Abstract

This paper develops an eigenfunction expansion approach to solve discretely monitored first passage time problems for a rich class of Markov processes, including diffusions and subordinate diffusions with jumps, whose transition or Feynman–Kac semigroups possess eigenfunction expansions in \(L^{2}\)-spaces. Many processes important in finance are in this class, including OU, CIR, (JD)CEV diffusions and their subordinate versions with jumps. The method represents the solution to a discretely monitored first passage problem in the form of an eigenfunction expansion with expansion coefficients satisfying an explicitly given recursion. A range of financial applications is given, drawn from across equity, credit, commodity, and interest rate markets. Numerical examples demonstrate that even in the case of frequent barrier monitoring, such as daily, approximating discrete first passage time problems with continuous solutions may result in unacceptably large errors in financial applications. This highlights the relevance of the method to financial applications.

Similar content being viewed by others

1 Introduction

First passage problems are ubiquitous in modelling with Markov processes in physical, biological and social sciences. In contrast to physical and biological applications, a distinguishing feature of many barrier crossing problems arising in financial economics applications is that while the underlying Markov process modelling some financial variable evolves continuously in time, the barrier is monitored by an observer at discrete times. In financial contracts with barrier features, such as a knock-out option that becomes null and void when the underlying asset price or financial variable crosses a prespecified level (barrier), barrier monitoring frequency is contractually specified to be daily, weekly, monthly, or quarterly. Contracts with such discrete observation barrier features are traded in equity, foreign exchange, interest rate, and commodity markets. In corporate bond markets, bonds sometimes have indenture provisions that give bond holders the right to declare a bond issuing firm in default if some financial variable falls below a prespecified barrier. Since in practice bond holders monitor compliance with indentures at discrete times, this is another instance of a discretely monitored first passage problem.

While continuous time first passage problems, and the methods to solve them, are widely studied in applied probability and financial mathematics (see [23, 24, 43, 63, 12, 10, 4, 45] for a sampling of papers in financial mathematics), the literature on discretely monitored barrier crossing problems is substantially smaller. When a solution to the continuous barrier crossing problem is available, one may wonder if it can be used as an approximation to discrete problems when the barrier monitoring frequency is high enough, such as approximating barrier options with daily monitoring with continuous barrier option solutions. However, solutions to discrete barrier crossing problems typically converge to the continuous barrier crossing solutions slowly as the time interval between the subsequent monitoring dates converges to zero, making such approximations inaccurate and unsuitable for applications in finance. In this paper, we confirm this observation for several standard financial models (see Tables 1, 3 and 4 in Sect. 4).

Early important contributions to the study of discrete barrier problems include [14, 15, 42, 37, 38], which derived simple and elegant continuity corrections for discrete barrier and lookback options under the Black–Scholes model that allow one to use solutions for continuous barrier options to value discrete barrier options by appropriately shifting the barrier. Since then this method has become popular in financial practice. Recently, [18] derived continuity corrections for the Merton jump-diffusion model and [26, 27] for exponential Lévy models. However, many financial models are based on Markov processes which do not have stationary and independent increments. No continuity corrections are available for non-Lévy processes at present. Even for Lévy processes and, indeed, even for the Black–Scholes model, the drawback of the continuity correction approach is that it provides acceptable approximations only when the barrier monitoring frequency is high enough. Alternatively, for the Black–Scholes model [32] obtained a solution by the Wiener–Hopf technique. For models where the return distribution is a mixture of Gaussians (including the Black–Scholes model and Merton’s jump-diffusion model), [16] developed a fast and accurate method based on the fast Gauss transform. For general Lévy processes, [65] proposed a Laplace transform approach based on Spitzer’s identity, while [28, 29] and [25] developed fast and accurate methods using the fast Hilbert transform and piecewise polynomial interpolation together with efficient Fourier inversion respectively. Outside the class of Lévy processes, [33] applied a method based on numerical quadrature to the constant elasticity of variance (CEV) diffusion, where the volatility is a negative power of the stock price (see [20]). In contrast to the continuity correction approach, which is purely analytical, the latter methods require numerical quadrature and/or numerical transform inversion.

The purpose of this paper is to apply the eigenfunction expansion method to solve discrete first passage problems for a rich class of Markov processes, including diffusions, jump-diffusions, and pure jump processes, whose transition or Feynman–Kac operators form symmetric semigroups with purely discrete spectra and possess eigenfunction expansions in appropriate Hilbert spaces. Fortunately, many processes important for financial applications are in this class, including Ornstein–Uhlenbeck (OU), Cox–Ingersoll–Ross (CIR) and CEV diffusions, as well as jump-diffusions and pure jump processes obtained from these diffusions by subordination in the sense of Bochner (i.e., via a time change with a Lévy subordinator), as well as its extension to additive subordinators.

To introduce the idea of our method, we sketch the calculation of the discretely observed first exit time of an OU diffusion from an interval. Let \(X\) be an OU diffusion with volatility \(\sigma>0\), long-run mean \(\theta \in{\mathbb{R}}\), and the rate of mean reversion \(\kappa>0\). It has a Gaussian stationary distribution

and a Gaussian transition kernel that can be written as \(P_{t}(x,dy)=p_{t}(x,y)m(dy)\) with the symmetric density \(p_{t}(x,y)=p_{t}(y,x)\) with respect to the stationary measure \(m\). The density \(p_{t}(x,y)\) admits a well-known bilinear eigenfunction expansion (e.g. [72], or [39, Eq. (13.12b)])

where \(H_{n}(x)\) is the \(n\)th order Hermite polynomial. The functions \((\varphi_{n}(x))_{n\geq0}\) form a complete orthonormal basis in \(L^{2}({\mathbb{R}},m)\) and they are eigenfunctions of the OU transition operator, that is, \(\mathcal{ P}_{t} \varphi_{n}(x)=\int_{\mathbb{R}}\varphi _{n}(y)p_{t}(x,y)m(dy)=e^{-\lambda_{n} t}\varphi_{n}(x)\). The bilinear expansion converges uniformly on compacts in \(x,y\) for each \(t>0\) (cf. [58]). For \(f\in L^{2}(\mathbb{R},m)\), \(\mathcal {P}_{t}f(x)\) admits an eigenfunction expansion in the form

where \((f,g)=\int_{\mathbb{R}}f(x)g(x)m(dx)\) is the \(L^{2}({\mathbb{R}},m)\)-inner product. For \(t\geq0\), the expansion converges in \(L^{2}(\mathbb{R},m)\). For \(t>0\), the expansion also converges uniformly on compacts in \(x\).

