaining life duration, whereas men tend to predict their survival chances more realistically. Both sexes, however, tend to overestimate the age gradient in mortality risk and underestimate the health risks of smoking.

Similar content being viewed by others

Notes

Earlier studies in this field have compared SSPs to actuarial survival probabilities when data on actual mortality were unavailable; see, for example, Hamermesh (1985), and Hurd and McGarry (1995) for the USA, O’Donnell et al. (2008) for the UK, and Peracchi and Perotti (2011) for Europe, Teppa and Lafourcade (2013) for the Netherlands, Bucher-Koenen and Kluth (2012) for Germany, and Wu et al. (2015) for Australia.

Alternative explanations exist for why life cycle models with actuarial survival probabilities might fail to explain observed patterns in the data. For instance, in the case of inadequate accumulated assets to finance retirement, the reasons may include lack of financial literacy (Lusardi and Mitchell 2011), incorrect beliefs about future retirement benefits (Rohwedder and van Soest, 2006), and/or hyperbolic discounting (Laibson et al. 1998).

For example, the probabilities of an individual who reports P75 = P80 = 0.5 are reassigned so that P75 = 0.55 and P80 = 0.45. Likewise, for the reasons discussed in the Appendix, the probabilities of 0 and 1 are replaced with 0.01 and 0.99, respectively. If the equal probabilities are P75 = P80 = 0.01, then P75 is set to 0.05, and if P75 = P80 = 0.99, then P80 is set to 0.95. We perform robustness checks of this assumption in Sect. 4.

It is also worth mentioning that, as Wilson (1994) and Perozek (2008) both noted, in very old age, mortality rates may increase at a lower rate than the Gompertz function predicts. In fact, Perozek (2008) found that a subjective cohort life table derived from the Gompertz distribution predicted about a 2-year shorter life expectancy than that derived from the Weibull distribution, suggesting that use of the Weibull distribution would produce slightly longer life expectancies implied by the objective and subjective mortality models.

When taking women as a reference group, we as well find an underestimation of the health risks of smoking.

The holder of a life insurance policy pays a yearly premium while alive for a certain sum that is then inherited by legal heirs, making it an advantageous purchase for someone whose life is short.

References

Alessie, R., Hochguertel, S., & van Soest, A. (2002). Household portfolios in the Netherlands. In L. Guiso, M. Haliassos, & T. Jappelli (Eds.), Household portfolios (pp. 341–388). Cambridge, MA: MIT Press.

Banks, J., Kapteyn, A., Smith, J. P., & van Soest, A. (2009). Work disability is a pain in the ****, especially in England, the Netherlands, and the United States. In D. Cutler & D. Wise (Eds.), Health in older ages: The causes and consequences of declining disability among the elderly. Chicago: Chicago University Press.

Bissonnette, L., Hurd, M. D., & Michaud, P. C. (2014). Individual survival curves comparing subjective and objective mortality risks. IZA Discussion Paper No., 8658.

Bucher-Koenen, T., & Kluth, S. (2012). Subjective life expectancy and private pension. MEA Discussion Paper No. 14–2012.

Cox, D. R. (1972). Regression models and life-tables. Journal of the Royal Statistical Society: Series B, 34(2), 187–220.

Delavande, A., & Rohwedder, S. (2011). Differential mortality in Europe and the US: Estimates based on subjective probabilities of survival. Demography, 48, 1377–1400.

Elder, T. (2013). The predictive validity of subjective mortality expectations: Evidence from the health and retirement study. Demography, 50(2), 569–589.

Fischhoff, B., & Bruine de Bruin, W. (1999). Fifty-Fifty = 50%? Journal of Behavioral Decision Making, 12, 149–163.

Gan, L., Gong, G., Hurd, M., & McFadden, D. (2004). Subjective mortality risk and bequests. NBER Working Paper No. 10789.

Gerking, S., & Khaddaria, R. (2011). Perceptions of health risk and smoking decisions of young people. Health Economics, 21, 865–877.

Gompertz, B. (1825). On the nature of the function expressive of the Law of Human Mortality and on a new mode of determining life contingencies. Philosophical Transactions of the Royal Society of London, 115, 513–585.

Hamermesh, D. S. (1985). Expectations, life expectancy, and economic behavior. Quarterly Journal of Economics, 100, 389–408.

Hudomiet, P., & Willis, R. J. (2013). Estimating second order probability beliefs from subjective survival data. Decision Analysis, 10(2), 152–170.

Lusardi, A., & Mitchell, O. (2011). Financial literacy and planning: Implications for retirement wellbeing, forthcoming. In A. Lusardi & O. Mitchell (Eds.), Financial literacy: Implications for retirement security and the financial marketplace (pp. 17–39). Oxford: Oxford University Press.

Human Mortality Database. (2014). http://www.mortality.org/.

Hurd, M. D. (1989). Mortality risk and bequests. Econometrica, 57(4), 779–813.

Hurd, M. (2009). Subjective probabilities in household surveys. Annual Review of Economics, 1, 543–562.

