Abstract

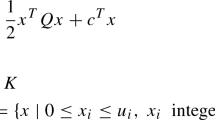

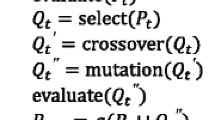

The NP-hard nature of cardinality constrained mean-variance portfolio optimization problems has led to a number of different algorithms with varying degrees of success in reaching optimality given limited computational resources and under the presence of strict time constraints present in practice. The proposed local relaxation algorithm explores the inherent structure of the objective function. It solves a sequence of small, local, quadratic-programs by first projecting asset returns onto a reduced metric space, followed by clustering in this space to identify sub-groups of assets that best accentuate a suitable measure of similarity amongst different assets. The algorithm can either be cold started using a suitable heuristic method such as the centroids of initial clusters or be warm started based on the last output. Results, using a basket of up to 3,000 stocks and with different cardinality constraints, indicates that the proposed algorithm can lead to significant performance gain over popular branch-and-cut methods. One key application of this algorithm is in dealing with large scale cardinality constrained portfolio optimization under tight time constraint, such as for the purpose of index tracking or index arbitrage at high frequency.

Similar content being viewed by others

Notes

Here we assume columns of R have zero mean.

The center-of-gravity is defined in the usual sense by assigning a weight of one to each asset on the projected space

In the sense of larger distance measure from the cluster centroid assets.

Note a cluster center is simply a point in the projected space, and does not necessarily coincide with any projected asset returns in this space.

References

Bienstock, D.: Computational study of a family of mixed-integer quadratic programming problems. Math. Program. 74, 121–140 (1995)

Chang, T.-J., Meade, N., Beasley, J.E., Sharaiha, Y.M.: Heuristics for cardinality constrained portfolio optimisation. Comput. Oper. Res. 27(13), 1271–1302 (2000)

Clausen, J.: Branch and bound algorithms—principles and examples (2003)

Dakin, T.J.: A tree-search algorithm for mixed integer programming problems. Comput. J. 8(3), 250–255 (1965)

Goldfarb, D., Idnani, A.: Dual and primal-dual methods for solving strictly convex quadratic programs. In: Numerical Analysis. Springer, Berlin (1982)

Hansen, P.R., Huang, Z., Shek, H.H.: Realized GARCH: a joint model for returns and realized measures of volatility. J. Appl. Econom. (2011). doi:10.1002/jae.1234. ISSN 1099-1255

Hastie, T., Tibshirani, R., Friedman, J. (eds.): The Elements of Statistical Learning: Data Mining, Inference, and Prediction. Springer Series in Statistics. Springer, Berlin (2003)

Hosrt, R., Pardalos, P.M. (eds.): Handbook of Global Optimization. Kluwer Academic, Norwel (1995)

IBM: IBM ILOG CPLEX optimization studio V12.2 documentation. IBM ILOG (2010)

Konno, H, Yamamoto, R: Integer programming approaches in mean-risk models. Comput. Manag. Sci. 2(4), 339–351 (2005). doi:10.1007/s10287-005-0038-9

Konno, H., Yamazaki, H.: Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Manag. Sci. 37(5), 519–531 (1991)

Land, A.H., Doig, A.G.: An automatic method of solving discrete programming problems. Econometrica 28(3), 497–520 (1960)

Leyffer, S.: Integrating SQP and branch-and-bound for mixed integer nonlinear programming. Comput. Optim. Appl. 18(3), 295–309 (2001)

Loraschi, A., Tettamanzi, A., Tomassini, M., Verda, P.: Distributed genetic algorithms with an application to portfolio selection. In: Artificial Neural Nets and Genetic, pp. 384–387. Springer, Berlin (1995)

Markowitz, H.M.: Portfolio selection. J. Finance 7, 77–91 (1952)

Markowitz, H.M. (ed.): Mean-Variance Analysis in Portfolio Choice and Capital Markets. Blackwell, Oxford (1987)

Murray, W., Shanbhag, V.V.: A local relaxation method for nonlinear facility location problems. Multiscale Optim. Methods Appl. 82, 173–204 (2006)

Murray, W., Shanbhag, U.V.: A local relaxation approach for the siting of electrical substation. Comput. Optim. Appl. 38(3), 299–303 (2007)

Perold, A.F.: Large scale portfolio optimization. Manag. Sci. 30(10), 1143–1160 (1984)

Shaw, D.X., Liu, S., Kopman, L.: Lagrangian relaxation procedure for cardinality-constrained portfolio optimization. Optim. Methods Softw. 23(3), 411–420 (2008)

Shek, H.H.: Modeling high frequency market order dynamics using self-excited point process. Working paper, Stanford University (2010)

Shek, H.H.: Statistical and algorithm aspects of optimal portfolios. PhD thesis (2010)

Yitzhaki, S.: Stochastic dominance, mean variance, and Gini’s mean difference. Am. Econ. Rev. 72(1), 178–185 (1982)

Acknowledgements

We thank the referees for their careful reading of the manuscript and for prompting us to improve the clarity of the presentation.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Murray, W., Shek, H. A local relaxation method for the cardinality constrained portfolio optimization problem. Comput Optim Appl 53, 681–709 (2012). https://doi.org/10.1007/s10589-012-9471-1

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10589-012-9471-1