Abstract

Although medical savings accounts (MSAs) have drawn intensive attention across the world for their potential in cost control, there is limited evidence of their impact on the demand for health care. This paper is intended to fill that gap. First, we built up a dynamic model of a consumer’s problem of utility maximization in the presence of a nonlinear price schedule embedded in an MSA. Second, the model was implemented using data from a 2-year MSA pilot program in China. The estimated price elasticity under MSAs was between −0.42 and −0.58, i.e., higher than that reported in the literature. The relatively high price elasticity suggests that MSAs as an insurance feature may help control costs. However, the long-term effect of MSAs on health costs is subject to further analysis.

Similar content being viewed by others

Introduction

As a model of financing health care that aims to promote personal responsibility for health and health care, medical savings accounts (MSAs) have been considered by some researchers as “an innovation” [62, 63], and have garnered intense attention around the world for their cost control potential [31]. It is argued that MSAs will give consumers incentives to save in a tax-sheltered environment, and to spend the funds in their own MSAs wisely on health care [30, 36, 61]. Following the first implementation of MSAs in Singapore in 1984, a number of countries, including Malaysia, South Africa, and the United States, began their own MSAs experiments in the 1990s [4, 59, 60, 61, 63]. In the early 2000s, both public and private health insurance started to offer MSAs in the US [15, 49]. In comparison, China has the largest experience with MSAs, which were first piloted in several cities in the mid-1990s and then expanded to 80 % of Chinese cities by 2001 [3]. MSAs also became a key feature of the New Rural Cooperative Medical Scheme—a social insurance program launched by the Chinese government in 2003 to target rural populations [48].

Researchers across the world have examined the effects of MSAs on medical expenditure, and have reported mixed results. For example, one review paper found that MSAs “are associated with both lower costs and lower cost increases” in the US [8]. A recent paper by Lo Sasso et al. [42] also found MSA enrollees spent less than non-MSA enrollees in the US. Similarly, one study in South Africa indicated that MSAs led to cost savings for prescription drugs [47]. By contrast, studies in Singapore found little evidence that MSAs had contained costs [4, 36, 40]. Two recent reviews have also generated conflicting conclusions. One review indicated that a small number of studies in the US tested the hypothesis that consumer-directed health plans, including MSAs, result in lower medical spending, but these studies demonstrated little support for this hypothesis [6]. The other review found that prior studies in the US had generally concluded that MSAs discouraged the use of both low- and high-value treatments, and reduced health care spending [70].

Given the mixed results, researchers have called for formal tests of the effects of MSAs on health care costs [61, 68]. This paper responds to the call by using empirical data from an MSA pilot project in China. It is interesting to note that the design of the pilot in China is strikingly similar to that offered by Definity Health—a private health plan in the US, a country that first started MSA experiments through the 1997 Balanced Budget Act and then expanded MSAs [known in the US as health savings accounts (HSAs)] through the 2003 Medicare Modernization Act and more recently by the 2010 Affordable Care Act (see [7] for a detailed description of the development of MSAs in the US). The private plan has drawn intensive media coverage, and has grown rapidly since it was launched in 2000 [14, 19, 46]. By mid-2002, Definity Health had signed up 42,000 members before it was bought by a large insurance company in the US in 2004 [50]. Definity Health shared some common features with the MSA pilot in China, including (1) being offered as employer-provided health insurance; (2) allocating part of the premiums to an account that has tax-exemption status, and is earmarked for purchasing health care services by the insured; (3) requiring the insured to pay out-of-pocket for an “actuarial gap” between the services purchased using funds in the account and the services covered by the insurance policy; and (4) allowing unused funds in the account to roll over to the next year [13]. Given the similarity, we hope that the analysis of China’s experience presented here could also be of some interest to the North American audience (see more discussions below).

This study aims to estimate price elasticity of MSA enrollees. We first describe the nonlinear price schedule embedded in a plan with MSAs, and then build up a dynamic model concerning the consumer’s problem of achieving utility maximization with effective price. The model indicated that even for those having no out-of-pocket expenditure, the effective price was positive despite zero nominal price. This provided an incentive for enrollees to save on their MSAs. The implementation of the model using empirical data from China showed that the price elasticity under MSAs was between −0.42 and −0.58, i.e., higher than that reported by the RAND Health Insurance Experiment, confirming that MSA enrollees were more price responsive.

The paper is organized as follows. “Methods” describes the methods, including a description of the pilot in China, the data collected, a theoretical model of consumer response to a nonlinear price schedule embedded in an MSA plan, and how the model was adapted to an empirically estimable form. “Results” presents the results of empirical analysis, and “Conclusion and discussion” concludes and discusses the study.

Methods

Key features of China’s pilot of medical savings accounts

The pilot has the following key features:

-

1.

The premium was decided by the government to be 12.5 % of payroll, with 11.5 % paid by employer and 1 % by the employee.

-

2.

Nearly half of the premium was allocated into individual MSAs, which was about 4–6 % of one’s salary depending on age. The rest of the premium was allocated to the social risk-pooling (SRP) fund, designed against catastrophic health events.

-

3.

If the fund in one’s MSA was not used up, it would roll over to the next year. On the other hand, if one’s MSA fund was used up, one should pay for medical expenditure out of pocket.

-

4.

When the self-payment was over 5 % of one’s last year salary, the SRP fund will pay for the rest of one’s medical expenditure with a declining co-payment from the insured, showed as Table 1.

-

5.

The insurance coverage provided a wide scope of benefits, including both routine care such as physician visits, outpatient and inpatient care, and specialized care such as dental care, mental care, lab tests, and prescription drugs.

-

6.