Hurd, M. D., & McGarry, K. (1995). Evaluating subjective probabilities of survival in the Health and Retirement Study. Journal of Human Resources, 30(Supplement), S268–S292.

Hurd, M., & McGarry, K. (2002). The predictive validity of subjective probabilities of survival. Economic Journal, 112, 966–985.

Kalwij, A. S., Alessie, R. J. M., & Knoef, M. G. (2013). The association between individual income and remaining life expectancy at the age of 65 in the Netherlands. Demography, 50, 181–206.

Khwaja, A., Sloan, F. A., & Chung, S. (2007). The relationship between individual expectations and behaviors: Evidence on mortality expectations and smoking decisions. Journal of Risk and Uncertainty, 35, 179–201.

Kleinjans, K. J., & van Soest, A. (2013). Rounding, focal point answers, and nonresponse to subjective probability questions. Journal of Applied Econometrics, 29(4), 567–585.

Laibson, D., Repetto, A., Tobacman, J., Hall, R. E., Gale, W. G., & Akerlof, G. A. (1998). Self-control and saving for retirement. Brookings papers on Economic Activity, 1998(1), 91–196.

Law, A., & Kelton, W. (1982). Simulation modelling and analysis. New York: McGraw-Hill.

Lazarsfeld, P. F. (1940). Panel studies. Public Opinion Quarterly, 4, 122–128.

Manski, C. F. (2004). Measuring expectations. Econometrica, 72, 1329–1376.

Nusselder, W. J., & Looman, C. W. N. (2004). Decomposition of differences in health expectancy by cause. Demography, 41(2), 315–334.

O’Donnell, O., Teppa, F., & Van Doorslaer, E. (2008). Can subjective survival expectations explain retirement behavior? DNB Working Paper No. 188.

Peracchi, F., & Perotti, V. (2011). Subjective survival probabilities and life tables: evidence from Europe. EIEF Working Paper No. 1016.

Perozek, M. (2008). Using subjective expectations to forecast longevity: Do survey respondents know something we don’t know? Demography, 45, 95–113.

Poterba, J. M., Venti, S. F., & Wise, D. A. (2011). Family status transitions, latent health, and the post-retirement evolution of assets. In D. A. Wise (Ed.), Explorations in the economics of aging (pp. 23–69). Chicago: University of Chicago Press.

Rohwedder, S., & Van Soest, A. (2006). The impact of misperceptions about social security on saving and well-being, Michigan Retirement Research Center Working Paper No. 2006-11.

Salm, M. (2010). Subjective mortality expectations and consumption and savings behaviours among the elderly. Canadian Journal of Economics, 43(3), 1040–1057.

Schoenbaum, M. (1997). Do smokers understand the mortality effects of smoking? Evidence from the Health and Retirement Survey. American Journal of Public Health, 87(5), 755–759.

Siegel, M., Bradley, E. H., & Kasl, S. V. (2003). Self-rated life expectancy as a predictor of mortality: Evidence from the HRS and AHEAD surveys. Gerontology, 49, 265–271.

Siermann, C., van Teeffelen, P., & Urlings, L. (2004). Equivalentiefactoren 1995–2000: Methode en belangrijkste uitkomsten. Sociaal-Economische Trends, 3, 63–66.

Smith, K. V., Taylor, D. H., & Sloan, F. A. (2001). Longevity expectations and death: Can people predict their own demise? American Economic Review, 91(4), 1126–1134.

Sturgis, P., Allum, N., & Brunton-Smith, I. (2009). Attitudes over time: The psychology of panel conditioning. In P. Lynn (Ed.), Methodology of longitudinal Surveys (pp. 113–126). Chichester: Wiley.

Teppa, F., & Lafourcade, P. (2013). Can the longevity risk alleviate the annuitization puzzle? Empirical evidence from survey data. DNB Working Paper.

Van Kippersluis, H., O’Donnell, O., & van Doorslaer, E. (2009). Long run returns to education: does schooling lead to an extended old age? Journal of Human Resources, 4, 1–33.

Van Ooijen, R., Alessie, R., & Kalwij, A. (2014). Saving behavior and portfolio choice after retirement. Netspar Panel Paper No. 42, Network for Studies on Pensions, Aging and Retirement (www.netspar.nl).

Van Santen, P. (2013). Precautionary saving, wealth accumulation and pensions: an empirical microeconomic perspective. Ph.D. Thesis, Netspar Theses, 2013-001.

Wilson, D. L. (1994). The analysis of survival (mortality) data: Fitting Gompertz, Weibull, and logistic functions. Mechanisms of Aging and Development, 74, 15–33.

Wu, S., Stevens, R., & Thorp, S. (2015). Cohort and target age effects on subjective survival probabilities: Implications for models of the retirement phase. Journal of Economic Dynamics and Control, 55(June), 39–56.

Zellner, A. (1962). An efficient method of estimating seemingly unrelated regressions and tests for aggregation bias. Journal of the American Statistical Association, 57, 348–368.

