Abstract

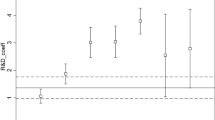

This study theoretically and empirically examines the productivity sorting pattern of the joint decisions related to research and development (R&D) strategies and exporting status using a simple theoretical framework that extends the firm heterogeneity model to account for both internal (a firm’s own R&D) and external (outsourcing R&D or technology purchase) R&D strategies. The empirical results from the nonparametric and semiparametric methods using Japanese firm-level data show that exporting firms engaged in R&D activities are more productive than non-exporters and exporters with no R&D, regardless of whether internal or external R&D strategy is adopted; further, exporters that employ both the R&D strategies are the most productive. The results suggest that the external R&D strategy is complementary to the in-house R&D strategy and is crucial for promoting the innovations of internationalized firms.

Similar content being viewed by others

Notes

If a firm exports, \(E=1\); otherwise, \(E=0\).

In other words, we assume that the fixed costs for R&D and fixed domestic costs are high enough relative to the fixed exporting costs. More precisely, we impose the following parameter restriction: \(\phi _{E}=\frac{f_{E}}{\tau ^{-\epsilon }Y^{*}}<\min \left( \frac{f_{D}+f_{ IR }}{\delta Y},\frac{f_{D}+f_{ ER }}{\lambda Y},\frac{f_{D}+f_{ IR }+f_{ ER }}{\gamma Y}\right) .\)

This paper does not provide a detailed technical explanation about QRs. For a brief introduction to QRs, see Koenker and Hallock (2001).

In fact, the distribution of total factor productivity (TFP) is highly skewed. For both TFP and log of TFP, the skewness/kurtosis tests for normality and the Shapiro–Wilk/Shapiro–Francia tests for normality reject the normality at the 1 % significance level.

The response rate of the METI survey is more than 80 % of the total population.

The survey covers 195,344 firms for the period 2001–2007, with 27,906 firms per year (on average). Manufacturing firms account for approximately 53 % of the sample; the number of manufacturing firms was 92,512 firms for the period 2001–2007, i.e., there were 13,216 manufacturing firms per year (on average) in the sample.

We use transportation and package costs to proxy unobserved productivity shocks since our data does not contain costs for electricity, materials, or fuels.

Following prior studies such as Arnold and Hussinger (2010), we use the standard variables in the estimation of the production functions.

Excluding non-exporters with any type of R&D reduces our sample from 92,512 to 69,644 firms. The restricted sample used in the analysis accounts for about 75 % of the full manufacturing sample. Including them in the analysis yielded qualitatively similar results, as reported in the “Appendix”.

The results of the KS tests for the other years are available on request.

However, the productivity premia of exporters with no R&D as compared to non-exporters are positive but insignificant when we include non-exporters with R&D in the category of non-exporters, as shown in Table A.4 in the “Appendix”.

References

Antras, P., & Helpman, E. (2004). Global sourcing. Journal of Political Economy, 112(3), 552–580.

Arnold, J. M., & Hussinger, K. (2010). Exports versus FDI in German manufacturing, firm performance and participation in international markets. Review of International Economics, 18(4), 595–606.

Aw, B. Y., Roberts, M. J., & Winston, T. (2007). Export market participation, investments in R&D and worker-training, and the evolution of firm productivity. World Economy, 30(1), 83–104.

Aw, B. Y., Roberts, M. J., & Xu, D. Y. (2011). R&D investment, exporting and productivity dynamics. American Economic Review, 101(4), 1312–1344.

Belderbos, R., Ito, B., & Wakasugi, R. (2008). Intra-firm technology transfer and R&D in foreign affiliates: Substitutes or complements? Evidence from Japanese multinational firms. Journal of the Japanese and International Economies, 22(3), 310–319.

Bernard, A. B, & Jensen, J. B. (1995). Exporters, jobs, and wages in US manufacturing: 1976–87. (Brookings papers on economic activity: Microeconomics) (pp. 67–112).

Bernard, A. B., & Jensen, J. B. (1999). Exceptional exporter performance: Cause, effect, or both? Journal of International Economics, 47(1), 1–25.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives, 21(3), 105–130.