One was not allowed to convert the MSA fund into cash. However, if one died, the fund left in one’s MSA would be inherited by one’s spouse or children.

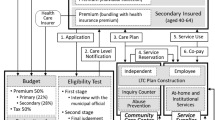

The design of the MSA pilot is summarized in Fig. 1. It actually has three parts of coverage with a nonlinear price schedule. The first part is a full coverage by MSAs; the second is a deductible with out-of-pocket payment up to 5 % of one’s annual salary; after the deductible is satisfied, the social risk-pooling fund as a component for catastrophic events will act as the last resort with different coinsurance rate depending on expenditures.

Eligibility, enrollment, and management of the pilot

As part of the health insurance reform sponsored by the central government,Footnote 1 the above pilot program was implemented in 1997 in Nantong, a city located in southeast of China with medium population size of 244,300 and relatively high income of US$ 1000 per year per employee at work in 1997 (compared with the average of US$ 500 for all cities in China).Footnote 2 The city government decided that the pilot would be an employment-based insurance, and every employer in the city would be eligible. If an employer participated in the pilot, both its current employees and those who already retired would be covered. Those who retired would not have MSAs, and they would be covered by the SRP fund. The pilot started in April 1997, and covered 70,644 people by the end of March 1999. All government employees were mandated to participate in the pilot, accounting for 27 % of all the enrollees. About 72 % of the enrollees were from the state-owned enterprises or the foreign joint ventures, for which the pilot was strongly suggested but not mandated. Less than 1 % of the enrollees were self-employed or from the private enterprises, for which the pilot was voluntary.

As a social health insurance, all premiums collected by the pilot would be used to pay for the benefits of the enrollees, while its loading fee was paid by the local government, who consequently created a management center to run the pilot.

Data

As part of an evaluation study conducted in December 1999, information about operation of the pilot between April 1997 and March 1999 was obtained from the computerized information system established by the local authority. This paper will use this information, including socio-demographic characteristics of the enrollees, income and expenditure of both the individual MSAs and the entire SRP fund, and utilization of and expenditure on different types of health services by the individual enrollees. It is noteworthy that all health expenditures incurred by the enrollees, either paid by the pilot or paid out-of-pocket by the enrollees, were recorded by the computerized information system. Data obtained from the information system avoids the most common problem with claims data, i.e., the lack of information about consumption with expenditure below the deductibles. This enables us to estimate the demand for medical care for all of the study population.

The study sample was restricted to those who had participated in the pilot for 2 years (April 1997–March 1999), and those who had MSAs since the study focuses on MSAs. As a result, the study population included 33,158 enrollees younger than 60 years. This is due to two reasons. First, men over 60 years old and women over 55 years old are required to retire by law in China, where the life expectancy at birth was 70 years in 1997 [69]. Second, by design, the pilot did not set up MSAs for those enrollees who have retired, and instead provided insurance coverage to them through the SRP fund. This caused problems with the pilot, and was discussed in another paper [73].

Model

As shown in Fig. 1, the MSAs change the price schedule of health care. At first sight, this may appear to increase demand for health care as it provides first-dollar coverage for the insured. However, since the balance in one’s MSA will roll over to the next year, it will become part of the next year’s MSA funding, and will eventually change the price schedule in the next year. The less one uses medical care, the more balance of MSA one has at the end of the current year, and the more MSA funding one will have for the next year. As any accumulation increases the critical threshold for the next year’s MSA funding, which provides full coverage, one is more likely to have no or small out-of-pocket payment in the future. Thus, a plan with MSAs gives the insured incentive to defer their care and/or to spend less on health care so that they can save more funds at their MSAs, which can be used to reduce the future price of their medical care. Through this way, MSAs becomes a means of income redistribution between the present time and the future. This is one of the key ideas behind MSAs—to encourage people to save for future medical care. Another key idea is that when people have disposable money in their own MSAs, they will become more cost-conscious, as well as more price responsive. This may potentially reduce moral hazard and help control costs.

The situation modeled here is a consumer facing a nonlinear price schedule in which the price at time t, P t, depends upon accumulated expenditures, x t, during a 1-year accounting period. The period of 1 year is a natural unit of analysis since, at the beginning of a year, new premiums will be collected and then split among individual MSAs and the SRP fund. For notational convenience, the quantity of health services purchased is measured in terms of dollars of expenditures, and the price in terms of the consumer’s marginal share of total medical expenditure paid out-of-pocket. As the out-of-pocket share of total expenditure, the price can be written as a function of x:

Although deductibles and coinsurance rates are common features of today’s insurance plans, modeling their impact on demand for medical care turns out to be a complex task. Keeler et al. [38] made an important theoretical contribution to studying consumer behavior with respect to a deductible and different coinsurance rates. They built up a dynamic program concerning both the stock and the flow of health and other goods, and demonstrated that the correct price for consumers to use was the “effective price”—the shadow price of one more unit of health consumption. Inspired by this dynamic model, many researchers have carried out empirical analysis of consumer behavior when prices are nonlinear. However, due to problems with realistic demand structure and the intractability of dynamic programming, most such empirical analyses have not incorporated the notion of the effective price. One exception is the methodology developed by Ellis [20] for analysis of the demand for metal health services. His work showed that a utility-maximizing consumer should use the expected end-of-year price to make consumption decisions during a 1-year period. The Ellis method has been used by recent studies, including that of Jung et al. [37]. Our model below, although very close to that developed by Ellis [20], uses explicitly a variable related to MSA. By design, the existence of MSA not only changes the current year’s price schedule, but also may affect next year’s price as the balance of one’s MSA funds roll over to the next year. The impact of MSA on price schedule is a dynamic problem, as discussed below.

