Abstract

The objective of this paper is to analyze criteria for portfolio choice when two investors are forced to invest in a common portfolio and share the proceeds by a linear sharing rule. A similar situation with many investors is typical for defined contribution pension schemes. The restriction implies two sources of suboptimal investment decisions as seen from each of the two investors individually. One is the suboptimal choice of portfolio, the other is the forced linear sharing rule. We measure the combined consequence for each investor by their respective loss in wealth equivalent. We show that significant losses can arise when investors are diverse in their risk attitude. We also show that an investor with a low degree of risk aversion, like the logarithmic or the square root investor, often applied in portfolio choice models, can either inflict or be subject to severe losses when being forced to participate in such a common investment pool.

Similar content being viewed by others

Notes

Note that the two utility functions behave rather differently, so an uncritical interpretation of the numerical value \(\mu \) as a parameter that weighs the two investors against each other is not possible.

There is no analytical solution available for this problem, even if the parameters are chosen in such a manner that the true Pareto optimal solution is available in analytical form. Hence, we are forced to rely on a numerical solution technique.

We tested the approximation on problems with known analytical solutions to check the accuracy. We found that the numerical solution and the analytical solution coincided with 4 decimals precision.

In some papers on heterogeneous agent models, see e.g. Benninga and Mayshar (2000), it is claimed that the RRA for the representative investor is a harmonic average of the two individual RRAs. In this representation the average is arithmetic. Of course, for any harmonic average there is an equivalent arithmetic average, just with other weights.

References

Balder, S., Mahayni, A.: How good is portfolio insurance? In: Kiesel, R., Scherer, M., Zagst, R. (eds.) Alternative Investments and Strategies, pp. 229–256. Singapore: World Scientific (2010)

Benninga, S., Mayshar, J.: Heterogeneity and option pricing. Rev Deriv Res 4, 7–27 (2000)

Brennan, M.J., Torous, W.N.: Individual decision making and investor welfare. Economic Notes by Banca Monte dei Paschi di Siena SpA, pp 119–143 (1999)

Cox, J.C., Ingersoll Jr., J.E., Ross, S.A.: An intertemporal general equilibrium model of asset prices. Econometrica 53(2), 363–384 (1985)

Cvitanić, J., Jouini, E., Malamud, S., Napp, C.: Financial markets equilibrium with heterogenous agents. Rev Finance 16(1), 285–321 (2012)

Duffie, D.: Dynamic Asset Pricing Theory, 2nd edn. Princeton: Princeton University Press (1996)

Dumas, B.: Two-person dynamic equilibrium in the capital market. Rev Financ Stud 2, 157–188 (1989)

Flor, C.R., Larsen, L.S.: Robust portfolio choice with stochastic interest rates. Ann Finance 10, 243–265 (2014)

Franke, G., Lüders, E.: Return predictibality and stock market crashes in a simple rational expectations model. Adv Dec Sci, Article ID 791025, doi:10.1155/2010/791025 (2010)

Franke, G., Stapleton, R.C., Subrahmanyam, M.G.: Who buys and who sells options: the role of options in an economy with background risk. J Econ Theory 82, 89–109 (1998)

Franke, G., Stapleton, R.C., Subrahmanyam, M.G.: When are options overpriced? The Black-Scholes model and alternative characterisations of the pricing kernel. Eur Finance Rev 3, 79–102 (1999)

Hara, C.: Heterogeneous risk attitudes in a continuous-time model. Jpn Econ Rev 57, 377–405 (2006)

Hara, C., Huang, J., Kuzmics, C.: Representative consumer’s risk aversion and efficient sharing rules. J Econ Theory 137, 652–672 (2007)

Jensen, B.A., Sørensen, C.: Paying for minimum interest rate guarantees: who should compensate who? Eur Financ Manag 7(2), 183–211 (2001)

Larsen, L.S., Munk, C.: The costs of suboptimal dynamic asset allocation: general rsults and applications to interest rate risk, stock volatility, and growth/value tilts. J Econ Dyn Control 36, 266–293 (2012)

Merton, R.C.: Optimum consumption and portfolio rules in a continuous time model. J Econ Theory 3, 373–413 (1971). erratum: Merton (1973). Reprinted in (Merton, 1992, Chapter 5)

Merton, R.C.: Erratum. J Econ Theory 6, 213–214 (1973)

