Abstract

This paper investigates the impact of bank size and competition on earnings volatility and insolvency risk using quarterly data for commercial banks operating in the Turkish banking industry for the period 2002Q1–2012Q2. The main result of the paper indicates that bank size and earnings volatility are negatively related, suggesting that larger banks are less risky. The results also indicate that competition measured by the Boone indicator increases earnings volatility. The results further suggest that higher capitalized banks, banks with a higher share of non-interest income in total income and efficient banks face lower earnings volatility. Finally, insolvency risk measured by Z-score and bank size are positively related, suggesting that larger banks are more stable.

Similar content being viewed by others

Notes

Losing control in financing fiscal deficits produced the financial crisis of 1994. The government interventions in the domestic debt market were the main reason of the crisis. The Turkish economy shrunk by 6 % and the inflation rate hit three digit levels. Moreover, the value of US dollar nearly doubled against Turkish lira and the Central Bank reserves decreased significantly. Three banks became insolvent and a full coverage deposit insurance system was introduced to restore financial stability.

The problem started with the exchange rate-based stabilization program of 1999. The main aim of the program was to control inflation, correct macroeconomic fundamentals and decrease the fragility of the financial system. After some initial success, the Turkish economy suffered a liquidity crisis in November 2000. However, the country got into a deepening crisis period that reached to its peak with the abandonment of the pegged exchange rate regime in February 2001.

The Turkish economy shrunk by 7.5 % and the Turkish lira depreciated around 11 % in real terms. As in the case of 1994 crisis, most of the Central Bank reserves eroded in managing the crisis. Banking system was the most affected by the crisis because of the high level of foreign currency dominated liabilities. Total assets of the system decreased about one-third in US dollar terms.

20 banks were taken over by the Savings Deposit Insurance Fund (SDIF) due to the weak financial positions during the period 1999–2003.

The Banking Regulation and Supervision Agency (BRSA), which was founded in September 2000, changed its main objective from supervision to restructuring and rehabilitation. The main duties of the BRSA during the crisis period were strengthening the private banks’ capital structures, restructuring the state-owned banks, resolving the banks taken over by the SDIF, and improving the quality of supervision in the banking system (Al and Aysan 2006).

The BAT stands for the Banks Association of Turkey. The BAT publishes annual reports called as the “banks in Turkey”. The figures have taken from the report published in 2012.

We also checked the inflation adjusted figures with the suggestion of the referee. $40 billion and $10 billion in 2002 correspond to around $51 billion and $12.8 billion in 2012, respectively. There were still 7 banks with an asset size above $51 billion, 5 banks with an asset size between $12.7 billion and $51 billion, and the rest with an asset size lower than $12.7 billion. Hence, this supports the above statement regarding the significant increase in the number of large banks in the system during the sample period.

Haselmann and Wachtel (2007) state that banks behave differently under different institutional settings.

Interested readers could refer to Baltagi (2005) for the technical details of the dynamic panel data models.

The System GMM estimator also eliminates the endogeneity problem that might arise due to the possible correlation between the bank-specific effects and the explanatory variables.

We also used the standard deviation of returns on equity (ROE) as a proxy for earnings volatility for bank i for a robustness check.

Market share for bank i is defined as \( ms_{i} = \frac{{q_{i} }}{{\sum\nolimits_{i = 1}^{n} {q_{i} } }} \), where \( q_{i} \) is the total loans of bank i. This measure is calculated for each quarter.

The HHI is calculated by using bank total loans as inputs (\( HHI = \sum\nolimits_{i = 1}^{n} {s_{i}^{2} } \), where s represents the market share of each bank in total loans in the market).

The H-statistic developed by Panzar and Rosse (1987) is another alternative measure used widely in the banking literature. It is computed as the sum of the estimated elasticities of revenues with respect to input prices. Hence, it provides an aggregate measure of competition. The main disadvantage of this statistic is that it maps the various degrees of market power only weakly and, therefore, cannot be viewed as a continuous variable (Bikker et al. 2012).

