Abstract

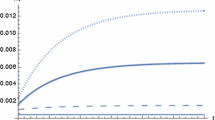

We study the optimal carbon tax in an economy in which climate change, stemming from polluting non-renewable resource, affects the economy’s growth potential. Our main contribution is to introduce and explore the natural time lag of the climate system between emissions and damages to capital accumulation in an endogenous growth setting. This allows us to investigate how optimal climate policy, and its interplay with climate dynamics, affect long-run growth and the transition of the economy towards it. Without pollution decay, a higher speed of emissions diffusion steepens the growth profile of the economy. With pollution decay, this leads to lower short-run but higher long-run economic growth during transition. Poor understanding of the emissions diffusion process leads to suboptimal carbon taxes, resource extraction and growth.

Similar content being viewed by others

Notes

For example the Montreal Protocol on the ozone layer or the ban of asbestos.

For a survey of the literature on the relationship between environmental pollution and growth, see Brock and Taylor (2005).

In this paper the closed-form solution of the Pigouvian tax depends on the assumption of constant savings rate all along the optimal path. This can be ensured if capital depreciates fully each period which makes it a flow rather than a stock variable.

We thereby assume that even if carbon emissions seize, the stock of harmful pollution will not decrease further than its initial level; see for example Grimaud and Rouge (2014) for an equivalent treatment.

Our emissions-damage response does not allow for a thick-tailed concentration of the carbon stock, where some part of the stock stays in the atmosphere for thousands of years, as proposed by natural scientists. We could have captured such a behavior with a richer “multi-box” climate module as in Gerlagh and Liski (2012). This added complexity would however not alter the results of the present paper in any fundamental way while it would make the model less tractable.

In a previous version, in order to capture this idea, we differentiated between a physical and a knowledge capital stock, the latter being unaffected by pollution. Physical capital was accumulated as in the present version, while we assumed that creation of new knowledge was knowledge intensive and used only itself as an input. However the widely-used Cobb–Douglas specification for (3), implying constant expenditure shares among inputs, makes the use of two differentiated stocks inessential; the results are qualitatively identical as in the current approach, while the model is now more tractable. For an endogenous growth framework with knowledge capital (but no physical capital) and flow pollution directly affecting utility see Grimaud and Rouge (2005).

In general we define \(g_{V}\equiv \dot{V}/V\) the growth rate of variable V.

We will discuss the effect of \(\sigma \ne 1\) on the SCC, and thus on the Pigouvian tax, in Sect. 6.

In fact this implies an equivalence between the per-unit tax that grows with consumption, as in our case, and a decreasing ad-valorem tax, as usually proposed by growth models with polluting resources, e.g. Groth and Schou (2007). To see this, note that the consumer price for the resource is \(p_{R,t}+ \tau _{t}^o=\pi _t p_{Rt}\), with \(\pi _t \equiv 1+\tau _{t}^o/p_{Rt}\), i.e. a decreasing ad-valorem tax rate.

Grimaud and Rouge (2014), however, using a model of endogenous growth with polluting non-renewable resources, show that in the presence of Carbon-Capture-and-Storage (CCS) activity the optimal tax rate is linear in consumption, yet unique. In the presence of a CCS activity agents should be indifferent between instruments as long as they have the same results in protecting from climate change, which uniquely pins down the optimal tax rate.

The complexity of the climate cycle does not allow for an explicit analytical solution. We can, however, approximate the solution using any mathematical software as an infinite sum of terms according to \(P_{t}=P_{0}+\kappa \frac{1-\alpha }{\kappa -\theta }\tilde{\tau }^{-1}\sum _{n=0}^{\infty }\left( \frac{1}{1-e^{\frac{S_{0}\rho }{1-\alpha }\tilde{\tau }}}\right) ^{n}\left( \frac{e^{-\kappa t}-e^{\rho nt}}{\kappa +\rho n}-\frac{e^{-\theta t}-e^{\rho n t}}{\theta +\rho n}\right) \). The interested reader can validate this expression to get the qualitative features of our climate system.