Assume the consumer consumes two goods during the year t: medical care, x t, and a composite commodity, y t. To simplify the problem without loss of generality, let the price of y t be 1. Following previous studies, we assume the consumer derive utility from stock of health, H, which is a function of x

At the beginning of an accounting year, the insurance plan will collect new premiums, part of which will be allocated into individual MSAs, and decide new deductibles, which are proportional to one’s salary. Neither the premiums nor the deductibles depend on prior-year expenditure. There are only two stock variables that will roll over from the previous year to the current year, including one’s health status, H, and the savings in one’s MSAs, S. We can assume, at the beginning of the year, one’s utility depends on these stock variables and y t, as indicated by the following equation:

With the flow of medical care and other goods during the year, the consumer’s end-of-year stock of utility, which can also be considered as that at the beginning of next year, i.e., year t + 1, can be written as a function of H, S, and W (stock of disposable wealth):

As the theories of previous studies suggested [20, 28, 38], the consumer makes medical consumption decision on the basis of effective price, P e . Then, as a rational consumer, one’s problem of utility maximization can be formulated as a dynamic program with respect to the expected sum of utility from the beginning to the end of the year. There are three state variables, H, W, and S, two continuous choice variables, x and y:

such that

V t is the expected utility of the year t. U t , U t+1 is the stock of utility at the beginning and the end of the year t, respectively. H t , H t+1 is the health status at the beginning and at the end of the year t, respectively. S t is the balance (savings) of MSA at the end of year t − 1, which rolls over to the year t. S t+1 is the balance (savings) of MSA at the end of year t. y t is the consumption of other goods during the year t. Price of y is assumed to equal 1. W t is the stock of disposable wealth at the beginning of the year t. x t is the quantity of health services purchased during the year t, measured in terms of dollars of expenditures. Then, x t * P e is out-of-pocket expenditures paid by the consumer. I t is the monetary income received during the year t. C t is the premiums paid during the year t. P e is the effective price of medical care during the year t, calculated as the out-of-pocket share of annual medical expenditure. MSA is the part of the premiums allocated into one’s MSA during the year t.

Both P e and S t+1 are step functions, depending on accumulated expenditure during the year, x t. If both of these are continuous functions, the solution to Eq. (3) would be relatively straightforward. In that case, the first-order conditions that must hold for the optimal choices of x* t and y* t are:

The first term of Eq. (5) represents the future utility derived from one’s current medical consumption; the second term reflects the direct cost of medical consumption expressed in the reduced utility from wealth (negative sign); the third term is of central interest to this study, which gives the expected effect of one’s current medical consumption on one’s future insurance coverage. Conceptually, spending one extra dollar on health care in the current period is equivalent to reducing the critical thresholds of full insurance coverage by one dollar both for the rest of the current year and for the next year. The potential change in medical price resulting from the reduced critical thresholds has both wealth effect and substitution effect on one’s future consumption. The wealth effect results from the increased likelihood of out-of-pocket payment as the thresholds of full coverage decreased. However, the wealth effect is likely to be small, since the published studies found that the income elasticity of demand for health care is small [53]. Thus, in order to focus on the substitution effect, we follow the analysis by Ellis [20] and make the following assumption to eliminate the wealth effect:

This is actually two assumptions. First, that a consumer’s utility is separable into H, W, and S. Second, that the utility is linear in W with constant marginal utility regardless of one’s health status.

An important result that follows from (6) is:

Since the price of y t is assumed to be 1, using (4) and (7), we get:

Using (7) and (8), we can rewrite (5) as

which can be rearranged as

As previous studies have shown [38], a moderate deductible would divide enrollees of an insurance plan into two groups: those who had severe illness and would use up their deductible, and those who were healthy or with minor illness and would not. Similarly, in the case of a plan with MSAs, some of the insured with bad health status will exhaust their MSAs funds while those who are relatively healthy will not. Let us first consider the situation when one uses up one’s MSA funding. In that case, S t+1 = 0. Then (3) becomes:

Consequently, we can develop (9) to:

This suggests that the effective price equals the marginal rate of substitution between x t and y t . This is consistent with Ellis’ finding [20].

If, on the other hand, at the end of a year, one has some balances in one’s MSA, it suggests that one has enjoyed full insurance coverage with no out-of-pocket expenditures during the year. In that case, Eq. (9) still holds. Since the expected utility from x t , y t , and S t+1 are positive, the left side of Eq. (9) is greater than zero, which means the right side, P e > 0. However, compared with Eq. (10), P e in Eq. (9) is smaller. This suggests that, although the nominal price for those who have no out-of-pocket expenditures is zero, there is a small price to be paid for full coverage under MSAs. It is worth noting that a similar conclusion was reached by one recent study of MSAs in the US, which, like the current study, took account of a consumer’s kinked budget constraint under MSAs, and found that people with savings in their MSAs pay a positive price despite having no out-of-pocket spending [23].

Equations (9) and (10) indicate that MSAs may have different impacts on demand for health care depending on whether or not one has MSA balances at the end of a year. While Eq. (10) suggests that those who exhaust their MSA funds face the same effective price as that found by previous studies, Eq. (9) implies that those who have savings in their MSAs effectively pay a positive price despite of no out-of-pocket expenditures. However, it is not clear what percentage of all the MSA enrollees will have no out-of-pocket expenditures, and what coinsurance rate those who exhaust their MSA funds will pay. Thus, it remains an empirical question if, as a whole, enrollees of a plan with MSAs will be more price-responsive than those who are enrolled in a traditional indemnity plan with copayment. The following empirical analysis aims to examine this question.

