Abstract

This paper provides new field evidence on the role of probability numeracy in health insurance purchase. Our regression results, based on rich survey panel data, indicate that the expenditure on two out of three measures of health insurance first rises with probability numeracy and then falls again. This non-monotonic relationship suggests that probability numeracy affects health insurance decisions through several channels. In the third case—the obligatory Dutch basic health insurance—we find that high levels of probability numeracy coincide with a lower deductible choice. We discuss possible explanations for the patterns we find, including status quo bias and ambiguity aversion, and the related policy implications.

Similar content being viewed by others

1 Introduction

Consumers do not always have a completely rational approach toward the purchase of insurance. In some instances, individuals have been found to under-insure relative to what the rational benchmark would suggest (Browne and Hoyt 2000; Ito and Kono 2010; Giné et al. 2008), while in other situations they tend to over-insure (Barseghyan et al. 2012; Cutler and Zeckhauser 2004; Huysentruyt and Read 2010; Sydnor 2006). Behavioral factors that have been advanced to explain such deviations from rational choice include the difficulty to deal with small probability events, the feelings of regret toward uninsured losses, and the susceptibility to context and framing (Johnson et al. 1993; Liebman and Zeckhauser 2008; Kunreuther et al. 2013).

This study examines whether the demand for health insurance is affected by individuals’ level of probability numeracy. Insurance purchase is ultimately a financial decision in the face of uncertainty. Whether someone buys insurance basically depends on his or her risk assessment and risk preferences. Risk assessment is based on the person’s knowledge (private and public information) and (cognitive) skills, including numeracy, that is, “the ability to understand probabilistic and mathematical concepts” (Peters 2012). For the purposes of this paper, we are particularly interested in probability numeracy, which we define as the specific ability to understand and process probabilistic concepts.

To study the relationship between health insurance decisions and probability numeracy, we use rich survey panel data on the purchase of three measures of health insurance and combine this with information on subjects’ probability numeracy and an extensive set of individual characteristics, including their stated and revealed risk preferences. The measures of health insurance purchase that we consider, are (A) whether or not someone has complementary health insurance, (B) total monthly expenditure on health insurances and (C) the amount of voluntary deductible in the Dutch universal health insurance.

If probability numeracy plays an important role in insurance purchase decisions, then this would have implications for social policy. For example, in ageing societies there is a growing budgetary pressure towards further privatization of health care costs, through increasing copayments and private insurance. In these circumstances it is increasingly relevant to know whether people are adequately equipped to make this kind of complex decisions and under which conditions they are able to cope with the challenging choices they face.

Our regression results indicate that the relationship between numeracy and two of our measures of health insurance purchase appears to be non-monotonic. Complementary health insurance purchases and total expenditure on health insurance first rise with probability numeracy and then, at the higher numeracy levels, fall again. In the case of the obligatory Dutch basic health insurance, we find that high levels of probability numeracy coincide with a lower deductible choice.

We discuss how the non-monotonic effect of probability numeracy on complementary health insurance and total health insurance expenditure could be explained. We speculate ex post that a minimal level of numeracy is needed to have an interest in purchasing health insurance at all. At intermediate numeracy levels, people see the value in health insurance but are unable to make reasonable risk assessments. At higher numeracy levels, people become more and more able to determine the actual level of risk instead of experiencing a state of ambiguity. That would allow them to choose a better aimed—and on average lower—level of health insurance. The challenge from a policy point of view would then be to get people to be both active and selective in their health insurance purchase decisions.

2 Literature Review and Hypotheses

The literature on the relationship between numeracy and complex decision making, like insurance purchase, indicates that numeracy is a very relevant characteristic. Peters et al. (2006) present a series of four studies that explore how the ability to work with probability numbers relates to performance on judgment and decision tasks. They find that highly numerate individuals were less susceptible to framing effects than less numerate individuals. High numeracy is generally, though not always, helpful for making better decisions. They conclude that numerical ability appears to matter to judgment and decisions in important ways and that this effect is not due to general intelligence. Pachur and Galesic (2012) corroborate these conclusions. They find that high numeracy individuals are more likely to choose the option with the highest expected value, guessed less often and relied less on a simple risk-minimizing strategy.

There is also specific attention for numeracy in the health domain. Reyna et al. (2009) present a review of literature on health literacy. They find that low numeracy distorts perceptions of risks and benefits of screening, reduces medication compliance, impedes access to treatments and appears to adversely affect medical outcomes. Low numeracy is also associated with greater susceptibility to mood, framing and biases in judgment and decision making. They do stress the fact that there is a need for more empirical work as the foundation for designing evidence-based policies and interventions to improve decision making and health outcomes.

An example of how increasingly complicated (public) insurance programs threaten to put the less numerate at a disadvantage is provided by Wood et al. (2011). They examine the case of the Medicare prescription drug program (Part D). This program has been designed to maximize choice for the consumer, making it a highly complex decision task with dozens of options. They find that participants performed better with less choice versus more choice, and that numeracy plays a critical role in decision making across decision domains and across the lifespan.