Using (21) in the no-tax case we can readily derive that \(P_{t}=P_{0}+\kappa \rho \phi S_{0}\left[ \frac{e^{-\rho t}}{(\theta -\rho )(\kappa -\rho )}\right. \left. -\frac{e^{-\theta t}}{(\kappa -\theta )(\theta -\rho )}+\frac{e^{-\kappa t}}{(\kappa -\theta )(\kappa -\rho )}\right] .\)

See, Barro and Sala-i-Martin (2003), Ch. 2.1.

In 2010 global consumption was around 49.8 billion US$ (about \(76\%\) of global GDP); World Bank Indicators, 2015. With this value, our calibration implies a carbon tax in 2010 between 50 $/tC (\(\kappa =0.02\)) and 75 $/tC (\(\kappa =0.04\)).

For convenience we will drop in this section the “\(^o\)” upper script, having however in mind that all results refer to the social optimum solution.

References

Barro RJ, Sala-i-Martin X (2003) Economic growth, 2nd Edn. Vol 1 of MIT Press Books. The MIT Press

Bovenberg A, Smulders S (1995) Environmental quality and pollution-augmenting technological change in a two-sector endogenous growth model. J Public Econ 57:369–391

Bretschger L, Valente S (2011) Climate change and uneven development. Scand J Econ 113:825–845

Brock WA, Taylor MS (2005) Chapter 28 economic growth and the environment: a review of theory and empirics. In: Aghion P, Durlauf SN (eds) Handbook of economic growth, vol 1, part B of handbook of economic growth. Elsevier, pp 1749–1821

Dasgupta P, Heal G (1979) Economic theory and exhaustible resources. Cambridge University Press, Cambridge

Daubanes J, Grimaud A (2010) Taxation of a polluting non-renewable resource in the heterogeneous world. Environ Res Econ 47:567–588

EIA (2015) Energy consumption, expenditures, and emissions indicators estimates, 1949–2011. http://www.eia.gov/totalenergy

EM-DAT The International Disasters Database (2015). http://www.emdat.be

Gaudet G, Lasserre P (2013) The taxation of nonrenewable natural resources. Cahiers de recherche 2013-10, Universite de Montreal, Departement de sciences economiques

Gerlagh R, Liski M (2012) Carbon prices for the next thousand years. CESifo Working Paper Series 3855, CESifo Group Munich

Golosov M, Hassler J, Krusell P, Tsyvinski A (2014) Optimal taxes on fossil fuel in general equilibrium. Econometrica 82:41–88

Grimaud A, Rouge L (2005) Polluting non-renewable resources, innovation and growth: welfare and environmental policy. Res Energy Econ 27(2):109–129

Grimaud A, Rouge L (2014) Carbon sequestration, economic policies and growth. Res Energy Econ 36:307–331

Groth C, Schou P (2007) Growth and non-renewable resources: the different roles of capital and resource taxes. J Environ Econ Manag 53:80–98

Hoel M, Kverndokk S (1996) Depletion of fossil fuels and the impacts of global warming. Res Energy Econ 18:115–136

IEA (2015) Monthly oil price statistics, 2006–2015. http://www.iea.org/statistics/relatedsurveys/monthlyenergyprices

Ikefuji M, Horii R (2012) Natural disasters in a two-sector model of endogenous growth. J Public Econ 96:784–796

IPCC (2013) Climate change 2013: the physical science basis, WG I Contribution to the IPCC 5, summary for policy makers. Cambridge University Press, Cambridge. http://www.climatechange2013.org

MacDonald N (1978) Time lags in biological models. Springer, Berlin

Michel P, Rotillon G (1995) Disutility of pollution and endogenous growth. Environ Res Econ 6:279–300

Nordhaus WD (Jun. 1992) Rolling the ’dice’: an optimal transition path for controlling greenhouse gases. Cowles Foundation Discussion Papers 1019, Cowles Foundation for Research in Economics, Yale University

