Abstract

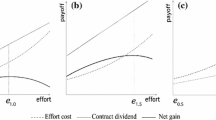

Conservation auctions have the potential to increase the efficiency of payments to farmers to adopt conservation-friendly management practices by fostering competition among them. The literature considers bidders that have complete information about the costs of adoption and optimal bidding behavior reflects this information advantage. Farmers seek information rents and bids decrease when risk aversion increases because farmers are more averse to losing the auction. We contribute to the literature by allowing for cost risk. Our paper shows that farmers must balance the risk of losing the auction (thus foregoing information rent) with the risk of submitting a bid that is not high enough to pay the costs of adopting conservation practices (thus incurring losses). We design an experiment to trade off these two risks and examine how risk aversion affects bidding behavior when participants face different sources and levels of risk. Our experiment contributes to a small literature on experimental auctions with risky product valuations. We find that participants decrease their bids as risk aversion increases, even in auctions with cost risk, suggesting that the risk of losing the auction dominates. These findings uncover new challenges for the practical implementation of conservation auctions as an efficient policy instrument.

Similar content being viewed by others

Change history

19 October 2016

An erratum to this article has been published.

Notes

Examples of BMPs include conservation or reduced tillage, establishing vegetation or fences along stream banks, and wetland retention and restoration.

Carbon sequestration and nutrient reduction are examples of EGS that can be obtained through the adoption of BMPs.

In Canada, federal-provincial government programs (e.g. the National Farm Stewardship Program) offered payments to farmers to adopt particular BMPs. However, these programs only provided partial costs of adoption for BMPs under a cost share arrangement and as a result levels of adoption for BMPs that provided significant public benefits were extremely low (Simpson et al. 2013).

Refer to Sect. 2 a review of the literature.

The loss prevention incentive can be thought of as an incentive to avoid the winner’s curse. This curse may arise through two channels: (i) the winning bid is lower than adoption costs such that the winner is worse off in absolute terms; or (ii) the cost is higher than the bidder expected and the bidder still has a net gain by bidding above cost, however, the gain is smaller than anticipated (Thaler 1988).

A discussion of these models is provided in Sect. 2.

Ferraro (2008) offers a discussion about how different contracting designs can be used to overcome the information asymmetry problem.

In the uniform-price auction the successful bidders receive a uniform price equal to the lowest rejected bid. In the discriminative-price auction, each successful bidder receives the actual bid offered.

In a budget-constrained auction, bids are accepted until the auction budget is exhausted. In a target-constraint auction, bids are accepted until a target level of environmental quality is reached.

The Keystone Pipeline was designed to send Canadian oil to the US Gulf Coast.

Source: Wall Street Journal, Sept. 18, 2014. Available at http://www.wsj.com/articles/keystone-pipeline-cost-expected-to-double-transcanada-ceo-says-1411067631.

As will be demonstrated below, this simplification allows for cleaner identification of hypotheses about the relationship between bidding behavior and risk aversion in auctions with and without cost risk. Refer to Vukina et al. (2008) for a model in which farmers do not face cost risk, but consider their environmental quality when placing bids.

We assume \(U(\cdot )\) is a concave utility function.

An important difference between the conservation auction model and standard models in the auction literature is that in conservation auctions several bids may be accepted while in standard non-reverse auctions (or standard procurement auctions) only one bid is accepted. As Latacz-Lohmann and Van der Hamsvoort (1997) discuss, the conservation auction model deviates from the mainstream models in the auction literature where optimal bids are determined endogenously. In the conservation auction, bids are influenced by expectations exogenously governed by F and the earnings from being one of possibly multiple winners. In the Latacz-Lohmann and Van der Hamsvoor model, farmers have an upper limit \(\overline{\beta }\) on their expectations about the bid threshold. As a result, the probability of having a bid accepted is \( \int \limits _{b}^{\overline{\beta }} f(b)db = 1 - F(b)\).

It seems reasonable to assume that \(S(0) = 1 - F(0) = 1\), that is, a bid of zero dollars will be accepted with certainty.

Throughout the paper, \(U^{\prime }\) denotes the derivative of utility w.r.t. earnings. \(U^{\prime \prime }\) and \(U^{\prime \prime \prime }\) denote the corresponding second and third derivatives.