Acknowledgements

We wish to thank CentERdata for making the data available to us, and Rob Alessie, Tabea Bucher-Koenen, Hans van Kippersluis, Sebastian Kluth, Clemens Kool, Bertrand Melenberg, Peter van Santen, and seminar participants at the MESS workshop (Amsterdam, September 2012), the CeRP conference (Turin, September 2012), the Netspar workshop (Den Haag, October 2012), the Netspar Pension Day (Utrecht, November 2012), the ESPE conference (Aarhus, June 2013), the ESEM conference (Gothenburg, August 2013), and the ASSA meeting (Philadelphia, January 2014) for valuable comments and discussions. Financial support has been provided by the Network for Studies on Pensions, Aging and Retirement (Netspar).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Derivation of the Median Remaining Life Duration

For each individual in our sample, we observe two survival function values, \(SSP_{1,i}\) and \(SSP_{2,i}\), at two different target ages \(t_{1,i}\) and \(t_{2,i}\) where \(t_{1,i} < t_{2,i}\). \(t_{0,i}\) is the baseline age at which the respondent reported the SSPs:

with \((t_{1,i} ,t_{2,i} ) \in \left\{ {(75,80),(80,85),(85,90),(90,95),(95,100)} \right\}\) and \((SSP_{1,i} ,SSP_{2,i} ) \in \left\{ {(P75,P80),(P80,P85),(P85,P90),(P90,P95),(P95,P100)} \right\}\), respectively. \(P75\) represents the subjective survival probability (SSP) to age 75, \(P80\) that to age 80, and so on. The Gompertz hazard rate function is given by \(\theta (t) = \lambda_{i} \exp \left\{ {\gamma_{i} t} \right\}\).

After substituting the hazard rate function into Eqs. (6) and (7), we evaluate the integral to find

Next, following Perozek (2008), we take logarithms of the survival functions [Eq. (10)] and estimate the parameters \(\gamma_{i}\) and \(\lambda_{i}\) for each individual using nonlinear least squares (NLLS). This procedure requires that we replace the survival probabilities of 0 and 1 with slightly different numbers, namely 0.01 and 0.99, respectively.

where \(\varepsilon_{j,i}\) is the error term, which is assumed to be independent and identically distributed (i.i.d.) and have a zero mean. We obtain the NLLS estimates of \(\gamma_{i}^{*}\) and \(\lambda_{i}^{*}\) by minimizing the following expression:

with

We then calculate the subjective median remaining life duration conditional on baseline age for each individual denoted by \(L_{i}^{R,S}\), where R and S denote ‘remaining’ and ‘subjective,’ respectively, based on the following formula:

The Gompertz hazard function is then \(\theta (s^{\prime} + t_{0,i} ) = \lambda_{i} \exp \left\{ {\gamma_{i} (s^{\prime} + t_{0,i} )} \right\}\), so evaluating the integral in Eq. (11) and taking the natural logarithm of both sides yields

We then replace \(\gamma_{i}\) and \(\lambda_{i}\) in Eq. (12) with their estimates \(\gamma_{i}^{*}\) and \(\lambda_{i}^{*}\), respectively. Because the variable \(L_{i}^{R,S}\) is created using individual subjective survival probabilities, it represents the subjective median remaining life duration conditional on baseline age for each individual.

1.2 Comparison of Objective and Subjective Predicted Remaining Life Durations (Table 6)

The common assumption in the objective and subjective mortality models is that life duration can be modeled using a Gompertz distribution. Under this assumption, the hazard function can be written as

where \(\lambda_{i} = \lambda^{obj} = \exp \left\{ {{\mathbf{x}}_{{\mathbf{i}}} {\varvec{\upbeta}}^{obj} } \right\}\), \(\gamma_{i} = \gamma^{obj}\) in the objective mortality model, and \(\lambda_{i} = \lambda^{subj} = \exp \left\{ {{\mathbf{x}}_{{\mathbf{i}}} {\varvec{\upbeta}}^{subj} } \right\}\), \(\gamma_{i} = \gamma^{subj}\) in the subjective mortality model. Hence, we replace \(\lambda^{obj}\), \(\gamma^{obj}\), \(\lambda^{subj}\), and \(\gamma^{subj}\) in Eq. (12) with their estimates, \(\hat{\lambda }^{obj}\),\(\hat{\gamma }^{obj}\), \(\hat{\lambda }^{subj}\), and \(\hat{\gamma }^{subj}\), respectively:

where \(\hat{L}^{R,O}\) and \(\hat{L}^{R,S}\) denote objective and subjective predicted remaining life durations, respectively, and \(\bar{t}_{0,i}\) is the baseline age, which is equal to 45. The vector \({\bar{\mathbf{x}}}_{i}\) contains fixed values of the control variables included in the estimation. For example, in the first row of Table 6, all of the dummy variables in both mortality models are equal to zero.

Rights and permissions

About this article

Cite this article

Kutlu-Koc, V., Kalwij, A. Individual Survival Expectations and Actual Mortality: Evidence from Dutch Survey and Administrative Data. Eur J Population 33, 509–532 (2017). https://doi.org/10.1007/s10680-017-9411-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10680-017-9411-y