Nordhaus WD (2011) Integrated economic and climate modeling. Cowles Foundation Discussion Papers 1839, Cowles Foundation for Research in Economics, Yale University

Rebelo S (1991) Long-run policy analysis and long-run growth. J Polit Econ 99:500–521

Sinclair PJN (1994) On the optimum trend of fossil fuel taxation. Oxf Econ Papers 46:869–877

Stern N (2007) The economics of climate change: the Stern review. Cambridge University Press, Cambridge

Stern N (2013) The structure of economic modeling of the potential impacts of climate change: grafting gross underestimation of risk onto already narrow science models. J Econ Lit 51:838–859

Tahvonen O (1997) Fossil fuels, stock externalities, and backstop technology. Can J Econ 30:855–874

van den Bijgaart I, Gerlagh R, Liski M (2016) A simple formula for the social cost of carbon. J Environ Econ Manag 77:75–94

van der Ploeg F, Withagen C (2010) Growth and the optimal carbon tax: when to switch from exhaustible resources to renewables? OxCarre Working Papers 055, Oxford Centre for the Analysis of Resource Rich Economies, University of Oxford

Withagen C (1994) Pollution and exhaustibility of fossil fuels. Res Energy Econ 16:235–242

Acknowledgements

This study has benefitted greatly by the comments and suggestions of Julien Daubanes, Alexandra Vinogradova and Andreas Schäfer. Moreover we are grateful for the suggestions of Sjak Smulders and two anonymous referees. We also thank the discussants at the SURED 2014 conference, Ascona–Switzerland, and at the 5th World Congress of Environmental and Resource Economists (2014), Istanbul–Turkey, for their valueable contribution.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Time Lags in the Climate System

In this part of the Appendix we present the mathematic modeling of distributed time lags in the climate system and its properties. For the analysis we rely largely on MacDonald (1978). Take first the case of instantaneous diffusion of emissions. In this case the usual assumption is that the use of a pollutant, \(R_{t}\), increases the harmful stock of emissions \(P_{t}\) at a rate

with \(\phi >0 \) representing the carbon intensity of the polluting energy resource, \(\theta \ge 0 \) the carbon decay parameter, and \(\bar{P} \in (0,P_0)\) the pre-industrial level of carbon concentration in the atmosphere. Now let’s introduce a distributed lag in the model in order to relax the usual assumption of instantaneous pollution accumulation and let this process depend on the history of resource use

With this formulation (25) becomes an integro-differential equation. The function \(G_{x}\) represents the memory of the system (or the delaying function) with \(\int _{0}^{\infty }G_{x}dx=1\). Function \(G_{x}\) could be also interpreted as the probability density function of the inherent time lag of the particular system so that the mean time lag \(\bar{T} \) for a given memory function would read \(\bar{T}=\int _{0}^{\infty }xG_{x}dx\) . With a special choice of the memory function one can replace (26) with a set of linear differential equations. For this purpose it is a standard approach to exploit the properties of the exponential functions by using the exponential distribution

The parameter \(\kappa \) measures the speed of emissions diffusion, or speed of adjustment, and is the reciprocal of the mean time lag \(\bar{T}\) from the same memory function, i.e. \(\kappa =\bar{T}^{-1}\). We can then define the lagged history of carbon emissions as \(Z_{t}\equiv \int _{-\infty }^{t}G_{t-s} \phi R_{s}ds\), and by using the Leibniz rule of integration to get the familiar equivalent system of differential equations, with \(P_0\) and \(Z_0\) given:

It can be proven that the corresponding system is globally stable for the relevant range of the parameters \(\kappa ,\phi , \theta >0\) and \(\bar{P} >0\). Since in general the initial value of \(Z_{t}\) cannot be defined, \(Z_{0}\) is chosen such that \(lim_{\kappa \rightarrow \infty }P_{t=0}=P_{0}\), as expected, i.e. \(Z_{0}=0\). The solution for the climate system given the rate of resource extraction for each time period, \(R_t\), now reads

