Abstract

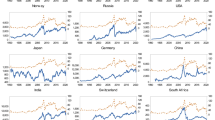

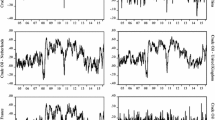

We present evidence of an asymmetric relationship between oil prices and stock returns. The two regime multivariate Markov switching vector autoregressive (MSVAR) model allow us to capture the state shifts in the relationship between regional stock markets and sectors. Results suggest that oil price risk is significantly priced in the sample used. The impact is asymmetric with respect to market phases, and regimes have been associated with world economic, social and political events. Our study also suggests asymmetric responses of sector stock returns to oil price changes and different transmission impacts depending on the sector analyzed. There is a high causality from oil to sectors like Industrials and Oil & Gas. Companies inside the Utilities sector were more able to hedge against oil price increases between 2007 and 2012. Historical crisis events between 1992–1998 and 2003–2007 do not seem to have affected the relationship between oil and sector stock returns, given the higher probability of remaining smoother. For all sectors there seems to be a turn back to stability from 2012 onwards. Finally, investors gain more through portfolio diversification benefits built across, rather than within sectors.

Similar content being viewed by others

Notes

This subgrouping includes the Industry Sector, Energy Sector, Energy Equipment & Services, Oil & Gas & Consumable fuels, Oil & Gas Exploration & Production and Oil & Gas Storage & Transportation indexes.

Results for unit root and cointegration tests are not presented here, but will be made available upon request.

In each m-partition (T1,…,Tm), the associated least squares estimates of the parameters (β1, …, βm) are obtained by minimizing the sum of squared residuals. Substituting the resulting estimates in the objective function and denoting the resulting sum of squared residuals S(T1, …, Tm), the estimated break points \( \left({\widehat{T}}_1,\dots, {\widehat{T}}_m\right) \) are the solution of the minimization of S(T1, …, Tm) over all partitions. Only afterwards are the stability tests implemented, in a sequential procedure. First, stability of the trend is tested against the hypothesis of one break. If stability is rejected, then one break date is imposed on the model, and the hypothesis of one break is tested against the hypothesis of two breaks. The second break date is obtained by testing all the possible models with two breaks after knowing the first break date against the one break model. The procedure is repeated until the number of breaks and the corresponding break dates are determined.

The rest of the results obtained for individual countries will be made available upon request. They showed to be very similar to those of the region representing them, and that is why they have been omitted.

Although results are not presented here for different regions they could be provided upon request.

References

Aloui C, Jammazi R (2009) The effects of crude oil shocks on stock market shifts behavior: a regime switching approach. Energy Econ 31:789–799. doi:10.1016/j.eneco.2009.03.009

Álvarez LJ, Hurtado S, Sánchez I, Thomas C (2011) The impact of oil price changes on Spanish and euro area consumer price inflation. Econ Model 28:422–431. doi:10.1016/j.econmod.2010.08.006

Apergis N, Miller SM (2009) Do structural oil-market shocks affect stock prices? Energy Econ 31:569–575. doi:10.1016/j.eneco.2009.03.001

Arouri ME (2011) Does crude oil move stock markets in Europe? A sector investigation. Econ Model 28:1716–1725. doi:10.1016/j.econmod.2011.02.039

Arouri ME, Nguyen D (2010) Oil prices, stock markets and portfolio investment: evidence from sector analysis in Europe over the last decade. Energ Policy 38:4528–4539. doi:10.1016/j.enpol.2010.04.007

Arouri ME, Lahiani A, Bellalah M (2010) Oil price shocks and stock market returns in oil-exporting countries: the case of GCC countries. Int J Econ Finance 2:132–139. http://ccsenet.org/journal/index.php/ijef/article/view/7971

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural. Econometrica 66:47–78. http://www.jstor.org/stable/2998540

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econ 18:1–22. doi:10.1002/jae.659

Balcilar M, Ozdemir ZA (2013) The causal nexus between oil prices and equity market in the U.S.: a regime switching model. Energy Econ 39:271–282. doi:10.1016/j.eneco.2013.04.014

Basher SA, Sadorsky P (2006) Oil price risk and emerging stock markets. Glob Finance J 17:224–251. http://128.118.178.162

Boyer MM, Filion D (2007) Common and fundamental factors in stock returns of Canadian oil and gas companies. Energy Econ 29:428–453. doi:10.1016/j.eneco.2005.12.003

Chen S (2010) Do higher oil prices push the stock market into bear territory? Energy Econ 32:490–495. doi:10.1016/j.eneco.2009.08.018

Cologni A, Manera M (2009) The asymmetric effects of oil shocks on output growth: a Markov-switching analysis for the G-7 countries. Econ Model 26:1–29. doi:10.1016/j.econmod.2008.05.006

Demirer R, Jategaonkar SP, Khalifa AAA (2015) Oil price risk exposure and the cross-section of stock returns: the case of net exporting countries. Energy Econ 49:132–140

Driesprong G, Jacobsen B, Maat B (2008) Striking oil: another puzzle? J Financ Econ 89:307–327. doi:10.1016/j.jfineco.2007.07.008