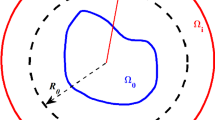

Consider an interval \((\ell,u)\) with \(-\infty\leq\ell< u\leq\infty\) with at least one endpoint finite, a positive constant \(h>0\), and a set of times \(\mathcal{ T}^{h}=\{t_{i}=ih, i=1,2,\dots\}\). Suppose an observer monitors the state of the OU diffusion at times \(t_{i}\) and records the first exit time \(\tau_{e}=\inf\{t\in\mathcal{ T}^{h}:X_{t}\notin(\ell,u)\}\). We are interested in its distribution. Clearly, \({\mathbb{P}}_{x}[\tau_{e}=t_{k}]=p^{k-1}_{h}(x)-p^{k}_{h}(x)\), \(k\geq1\), where \(p^{0}_{h}(x)=1\) and for \(k\geq1\),

where \(x\in{\mathbb{R}}\) is the initial state and \(\mathbf{1}_{(\ell ,u)}(x)\) the indicator function of the interval \((\ell,u)\). At first sight, this calculation requires numerically evaluating the \(k\)-dimensional integral

In realistic applications, \(k\) is often large, thus direct calculation of this multidimensional integral is certainly not computationally efficient. Fortunately, the eigenfunction expansion (1.1) can be profitably used to explicitly calculate this probability in an efficient way as follows. Observe that the \(p^{k}_{h}\) are related by the recursion

Since \(\mathbf{1}_{(\ell,u)}\in L^{2}({\mathbb{R}},m)\) and \(\mathcal{ P}_{t}\) maps \(L^{2}({\mathbb{R}},m)\) to \(L^{2}({\mathbb{R}},m)\) for each \(t\), we have \(p^{k}_{h}\in L^{2}({\mathbb{R}},m)\) for each \(k\). Because the \(\varphi_{n}\) form a complete orthonormal basis in \(L^{2}({\mathbb{R}},m)\), each \(p^{k}_{h}\) has the eigenfunction expansion

with expansion coefficients satisfying the recursion

The convergence in (1.2) is uniform on compacts in \(x\), as well as in \(L^{2}({\mathbb{R}},m)\). The calculation is thus reduced to the calculation of \((\mathbf{1}_{(\ell,u)},\varphi_{n})\) and \((\mathbf{1}_{(\ell,u)}\varphi_{m},\varphi_{n})\), which can be done in closed form for the OU eigenfunctions. The solution is thus explicit. From the computational standpoint, it is convenient to employ the classical recursion for Hermite polynomials to evaluate all the quantities involved. Figure 1 in Sect. 4 provides a numerical example.

Probability distribution of \(\tau_{e}\) for \(u=0.0\), \(l=-\infty\). For the OU diffusion, \(\theta=0.0\), \(\kappa=0.5\), \(\sigma=0.35\), \(x_{0}=-0.1\). For the subOU process, the time change is a compound Poisson random clock with jump arrival rate of 5 jumps per year, with exponential jump size with mean jump of 0.1, and drift \(\gamma =1\)

The purpose of this paper is to make precise and extend the idea sketched above in the following directions:

(i) The process \(X\) can be a one-dimensional diffusion (possibly with killing to model bankruptcy in the finance context) possessing an eigenfunction expansion of its transition semigroup or its Feynman–Kac semigroup associated with a discount rate allowed to be a function of the diffusion (for applications to stochastic interest rates), a diffusion time changed with a Lévy subordinator (to model state-dependent jumps) or an additive subordinator (if time-inhomogeneity is desired in an application).

(ii) The first passage problem may involve non-equidistant observation times \(t_{i}\), time-dependent barriers \(\ell_{i}\) and \(u_{i}\). We first solve the knock-out barrier option pricing problem with rebates. The joint distribution of the discretely observed first passage time \(\tau_{e}\) and the state of the process at that time \(X_{\tau_{e}}\) is then obtained as a special case.

(iii) Explore a range of financial applications drawn from across equity, credit, interest rate, and commodity markets.

We stress in particular that the method applies to jump-diffusions and pure jump processes obtained from diffusions via subordination as well as to pure diffusions. Time changing a time-homogeneous diffusion with a Lévy subordinator yields a jump-diffusion or a pure jump process with (depending on whether or not the subordinator has drift) state-dependent jumps, which leads in some financial applications to more realistic models compared to Lévy models that feature stationary and independent increments. Applications of Lévy subordination of diffusions with state-dependent drift and volatility in finance include [7] for equity options modelling, [3] and [59] for unified credit-equity modelling, [51] for commodity modelling, [11] and [53] for interest rate modelling, and [62] for credit risk modelling. The remarkable result is that if the underlying diffusion possesses the eigenfunction expansion, then the subordinate diffusion has the expansion in the same eigenfunctions \(\varphi_{n}\) with \(\phi(\lambda_{n})\) replacing \(\lambda_{n}\), where \(\phi(\lambda)\) is the Laplace exponent of the subordinator. Furthermore, recently [52] and [49] replaced Lévy subordinators with additive subordinators to introduce time-inhomogeneity in the subordinate process in order to be able to capture the term structure of implied volatilities in commodity options markets (recall that an additive subordinator is a Lévy subordinator without the requirement of stationary increments; see, e.g. [69]). Time changing a time-homogeneous diffusion by an additive subordinator yields a time-inhomogeneous jump-diffusion or a pure jump process with state- and time-dependent jumps. Remarkably, the additive subordination procedure also preserves the eigenfunctions.

This paper is organized as follows. In Sect. 2, we make precise the class of Markov processes we work with, and discuss conditions for their eigenfunction expansions to converge uniformly on compacts, as well as extensions to bounded payoffs that are not necessarily in \(L^{2}\). In Sect. 3, we formulate the eigenfunction expansion method to solve discretely monitored first passage problems and show how to compute a variety of quantities involving the first passage time and the state of the process of interest in applied probability and finance using the eigenfunction expansion method. To illustrate the versatility of the method, we consider several valuation problems which span applications in equity, credit, commodity and interest rate markets. In Sect. 4.1, we compute discretely monitored first passage probabilities for an OU diffusion and a jump-diffusion obtained by time changing the OU diffusion with a Lévy subordinator. As an application, we price commodity options with barriers under the commodity models in [51] and [52]. In Sect. 4.2, we price equity barrier options under the CEV model, its jump-to-default extension (JDCEV) in [17], and the model obtained by subordination of the JDCEV process in [59]. In Sect. 4.3, we evaluate bonds with barriers under the CIR short rate model and its subordinate extension.

