Abstract

This paper studies greenhouse-gas emission (GHG) controls in the presence of international carbon leakage through international firm relocation. In a new economic geography model with two countries (‘North’ and ‘South’), only North sets a target for GHG emissions. We compare the consequences of emission quotas and emission taxes under trade liberalization on location of two manufacturing sectors with different emission intensities and degrees of carbon leakage. With low trade costs, further trade liberalization increases global emissions by facilitating carbon leakage. Regulation by quotas leads to spatial sorting, resulting in less carbon leakage and less global emissions than regulation by taxes.

Similar content being viewed by others

Notes

International carbon leakage may also occur through fuel price changes (e.g., Felder and Rutherford 1993; Burniaux and Martins 2000; Ishikawa and Kiyono 2000; Kiyono and Ishikawa 2004, 2013). When a country adopts policies to reduce GHG emissions, its demand for fossil fuels is likely to decrease. If the world prices of fossil fuels fall as a result of this decrease in a country attempting to reduce its GHG emissions, the demand for fossil fuels rises in other countries with weak regulations.

In Markusen et al. (1993), two polluting firms (one is domestic and the other is foreign) choose the number of plants and plant locations when only the home country adopts emission taxes. They are primarily concerned with market structures induced by taxes. In Markusen et al. (1995), a single firm decides the plant number and locations when both countries adopt environmental policies non-cooperatively. See also Rauscher (1995) and Ulph and Valentini (2001).

According to Jaffe et al. (1995), differences in environmental policies have little or no effect on trade patterns, investment or firm location. However, Henderson (1996), Becker and Henderson (2000), Greenstone (2002), List et al. (2003), Dean et al. (2009) and Duvivier and Xiong (2013) find that pollution-intensive plants are responding to environmental regulations. Javorcik and Wei (2004) discuss factors that may make the evidence of the hypothesis weak. Levinson and Taylor (2008) point out that the pollution haven effect has been underestimated.

Keller and Levinson (2002), Eskeland and Harrison (2003), Fredriksson et al. (2003), Cole and Elliott (2005), Cole et al. (2006, 2014) and Javorcik and Wei (2004) study the impact of environmental regulations on FDI and trade. Turning to inter-regional analysis, Cai et al. (2016) investigates the impact of regulations by central government on pollution across Chinese counties.

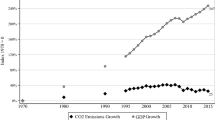

For example, in the Kyoto protocol, the industrialized countries, referred to as Annex I Parties, made a commitment to decrease their GHG emissions by 5.2 % compared to their 1990 baseline levels over the 2008 to 2012 period. Meanwhile, developing countries such as China and India had no obligation to undertake the reduction.

The early version of this paper, Ishikawa and Okubo (2008), examines the case with an agricultural sector and a single manufacturing sector.

When a country adopts exceedingly lax environmental policies in order to keep its competitive advantage, its strategy is sometimes called “environmental (or ecological) dumping.” On the other hand, when a country adopts overly stringent environmental policies in order to reduce local pollution, this strategy is called “Not in my back yard (NIMBY).” There are a number of studies which, following Markusen et al. (1995), analyze environmental dumping and NIMBY strategies (e.g., Rauscher 1995; Ulph and Valentini 2001).

Venables (2001) studies the impact of an ad valorem tax on equilibrium in a vertical linkage model. In the case of energy taxes that are unilaterally introduced in one country, he discusses hysteresis in location but does not investigate quotas. Elbers and Withagen (2004) study the impact of an emission tax on agglomeration in the presence of labor migration. Ishikawa and Okubo (2011) explore the effect of environmental product standards on the environment.

Ishikawa et al. (2012) extend the analysis of emission quotas in Ishikawa and Kiyono (2006) by incorporating South’s emission quotas into the model. Kiyono and Ishikawa (2004, 2013) focus on the international interdependence of environmental management policies in the presence of international carbon leakage.

Here the income effect means that higher income results in lower emissions. Evidence of the income effect is also mixed. See, for example, Barbier (1997).