The limiting cases for \(\kappa \rightarrow 0\) and \(\kappa \rightarrow \infty \) follow readily from the last equation. From (29), the marginal increase in the stock of carbon in period \(\nu \) from a marginal unit of emissions in period t reads:

Appendix 2: Social Optimum

The social planner chooses the share \(\epsilon _{t}\), and resource extraction \(R_{t}\) in order to maximize lifetime utility \(\int _{0}^{\infty }U_{t}e^{-\rho t}dt\), with \(U_{t}=\log (C_{t})\) if \(\sigma =1\) and \(U_{t}=\frac{C_{t}^{1-\sigma }}{1-\sigma }\) otherwise, subject to Eqs. (3)–(6). The Hamiltonian of the social planner reads

with \(\lambda _{Ct},\lambda _{Kt},\lambda _{St},\lambda _{Pt},\lambda _{Zt}\), the shadow prices of the consumption good, \(C_{t}\), capital stock, \(K_{t}\), stock of non-renewable resources, \(S_{t}\), stock of pollution, \(P_{t}\), and the lagged history of emissions, \(Z_{t}\). Assuming an internal solution, the first order conditions w.r.t. the \(C_{t},\epsilon _t, R_{t}\), i.e. \(\partial H_{t}/\partial (\cdot )=0\) imply

Moreover \(\partial H_{t}/\partial (\cdot )=\rho q_{t}-\dot{q}_{t}\) for every state variable, \(K_{t},S_{t},P_{t},Z_{t}\), with \(q_{t}\) its shadow price. This leads to

Finally, the relevant transversality conditions read

From (35) we get that \(\hat{\lambda } _{St}=\rho \), i.e. the Hotelling rule for the extraction of the non-renewable resource. Equation (32) shows indifference about allocating capital between the two activities: producing the consumption and the investment good. When \(\sigma =1\) we can combine (32), with \(\lambda _{Ct}C_{t}=1\), from (31), and (34), to get \(\dot{\epsilon }_{t}=B\epsilon _{t}^{2}-\rho \epsilon _{t}\). With the use of the transversality condition (39), we get that the capital share jumps immediately to its steady state value, \(\bar{\epsilon }=\rho /B\).

Appendix 3: Asymptotic Constancy of Capital Share and Resource Depletion Rate

In this part of the Appendix we derive the asymptotic constancy of the capital share \(\epsilon \), and the resource depletion rate \(u=R/S\), in the general case of \(\sigma \ne 1.\) In the main text we explained that the economy at hand is always in transition while it reaches a balanced growth path at the limit when resources get asymptotically depleted and pollution reaches its steady state value. The transversality condition (39) implies that \(\widehat{\lambda _{Kt}K_{t}}-\rho <0\) while (34) with (32) can be rewritten as \(\widehat{\lambda _{Kt}K_{t}}=-B\epsilon _{t}+\rho \). We combine these two conditions to get that \(\lim _{t\rightarrow \infty }\epsilon _{t}>0\). From (5), asymptotic constancy of \(\hat{K}_{t}\) implies \(\lim _{t\rightarrow \infty }\hat{\epsilon }_{t}\le 0\). Since \(\epsilon _{t}\) is strictly positive, the last inequality implies that \(\lim _{t\rightarrow \infty }\hat{\epsilon }_{t}=0\). From the transversality condition for the stock of resources, (38), we get that \(\hat{\lambda }_{St}+\hat{S}_{t}-\rho <0\). We substitute \(\hat{\lambda }_{St}=\rho \) and \(\hat{S}_{t}=-u_{t}\) to get \(\lim _{t\rightarrow \infty }u_{t}>0\). We then log-differentiate the production function for the consumption good, (3), with constant \(\epsilon \) at the limit. Asymptotic constancy of \(\hat{C}_{t}\) then demands that \(\lim _{t\rightarrow \infty }\hat{u}_{t}\le 0\). The last two conditions indicate that \(\lim _{t\rightarrow \infty }\hat{u}_{t}=0\), i.e. u asymptotically constant and positive, i.e. \(g_R\) asymptotically constant and negative. The upper bound \(\epsilon _{t},u_{t}<1\) follows from the essentiality of the resource and capital in the production function.