The joint determination of cost and performance could be the case in this regression model. Hence, we also tested whether endogenity problem is present in our specification. The results of endogenity test show that marginal costs have been considered as exogenous at the conventional significance levels in the estimation of Eq. (4).

Although not reported, the t values of each quarter are available upon request from the authors.

As discussed before, the Boone indicator is inversely proportional to competition. That is, the more negative the measure is, the more competitive the banking market is.

Following De Haan and Poghosyan (2012a) the interaction of competition and size is also added to investigate whether competition conditions the impact of size. Due to the high correlation between the interaction term and Boone indicator, coefficients of key variables were statistically insignificant. Hence, we dropped the interaction term from the regressions. Although not reported, they are available from the authors upon request.

It should be noted that the relationship between ROA volatility and capitalization is mostly significantly positive, implying that higher capitalized banks face higher ROA volatility.

Demirguc-Kunt and Huizinga (2010) show that banks in developing countries have relatively more non-interest income share in total operating income (0.385) compared to developed countries (0.342).

We also include dummy variables to control for global crisis and foreign ownership in the regression. Our aim was to check whether global financial crisis and foreign ownership have impacts on earnings volatility and insolvency risk. Coefficients of these dummies were statistically insignificant at the conventional levels. In addition, following the suggestion of one of the referees, we also exercised the Chow test to check whether there is a structural break in the relationship between earnings volatility and explanatory variables. For this purpose, the sample period was divided into two sub-periods: 2002:Q1–2007:Q4 and 2008:Q1–2012:Q2 (pre- and post-global crisis period). The test result produced an F-statistic value that was insignificant at the conventional significance levels. Therefore, the null hypothesis which asserted that the model parameters were stable during the sample period was not rejected.

Bank non-traditional activities such as off-balance sheet and non-interest income have commonly been used as an additional bank output in the banking literature in recent years (see for example Lozano-Vivas and Pasiouras 2010).

References

Akin GG, Aysan AF, Kara GI, Yildiran L (2009) Transformation of the turkish financial sector in the aftermath of the 2001 crisis. In: Onis Z Z, Senses F (eds) Turkish Economy in the Post-Crisis Era: The New Phase of Neo-Liberal Restructuring and Integration to the Global Economy. Routledge, New York, pp 73–100

Al H, Aysan AF (2006) Assessing the preconditions in establishing an independent regulatory and supervisory agency in globalized financial markets: the case of Turkey. Int J Appl Bus Econ Res 4:125–146

Albertazzi U, Gambacorta L (2009) Bank profitability and the business cycle. J Financ Stab 5:393–409

Allen F, Gale D (2004) Competition and financial stability. J Money Credit Bank 36:453–480

Arellano M, Bond SR (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variables estimation of error components models. J Econom 68:29–51

Assaf AG, Matousek R, Tsionas E (2012) Turkish bank efficiency: Bayesian estimation with undesirable outputs. J Bank Finance 37:506–517

Baltagi B (2005) Econometric analysis of panel data, 3rd edn. John Wiley & Sons Limited, Hoboken

Banks Association of Turkey (BAT) (2002) “Banks in Turkey 2002”, June 2003. http://www.tbb.org.tr/Dosyalar_eng/istatistiki_raporlar/Banks_in_Turkey_-_USD/314/Ekler/turkisheconomy.pdf

Banks Association of Turkey (BAT) (2012) “Banks in Turkey 2012”, June 2013. http://www.tbb.org.tr/en/Content/Upload/istatistikiraporlar/ekler/358/Turkish_Economy_and_Banking_System_2012.pdf

Beck T, Demirgüc-Kunt A, Levine R (2006) Bank concentration, competition, and crises: first results. J Bank Financ 30:1581–1603

Berger A, Klapper L, Turk-Ariss R (2009) Bank competition and financial stability. J Financ Serv Res 21:849–870

