Abstract

In China, many firms advertise that they follow environmentally friendly practices to cover their true activities, a practice called greenwashing, which can cause the public to doubt the sincerity of greenization messages. In this study, I investigate how the market values greenwashing and further examine whether corporate environmental performance can explain different and asymmetric market reactions to environmentally friendly and unfriendly firms. Using a sample from the Chinese stock market, I provide strong evidence to show that greenwashing is significantly negatively associated with cumulative abnormal returns (CAR) around the exposure of greenwashing. In addition, corporate environmental performance is significantly positively associated with CAR around the exposure of greenwashing. Furthermore, my findings suggest that corporate environmental performance has two distinct effects on CAR around the exposure of greenwashing: the competitive effect for environmentally friendly firms and the contagious effect for potential environmental wrongdoers, respectively. The results are robust to various sensitivity tests.

Similar content being viewed by others

Notes

“Green public relation (PR) is a sub-field of PRs that communicates an organization’s corporate social responsibility or environmentally friendly practices to the public. The goal is to produce increased brand awareness and improve the organization's reputation. Tactics include placing news articles, winning awards, communicating with environmental groups and distributing publications” (available at: http://en.wikipedia.org/wiki/Green_PR).

Jay Westervelt, a New York environmentalist, first coined the term greenwashing in his 1986 essay regarding the hotel industry’s practice of placing placards in each room asking guests to reuse their towels to “save the environment”. He argued that hotels were actually using their green campaigns to reduce costs (Hayward 2009; "Usage" in Wikipedia 2013).

“Since 2007, the Ministry of Environmental Protection of China has enacted measures regarding corporate environmental reporting” (Du et al. 2013, p. 3). “The Regulation on Environmental Information Disclosure, effective May 1, 2008, compels environmental agencies and heavy-polluting companies to publically disclose certain environmental information. Moreover, the government has enacted stricter regulations requiring Chinese listed firms to take environmental responsibility. Shanghai and Shenzhen stock exchanges issued several regulations and required a subset of listed firms to issue CSR reports from 2008 considering social, economic, and governmental sustainability and recognizing that environmental protection is one of the most important aspects of CSR. These regulations include: (1) notice of supervising the listed firms in Shanghai Stock Exchange to disclose the annual report of year 2008 (SHSE); (2) notice of supervising the listed firms in Shenzhen Stock Exchange to disclose the annual report of year 2008 (SZSE); and (3) guide to environmental information disclosure for listed firms in Shanghai Stock Exchange of year 2008 (SHSE) (Du et al. 2013, Footnote #3)”.

For example, greenwashing has less influence in developed countries because of enforcement by regulatory agencies such as the Federal Trade Commission in the United States, the Competition Bureau in Canada, and the Committee of Advertising Practice and the Broadcast Committee of Advertising Practice in the United Kingdom (Wikipedia 2013).

EntreMed’s stock price rose from 12.063 at the Friday close. On Monday, it opened at 85 and closed near 52 (Huberman and Regev 2001).

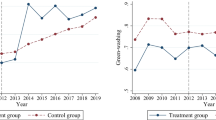

Greenwashing lists provide investors with information about environmentally unfriendly activities. Investors can infer that firms with worse environmental conservation will be more likely to be environmentally unfriendly, although they might be not on the greenwashing list. In addition, greenwashing lists convey information about environmentally unfriendly firms in relation to others in an industry. As a result, around the exposure of greenwashing, I predict that those with worse environmental conservation will display contagious effects and those with better conservation will display competitive effects.

The results are not qualitatively changed by deleting the top and the bottom 1 % of the sample, by no deletion, or by no winsorization.

I acknowledge my great thanks to the referee for his/her insightful suggestion. The data in my study are quasi-panel-data type, so the OLS regression procedure is not very suitable. As a result, I conduct Hausman tests to determine whether fixed effects or random effects are appropriate for quasi-panel data in my study. Non-tabulated results of Hausman tests show that all null hypotheses are not rejected because all χ 2 values are insignificant. Therefore, according to Greene (2012), random effects regression using the feasible generalized least squares (FGLS) approach is more appropriate than fixed effects and the LSDV (the least squares dummy variable estimation) approach.