An indication of the direction in which low numeracy could steer insurance purchase decisions is given by Chan and Elbel (2012), who look at the complex supplemental coverage landscape in addition to traditional Medicare. They found that people in the lower third of the cognitive ability and numeracy distributions are at least eleven percentage points less likely than those in the upper third to enroll in a supplemental Medicare insurance plan and thus lack the financial protection and other potential benefits of supplemental enrolment.

A potentially relevant policy option is studied by Gaurav et al. (2011). They report on a field experiment which offered an innovative new financial product, rainfall insurance, to 600 small-scale farmers in India. They evaluate the effect of a financial literacy training using a randomized controlled trial and find that financial education has a positive and significant effect on rainfall insurance adoption, increasing take-up from 8 to 16 %.

Based on the above, probability numeracy can be expected to play a role in insurance purchase decisions. It is not yet straightforward, though, what the direction would be of the expected impact of probability numeracy on different specific insurance purchase cases. The less probability numerate can on average be expected to make the less rational choice. That could in theory result in buying too little insurance, as seems to be the case with Medicare, but it could also lead to over-insurance.

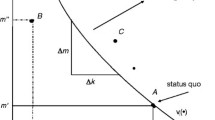

The less probability numerate have been found to be more prone to framing effects. A hypothesis that seems to follow naturally from this, is that less numerate individuals are less likely to deviate from the default choice. In many cases this would mean that numeracy increases insurance demand, since getting insurance usually requires an active choice. But in the case of deductible choice that we study, we would expect the opposite result (i.e., more exposure to risk for the numerate), since the default here is to have a zero voluntary deductible (on top of a fixed mandatory deductible). The numerate would be more likely to deviate from this and thus end up with a relatively lower level of insurance.

3 Data

The analyses are based on data from a variety of surveys of the LISS (Longitudinal Internet Studies for the Social sciences) panel administered by CentERdata (Tilburg University, The Netherlands). The LISS panel is a representative sample of Dutch individuals. The panel is based on a true probability sample of households drawn from the population register. The panel members take part in monthly Internet surveys. If necessary for their participation, households are provided with a computer and Internet connection. The panel is in full operation since October 2007. Background variables like age, gender, household composition, education and several income measures are updated at regular time intervals by one member of the household. A longitudinal survey is fielded in the panel every year, covering a large variety of domains including work, education, income, housing, time use, political views, values and personality. The panel also contains a number of separate unique studies on a range of subjects, like measuring disease prevention, time use and consumption or risk attitudes. This paper combines information from several of these studies (see “Appendix 1”).

3.1 Health Insurance Purchase

We analyze three separate dependent variables (A–C). In this section we describe the data sources we have used for these analyses.

3.1.1 Complementary Health Insurance (A)

In the Netherlands everyone is obliged to have basic health insurance and all insurers are obliged to accept every applicant, at community-rated premiums. Premiums can differ between insurers and typically amount to 100 euro per month per person.Footnote 1 Children below the age of 18 years are insured free of charge, and without a (mandatory or voluntary) deductible.

On top of the Dutch mandatory basic health insurance policy everyone can decide whether or not to take a complementary health insurance policy. Complementary health insurance can cover those health expenditures that are otherwise not covered, like dental care, physiotherapy or alternative medicine. Insurers are not obliged to accept everyone for their complementary health insurance policies and are allowed to charge extra because of someone’s age and/or health status.Footnote 2 In November and December 2009–2011 the following question was posed to each member of the LISS panel: “Did you take out a complementary health insurance in \(<\)year\(>\) (for instance for dentistry, physiotherapy or alternative medicine)?”

Around 84 % of our sample reports having a complementary health insurance in that period. According to Vektis, the healthcare information centre established by Dutch health insurers, the Dutch population average was around 89 % in that period. There is a slightly downward trend over the years; in 2006 around 93 % had a complementary health insurance. This percentage is known to be relatively higher for those who participate in a collective insurance policy and for women. Also, it first rises with age, but around the age of eighty it starts to drop again (Vektis 2012).

3.1.2 Health Insurance Premiums (B)

The question posed to each member of the LISS panel was: “How much is the health insurance premium in total (including premiums for supplementary policies) per [month in \(<\)year\(>\)]Footnote 3?” The median health insurance premium of those respondents who only pay for themselves rises from around 114 euro per month in 2009 to around 127 euro per month in 2011, with on average 80 % within a range from 90 to 150 euro a month.Footnote 4

3.1.3 Voluntary Deductible (C)

In November and December 2009–2011 the following question was posed to each member of the LISS panel: “In \(<\) year \(>\) you have a mandatory deductible of \(<\) X \(>\) euro. Besides a voluntary deductible is possible. How much is your voluntary deductible in \(<\) year \(>\)?” We removed those respondents who reported that they do not pay the health insurance premiums for the basic policy for themselves or who did not answer that question (3 and 5 % of our sample respectively).