Bikker JA, Hu H (2002) Cyclical patterns in profits, provisioning and lending of banks and procyclicality of the new Basle Capital Requirements. BNL Q Rev 22:143–175

Bikker JA, Shaffer S, Spierdijk L (2012) Assessing competition with the Panzar–Rosse model: the role of scale, costs, and equilibrium. Rev Econ Stat 94:1025–1044

Blundell R, Bond SR (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143

Boone J (2001) Intensity of competition and the incentive to innovate. Int J Ind Organ 19:705–726

Boone J (2008) A new way to measure competition. Econ J 118:1245–1261

Boyd JH, De Nicolo G (2005) The theory of bank risk taking and competition revisited. J Financ 60:1329–1343

Boyd JH, Runkle DE (1993) Size and performance of banking firms: testing the predictions of theory. J Monet Econ 31:47–67

Boyd JH, De Nicolo G, Jalal A (2006) Bank risk taking and competition revisited: new theory and new evidence. Working paper WP/06/297, International Monetary Fund, Washington, DC

Claessens S, Laeven L (2004) What drives bank competition? Some international evidence. J Money Credit Bank 36:563–584

Couto R (2002) Framework for the assessment of bank earnings. Financial Stability Institute, Bank for International Settlements, Basel

De Haan J, Poghosyan T (2012a) Bank size, market concentration, and bank earnings volatility in the US. J Int Financ Mark Inst Money 22:35–54

De Haan J, Poghosyan T (2012b) Size and earnings volatility of US bank holding companies. J Bank Financ 36:3008–3016

De Nicoló G (2000) Size, charter value and risk in banking: an international perspective. International Finance Discussion Paper 689, Board of Governors of the Federal Reserve System

Demirgüç-Kunt A, Huizinga H (2010) Bank activity and funding strategies: the impact on risk and returns. J Financ Econ 98:626–650

Fu XM, Lin YR, Molyneux P (2014) Bank competition and financial stability in Asia Pacific. J Bank Financ 38:64–77

Hasan I, Marton K (2003) Development and efficiency of the banking system in a transitional economy: Hungarian experience. J Bank Financ 27:2249–2271

Haselmann R, Wachtel P (2007) Risk taking by banks in the transition countries. Comp Econ Stud 49:411–429

Isik I, Hassan MK (2003) Financial deregulation and total factor productivity change: an empirical study of Turkish commercial banks. J Bank Financ 27:1455–1485

Jondrow J, Lovell CAK, Materov IS, Schmidt P (1982) On the estimation of technical efficiency in the stochastic frontier production function model. J Econom 19:233–238

Keeley MC (1990) Deposit insurance, risk, and market power in banking. Am Econ Rev 80:1183–1200

Leuvensteijin M, Bikker JA, van Rixtel ARJM, Sorensen CK (2011) A new approach to measuring competition in the loan markets of the euro area. Appl Econ 43:3155–3167

Liu H, Molyneux P, Nguyen LH (2012) Competition and risk in South East Asian commercial banking. Appl Econ 44:3627–3644

Lozano-Vivas A, Pasiouras F (2010) The impact of non-traditional activities on the estimation of bank efficiency: international evidence. J Bank Financ 34:1436–1449

Mishkin FS (2006) How big a problem is too big to fail? J Econ Lit 44:988–1004

Panzar JC, Rosse JN (1987) Testing for monopoly equilibrium. Journal of Industrial Economics 35:443–456

Roodman D (2009) A note on the theme of too many instruments. Oxford Bull Econ Stat 71:135–158

Rosenblum H (2011) Choosing the road to prosperity: why we must end too big to fail now. Federal Reserve Bank of Dallas, annual report, pp 3–23

Schaeck K, Cihak M (2008) How does competition affect efficiency and soundness in banking? New empirical evidence. Working paper no. 932, European Central Bank