The total number of households (population) is one in the world, because each individual has one unit of labor, K-capital and H-capital. The level of demand depends on population size rather than income.

This normalization is not crucial for our main results, though the value of \(\sigma \) is bound to \(\upmu \) and vice versa. Even if we do not employ this normalization, all main results remain valid.

Note that each firm’s profit is \(1/\sigma \) times firm revenue. The (1 – \(1/\sigma \)) terms cancel out in the price of a product variety and in CES composition.

Full agglomeration is not necessarily assumed in the initial equilibrium without emission policies.

In Fig. 1, we have \(s=0.6\), \(\sigma =1.5\), \(\gamma =1.2\), \(t=0.02\), \(\mu =1/3\), and \(\bar{{\chi }}=2.1522\).

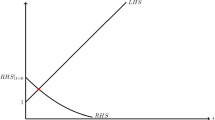

Figure 2 assumes s=0.6, \(\sigma =1.5\) and \(\gamma =2\).

In Figs. 3 and 4, we have \(s=0.6\), \(\sigma =2\), \(\gamma =1.2\), \(t=0.5\), \(\mu =0.45\) and \(\bar{{\chi }}=17/12\).

Since 4(1 – s)\(s <\) 1 for \(s >\) 1/2 and \(1>(1+t)^{2(1-\sigma )}>(1+\gamma t)^{2(1-\sigma )}\), \(1-4s(1-s)(1+t)^{2(1-\sigma )}>0\) and \(1-4s(1-s)(1+\gamma t)^{2(1-\sigma )}>0\) always hold. Thus, \(\phi ^S \)in each sector is a real number.

Inherently, this stems from so-called the hump-shaped agglomeration rent (Baldwin and Krugman 2002; Baldwin et al. 2003).

There exists the bifurcation point, \(\phi ^{B}>0\) under the condition of \(\overline{\chi }>\mu (1+\gamma )s\). This indicates that as North emission policy becomes less stringent, the quota is less likely to be binding and the bifurcation point rises, and vice versa. Note that \(\phi ^{B}<1\) always holds due to \(\hbox {s}>0.5\).

The level of the quota could be less than the total emissions by all C-sector firms.

Here, we assume tax and quota revenues are distributed to individuals in a lump-sum manner.

Our model sets the same maximum level of North emissions between emission taxes and quotas as in (7). If all C-sector and D-sector firms locate in North under quotas, the permit price \(\bar{{q}}\) is determined by: \(\bar{{\chi }}\equiv \frac{1}{1+t}+\frac{\gamma }{1+\gamma t}=\frac{1}{1+\bar{{q}}}+\frac{\gamma }{1+\gamma \bar{{q}}}\). However, full agglomerate of the D-sector in North would not arise in the case of quotas, while it does in the case of taxes for some trade costs. This indicates that the permit price is always lower than the corresponding tax rate t (and \(\bar{{q}}\)) in equilibrium.

By contrast, Copeland (1996) imposes a tax on imports without refunding taxes to domestic exporters.

References

Baldwin R, Forslid R, Martin P, Ottaviano G, Robert-Nicoud F (2003) Economic geography and public policy. Princeton University Press, Princeton

Barbier EB (1997) An introduction to the environmental Kuznets curve special issue. Environ Econ Dev 2:369–381

Becker R, Henderson V (2000) Effects of air quality regulations on polluting industries. J Polit Econ 108:379–421

Burniaux J, Martins JO (2000) Carbon emission leakages: a general equilibrium view. OECD Economics Department Working Papers, No. 242, OECD Publishing

Brunel C, Levinson A (2013) Measuring environmental regulatory stringency. OECD Trade and Environment Working Papers, 2013/05, OECD Publishing

Cai H, Chen Y, Gong Q (2016) Polluting thy neighbor: unintended consequences of China’s pollution reduction mandates. J Environ Econ Manag (forthcoming)

Cole MA, Elliott RJ (2003) Determining the trade-environment composition effect: the role of capital, labor and environmental regulations. J Environ Econ Manag 46(3):363–383