The percentage of our sample reporting a positive voluntary deductible rises from 16 % in 2009 to 19 % in 2011 (excluding the group that answered “don’t know”, which drops from 15 % of respondents in 2009 to 13 % in 2011). The Dutch population average for having a positive voluntary deductible in that period was around 6 % (Vektis 2011). It is not unusual to find this kind of difference between survey and registration data. E.g. Gorter et al. (2012) find similarly higher fractions in their sample. Especially the fractions that chose voluntary deductibles of 100 or 200 euro are relatively high in our sample. From population data it is also known that the average voluntary deductible almost continuously drops with age, except for a short rise when people are in their thirties, and that women on average choose a substantial lower voluntary deductible than men (Vektis 2013).

3.2 Probability Numeracy

To determine the probability numeracy of the individuals in our sample we construct a probability numeracy scale, based on the questions Carman and Kooreman (2014) used in their LISS study “Disease prevention”. Their survey was conducted in September 2008. It was sent to 8143 panel members of whom 5818 (71.4 %) responded. The survey contained eleven questions which required a basic understanding of percentages and probabilities. Together, these 11 items form the Numeracy Scale developed by Lipkus et al. (2001), which was used in the aforementioned four studies by Peters et al. (2006) as well. The LISS study also contained two sets of questions which required internal consistency which provided an extra opportunity to assess one’s probability numeracy. The thus constructed probability numeracy scale runs from 0 (all questions were answered incorrectly) till 13 (all questions were answered correctly). On average subjects scored 10.2 correct answers. The median score was 11. Somewhat over 20 % reached the maximum score of 13. Almost 12 % answered more than half of the questions incorrectly. “Appendix 2” gives a complete overview of the questions (Table 3), including the percentages of correct answers, and some more descriptive statistics (Table 4). To allow for non-linear effects in our regression analyses we added a quadratic term of probability numeracy to our regression specification. We also looked at probability numeracy quintile dummies. For more details, see the results section.

3.3 Alpha—Overestimating Risks

Carman and Kooreman (2014) also calculate the panel members’ tendency to overestimate risks, based on the difference between perceived and epidemiologically predicted risks. They summarize the degree of bias in a single parameter—alpha—based on the probability weighting function of Prelec (1998): \(\hbox {w(p)} = \exp [-(-\ln \hbox {p})^{\upalpha }\)]. If alpha equals one, there is no bias. Smaller values of alpha indicate overestimation of small chances. Values larger than one conversely indicate underestimation of small chances. Yet, almost 90 % of the panel members has an alpha below 1 and the median estimated alpha is 0.50. So, on average, the respondents have the tendency to (substantially) overestimate small risks. E.g. an alpha of 0.50 corresponds with overestimating a true risk of 0.01 at a level of 0.117.

3.4 Risky Behavior

In our analyses we look at several measures for risky behavior and their relationship to health insurance purchase decisions. Examples of risky behavior we look at include smoking (yes/no), daily drinking (drinking alcohol almost every day over the last 12 months, yes/no), obesity (BMI over 30, yes/no) and whether or not someone is self-employed.

3.5 Deductible Discounts

The advantage of a higher voluntary deductible is the corresponding discount on the insurance premium. The LISS core Health study does not contain the discount the respondents received, but it does contain the insurer where the respondents took out their basic health insurance policy. We collected detailed information on the discounts per insurer and level of voluntary deductible from the Dutch Healthcare Authority (NZa).Footnote 5 For the effect of the relative level of discount of the insurer where the respondent has taken out his basic health insurance policy, we add the discount the insurer gives at a voluntary deductible of 500 euro as an explanatory variable to the analysis. In some cases a single insurer offers multiple basic health care policies with differing discounts at the voluntary deductible of 500 euro. In those cases the average discount the insurer offered over his policies was used. Not all insurers were included in the list of discounts of the NZa, so there was a small loss in observations. The match varies from 92.1 % in 2010 (3615 out of 3924 observations) to 94.3 % in 2009 (4075 out of 4321 observations).

4 Empirical Results

This section presents the results of the regression analyses we performed on separate measures of health insurance purchase. We estimate the following model:

In this formula, \({\textit{IP}}_{i,t}\) stands for Insurance Purchase by individual (i) at year (t), \({ PN}\) for Probability Numeracy and \({ RA}\) for Risk Attitudes. The measures of health insurance purchase that we consider, are (A) whether or not someone has complementary health insurance, (B) total monthly expenditure on health insurances and (C) the amount of voluntary deductible in the Dutch universal health insurance. We include several measures for risk attitude and make use of a range of control variables \((X')\), such as age, gender, education and income. The analysis is done at the individual level, but in about one third of the cases more than one household member is included in the analysis, so we use clustered standard errors at the household level.

We construct a panel data set with several observations for each of the three dependent variables we study. For the personal background characteristics (e.g. age, gender and income) we use the values at December of the year \((t-1)\), because most decisions on health insurance purchase take place in that period. We thus have a complete panel data set for the years 2009–2011.

