Abstract

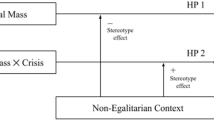

Although non-profit organisations typically have high representation of females on their boards, relatively little is known about the effects of gender diversity in these organisations particularly in relation to financial management. In this archival study, resource dependency theory and agency analysis are combined to provide theoretical insight and empirical analysis of gender diversity on effective financial management in member-governed, community financial institutions. The investigation is possible due to the unique characteristics of the organisational form and region being examined—credit unions in Northern Ireland. The sector has not been subject to external regulation on board gender, yet a wide array of gender mix on boards ranging from 100 % male to 100 % female are in existence. In addition, effective financial management is crucial to their survival and their ability to meet member objectives. Boards with higher female representation exhibit superior financial management first, in respect of loan book quality in the period of austerity following the financial crisis and second when measured against return on assets.

Similar content being viewed by others

Notes

Proxies used to capture non-profit performance in prior empirical studies include objective and subjective measures. Objective measures are typically financial ratios that are proxies for the board’s ability to obtain resources; such as growth in budget (Bradshaw et al. 1992, 1996), size of budget deficit (Bradshaw et al. 1992, 1996), the efficient use of resources, such as an average administration to revenue ratio (Siciliano 1996), a total operating expenses to total revenue ratio (Reddy et al. 2013) or social spend, such as growth in contributions (Callen et al. 2010). Subjective measures of performance typically are third party assessments of the performance of the board (Cornforth 2012; Bradshaw et al. 1992).

Some empirical studies report a positive association between gender diversity and financial performance (Luckerath-Rovers 2013; Andrés-Alonso et al. 2009; Adams and Ferreira 2009; Carter et al. 2003), others a negative (Shrader et al. 1997) or no relation (Ali et al. 2014; Carter et al. 2010; Rose 2007; Farrell and Hersch 2005).

Reddy et al. (2013) do not disclose information on the %WOB, opting to report absolute numbers. The mean number of women on the board is 2.4 (mean board size is 7). The minimum is 0 woman and the greatest number of women present on any board is 11 (overall board size ranges from 2 to 25). Hartarska and Nadolnyak’s study covered a sample of 393 observations from 140 community development loan funds in the US. The mean %WOB was 37.5 %, the minimum was 0 and the maximum was 83 %.

Themudo (2009) reports that this pattern is only relevant in countries, such as the US, where women are more empowered to act in public affairs.

The World Council for Credit Unions provide guidance on good corporate governance and emphasise ‘Balance’. Consistent with RDT the guidance states that ‘credit unions should strive for a board that responds to the demands of the general membership. By creating a board in this manner, members are more likely to feel that they have a voice on the board and are more likely to feel a stronger connection with the credit union. … The composition of the board should aim to reflect the demographic makeup of its members and the financial needs of members. By creating a board that reflects the age, gender and ethnic background of the credit union, the desires of the general assembly can more easily be developed by directors’. The guidance goes on to state that ‘although diversity is an important component of board makeup, financial or strategic experience should also play a part. Members with a strong financial background have a great deal to contribute to the development of the institution’ (Niederkohr and Ikeda 2005, p. 7).

In some countries, such as Canada and Australia, the board of directors in the larger credit unions now receive payment.

In 19 of the 1490 observations the boards are all female. In 78 instances over 80 % of the directors on boards are female.

References

Adams, R., & Ferreira, D. (2007). A theory of friendly boards. Journal of Finance, 62, 217–250.

Adams, R., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94(2), 291–309.

Adams, R., Hermalin, B., & Weisbach, M. (2010). The role of boards of directors in corporate governance: A conceptual framework and survey. Journal of Economic Literature, 48, 58–107.

Adams, R., de Haan, J., Terjesen, S., & van Ees, H. (2015). Board diversity: Moving the field forward. Corporate Governance: An International Review, 23(2), 77–82.

Ali, M., Ng, Y. L., & Kulik, C. T. (2014). Board age and gender diversity: A test of competing linear and curvilinear predictions. Journal of Business Ethics, 125, 497–512.

Amel, D. F., & Prager, R. A. (2014). Community bank performance: How important are managers., Finance and economics discussion series Washington, DC: Division of Research & Statistics and Monetary Affairs Federal Reserve Board.

Andrés-Alonso, P., Azofra-Palenzuela, V., & Romero-Merino, E. (2009). Determinants of nonprofit board size and composition: The case of Spanish foundations. Nonprofit and Voluntary Sector Quarterly, 38(5), 784–809.

