Abstract

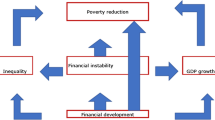

Poverty has remained one of the prominent challenges of humanity. Different solutions have been suggested to curb poverty. Economic growth and financial development are two such crucial tools for overcoming poverty, as frequently pointed out by economists. These tools work through the so-called trickle-down hypothesis, which contends that a well-functioning financial system would enhance poverty reduction by promoting economic growth. One country that appears to have manifested this hypothesis is China. However, the empirical test of the trickle-down hypothesis for China is scant. In addition, most of the existing studies have failed to account for regime-shift in parameters or structural breaks. This paper attempts to fill this void by testing the trickle-down hypothesis for China during the period 1985–2014. We utilized two standard proxies for financial development, namely: the domestic credit to private sector by banks as percentage of GDP, and money and quasi money as percentage of GDP; annual percentage change in real GDP per capita to proxy economic growth; and a standard proxy for poverty reduction namely: the household final consumption expenditure per capita growth. By accounting for structural breaks in our empirical specifications, we found overwhelming support for the trickle-down hypothesis at the national level. That is, we found financial development to cause economic growth, which in turn causes poverty reduction in China at the national level. This has important policy implications.

Source World Development Indicators (WDI 2016)

Similar content being viewed by others

Notes

Note that very recent data is not available to us from reliable sources. Hence post-2007 figures have been left out.

The data is available up to year 2010 according to WDI (2016).

Panel here refers to studies that investigated the issue using several countries in either time series, cross-sectional, or panel data setting.

There are also studies which have examined the links between finance and growth in countries undertaking economic reforms similar to the Chinese experience. Two of such studies are Gaffeo and Garalova (2014), and Nain and Kamaiah (2014). The former found finance to spur growth in thirteen Central and Eastern Europe countries, while the latter found no causal relationship between finance and growth in India.

References

Abosedra S, Shahbaz M, Nawaz K (2016) Modeling causality between financial deepening and poverty deduction in Egypt. Soc Indic Res 126:955–969

Allen F, Qian J, Qian M (2005) China’s financial system: past, present and future. In: Brandt L, Rawski T (eds) China’s great economic transformation. Cambridge University Press, Cambridge

Anderson G, Ge Y (2004) Do economic reforms accelerate urban growth? The case of China. Urban Stud 41(11):2197–2210

Ang JB, McKibbin WJ (2007) Financial liberalization, financial sector development and growth: evidence from Malaysia. J Dev Econ 84(1):215–233

Ayyagari M, Demirgüç-Kunt A, Maksimovic V (2010) Formal vs. informal finance. Evidence from China. Rev Financ Stud 23:3048–3097

Aziz J, Duenwald C (2002) Growth-financial intermediation nexus in China. Discussion paper no. 02/194, International Monetary Fund, Washington

Beck T, Levine R (2004) Stock markets, banks, and growth: panel evidence. J Bank Financ 28:423–442

Beck T, Demirgüç-Kunt A, Levine R (2007) Finance, inequality and the poor. J Econ Growth 12(1):27–49

Birdsall N, Londono J (1997) Asset inequality matters: an assessment of the World Bank’s approach to poverty reduction. Am Econ Rev 87(2):32–37

Boyd H, Levine R, Smith BD (2001) The impact of inflation on financial sector performance. J Monet Econ 47(2):221–248

Boyreau-Debray G (2003) Financial Intermediation and Growth-Chinese Style. Working paper 3027, The World Bank, Washington

Burgess, R, Pande R (2003) Do rural banks matter? Evidence from the Indian social banking experiment. BREAD Working Paper, WP No. 37

Burgess R, Pande R (2005) Do rural banks matter? Evidence from the Indian social banking experiment. Am Econ Rev 95(3):780–795

Calderón C, Lin L (2003) The direction of causality between financial development and economic growth. J Dev Econ 72:321–334

Callan T, Nolan B, Whelan CT (1993) Resources, deprivation, and the measurement of poverty. J Soc Policy 22:141–172

Caner M, Kilian L (2001) Size distortion of tests of the null hypothesis of stationarity: evidence and implication for the PPP debate. J Int Money Financ 20:639–657

Carroll CD, Weil DN (1994) Saving and growth: a reinterpretation. In: Carnegie-Rochester conference series on public policy, vol 40, pp 133–192

Chang P, Jia C, Wang A (2010) Bank fund reallocation and economic growth: evidence from China. J Bank Financ 34:2753–2766

Chen KC, Wu L, Wen J (2013) The relationship between finance and growth in China. Glob Financ J 24(1):1–12

Chow GC (2004) Economic reform and growth in China. Ann Econ Financ 5:127–152

Claessens S, Feijen E (2006) Financial sector development and the millennium development goals. World bank working paper no. 89, World Bank, Washington