Appendix 4: The Social Cost of Carbon

We defined as \(X_t=-\phi \kappa \lambda _{Zt}/\lambda _{Ct}\) the marginal externality damage from burning an additional unit of polluting non-renewable resource. We will now prove that this is equivalent to expression (8). From (29), it follows that \(P_{\nu }\ge P_{s}e^{-\theta (\nu -s)}\), for each \(\nu \ge s\). We combine the previous inequality with the transversality condition (40) to get that \(0=\lim _{\nu \rightarrow \infty }\lambda _{P\nu }P_{\nu }e^{-\rho \nu }\ge \lim _{\nu \rightarrow \infty }\lambda _{P\nu }P_{s}e^{-\theta (\nu -s)}e^{-\rho \nu }\) or that

Following the same procedure for the transversality condition (41) we get

We multiply Eq. (36) with \(e^{-(\rho +\theta )(\nu -s)}\) to get that \(\dot{\lambda }_{P\nu }e^{-(\rho +\theta )(\nu -s)}-(\rho +\theta )\lambda _{P\nu }e^{-(\rho +\theta )(\nu -s)}=\eta D'(P_v)\lambda _{K\nu }K_{\nu }e^{-(\rho +\theta )(\nu -s)}\), i.e. \(d\left[ \lambda _{\nu }e^{-(\rho +\theta )(\nu -s)}\right] /d\nu =\eta D'(P_v)\lambda _{K\nu }K_{\nu }e^{-(\rho +\theta )(\nu -s)}\). Using (42) we can then calculate the definite integral from \(\nu =s\) to \(\nu \rightarrow \infty \) as

while the same procedure for (37) gives

Substituting \(\lambda _{Pt}\) from (44) into (45) and using (31) we get that

Using (31) and (32) we get expression (8). If \(\sigma =1\), \(X_t\) rewrites as in (9), all along the optimal path. If \(\sigma \ne 1\), on the asymptotic BGP, due to constancy of the \(\epsilon \) share, it holds, by combining (34) with (32), that \(\lim _{t\rightarrow \infty }\widehat{\lambda _{Ct}C_{t}}=\lim _{t\rightarrow \infty }\widehat{\lambda _{Kt}K_{t}}=-B {\epsilon _\infty }+\rho \), constant. Accordingly, the double integral in (46) gives at the limit \(\frac{\chi \eta }{(B \epsilon _\infty +\theta )(B \epsilon _\infty +\kappa )}\lambda _{Kt}K_{t}\), and with (32), (46) can be written as

In “Appendix 7” we will calculate the steady state value \(\epsilon _\infty =\left( B \sigma \right) ^{-1}(\rho +\alpha \left( \sigma -1\right) (B-\eta (\delta +\chi P_\infty ))\) in the general case of \(\sigma \ne 1\). Substituting the result in (47) leads to Eq. (23) in the main text.

Appendix 5: Decentralized Equilibrium with Log-Utility

For ease of exposition we define \(\psi \equiv p_{Rt}/\left( p_{Rt}+\tau _{t}\right) \), the fraction of the producers’ price in the total price for the non-renewable resource. Log-differentiating this expression gives \(\hat{\psi }_{t}=\left( 1-\psi \right) \left( \hat{p}_{Rt}-\hat{\tau }_{t}\right) \), where we define \(\hat{V}_{t}=g_{Vt}\equiv \dot{V}_{t}/V_{t}\) the growth rate of variable \(V_{t}\). The equations that characterize the decentralized economy can be found by log-differentiating the production function (3) with \(Y_{t}=C_{t}\), the FOC (10) for the capital share and resource demand, together with the aggregate version of the Keynes–Ramsey rule, (14), the Hotelling rule, (15), the no-arbitrage condition, (16), and the aggregate capital accumulation, (5). Solving the occuring system in \(g_{C},g_{K},g_{R},g_{\epsilon },g_{\psi },g_{pK},g_{pR},r\) in the case of \(\sigma =1\) leads to the following dynamic equation for \(\epsilon \):