Cole MA, Elliott RJ (2005) FDI and the capital intensity of “dirty” sectors: a missing piece of the pollution haven puzzle. Rev Dev Econ 9(4):530–548

Cole MA, Elliott RJ, Fredriksson PG (2006) Endogenous pollution havens: does FDI influence environmental regulations? Scand J Econ 108(1):157–178

Cole MA, Elliott RJR, Okubo T (2010) Trade, environmental regulations and industrial mobility: an industry-level study of Japan. Ecol Econ 69(10):1995–2002

Cole MA, Elliott RJR, Okubo T (2014) International environmental outsourcing. Rev World Econ 150:639–664

Cole MA, Elliott RJR, Shimamoto K (2005) Industrial characteristics, environmental regulations and air pollution: an analysis of the UK manufacturing sector. J Environ Econ Manag 50(1):121–143

Copeland BR (1996) Pollution content tariffs, environmental rent shifting, and the control of cross-border pollution. J Int Econ 40(3):459–476

Copeland B, Taylor MS (1995) Trade and the environment: a partial synthesis. Am J Agric Econ 77:765–771

Copeland B, Taylor MS (2005) Free trade and global warming: a trade theory view of the Kyoto protocol. J Environ Econ Manag 49:205–234

Dean JM, Lovely ME, Wang H (2009) Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. J Dev Econ 90(1):1–13

Duvivier C, Xiong H (2013) Transboundary pollution in China: a study of polluting firms’ location choices in Hebei province. Environ Dev Econ 18(04):459–483

Ederington J, Levinson A, Minier J (2005) Footloose and pollution-free. Rev Econ Stat 87(1):92–99

Elbers C, Withagen C (2004) Environmental policy, population dynamics and agglomeration. Contrib Econ Anal Policy 3(2):3

Elliott J, Foster I, Kortum S, Munson T, Cervantes FP, Weisbach D (2010) Trade and carbon taxes. Am Econ Rev 100(2):465–469

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70:1–23

Felder S, Rutherford TF (1993) Unilateral CO reductions and carbon leakage: the consequences of international trade in oil and basic materials. J Environ Econ Manag 25:162–176

Forslid R, Okubo T, Sanctuary M (2013) Trade, transboundary pollution and market size. CEPR Discussion Paper, 9412

Fredriksson PG, List JA, Millimet DL (2003) Bureaucratic corruption, environmental policy and inbound US FDI: theory and evidence. J Public Econ 87(7–8):1407–1430

Greenstone M (2002) The impacts of environmental regulations on industrial activity: evidence from the 1970 and 1977 clean air act amendments and the census of manufactures. J Polit Econ 110:1175–1219

Gurtzgen N, Rauscher M (2000) Environmental policy, intra-industry trade and trans-frontier pollution. Environ Resour Econ 17(1):59.71

Helm D, Hepburn C, Ruta G (2012) Trade, climate change, and the political game theory of border carbon adjustments. Oxf Rev Econ Policy 28(2):368–394

Henderson JV (1996) Effects of air quality regulation. Am Econ Rev 86:789–813

Ishikawa J, Kiyono K (2000) International trade and global warming. CIRJE Discussion Paper Series, CIRJE-F-78. Faculty of Economics, University of Tokyo

Ishikawa J, Kiyono K (2006) Greenhouse-gas emission controls in an open economy. Int Econ Rev 47:431–450

Ishikawa J, Kiyono K, Yomogida M (2012) Is emission trading beneficial? Jpn Econ Rev 63:185–203

Ishikawa J, Okubo T (2008) Greenhouse-gas emission controls and international carbon leakage through trade liberalization. CCES Discussion Paper Series No. 3, Hitotsubashi University

Ishikawa J, Okubo T (2011) Environmental product standards in north–south trade. Rev Dev Econ 15:458–473

Jakob M, Marschinski R, Hübler M (2013) Between a rock and a hard place: a trade-theory analysis of leakage under production-and consumption-based policies. Environ Resour Econ 56(1):47–72