Barron, D. N., West, E., & Hannon, M. T. (1994). A time to grow and a time to die: growth and mortality of credit unions in New York City, 1914–1990. American Journal of Sociology, 100(2), 381–421.

Bear, S., Rahman, N., & Post, C. (2010). The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics, 97(2), 207–221.

Bowles, S., & Gintis, H. (2002). Social capital and community governance. The Economic Journal, 112(483), F419–F436.

Bradshaw, P., Murray, V., & Wolpin, J. (1992). Do nonprofit boards make a difference? An exploration of the relationship among board structure, process, and effectiveness. Nonprofit and Voluntary Sector Quarterly, 21(3), 227–249.

Bradshaw, P., Murray, V., & Wolpin, J. (1996). Women on boards of nonprofits: What difference do they make? Non-profit Management and Leadership, 6(3), 241–254.

Brammer, S., Millington, A., & Pavelin, S. (2009). Corporate reputation and women on the board. British Journal of Management, 20(1), 17–29.

Brown, W. A. (2005). Exploring the association between board and organizational performance in non-profit organizations. Nonprofit Management and Leadership, 15(3), 317–339.

Callen, J. L., Klein, A., & Tinkelman, D. (2003). Board composition, committees, and organizational efficiency: The case of nonprofits. Nonprofit and Voluntary Sector Quarterly, 32(4), 493–520.

Callen, J. L., Klein, A., & Tinkelman, D. (2010). The contextual impact of nonprofit board composition and structure on organizational performance: Agency and resource dependence perspectives. Voluntas, 21(1), 101–125.

Campbell, K., & Mínguez-Vera, A. (2008). Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics, 83(3), 435–451.

Carter, D. A., Simkins, B. J., & Simpson, W. G. (2003). Corporate governance, board diversity and firm value. The Financial Review, 38(1), 33–35.

Carter, D. A., D’Souza, F., Simkins, B. J., & Simpson, W. G. (2010). The gender and ethnic diversity of US board committees and firm financial performance. Corporate Governance: An International Review, 18(5), 396–414.

Chen, L. (2004). Membership incentives: Factors affecting individuals’ decisions about participation in athletics-related professional associations. Journal of Sport Management, 18(2), 111–131.

Conry, J. C., & McDonald, J. E. (1994). Moving towards a matrix: Gender and the nonprofit culture of the nineties. New Directions for Philanthropic Fundraising, 5, 45–53.

Coombes, S. M., Morris, M. H., Allen, J. A., & Webb, J. W. (2011). Behavioural orientations of non-profit boards as a factor in entrepreneurial performance: Does governance matter? Journal of Management Studies, 48(4), 829–856.

Cornforth, C. (2012). Nonprofit governance research: Limitations of the focus on boards and suggestions for new directions. Nonprofit and Voluntary Sector Quarterly, 41(6), 1116–1135.

Croteau, J. T. (1963). The economics of the Credit Union. Detroit: Wayne State University Press.

Dalton, D. R., Daily, C., Johnson, J. L., & Ellstrand, M. (1999). Number of directors and financial performance: A meta-analysis. Academy of Management Journal, 42(6), 674–686.

Davis, K. (2007). Australian credit unions and the demutualization agenda. Annals of Public and Cooperative Economics, 78(2), 277–300.

Dekker, P., & van den Broek, A. (1998). Civil society in comparative perspective: Involvement in voluntary associations in North America and Western Europe. Voluntas, 9(1), 11–38.

Dunn, P. (2012). The role of gender and human capital on the appointment of new corporate directors to boardroom committees: Canadian evidence. International Business Research, 5(5), 16–25.

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. The Academy of Management Review, 14(1), 57–74.

Farrell, K. A., & Hersch, P. L. (2005). Additions to corporate boards: The effect of gender. Journal of Corporate Finance, 11(1–2), 85–106.

Ferreira, D. (2010). Board diversity. In R. Anderson & H. K. Baker (Eds.), Corporate Governance: A synthesis of theory, research, and practice (pp. 225–242). Hoboken, NJ: Wiley.

Forker, J. J., & Ward, A. M. (2012). Prudence and financial self-regulation in credit unions in Northern Ireland. The British Accounting Review, 44(4), 221–235.

Forker, J. J., Grosvold, J., & Ward, A. M. (2014). Management models and priorities in member associations: Is credit unions’ community involvement crowded-out? Nonprofit and Voluntary Sector Quarterly, 43(2S), 105S–123S.

Francoeur, C., Labelle, R., & Sinclair-Desgagné, B. (2008). Gender diversity in corporate governance and top management. Journal of Business Ethics, 81(1), 83–95.