A similar assumption is made by Vukina et al. (2008) when examining optimal bidding in a model in which the rate of change of the acceptance probability is affected by environmental quality.

Throughout the paper we refer to \(U(\cdot )\) as Bernoulli utility, i.e. utility over earnings. This contrasts with the expected utility \(U(\cdot )[1 - F(\cdot )]\), also known as von-Neumann-Morgenstern utility.

To see this, notice that the first order condition (3) can be re-arranged as \(\frac{U^{\prime }(b^*)}{U(b^*)} = \frac{f(b^*)}{1 - F(b^*)}\).

The winning bid incentive refers to the increase in expected utility due to a higher probability of winning, holding everything else equal.

In fact, the previously discussed environment in which cost is known by the farmer is equivalent to this type of risky environment with \(x=0\).

The variance of cost is equal to \(((c+x) - (c-x))^2 \times 1/2 \times 1/2 = x^2\).

Under prudence, a $1 loss from $11 to $10 hurts less than a $1 loss from $10 to $9; while a $1 loss from $101 to $100 is about as painful as going from $100 to $99.

In a private value auction each bidder knows the value of the good to himself. Interdependent value refers to a setting where bidders may have different information about the value of the good being auctioned. Therefore, a bidder’s valuation of the good can vary not only from changes in his own signal about the value, but also if information about others’ signals becomes available.

The Arrow–Pratt measure is \(A(\theta ) = (\theta - 1){/}\theta (b-c)\). It makes sense for \(\theta \) to be positive for utility to be increasing in earnings. The farmer is risk loving for \(0<\theta <1\) and risk neutral for \(\theta =1\). For \(\theta >1\), the farmer is both risk averse (\(U^{\prime \prime }<0\)) and prudent (\(U^{\prime \prime \prime }>0\)). Also, risk aversion increases with \(\theta \): \(\partial A(\theta ){/}\partial \theta >0\).

Note that the auction participation constraint \(b^* \ge c\) is satisfied for \(\beta \ge c\).

Students have been used in other conservation auction research and are assumed to act similarly to a rational profit maximizing firm/individual (Cason and Gangadharan 2004, 2005; Cason et al. 2003; Schilizzi and Latacz-Lohmann 2007). Students and producers appear to perform in a similar manner in experimental conservation auctions (Boxall et al. 2008). Previous experiments by Brookshire et al. (1987) and List and Shogren (1998) suggest that experimental auctions tend to be externally valid.

Instructions are available in “Experimental Instructions” section in “Appendix”. All sessions were implemented by the same set of researchers. The presentation of instructions was given by the same researcher in all sessions such that all participants were exposed to the same content.

Screen shoots are available in “Screen Shoots” section in “Appendix”.

Redrawing costs gives participants a similar set of opportunities and reduces lack of attention span of high-cost participants that have little chance to win the auction. Hence, this randomization has the potential to reduce noise in the data.

In both treatments, the densities of each of the seven possible costs, from left to right, are 0.046, 0.083, 0.167, 0.4, 0.167, 0.083, and 0.046. The variances for the Low and High risk treatments are, respectively: \(\sigma ^2_{L}=0.0046\hat{C}\) and \(\sigma ^2_{H}=0.0183\hat{C}\).

Demand effects (i.e., when participants form expectations about the experimenter’s intention and try to conform) are generally thought to be stronger in a within design [see Charness et al. (2012)]. However, in our experiment, due to the existence of two conflicting incentives (the winning bid and the loss prevention), it is unlikely that participants are attempting to behave in a way to satisfy the experimenters’ expectations. In fact, we did not have prior expectations about how risk aversion would affect bidding as both positive and negative effects are theoretically possible.

Risk preferences elicited by simple methods like the Eckel–Grossman are correlated to real world risk-taking behavior, see Charness et al. (2013). Refer to their research for a discussion about different methods to elicit risk preferences.

No participants ever chose to leave the experiment before completion.

This lower bound payoff rule was not pre-announced and thus should not have had an impact on experimental behavior. Moreover, this was a rare occurrence as only 4.7 % of successful bids were below cost.

For simplicity, our main analyses are based on regressions with cost as a linear term. “Nonlinear Effects of Expected Costs on Bids” section in “Appendix” uses a quadratic specification to investigate possible nonlinear effects of cost on bidding behavior.