Jaffe AB, Peterson SR, Portney PR, Stavins RN (1995) Environmental regulations and the competitiveness of U.S. manufacturing: what does the evidence tell us? J Econ Lit 33:132–163

Javorcik BS, Wei S-J (2004) Pollution havens and foreign direct investment: dirty secret or popular myth? Contrib Econ Anal Policy 3(2):8

Keller W, Levinson A (2002) Pollution abatement costs and foreign direct investment inflows to U.S. states. Rev Econ Stat 84(4):691–703

Kiyono K, Ishikawa J (2004) Strategic emission tax-quota non-equivalence under international carbon leakage. In: Ursprung H, Katayama S (eds) International economic policies in a globalized world. Springer, Berlin, pp 133–150

Kiyono K, Ishikawa J (2013) Environmental management policy under international carbon leakage. Int Econ Rev 54:1057–1083

Levinson A, Taylor MS (2008) Unmasking the pollution haven effect. Int Econ Rev 49:223–254

List JA, Millimet DL, Fredriksson PG, McHone WW (2003) Effects of environmental regulations on manufacturing plant births: evidence from a propensity score matching estimator. Rev Econ Stat 85:944–952

Markusen JR, Morey ER, Olewiler ND (1993) Environmental policy when market structure and plant locations are endogenous. J Environ Econ Manag 24:69–86

Markusen J, Morey E, Olewiler N (1995) Competition in regional environmental policies when plant locations are endogenous. J Public Econ 56:55–77

Martin P, Rogers CA (1995) Industrial location and public infrastructure. J Int Econ 39:335–351

Mattoo A, Subramanian A, van der Mensbrugghe D, He J (2013) Trade effects of alternative carbon border-tax schemes. Rev World Econ 149:587–609

Nordhaus W (2015) Climate clubs: overcoming free-riding in international climate policy. Am Econ Rev 105(4):1339–1370

Pflüger M (2001) Ecological dumping under monopolistic competition. Scand J Econ 103:689–706

Pethig R (1976) Pollution, welfare, and environmental policy in the theory of comparative advantage. J Environ Econ Manag 2:160–169

Rauscher M (1995) Environmental regulation and the location of polluting industries. Int Tax Public finance 2:229–244

Ulph A, Valentini L (2001) Is environmental dumping greater when plants are footloose? Scand J Econ 103:673–688

Venables AJ (2001) Economic policy and the manufacturing base: hysteresis in location. In: Ulph A (ed) environmental policy, international agreements, and international trade. OUP, Oxford

Zeng D, Zhao L (2009) Pollution havens and industrial agglomeration. J Environ Econ Manag 58(2):141.153

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to Richard Baldwin, Masahisa Fujita an anonymous referee and an editor for their helpful comments and suggestions. This research is supported by Japan Society for Promotion of Science KAKENHI. Any remaining errors are our own responsibility.

Appendices

Appendix 1

In this appendix, we prove Proposition 2. First, note that the relocation of firms from North to South under trade liberalization means \(\frac{dn}{d\phi }<0\) and \(\frac{dm}{d\phi }<0\).

Differentiating global emissions in sector C with respect to \(\phi \), we can derive

where \(B_C \equiv \frac{s}{\Delta _C }\) and \(B_C ^{*}\equiv \frac{1-s}{\Delta _C ^{*}}\). We now focus on emissions by C-sector firms. D-sector is isomorphic. Here we omit subscript “C” for simplicity.

The first term can be rewritten as

where \(T_C \equiv (1+t)^{-\sigma }\). The second term can be given as \(\frac{d\chi ^{W}}{d\phi }=nB^{*}T_C +(1-n)B\). The third and fourth terms are

where \(\tilde{T}\equiv (1+t)^{1-\sigma }>T_C \).