Granovetter, M. S. (1985). Economic action and social structure: the problem of embeddedness. American Journal of Sociology, 91(3), 481–510.

Hafsi, T., & Turgut, G. (2013). Boardroom diversity and its effect on social performance: Conceptualization and empirical evidence. Journal of Business Ethics, 112(3), 463–479.

Harrison, D., Price, K., & Bell, M. (1998). Beyond relational demography: Time and the effects of surface-and deep-level diversity on work group cohesion. Academy of Management Journal, 41(1), 96–107.

Hartarska, V., & Nadolnyak, D. (2012). Board size and diversity as governance mechanisms in community development loan funds in the USA. Applied Economics, 44(33), 4313–4329.

Heinrich, J., & Kashian, R. (2008). Credit union to mutual conversion: Do interest rates converge? Contemporary Economic Policy, 26(1), 107–117.

Herman, R. D., & Renz, D. O. (2004). Doing things right: effectiveness in local nonprofit organisations, a panel study. Public Administration Review, 64(6), 694–705.

Hill, C. W. L., & Jones, T. M. (1992). Stakeholder-agency theory. Journal of Management Studies, 29(2), 131–154.

Hillier, D., Hodgson, A., Stevenson-Clarke, P., & Lhaopadchan, S. (2008). Accounting window dressing and template regulation: A case study of the Australian credit union industry. Journal of Business Ethics, 83(3), 579–593.

Hillman, A. J., Cannella, A. A., & Paetzold, R. L. (2000). The resource dependency role of corporate directors: Strategic adoption of board composition in response to environmental change. Journal of Management Studies, 37(2), 235–255.

Hillman, A. J., Cannella, A. A, Jr, & Harris, I. C. (2002). Women and racial minorities in the boardroom: How do directors differ? Journal of Management, 28(6), 747–763.

Ibarra, H. (1992). Homophily and differential returns: Sex differences in network structure and access in an advertising firm. Administrative Science Quarterly, 37(3), 422–447.

Ibarra, H. (1993). Personal networks of women and minorities in management: A conceptual framework. Academy of Management Review, 18(1), 56–87.

ILCU (2010). Standard rules for credit unions (Northern Ireland). Dublin: ILCU.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Kesner, I. F. (1988). Directors’ characteristics and committee membership: An investigation of type, occupation, tenure and gender. Academy of Management Journal, 31(1), 66–84.

Kupiec, P. & Lee, Y. (2012). What factors explain differences in return on assets among community banks? Federal Deposit Insurance Corporation FDIC (working paper).

Landrum, N. (2007). Advancing the ‘base of the pyramid’ debate. Strategic Management Review, 1(1), 1–12.

Lau, D. C., & Murnighan, J. K. (1998). Demographic diversity and faultlines: The compositional dynamics and organisational groups. Academy of Management Review, 23(2), 325–340.

Luckerath-Rovers, M. (2013). Women on boards and firm performance. Journal of Management and Governance, 17(2), 491–509.

Luis-Carnicer, P., Martínez-Sánchez, A., Pérez-Pérez, M., & Vela-Jiménez, M. J. (2008). Gender diversity in management: Curvilinear relationships to reconcile findings. Gender in Management: An International Journal, 23(8), 583–597.

Mallin, C. A. (2010). Corporate governance. Oxford: Oxford University Press.

McKillop, D. G., Briscoe, R., McCarthy, O., & Ward, M. (2003). Irish credit unions: Exploring the gender mix. International Journal of Voluntary and Non-Profit Organisations, 14(3), 339–358.

McKillop, D. G., Glass, C., & Ward, A. M. (2005). Cost efficiency, environmental influences and UK credit unions, 1991 to 2001. Managerial Finance, 31(11), 72–86.

McKillop, D. G., Goth, P., & Hyndman, N. (2006). Credit unions in Ireland: Structure performance and governance. Dublin: Institute of Chartered Accountants in Ireland.

McKillop, D. G., Ward, A. M., & Wilson, J. (2010). The good, the bad and the ugly: A discussion of the impact of regulatory reform on the UK credit union sector. Edinburgh, Scotland: SATER (The Scottish Accountancy Trust for Education and Research).

Midgley, J. (2006). Gendered economies: Transferring private gender roles into the public realm through rural community development. Journal of Rural Studies, 22(2), 217–231.

Miller-Millesen, J. L. (2003). Understanding the behaviour of nonprofit boards of directors: A theory-based approach. Nonprofit and Voluntary Sector Quarterly, 32(4), 521–547.