In auctions with complete information (no-risk estimates from columns 1 to 2), expected cost is equal to actual cost. This is not the case with cost risk. With risk, actual costs are unknown and bids are submitted based on information about the distribution of costs (columns 3–6).

The Eckel–Grossman gamble choice can also be interpreted in terms of the underlying risk coefficient under the assumption of constant relative risk aversion (CRRA). Assume participants obtain utility from earnings e according to a CRRA utility function \(U(e) = e^{(1-r)}{/}(1-r)\). Theoretically, \(r<0\) indicates risk loving, \(r=0\) indicates risk neutrality, and \(r>0\) indicates risk aversion. As Eckel and Grossman (2008) and Charness et al. (2013) show, the Eckel and Grossman (2002) risk task allows us to calculate the range of r that matches each gamble choice. Theses ranges for the gambles in our paper (rounding the bounds of r to 2 decimal places) are: gamble 1, \(r \ge 3.46\); gamble 2, \(1.17 \le r \le 3.45\); gamble 3, \(0.71 \le r \le 1.16\); gamble 4, \(0.50 \le r \le 0.70\); gamble 5, \(0 \le r \le 0.49\); gamble 6, \(r \le 0\). In our experiment, the average value of Risk Aversion is 3.07 (i.e. gamble 4 was chosen on average). Using the gamble interval midpoint as an estimate of r, the coefficient of constant relative risk aversion of the average participant is \(r=0.60\) [similar to that of 0.54 found by Castillo et al. (2011)]. The marginal change in Risk Aversion for the average participant corresponds to an increase of r from 0.60 to 0.94.

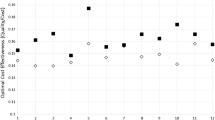

Using the within-subject variation with cluster-robust standard errors, we find that, controlling for risk aversion, the average markup increase (of three cents on a dollar) between no-risk and high-risk is statistically significant (\(p<0.05\)), however, the increase from no-risk to low-risk is not.

Potential measurement error issues arise when one includes a measure of risk aversion in models of experiment outcomes [see Gillen et al. (2015)]. Gillen et al. use experimental data to show that the estimate of effect of gender on willingness to compete changes significantly between models that control for risk preferences using one (or a combination) of various proxies of risk aversion, and argue that this sensitivity is evidence of measurement error bias. Since female and older subjects are normally more risk averse [see Eckel and Grossman (2008) and Bonsang and Dohmen (2015), respectively], we use data on gender and age as additional proxies for risk preferences and find that markup estimates are not sensitive to including different (or all) risk measures. Nevertheless, as a robustness check, we estimate markups in the three risk settings using the obviously related instrumental variables approach proposed by Gillen et al. to address measurement error issues with experimental data [see section 4.4.1 of Gillen et al. (2015)]. This approach delivers markup estimates very similar to the ones reported in Table 3. Specifically, the ORIV coefficients of expected cost (and cluster-robust standard errors) are: (i) no risk: 1.035 (0.012); (ii) low risk: 1.046 (0.026); (iii) high risk: 1.066 (0.018), all with \(p < 0.01\).

The experiment consisted of 180 subjects playing 18 auction periods. Bids were not submitted in 99 participant-auction observations. Thirty-nine subjects (or 21.7 % of subjects) did not participate in all 18 auctions.

References

Arnold M, Duke J, Messer K (2013) Adverse selection in reverse auctions for ecosystem services. Land Econ 89:287–412

Banerjee S, Kwasnica A, Shortle J (2015) Information and auction performance: a laboratory study of conservation auctions for spatially contiguous land management. Environ Resour Econ 61:409–431

Bonsang E, Dohmen T (2015) Risk attitude and cognitive aging. J Econ Behav Organ 112:112–126

Boone J, Goeree J (2009) Optimal privatization using qualifying auctions. Econ J 119:277–297

Boxall P, Perger O, Weber M (2013) Reverse auctions for agri-environmental improvements: selection rules and pricing for beneficial management practice adoption. Can Public Policy 39(S2):23–36

Boxall P, Weber M, Perger O, Cutlac M, Samarawickrema A (2008) Results from the farm behaviour component of the integrated economic hydrologic model for the watershed evaluation of beneficial management practices program: summary of phase 1 progress. Working Paper. Department of Rural Economy, University of Alberta, Edmonton, Alberta, Canada. 109 pp