Datt G, Ravallion M (1992) Growth and distribution components of changes in poverty measures. J Dev Econ 38(3):275–295

Ding Z, Tan L, Zhao J (2011) The effect of rural financial development on poverty reduction. Issues Agric Econ 2011(11):1–13

Dollar D, Kraay A (2002) Growth is good for the poor. J Econ Growth 7(3):195–225

Elliott G, Rothenberg T, Stock J (1996) Efficient tests for an autoregressive unit root. Econometrica 64(4):813–836

Gaffeo E, Garalova P (2014) On the finance-growth nexus: additional evidence from Central and Eastern Europe countries. Econ Change Restruct 47(2):89–115

Galbraith J (1958) The affluent society. Houghton-Mifflin, Boston

Gao T (2002) The impact of foreign trade and investment reform on industry location: the case of China. J Int Trade Econ Dev 11(4):367–386

Geda A, Shimeles A, Zerfu D (2006) Finance and poverty in Ethiopia. UNU-WIDER research paper no. 2006/51, United Nations University, Helsinki

Guariglia A, Poncet S (2008) Could financial distortions be no impediment to economic growth after all? Evidence from China. J Comp Econ 36(4):633–657

Hamori S, Hashiguchi Y (2012) The effect of financial deepening on inequality: some international evidence. J Asian Econ 23(4):353–359

Hao C (2006) Development of financial intermediation and economic growth: the Chinese experience. China Econ Rev 17:347–362

Hasan I, Zhou M (2006) Financial sector development and growth: the Chinese experience. UNU-WIDER research paper no. 2006/85, United Nations University, Helsinki

Hasan I, Wachtel P, Zhou M (2009) Institutional development, financial deepening and economic growth: evidence from China. J Bank Financ 33(1):157–170

He X, Cao Y (2007) Understanding high saving rate in China. China World Econ 15(1):1–13

Honohan P (2004) Financial development, growth and poverty: how close are the links. In: Goodhart C (ed) Financial development and economic growth: explaining the links. Palgrave Macmillan, Busingstoke

Hsueh SJ, Hu YH, Tu CH (2013) Economic growth and financial development in Asian countries: a bootstrap panel Granger causality analysis. Econ Model 32(294):301

Husain I (2004) Financial sector reforms and pro-poor growth: case study of Pakistan. Presidential address at the annual general meeting of the institute of bankers Pakistan, Karachi, 21 Feb 2004

Inoue T, Hamori S (2012) How has financial deepening affected poverty reduction in India: empirical analysis using state-level panel data. App Financ Econ 22(5):395–403

Iyke BN, Antwi-Asare TO, Gockel AF, Abbey EN (2016) The linkages between financial deepening, trade openness, and economic growth in the West African Economic and Monetary Union (WAEMU). Afr Financ J 18(2):93–116

Jalilian H, Kirkpatrick C (2002) Financial development and poverty reduction in developing countries. Int J Financ Econ 7(2):97–108

Jalilian H, Kirkpatrick C (2005) Does financial development contribute to poverty reduction? J Dev Stud 41(4):636–656

Jeanneney SG, Kpodar K (2008) Financial development and poverty reduction: can there be a benefit without a cost. IMF working paper no. WP/08/62, International Monetary Fund, Washington

Jefferson Gary H, Rawski Thomas G (1994) Enterprise reform in Chinese industry. J Econ Perspect 8(2):47–70

Johnson DG (1988) Economic reforms in the People’s Republic of China. Econ Dev Cult Change 36(3):225–245

Kumbhakar SC, Wang D (2007) Economic reforms, efficiency and productivity in Chinese banking. J Regul Econ 32(2):105–129

Levine R (2004) Finance and growth: theory and evidence. NBER working paper no. 10766

Levine R, Zervos S (1996) Stock market development and long-run growth. World Bank Econ Rev 10(2):323–340

Levine R, Zervos S (1998) Stock markets, banks, and economic growth. Am Econ Rev 88(3):537–558

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46(1):31–77

Liang Q, Teng JZ (2006) Financial development and economic growth: evidence from China. China Econ Rev 17:395–411

Lin JY (1992) Rural reforms and agricultural growth in China. Am Econ Rev 82(March):34–51

Lin JY, Liu Z (2000) Fiscal decentralization and economic growth in China. Econ Dev Cult Change 49(1):1–21

Lin JY, Sun X, Wu HX (2015) Banking structure and industrial growth: evidence from China. J Bank Financ 58:131–143

Mack J, Lansley S (1985) Poor Britain. Allen & Unwin Limited, London

Meng X (2003) Unemployment, consumption smoothing, and precautionary saving in Urban China. J Comp Econ 31(3):465–485

Modigliani F, Cao SL (2004) The Chinese saving puzzle and the life-cycle hypothesis. J Econ Lit 42(1):145–170