Then we can reorganize the above four terms into the following three parts. The first and second parts are given as

where \(\alpha \equiv \frac{nT_C +(1-n)\phi }{n\tilde{T}+(1-n)\phi }<1\) and \(\beta \equiv \frac{n\phi T_C +(1-n)}{n\phi \tilde{T}+(1-n)}<1\). This is because \(\tilde{T}>T_C \quad T_C -\alpha \tilde{T}=\frac{(1-n)\phi (T_C -\tilde{T})}{n\tilde{T}+(1-n)\phi }<0\) and \(T_C -\beta \tilde{T}=\frac{(1-n)(T_C -\tilde{T})}{n\phi \tilde{T}+(1-n)}<0\). The third part is given by

Note that B\(>\)B* and \(\Delta <\Delta ^{*}\). Since all of these three parts are positive and the same is true for D-sector, \(\frac{d\chi ^{W}}{d\phi }>0\) always holds when \(\frac{dn}{d\phi }<0\).

Appendix 2

In this appendix, we prove Proposition 4. South emissions are given by\(\chi ^{*}=(1-n)(\phi B_C +B_C ^{*})+(1-m)(\phi B_D +B_D ^{*})\). Differentiating South emissions with respect to \(\phi \), we get

Note that \(\frac{d\chi ^{*}}{dn}<0\) and \(\frac{d\chi ^{*}}{dm}<0\).

Now we consider two extreme cases, (i) the bifurcation point and (ii) free trade.

1.1 At the Bifurcation Point

Note that in the following, we consider D-sector only, because C-sector is in isomorphic expression. First of all, we prove \(\frac{dm}{dq}<0\). We can derive

where \(Q\equiv (1+\gamma q)^{1-\sigma }\) and \(\frac{dQ}{dq}<0\). At the bifurcation point, as discussed in main text, the permit price is zero, i.e. Q=1, \(\frac{dm}{dq}=\left( {\frac{\phi }{(1-\phi )^{2}}} \right) \frac{dQ}{dq}<0\). Since the bifurcation point is assumed to be small (i.e., \(\phi ^{B}\) is assumed to be small), \(\frac{dm}{dq}\) is close to zero. In the same manner, we can derive \(\frac{dn}{dq}<0\) which is close to zero. Next, we prove \(\frac{dm}{d\phi }>0\). With Q=1, we have

Thus, \(\frac{dm}{d\phi }>0\) always holds. \(\frac{dn}{d\phi }>0\) for sector C can be derived in the same manner. Using these results, we have

Then the other three terms for D-sector are given as\((1-m)B_D \),

and \(\frac{d\chi ^{*}}{dB_D ^{*}}\left( {\frac{dB_D ^{*}}{d\Delta _D ^{*}}\left( {\frac{d\Delta _D ^{*}}{d\phi }+\frac{d\Delta _D ^{*}}{dm}\frac{dm}{d\phi }+\frac{d\Delta _D ^{*}}{dm}\frac{dm}{dq}\frac{dq}{d\phi }} \right) } \right) \cong \frac{d\chi ^{*}}{dB_D ^{*}}\left( {\frac{dB_D ^{*}}{d\Delta _D ^{*}}\left( {\frac{d\Delta _D ^{*}}{d\phi }+\frac{d\Delta _D ^{*}}{dm}\frac{dm}{d\phi }} \right) } \right) \)

The last term can be decomposed as \(\frac{d\chi ^{*}}{dB_D ^{*}}\left( {\frac{dB_D ^{*}}{d\Delta _D ^{*}}\frac{d\Delta _D ^{*}}{d\phi }} \right) <0\) and \(\frac{d\chi ^{*}}{dB_D ^{*}}\left( {\frac{dB_D ^{*}}{d\Delta _D ^{*}}\frac{d\Delta _D ^{*}}{dm}\frac{dm}{d\phi }} \right) =(1-m)\frac{B^{*}}{\Delta ^{*}}(1-Q\phi )\frac{dm}{d\phi }>0\). Here the subscript “D” is omitted for simplicity.