Bustos, P. (2011). Trade liberalization, exports, and technology upgrading: Evidence on the impact of MERCOSUR on Argentinian firms. American Economic Review, 101(1), 304–340.

Cassiman, B., & Veugelers, R. (2006). In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Management Science, 52(1), 68–82.

Cohen, W., & Levinthal, D. (1989). Innovation and learning: The two faces of R&D. The Economic Journal, 99(397), 569–596.

Cohen, W., & Levinthal, D. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Delgado, M., Jose, C. F., & Ruano, S. (2002). Firm productivity and export markets: A nonparametric approach. Journal of International Economics, 57(2), 397–422.

Grossman, S. J., & Hart, O. (1986). The cost and benefit of ownership: A theory of vertical and lateral integration. Journal of Political Economy, 94(4), 691–719.

Hart, O., & Moore, J. (1990). Property rights and the nature of the firm. Journal of Political Economy, 98(6), 1119–1158.

Head, K., & Ries, J. (2001). Overseas investment and firm exports. Review of International Economics, 9(1), 108–122.

Head, K., & Ries, J. (2003). Heterogeneity and the FDI versus export decision of Japanese manufacturers. Journal of the Japanese and International Economies, 17(4), 448–467.

Helpman, E., Melitz, M. J., & Yeaple, S. R. (2004). Export versus FDI with heterogeneous firms. American Economic Review, 94(1), 300–316.

Kimura, F., & Kiyota, K. (2006). Exports, FDI, and productivity of firm: Dynamic evidence from Japanese firms. Review of World Economics, 142(4), 695–719.

Koenker, R., & Hallock, K. F. (2001). Quantile regression. Journal of Economic Perspectives, 15(4), 143–156.

Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. The Review of Economic Studies, 70(2), 317–341.

Lileeva, A., & Trefler, D. (2010). Improved access to foreign markets raises plant-level productivity\(\ldots \)for some plants. Quarterly Journal of Economics, 125(3), 1051–1099.

Lokshin, B., Belderbos, R., & Carree, M. (2008). The productivity effects of internal and external R&D: Evidence from a dynamic panel data model. Oxford Bulletin of Economics and Statistics, 70(3), 399–413.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

OECD (2014). Science, technology and industry outlook 2014. Paris: OECD.

Tomiura, E. (2007). Foreign outsourcing, exporting, and FDI: A productivity comparison at the firm level. Journal of International Economics, 72(1), 113–127.

Wagner, J. (2006). Export intensity and plant characteristics: What can we learn from quantile regression? Review of World Economics, 142(1), 195–203.

Wakasugi, R., Ito, B., Matsuura, T., Sato, H., Tanaka, A., & Todo, Y. (2014). Features of Japanese internationalized firms: Findings based firm-level data. In R. Wakasugi (Ed.), Internationalization of Japanese firms: Evidence from firm-level data (pp. 15–45). Tokyo: Springer.

Williamson, O. E. (1975). Markets and hierarchies. New York: Free Press.

Williamson, O. E. (1985). The economic institutions of capitalism. New York: Free Press.

Yeaple, S. R. (2005). A simple model of firm heterogeneity, international trade, and wages. Journal of International Economics, 65(1), 1–20.

Acknowledgments

This study is part of the research project on “International Trade and Firms” of the Research Institute of Economy, Trade and Industry (RIETI). The authors are grateful to Masahisa Fujita, Masayuki Morikawa, Ryuhei Wakasugi, other seminar participants at RIETI, and participants at ETSG 2012 annual conference in Leuven for helpful comments and suggestions. The authors also thank the statistics offices of the Ministry of Economy, Trade and Industry (METI) and the RIETI for granting permission to access firm-level data. This work was supported by the JSPS Grants-in-Aid for Scientific Research Grant No. 26380315.

Author information

Authors and Affiliations

Corresponding author

Appendix: Estimations of input share and results using full sample

Appendix: Estimations of input share and results using full sample

See Tables A.1, A.2, A.3, A.4 and A.5.

About this article

Cite this article

Ito, B., Tanaka, A. External R&D, productivity, and export: evidence from Japanese firms. Rev World Econ 152, 577–596 (2016). https://doi.org/10.1007/s10290-015-0240-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-015-0240-y