Abstract

Using parent–foreign affiliate matched data on Japan from 1995 to 2009, this paper examines the effects of foreign direct investment (FDI) on domestic employment, especially in manufacturing. One of the contributions of this paper is that we utilize the matched data for each country in which Japanese multinational firms operate, which enables us to identify the differences in the impact of FDI between destinations. Results indicate that the increases in the investment goods price in China but the decreases in it in the United States negatively affected the domestic labor demand of multinationals in Japan. This contrast may reflect a difference in specialization patterns across countries. We also found that disemployment in Japan was driven mainly by substitution between capital and labor, rather than by the reallocation of labor from Japan to overseas.

Similar content being viewed by others

Notes

In the literature, disemployment by multinationals is also called job offshoring, or the hollowing out of industries.

A recent study by Hayakawa et al. (2013) also examined the effects of FDI on domestic employment in Japan. However, their analysis focused only on whether firms are multinationals, and global resource allocation by multinationals is beyond the scope of their paper.

Like those of Y&F and H&M, our sample consists of multinationals. This means that this paper focuses on the intensive margin (i.e., existing foreign affiliates) rather than the extensive margin (i.e., newly established foreign affiliates).

In 2002, the BSJBSA covered approximately one-third of Japan’s total labor force is employed in industries other than the public sector, finance industry, or other service industries (Kiyota et al. 2008).

The coverage of our data is presented in Table 8 in the Appendix.

The JIP database was compiled as part of a research project of the RIETI and Hitotsubashi University. The JIP2012 database consists of 52 manufacturing and 56 nonmanufacturing industries from 1970 to 2009. The JIP database provides us with the prices of final and investment goods in each industry for each year, as does the National Bureau of Economic Research (NBER) manufacturing database. For more details about the JIP database, see Fukao et al. (2007). We last accessed the PWT on June 18, 2013.

The coverage of our sample is presented in Table 8 in the Appendix.

In the BSJBSA (and other Japanese government statistics in general), regular workers are defined as workers who are employed for more than one month, or more than 18 days in the previous two months before the latest month-end closing of accounts. The term thus may include not only full-time but also part-time workers.

The sample size for 2004 is small. This may be caused by the incompleteness of the concordance provided by the RIETI.

According to the Labor Force Survey, the number of nonagricultural employees increased by 4 % from 1995 to 2009.

See Table 1 in H&M.

Similarly, the unconditional factor demand function for the n *-th input for the firm \(i\) abroad can be obtained by substituting \(n\) with \(n^{*}, n^{*} = 1, \ldots, N^{*}\).

Although we utilize affiliate-level data, we control for parent firm fixed effects because the dependent variable is firm-level employment.

Unfortunately, because the data do not include any information on the quality of human capital and its factor prices (e.g., educational attainments), we cannot distinguish between demand for skilled and unskilled labor. While the effect of FDI on the quality of domestic jobs (i.e., the skill composition in domestic markets) is another important issue, this paper focuses on the effect of FDI on the number of jobs because of the limited data available.

It may be better to use the user cost of capital rather than the investment goods price index. However, because of the limited availability of these data, following H&M (2011), this paper utilizes the investment goods price. The difficulty in obtaining the rental rate is also pointed out by Kiyota et al. (2008), who utilized the same parent–foreign affiliate matched data for Japan. In the Appendix of Kambayashi and Kiyota (2014), we discuss about this issue in more detail.

In our sample, the correlation between the (log of) final and investment goods prices is 0.5 for Japan and 0.9 for foreign countries.

One may further ask why imports affect labor demand, because prices are given in the labor demand function. One explanation is that the product is differentiated across countries, as in the Armington assumption, which is often used to balance perfect competition and intraindustry trade in Computable General Equilibrium analysis. Note also that cheap products are not necessarily imported from abroad if there are high trade costs (e.g., transportation cost). The share of imports can thus control for some of the effects that are not captured by information on foreign prices.

Another concern is that our sample includes not only wholly owned foreign affiliates but also joint ventures (i.e., shared equity). However, information on equity shares is only available from 2000. Moreover, in 2009, minority-owned affiliates (i.e., less than 50 % equity share) accounted for only 10.6 % of all Japanese foreign affiliates, implying that the difference in the equity shares has little if any effect on our results. This paper thus did not control for the equity shares of the Japanese parent firms.

The small effect of wages may come from the substitution between skilled and unskilled jobs, although we cannot distinguish between them because of the limited data availability discussed above.

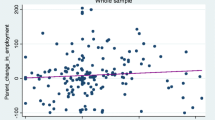

One may be concerned about the low R2 value for the regression results. However, in panel data analysis with a large cross-section of observations, we frequently observe low R2 values. Indeed, H&M also reported low R2 values (0.04–0.05 in Tables 4 and 5), and the sample size in our analysis is 20 times greater than that of H&M.