2 Subordination of diffusions and eigenfunction expansions

2.1 One-dimensional diffusions and subordinate diffusions

Consider a 1D time-homogeneous diffusion process \((X_{t})_{t\geq0}\) on an interval \(I\subseteq\mathbb{R}\) with left and right endpoints \(e_{1}\) and \(e_{2}\) and starting at \(x\), \(-\infty\leq e_{1}< x< e_{2}\leq+\infty\), with diffusion coefficient \(\sigma (x)\), drift \(\mu(x)\), and killing rate \(k(x)\). For simplicity, we assume that \(\mu (x)\), \(\sigma(x)\) and \(k(x)\) are continuous and \(\sigma(x)>0\), \(k(x)\geq 0\) on \((e_{1},e_{2})\). These assumptions are not necessary and the theory of one-dimensional diffusions can be formulated in much greater generality (see [9, Chapter II] for a summary). We make this assumption to simplify the exposition in view of the fact that it is often satisfied in applications. The infinitesimal generator of \(X\) can be written in the formally self-adjoint form

where \(s(x)\) and \(m(x)\) are the scale and speed densities \(s(x)=\exp(-\int\frac{2\mu(y)}{\sigma^{2}(y)}dy)\), \(m(x)=\frac{2}{\sigma ^{2}(x)s(x)}\). Feller’s classification of boundaries can be formulated in terms of the behaviour of \(\mu\), \(\sigma\) and \(k\) near the boundaries \(e_{1}\) and \(e_{2}\) (see [9, II.6] for details). If any of the boundaries is regular, we specify it either as a killing boundary by sending the process to an isolated cemetery state \(\varDelta \) or as an instantaneously reflecting boundary. In the case of killing boundaries, the process can be killed either at the first exit time \(T_{e_{1},e_{2}}\) from the open interval \((e_{1},e_{2})\) or by the positive continuous additive functional \(\int_{0}^{t}k(X_{u})du\). The process is sent to the cemetery state \(\varDelta \) at its lifetime \(\zeta\), where it remains for all \(t\geq\zeta\). The lifetime can be constructed as \(\zeta=\inf\{t\in[0,T_{e_{1},e_{2}}]:\int_{0}^{t} k(X_{u})du\geq \mathcal{E}\}\), where ℰ is an independent unit-mean exponential random variable and, by convention, \(\zeta=T_{e_{1},e_{2}}\) if \(\int_{0}^{T_{e_{1},e_{2}}} k(X_{u})du< \mathcal{E}\) (see [9, II.22 and II.23]). Killing is a natural tool for modelling bankruptcy (see, e.g. [56, 17, 59]).

Under these assumptions, \(X\) is a symmetric Markov process with its speed measure \(m(dx)=m(x)dx\) being its symmetrizing measure (cf. [30] for the theory of symmetric Markov processes). That is, the transition kernel of \(X\) defines a strongly continuous semigroup \((\mathcal{P}^{d}_{t})_{t\geq0}\) on \(L^{2}(I,m)\) that is symmetric, i.e. \((\mathcal{P}^{d}_{t}f,g)=(f,\mathcal {P}^{d}_{t}g)\), with respect to the inner product \((f,g)=\int_{I} f(x)g(x)m(x)dx\). Its infinitesimal generator \(\mathcal{G}^{d}\) is a self-adjoint operator on \(L^{2}(I,m)\). We can then apply the spectral theorem to obtain the spectral representation of \(\mathcal{P}^{d}_{t}\). The spectral representation of a transition semigroup of a general one-dimensional diffusion has been first obtained by [58]. From the computational point of view, things simplify when the spectrum is purely discrete. Sufficient conditions for the spectra of \(\mathcal{G}^{d}\) and \(\mathcal{P}^{d}_{t}\) to be purely discrete in terms of the behaviour of \(\sigma\), \(\mu\) and \(k\) near the boundaries \(e_{1}\) and \(e_{2}\) can be found in [55, 57]. Many important processes in finance satisfy these conditions, including the classical OU, CEV and CIR diffusions. When the spectrum is purely discrete, we can write

where \(\varphi_{n}(x)\) are eigenfunctions of \(\mathcal{G}^{d}\) and \(\mathcal{P}^{d}_{t}\) with eigenvalues \(-\lambda^{d}_{n}\) and \(e^{-\lambda^{d}_{n}t}\), respectively (\(0\leq\lambda^{d}_{1}\leq\lambda^{d}_{2}\leq\cdots\)), and \(f_{n}=(f,\varphi_{n})\) are the expansion coefficients.

Next we consider subordinate diffusions. Let \((T_{t})_{t\geq0}\) be a Lévy subordinator, i.e. a nonnegative Lévy process. Its Laplace transform is given by the Lévy–Khintchine formula (\(\phi(\cdot)\) is called the Laplace exponent)

with drift \(\gamma\geq0\) and the Lévy measure \(\nu(ds)\) satisfying \(\int_{(0,\infty)}(s\wedge1)\nu(ds)<\infty\) (see [69]). A family of subordinators widely used in financial application is the tempered stable family where \(\nu(ds)=Cs^{-1-\alpha}e^{-\eta s}ds\) with \(0<\alpha<1\) and \(\eta>0\).

A subordinate diffusion process \((X^{\phi}_{t})_{t\geq0}\) is defined as \(X^{\phi}_{t} = X_{T_{t}}\) for \(t<\zeta^{\phi}\) and \(X^{\phi}_{t}=\varDelta \) for \(t\geq\zeta^{\phi}\) with lifetime \(\zeta^{\phi}= \inf\{t\geq0: T_{t}\geq\zeta\}\) (\(T\) is assumed to be independent of \(X\); \(\phi\) in \(X^{\phi}_{t}\) indicates that the Laplace exponent of the subordinator is \(\phi\)). In general, \(X^{\phi}\) is a Markov jump-diffusion (when \(\gamma>0\)) or pure jump (when \(\gamma=0\)) process. Its infinitesimal generator is given in [50]. There it is shown that in general when \(X\) is not a Brownian motion with drift, the jump measure of \(X^{\phi}\) is state-dependent.

It can be shown that \(X^{\phi}\) is again a symmetric Markov process with the same symmetrizing measure \(m(dx)\). That is, its transition semigroup \((\mathcal{P}^{\phi}_{t})_{t\geq0}\) is a strongly continuous symmetric semigroup on \(L^{2}(I,m)\). If \(\mathcal{P}^{d}_{t}\) has the eigenfunction expansion (2.1), the transition operator \(P^{\phi}_{t}\) of \(X^{\phi}\) has the eigenfunction expansion (cf. [57], or [70, Chap. 12])

Subordination replaces the semigroup eigenvalues \(e^{-\lambda^{d}_{n}t}\) with \(e^{-\phi(\lambda^{d}_{n})t}\), leaving the eigenfunctions unchanged. This result is key to a host of financial applications. Starting from diffusions with known spectral representations of their transition semigroups, subordination allows us to construct rich families of jump-diffusion and pure jump processes with state-dependent jumps and to obtain immediate analytical tractability of their transition semigroups by replacing \(\lambda^{d}_{n}\) with \(\phi(\lambda^{d}_{n})\).