Merton, R.C.: Continuous-Time Finance. Cambridge: Basil Blackwell Inc. (1992)

Rogers, L.: The relaxed investor and parameter uncertainty. Finance Stoch 5, 131–154 (2001)

Stapleton, R.C., Subrahmanyam, M.G.: Risk aversion and the intertemporal behavior of asset prices. Rev Financ Stud 3, 677–693 (1990)

Wang, J.: The term structure of interest rates in a pure exchange economy with heterogeneous investors. J Financ Econ 41, 75–110 (1996)

Weinbaum, D.: Investor heterogeneity, asset pricing and volatility dynamics. J Econ Dyn Control 33, 1379–1397 (2009)

Acknowledgments

We would like to thank Marcel Fischer, Antje Mahayni and an anonymous referee for useful comments on earlier versions of the manuscript. We are grateful for financial support from the Pension Research Center (PerCent) at Copenhagen Business School.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of Theorem 3

For any given constant proportional portfolio policy with portfolio weight \(\pi \) allocated to the risky asset, the terminal wealth is, cf. Eq. (5):

Routine calculations with expected values of log-normal distributions lead to:

The optimal portfolio weight \(\pi \) for any given value of \(\gamma \) is found by maximizing the expression \(\pi \eta \sigma -\frac{\gamma }{2}\pi ^2\sigma ^2\), which leads to the classical result that \(\pi =\frac{\eta }{\gamma \sigma }\).

If a suboptimal portfolio weight is imposed, arising from an “erroneous” choice of \(\bar{\gamma }\) instead of the “true” \(\gamma \), we can insert \(\bar{\pi }=\frac{\eta }{\bar{\gamma }\sigma }\) in Eq. (27) and get the following closed form expression for the expected utility:

Compare this with an optimally invested inital wealth \(\widehat{W}_0\):

The wealth equivalent is the magnitude of \(\widehat{W}_0\) that equates the expected utility in Eq. (28) with the expected utility in Eq. (29). That is:

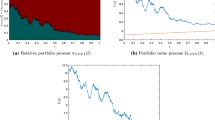

Appendix 2: The derivations behind Fig. 7

The Pareto optimal allocation is clearly affected by the choice of \(\mu \) as shown in Fig. 3. The technical derivations behind Fig. 7 are given here. The starting point is the first order condition (18), which is subjected to a series of differentiations. We denote the conglomerate utility function of the “representative investor” by \(\mathcal{U}\).

Upon dividing (33) by (31) we arrive at the following expression for the relative risk aversion of the “representative investor”

where

Relation (34) shows that the representative investor has a relative risk aversion \(\mathcal{R({\mathcal{W}})}\) equal to an arithmetically weighted average of the two \(\gamma \)-values with weights given by their contribution to the central planner’s marginal utility of wealth.Footnote 7 Furthermore, by dividing (32) by (31) and making use of the relations in (35) defining the weights \(\varPhi _1\) and \(\varPhi _2=1-\varPhi _1\) we get the following relation:

The variable \(\lambda \) is the Lagrangian multiplier for the budget constraint; it depends on the weight \(\mu \), but is clearly independent of any particular realization \({\mathcal{W}}\):

Let \(\varPsi ({\mathcal{W}})\) denote the elasticity of \({\mathcal{W}}\) with respect to the weighting parameter \(\mu \):

and define k as:

Then relation (37) turns into:

Assume without loss of generality that \(\gamma _1<\gamma _2\). Then it follows from (35) that \(\varPhi _1\nearrow 1\) as \({\mathcal{W}}\nearrow \infty \), i.e. the least risk averse individual dominates the right hand tail. In the other end \(\varPhi _1\searrow 0\) as \({\mathcal{W}}\searrow 0\).

It can be ruled out that k can be negative. In that case \(\varPsi ({\mathcal{W}})\) must always be positive, which will violate the budget constraint. Hence we can conclude that

Rights and permissions

About this article

Cite this article

Jensen, B.A., Nielsen, J.A. How suboptimal are linear sharing rules? . Ann Finance 12, 221–243 (2016). https://doi.org/10.1007/s10436-016-0279-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-016-0279-3

Keywords

- Constrained portfolio choice

- Pareto optimal sharing rules

- Suboptimal sharing rules

- Linear sharing rules