Abstract

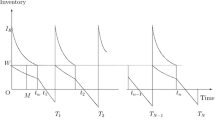

In this paper we develop a multi-item multi-warehouse inventory model for deteriorating items for m secondary warehouses (SWs) and one primary warehouse (PW) with displayed stock and price dependent demand under permissible delay in payment. Items are sold from PW which is located at the main market and due to large stock and insufficient space of existing PW, excess items are stored at m SWs of finite capacity. Due to different preserving facilities and storage environment, inventory holding cost is considered to be different in different warehouses. Here the demand of items is a deterministic function of corresponding selling price and the displayed inventory. Shortages are allowed and partially backlogged. The items of SWs are transported to the PW in continuous release pattern and associated transportation cost is proportional to the distance from PW to SWs. Here \(M_{i} (<T_{i}\), cycle time) be the period of permissible delay in settling account for ith item, without the interest charges. But if the retailer settles the account after \(M_{i}\), he will have to pay with interest per cycle for the inventory not sold after the due date \(M_{i}\). A single objective inventory problem is solved numerically by developing Genetic algorithm and the maximum average profit and the corresponding optimum decision variables are evaluated. Finally the model is illustrated using a numerical example. A sensitivity analysis of the optimal solution with respect to the parameters of the system is carried out.

Similar content being viewed by others

References

Aggarwal, S. P., & Jaggi, C. K. (1995). Ordering policies of deteriorating items under permissible delay in payments. Journal of the Operational Research Society, 46, 658–662.

Abad, P. L. (1996). Optimal pricing and lot-sizing under conditions of perishability and partial back ordering. Management Science, 42, 1093–1104.

Abad, P. L. (2001). Optimal pricing and order size for a reseller under partial backlogging. Computers and Operations Research, 28, 53–65.

Abad, P. L. (2003). Optimal pricing and lot-sizing under conditions of perishability, finite production and partial backlogging and lost sale. European Journal of Operational Research, 144, 677–685.

Buzacott, J. A. (1975). Economic order quantities with inflation. Operational Research Quarterly, 26, 553–558.

Bhunia, A. K., Mandal, B., & Maiti, M. (1994). A two warehouse inventory model for a linear trend in demand. Opsearch, 31(4), 318–329.

Benkherouf, L. (1997). A deterministic order level inventory model for deteriorating items with two storage facilities. International Journal of Production Economics, 48, 167–175.

Bhunia, A. K., & Maiti, M. (1997). An inventory model for decaying items with selling price, frequency of advertisement and linearly time-dependent demand with shortages. IAPQR Transactions, 22, 41–49.

Bhunia, A. K., & Maiti, M. (1998). A two warehouses inventory model for deteriorating items with a linear trend in demand and shortages. Journal of the Operational Research Society, 49, 287–292.

Chu, P., Chung, K. J., & Lan, S. P. (1998). Economic order quantity of deteriorating items under permissible delay in payments. Computers and Operations Research, 25, 817–824.

Chung, K. J. (1998). A theorem on the determination of economic order quantity under conditions of permissible delay in payments. Computers and Operations Research, 25, 49–52.

Chang, H. J., & Dye, C. Y. (1999). An EOQ model for deteriorating items with time varying demand and partial backlogging. Journal of Operational Research Society, 50, 1176–1182.

Chang, H. J., & Dye, C. Y. (2001). An inventory model for deteriorating items with partial backlogging and permissible delay in payment. International Journal of Systems Science, 32, 345–352.

Chung, K. J., & Huang, Y. F. (2003). The optimal cycle time for EPQ inventory model under permissible delay in payments. International Journal of Production Economics, 84, 307–318.

Dave, U. (1989). A deterministic lot-size inventory model with shortages and a linear trend in demand. Naval Research Logistics, 36, 507–514.

Datta, T. K., & Pal, A. K. (1991). Effects of inflation and time value of money on a inventory model with linear time dependent demand rate and shortages. European Journal of Operational Research, 52(2), 326–333.

Dey, J. K., Mondal, S. K., & Maiti, M. (2008). Two storage inventory problem with dynamic demand and interval valued lead time over finite time horizon under inflation and time value of money. European Journal of Operational Research, 185(1), 170–194.

Goyal, S. K. (1985). Economic order quantity under conditions of permissible delay in payments. Journal of the Operational Research Society, 36, 335–338.

Goldberg, D. E. (1998). Genetic algorithms in search, optimization and machine learning. New York: Addison Wesley.

Goswami, A., & Chaudhuri, K. S. (1992). An economic order quantity model for items with two levels of storage for a linear trend in demand. Journal of Operational Research Society, 43, 157–167.

Holland, J. H. (1975). Adaptation in natural and artificial systems. Ann Arbor MI: University of Michigan Press.

Hartely, R. V. (1976). Operations Research-a managerial emphasis. (Vol. 3, pp. 315–317). California: Goodyear Publishing Company.

Hariga, M. (1996). Optimal EOQ models for deteriorating items with time-varying demand. Journal of Operational Research Society, 47, 1228–1246.

Hariga, M., & Ben-Daya, M. (1996). Optimal time-varying lot-sizing models under inflationary conditions. European Journal of Operational Research, 89, 313–325.

Horowitz, I. (2000). EOQ and inflation uncertainty. International Journal of Production Economics, 65, 217–224.

Huang, Y. F. (2007). Economic order quantity under conditionally permissible delay in payments. European Journal of Operational Research, 176, 911–924.

Jamal, A. M. M., Sarker, B. R., & Wang, S. (1997). An ordering policy for deteriorating items with allowable shortage and permissible delay in payment. Journal of the Operational Research Society, 48, 826–833.