To confirm our interpretation of the substitution from labor to capital, we estimated the same equation as in Table 3 but replaced the dependent variable with capital stock, as shown in Table 13 in the Appendix. Although our data only provide the nominal book value of capital stock, the estimated results confirm that the price of investment goods negatively affects the capital stock, which supports our interpretation.

The order is based on the number of foreign affiliates (Table 11 in the Appendix). These 15 countries cover 86 % of foreign affiliates in total. Countries in Latin America, Africa, the Middle East, the rest of Oceania, the rest of Asia, and the rest of Europe are classified as the rest of the world.

References

Bernard, A., Jensen, J. B., & Schott, P. K. (2006). Survival of the best fit: Exposure to low-wage countries and the (uneven) growth of US manufacturing. Journal of International Economics, 68(1), 219–237.

Desai, M. A., Foley, C. F., & Hines, J. R., Jr. (2009). Domestic effects of the foreign activities of US multinationals. American Economic Journal: Economic Policy, 1(1), 181–203.

Fukao, K., Hamagata, S., Inui, T., Ito, K., Kwon, H. U., Makino, T., et al. (2007). Estimation procedures and TFP analysis of the JIP database 2006. (RIETI Discussion Paper, 07-E-003). Tokyo: Research Institute of Economy, Trade and Industry.

Harrison, A., & McMillan, M. (2011). Offshoring Jobs? Multinationals and US manufacturing employment. Review of Economics and Statistics, 93(3), 857–875.

Hayakawa, K., Matsuura, T., Motohashi, K., & Obashi, A. (2013). Two-dimensional analysis of the impact of FDI on performance at home: Evidence from Japanese manufacturing firms. Japan and the World Economy, 27, 25–33.

Kambayashi, K., & Kiyota, K. (2014). Disemployment caused by foreign direct investment? Multinationals and Japanese employment. (RIETI Discussion Paper, 14-E-051). Tokyo: Research Institute of Economy, Trade and Industry.

Kiyota, K., Matsuura, T., Urata, S., & Wei, Y. (2008). Reconsidering the backward vertical linkage of foreign affiliates: Evidence from Japanese multinationals. World Development, 36(8), 1398–1414.

Matsuura, T. (2011). Dose outward FDI promote hollowing out of industries at home? A review of empirical research (Kudo-ka - Kaigai Tyokusetsu Toshi de “Kudo-ka” ha Susunda Ka?). Japanese Journal of Labour Studies, 609, 18–21 (in Japanese).

Muendler, M.-A., & Becker, S. O. (2010). Margins of multinational labor substitution. American Economic Review, 100(5), 1999–2030.

Research and Statistics Department, Ministry of Economy, Trade and Industry (METI). (1995–2009). Kigyou Katsudou Kihon Chousa Houkokusho (Basic Survey of Japanese Business Structure and Activities). Tokyo: METI (in Japanese).

Research and Statistics Department, Ministry of Economy, Trade and Industry (METI). (1995–2009). Kaigai Jigyou Katsudou Kihon Chousa Houkokusyo (Basic Survey of Overseas Business Activities). Tokyo: METI (in Japanese).

Tomiura, E. (2003). The impact of import competition on Japanese manufacturing. Journal of the Japanese and International Economies, 17(2), 118–133.

Tomiura, E. (2012). Globalization and Japan’s domestic employment: International trade, offshore production, and offshore outsourcing (Global-ka to wagakuni no kokunai koyou-Boueki, kaigaiseisan, autososingu). Japanese Journal of Labour Studies, 623, 60–70 (in Japanese).

Yamashita, N., & Fukao, K. (2010). Expansion abroad and jobs at home: Evidence from Japanese multinational enterprises. Japan and the World Economy, 22(2), 88–97.

Acknowledgments

This research was conducted as a part of the Research Institute of Economy, Trade and Industry (RIETI) research project entitled “Competitiveness of Japanese Firms: Causes and Effects of the Productivity Dynamics”. The authors acknowledge helpful comments on an earlier draft from Taro Akiyama, Masahisa Fujita, Kyoji Fukao, Toshiyuki Matsuura, Hoang Thi Anh Ngoc, Kazuo Ogawa, Yasuyuki Todo, Nobuaki Yamashita, Liu Yang, the seminar participants at the IDE-JETRO, Kobe University, Kyoto University, RIETI, the University of Tokyo, Yokohama National University, and participants at the SFU–NIESG workshop at Simon Fraser University, the EITI 2014 in Phuket, and the Spring 2014 Meeting of the Japanese Economic Association. Financial support received from the Japan Society for the Promotion of Science (Grant-in-aid A-22243023 and B-26285058) is also gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Tables 8, 9, 10, 11, 12 and 13.

About this article

Cite this article

Kambayashi, R., Kiyota, K. Disemployment caused by foreign direct investment? Multinationals and Japanese employment. Rev World Econ 151, 433–460 (2015). https://doi.org/10.1007/s10290-014-0205-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-014-0205-6