Abstract

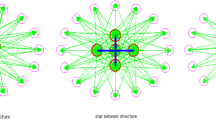

This article is particularly concentrated on measuring systemic risk based on network topology of bilateral exposures and obligations specifically for the sectoral level of global banking systems in 2010. Financial network models based on financial exposures are models that aim to depict causal chains of exposures and obligations of counterparties rather than rely solely on statistical correlations on market price-based data for financial institutions. Our starting point is the bilateral claims of the ultimate risk of the main institutional sectors that include banks, non-bank private sectors and non-allocated sectors of the 10 reporting countries that consist of Belgium, France, Germany, Italy, Japan, Spain, Switzerland, Turkey, the United Kingdom and the United States of America. The other non-reporting countries will be merged into one group. The results show that banking systems in countries such as the United States and the United Kingdom in particular are making vast amounts of foreign investments, implying that they constitute a central hub in the core. The results in the contagion effect show that all of the other countries are collapsed after a shock from a core country such as the United Kingdom in both rates of loss given defaults of 100 and 60 %.

Similar content being viewed by others

Notes

We adjust the amounts to be in 2005 US dollars by using the U.S. Department of Labor Bureau of Labor Statistics Consumer Price Index (CPI). We take the average of annualised monthly index values rather than using the year-end index values in order to capture the inherent structure of flows.

Newman (2010, p. 237) suggests that the majority of the social, information, technological and biological networks are scale-free networks such that the exponent \(\alpha \) ranges between 2 and 3. For instance, the exponent for networks such as the World Wide Web, film actors and telephone calls are 2.5, 2.3 and 2.1, respectively.

In this research, the condition that \(k_{\min }\) is greater than \(3^{\prime \prime }\) is satisfied for all networks during 2010.

For the proof, pls. see pp. 346 and 347 of Newman (2010).

We follow the same method of Degryse et al. (2010) for the calculation of a banking system aggregate equity. Additionally, we prefer to use consolidated accounting statements if they are available. On the other hand, we prefer to use accounting statements based on International Financial Reporting Standards (IFRS).

References

Acharya et al. (2010). Measuring systemic risk. Federal reserve bank of Cleveland. 1002 working paper.

Allen, F., & Gale, d. (2000). Financial Contagion. Journal of Political Economy, 108, 1–33.

Andrian, T., & Brunnermeier, M.K. (2009). CoVar. Federal Reserve Bank of New York Staff Reports 348.

Babus, A. (2007). The formotion of financial networks. Discussion paper 06-093. Tinbergen Institute.

Bank for International Settlements. (2012a). Guidelines to the international consolidated banking statistics. Basel, June

Barabasi, A. L., & Albert, R. (1996). Emergence of sealing in random networks. Science, 286, 508–512.

Bech, M., & Atalay, E. (2008). The topology of the Federal funds market. Federal Reserve Bank of New York: Staff report, no. 354.

Blåvarg, M., & Nimander, P. (2002). Interbank exposures and systemic risk. In Risk measurement and systemic risk. Bank for International Settlements, Basel.

Borio & Drehmann. (2009). Towards an operational framework for financial stability: “ fuzzy” measurement and its consequences. Central Bank of Chile Working Papers.

Borio, C. (2003a). Towards a macroprudential framework for financial supervision and regulation? CESifo Economic Studies, 49, 181–216.

Boss et al. (2003). The network topology of the interbank market. arXiv:cond-mat/0309582v1. Accessed 25 Sept 2003.

Boss, et al. (2004). The network topology of the interbank, Oesterreichische Nationalbank. Financial Stability Review, 7, 84–95.

Buiter, W. (2009). The unfortunate uselessness of most ‘state of the art’ academic monetary economics. www.voxeu.org/index.php?q=node/3210. Accessed 3 May 2013.

Castren, O., & Rancan, M. (2013). Macro-networks: an application to Euro Area Finance Accounts. ECB Working Paper Series.

Chan, J. A. (2010). Balance sheet network analysis of too-connected-to-fail risk in global and domestic banking systems. IMF working paper. 10/107 (Washington: International Monetary Fund).

Colander, & Howitt, (2008). Beyond DSGE models. Towards an empirically based macroeconomics papers and proceedings of the American Economic Association. American Economic Review, 98(2), 236–240.

Cont et al. (2010). Network structure and systemic risk in banking systems. Available from SSRN; http://ssrn.com/abstract=1733528.

Craig, B., & von Peter, G. (2010). Interbank Tiering and money center banks. BIS working paper 322.

De Masi, G., Iori, G., Caldarelli, G. (2006). A Fitness model for the interbank money market. Physical Review E, 74, 066112.

Degryse, H., et al. (2009). Cross-border exposures and financial contagion. European Banking Sector Discussion Paper 2009-02.

Degryse, et al. (2007). Interbank exposures: An empirical examination of systemic risk in the Belgian Banking System. International Journal of Central Banking, 3, 23–172.

Degryse, H., Elahi, M. A., & Penas, M. F. (2010). Cross-border exposures and financial contagion. International Review of Finance, 10(2), 209–240.

Eichengreen, B. (2010). Globalization and the crisis. Institute of Economic Research University of Munich CES ifo Forum Journal, 11(3), 20–24.

Elsinger, H. A. L., & Summer, M. (2006). Risk assessment for banking systems. Management Science, 52(9), 1301–1314.

Erdös, P., & Renyi, A. (1959). On Random graphs, I. Publicationes Mathematicae (Debrecen), 6, 290–297.

Fagiolo, G., et al. (2010). The evolution of the world trade web: A weighted network analysis. Journal of Evolutionary Economics, 20(4), 479–514.

Furfine, C. H. (2003). Interbank exposures: Quantifying the risk of contagion. Journal of Money, Credit and banking, 35(1), 111–125.