Our model is based on several important assumptions. As pointed out above, the constant marginal utility of wealth at the end of the year was a strong simplifying assumption, suggesting that the consumer is risk-neutral. The justification for this assumption is that we are studying how the insured people behave, not why they bought the insurance. On the other hand, previous studies found that the magnitude of risk-aversion was small [26]. Even when risk aversion is considered, the expected end-of-year price can be showed to be close to the true shadow price of health care [20], and the model of consumer behavior in the presence of uncertainty still remains useful.

Empirical implementation

The above theoretical model implies that a rational consumer uses the effective price to make decisions in the presence of a nonlinear price schedule. Using the effective price has the advantage of avoiding biased estimates associated with average nominal price [39, 54]. However, it is not easy to specify the effective price because, to operationalize the theoretical model, one had to specify the demand structure of medical care and the consumer’s expectation.

To simplify the problem, we use the probability distribution of actual end-of-year prices to reflect consumer rational expectations. A set of simultaneous equations were developed as follows.

where π i is probability of ending a year with the price P i, which is the actual share of medical expenditure paid by the insured out-of-pocket. In other words, π i represents the probability of ending the year on each segment of the price schedule described in “Model” (spending less than the MSA funds, more than the MSA funds but less than the deductible, or more than the deductible). R is a vector of socioeconomic variables that affect the demand for and utilization of health care. Other variables were defined as above.

Because the effective price is not observable, we have to use a proxy defined in Eq. (12), which is based on Eq. (11), a multinomial logit model. Equation (11) was used to estimate both the probability of using health care by a consumer in a year, and the possibility that the consumer exceeds, is equal to, or below various price thresholds at the end of a year. The predicted probability from Eq. (11) was multiplied by the appropriate price for each interval between the thresholds. Sum of the multiplications is the expected price defined in Eq. (12), which in this study was used as a proxy for a consumer’s rational expectation.

The price proxy was used in Eq. (13) for estimation of demand for health care. There is one statistical issue related to this equation. Although researchers have used a variety of statistical models for expenditure data, such as OLS, GLM, and Cox models, there is no current consensus about the best model [5, 21, 45, 52]. As Newhouse and colleagues pointed out [54], the fundamental problem is that there was little empirical evidence to guide us in choosing how the form of medical expenditures distribution varied as a function of the insurance policy with copayment and deductibles. Among the models of health expenditures, the two-part model has been applied widely and studied intensively [2, 16, 18, 44, 52]. This study first tried the two-part model with logged OLS for the second part, and found that the specification was not appropriate for this analysis because the log-scaled residuals of the second-part is heteroscedastic across continuous variables, which makes it difficult to use the smearing retransformation, for which there is no easy solution in the current literature. Then, we followed the recommendation by Manning and Mullahy [45] for comparing different GLM models, and chose a GLM model with Gamma distribution and log link for the second part of the two-part model. Finally, we put the two parts together to predict expenditures, and to solve for the marginal effect of price on expenditures by differentiating the predicted expenditures.

In addition, as in prior studies [20], this study specified a Tobit model with logged expenditures as the dependent variable, which treated the expenditure data as censored to the left on the point of zero. One advantage of using Tobit model for Eq. (13) is that it easily provides an estimate of price elasticity for the study population as a whole, including both non-users and users of health care.

Results and discussion

The study period covered 2 years, with the period from 1 April 1997 to 31 March 1998 defined as Year 1, and the period from 1April 1998 to 31 March 1999 as Year 2. Table 2 shows the distribution of the study population by end-of-year price in Year 2. Over 15 % of the study population did not use health care; 56.6 % used health care, but did not exhaust their MSA funds; and 21.7 % exhausted their MSAs, but did not reach the ceiling of out-of-pocket payment. Together, these three groups of people accounted for 93.5 % of the study population, and 52.2 % of total expenditures by the population. In comparison, those who exceeded the ceiling of out-of-pocket payment and ended the year with different co-insurance rates accounted for less than 7 % of the study population, and incurred 47.8 % of all expenditures by the whole population. In particular, those who ended the year with a 10 % co-insurance rate are the most expensive group—only 0.02 % of the study population fell in this category, but incurred 2.3 % of all expenditures by the population.

The variables for the multivariate analyses are summarized in Table 3. Based on Andersen’s model of health care seeking behaviour [1], the covariates are classified into three categories, including predisposing characteristics (age and gender), enabling factors (salary, white collar vs. blue collar, urban vs. rural residence, government employee, and MSA funds available for Year 2, which include funds allotted into one’s MSA in Year 2 plus one’s MSA balances rolled over from Year 1), and need factors (prior year use and expenditures as proxy of health status). Age is used as a categorical variable because the allocation of MSA funds depends on age groups. Because the retired are not included in the study as described above, the study population is relatively young, with more than 40 % being at or under the age of 35.

Table 4 shows the results of the Tobit model and the GLM with Gamma distribution and log link. Most variables are statistically significant at the 0.01 level. Females have significantly higher expenditures than males. Compared with enrollees aged 35 or less, both those who are between 35 and 45 years old and those who are 46 years of age or older have significantly higher expenditures. Health expenditures are positively associated with salary. On the contrary, there is a negative association between health expenditure and MSA funds in Year 2, which is related to one’s salary in Year 2 plus MSA balance rolled over from Year 1, and reflects both one’s wealth and one’s health status in the previous year. The fact that enrollees with White-Collar occupation have less expenditure than those who have Blue-Collar occupations may be due to different health status between these two groups [29].