Mood C, Jonsson JO (2016) The social consequences of poverty: an empirical test on longitudinal data. Soc Indic Res 127(2):633–652

Nain MZ, Kamaiah B (2014) Financial development and economic growth in India: some evidence from non-linear causality analysis. Econ Change Restruct 47(4):299–319

Park A, Ren C, Wang S (2004) Micro-finance, poverty alleviation, and financial reform in China. In: Rural Finance and credit infrastructure in China, OECD 2004, pp 256–270

Perkins D (1994) Completing China’s move to the market. J Econ Perspect 8(2):23–46

Perron P (1997) Further evidence on breaking trend functions in macroeconomic variables. J Econom 80(2):355–385

Pesaran MH, Shin Y (1999) An autoregressive distributed lag modeling approach to cointegration analysis, Chapter 11. In: Strom S (ed) Econometrics and economic theory in the 20th century: the ragnar frisch centennial symposium. Cambridge University Press, Cambridge

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Quartey P (2005) Financial sector development, savings mobilisation and poverty reduction in Ghana. UNU-WIDER research paper no. 2005/71, United Nations University, Helsinki

Ravallion M, Datt G (2002) Why has economic growth been more pro-poor in some states of India than others. J Dev Econ 68(2):381–400

Sala-i-Martin X (2006) The world distribution of income: falling poverty and … convergence, period. Quart J Econ 121(2):351–397

Schwert W (1986) Test for unit roots: a Monte Carlo investigation. J Bus Econ Stat 7:147–159

Seetanah B (2008) Financial development and economic growth: an ARDL approach for the case of the small island state of Mauritius. Appl Econ Lett 15:809–813

Sehrawat M, Giri AK (2016a) Financial development and poverty reduction in India: an empirical investigation. Int J Soc Econ 43(2):106–122

Sehrawat M, Giri AK (2016b) Financial development and poverty reduction: panel data analysis of South Asian countries. Int J Soc Econ 43(4):400–416

Sen A (1983) Poor, relatively speaking. Oxf Econ Pap 35:153–169

Siddiki JU (2002) Trade and financial liberalisation and endogenous growth in Bangladesh. Int Econ J 16(3):23–37

Söderlund B, Tingvall PG (2016) Captial freedom, financial development and provincial economic growth in China. World Econ. doi:10.1111/twec.12391

Stiglitz J (1998) The role of the state in financial markets. In: Proceedings of the world bank annual conference on development economic, pp 19–52

Turner G, Tan N, Sadeghian D (2012) The Chinese banking system. Reserve Bank Aust Bull 2012:53–64

Uddin GS, Shahbaz M, Arouri M, Teulon F (2014) Financial development and poverty reduction nexus: a cointegration and causality analysis in Bangladesh. Econ Model 36:405–412

United Nations Development Programme (2008) China human development report. 2007–2008: basic public services benefiting 1.3 billion Chinese people. United Nations Development Programme, New York

Wang S, Li Z, Ren Y (2004) The 8–7 national poverty reduction program in China—the national strategy and its impact. World Bank, Washington

Wen T, Ran G, Xiong D (2005) Financial development and the income growth of farmers in China. Econ Res J 2005(09):30–43

World Bank (1990) World development report 1990: poverty. Oxford University Press, New York

World Bank (1995) Bangladesh: from counting the poor to making the poor count. Poverty Reduction and Economic Management Network, South Asia Division, World Bank, Washington

World Bank (2001) World development report 2000/2001. Oxford University Press, New York

World Bank (2009) From poor areas to poor people: China’s evolving poverty reduction agenda. An assessment of poverty and inequality in China. The World Bank, East Asia and Pacific Region

World Bank (2014). Global Financial Development Report 2014. http://worldbank.org/financialdevelopment. Accessed 1 July 2016

World Development Indicators (2016). http://data.worldbank.org/products/wdi. Accessed 6 July 2016

Yang DT, Zhang J, Zhou S (2012) Why are saving rates so high in China? In: Capitalizing China. University of Chicago Press, Chicago, USA, pp 249–278

Yao S (1999) Economic growth, income inequality and poverty in China under economic reforms. J Dev Stud 35(6):104–130

Ye Q, Xu Z, Fang D (2012) Market structure, performance, and efficiency of the Chinese banking sector. Econ Change Restruct 45(4):337–358

Zhang J, Wang L, Wang S (2012) Financial development and economic growth: recent evidence from China. J Comp Econ 40(3):393–412

Zou D (1996) The open door policy and urban development in China. Habitat Int 20(4):525–529

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ho, SY., Iyke, B.N. Finance-growth-poverty nexus: a re-assessment of the trickle-down hypothesis in China. Econ Change Restruct 51, 221–247 (2018). https://doi.org/10.1007/s10644-017-9203-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-017-9203-8