Remark 2.1

Additive subordination of diffusions. To improve calibration performance to the term structure of interests, such as implied volatilities, [52] and [49] proposed to time change diffusions with additive subordinators (an additive subordinator is a Lévy subordinator without the assumption of stationary increments), which creates jump-diffusions or pure-jump processes with time-dependent characteristics. We refer readers to [49] for a detailed characterization of additive subordinate diffusions, whose transition operator admits an eigenfunction expansion in the same form as (2.3), with the Laplace transform of the Lévy subordinator replaced by the Laplace transform of the additive subordinator.

Remark 2.2

Diffusion short rate models and their subordinate versions. In diffusion short rate models, the state variable \(X\) is a conservative (i.e., no killing) diffusion process and the short rate is a function of \(X\), denoted by \(r(\cdot)\). In these models, the pricing operator is the Feynman–Kac (FK) operator

By interpreting the short rate \(r(x)\) as a killing rate (see [55, 57]), the spectral analysis of the FK semigroup is equivalent to the analysis of the transition semigroup of a diffusion process with the same drift and volatility, but killed at the rate \(r(x)\). Hence one can treat diffusion short rate models as a special case of general diffusions with killing when computing the semigroup. The FK semigroup in many popular short rate models admits an eigenfunction expansion representation, including the Vasiček model [71], Cox–Ingersoll–Ross (CIR) model [21], the 3/2 model [2], Black’s model of interest rates as options [36], and the quadratic model [8, 48]. These diffusion-based models can be further improved to incorporate jumps by applying subordination to the diffusion FK semigroup, and the resulting FK semigroup is also represented by an eigenfunction expansion (see [53] for details).

2.2 Convergence of eigenfunction expansions and extensions to bounded payoffs

In this section, we discuss convergence of eigenfunction expansions to prepare for the formulation of our method for discrete first passage problems. In light of Remarks 2.1 and 2.2, we only present results for diffusions and Lévy subordination. The corresponding results for additive subordination and diffusion short rate models can be obtained following these remarks. To save space, we discuss diffusion transition semigroups and their subordinate versions in a unified manner, and make the following notational convention. If the result applies to diffusion only, we use the superscript \(d\) as in \(\mathcal{P}_{t}^{d}\) and \(\lambda_{n}^{d}\) for diffusion, and superscript \(\phi \) (for the Laplace exponent of the subordinator) as in \(\mathcal {P}^{\phi}_{t}\) and \(\lambda_{n}^{\phi}\) for the subordinate diffusion. If the result applies to both diffusions and subordinate diffusions, the relevant quantity will not have a superscript as in \(\mathcal{P}_{t}\) and \(\lambda_{n}\).

In the example in the introduction, we used the fact that the OU transition semigroup has a purely discrete spectrum in \(L^{2}({\mathbb{R}},m)\) and, moreover, the corresponding eigenfunction expansion (1.1) converges not only in the \(L^{2}({\mathbb{R}},m)\)-norm, but, for each \(t>0\), uniformly on compacts in \(x\) as well. The latter property is important in financial applications, since we are interested in option prices at particular values of the underlying variable, and \(L^{2}\)-convergence does not generally guarantee pointwise convergence. Moreover, to compute eigenfunction expansions numerically, we need to truncate the infinite summation. Uniform convergence on compacts yields uniform truncation error bounds on compact computational domains. We are thus interested in conditions that ensure that the transition semigroup of a subordinate diffusion possesses an eigenfunction expansion converging uniformly on compacts in the state variable for each \(t>0\).

We start by citing Propositions 1 and 2 from [50] (which we combine into one result here).

Theorem 2.3

(i) Consider \((\mathcal{P}_{t})_{t\geq0}\), a symmetric and strongly continuous contraction semigroup defined on \(L^{2}(I,m)\). Suppose it is trace-class, i.e. for each \(t>0\) the operator \(\mathcal{P}_{t}\) is trace-class (see, e.g. [67, VI.6]). Then \((\mathcal{P}_{t})_{t\geq0}\) and its infinitesimal generator \(\mathcal{G}\) have purely discrete spectra with eigenvalues \((e^{-\lambda_{n}t})_{n\in\mathbb{N}_{1}}\) (for \(t>0\)) and \((-\lambda_{n})_{n\in\mathbb{N}_{1}}\), respectively, and \(\mathcal{P}_{t}f\) has an eigenfunction expansion of the form

where \(0\leq\lambda_{1}\leq\lambda_{2}\leq\cdots<\infty\) and

The eigenfunctions \((\varphi_{n})_{n\in\mathbb{N}_{1}}\) form a complete orthonormal basis in \(L^{2}(I,m)\). Moreover, each \(\mathcal{P}_{t}\) with \(t>0\) admits with respect to \(m\) a unique symmetric kernel \(p_{t}(x,y)\in L^{2}(I\times I, m\times m)\), i.e. we have \(\mathcal{P}_{t}f(x)=\int_{I} p_{t}(x,y)f(y)m(dy)\) for any \(f\in L^{2}(I,m)\) and \(p_{t}(x,y)=p_{t}(y,x)\) and \(\int_{I\times I}p_{t}^{2}(x,y) m(dx)m(dy)<\infty\), and \(\operatorname{tr}\mathcal{ P}_{t}=\int_{I} p_{t}(x,x)m(dx)<\infty\), with the bilinear eigenfunction expansion

The convergence in (2.4) and (2.5) is in \(L^{2}(I,m)\) and \(L^{2}(I\times I, m\times m)\), respectively.

(ii) If in addition we assume that the kernel \(p_{t}(x,y)\) is jointly continuous in \(x\) and \(y\) for each \(t>0\), then the following results hold:

-

(a)

Each \(\varphi_{n}\) is continuous and satisfies

$$ \left|\varphi_{n}(x)\right|\leq e^{\lambda_{n}t/2}\sqrt{p_{t}(x,x)} $$(2.6)for all \(n\), \(x\) and \(t>0\).

-

(b)

For each \(f\in L^{2}(I,m)\), the eigenfunction expansion (2.4) converges to \(\mathcal{P}_{t}f(x)\) uniformly on compacts (u.o.c.) in \(x\), and \(\mathcal{P}_{t}f(x)\) is continuous in \(x\), for \(t>0\).