Now we combine two parts \(\frac{d\chi ^{*}}{dB^{*}}\left( {\frac{dB^{*}}{d\Delta ^{*}}\frac{d\Delta ^{*}}{dm}\frac{dm}{d\phi }} \right) >0\) and \(\frac{d\chi ^{*}}{dm}\left( {\frac{dm}{d\phi }} \right) <0\). Then we finally get\(\left( {\frac{d\chi ^{*}}{dB^{*}}\frac{dB^{*}}{d\Delta ^{*}}\frac{d\Delta ^{*}}{dm}+\frac{d\chi ^{*}}{dm}} \right) \left( {\frac{dm}{d\phi }} \right) =\left( {(1-m)\frac{B^{*}}{\Delta ^{*}}(1-Q\phi )-(\phi B+B^{*})} \right) \frac{dm}{d\phi }<0\)

because \(\frac{(1-m)(1-Q\phi )}{\Delta ^{*}}<1\).

Next, the remaining parts are combined as

The same is true for C-sector. Thus, we can conclude that \(\frac{d\chi ^{*}}{d\phi }<0\) always holds at the bifurcation point.

1.2 Free Trade

To examine the case of free trade, we first show that the permit price is hump-shaped in \(\phi \). The hump-shaped permit price indicates that \(\frac{dq}{d\phi }\) is first positive, then negative and finally goes to zero at \(\phi =1\). It is obvious that \(\frac{dq}{d\phi }>0\) when quota is binding at the bifurcation point. Thus, here we prove \(\lim _{\phi \rightarrow 1} \frac{dq}{d\phi }=-0\). Defining the quota constraint (15) as a function F, we differentiate (15) with respect to q:

where \(\Omega \equiv (1+\gamma q)^{-\sigma }\left( {B+\phi B^{*}} \right) \). Note that the first term is from North emissions by C-firms, \(\frac{1}{1+q}\).

C-firms already concentrate in North at the sustain point and trade cost reduction at\(\phi \)=1 does not influence C-firms’ location. The change of the permit price affects only total C-firm emissions. Setting m=0, we can get \(\frac{dF}{dq}=-\frac{1}{(1+q)^{2}}<0\) and \(\lim \limits _{m\rightarrow +0} \frac{dF}{dq}=-\frac{1}{(1+q)^{2}}<0\). Likewise we derive

and \(\lim \limits _{m\rightarrow +0} \frac{dF}{d\phi }=0\). Using \(\frac{dq}{d\phi }=-\frac{\frac{dF}{d\phi }}{\frac{dF}{dq}}\), we obtain \(\frac{dq}{d\phi }<0\) and \(\lim \limits _{\phi \rightarrow 1} \frac{dq}{d\phi }=-0\).

Since all C-sector firms already concentrate in North at the sustain point, the marginal change of trade costs at \(\phi \)=1 affects only D-sector firms. Thus, the differentiation in terms of\(\phi \)is only for D-sector firms:

where the subscript “D” is omitted. We now prove \(\frac{dm}{d\phi }<0\).

Note that \(2Q(1-s)\phi -1<0\). Keeping \(Q>\phi \), as Q and \(\phi \) converge to one, we can get \(Q(s+(1-s)\phi ^{2})-\phi \cong \phi (s+(1-s)\phi ^{2})-\phi <0\). Thus, we have \(\frac{dm}{d\phi }<0\). Using these results, we can derive \(\frac{d\chi ^{*}}{dm}\left( {\frac{dm}{d\phi }+\frac{dm}{dq}\frac{dq}{d\phi }} \right) =\frac{d\chi ^{*}}{dm}\left( {\frac{dm}{d\phi }} \right) >0\).

Then, converging Q and \(\phi \) to one, we can simplify other terms:

The last term is (1-m)B = B\(>\)0. Based on all of these results, \(\frac{d\chi ^{*}}{d\phi }>0\) always holds at \(\phi \)=1.

Rights and permissions

About this article

Cite this article

Ishikawa, J., Okubo, T. Greenhouse-Gas Emission Controls and Firm Locations in North–South Trade. Environ Resource Econ 67, 637–660 (2017). https://doi.org/10.1007/s10640-015-9991-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-015-9991-0