To better and more visually illustrate the competitive effects and the contagious effects, I plot Figure 2 using adjusted CAR, measured as a firm’ s CAR minus average CAR of firms with exposed greenwashing. Also, the tendencies on CAR remain qualitatively similar to Figure 2 using the raw (original) CAR.

References

Al-Tuwaijri, S. A., Christensen, T. E., & Hughes, K. E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Accounting, Organizations and Society, 29(5–6), 447–471.

Alves, I. (2009). Green spin everywhere: How greenwashing reveals the limits of the CSR paradigm. Journal of Global Change and Governance, I(1), 1–26.

Baker, M., Litov, L., Wachter, J. A., & Wurgler, J. (2010). Can mutual fund managers pick stocks? Evidence from their trades prior to earnings announcements. Journal of Financial and Quantitative Analysis, 45(5), 1111–1113.

Blacconiere, W. G., & Northcut, W. D. (1997). Environmental information and market reactions to environmental legislation. Journal of Accounting, Auditing & Finance, 12(2), 149–178.

Bragdon, J., & Marlin, J. (1972). Is pollution profitable? Risk Management, 19(4), 9–18.

Brown, T. J., & Dacin, P. A. (1997). The company and product: Corporate associations and consumer product response. Journal of Marketing, 61, 68–84.

Brown, S. J., & Warner, J. B. (1985). Using daily stock returns: The case of event studies. Journal of Financial Economics, 14, 3–31.

Burdick, D. (2009). Top 10 greenwashing companies in America. Retrieved August 25, 2013 from http://www.huffingtonpost.com/2009/04/03/top-10-greenwashingcompa_n_182724.html.

Bushee, B. J., Core, J. E., Guay, W., & Hamm, S. J. (2010). The role of the business press as an information intermediary. Journal of Accounting Research, 48(1), 1–19.

Chen, Y.-S. (2008a). The driver of green innovation and green image—Green core competence. Journal of Business Ethics, 81(3), 531–543.

Chen, Y.-S. (2008b). The positive effect of green intellectual capital on competitive advantages of firms. Journal of Business Ethics, 77(3), 271–286.

Chen, Y.-S. (2010). The drivers of green brand equity: Green brand image, green satisfaction, and green trust. Journal of Business Ethics, 93(2), 307–319.

Chen, Y.-S., & Chang, C.-H. (2013). Greenwash and green trust: The mediation effects of green consumer confusion and Green Perceived Risk. Journal of Business Ethics, 114, 489–500.

Chen, Y.-S., Lai, S.-B., & Wen, C.-T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics, 67(4), 331–339.

Cho, C. H., Guidry, R. P., Hageman, A. M., & Patten, D. M. (2012). Do actions speak louder than words? An empirical investigation of corporate environmental reputation. Accounting, Organizations and Society, 37(1), 14–25.

Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4), 303–327.

Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2011a). Does it really pay to be green? Determinants and consequences of proactive environmental strategies. Journal of Accounting and Public Policy, 30(2), 122–144.

Clarkson, P. M., Overell, M. B., & Chapple, L. (2011b). Environmental reporting and its relation to corporate environmental performance. Abacus, 47(1), 27–60.

Coase, R. H. (1960). The problem of social cost. Journal of Law and Economics, 3(1), 1–44.

Cormier, D., & Magnan, M. (1999). Corporate environmental disclosure strategies: Determinants, costs and benefits. Journal of Accounting, Auditing and Finance, 14(3), 429–451.

Dahl, R. (2010). Green washing: Do you know what you’re buying? Environmental Health Perspectives, 118(6), A246–A252.

Dasgupta, S., Laplante, B., & Mamingi, N. (2001). Pollution and capital markets in developing countries. Journal of Environmental Economics and Management, 42(3), 310–335.

De Villiers, C., & Van Staden, C. J. (2010). Shareholders’ requirements for corporate environmental disclosures: A cross country comparison. The British Accounting Review, 42(4), 227–240.

Deegan, C., & Gordon, B. (1996). A study of the environmental disclosure practices of Australian corporations. Accounting and Business Research, 26(3), 187–199.