Brookshire DS, Coursey DL, Schulze WD (1987) The external validity of experimental economic techniques: analysis of demand behaviour. Econ Inq 25:239–250

Brown LKR, Troutt C, Edwards B Gray, Hu W (2011) A uniform price auction for conservation easements in the Canadian prairies. Environ Resour Econ 50:49–60

Cason TN, Gangadharan L (2004) Auction design for voluntary conservation programs. Am J Agric Econ 86:1217–1222

Cason TN, Gangadharan L (2005) A laboratory comparison of uniform and discriminative price auctions for reducing non-point source pollution. Land Econ 81:51–70

Cason TN, Gangadharan L, Duke C (2003) A laboratory study of auctions for reducing non-point source pollution. J Environ Econ Manag 46:446–471

Castillo M, Ferraro P, Jordan J, Petrie R (2011) The today and tomorrow of kids: time preferences and educational outcomes of children. J Public Econ 95:1377–1385

Charness G, Gneezy U, Imas A (2013) Experimental methods: eliciting risk preferences. J Econ Behav Organ 87:43–51

Charness G, Gneezy U, Kuhn M (2012) Experimental methods: between-subject and within-subject design. J Econ Behav Organ 81:1–8

Claassen R, Cattaneo A, Johanssonc R (2008) Cost-effective design of agri-environmental payment programs: U.S. experience in theory and practice. Ecol Econ 65:737–752

Connor J, Ward J, Bryan B (2008) Exploring the cost effectiveness of land conservation auctions and payment policies. Aust J Agric Resour Econ 51:303–319

Cooper D, Fang H (2008) Understanding overbidding in second price auctions: an experimental study. Econ J 118(532):1572–1595

Cox James C, Roberson Bruce, Smith Vernon L (1982) Theory and behavior of single object auctions. In: Smith VL (ed) Research in experimental economics. JAI Press, Greenwich

Eaton D (2005) Valuing information: evidence from guitar auctions on eBay. J Appl Econ Policy 24:1–19

Eckel CC, Grossman PJ (2002) Sex differences and statistical stereotyping in attitudes toward financial risk. Evol Hum Behav 23:281–295

Eckel CC, Grossman PJ (2008) Forecasting risk attitudes: an experimental study using actual and forecast gamble choices. J Econ Behav Organ 68:1–17

Eso P, White L (2004) Precautionary bidding in auctions. Econometrica 72:77–92

Ferraro Paul (2008) Asymmetric information and contract design for payments for environmental services. Ecol Econ 65:810–821

Fischbacher U (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10:171–178

Fooks J, Higgins N, Messer K, Duke J, Hellerstein D, Lynch L (2016) Conserving spatially explicit benefits in ecosystem service markets. Am J Agric Econ. doi:10.1093/ajae/aav061

Fooks J, Messer K, Duke J (2015) Dynamic entry, reverse auctions, and the purchase of environmental services. Land Econ 91:57–75

GAO-09-326SP (2009) Defense acquisitions: Assessments of selected weapons programs. In: Report to Congressional Committees, Government Accountability Office. http://www.gao.gov/assets/290/287947

Gillen B, Snowberg E, Yariv L (2015) Experimenting with measurement error: techniques with applications to the Caltech cohort study. Working Paper No. 21517, National Bureau of Economic Research. http://www.nber.org/papers/w21517

Goeree J, Holt C, Palfrey Thomas (2002) Quantal response equilibrium and overbidding in private-value auctions. J Econ Theory 104(1):247–272

Greiner Ben (2015) Subject pool recruitment procedures: organizing experiments with ORSEE. J Econ Sci Assoc 1(1):114–125

Haile P (2003) Auctions with private uncertainty and resale opportunities. J Econ Theory 108:72–110

Hill MRJ, McMaster DG, Harrison T, Hershmiller A, Plews T (2011) A reverse auction for wetland restoration in the Assiniboine River Watershed, Saskatchewan. Can J Agric Econ 59:245–258

Jack K, Leimona B, Ferraro P (2008) A revealed preference approach to estimating supply curves for ecosystem services: use of auctions to set payments for soil erosion control in Indonesia. Conserv Biol 23(2):359–367