As expected, prior use and expenditure have positive signs. Expenditure is not significantly associated with whether or not health care was used in the previous year, while it is significantly associated with prior expenditure. The higher one’s expenditure in Year 1, the more one spends on health care in Year 2. This is consistent with findings that health expenditures at individual level are positively correlated [67].

The most interesting result from this analysis was the coefficient estimate of the proxy of effective price—the expected end-of-year price. The estimate was −0.575 in the Tobit model, and was significant at 0.05 level. In a separate analysis using bootstrapping method of 1000 replications, the coefficient is the same, with a bias of 0.0003 and a standard error of 0.204. The bootstrapping analysis revealed that the 95 % of confidence interval is (−1.099, −0.297), (−1.096, −0.300), and (−1.103, −0.313), respectively, by using the normal distribution method, the percentile method, and the bias-corrected method, each of which confirms that the estimate is negative and statistically significant at the 0.05 level. On the other hand, the coefficient estimate of the end-of-year price was −0.528, using the GLM model, and, after putting the two-part model together, the estimated price elasticity is −0.42, as shown in Table 5.

To facilitate comparison with findings by other researchers, the parameter is expressed as the percentage reduction in consumption at various coinsurance levels relative to the free-care level, shown in Table 5. Compared with consumption at the free-care level, consumption at full price level under MSAs will be reduced by 56 % and 58 % using the Tobit, and the two-part model, respectively.

Compared with those who were enrolled in the RAND Health Insurance Experiment (RHIE), the MSA enrollees are more price responsive. Manning and colleagues (1987) reported that annual expenditure in the 95 % coinsurance plan of the RHIE to be 72 % of expenditure in the free-care plan. Keeler and Rolph [39] analyzed the RHIE data based on episodes of treatment instead of annual spending, and found that elasticities fell in the range of −0.1 to −0.3 for most medical services. The only exception was “well care” with an elasticity of −0.43. Overall, the RHIE participants are less price responsive than the MSA enrollees in this study.

The findings of this study are most comparable to those of Horgan [35], who estimated the price elasticity of demand for ambulatory mental care was −0.44. The findings are also consistent with those found by Ellis [20] and Taube et al. [66]. Ellis used the expected end-of-year price as a proxy for the effective price, and found that the elasticity of demand for ambulatory mental care was −0.59. Taube and colleagues [66] reported an elasticity of −0.54 for ambulatory mental care using an average price. Unlike this paper, which used a two-part model to analyze all the study population, the above three studies of ambulatory mental care focused exclusively on health care users. In essence, the estimated elasticities are simple price responsiveness for those who used health care.

Conclusion

We have two key findings. First, to understand the impact of MSAs on demand for medical care, this paper developed a model of medical consumption decision in the presence of nonlinear price schedule. The model suggests that status of the MSA balance at the end of a year would change the effective price. For those who expect to have no MSA balance, the effective price is the marginal rate of substitution between medical care and other goods. For those who expect to have balances at their individual MSAs at the end of a year, they face a positive price despite nominally free care. Second, the econometric specification of our model was implemented on a sample from the MSA pilot in China, and the results showed the estimated price elasticity under MSAs is higher than that reported by the RAND Health Insurance Experiment. Together, these findings suggest that MSAs have the potential of reducing costs since holders of MSAs are more price responsive, and subsequently may make more cautious decisions on medical consumption.

Our finding that those who do not exhaust the funds in their individual MSAs at the end of a year pay a small price despite nominally free care is consistent with that reported by Feldman and Parente [23], who found that American employees with savings in their MSAs paid a positive price for health care despite having no out-of-pocket spending. Our result that MSAs are associated with higher price elasticity than that reported by the RAND Health Insurance Experiment suggests the potential for cost control by MSAs. This result is consistent with that reported by prior studies in the US. Buntin and colleagues [43] estimated the effects of MSA enrollment on health care costs in 2004 and 2005, and found that families enrolled in MSAs spent 14 % less than similar families enrolled in conventional plans. Lo Sasso et al. [42] analyzed data from a national insurer in the US, and found that MSA enrollees spent less than non-MSA enrollees in 2006 and 2007. In particular, a group of researchers from the University of Minnesota published a series of papers demonstrating the negative effects of MSAs on health expenditures [23, 55–58]. In addition, one new literature review published earlier this year concluded that prior studies in the US indicated that MSAs led to lower costs [7].

Our findings are important given the ongoing debates about the future of MSAs in several countries, especially in China and the US. Chinese policymakers decided to achieve 100 % of MSA participation rate in each and every city by 2020 as part of the ongoing national health care reform [10]. On the other hand, some experts were concerned that China’s MSAs did not offer adequate financial protection, especially for patients with high health care needs [72]. In order to alleviate the concern, there has been a call to abolish MSAs and improve financial protection through a larger social risk-pooling fund [71]. While our finding that MSAs are associated with relatively high price elasticity, suggesting the potential of cost control, it will be a challenge for Chinese policymakers to maintain a balance between the MSAs’ intended goal of cost control while avoiding the unintended consequence of deteriorating equity and financial protection.

Given the similarity in design between the MSAs in this study and those offered in the US as described above, the study findings are also important for the development of MSAs in the US. The 2010 Affordable Care Act (ACA)—President Obama’s signature health care reform law—represented a mix of good and bad news for MSAs [called health savings accounts (HSAs) in the ACA]. The ACA has not only significantly extended insurance coverage to millions of Americans, of whom a substantial proportion is eligible for MSAs, but also helped the MSA enrollees by imposing limits on their maximum out-of-pocket expenditures. However, several provisions of the ACA posed challenges to the development of MSAs. For example, the ACA set up standards that health plans (e.g., MSAs) must meet, including coverage of “minimum essential benefits” and a minimum actuarial value of 60 %, both of which caused problems to the MSAs that existed prior to the ACA since most of them did not meet the standards [25]. The ACA also increased the penalty for drawing on MSAs for nonmedical expenses from 10 % to 20 % [7]. To address the challenges, insurers have designed a variety of MSA products that meet the requirements by the ACA and made the products available in nearly all markets [33]. After the ACA, the MSA enrollment in the US kept growing from 1.0 million in 2005 to 13.5 million in 2012 [7]. Our results suggest that MSAs could damp medical care demand through higher medical care price sensitivity, implying that the growth of MSAs in the US might contribute to cost control—a key objective of the ACA.