-

(c)

The bilinear expansion (2.5) converges u.o.c. in \((x,y)\).

McKean [58] showed that the transition semigroup of a general one-dimensional diffusion has a continuous symmetric kernel \(p^{d}_{t}(x,y)=p^{d}_{t}(y,x)\) with respect to the speed measure \(m(dy)\) of the diffusion. From Mercer’s theorem (see [22, Proposition 5.6.9]), \(\operatorname{tr}\mathcal{ P}^{d}_{t}=\int_{I} p^{d}_{t}(x,x)m(dx)\). Thus for one-dimensional diffusions, the trace-class condition is equivalent to

which can be verified directly if \(p^{d}_{t}(x,x)\) is known. Under this condition, both parts (i) and (ii) of Theorem 2.3 hold for one-dimensional diffusions.

However, the transition semigroup of a subordinate diffusion does not, in general, possess a continuous kernel. We now give an easy to verify sufficient condition that ensures the existence of a continuous kernel for a subordinate diffusion.

Proposition 2.4

Suppose the diffusion semigroup \((\mathcal{P}^{d}_{t})_{t\geq0}\) is trace-class. The subordinate diffusion semigroup \((\mathcal{P}^{\phi}_{t})_{t\geq0}\) is trace-class and has a symmetric kernel \(p^{\phi}_{t}(x,y)\) with respect to \(m(dy)\) which is jointly continuous in \(x\) and \(y\) if one of the following two conditions is satisfied:

-

(i)

The Lévy subordinator has a positive drift, i.e. \(\gamma>0\).

-

(ii)

The Lévy subordinator has no drift, i.e. \(\gamma=0\), but for any compact set \(J\subseteq I\), there exists some constant \(C_{J}\) such that for all \(n\), \(|\varphi_{n}(x)|\leq C_{J}\) for all \(x\in J\), and its Laplace exponent \(\phi\) satisfies \(\sum_{n=1}^{\infty}e^{-\phi (\lambda^{d}_{n})t}<\infty\).

The proof is given in the Appendix. Combined with Theorem 2.3, this proposition gives explicit sufficient conditions to ensure that the subordinate diffusion has an eigenfunction expansion converging uniformly on compacts in \(x\).

Remark 2.5

The diffusion eigenvalues and eigenfunctions are solutions to the eigenvalue problem of the associated Sturm–Liouville (SL) problem. For regular SL problems, on any compact \(J\), there exists some constant \(C_{J}\) such that for all \(n\), \(|\varphi_{n}(x)|\leq C_{J}\) for all \(x\in J\) (cf. [31]). For singular SL problems, this has to be checked case by case. It is satisfied in many financial applications.

Based on Theorem 2.3 and Proposition 2.4, we make the following standing assumption for the rest of this paper.

Assumption 2.6

The diffusion semigroup \((\mathcal{P}^{d}_{t})_{t\geq0}\) is trace-class. The subordinator either has positive drift, or in the zero drift case its Laplace exponent \(\phi(\lambda)\) and the eigenfunctions \(\varphi_{n}\) satisfy the conditions in Proposition 2.4(ii).

The eigenfunction expansion (2.4) holds for any \(f\in L^{2}(I,m)\). In financial applications, it is sometimes the case that the function of interest is not in \(L^{2}(I,m)\). Fortunately, under some conditions it is possible to extend the eigenfunction expansion (2.4) for \(t>0\) to bounded functions that are not in \(L^{2}(I,m)\). Under these conditions, while \(f\) does not have an eigenfunction expansion, \(\mathcal{ P}_{t} f\) does have an eigenfunction expansion for \(t>0\). This extension is important in the CEV and JDCEV model (see Remark 4.2).

Theorem 2.7

For any \(f\in\mathcal{B}_{b}(I)\) (Borel-measurable bounded functions on \(I\)) denote by \(\mathcal{S}_{f}\) the support of \(f\). Under Assumption 2.6, if \(\int_{\mathcal{S}_{f}}\sqrt {p_{t}(x,x)}m(dx)<\infty\) for all \(t>0\), then for any \(f\in\mathcal {B}_{b}(I)\), the function \(\mathcal{P}_{t}f\) is in \(L^{2}(I,m)\) for all \(t>0\), has an eigenfunction expansion

converging uniformly on compacts in \(x\), as well as in \(L^{2}\), and \(\mathcal{P}_{t}f(x)\) is continuous in \(x\).

Remark 2.8

In order for the expansion to hold for some given \(t\), it is sufficient to assume \(\int_{\mathcal{S}_{f}}\sqrt{p_{t'}(x,x)}m(dx)<\infty\) for some \(t'\) such that \(0< t'< t\).

Theorem 2.7, whose proof is in the Appendix, provides an explicit sufficient condition allowing us to apply the eigenfunction expansion method to options with bounded but non-\(L^{2}\) payoffs. In the literature, applications of the eigenfunction expansion method to option pricing for non-\(L^{2}\) payoffs have been previously treated in an ad hoc way (see, e.g. [24]).

3 Discretely monitored first passage problems

3.1 Discrete barrier options

We assume \(X\) is either a one-dimensional diffusion or a subordinate diffusion on the interval \(I\) with endpoints \(e_{1}\) and \(e_{2}\) as in Sect. 2.1. We denote by \(I_{\varDelta }:=I\cup\{\varDelta \}\) the extended state space with the cemetery state adjoined as an isolated point. Let \(\mathcal{ T}=\{t_{1},\ldots,t_{N}\}\), \(0< t_{1}< t_{2}<\cdots<t_{N}\), denote the set of times (not necessarily equidistant). Let \((\ell_{i},u_{i})\), \(e_{1}\leq\ell_{i}< u_{i}\leq e_{2}\), be a sequence of intervals in \(I\) which are associated with the times \(t_{i}\). We define the discrete first exit time \(\tau_{e}:=\inf\{t\in\mathcal{ T}: X_{t}\notin(\ell(t),u(t))\}\), where \(\ell(t_{i})=\ell_{i}\), \(u(t_{i})=u_{i}\). We consider a barrier option that delivers a payoff \(f(X_{t})\) at its expiration at time \(t=t_{N}\) if \(\tau_{e}>t\), or pays a rebate \(g(X_{\tau _{e}},\tau_{e})\) at \(\tau_{e}\) if \(\tau_{e}\leq t\). The payoff \(f\) depends on the state \(X_{t}\) of the process at the option expiration \(t=t_{N}\) (the end of the barrier monitoring horizon). The rebate depends on the discrete first exit time and the state of the process at \(\tau_{e}\). To simplify notation, we assume that the interest rate \(r\) is constant. The stochastic interest rate models of Sect. 2.1 (see Remark 2.2) can be treated similarly by replacing the transition operator of \(X\) with the FK operator (see Remark 3.3, and an example will be considered in Sect. 4.3). We wish to determine the value of the barrier option as a function of the initial state of the process, i.e.