For our analyses we make use of random-effects GLS regressions. We use random effects because of the fact that some of our key explanatory variables are observed only once, most importantly Probability Numeracy and several of the risk attitude measures. Because cognitive abilities, especially during adulthood, are found to be fairly stable over time (Plomin et al. 1994; Neisser et al. 1996), Probability Numeracy can relatively safely be assumed to be time-invariant for our analyses. On the stability of risk attitude measures there is some debate among psychologists, primarily about the importance of domain-specificity. Weber et al. (2002) find respondents’ degree of risk taking highly domain-specific. Dohmen et al. (2011), on the other hand, find that risk-attitudes are relatively stable across different contexts, but they do find an age profile in risk attitudes: on average the willingness to take risks decreases with age. Yet, they show that the impact of age appears to be relatively small in financial matters. All in all, this means that the need to presume risk attitudes to be time-invariant is somewhat of a disadvantage, but not a prohibitive objection, given the timeframe (a maximum of three years) and the fact that age itself is part of our regression specifications too. We conduct Hausman tests and find that the difference in coefficients between the fixed-effects and the random-effects regression is systematic at the 5 %-level in two out of our three regression specifications (A and C). The Hausman p values are shown in (Table 2). Regression specification B, concerning the total monthly expenditure on health insurance, thus delivers the most convincing evidence on the non-linear effect of probability numeracy on health insurance purchase.

4.1 Analysis A: Complementary Health Insurance

4.1.1 Introduction

As we explained in Sect. 3, complementary health insurance can cover those health expenditures that are not covered by the Dutch basic health insurance policy, like dental care, physiotherapy or alternative medicine. Table 1 presents some descriptive statistics on the panel data set we have constructed for the three separate regression analyses. For analysis A we can make use of data on 2752 individuals whom we observe 2.1 times on average in our panel. About 84 % of the respondents has taken out complementary health insurance in the period 2009–2011. The average age in our sample is 52 years. Half of the respondents is female, three quarters are part of a couple and about as many people own their home. About 5 % is self-employed. One in twelve has a university degree. One in five smokes and there are almost as many respondents who drink alcohol on a daily basis. About one in eight is obese. Somewhat over a fifth has savings (current accounts, savings accounts, term deposit accounts, savings bonds or savings certificates) with a total value of over 25,000 euros. Almost 60 % has taken out their health insurance through a collective. The average discount their insurer gave in this period for choosing the maximum voluntary deductible is around 215 euros.

4.1.2 Results

Table 2 shows the results of three random-effects GLS regression specifications of Eq. (1). The dependent variable for the first column (A) is 1 for those who have taken out complementary health insurance and 0 for those who have not. Each regression includes, next to probability numeracy, several background characteristics and additional information on a few forms of risky behavior.Footnote 6

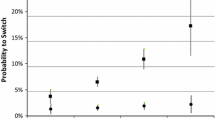

The regression results show that in analysis (A) probability numeracy appears to have a statistically significant, non-monotonic relationship with complementary health insurance. First, the take out of complementary health insurance seems to rise with probability numeracy and then, at the higher numeracy levels, it appears to fall again. The tipping point is reached at a numeracy level of 10.0. Given the previously discussed distribution of probability numeracy in our sample, this means that a small majority of our sample occupies the range in which the relationship between probability numeracy and complementary health insurance is negative.Footnote 7

Table 2 also shows a strong and significant relationship between age and gender on the one hand and complementary health insurance on the other hand. This is in accordance to what we previously described to be the case in the general population. The age at which health insurance takeout peaks seems to be around 56 years in our sample, which would be below the population peak, but graphs for both genders seem rather flat for quite a substantial age frame. Women on average have complementary health insurance more often. Also in accordance to Vektis, we find a significant positive effect of having a collective basic health insurance on the choice for complementary health insurance. Those whose insurer offers a larger premium discount at a voluntary deductible of 500 euros tend to opt less often for a complementary health insurance, which is consistent with having the goal of spending as little as possible on health insurance.

People who asses their own health to be relatively good also tend to be less insured, as can be expected. A good health lowers the expected benefits of (complementary) health insurance. Wealth related variables seem to be primarily insignificant, except for a weak relationship with savings. Lower complementary health insurance takeout for those with relatively substantial savings seems plausible.

The only measure of risky behavior that has a significant relationship with complementary health insurance is smoking. Smokers tend to be less insured. The six education dummies (the reference point is primary school) give no clear picture, but those with intermediate vocational education seem to take out complementary health insurance more often, compared to those with only primary education. The three year dummies (the reference point is 2009) do not show the downward trend in complementary health insurance that Vektis found on the population level over a longer period, but over the specific interval 2009–2011 Vektis does not show a clear trend either.