Niederkohr, K. & Ikeda, J. (2005). Credit union governance: White paper. WOCCU, pp. 1–12.

Nielsen, S., & Huse, M. (2010). Women directors’ contribution to board decision-making and strategic involvement: The role of equality perception. European Management Review, 7(1), 16–29.

Ostrower, F., & Stone, M. M. (2010). Moving governance research forward: A contingency-based framework and data application. Nonprofit and Voluntary Sector Quarterly, 39(5), 901–924.

Pajunen, K. (2006). Stakeholder influences in organizational survival. Journal of Management Studies, 43(6), 1261–1288.

Peterson, C. A., & Philpot, J. (2007). Women’s roles on US Fortune 500 boards: Director expertise and committee membership. Journal of Business Ethics, 72(2), 177–196.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: a resource dependence perspective. New York: Harper and Row.

Reddy, K., Locke, S., & Fauzi, F. (2013). Relevance of corporate governance practices in charitable organisations: A case study of registered charities in New Zealand. International Journal of Managerial Finance, 9(2), 110–132.

Rose, C. (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), 404–413.

Savage, G. T., Nix, T. W., Whitehead, C. J., & Blair, J. D. (1991). Strategies for assessing and managing organizational stakeholders. Academy of Management Executive, 5(2), 61–75.

Shaiko, R. G. (1997). Female participation in association governance and political representation: Women as executive directors, board members, lobbyists and political action committee directors. Non-Profit Management and Leadership, 8(2), 121–139.

Shrader, C., Blackburn, V., & Iles, P. (1997). Women in management and firm financial performance: An exploratory study. Journal of Management Issues, 9(3), 355–372.

Siciliano, J. L. (1996). The relationship of board member diversity to organisational performance. Journal of Business Ethics, 15(4), 1313–1320.

Silverman, I. W. (2003). Gender difference in delay of gratification: A meta-analysis. Sex Roles, 49(9–10), 451–463.

Singh, V., Terjesen, S., & Vinnicombe, S. (2008). Newly appointed directors in the boardroom: How do women and men differ? European Management Journal, 26(1), 48–58.

Stone, M. M., & Ostrower, F. (2007). Acting in the public interest? Another look at governance research in nonprofit organisations. Nonprofit and Voluntary Sector Quarterly, 36(3), 416–438.

Themudo, N. S. (2009). Gender and the nonprofit sector. Nonprofit and Voluntary Sector Quarterly, 38(4), 663–683.

Van Puyvelde, S., Caers, R., Du Bois, C., & Jegers, M. (2012). The governance of nonprofit organizations: Integrating agency theory with stakeholder and stewardship theories. Nonprofit and Voluntary Sector Quarterly, 41(3), 431–451.

Ward, A. M., & McKillop, D. G. (2005). An investigation into the link between UK credit union characteristics, location and their success. Annals of Public and Cooperative Economics, 76(3), 461–489.

Williams, K. Y., & O’Reilly, C. A. (1998). Demography and diversity in organizations: A review of 40 years of research. In B. Staw & R. Sutton (Eds.), Research in organizational behavior (Vol. 20, pp. 77–140). Greenwich, CT: JAI Press Inc.

Wilson, J., & Musick, M. (1997). Who cares? Toward an integrated theory of volunteer work. American Sociological Review, 62(5), 694–713.

Wiseman, R. M., Cuevas-Rodríguez, G., & Gomez-Mejia, L. R. (2012). Towards a social theory of agency. Journal of Management Studies, 49(1), 202–222.

WOCCU. (2013). Statistical report 2013. World Council of Credit Unions website. Retrieved Oct 20, 2014 from http://www.woccu.org.

Yermack, D. (1996). Higher market valuation of companies with a small board of directors’. Journal of Financial Economics, 40(1), 185–212.

Acknowledgments

We are grateful for financial support provided by the Irish Accounting Education Trust (Chartered Accountants Ireland) and for the very helpful comments received from three anonymous reviewers, from Barry Reilly and Catherine Seierstad, from seminar participants when the paper was presented at the Universities of Ulster and Sussex and from conference participants at the 2013 conferences of the British Accounting and Finance Association, the Academy of Management, the Irish Accounting and Finance Association and the EIASM 9th Workshop on Challenges in Managing the Third Sector.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ward, A.M., Forker, J. Financial Management Effectiveness and Board Gender Diversity in Member-Governed, Community Financial Institutions. J Bus Ethics 141, 351–366 (2017). https://doi.org/10.1007/s10551-015-2699-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-015-2699-9