with a solution given by \(\epsilon _{t}=\left( \frac{B}{\rho }\left( 1-e^{\rho t}\right) +\frac{e^{\rho t}}{\epsilon _{0}}\right) ^{-1}\). Combining the demand for capital in (10) and the aggregate version of the transversality condition (17) for capital pins down the initial level of the capital shares \(\epsilon _{0}=\rho /B\) . Substituting this back to the solution we get that \(\epsilon _{t}=\bar{\epsilon }=\rho /B\) for every t.

Appendix 6: Dynamics of the Optimal Per-unit Tax

To see why any term in the optimal per-unit tax that grows with the interest rate has no effect on the extracting behavior of the economy proceed as follows. Given Assumptions 1 and 2, apply the optimal tax on the FOC for the non-renewable resource, (10), with \(C_t=Y_t\) in equilibrium: \(R_t^o=\left( 1-\alpha \right) \left( \frac{p_{Rt}}{C_t} +\frac{\tau _t^o}{C_t}\right) ^{-1}\); \(R_t^o\) is the optimal path of resource extraction. Substituting \(p_{Rt}=p_{R0}e^{\int _0^t r_s ds}\), from (15), and \(C_t=C_0 e^{\int _0^t(r_s -\rho )ds}\), from (14), gives \(R_t^o=(1-\alpha )\left( \frac{p_{R0}}{C_0}e^{\rho t}+\frac{\tau _t^o}{C_t}\right) ^{-1}\). Now consider a different tax \(\tau _t^o+\Delta e^{\int _0^1 r_s ds}\) with \(\Delta > -p_{R0}\). It is straightforward to verify that in this case \(R_t^o=(1-\alpha )\left( \frac{p_{R0}+\Delta }{C_0}e^{\rho t}+\frac{\tau _t^o}{C_t}\right) ^{-1}\). Since \(\tau _t^o/C_t\) is constant, and the resource is essential, we can use the feasibility constraint \(\int _0^\infty R_t dt{=}S_0\) to calculate in both cases the same optimal resource extraction path as \(R_t^o=(1-\alpha )\left[ \frac{\tau _t^o}{C_t}\left( 1+e^{\rho t}\left( e^{\frac{S_0 \rho }{1-\alpha } \frac{\tau _t^o}{C_t}}-1 \right) ^{-1}\right) \right] ^{-1}\).

Appendix 7: Social Optimum with Non-logarithmic Utility

This part of the Appendix provides the dynamic system used in the simulation for Sect. 6, i.e. we treat the asymptotic balanced growth path and stability in the general case of \(\sigma \ne 1.\) It will be convenient to modify the dynamic system of the social planner in variables that converge to a constant at the limit. In “Appendix 3” we proved asymptotic constancy of \(\epsilon \), and \(u=R/S\). Moreover, we showed that \(\tilde{\tau }^o_{t}=\frac{\tau _{t}^{o}}{C_{t}}=-\phi \kappa \frac{\lambda _{Zt}}{\lambda _{Ct}C_{t}}\) reaches also a constant value at the limit. From (44) and (32) with \(\lim _{t\rightarrow \infty }\widehat{\lambda _{Kt}K_{t}}=-B \epsilon _\infty +\rho \) same holds for \(\tilde{\gamma _{t}}=\frac{\lambda _{Pt}}{\lambda _{Ct}C_{t}}\). Furthermore, we define, as in “Appendix 5”, \(\psi _{t}\equiv p_{Rt}/(p_{Rt}+ \tau _{t}^{o})=(\lambda _{St}/\lambda _{Ct})/(\lambda _{St}/\lambda _{Ct}-\kappa \phi \lambda _{Zt}/\lambda _{Ct})\), the fraction of the producers’ price in the total price paid by consumers. It follows from the asymptotic constancy of \(\tau _{t}^{o}/C_{t}\), the Hotelling rule, \(\hat{p}_{Rt}=r_{t}\), and the Keynes-Ramsey rule, \(\sigma \hat{C}_{t}=r_{t}-\rho \), that the term \(\tau _{t}^{o}/p_{Rt}\) grows at \(-((\sigma -1)r_{t}+\rho )/\sigma <0\), for \(\sigma \ge 1\), which we conventionally assume, so that \(\lim _{t\rightarrow \infty }\psi _{t}=1\). To get the dynamic system in \(\{\epsilon _{t},u_{t},\tilde{\tau } _{t},\tilde{\gamma }_{t},\psi _{t},S_{t},P_{t},Z_{t}\}\) we proceed as follows.Footnote 17 By log-differentiating (3) with \(u_{t}=R_{t}/S_{t}\), using (5) we get