El-Sharif I, Brown D, Burton B, Nixon B, Russel A (2005) Evidence on the nature and extent of the relationship between oil and equity value in UK. Energy Econ 27:819–830. doi:10.1016/j.eneco.2005.09.002

Faff R, Brailsford T (1999) Oil price risk and the Australian stock market. J Energy Financ Dev 4:69–87. doi:10.1016/S1085-7443(99)00005-8

Francis N, Owyang MT (2005) Monetary policy in a Markov-switching vector error-correction model: implications for the cost of disinflation and the price puzzle. J Bus Econ Stat 23:305–313. doi:10.1198/073500104000000325

Gogineni S (2010) Oil and the stock market: an industry level analysis. Financ Rev 45:995–1010. doi:10.1111/j.1540-6288.2010.00282.x

Guo F, Chen RC, Huang YS (2011) Markets contagion during financial crisis: a regime-switching approach. Int Rev Econ Financ 20:95–109. doi:10.1016/j.iref.2010.07.009

Hamilton JD (1983) Oil and the macroeconomy since World War II. J Polit Econ 91:228–248. http://www.jstor.org/stable/1832055

Hamilton JD (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57:357–384. doi:10.2307/1912559

Hamilton JD (2003) What is an oil shock? J Econ 113:363–398. http://www.elsevier.com/locate/jeconom

Jawadi F, Arouri ME, Bellalah M (2010) Nonlinear linkages between oil and stock markets in developed and emerging countries. Int J Bus 15:19–31. http://www.craig.csufresno.edu/International_Programs/JC/IJB/Volumes/Volume%2015/V151-2.pdf

Kilian L (2008) Exogenous oil supply shocks: how big are they and how much do they matter for the US economy? Rev Econ Stat 90:216–240. doi:10.1162/rest.90.2.216

Ko JH, Morita H (2013) Regime switches in Japanese fiscal policy: Markov–Switching VAR approach, Global COE Hi-Stat Discussion Paper Series 270, Institute of Economic Research, Hitotsubashi University, Kunitachi. http://gcoe.ier.hit-u.ac.jp/research/discussion/2008/pdf/gd12-270.pdf

Milani F (2009) Expectations, learning, and the changing relationship between oil prices and the macroeconomy. EnergyEcon 31:827–837. doi:10.1016/j.eneco.2009.05.012

Miller JI, Ratti RA (2009) Crude oil and stock markets: stability, instability and bubbles. Energy Econ 31:559–568. doi:10.1016/j.eneco.2009.01.009

Mohamed A (2011) Stock returns and oil price changes in Europe: a sector analysis. Manch Sch 80:237–261. doi:10.1111/j.1467-9957.2010.02223.x

Mohanty SK, Nandha M, Turkistani AQ, Alaitani MY (2011) Oil price movements and stock market returns: evidence from Gulf Cooperation Council (GCC) countries. Glob Financ J 22:42–55. doi:10.1016/j.gfj.2011.05.004

Naifar N, Dohaiman MSA (2013) Nonlinear analysis among crude oil prices, stock markets’ return and macroeconomic variables. Int Rev Econ Financ 27:416–431. doi:10.1016/j.iref.2013.01.001

Nandha M, Faff R (2008) Does oil move equity prices? A global view. Energy Econ 30:986–997. doi:10.1016/j.eneco.2007.09.003

Park J, Ratti RA (2008) Oil price shocks and stock markets in the US and 13 European countries. Energy Econ 30:2587–2608. doi:10.1016/j.eneco.2008.04.003

Qiao Z, Li Y, Wong W-K (2011) Regime-dependent relationships among the stock markets of the US, Australia and New Zealand: a Markov-switching VAR approach. Appl Financ Econ 21:1831–1841. doi:10.1080/09603107.2011.595678

Qinbin F, Mohammad R, Parvar J (2012) U.S. industry-level returns and oil prices. Int Rev Econ Financ 22:112–128. doi:10.2139/ssrn.1927641

Ramshand L, Susmel R (1998) Volatility and cross correlation in global equity markets. J Empir Financ 5:397–416. doi:10.1016/S0927-5398(98)00003-6

Sadorsky P (2001) Risk factors in stock returns of Canadian oil and gas companies. Energy Econ 23:17–28. doi:10.1016/S0140-9883(00)00072-4

Wai PS, Ismail MT, Kun SS (2013) Commodity price effect on stock market: a Markov switching vector autoregressive approach. Int J Sci Eng Res 4:19–24. http://www.ijser.org/onlineResearchPaperViewer.aspx?Commodity-Price-Effect-on-Stock-Market.pdf

Acknowledgments

Empirical work was performed with Matlab. We thank the participants of the first ICEE Energy & Environment Conference, FEP, University of Porto held in 9-10 May, 2013, for their helpful comments. The usual caveat applies.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Pinho, C., Madaleno, M. Oil prices and stock returns: nonlinear links across sectors. Port Econ J 15, 79–97 (2016). https://doi.org/10.1007/s10258-016-0117-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-016-0117-6