To simplify notations, and without loss of generality, assume that the times are equidistant with step \(h\), i.e. \(t_{i}=ih\). We note that if \(\tau_{e}=t_{i}\), then \(X_{\tau_{e}}\) is either in \((\ell _{i},u_{i})^{c}=I\backslash(\ell_{i},u_{i})\) (the complement of \((\ell_{i},u_{i})\) in \(I\)) or \(X_{\tau_{e}}=\varDelta \) (if the process is killed during \((t_{i-1},t_{i}]\), so it is observed in the cemetery state \(\varDelta \) at the observation time \(t_{i}\)). In the former case, the rebate \(g(x,t_{i})\) is paid at \(t_{i}\) if \(X_{\tau_{e}}=x\). In the latter case, the rebate is \(g(\varDelta ,t_{i})\).

Define the killing probability \(K_{t}(x):=\mathbb{P}_{x}[\zeta\leq t]=P_{t}(x,\{\varDelta \})\) for \(x\in I\) and \(t\geq 0\) (the probability of entering the cemetery state by time \(t\)). We make the following assumptions on the payoff \(f\), rebate \(g\), and \(K\) (below \(g(\cdot,t)\) and \(K_{t}(\cdot)\) should be understood as functions of \(x\) for fixed \(t\)).

Assumption 3.1

(i) \(\mathbf{1}_{(\ell_{N},u_{N})}(\cdot)f(\cdot)\) is in either \(L^{2}(I,m)\) or \(\mathcal{B}_{b}(I)\). In the latter case, we also assume that \(\int_{\mathcal{S}_{f'}}\sqrt{p_{h'}(x,x)}m(dx)<\infty\) for some \(h'\) such that \(0< h'< h\), where \(\mathcal{S}_{f'}\) is the support of the function \(\mathbf{1}_{(\ell_{N},u_{N})}(\cdot)f(\cdot)\).

(ii) For each \(i=1,2,\dots,N\), \(\mathbf{1}_{(\ell_{i},u_{i})^{c}}(\cdot)g(\cdot ,t_{i})\) is in either \(L^{2}(I,m)\) or \(\mathcal{B}_{b}(I)\). In the latter case, we assume \(\int_{\mathcal{S}_{g'_{i}}}\sqrt{p_{h'}(x,x)}m(dx)<\infty \) for some \(h'\) such that \(0< h'< h\), where \(\mathcal{S}_{g'_{i}}\) is the support of \(\mathbf{1}_{(\ell_{i},u_{i})^{c}}(\cdot)g(\cdot,t_{i})\).

(iii) For each \(i=1,2,\dots,N\), either \(\mathbf{1}_{(\ell_{i},u_{i})}(\cdot )K_{h}(\cdot)\) is in \(L^{2}(I,m)\), or we assume that \(\int_{\mathcal{S}_{K'_{i}}}\sqrt{p_{h'}(x,x)}m(dx)<\infty\) for some \(h'\) such that \(0< h'< h\), where \(\mathcal{S}_{K'_{i}}\) is the support of \(\mathbf{1}_{(\ell_{i},u_{i})}(\cdot)K_{h}(\cdot)\).

Recall that \((f,g)\) denotes the inner product of \(f\) and \(g\) in \(L^{2}(I,m)\). Introduce the notation

for Borel sets \(A\subseteq I\), \(i=1,2,\dots,N\), and \(m,n=1,2,\dots\). When \(A=(\ell,u)\), we write \(f_{n}(\ell,u)\), etc. Note that \((\pi _{m,n}(A))\) is the matrix of the operator of multiplication with \(\mathbf{1}_{A}(x)\) in the eigenfunction basis \(\varphi_{n}\). We are now ready to formulate our main result.

Theorem 3.2

Suppose Assumptions 2.6 and 3.1 hold. Then \(V(x)\) has the representation

with the eigenfunction expansion converging uniformly on compacts in \(x\) and the expansion coefficients \(c_{n}=c_{n}^{0}\), where the \(c_{n}^{i}\) satisfy the recursion

for \(i=N-2,\dots,0\).

This result gives an eigenfunction expansion for the value of the barrier option with \(N\) barrier monitoring dates and with rebates, including the rebate in the event of killing (default in credit risk applications). If we assume that \(K_{h}\in L^{2}(I,m)\), then we can also expand \(K_{h}\) in the eigenfunction basis and absorb the second term in \(V(x)\) in the expansion. However, here we only require that \(K^{h}_{n}(A)=(\mathbf{1}_{A}K_{h},\varphi_{n})\) exist for \(A=(\ell_{i},u_{i})\) and do not require that \(K_{h}\in L^{2}(I,m)\). This is sufficient for the formulation of our result (this extension covers one of our applications in Sect. 4, the credit-equity JDCEV model).

Proof of Theorem 3.2

Let \(V^{i}(x)\) denote the value of the barrier option at time \(t_{i}=ih\), \(i=0,1,\dots,N\), with \(V(x)=V^{0}(x)\). By repeatedly using conditioning and the Markov property, we can write the following backward recursion starting from time \(t_{N}\):

Define \(C^{i}(x):=e^{-rh}\mathbb{E}_{x}[V^{i+1}(X_{h})\mathbf{1}_{\{\zeta>h\} }]=e^{-rh}\mathcal{ P}_{h}V^{i+1}(x)\) for \(x\in I\) and for \(i=N-1,\dots,0\). Since

we have for \(i=N-1,\dots,1\) that

We first note that

By Assumption 3.1, Theorems 2.3 and 2.7 imply that \(C^{N-1}\)is in \(L^{2}(I,m)\) and possesses the eigenfunction expansion

Next consider \(C^{N-2}(x)\); we have

Again by Assumption 3.1, Theorems 2.3 and 2.7 imply that \(C^{N-2}\) is in \(L^{2}(I,m)\) and possesses the eigenfunction expansion

with

The last step is justified by the continuity of the inner product. By induction, the result also holds for \(i=N-3,\dots,0\). □

Theorem 3.2 reduces the calculation of the barrier option value \(V(x)\) to the calculation of the expansion coefficients of the payoff, rebate, and the killing probability \(f_{n}(\ell,u)\), \(g^{i}_{n}((\ell,u)^{c})\), \(K^{h}_{n}(\ell,u)\), as well as the matrix \(\pi _{m,n}(\ell,u)\) of the operator of multiplication with \(\mathbf{1}_{(\ell,u)}(x)\). Fortunately, for all the applications shown in Sect. 4, \(f_{n}(\ell,u)\), \(g^{i}_{n}((\ell,u)^{c})\) and \(K^{h}_{n}(\ell,u)\) can be computed in closed form. When the eigenfunctions are expressed in terms of orthogonal polynomials, \(\pi_{m,n}(\ell,u)\) can be efficiently computed using classical recursions for orthogonal polynomials. In Sect. 4, we show results for Hermite and generalized Laguerre polynomials.

