Abstract

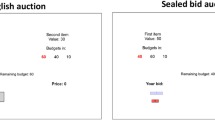

This paper considers two multi-item auction formats (ascending and sealed bid) which both identify the minimum Walrasian equilibrium prices and where truthful preference revelation constitutes an equilibrium. Even though these auction formats share many theoretical properties, there are behavioral aspects that are not easily captured. To explore this issue in more detail, this paper experimentally investigates what role the design of the auction format has for its outcome. The results suggest that the sealed bid mechanism performs weakly better in all of the investigated measures (consistent reporting, efficiency etc.). In addition, we find that the performance of the ascending auction is increasing over time, whereas the sealed bid auction shows no such tendency.

Similar content being viewed by others

References

Alsemgeest P, Noussair C, Olson M (1998) Experimental comparisons of auctions under single- and multi-unit demand. Econ Inq 36: 87–97

Andersson O, Holm HJ (2010) Endogenous communication and tacit coordination in market entry games—an explorative experimental study. Int J Ind Organ 28: 477–495

Andersson O, Wengström E (2007) Do antitrust laws facilitate collusion: experimental evidence on costly communication in duopolies. Scand J Econ 109: 321–339

Andersson O, Wengström E (2012) Credible communication and cooperation: experimental evidence from multi-stage games. J Econ Behav Organ 81: 207–219

Andersson T, Andersson C (2012) Properties of the DGS auction mechanism. Comput Econ 39: 113–133

Attiyeh G, Franciosi R, Isaac RM (2000) Experiments with the pivot process for providing public goods. Public Choice 102: 95–114

Chen Y, Sönmez T (2002) Improving efficiency of on-campus housing: an experimental study. Am Econ Rev 92: 1669–1686

Chen Y, Sönmez T (2006) School choice: an experimental study. J Econ Theory 127: 202–231

Chen Y, Takeuchi K (2010) Multi-object auctions with package bidding: an experimental comparison of Vickrey and iBEA. Games Econ Behav 68: 557–579

Coppinger VM, Smith VL, Titus JA (1980) Incentives and behavior in English, Dutch and sealed-bid auctions. Econ Inq 43: 1–22

Cox JC, Smith VL, Walker JM (1985) Expected revenue in discriminative and uniform price sealed bid auctions. In: Smith VL (eds) Research in experimental economics, vol 3. JAI Press, Greenwich

Cramton P (1998) Ascending auctions. Eur Econ Rev 42: 745–756

de Vries S, Schummer J, Vohra RV (2007) On ascending Vickrey auctions for heterogeneous objects. J Econ Theory 132: 95–118

Demange G, Gale D (1985) The strategy structure of two-sided matching markets. Econometrica 53: 873–888

Demange G, Gale D, Sotomayor M (1986) Multi-item auctions. J Polit Econ 94: 863–872

Engelbrecht-Wiggans R, Kahn CM (1998) Multi-unit auctions with uniform prices. Econ Theory 12: 227–258

Goeree K, Schram A, Offerman T (2006) Using first-price auctions to sell heterogeneous licenses. Int J Ind Organ 24: 555–581

Harstad RM (2000) Dominant strategy adoption and bidders’ experience with pricing rules. Exp Econ 3: 261–280

Kagel JH, Harstad RM, Levin D (1987) Information impact and allocation rules in auctions with affiliated private values: a laboratory study. Econometrica 55: 1275–1304

Kagel JH (1995) Auctions: a survey of experimental research. In: Roth AE, Kagel JH (eds) Handbook of experimental economics. Princeton University Press, Princeton

Kagel JH, Levin D (1993) Independent private value auctions: bidder behavior in first-, second- and third-price auctions with varying number of bidders. Econ J 103: 868–879

Kagel JH, Levin D (2001) Behavior in multi-unit demand auctions: Experiments with uniform price and dynamic Vickery auctions. Econometrica 69: 413–454

Kagel JH, Levin D (2011) Auctions: a survey of experimental research, 1995–2010 (Forthcoming). In: Roth AE, Kagel JH (eds) Handbook of experimental economics, vol 2. Princeton University Press, Princeton

Kawagoe T, Mori T (2001) Can the pivotal mechanism induce truth-telling? An experimental study. Public Choice 108: 331–354

Ledyard JO, Porter D, Rangel A (1997) Experiments testing multiobject allocation mechanisms. J Econ Manag Strateg 6: 639–675

Leonard H (1983) Elicitation of honest preferences for the assignment of individuals to positions. J Polit Econ 91: 1–36

McCabe KA, Rassenti SJ, Smith VL (1990) Auction institutional design: theory and behavior of simultaneous multiple-unit generalizations of the Dutch and English auctions. Am Econ Rev 80: 1276–1283

Mishra D, Parkes DC (2007) Ascending price Vickrey auctions for general valuations. J Econ Theory 132: 335–366

Olson M, Porter D (1994) An experimental examination into the design of decentralized methods to solve the assignment problem with and without money. Econ Theory 4: 11–40

Pais J, Pintér A (2008) School choice and information: an experimental study on matching mechanisms. Games Econ Behav 64: 303–328

Pais J, Pintér A, Veszteg RF (2011) College admissions and the role of information: an experimental study. Int Econ Rev 52: 713–737

Parkes D, Ungar L (2002) An ascending-price generalized Vickrey auction. In: Proceedings of 2002 Stanford Institute for Theoretical Economics, Workshop on the economics of the internet, Stanford, CA

Rassenti SJ, Smith VL, Bulfin RL (1982) A combinatorial auction mechanism for airport time slot allocation. Bell J Econ 13: 402–417

Shapley L, Shubik M (1972) The assignment game I: the core. Int J Game Theory 1: 111–130

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to the anonymous referee and the Editor in charge of this paper for helpful comments and suggestions. Financial support from the Jan Wallander and Tom Hedelius Foundation is gratefully acknowledged by all three authors.

Rights and permissions

About this article

Cite this article

Andersson, C., Andersson, O. & Andersson, T. Sealed bid auctions versus ascending bid auctions: an experimental study. Rev Econ Design 17, 1–16 (2013). https://doi.org/10.1007/s10058-012-0129-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-012-0129-3