Finally, we would like to acknowledge the limitations of this study and point out directions for future studies. First, like prior studies [9, 22, 43, 68], this paper focused on the first 2 years of MSA enrollment, and demand for medical care might change as the MSAs build up over the years. Prior studies have documented that the effect of MSAs on health expenditures differed by year. For example, one US study [58] had a 2-year study period, including 1 year before and 1 year after MSA enrollment, and found that the MSA enrollment led to cost savings, a conclusion similar to that reported by this study. In contrast, another study by the same group had a 5-year study period, including 1 year before and 4 years after MSA enrollment, but reached the different conclusion that MSAs were cost-neutral relative to traditional health plans [12]. Given the mixed findings available in the current literature, future studies are warranted to examine the long-term effect of MSAs on medical costs.

Second, our study did not distinguish the impact among subgroups. Researchers in both China [41, 71, 72] and the US [23, 34, 56, 68] found that the impact of MSAs on health care demand differed by subgroup: While those MSA enrollees who are healthy or have only minor diseases may save through their individual MSAs for future health care, those enrollees with serious health problems will be likely to exhaust their MSA funds and incur out-of-pocket expenditures. Given the heterogeneous effects of the MSAs on health expenditures, further research is needed to analyze how MSAs affect health status, especially for vulnerable groups such as the chronically ill.

Third, this paper focused on aggregate data on total expenditure, and did not perform analysis based on episodes of treatment. As Keeler and Rolph reported [39], analysis of expenditures based on episodes of treatment is appropriate in the presence of a nonlinear price schedule, and produces more reliable results than the analysis of annual expenditure.

Fourth, this study did not examine expenditure by type of health care services. Since MSAs aim to encourage patients to be cost-conscious and make decisions that they might not be qualified to make, they might lead patients to skimp on preventive checkups and other types of health care whose benefits are not immediately obvious. A number of studies have raised such concerns [9, 11, 17, 24, 27, 32, 57]. Given these concerns, it is particularly important for future studies to examine the long-term impact of MSAs on health care costs because even if we see that costs decrease in the short term as indicated by this paper, costs might start to creep back up in the long-term if people are hospitalized with more serious conditions due to skimping.

Last but not least, this study did not assess if the MSA holders have access to, and can use effectively, medical price information for their medical consumption. Whether or not MSAs are effective at controlling costs depends to a large extent on whether MSA enrollees have access to accurate information about price and quality of health care, which facilitates their capacity to choose the right providers when purchasing health care services. Prior studies in the US have documented the difficulty patients had in obtaining price and quality information about health care services in general [51, 65], and the low awareness of price information among MSA enrollees in particular [64]. Future studies need to examine whether similar problems exist in China.

Notes

The central government started the pilot with MSAs in two cities in 1994, and in 1996 expanded it to nearly 60 cities including the city described in this study. By 2001, more than 80 % of all cities in China had implemented programs with MSAs.

One US$ was approximately 8.3 Chinese Yuan in 1997.

References

Andersen, R.: Revisiting the behavioral model and access to care: does it matter? J. Health Soc. Behav. 36, 1–10 (1995)

Ai, C., Norton, E.C.: Standard Errors for the retransformation problem with heteroscedasticity. J. Health Econ. 19, 697–718 (2000)

Bai, Y.: Health insurance reform in urban China. People’s Daily (2001)

Barr, M.D.: Medical savings accounts in Singapore: a critical inquiry. J. Health Politics Policy Law 26(4), 709–726 (2001)

Blough, D., Madden, C., Hornbrook, M.C.: Modeling risk using generalized linear models. J. Health Econ. 18, 153–171 (1999)

Buchmueller, T.C.: Consumer-oriented health care reform strategies: a review of the evidence on managed competition and consumer-directed health insurance. Milbank Q. 87, 820–841 (2009)

Bundorf, M.K.: Consumer-directed health plans: a review of the evidence. J. Risk Insur. 83(1), 9–41 (2016)

Buntin, B.M., Damberg, C., Haviland, A., Kapur, K., Lurie, N., McDevitt, R., Marquis, M.S.: Consumer-directed health care: early evidence about effects on cost and quality. Health Aff. Web Exclus. 25(6), w516–w530 (2006)

Buntin, M.B., Haviland, A.M., McDevitt, R., Sood, N.: Healthcare spending and preventive care in high-deductible and consumer-directed health plans. Am. J. Manag. Care. 17(3), 222–230 (2011)

Central Committee of Chinese Communist Party: State Council. Suggestions for deepening health care reform. http://www.gov.cn/jrzg/2009-04/06/content_1278721.htm (2009). Accessed 15 August 2011

Charlton, M., Levy, B., High, R., Schneider, J.E., Brook, J.: Effects of health savings account-eligible plans on utilization and expenditures. Am. J. Manag. Care 17(1), 79–86 (2011)

Chen, S., Feldman, R., Parente, S.T.: A five-year study of health expenditures among full replacement CDHPs, optional CDHPs and traditional managed care plans. Insur. Mark. Co. Anal. Actuar. Comput. 5(1), 6–16 (2014)