Jeffrey S, Cortus B, Dollevoet B, Koeckhoven S, Trautman D, Unterschultz JR (2012) Farm level economics of ecosystem service provision. Working Paper. Department of Resource Economics and Environmental Sociology, University of Alberta, Edmonton, Alberta, Canada. 46 pp

Kimball MS (1990) Precautionary saving in the small and in the large. Econometrica 58(1):53–73

Kirwan B, Lubowski R, Roberts M (2005) How cost-effective are land retirement auctions? Estimating the difference between payments and willingness to accept in the conservation reserve program. Am J Agric Econ 87:1239–1247

Kocher M, Pahlke J, Trautmann S (2015) An experimental study of precautionary bidding. Eur Econ Rev 78:27–38

Latacz-Lohmann U, Van der Hamsvoort C (1997) Auctioning conservation contracts: a theoretical analysis and an application. Am J Agric Econ 79:407–418

Latacz-Lohmann U, Van der Hamsvoort C (1998) Auctions as a means of creating a market for public goods from agriculture. J Agric Econ 49:334–345

Lewis G (2011) Asymmetric information, adverse selection and online disclosure: the case of eBay motors. Am Econ Rev 101:1535–1546

List J, Shogren JF (1998) Calibration of the differences between actual and hypothetical valuations in a field experiment. J Econ Behav Organ 37:193–205

Packman KA (2010) Investigation of reverse auctions for wetland restoration in Manitoba. Unpublished M.Sc. thesis, Department of Resource Economics and Environmental Sociology, University of Alberta, Edmonton, AB, Canada

Pant KP (2015) Uniform-price reverse auction for estimating the costs of reducing open-field burning of rice residue in Nepal. Environ Resour Econ 62:567–581

Schilizzi S, Breustedt G, Latacz-Lohmann U (2011) Does tendering conservation contracts with performance payments generate additional benefits? Working Paper No. 1102, School of Agricultural and Resource Economics, University of Western Australia, Crawley, Australia

Schilizzi S, Latacz-Lohmann U (2007) Assessing the performance of conservation auctions: an experimental study. Land Econ 83(4):497–515

Shoemaker R (1989) Agricultural land values and rents under the conservation reserve program. Land Econ 65:131–137

Simpson S, Rollins C, Boxall PC (2013) Assessing the effectiveness of the Natural Advantage Program, Linking Environment and Agriculture Research Network (LEARN), Project Report PR-03-2013

Stoneham G, Chaudhri V, Ha A, Strapazzon L (2003) Auctions for conservation contracts: an empirical examination of Victoria’s BushTender trial. Aust J Agric Resour Econ 47:477–500

Thaler Richard H (1988) Anomalies: the winner’s curse. J Econ Perspect 2(1):191–202

Vogt N (2015) Environmental risk negatively impacts trust and reciprocity in conservation contracts: evidence from a laboratory experiment. Environ Resour Econ 62:417–431

Vukina T, Zheng X, Marra M, Levy A (2008) Do farmers value the environment? Evidence from a conservation reserve program auction. Int J Ind Organ 26(6):1323–1332

Wilson SA (2013) Incorporating variable costs of adoption into conservation auctions. Unpubl. M.Sc. thesis, Department of Resource Economics and Environmental Sociology, University of Alberta, Edmonton, AB, Canada

Windle J, Rolfe JC, McCosker JC, Whitten S (2004) Designing Auctions with Landholder Cooperation: Results from Experimental Workshops. Establishing East-West Corridors in the Southern Desert Uplands Research Report No. 4. Emerald: Central Queensland University, Queensland Australia

Acknowledgments

We would like to thank Philippe Marcoul and Jens Schubert for helpful comments. Financial support for this research was provided by the Watershed Evaluation of Beneficial Management Practices (WEBs) project of Agriculture and Agri-Food Canada (AAFC 1585-10-3-2-1-3) and from the Australian Research Council’s Discovery Fund, Project ID 150104219. The authors are solely responsible for any omissions or deficiencies.

Author information

Authors and Affiliations

Corresponding author

Additional information

An erratum to this article is available at https://doi.org/10.1007/s10640-016-0073-8.

