Abstract

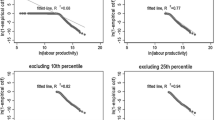

A vast literature on the international activities of heterogeneous firms finds the existence of a positive exporter productivity premium. On average, exporting firms are more productive than firms that sell on the national market only. The Melitz (Econometrica 71:1695–1725, 2003) model, however, has implications for not only mean differences but also differences in the distribution of productivity. Furthermore, exporting firms may be different from non-exporting firms for reasons that are not included in the Melitz model. We believe that conditioning on firm fixed effects and studying the distribution of productivity are both necessary for empirical tests of the Melitz model. This paper is the first to employ a new quantile estimation technique for panel data introduced in Powell (Did the economic stimulus payments of 2008 reduce labor supply? Evidence from quantile panel data estimation. RAND Corporation Publications Department, Santa Monica, 2014). We find that the premium is positive at all productivity levels, but highest at the lowest quantiles. These results support theoretical models which suggest that there is a division in productivity between exporters and non-exporters.

Similar content being viewed by others

Notes

For a discussion of the differences in exporting between West German and East German manufacturing firms see Wagner (2008).

The survey has information about investment that might be used to approximate the capital stock. A close inspection of the investment data, however, reveals that many firms report no or only a very small amount of investment in many years, while others report huge values in 1 year. Any attempt to compute a capital stock measure based on these data would result in a proxy that seems to be useless.

Note that Bartelsman and Doms (2000) point to the fact that heterogeneity in labor productivity has been found to be accompanied by similar heterogeneity in total factor productivity in the reviewed research where both concepts are measured. Furthermore, Foster et al. (2008) show that productivity measures that use sales (i.e., quantities multiplied by prices) and measures that use quantities only are highly positively correlated. In a recent comprehensive survey Syverson (2011) argues that “(t)he inherent variation in establishment- or firm-level microdata is typically so large as to swamp any small measurement-induced differences in productivity metrics. Simply put, high-productivity producers will tend to look efficient regardless of the specific way that their productivity is measured.”

Due to the restricted nature of our data, some cells are confidential and summary statistics cannot be reported.

The same holds for all other years in the sample period; results are available from the second author on request.

The percentage value is computed from the estimated regression coefficient \(\beta \) as \(100(e^{\beta }-1)\).

References

Bartelsman, E. J., & Doms, M. (2000). Understanding productivity: Lessons from longitudinal microdata. Journal of Economic Literature, 38(3), 569–594.

Bellone, F., Guillou, S., & Nesta, L. (2010). To what extent Innovation accounts for firm export premia? Tech. rep.: University of Nice—Sophia Antipolis.

Bernard, A. B., & Jensen, J. B. (1995). Exporters, jobs, and wages in U.S. manufacturing: 1976–1987. Brookings Papers on Economics Activity, Microeconomics, pp. 67–119.

Buchinsky, M. (1994). Changes in the U.S. wage structure 1963–1987: Application of quantile regression. Econometrica, 62(2), 405–58.

Bundesministerium für Wirtschaft und Technologie (2011). Jahreswirtschaftsbericht 2011: Deutschland im Aufschwung—den Wohlstand von Morgen sichern. Tech. rep., Berlin: BMWi.

Canay, I. A. (2011). A note on quantile regression for panel data models. The Econometrics Journal, 14, 368–386.

Chernozhukov, V., & Hansen, C. (2006). Instrumental quantile regression inference for structural and treatment effect models. Journal of Econometrics, 132(2), 491–525.

Chernozhukov, V., & Hansen, C. (2008). Instrumental variable quantile regression: A robust inference approach. Journal of Econometrics, 142(1), 379–398.

Dimelis, S., & Louri, H. (2002). Foreign ownership and production efficiency: A quantile regression analysis. Oxford Economic Papers, 54(3), 449–469.

Doksum, K. (1974). Empirical probability plots and statistical inference for nonlinear models in the two-sample case. The Annals of Statistics, 2(2), 267–277.

Falzoni, A. M., & Grasseni, M. (2005). Home country effects of investing abroad: Evidence from quantile regressions (KITeS Working Papers 170). KITeS, Centre for Knowledge, Internationalization and Technology Studies, Universita’ Bocconi, Milano, Italy.

Foster, L., Haltiwanger, J., & Syverson, C. (2008). Reallocation, firm turnover, and efficiency: Selection on productivity or profitability? American Economic Review, 98(1), 394–425.

Galvao, A. F, Jr. (2011). Quantile regression for dynamic panel data with fixed effects. Journal of Econometrics, 164(1), 142–157.

Greenaway, D., & Kneller, R. (2007). Firm heterogeneity, exporting and foreign direct investment. Economic Journal, 117(517), F134–F161.

Hallak, J. C., & Sivadasan, J. (2010). Firms’ exporting behavior under quality constraints (Working Papers 99). Universidad de San Andres, Departamento de Economia.

Haller, S. A. (2012). Intra-firm trade, exporting, importing, and firm performance. Canadian Journal of Economics/Revue canadienne d’conomique, 45(4), 1397–1430.