Remark 3.3

For short rate models, the value of the barrier option becomes

where \(X\) is the state variable and \(r(X)\) is the short rate process. We impose Assumption 2.6 on the FK semigroup. Since \(X\) and the short rate process are conservative, \(K_{t}(x)=0\), and only (i) and (ii) in Assumption 3.1 are needed. Theorem 3.2 is changed as follows. Set \(g(\varDelta ,t_{i})=0\) for all \(t_{i}\), and replace \(e^{-rh}\mathcal{P}_{h}\) with \(\mathcal{P}^{r}_{h}\). The result is the same as in Theorem 3.2 with the factor \(e^{-(\lambda_{n}+r)h}\) replaced with \(e^{-\lambda^{r}_{n}h}\), where \(\lambda^{r}_{n}\) is now the eigenvalue of the FK operator \(\mathcal{P}^{r}_{h}\).

3.2 Joint distribution of \(\tau_{e}\) and \(X_{\tau_{e}}\)

The distribution of \(\tau_{e}\), as well as the joint distribution of \(\tau _{e}\) and \(X_{\tau_{e}}\), can be obtained as immediate corollaries of Theorem 3.2. Suppose the lower and upper barrier are time-independent, \(\ell_{i}=\ell\) and \(u_{i}=u\), respectively.

Proposition 3.4

Suppose Assumption 2.6 holds.

(i) Suppose either \(\mathbf{1}_{(\ell,u)}\in L^{2}(I,m)\) or \(\int_{\ell}^{u} \sqrt{p_{h'}(x,x)}m(dx)<\infty\) for some \(h'\) such that \(0< h'< h\). Then for each \(i=1,2,\dots\),

with

(ii) For a Borel set \(A\subseteq I\backslash(\ell,u)\), suppose that we have either \(\mathbf{1}_{A}\in L^{2}(I,m)\) or \(\int_{A}\sqrt {p_{h'}(x,x)}m(dx)<\infty\) for some \(h'\) such that \(0< h'< h\). Then for \(i=1,2,\dots\),

with

If Assumption 3.1(iii) holds with \(\ell_{i}=\ell\) and \(u_{i}=u\), then for \(i=1,2,\dots\),

with

Proof

(i) Observe that for each \(t_{i}\), the probability \(\mathbb {P}_{x}[\tau_{e}>t_{i}]\) can be cast in the form (3.1) with the “payoff” \(f(x)=1\) at “maturity” \(t_{i}\) and zero “rebates” \(g(x,t_{j})=0\) for all \(j\leq i\) and \(x\in I_{\varDelta }\). Hence, Theorem 3.2 yields the result. Here we changed the indexing of the coefficients from backward to forward as follows. In the context of Theorem 3.2, \(t_{i}\) is the “maturity” date (\(t_{N}\) in Theorem 3.2). In the notation of Theorem 3.2, the backward recursion for the coefficients starts from \(c^{i}_{n}=(\mathbf{1}_{(\ell,u)},\varphi_{n})\) and proceeds as \(c^{j}_{n}=\sum_{m=1}^{\infty}c^{j+1}_{m}e^{-\lambda_{m}h}\pi_{m,n}(\ell,u)\) for \(j=i-1,\dots,0\). In our forward notation in this proposition, \(p^{1}_{n}=c^{i-1}_{n}\) and \(p^{j}_{n}=c^{i-j}_{n}\), \(j=2,\dots,i\).

(ii) Observe that for each \(t_{i}\), the probability \(\mathbb{P}_{x}[\tau _{e}=t_{i},X_{\tau_{e}}\in A]\) can be cast in the form (3.1) with zero “payoff” \(f(x)=0\), \(g(x,t_{i})=\mathbf{1}_{A}(x)\) for \(x\in I_{\varDelta }\), and \(g(x,t_{j})=0\) for all \(j< i\) and \(x\in I_{\varDelta }\). For each \(t_{i}\), the probability \(\mathbb{P}_{x}[\tau_{e}=t_{i},X_{\tau_{e}}\in \varDelta ]\) can be cast in the form (3.1) with the zero “payoff” \(f=0\), \(g(\varDelta ,t_{i})=1\), \(g(\varDelta ,t_{j})=0\) for all \(j< i\), and \(g(x,t_{j})=0\) for all \(j\leq i\) and \(x\in I\). Hence, Theorem 3.2 yields the results as in (i). □

4 Applications and examples

4.1 (Subordinate) OU diffusions and applications to commodity derivatives

When \(X\) is an OU diffusion, the reference measure \(m\) is Gaussian, the eigenfunctions \(\varphi_{n}\) are given in terms of Hermite polynomials in Sect. 1, and \(\lambda^{d}_{n}=\kappa n\), \(n=0,1,\dots\). Note that throughout this section, we index eigenfunctions starting from 0, rather than 1 as in Sects. 2 and 3. This notation is more convenient when working with orthogonal polynomials. The OU semigroup is clearly trace-class, since \(\sum_{n=0}^{\infty}e^{-\kappa n t}<\infty\) for all \(\kappa>0\) and \(t>0\). To efficiently compute the eigenfunctions, we start with \(\varphi _{0}(x)=1\) and \(\varphi_{1}(x)=\frac{\sqrt{2\kappa}}{\sigma}(x-\theta)\) and use the following recursion easily derived from the classical recursion for Hermite polynomials:

For a subordinate OU (subOU) process \(X^{\phi}_{t}:=X_{T_{t}}\), where \(T\) is a Lévy subordinator with Laplace exponent \(\phi\) and independent of \(X\), if \(\gamma>0\), the subOU semigroup is trace-class and the kernel is continuous without any further conditions. If \(\gamma=0\), we assume \(\phi\) satisfies

We also note that on every compact subset \(J\subseteq I\), there exists a constant \(C_{J}\) such that for all \(n\), \(\max_{x\in J}|\varphi _{n}(x)|\leq C_{J}/n^{\frac{1}{4}}\) (cf. [64, Eq. (28a)]). Therefore, Assumption 2.6 holds for the subOU transition semigroup under the trace-class condition (4.1).