Christianson, J., Parente, S.T., Taylor, R.: Defined contribution health insurance products: development and prospects. Health Aff. 21(1), 49–64 (2002)

Cohn, L.: Giving power to the patient. Business Week (2002)

Delaney, C.: Definity health launches Nation’s First Consumer Driven E-Health Plan. http://www.definityhealth.com/marketing/news1.html (2000). Accessed 5 April 2002

Diehr, P., Yanez, D., Ash, A., Hornbrook, M., Lin, D.Y.: Methods for analyzing health care utilization and costs. Annu. Rev. Publ. Health 20, 125–144 (1999)

Dixon, A., Greene, J., Hibbard, J.: Do consumer-directed health plans drive changes in enrollees’ health care behavior? Health Aff. 27(4), 1120–1131 (2008)

Duan, N., Manning, W., Morris, C., Newhouse, J.A.: A comparison of alternative models for the demand for medical care. J. Bus. Econ. Stat. 1(2), 115–126 (1983)

Eisenberg, D.: Stitch up an HMO. Time 158(17), Y15–Y16 (2001)

Ellis, R.: Rational behavior in the presence of coverage ceilings and deductibles. Rand J. Econ. 17(2), 158–175 (1986)

Etzioni, R., Feuer, E., Sullivan, S.D., Lin, D., Hu, C., Ramsey, S.D.: On the use of survival analysis techniques to estimate medical care cost. J. Health Econ. 18, 365–380 (1999)

Feldman, R.D., Parente, S.T., Christianson, J.B.: Consumer-directed health plans: new evidence on spending and utilization. Inquiry. 44, 26–40 (2007)

Feldman, R.D., Parente, S.T.: Employee incentives in consumer directed health plans: spend now or save for later? Forum Health Econ. Policy. 13(2), (2010)

Fronstin, P., Sepúlveda, M.J., Roebuck, M.C.: Medication utilization and adherence in a health savings account-eligible plan. Am. J. Manag. Care 19(12), e400–e407 (2013)

Gabel, J., Lore, R., McDevitt, R., Pickreign, J., Whitmore, H., Slover, M., Levy-Forsythe, E.: More than half of individual health plans offer coverage that falls short of what can be sold through exchanges as of 2014. Health Aff. 31(6), 1339–1348 (2012)

Garber, A., Phelps, C.: Economic foundations of cost-effectiveness analysis. J. Health Econ. 16, 1–31 (1997)

Greene, J., Hibbard, J., Murray, J., Teutsch, S., Berger, M.: The impact of consumer-directed health plans on prescription drug use. Health Aff. 27(4), 1111–1119 (2008)

Grossman, M.: The Demand for Health: A Theoretical and Empirical Investigation. Columbia University Press (for the National Bureau of Economic Research). New York (1972)

Gu, X., Tang, S.: Reform of the Chinese health care financing system. Health Policy 32, 181–191 (1995)

Ham, C.: Values and health policy: the case of Singapore. J. Health Politics Policy Law 26(4), 739–745 (2001)

Hanvoravongchai, P.: Medical savings accounts: lesson learned from international experience, EIP Discussion Paper No 52. World Health Organization, Geneva (2002)

Hardie, N.A., Lo Sasso, A.T., Shah, M., Levin, R.A.: Behavioral healthcare services use in health savings accounts versus traditional health plans. J. Mental Health Policy Econ. 13(4), 159–165 (2010)

Howard, P., Feyman, Y.: Health savings accounts under the affordable care act: challenges and opportunities for consumer-directed health plans. Manhattan Institute for Policy Research, New York (2014)

Haviland, A.M., Sood, N., McDevitt, R., Marquis, M.S.: How do consumer-directed health plans affect vulnerable populations? Forum Health Econ. Policy 14(2), 1–12 (2011)

Horgan, C.: The demand for ambulatory mental health services from specialty providers. Health Serv. Res. 21(2), 291–319 (1986)

Hsiao, W.: Behind the ideology and theory: what is the empirical evidence for medical savings accounts? J. Health Politics Policy Law 26(4), 733–737 (2001)

Jung, K., Feldman, R., McBean, M.: Demand for prescription drugs under non-linear pricing in medicare Part D. Int. J. Health Care Financ. Econ. (2013). doi:10.1007/s10754-013-9137-2

Keeler, E., Newhouse, J., Phelps, C.: Deductibles and the demand for medical care services: the theory of a consumer facing a variable price schedule under uncertainty. Econometrica 45(3), 641–655 (1977)

Keeler, E., Rolph, J.: The demand for episodes of treatment in the health insurance experiment. J Health Econ. 7, 337–367 (1988)

Lim, J.: Health care reform in Singapore: the medisave scheme. In: Meng, T.T., Beng, C.S. (eds.) Affordable health care: issues and prospects, pp. 277–285. Prentice Hall, Singapore (1997)

Liu, J., Chen, T.: Sleeping money: investigating the huge surpluses of social health insurance in China. Int J Health Care Finance Econ. 13(3–4), 319–331 (2013)

Lo Sasso, A.T., Helmchen, L.A., Kaestner, R.: The effects of consumer-directed health plans on health care spending. J. Risk Insur. 77(1), 85–103 (2010)

Lo Sasso AT, Shah, M., Frogner, B.K.: Health savings accounts and healtfh care spending. HSR Health Serv. Res. 45(4), 1041–1060 (2010)

Manning, W.: The logged dependent variable, heteroskedasticity, and the retransformation problem. J. Health Econ. 17, 283–296 (1998)