With our definitions, Eq. (33) can be written as \((1-\alpha )C_{t}/(u_{t}S_{t})=p_{Rt}+\tau _{t}^{o}\). We log-differentiate this expression with \(\hat{p}_{Rt}=\hat{\lambda }_{St}-\hat{\lambda }_{Ct}=\rho +\sigma \hat{C}_{t}\) from (31), the Hotelling rule \(\hat{\lambda }_S=\rho \), and \(\tilde{\tau }_{t}=\tau _{t}^{o}/C_{t}\), to get

Furthermore, we log-differentiate the definition for \(\psi _{t}\) which gives

From (31), (32) and (34) we get

Finally, we substitute the growth rate of the shadow prices in the log-differentiated version of the definitions for \(\tilde{\tau }_{t}=\frac{\tau _{t}^{o}}{C_{t}}=-\kappa \phi \frac{\lambda _{Zt}}{\lambda _{Ct}C_{t}}\) and \(\tilde{\gamma _{t}}=\frac{\lambda _{Pt}}{\lambda _{Ct}C_{t} }\) from (31), (36), and (37) to get

We then combine Eqs. (49)–(54) to get the relevant dynamic system in \(\{\epsilon _{t},u_{t},\tilde{\tau }_{t},\tilde{\gamma }_{t},\psi _{t},S_{t},P_{t},Z_{t}\}\), as

along with (1) and (6), with \(\Theta _{t}=B-\eta \left( \delta +\chi P_{t}\right) \), and \(R_{t}=u_{t}S_{t}\). The steady state values read

The eigenvalues of the jacobian matrix of the corresponding system, calculated at the steady state values, are \(\{-\theta ,-\kappa ,-\frac{\rho +\alpha (\sigma -1)\Theta _\infty }{\sigma },-\frac{\rho +\alpha (\sigma -1)\Theta _\infty }{\sigma },\frac{\rho +\alpha (\sigma -1)\Theta _\infty }{\sigma },\frac{\rho +\alpha (\sigma -1)\Theta _\infty }{\sigma },\frac{\rho +\theta \sigma +\alpha (\sigma -1)\Theta _\infty }{\sigma },\frac{\rho +\kappa \sigma +\alpha (\sigma -1)\Theta _\infty }{\sigma }\}\), with \(\Theta _\infty =B-\eta (\delta +\chi P_\infty )\), and \(P_\infty =P_{0}+\phi S_{0}\), if \(\theta =0\), or \(\bar{P}=P_{0}\), if \(\theta >0\), i.e. four negative and four positive eigenvalues, implying a saddle-path stability around the steady state. The growth rate of consumption can be calculated by (49) to be