Appendix

Appendix

1.1 Proofs

Proposition 1

In a conservation auction with known adoption costs, the farmer’s optimal bid is inversely related to his degree of risk aversion.

Proof

Applying the implicit function theorem to the first order condition (3) leads to:

where \(\textit{SOC}\) is the second order condition of problem (2) and hence is assumed to be negative. The numerator of (8) must be negative for \(\frac{\partial b^*}{\partial \theta } \le 0\). As the terms \(\frac{\partial U^{\prime }(\cdot )}{\partial \theta } \) and \(\frac{\partial U(\cdot )}{\partial \theta }\) have negative signs, the numerator is negative when Assumption 2 holds. Therefore, if the relative effect of risk aversion is greater than the hazard rate, increases in risk-aversion decrease the optimal bid.

Corollary 1

The efficiency of a conservation auction with known adoption costs is positively associated with the degree of risk aversion of its participants.

Proof

Typically, efficiency of conservation auctions is measured by the level of EGS that the auction is capable of generating for a given budget. In our simple framework, heterogeneity between farmers is due to risk preferences and costs of adoption. Farmers are assumed to be homogeneous in terms of the benefit generated by their adoption, therefore, the number of adopters define the level of EGS. To prove the corollary we will show that an increase in the average level of risk aversion (weakly) increases the provision of EGS.

Let \(\mathbf{b}({\varvec{\theta }}\)) denote a sorted bid profile; a vector that collects bids such that \(b_1(\theta _1) \le b_2(\theta _2) \le \cdots \le b_n(\theta _n)\), where \(\varvec{\theta }\) is the auction’s risk aversion profile \((\theta _1, \theta _2, \ldots , \theta _n\)) and n is the number of participants in the conservation auction. Let B denote the regulator’s limited budget \(\left( B < \sum \nolimits _{i=1}^n b_i(\theta _i)\right) \). Bids are accepted from the lowest one upwards until the budget is exhausted (or insufficient to finance an additional bid). Let \(b_k(\theta _k)\) denote the last affordable bid, i.e. the bid of farmer k such that \(B \ge \sum \nolimits _{i=1}^k b_i(\theta _i)\) and \(B < \sum \nolimits _{i=1}^{k+1} b_i(\theta _i)\) . All farmers \(i \le k\) are winners and adopt the conservation technology, therefore, the level of EGS induced by the auction can be measured by k. Consider the auction’s risk aversion profile \(\varvec{\theta }^{\prime } \ge \varvec{\theta }\) in which \(\theta _i^{\prime } \ge \theta _i\) for all i. Let t denote the winning threshold associated with \(\varvec{\theta }^{\prime }\): \(B \ge \sum \nolimits _{i=1}^t b_i(\theta _i^{\prime })\) and \(B < \sum \nolimits _{i=1}^{t+1} b_i(\theta _i^{\prime })\). From Proposition 1 we know that \(\frac{\partial b}{\partial \theta } \le 0\). As a result, \(\sum \nolimits _{i=1}^k b_i(\theta _i) =\sum \nolimits _{i=1}^k b_i(\theta _i^{\prime }) + X\), where \(X\ge 0\). If \(X \ge b_{k+1}(\theta _{k+1}^{\prime })\), then \(t >k\). If \(X < b_{k+1}(\theta _{k+1}^{\prime })\), then \(t = k\). This concludes the proof as we showed that the supply of EGS under \(\varvec{\theta }\) is less than (or equal to) the EGS supply under a higher level of risk aversion \(\varvec{\theta }^{\prime }\), i.e. \(k \le t\). Note that when \(k=t\), the same amount of EGS is generated under \(\varvec{\theta }\) and \(\varvec{\theta }^{\prime }\), however, the cost of provision is smaller under the \(\varvec{\theta }^{\prime }\) profile.

Proposition 2

Farmers increase their bids in response to increases in cost risk.