Dixon-Fowler, H. R., Slater, D. J., Johnson, J. L., Ellstrand, A. E., & Romi, A. M. (2013). Beyond “Does it pay to be green?” A meta-analysis of moderators of the CEP–CFP relationship. Journal of Business Ethics, 112(2), 353–366.

Djankov, S., McLiesh, C., Nenova, T., & Shleifer, A. (2001). Who owns the media? National Bureau of Economic Research Working Paper No. w8288.

Du, X. (2012). Does religion matter to owner-manager agency costs? Evidence from China. Journal of Business Ethics,. doi:10.1007/s10551-012-1569-y.

Du, X., Jian, W., Zeng, Q., & Du, Y. (2013). Corporate environmental responsibility in polluting industries: Does religion matter? Journal of Business Ethics,. doi:10.1007/s10551-013-1888-7.

Dyck, A., Volchkova, N., & Zingales, L. (2008). The corporate governance role of the media: Evidence from Russia. The Journal of Finance, 63(3), 1093–1135.

Dyck, A., & Zingales, L. (2002). The corporate governance role of the media. In R. Islam (Ed.), The right to tell: The role of the media in development (pp. 107–137). Washington, DC: The World Bank.

Fang, L., & Peress, J. (2009). Media Coverage and the Cross-section of Stock Returns. The Journal of Finance, 64(5), 2023–2052.

Fieseler, C., Fleck, M., & Meckel, M. (2010). Corporate social responsibility in the blogosphere. Journal of Business Ethics, 91, 599–614.

Global Reporting Initiative (GRI) (2006). Sustainable Reporting Guildlines. Retrieved December 3, 2013 from http://www.globalreporting.org.

Gray, R., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting Auditing and Accountability Journal, 8(2), 47–77.

Greene, W. H. (2012). Econometric analysis (7th ed.). Upper Saddle River, NJ: Prentice Hall.

Greenpeace USA. (2013). Greenpeace greenwash criteria. Retrieved August 25, 2013 from http://www.stopgreenwash.org.

Gupta, S., & Goldar, B. (2005). Do stock markets penalize environment-unfriendly behavior? Evidence from India. Ecological Economics, 52(1), 81–95.

Guthrie, J., & Parker, L. (1989). Corporate social reporting: A rebuttal of legitimacy theory. Accounting and Business Research, 19(76), 343–352.

Hamilton, J. T. (1995). Pollution as news: Media and stock market reactions to the toxics release inventory data. Journal of Environmental Economics and Management, 28(1), 98–113.

Hayward, P. (2009). The real deal? Hotels grapple with green washing. Lodging Magazine. Retrieved August 25, 2013 from http://www.lodgingmagazine.com/Main/Home.aspx.

Herman, E. (2002). The media and market in the United States. The right to tell the role of mass media in economic development (pp. 61–81). Washington, DC: The World Bank Institute.

Holliday, C. O., Schmidheiny, S., & Watts, P. (2002). Walking the talk: The business case for sustainable development. Sheffield: Greenleaf.

Hooks, J., & van Staden, C. J. (2011). Evaluating environmental disclosures: The relationship between quality and extent measures. The British Accounting Review, 43(3), 200–213.

Horiuchi, R., & Schuchard, R. (2009). Understanding and preventing greenwash: A business guide. London: Futerra Sustainability Communications.

Howard, J., Nash, J., & Ehrenfeld, J. (1999). Industry codes as agents of change: Responsible care adoption by U.S. chemical companies. Business Strategy and the Environment, 8, 281–295.

Huang, C. L., & Kung, F. H. (2010). Drivers of environmental disclosure and stakeholder expectation: Evidence from Taiwan. Journal of Business Ethics, 96(3), 435–451.

Huberman, G., & Regev, T. (2001). Contagious speculation and a cure for cancer: A nonevent that made stock prices soar. The Journal of Finance, 56(1), 387–396.

Hughes, S. B., Anderson, A., & Golden, S. (2001). Corporate environmental disclosures: Are they useful in determining environmental performance? Journal of Accounting and Public Policy, 20, 217–240.