4.2 Analysis B: Health Insurance Premiums

4.2.1 Introduction

In analysis A we looked at the take out of complementary health insurance. In this analysis we look at what people spend on total health insurance premiums per month. Of course these two variables are closely related. In fact, a regression specification with total health insurance spending as dependent variable and complementary health insurance as explaining variable would clearly show the expected relationships (and render several other explanatory variables insignificant, partly due to endogeneity). But because complementary health insurance policies come in many forms and price ranges, total health insurance spending contains valuable additional information that can be analyzed.

To make a clean comparison of the total monthly health insurance premiums, we look at those who report they only pay the health insurance premiums for the basic policy for themselves, not for their partner and/or children. Nearly half of our panel reports also paying for their partner. A much smaller fraction reports also paying premiums for one or more children, probably because basic health and dental care for children below 18 is paid for by the government. Table 1, column B, presents the descriptive statistics for the analysis on health insurance premiums.

The selection of those only paying their own premiums causes a drop in observations of about 54 %. This selection also causes some predictable changes in the descriptive statistics, e.g. a lower average age (50 years), a lower percentage of couples and less children living at home. The percentage of women rises to 57. The share of homeowners drops below two thirds. The number of smokers is slightly higher, the number of daily drinkers slightly lower. The group with savings with a total value of over 25,000 euros is a few percent lower. The percentage that has taken out their health insurance through a collective has dropped to 53.

4.2.2 Results

Table 2, column B, shows the results of the random-effects GLS regression for this analysis. The dependent variable is the natural log of total health insurance premiums. Probability numeracy appears to have a statistically significant non-monotonic relationship with (the log of) total monthly health insurance premiums. This is comparable to what we found with complementary health insurance takeout. First, the monthly premiums seem to rise with probability numeracy and then, at the higher numeracy levels, they appear to fall again.Footnote 8 The tipping point lies at a numeracy level of 8.1 (on a scale from 0 to 13). This means that the majority of our sample (over two thirds) occupies the range in which the relationship between probability numeracy and monthly health premiums is negative.Footnote 9

Again, we find a significant, non-monotonic relationship between age and monthly health insurance premiums. The age at which monthly health insurance premiums peak, seems to be around 58 years. Self-employed seem to pay higher health insurance premiums on average. The only other personal characteristics with a significant relationship with health insurance spending are household income and number of children living at home. Household income has a non-monotonic relationship with insurance spending. First insurance rises with income, then it falls. Households with larger numbers of children tend to spend less on health insurance on average. Somewhat surprisingly, other in analysis A established relationships between health insurance takeout and for example gender, self-assessed health status or collective insurance do not show up in this regression analysis.

There seems to be a slightly positive relationship between being a daily drinker and health insurance spending. Insurance spending is slightly lower for those whose insurer gives a larger discount for choosing the maximum voluntary deductible. The year dummies suggest a drop in total health insurance spending in 2010 with a subsequent rise in 2011.

4.3 Analysis C: Voluntary Deductible in Basic Health Insurance

4.3.1 Introduction

For everyone above 18 years there is a mandatory deductible per year within the basic health insurance. This mandatory deductible was 150/165/170 euro in 2009/2010/2011. On top of that, people can freely choose a voluntary deductible of 0, 100, 200, 300, 400 or 500 euro, irrespective of their deductible choice in previous years. A voluntary deductible of 500 euro typically means a premium discount of somewhat over 200 euro. Table 1, column C, presents some descriptive statistics on the panel data set we have constructed on voluntary deductibles. The differences with Table 1, column A, are caused by those who answered that they did not know their voluntary deductible, which leads to a drop in observations of about 11 %. The effects on the descriptive statistics for the other variables are minimal.

4.3.2 Results

Table 2, column C, shows the results of the random-effects GLS regression on the voluntary deductible choice. The dependent variable ranges from 0 to 5, with 5 representing a voluntary deductible of 500 euros. We find a significant negative relationship between probability numeracy and the voluntary deductible in the basic health insurance. High levels of probability numeracy coincide with a lower voluntary deductible.Footnote 10 There is a significant negative relationship between age and the voluntary deductible as well, in accordance with the findings of Vektis (2013). Because the average (expected) health care costs rise significantly with age, this was to be expected. This effect is also shown by the fact that people who asses their own health to be relatively good tend to accept more financial risk in the form of a higher voluntary deductible.

We find that women are significantly less inclined to choose a voluntary deductible. Couples seem to choose a lower voluntary deductible on average too, but on the other hand the voluntary deductible appears to rise with the number of children in the household. That concerns the age group for which Vektis found a temporary rise in voluntary deductible as well. An explanation might be that people with children in the household are themselves in an age group with relatively low health costs and at the same time are the relatively healthy persons within their age group. Remember that the children are exempted from paying health insurance premiums or any kind of deductible. It might also have to do with the fact that households with more children ceteris paribus face a tighter budget constraint in the short run. A higher voluntary deductible would then help reduce their monthly spending on health insurance.