Proof

The relationship between the farmer’s optimal bid and the level of cost risk is obtained through the implicit function theorem as follows.

where SOC is the second order condition of problem (5) and hence is assumed to be negative. Assumption 3 is needed to analytically derive the sign of Eq. (10). If farmers are prudent, then \( \left( - \frac{\partial U^{\prime }(b^{**}-c- x| \theta )}{\partial x} +\frac{\partial U^{\prime }(b^{**}-c+ x| \theta )}{\partial x}\right) \ge 0\). If farmers are risk-averse, then \( \left( - \frac{\partial U(b^{**}-c- x| \theta )}{\partial x}+\frac{\partial U(b^{**}-c+ x| \theta )}{\partial x}\right) \le 0\). It follows that \(\frac{\partial b^{**}}{\partial x} \ge 0\).

Corollary 2

The conservation auction efficiency is negatively associated with the level of adoption cost risk.

Proof

The proof is similar to that of Corollary 1. Cost risk is introduced through a mean preserving spread of adoption costs, therefore, the level of risk is determined by x. Let \(\mathbf{b (x)}\) denote a sorted bid profile, where \(\mathbf x\) is the corresponding cost risk profile. Let \(\mathbf x^{\prime }\) denote a cost risk profile such that \(x_i^{\prime } \le x_i\) for all i. We use the notation of the proof of Corollary 1. Let k and t index the threshold bids such that \(B \ge \sum \nolimits _{i=1}^k b_i(x_i)\) and \(B < \sum \nolimits _{i=1}^{k+1} b_i(x_i)\), and \(B \ge \sum \nolimits _{i=1}^t b_i(x_i^{\prime })\) and \(B < \sum \nolimits _{i=1}^{t+1} b_i(x_i^{\prime })\). From Proposition 2 we know that \(\frac{\partial b}{\partial x} \ge 0\). It follows that \(\sum \nolimits _{i=1}^k b_i(x_i) =\sum \nolimits _{i=1}^k b_i(x_i^{\prime }) + X\), where \(X\ge 0\). As a result, \(k \le t\), where k is the level of EGS under x and t is the EGS level under \(\mathbf x^{\prime }\).

Corollary 3

A risk-neutral farmer does not change his bidding strategy in response to mean preserving spreads of the cost distribution.

Proof

The risk-neutral farmer’s problem is to maximize expected payoff from auction participation:

and the optimal bid \(b^{n}\) is determined by the following first order condition:

This implicit function that determines optimal bid for risk-neutral farmers is equivalent to that reported by Latacz–Lohmann and Van der Hamsvoort [1997, equation (5)]. The optimal bid consists of the opportunity cost of adoption plus an auction participation premium, and it does not depend on the variance of the cost distribution. \(\square \)

1.2 Experimental Instructions

1.3 Eckel–Grossman Risk Task

1.4 Screen Shoots

1.5 Nonlinear Effects of Expected Costs on Bids

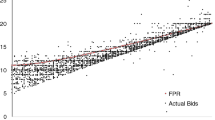

Thus far, our analyses are based on regressions with cost as a linear term. However, as expected costs increase, bids may increase at a decreasing rate if high cost bidders decrease markups as they compete to win the auction. Using all experimental data, we estimate bidding models with a quadratic specification to explore nonlinear effects of expected costs on bids. Results are presented in Table 7.

First, note that the main findings of the paper remain unchanged. Controlling for nonlinear effects of expected costs on bids, we find that: (i) bids are higher in auctions with cost risk (see column 2); (ii) there is a negative overall effect of risk aversion on bids, i.e. the winning bid incentive dominates (see column 3); and (iii) participants respond to both incentives and the effect of risk aversion on bids is attenuated in auctions with cost risk (see column 4).

Next, note that in all models the coefficient of Expected Cost is positive and significant and the coefficient of Expected Cost Squared is negative and significant. These estimates confirm the hypothesis that bids increase with expected costs at a decreasing rate. We use the estimates of column 1 to predict a bid curve. Figure 5 shows the bid curve and provides a visual illustration of the demand for information rents (i.e., the difference between the bid curve and the 45\(^{\circ }\) line). As we move along the bid curve, from low cost to high cost, we find that information rent requests are small when cost is low (e.g. approximately $0.5 when cost is equal to $1), increase to $4 when expected cost is $19, and decreases to $2.5 when expected cost is $51.

Rights and permissions

About this article

Cite this article

Wichmann, B., Boxall, P., Wilson, S. et al. Auctioning Risky Conservation Contracts. Environ Resource Econ 68, 1111–1144 (2017). https://doi.org/10.1007/s10640-016-0063-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-016-0063-x