Schaeck K, Cihak M (2010) Competition, efficiency, and soundness in banking: an industrial organization perspective. European Banking Center, discussion paper no. 2010-20S. http://ssrn.com/paper=1635245

Schaeck K, Cihak M, Wolfe S (2009) Are more competitive banking systems more stable? J Money Credit Bank 41:567–607

Shehzad CT, De Haan J, Scholtens B (2010) The impact of bank ownership concentration on impaired loans and capital adequacy. J Bank Financ 34:399–408

Stiroh KJ (2004) Diversification in banking: is non-interest income the answer? J Money Credit Bank 36:853–882

Stiroh KJ, Rumble A (2006) The dark side of diversification: the case of US financial holding companies. J Bank Financ 30:2131–2161

Yeyati EI, Micco A (2007) Concentration and foreign penetration in the Latin American Banking sectors; impact on competition and risk. J Bank Financ 31:1633–1647

Yildirim C (2014) Competition in Turkish banking: impacts of restructuring and the global financial crisis. Dev Econ 52:95–124

Acknowledgments

We would like to acknowledge the financial support provided by the Turkish Scientific and Technological Research Council under the Project No. SOBAG-112K039.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

To estimate Eq. (4) we need the computation of marginal costs for each bank and quarter. As marginal costs cannot be directly observed, we estimate them by using a translog cost function, which is common in the related literature since it does not require too many restrictive assumptions about the nature of the technology. The multi-product cost function for a given bank s at time t can be specified as follows:

where tc is the total cost and y denotes three outputs; total loans, other earning assets and non-interest income. The last output is a proxy for bank non-traditional activity.Footnote 22 w represents two input prices: price of funds and a common price of labor and capital. Since personnel expenses are not reported in some quarters, we calculate a common price for labor and capital (see Hasan and Marton 2003). The common price is calculated as the ratio between operating costs and total assets. The price of funds is calculated by dividing total interest expenses by total deposits. Both financial and operating costs are included in the estimation of the cost function. In addition, D, which represents time dummies for each quarter, is included to capture technological progress, and \( \varepsilon = v + u \) is a composite error term where v represents standard statistical noise and u captures inefficiency. To ensure that the estimated cost frontier is well-behaved, two standard properties of the cost function, symmetry and linear homogeneity, are imposed via parameter restrictions. The linear homogeneity conditions are imposed by normalizing total cost (tc) and the price of labor (\( w_{1} \)) by the price of funds (\( w_{2} \)). The symmetry condition requires \( \alpha_{ik} = \alpha_{ki\;} \forall \;i,\;k \) and \( \beta_{jm} = \beta_{mj\;} \forall \;j,\;m \).

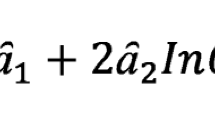

The marginal costs for loans (l) can be obtained by taking the first derivative of the dependent variable in Eq. (5) with respect to output \( y_{lst} \) as follows:

We also estimate cost efficiency using Jondrow et al. (1982) approach. Bank-specific estimates of inefficiency, u, can be computed by using the distribution of the inefficiency term conditional on the estimate of the composite error term. The random error term (v) is assumed to be normally distributed and the inefficiency term (u) is assumed to be one-sided.

The descriptive statistics of variables used in the translog cost function are reported in Table 4.

Earnings volatility (SD), bank stability (Z-score), capitalization, diversification, inefficiency, and size over the period 2003Q1–2012Q1. Standard deviations of earnings (ROA) are computed using a four-quarter rolling time windows. Total assets are in millions of US dollars. a Earnings volatility. b Bank stability. c Bank capitalization and diversification. d Bank inefficiency. e Total assets

Rights and permissions

About this article

Cite this article

Kasman, A., Kasman, S. Bank size, competition and risk in the Turkish banking industry. Empirica 43, 607–631 (2016). https://doi.org/10.1007/s10663-015-9307-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-015-9307-1