Homeowners seem to choose a relatively higher deductible. Those who took out their health insurance collectively (e.g. through an employer, an association or trade union) on average have a lower voluntary deductible. Those whose health insurance company offers a relatively high premium discount at a voluntary deductible of 500 euros have higher deductibles on average. The education dummies suggest a slightly positive relationship between educational level and deductible choice. The year dummies seem to capture the trend that more people choose a positive voluntary deductible each year (Vektis 2011).

Self-employed tend to choose a higher voluntary deductible. Smoking is slightly positively correlated with choosing a voluntary deductible, drinking and obesity seem to have little correlation with deductible choice. Alpha is, again, not significant, so overestimating small chances does not seem to have an impact on deductible choice either.

5 Discussion

In this study we examined whether the demand for health insurance is affected by the individual’s level of probability numeracy. We find that the relationship between probability numeracy and two out of three health insurance purchase decisions appears to be non-monotonic. Complementary health insurance takeout and total monthly expenditure on health insurance first rise with probability numeracy and then, at the higher numeracy levels, start to fall again. For the third health insurance purchase decision we find that high levels of probability numeracy coincide with a lower deductible choice in the Dutch universal health insurance.

How do these results compare to the previously formulated hypothesis that less numerate individuals are less likely to deviate from the default choice? Can this explain the relationship we found between probability numeracy and health insurance purchase?

Obviously, the status quo bias alone cannot explain the non-monotonic relationship that we found in two of our three analyses. The low level of health insurance purchase by the least numerate could be attributed to inertia, but for the subsequent drop in health insurance purchase from a certain intermediate level of numeracy another explanation is needed. This explanation might be ambiguity aversion, since this tends to raise the incentive to insure (Alary et al. 2013). When you are better capable of assessing the true risks you face, you can be more selective in your choices for what to insure and how much. When the less numerate perceive the risks they are confronted with as more ambiguous, they will on average choose higher health insurance. Ambiguity aversion has been linked to limited capabilities to deal with complexity and to bounded rationality before (see e.g. Halevy 2007; Al-Najjar and Weinstein 2009).

In the case of the voluntary deductible choice within the Dutch basic health insurance, the found relationship between numeracy and health insurance purchase can also not be explained by more status quo bias for the probability innumerate. The usual default currently is a zero voluntary deductible. Yet, the less numerate on average seem to choose a higher voluntary deductible.

Because the Dutch basic health insurance is obligatory, choosing a positive deductible is effectively the only way to ‘un-insure’ to a certain extent. Possibly, this relatively high interest in ‘un-insuring’ is due to the inability of the very innumerate to appreciate what insurance is and why you should pay money for it. If a person does not see a utility difference between being insured and not being insured, it may be an attractive strategy to simply go for the cheapest option (at least in the short term). Since insurance typically comes at a direct cost this implies that the very innumerate will buy as little insurance as possible (irrespective of the default). An alternative explanation might be that there is a relation between numeracy and classification errors. We find relatively high levels of voluntary deductibles in our sample, which could be due to mistakes. If especially less numerate people have a higher tendency to state incorrectly that they have taken out a voluntary deductible, this could also help explain the relationship we find. The fact that those who report that they do not know their voluntary deductible are on average significantly less numerate supports this hypothesis.

The combination of avoiding health insurance by the least numerate and ambiguity aversion could explain the non-monotonic relationship that we found between probability numeracy and health insurance. Admittedly, this explanation is constructed ex post, and rather speculative. An assessment of its validity and generalizability would require further study. The hypothesis would then be that a minimal level of numeracy is needed to have an interest in purchasing insurance at all. Health insurance purchase will peak at a numeracy level at which people are able to see the value in insurance but are unable to make reasonable risk assessments. At excess of that level of numeracy, people become more and more able to determine the actual level of risk instead of experiencing a state of ambiguity. That would allow them to choose a better aimed—and on average lower—level of insurance.

For policy makers it is relevant to know if they can expect this non-monotonic relationship between numeracy and health insurance purchase to occur. Certain forms and levels of health insurance can be efficient from a private perspective as well as from a collective perspective. Commercial parties have a natural incentive to help people overcome inertia and buy health insurance (at least in the case of the relatively good risks), but they will not necessarily feel the need to prevent people from over-insurance because of low numeracy and ambiguity aversion. This would present policy makers with a challenge. Their goal should be to get people to be both active and selective in their health insurance purchase decisions. Though Gaurav et al. (2011) showed that financial training could help people to overcome inertia, whether financial training can also help diminish ambiguity aversion and thus lower over-insurance by the less numerate could be a another subject for further study.

Notes

The average nominal premium for the basic health insurance policy in 2011 was 1262 euro (Vektis 2011).

It is possible to take out the basic and the complementary health insurance policies from different insurers, but this is usually more expensive and extremely rare. About 0.2 % of the Dutch population take out their basic and their complementary health insurance policies at separate insurers (Vektis 2012).

For those paying at different intervals than per month, we calculated their monthly expenditure.