Ilinitch, A. Y., Soderstrom, N. S., & Thomas, T. E. (1998). Measuring corporate environmental performance. Journal of Accounting and Public Policy, 17(4-5), 383–408.

Ingram, R., & Frazier, K. B. (1980). Environmental performance and corporate disclosure. Journal of Accounting Research, 18, 612–622.

Investor Responsibility Research Center. (1992). Corporate environmental profiles directory. Washington, DC: Investor Responsibility Research Center.

Joe, J. R., Louis, H., & Robinson, D. (2009). Managers’ and investors’ responses to media exposure of board ineffectiveness. Journal of Financial and Quantitative Analysis, 44(03), 579–605.

Joshua, K. (2001, March 22). A brief history of greenwash. CorpWatch.

Khanna, M., Quimio, W. R. H., & Bojilova, D. (1998). Toxics release information: A policy tool for environmental protection. Journal of Environmental Economics and Management, 36(3), 243–266.

King, A. A., & Lenox, M. (2000). Industry self-regulation without sanctions: The chemical industry’s responsible care program. Academy of Management Journal, 43, 698–716.

Klassen, R. D., & McLaughlin, C. P. (1996). The impact of environmental management on firm performance. Management Science, 42(8), 1199–1214.

Kolari, J. W., & Pynnönen, S. (2010). Event study testing with cross-sectional correlation of abnormal returns. The Review of Financial Studies, 23(11), 3996–4025.

Konar, S., & Cohen, M. A. (2001). Does the market value environmental performance? Review of Economics and Statistics, 83(2), 281–289.

Lanoie, P., Laplante, B., & Roy, M. (1998). Can capital markets create incentives for pollution control? Ecological Economics, 26(1), 31–41.

Laplante, B., & Lanoie, P. (1994). The market response to environmental incidents in Canada: A theoretical and empirical analysis. Southern Economic Journal, 60, 657–672.

Laufer, W. S. (2003). Social accountability and corporate greenwashing. Journal of Business Ethics, 43(3), 253–261.

Lewellen, S. & Metrick, A. (2010). Corporate governance and equity prices: Are results robust to industry adjustments? Working paper. Retrieved August 25, 2013 from https://wpweb2.tepper.cmu.edu/wfa/wfasecure/upload2010/2010_7.382644E+08_PARE_IGE_WFA.pdf.

Logsdon, J. M. (1985). Organizational responses to environmental issues: Oil refining companies and air pollution. In L. E. Preston (Ed.), Research in corporate social performance and policy (Vol. 7, pp. 47–71). Greenwich, CT: JAI.

Lyon, T. P., & Maxwell, J. W. (2011). Greenwash: Corporate environmental disclosure under threat of audit. Journal of Economics & Management Strategy, 20(1), 3–41.

Lyon, T. P., & Montgomery, A. W. (2013). Tweetjacked: The impact of social media on corporate greenwash. Journal of Business Ethics, 118(4), 747–757.

Miller, G. S. (2006). The press as a watchdog for accounting fraud. Journal of Accounting Research, 44(5), 1001–1033.

Morris, S., & Shin, H. S. (2002). Social value of public information. The American Economic Review, 92(5), 1521–1534.

Nyhan, B., & Reifler, J. (2010). When corrections fail: The persistence of political misperceptions. Political Behavior, 32(2), 303–330.

Parguel, B., Benoît-Moreau, F., & Larceneux, F. (2011). How sustainability ratings might deter ‘greenwashing’: A closer look at ethical corporate communication. Journal of Business Ethics, 102(1), 15–28.

Patten, D. M. (1992). Intra-industry environmental disclosures in response to the Alaskan oil spill. Accounting, Organizations and Society, 17(5), 471–475.

Peng, X. (2012). Supervise to the end: The yearly list of greenwashing. Retrieved December 3, 2013 from http://green.sohu.com/20120216/n334949898.shtml.

Polonsky, M. J., Grau, S. L., & Garma, R. (2010). The new greenwash? Potential marketing problems with carbon offsets. International Journal of Business Studies, 18(1), 49–54.

Rahman, N., & Post, C. (2012). Measurement issues in environmental corporate social responsibility (ECSR): Toward a transparent, reliable, and construct valid instrument. Journal of Business Ethics, 105(3), 307–319.