with a steady state value of

1.1 Linearized Version of the Model for \(\sigma \ne 1\)

In order to simulate the model we use the standard linearization technique: the linearized version of our autonomous dynamic system in \(\mathbf{x}_t = \{\epsilon _t, u_t, \tilde{\tau }_t,\tilde{\gamma }_t,\psi _t, S_t, P_t, Z_t\}^{\top }\) can be obtained by using the jacobian matrix \(\mathbf {J}\) evaluated at the steady states presented above as \(d(\mathbf {x}_t-{\mathbf{x}}_{\infty })/dt \approx \mathbf{J}(\mathbf{x}_t-{\mathbf{x}}_{\infty })\), with \(\mathbf {x_\infty }=\{\epsilon _\infty , u_\infty , \tilde{\tau }_\infty , \tilde{\gamma }_\infty , \psi _\infty , S_\infty , P_\infty , Z_\infty \}^{\top }\), which allows for an easy solution of the system of linear homogenous equations. For the simulation we use as initial conditions \(\{\psi _0=0.65, S_0=6000\) GtC, \(P_0=830\) GtC, \(Z_0=0\}\), while we calculate the initial level of the control variables \(\{\epsilon _0, u_0, \tau _0, \gamma _0\}\) such that the constants of integration associated with the unstable roots (positive eigenvalues) are zero. The parameters chosen are \(\{\rho =0.015, \sigma =1.5, \alpha =0.9, \theta = 0, \delta =0.05, B=0.106, \chi =1.7 \times 10^{6}\)$/GtC, \(\phi =1, \eta =1, \kappa _{\text {low}}=0.02,\kappa _{\text {high}}=0.04\}\). Below we justify our choices for the numerical exercise.

1.2 Choice of Initial Conditions and Parameters

We choose 2010 to be our \(t=0\). An approximation for \(\psi _0\), the share of the before tax price to the total price paid by consumers, can be taken from the IEA Monthly Oil Statistics, IEA (2015), to be around 0.65 as an average for the period 2006–2015. \(S_0=6000\) GtC follows estimates from the 2010 version of the DICE model. \(P_0=830\) GtC was retrieved by data from the European Environmental Agency.Footnote 18 \(Z_0=0\) is chosen according to our discussion in “Appendix 1”. The values of \(\rho \), \(\sigma \) and \(\delta \) are standard in the literature of endogenous growth. We normalize \(\phi =1\), so that a unit of resource use equals a unit of emissions; we also set \(\eta =1\) in the numerical exercise. In this model real GDP equals to \(C_t+p_{It}I_t\). Worldwide gross capital formation, \(p_{It}I_t/GDP_t\), is on average 0.24 for the period 1960–2014, World Bank Indicators, 2015. Accordingly \(C_t/GDP_t=0.76\). Energy expenditure as share of GDP in the US for the period 1949–2011 is in the range of 0.04–0.1, EIA (2015). We choose then a value of 0.08. Using now the FOC (10) for energy we can calculate \(\alpha =1- \frac{(p_{Rt}+\phi \tau _t)R_t/GDP_t}{C_t/GDP_t} \approx 0.9\). The value of natural disasters reported in the period 2005–2015 amounts on average to \({139 \times 10^9}\) $/year (EM-DAT The International Disasters Database 2015). Using the value for the stock of capital from the 2010 version of the DICE model (DICE2010) and \(P_0=830\) GtC, we get that \({\chi =1.7 \times 10^{6}}\) $/GtC. B was chosen so that the initial level of the interest rate is about \(5\%\) (as in DICE2010) and that it satisfies the condition \(\alpha (B-\eta (\delta +\chi (P_0+\phi S_0))>\rho \), from (69), equivalent to the one assumed in Sect. 4.2. Parameter \(\kappa \) is the reciprocal of the mean time lag. We choose a low value to reflect a time lag of 50 years, and a high value to reflect a time lag of 25 years.

Rights and permissions

About this article

Cite this article

Bretschger, L., Karydas, C. Optimum Growth and Carbon Policies with Lags in the Climate System. Environ Resource Econ 70, 781–806 (2018). https://doi.org/10.1007/s10640-017-0153-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0153-4