As we only have information on the total health premium paid, we are unable to provide detailed information on the separate premium paid for the basic health insurance policy and the premium paid for the complementary health insurance policy (if applicable). If we look at the almost 500 observations in analysis B where respondents do not have a complementary health insurance, they pay almost 100 euro on average per month for their health insurance. In the 2100 observations in analysis B where respondents do have complementary health insurance, they pay on average just over 127 euro per month for their health insurance.

The NZa is the supervisory body for all the healthcare markets in the Netherlands. The NZa supervises both healthcare providers and insurers.

We have also looked at several alternative indicators for stated as well as revealed risk preferences. Including these variables lead to a substantial loss in observations and in the smaller subsamples the coefficients of these risk measures turned out to be largely insignificant, while the main conclusions on the effect of probability numeracy on health insurance purchase do not change. For the specific willingness to take risk in financial matters—which is what insurance purchase decisions are ultimately about—we used the following question: “People can behave differently in different situations. How would you rate your willingness to take risks in the following areas? Your willingness to take risks...[in financial matters]”, where 0 means ‘highly risk averse’ and 10 means ‘fully prepared to take risks’. For revealed risk preferences we used the measures for risk aversion, prudence and temperance as derived by Noussair et al. (2014). In their study, they asked subjects to choose between several pairs of gambles. These subjects were classified as increasingly risk-averse when they preferred certain outcomes over uncertain outcomes with the same expected value, prudent when they accepted more risk at higher levels of income or wealth and temperate when they preferred not to add risk to risk but spread the risk as equally as possible over all options. All three indicators were measured on a 0–5 scale, with 5 meaning maximally risk averse, prudent or temperate.

As a robustness check we also performed this analysis with respondents divided into five quintiles. Regression results show the same inverted U shape, with a peak at the middle quintile. Such a peak between the 40th and the 60th percentile is consistent with our parametric results discussed above.

We checked whether this effect was driven by having taken out a complementary health insurance in the first place, because this is an important part of health insurance spending. But we find the same non-monotone relationship for both those with and those without complementary health insurance. Significance levels are lower, but that is also influenced by the smaller sample sizes.

Again, as a robustness check we also performed this analysis with respondents divided into five quintiles. Regression results show the same inverted U shape, with a peak at the second quintile, thus at a relatively low level of numeracy. Such a peak between the 20th and the 40th percentile is consistent with our parametric results discussed above.

The robustness check with respondents divided into five quintiles also shows a drop in voluntary deductible choice with numeracy. The 20 % with the lowest level of numeracy choose the highest voluntary deductible, consistent with our parametric results discussed above.

References

Alary, D., Gollier, C., & Treich, N. (2013). The effect of ambiguity aversion on insurance and self-protection. The Economic Journal, 123(573), 1188–1202.

Al-Najjar, N. I., & Weinstein, J. (2009). The ambiguity aversion literature: A critical assessment. Economics and Philosophy, 25(03), 249–284.

Barseghyan, L., Molinari, F., O’Donoghue, T., & Teitelbaum, J. (2012). The nature of risk preferences: Evidence from insurance choices. CESifo Working Paper Series No. 3933.

Browne, M. J., & Hoyt, R. E. (2000). The demand for flood insurance: Empirical evidence. Journal of Risk and Uncertainty, 20(3), 291–306.

Carman, K. G., & Kooreman, P. (2014). Probability perceptions and preventive health care. Journal of Risk and Uncertainty, 49(1), 43–71.

Chan, S., & Elbel, B. (2012). Low cognitive ability and poor skill with numbers may prevent many from enrolling in Medicare supplemental coverage. Health Affairs, 31(8), 1847–1854.

Cutler, D. M., & Zeckhauser, R. (2004). Extending the theory to meet the practice of insurance. Brookings-Wharton Papers on Financial Services, 2004(1), 1–53.

Dohmen, T., Falk, A., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association, 9(3), 522–550.

Gaurav, S., Cole, S., & Tobacman, J. (2011). Marketing complex financial products in emerging markets: Evidence from rainfall insurance in India. Journal of Marketing Research, 48(SPL), S150–S162.

Giné, X., Townsend, R., & Vickery, J. (2008). Patterns of rainfall insurance participation in rural India. The World Bank Economic Review, 22(3), 539–566.

Gorter, J., & Schilp, P. (2012). Risk preferences over small stakes: Evidence from deductible choice. DNB Working Paper No. 338.

Halevy, Y. (2007). Ellsberg revisited: An experimental study. Econometrica, 75(2), 503–536.

Huysentruyt, M., & Read, D. (2010). How do people value extended warranties? Evidence from two field surveys. Journal of Risk and Uncertainty, 40(3), 197–218.

Ito, S., & Kono, H. (2010). Why is the take-up of microinsurance so low? Evidence from a health insurance scheme in India. The Developing Economies, 48(1), 74–101.

Johnson, Eric J., Hershey, John, Meszaros, Jacqueline, & Kunreuther, Howard. (1993). Framing, probability distortions, and insurance decisions. Journal of Risk and Uncertainty, 7(1), 35–51.