Manning, W., Mullahy, J.: Estimating log models: to transform or not to transform. J. Health Econ. 20, 461–494 (2001)

Martinez, B.: Health plan that puts employees in charge of spending catches on. Wall Street J. January 8 (2002)

Matisonn, S.: Medical Savings Accounts in South Africa. NCPA Policy Report, No. 234. National Center for Policy Analysis, Dallas, Texas. http://www.ncpa.org/pub/st234(2000). Accessed 8 Aug 2005

Meng, Q., Tang, S.: Universal health care coverage in China: challenges and Opportunities. Proc. Social Behav. Sci. 77, 330–340 (2013)

Minicozzi, A.: Medical savings accounts: What story do the data tell? Health Aff. 25(1), 256–267 (2006)

Moukherber, Z.: Give them a stake. Forbes (2002)

Muhlestein, D.B., Wilks, C.E., Richter, J.P.: Limited use of price and quality advertising among American hospitals. J. Med. Internet Res. 15(8), e185 (2013)

Mullahy, J.: Much ado about two: reconsidering retrasformaiton and the two-part model in health economics. J. Health Econ. 17, 247–282 (1998)

Newhouse, JP.: A summary of the RAND health insurance study. Ann N Y Acad Sci. 387, 111–114 (1982)

Newhouse, J., Rolph, J., et al.: The effect of deductible on the demand for medical care services. J. Am. Stat. Assoc. 75(371), 525–533 (1980)

Parente, S., Feldman, R., Christianson, J.: Evaluation of the effect of a consumer-driven health plan on medical care expenditures and utilization. Health Serv. Res. 39(4 Pt 2), 1189–1210 (2004)

Parente, S., Christianson, J., Feldman, R.: Consumer-directed health plans and the chronically ill. Dis Manage Health Outcomes. 15(4), 239–248 (2007)

Parente, S., Feldman, R., Chen, S.: Effects of a consumer driven health plan on pharmaceutical spending and utilization. Health Serv. Res. 43(5), 1542–1556 (2008)

Parente, S., Feldman, R., Xu, Y.: Impact of full replacement with consumer driven health plans. Insur. Mark. Co. Anal. Actuar. Comput. 1(1), 4–14 (2010)

Pauly, M.: Do two wrongs make a right: an analysis of medical savings accounts. American Enterprise Institute, Washington (1994)

Pauly, M., Goodman, J.: Tax credits for health insurance and medical savings accounts. Health Aff. 14(1), 126–139 (1995)

Pauly, M.: Medical savings accounts in Singapore: what can we know? J. Health Politics Policy Law 26(4), 727–731 (2001)

Phua, K.: Saving for health. World Health Forum 8, 38–41 (1987)

Prescott, N., Nichols, M.: International comparison of medical savings accounts. In: Prescott, N. (ed.) Choice in financing health care and old age security. World Bank Discussion Paper No. 392, Washington (1998)

Reed, M., Benedetti, N., Brand, R., Newhouse, J., Hsu, J.: Perspectives from deductible plan enrollees: plan knowledge and anticipated care-seeking changes. BMC Health Services Research 9, 244 (2009)

Reinhardt, U.E.: The pricing of US hospital services: chaos behind a veil of secrecy. Health Aff. 25(1), 57–69 (2006)

Taube, C.A., Kessler, L.G., Burns, B.J.: Estimating the probability and level of ambulatory mental health services use. Health Serv. Res. 21(2), 321–340 (1986)

van de Ven, W., Ellis, R.: Risk Adjustment in competitive health plan markets. Handbook of health economics. A.J.Culyer and J.P.Newhouse (Eds.). 1, 755-845 (2000)

Waters, T.M., Chang, C.F., Cecil, W.T., Kasteridis, P., Mirvis, D.: Impact of high-deductible health plans on health care utilization and costs. Health Serv. Res. 46(1), 155–172 (2011)

World Bank: World development indicators. The World Bank, Washington (1999)

Wouters, O.J., Cylus, J., Yang, W., Thomson, S., McKee, M.: Medical savings accounts: assessing their impact on efficiency, equity, and financial protection in health care. Health Econ. Policy Law (2016). doi:10.1017/S1744133116000025

Xia, Y.: Medical saving account for urban employee insurance—is it worth keeping?. Microeconomics 4(1), 51 (2014) (in Chinese)

Yip, W., Hsiao, W.: Non-evidence-based policy: how effective is China’s new cooperative medical scheme in reducing medical impoverishment? Soc. Sci. Med. 68(2), 201–209 (2009)

Yu, H., Gong, Y.: Lessons from a health insurance experiment in China [abstract]. Academy for Health Services Research and Health Policy annual meeting, Atlanta, GA (2001)

Acknowledgments

The field work for data collection was funded by the European Union for a study of urban health reform in China. The funder has not been involved in the design and conduct of the study, in the collection, analysis, and interpretation of the data, and in the preparation, review, or approval of the manuscript. The study was approved by the IRB at School of Public Health, Shanghai Medical University. The author is grateful to Deming Huang, Jiaying Chen, Shenglan Tang, and Youlong Gong for assistance in data collection, and to Emmett Keeler, Andrew Dick, and two anonymous reviewers for helpful comments. In particular, the author would like to thank Charles Phelps whose constant encouragement made it possible to complete this paper, which was first drafted as a coursework at the University of Rochester.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yu, H. China’s medical savings accounts: an analysis of the price elasticity of demand for health care. Eur J Health Econ 18, 773–785 (2017). https://doi.org/10.1007/s10198-016-0827-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10198-016-0827-9

Keywords

- Medical savings accounts

- Health insurance

- Nonlinear price schedule

- Elasticity

- Demand for health care

- China