Abstract

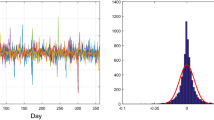

Inspired by the analysis of the limit order book and order flows in the order-driven model of Chiarella et al. this paper conducts a dynamic analysis of a microstructure model and discusses the origin of price fluctuations. Agents are assumed to use either a fully fundamental-value reversion or a trend following strategy to form their expectation of future asset returns. Furthermore, the probability of changing strategies and the parameters for the strategy are chosen based on a fitness measure. In this way, the agents’ strategy choices are better related to the evolution of the market. We also add a layer of intraday activity. This model can obtain the results of the original model, such as the impacts of the traders’ strategy and the stylized facts. Furthermore, we exhibit many empirically observed features in both the intraday and the daily horizon. The results provide evidence that the agents’ expectations and trading volume can generate large daily price changes and that intraday price fluctuations can be caused by large trading size or liquidity fluctuations in different conditions.

Similar content being viewed by others

References

Bouchaud, J., & Potters, M. (2000). Theory of financial risks: From statistical physics to risk management. Cambridge: Cambridge University Press.

Chiarella, C., & Iori, G. (2002). A simulation analysis of the microstructure of double auction markets. Quantitative Finance, 2(5), 346–353.

Chiarella, C., He, X., & Pellizzari, P. (2011). A dynamic analysis of the microstructure of moving average rules in a double auction market. Macroeconomic Dynamics, 16, 556–575.

Chiarella, C., Iori, G., & Perelló, J. (2009). The impact of heterogeneous trading rules on the limit order book and order flows. Journal of Economic Dynamics and Control, 33(3), 525–537.

Farmer, J. D., Gillemot, L., Lillo, F., Mike, S., & Sen, A. (2004). What really causes large price changes? Quantitative Finance, 4(4), 383–397.

Gabaix, X., Gopikrishnan, P., Plerou, V., & Stanley, H. E. (2003). A theory of power-law distributions in financial market fluctuations. Nature, 423(6937), 267–270.

Gillemot, L., Farmer, J. D., & Lillo, F. (2006). There’s more to volatility than volume. Quantitative Finance, 6(5), 371–384.

Lo, A. W. (1991). Long-term memory in stock market prices. Econometrica, 59(5), 1279–1313.

Mike, S., & Farmer, J. D. (2008). An empirical behavioral model of liquidity and volatility. Journal of Economic Dynamics and Control, 32(1), 200–234.

Pagan, A. (1996). The econometrics of financial markets. Journal of Empirical Finance, 3(1), 15–102.

Plerou, V., Gopikrishnan, P., & Stanley, H. E. (2005). Quantifying fluctuations in market liquidity: Analysis of the bid-ask spread. Physical Review E, 71, 46131.

Raberto, M., Cincotti, S., Focardi, S. M., & Marchesi, M. (2001). Agent-based simulation of a financial market. Physica A: Statistical Mechanics and its Applications, 299(1–2), 319–327.

Slanina, F. (2008). Critical comparison of several order-book models for stock-market fluctuations. The European Physical Journal B: Condensed Matter and Complex Systems, 61, 225–240.

Acknowledgments

We wish to thank Xuezhong He and Youwei Li for useful comments and discussions, and anonymous referees for helpful comments. None of the above is responsible for any of the errors in this paper. This work was supported by the Fundamental Research Funds for the Central Universities under Grant No. 2012LZD01 and the National Science Foundation of China under Grant No.70871013.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ji, M., Li, H. Exploring Price Fluctuations in a Double Auction Market. Comput Econ 48, 189–209 (2016). https://doi.org/10.1007/s10614-015-9520-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-015-9520-9