Kunreuther, H., Pauly, M., & McMorrow, S. (2013). Insurance and behavioral economics: Improving decisions in the most misunderstood industry. Cambridge: Cambridge University Press.

Liebman, J., & Zeckhauser, R. (2008). Simple humans, complex insurance, subtle subsidies (No. w14330). National Bureau of Economic Research.

Lipkus, I. M., Samsa, G., & Rimer, B. K. (2001). General performance on a numeracy scale among highly educated samples. Medical Decision Making, 21, 37–44.

Neisser, U., Boodoo, G., Bouchard, T. J, Jr, Boykin, A. W., Brody, N., Ceci, S. J., et al. (1996). Intelligence: Knowns and unknowns. American Psychologist, 51(2), 77.

Noussair, C. N., Trautmann, S. T., & Van de Kuilen, G. (2014). Higher order risk attitudes, demographics, and financial decisions. The Review of Economic Studies, 81(1), 325–355.

Pachur, T., & Galesic, M. (2012). Strategy selection in risky choice: The impact of numeracy, affect, and cross-cultural differences. Journal of Behavioral Decision Making, 26(3), 260–271.

Peters, E., Västfjäll, D., Slovic, P., Mertz, C. K., Mazzocco, K., & Dickert, S. (2006). Numeracy and decision making. Psychological Science, 17(5), 407–413.

Peters, E. (2012). Beyond comprehension, the role of numeracy in judgments and decisions. Current Directions in Psychological Science, 21(1), 31–35.

Plomin, R., Pedersen, N. L., Lichtenstein, P., & McClearn, G. E. (1994). Variability and stability in cognitive abilities are largely genetic later in life. Behavior Genetics, 24(3), 207–215.

Prelec, D. (1998). The probability weighting function. Econometrica, pp. 497–527.

Reyna, V. F., Nelson, W. L., Han, P. K., & Dieckmann, N. F. (2009). How numeracy influences risk comprehension and medical decision making. Psychological bulletin, 135(6), 943.

Sydnor, J. (2006). Sweating the small stuff: The demand for low deductibles in homeowners insurance. Manuscript: University of California, Berkeley.

Weber, E. U., Blais, A. R., & Betz, N. E. (2002). A domain-specific risk-attitude scale: Measuring risk perceptions and risk behaviors. Journal of Behavioral Decision Making, 15(4), 263–290.

Wood, S., Hanoch, Y., Barnes, A., Liu, P. J., Cummings, J., Bhattacharya, C., et al. (2011). Numeracy and Medicare Part D: The importance of choice and literacy for numbers in optimizing decision making for Medicare’s prescription drug program. Psychology and Aging, 26(2), 295.

Online sources: http://www.vektis.nl/index.php/publicaties/publicatiezorgthermometer

Vektis Zorgthermometer – Verzekerden in beweging (2011)

Vektis Zorgthermometer – Verzekerden in beweging (2012)

Vektis Zorgthermometer – Verzekerden in beweging (2013)

Acknowledgments

The authors would like to thank the participants of the TIBER XI Symposium on Psychology and Economics on August 24, 2012 at Tilburg University and Job van Wolferen and the other participants of the Netspar Pension Day on November 9, 2012 in Utrecht and two anonymous referees for valuable comments and suggestions. The LISS panel data used in this study were collected by CentERdata (Tilburg University, The Netherlands) through its MESS project funded by the Netherlands Organization for Scientific Research.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: LISS Panel Data—Studies and Variables Used

-

1 - Background Variables (December 2008–2011)

-

age, gender, couple, number of children in the household, homeowner, self-employed, net household income, education

-

-

2 - Health: Liss Core Study—wave 3 (November 2009) through wave 5 (November 2011)

-

Analysis A: complementary health insurance (yes/no)

-

Analysis B: health insurance premiums, in log(euro per month)

-

Analysis C: voluntary deductible (0, 100, 200, 300, 400, 500 euro)

-

self-assessed health status, smoking, drinking, bmi, collective/individual health insurance, who pays premiums for whom

-

-

9 - Assets: Liss Core Study—wave 1 (June 2008) and wave 2 (June 2010)

-

savings (total value current accounts, savings accounts, etc. is over 25.000 euro (yes/no))

-

-

33 - Disease Prevention (September 2008)

-

Probability Numeracy (scale from 0 to 13, see “Appendix 2”)

-

Alpha’s (under/overestimating small probabilities)

-

-

38 - Measuring Higher Order Risk Attitudes of the General Population (December 2009)

-

risk aversion, prudence, temperance

-

-

49 - Commercial Opportunities (August 2010)

-

risk attitude (financial)

-

More information about the LISS panel can be found at: www.lissdata.nl.

Appendix 2: Probability Numeracy Scale

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Dillingh, R., Kooreman, P. & Potters, J. Probability Numeracy and Health Insurance Purchase. De Economist 164, 19–39 (2016). https://doi.org/10.1007/s10645-015-9258-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10645-015-9258-8