Ramus, C. A., & Montiel, I. (2005). When are corporate environmental policies a form of greenwashing? Business and Society, 44(4), 377–414.

Self, R. M., Self, D. R., & Bell-Haynes, J. (2010). Marketing tourism in the Galapagos Islands: Ecotourism or greenwashing? International Business & Economics Research Journal, 9(6), 111–125.

Sharfman, M. P., & Fernando, C. S. (2008). Environmental risk management and the cost of capital. Strategic Management Journal, 29(6), 569–592.

Sharma, S., Pablo, A. L., & Vredenburg, H. (1999). Corporate environmental responsiveness strategies: The importance of issue interpretation and organizational context. Journal of Applied Behavioral Science, 35, 87–108.

TerraChoice. (2010). The sins of greenwashing. Ottawa, ON: TerraChoice Environmental Marketing.

TerraChoice Environmental Marketing. (2009). The seven sins of greenwashing: Environmental claims in consumer markets. Retrieved December 3, 2013 from http://sinsofgreenwashing.org/findings/greenwashing-report-2009.

Tolliver-Nigro, H. (June 29, 2009). Green market to grow 267 percent by 2012. Matter Network. Retrieved December 3, 2013 from www.matternetwork.com/2009/6/green-market-grow-267-percent.cfm.

Walley, N., & Whitehead, B. (1994). It’s not easy being green. Harvard Business Review, 72(3), 46–52.

Wikipedia. (2013). Greenwashing. Retrieved August 25, 2013 from http://en.wikipedia.org/wiki/Greenwashing.

Winn, M. I., & Angell, L. C. (2000). Towards a process model of corporate greening. Organization Studies, 21, 1119–1147.

Wiseman, J. (1982). An evaluation of environmental disclosures made in corporate annual reports. Accounting, Organizations and Society, 7(1), 53–63.

Ye, K., & Zhang, R. (2011). Do lenders value corporate social responsibility? Evidence from China. Journal of Business Ethics, 104, 197–206.

Yeomans, M. (2013). Communicating sustainability: The rise of social media and storytelling. Retrieved August 25, 2013 from http://www.guardian.co.uk/sustainable-business/communicating-sustainability-social-media-storytelling?CMP.

Yoon, Y., Gurhan-Ganli, Z., & Zhu, C. (2003). Drowing inferences about others on the basis of corporate association. Academy of Marketing Science, 34(2), 167–173.

Zeghal, D., & Ahmed, S. (1990). Comparison of social responsibility information disclosure media by Canadian firms. Accounting, Auditing, and Accountability Journal, 3(1), 38–53.

Zeng, S. X., Xu, X. D., Yin, H. T., & Tam, C. M. (2012). Factors that drive Chinese listed companies in voluntary disclosure of environmental information. Journal of Business Ethics, 109(3), 309–321.

Acknowledgments

I am especially grateful to the editor (Prof. Professor Gary S. Monroe) and two anonymous reviewers for their many insightful and constructive suggestions. I appreciate constructive comments from Quan Zeng, Yingjie Du, Wentao Feng, Dongchang Ke, Wei Jian, Hongmei Pei, Feng Liu, Jinhui Luo, Yingying Chang, Shaojuan Lai, Jun Lu, Hao Xiong, Xue Tan, and participants of my presentations at Xiamen University, Anhui University, Ocean University of China, Shandong university, and Shanghai University. I also thank Quan Zeng and Yingjie Du for excellent research assistance. I acknowledge the National Natural Science Foundation of China (Approval Number: 71072053), the Key Project of Key Research Institute of Humanities and Social Science in Ministry of Education (Approval Number: 13JJD790027), the Specialized Research Fund for the Doctoral Program of Higher Education of China (Approval Number: 20120121110007) and Xiamen University’s Prosperity Plan Project of Philosophy and Social Sciences (Sub-project for School of Management) for financial support.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Du, X. How the Market Values Greenwashing? Evidence from China. J Bus Ethics 128, 547–574 (2015). https://doi.org/10.1007/s10551-014-2122-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-014-2122-y