Kar, S., Bhunia, A. K., & Maiti, M. (2001). Deterministic inventory model with two-levels of storage, a linear trend in demand and a fixed time horizon. Computers and Operations Research USA, 28, 1315–1331.

Lee, C. C., & Ma, C. Y. (2000). Optimal inventory policy for deteriorating items with two-warehouse and time dependent demand. Production Planning Control, 11(7), 689–696.

Liao, H. C., Tsai, C. H., & Su, C. T. (2000). An inventory model with deteriorating items under inflation when a delay in payment is permissible. International Journal of Production Economics, 63, 207–214.

Misra, R. B. (1979). A note on optimal inventory management under inflation. Naval Research Logistics, 26(1D), 161–165.

Murdeshwar, T. M., & Sathi, Y. S. (1985). Some aspects of lot-size models with two levels of storage. Opsearch, 22, 255–262.

Michalewicz, Z. (1992). Genetic algorithms + data structure = evolution programs. Berlin: Springer.

Ouyand, L. Y., Teng, J. T., Chuang, K. W., & Chuang, B. R. (2005). Optimal inventory policy with noninstantaneous receipt under trade credit. International Journal of Production Economics, 98, 290–300.

Pakhala, T. P. M., & Achary, K. K. (1992a). Discrete time inventory model for deteriorating items with two warehouses. Opsearch, 29, 90–103.

Pakhala, T. P. M., & Achary, K. K. (1992b). A deterministic inventory model for deteriorating items with two warehouses and finite replenishment rate. European Journal of Operational Research, 57, 71–76.

Pal, A. K., Bhunia, A. K., & Mukherjee, R. N. (2006). Optimal lot size model for deteriorating items with demand rate dependent on displayed stock level (DSL) and variable backlogging. European Journal of Operational Research, 175, 977–991.

Roy, A., Maiti, M. K., Kar, S., & Maiti, M. (2007). Two storage inventory model with fuzzy deterioration over a random planning horizon. Mathematical and Computer Modeling, 46, 1419–1433.

Sarma, K. V. S. (1983). A deterministic inventory model with two levels of storage and an optimum release rule. Opsearch, 20, 175–180.

Sarma, K. V. S. (1987). A deterministic order-level inventory model for deteriorating items with two storage facilities. European Journal of Operational Research, 29, 70–73.

Sarkar, B. R., Jamal, A. M. M., & Wang, S. (2000a). Optimal payment time under permissible delay in payment for products with deterioration. Production Planning and Controll, 11, 380–390.

Sarkar, B. R., Jamal, A. M. M., & Wang, S. (2000b). Supply chain models for perishable products under inflation and permissible delay in payment. Computers and Operations Research, 27, 59–75.

Salameh, M. K., Abboud, N. E., El-Kassar, A. N., & Ghattas, R. E. (2003). Continuous review inventory model with delay in payments. International Journal of Production Economics, 85, 91–95.

Trivedi, C. J., & Shah, Y. K. (1994). A deterministic inventory model with two levels of storage and an optimum release rule under permissible delay in payment when supply is random. International Journal of Management Systems, 10, 75–88.

Teng, J. T. (2002). On the economic order quantity under conditions of permissible delay in payments. Journal of the Operational Research Society, 53, 915–918.

Teng, J. T., Yang, H. L., & Ouyang, L. Y. (2003). On an EOQ model for deteriorating items with time varying demand and partial backlogging. Journal of Operational Research Society, 54(4), 432–436.

Teng, J. T., & Yang, H. L. (2004). Deterministic EOQ models with partial backlogging when demand and cost are flactuating with time. Journal of the Operational research Society, 55(5), 495–503.

Wee, H. M. (1999). Deteriorating inventory model with quantity discount, pricing and partial back-ordering. International Journal of Production Economics, 59, 511–518.

Yang, P. C., & Wee, H. M. (2003). An integrated multi-lot-size production inventory model for deteriorating item. Computers and Operations Research, 30(5), 671–682.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Calculations for Case-II and Case-III with allowable shortage and no inflation

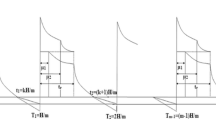

Case-II: (\( t_{1i}\le M_{i}< t_{2i}\)).

The interest payable per cycle for the inventory not sold after the due date \(M_{i}\) is given by

The interest earned at time t during the positive inventory is given by

Case-III: (\( t_{2i}\le M_{i}< T_{i}\)).

The interest earned at time t during the positive inventory period plus the interest earned from the cash invested during the time period \((t_{2i}, M_{i})\) after the inventory is exhausted at time \(t_{2i}\), and it is given by

1.2 Calculations for Case-II and Case-III with allowable shortage and inflation

Case-II: (\( t_{1i}\le M_{i}< t_{2i}\)).

The interest payable rate at time t is \((e^{i_{p}t}-1)\) dollars per dollar, so the present value (at t=0) of interest payable rate at time t is \(I_{p}(t)=(e^{i_{p}t}-1)e^{-rt}\)dollars per dollar. Therefore, the interest payable per cycle for the inventory not sold after the due date \(M_{i}\) is given by

The present value of the interest earned at time t, \(I_{e}(t)\) is \((e^{i_{e}t}-1)e^{-rt}\). The interest earned during the positive inventory, is given by

Case-III: (\( t_{2i}\le M_{i}< T_{i}\)).

The interest earned per cycle is the interest earned during the positive inventory period plus the interest earned from the cash invested during the time period (\(t_{2i}, M_{i}\)) after the inventory is exhausted at time \(t_{2i}\), is given by

Rights and permissions

About this article

Cite this article

Das, D., Roy, A. & Kar, S. A multi-warehouse partial backlogging inventory model for deteriorating items under inflation when a delay in payment is permissible. Ann Oper Res 226, 133–162 (2015). https://doi.org/10.1007/s10479-014-1691-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1691-6