Harding, M., & Lamarche, C. (2009). A quantile regression approach for estimating panel data models using instrumental variables. Economics Letters, 104(3), 133–135.

Helpman, E. (2006). Trade, FDI, and the organization of firms. Journal of Economic Literature, 44(3), 589–630.

International Study Group on Exports and Productivity (2008). Understanding cross-country differences in exporter premia: Comparable evidence for 14 countries. Review of World Economics/Weltwirtschaftliches Archiv, 144(4), 596–635.

Koenker, R. W. (2004). Quantile regression for longitudinal data. Journal of Multivariate Analysis, 91(1), 74–89.

Koenker, R. W., & Bassett, G. (1978). Regression quantiles. Econometrica, 46(1), 33–50.

Lamarche, C. (2010). Robust penalized quantile regression estimation for panel data. Journal of Econometrics, 157(2), 396–408.

Lileeva, A., & Trefler, D. (2010). Improved access to foreign markets raises plant-level productivity for some plants. The Quarterly Journal of Economics, 125(3), 1051–1099.

López, R. A. (2005). Trade and growth: Reconciling the macroeconomic and microeconomic evidence. Journal of Economic Surveys, 19(4), 623–648.

Malchin, A., & Voshage, R. (2009). Official firm data for germany. Schmollers Jahrbuch : Journal of Applied Social Science Studies/Zeitschrift für Wirtschafts- und Sozialwissenschaften, 129(3), 501–513.

Manjón, M., Máñez, J. A., Rochina-Barrachina, M. E., & Sanchis-Llopis, J. A. (2013). Reconsidering learning by exporting. Review of World Economics/Weltwirtschaftliches Archiv, 149(1), 5–22.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Politis, D. N., & Romano, J. P. (1994). Large sample confidence regions based on subsamples under minimal assumptions. The Annals of Statistics, 22(4), 2031–2050.

Ponomareva, M. (2011). Identification in quantile regression panel data models with fixed effects and small T, referenced here. http://www.niu.edu/ponomareva/QRPD-short.pdf.

Powell, D. (2014). Did the economic stimulus payments of 2008 reduce labor supply? Evidence from quantile panel data estimation (RAND Working Paper 720). Santa Monica: RAND Corporation Publications Department.

Rosen, A. M. (2012). Set identification via quantile restrictions in short panels. Journal of Econometrics, 166(1), 127–137.

Serti, F., & Tomasi, C. (2009). Self-selection along different export and import markets (LEM Papers Series). 2009/18, Pisa: Laboratory of Economics and Management (LEM), Sant’Anna School of Advanced Studies.

Syverson, C. (2011). What determines productivity? Journal of Economic Literature, 49(2), 326–365.

Trofimenko, N. (2008). Learning by exporting: Does it matter where one learns? Evidence from Colombian manufacturing firms. Economic Development and Cultural Change, 56, 871–894.

Wagner, J. (1995). Exports, firm size, and firm dynamics. Small Business Economics, 7, 29–39.

Wagner, J. (2006). Export intensity and plant characteristics: What can we learn from quantile regression? Review of World Economics/Weltwirtschaftliches Archiv, 142(1), 195–203.

Wagner, J. (2007). Exports and productivity: A survey of the evidence from firm-level data. The World Economy, 30(1), 60–82.

Wagner, J. (2008). A note on why more West than East German firms export. International Economics and Economic Policy, 5(4), 363–370.

Wagner, J. (2011). From estimation results to stylized facts twelve recommendations for empirical research in international activities of heterogeneous firms. De Economist, 159(4), 389–412.

Wagner, J. (2012). International trade and firm performance: A survey of empirical studies since 2006. Review of World Economics/Weltwirtschaftliches Archiv, 148(2), 235–267.

Yasar, M., & Morrison Paul, C. J. (2007). International linkages and productivity at the plant level: Foreign direct investment, exports, imports and licensing. Journal of International Economics, 71(2), 373–388.

Yasar, M., Nelson, C. H., & Rejesus, R. (2006). Productivity and exporting status of manufacturing firms: Evidence from quantile regressions. Review of World Economics/Weltwirtschaftliches Archiv, 142(4), 675–694.

Zühlke, S., Zwick, M., Scharnhorst, S., & Wende, T. (2004). European data watch: The research data centres of the federal statistical office and the statistical offices of the länder. Schmollers Jahrbuch: Journal of Applied Social Science Studies/Zeitschrift für Wirtschafts- und Sozialwissenschaften, 124(4), 567–578.

Acknowledgments

We thank Daniel Trefler, Philipp Schröder, and Alan Sörensen for helpful comments and discussions. All computations were done in the research data centre of the Statistical Office in Berlin using Stata Version 11. The data used are confidential but not exclusive; information on how to access the data is provided in Zühlke et al. (2004). To facilitate replication and extensions Stata code for QRPD is available from the first author, and the Stata do-files used to compute the empirical results in the application are available from the second author on request.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Powell, D., Wagner, J. The exporter productivity premium along the productivity distribution: evidence from quantile regression with nonadditive firm fixed effects. Rev World Econ 150, 763–785 (2014). https://doi.org/10.1007/s10290-014-0192-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-014-0192-7