Gauthier, C. et al. (2010). Macroprudential regulation and systemic capital requirements. Working Papers 10-4, Bank of Canada.

Hattori, M., & Suda, Y. (2007). Developments in a cross-border bank exposure network. Bank of Japan Working Paper: 07-21.

Ielyveld, Van, & Liedorp, F. (2006). Interbank Contagion in the Dutch banking sector: A sensitivity analysis. International Journal of Central Banking, 2, 99–133.

Kiyotaki, N., & Moore, J. (1997). Credit cycles. Journal of Political Economy, 105, 211–248.

Laeven, L. & Valencia, F. (2008). Systemic Banking Crisis: A New Database. IMF Working Paper, No.08/224.

Leitner, Y. (2005). Financial networks: Contagion, commitment, and private sector bailouts. Journal of Finance, 60(6), 2925–2953.

Lelyveld, I. & Liedorp, F. (2004) Interbank Contagion in the Dutch Banking Sector. DNB Working Paper No. 5, 1–31.

Lelyveld, I., & Liedorp, F. (2006). Interbank Contagion in the Dutch banking sector: A sensitivity analysis. International Journal of Central Banking, 2(2), 99–133.

Lublóy, A. (2005). Domino effect in the Hungarian interbank market. Hungarian Central Bank Working Paper: 2004–10.

Markose & Goktan, (2013). Euro-Zone cross border banking flows and Soverign Contagion: A network analysis. PhD Thesis University of Essex.

Markose, S. M. (2011). Multi-Agent Financial Modelling and Complexity Approachto Systemic Risk Monitoring for G10 and BRICs: A Post 2007 Perspective. Talk given at Reserve Bank of India, Financial Stability Unit, August 2010.

Markose, S. M. (2012). Systemic risk from global financial derivatives: A network analysis of Contagion and Its mitigation with super-spreader tax. IMF Working Paper, No.12/282.

Markose, S. M. (2013). Systemic risk analytics: A data driven multi-agent financial network (MAFN) approach. Journal of Banking Regulation, 14(3/4), 285–305.

McGuire, P. & Wooldridge, P. (2005). The BIS consolidated banking statistics: structure, uses and recent enhancements. BIS Quarterly Review. http://www.bis.org/publ/qtrpdf/r_qt0509f.pdf

McGuire, P., & Wooldridge, P. (2005). The BIS Consolidated banking statistics: structure, uses and recent enhancements. BIS Quarterly Review.

Milgram, S. (1967). The small world problem. Psycology Today., 2, 60–67.

Minoiu & Reyes. (2011). A network analysis of global banking: 1978–2009. IMF Working Paper. WP/11/74.

Minoiu, C. & Reyes, J.A. A network analysis of global banking: 1978–2009. IMF Working Paper, WP/11/74.

Minsky, H. P. (1982). Can ‘it’ happen again? Essays on Instability and Finance, Armonk: M.E. Sharpe.

Mistrulli, P. E. (2011). Assessing Financial Contagion in the Interbank market: Maximum entropy versus Observed interbank lending patterns. Journal of banking and Finance, 35, 114–1127.

Newman M. E. J. (2003). Random graphs as models of networks. Santa Fe Institue, 1399 Hyde Park Road, Santa Fe, NM 87501, USA.

Newman, Me E J. (2010). Networks: an introduction. Oxford: Oxford University Press.

Nier, et al. (2007). Network models and financial stability. Journal of Economic Dynamic and Control, 31, 2033–2060.

Pool, I. S., & Kochen, M. (1978). Contacts and influence. Social Networks, 1, 5–51.

Provan, K. G., & Milward, H. B. (2001). Do networks really work? A framework for evaluating public-sector organizational networks. Public Administration Review, 61(4), 414–423.

Rochet, J., & Tirole, J. (1996). Interbank lending and systemic risk. Journal of Money, Credit and Banking, 28, 33–62.

Sheldon, G., & Maurer, M. (1998). Interbank lending and systemic risk: An empirical analysis for Switzerland. Swiss Journal of Economics and Statistics, 134(4.2), 685–704.

Sinha, S., et al. (2005). Complexity vs Stability in small world networks. Physical A (Amsterdam)., 346, 147–153.

Sinha, S. (2010). Are large complex economic systems unstable ? Science and Culture (Special Issue on Econophysics), 76, 454–458.

Tannuri, M. (2006). Contagion in the Brazilian interbank currency exchange market. Est. econ., São Paulo, 36(2), 251–262. ABRIL-JUN HO 2006.

Tesfatsion, L., & K. L., Judd. (2006) Handbook of Computational Economics, Volume 2: Agent-based Computational Economics. Handbook in Economics Series, Amsterdam: North-Holland.

Toivanen, M. (2009). Financial Interlinkages and risk of contagion in the Finnish Interbank Market. Discussion paper 6/2009. Bank of Finland.

Upper, C. (2007). Using Counter Factors Simulations to access the danger of contagion in interbank markets. BIS Working Paper. No. 234, Basel.

Upper, C., & Worms, A. (2004). Estimating bilateral exposures in the German Interbank Market. Is there a danger of contagion? European Economic Review, 48, 827–849.

Watts, D. (1999). Small worlds. Princeton: Princeton University Press.

Watts, D. J., & Strogatz, S. H. (1998). Collective dynamic of small-world networks. Nature, 393, 440–442.

Wells, S. (2004). UK Interbank exposures: Systemic risk implications. Journal of monetary economics, 2, 66–77.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Said, F.F. Global Banking on the Financial Network Modelling: Sectorial Analysis. Comput Econ 49, 227–253 (2017). https://doi.org/10.1007/s10614-015-9556-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-015-9556-x