Several alternative representations for the density of the continuous first passage time of an OU diffusion through a single constant barrier are well known in the literature, including [40, 68, 47, 46, 35, 54, 5], In the special case when the barrier is equal to the long-run level \(\theta\), [73] gives a simple relation between the first passage probability and the transition probability of the OU diffusion.

Here we consider the calculation of \(\mathbb{P}_{x}[\tau_{e}>t_{i}]\) for the discretely observed first exit time from the interval \((\ell,u)\). Single barrier results immediately follow by setting \(\ell=-\infty\) or \(u=\infty\). Since \(\mathbf{1}_{(\ell,u)}\in L^{2}(\mathbb{R},m)\) for any \(-\infty\leq \ell< u\leq\infty\), Proposition 3.4 applies. Since \(\varphi_{0}=1\) and \((\mathbf{1}_{(\ell,u)},\varphi_{n})=\pi_{0,n}(\ell,u)\) in this case, we only need to calculate \(\pi_{m,n}(\ell,u)=\pi_{m,n}(-\infty,u)-\pi _{m,n}(-\infty,\ell)\). For \(x\in\mathbb{R}\), the inner products in \(\pi _{m,n}(-\infty,x)\) can be calculated in closed form, resulting in the convenient representation (as shown in [50])

where \(\varPhi(x)\) is the standard normal CDF.

To illustrate, Table 1 computes the probability \(\mathbb {P}_{x}[\tau_{e}>t_{i}]\) for an OU diffusion to stay below an upper barrier \(u\) at the barrier monitoring times \(t_{i}=ih\) with different monitoring intervals \(h=1/12\) (monthly), \(h=1/52\) (weekly) and \(h=1/252\) (daily), and different volatilities \(\sigma\) (\(\ell=-\infty\) in this example). The code was written in C++, Hermite polynomials were computed efficiently via their classical recursion, and the infinite eigenfunction expansions were truncated after the desired user-specified error tolerance was reached. The continuous-time solution computed as in [73] is also given for comparison. Next to each computed value for the discretely monitored probability, the percentage is given showing the percentage difference with the continuous probability. We observe that the differences between discrete and continuous solutions are quite substantial even for the daily barrier monitoring. Moreover, the differences increase with the volatility. This example demonstrates that using continuous solutions to approximate discrete solutions would result in sizable errors.

Figure 1 plots the probability distribution of the discrete random variable \(\tau_{e}\) for an OU diffusion, as well as a subOU process, first passing through an upper barrier at the discrete monitoring times \(t_{i}=ih\). For the OU diffusion, the shape of the distribution function under daily and weekly barrier monitoring is similar to the continuous first hitting time density in [54, Fig. 6]. Under monthly monitoring, the distribution function is decreasing (the probability of crossing the barrier is the highest at the end of the first month). The tail of the discrete first passage time distribution under monthly monitoring is thicker than under weekly monitoring, which is in turn thicker than under daily monitoring. This is not surprising, since as the monitoring frequency decreases, it takes longer to observe the first passage. The figure also plots the distribution for a subOU process with the same OU parameters and the subordinator time change with drift \(\gamma=1\) and compound Poisson jumps with exponential jump sizes. This subOU process has the same OU diffusion component as the pure diffusion case, plus mean-reverting jumps arising from the subordination. Mean-reverting jumps make the subOU process more likely to cross the barrier sooner (in this example \(u=\theta\), so the process tends to jump in the direction of the barrier). Figures 1(b) and (c) show that for the subOU process, the peak of the distribution is higher, while the tail is lighter than for the OU diffusion.

OU diffusions are ubiquitous in financial applications. To illustrate, in the corporate credit risk model of [19], the logarithm of the default barrier minus the logarithm of the value of the assets of the firm, denoted by \(X\), is a mean-reverting OU diffusion with the starting point \(x<0\). This reflects the fact that firms change their capital structure over time to keep the leverage ratio around some target level. The authors of [19] assume continuous monitoring of the default barrier for analytical tractability and derive analytical results for the probability of default and for corporate bond prices and credit spreads. In practice, bondholders can only monitor the credit quality of a firm at discrete time intervals as the new financial data are made available by the firm. Our method provides a solution to this more realistic setting. In particular, coupon bonds can be priced by replacing the continuous probability in (25) of [19] with the discretely monitored probability.

As our next application, we consider commodity options with barriers (see, e.g. [34] for a discussion of commodity barrier options). The authors of [51] develop a class of commodity models based on subOU processes. Under the risk-neutral measure chosen by the market, the spot price of a commodity is assumed to follow

where \(X^{\phi}\) is the subOU process, \(\{F(0,t),t\geq0\}\) is the initial futures curve observed in the market at time 0, and \(G(t)=\ln\mathbb {E}[e^{X^{\phi}_{t}}]\) so that under the risk-neutral measure, \(\mathbb {E}[S_{t}]=F(0,t)\). This model features mean-reverting jumps, Samuelson’s maturity effect in commodity futures, is consistent with the initial futures curve, admits analytical solutions for futures options in terms of Hermite expansions, and is capable of fitting a variety of single-maturity volatility smile patterns observed in commodity futures options (see [51]). In [52], this model is further improved by replacing the Lévy subordinator with an additive subordinator. Compared to the subOU model, the asubOU model (a stands for additive) is able to calibrate well to the entire volatility surface. For the asubOU model, if we impose on the additive subordinator the condition

then all results hold by replacing \(e^{-\phi(\lambda^{d}_{n})t}\) with \(e^{-\int_{s}^{t}\psi(\lambda^{d}_{n},u)du}\), where \(\psi(\lambda^{d}_{n},u)\) is the density of the Laplace exponent of the additive subordinator (see [49] for details).

Denote by \(F(x,s,t)\) the futures price at time \(s\) for maturity \(t\) given \(X^{\phi}_{s}=x\). Li and Linetsky [51] obtained for the futures price the explicit eigenfunction expansion

We assume (4.1) holds if \(\gamma=0\) so that Assumption 2.6 is valid for the subOU transition semigroup. We are in the setting of Sect. 3.1 and price a call option with strike \(K\) and expiration at time \(t\) written on a futures with maturity at \(t^{*}>t\) and with barriers set at \(L\) and \(U\) based on the level of the futures price and with no rebates. Assumptions 3.1 hold for any \(-\infty\leq\ell< u\leq \infty\) in this case. We first transform \(L\), \(U\), \(K\) into the barrier and strike levels for the subOU process \(X^{\phi}\), which are solutions to the equations \(F(x,t_{i},t^{*})=L\), \(F(x,t_{i},t^{*})=U\) (\(i=1,2,\dots,N\)) and \(F(x,t,t^{*})=K\). The solution to each equation is unique since the futures price is strictly increasing in \(x\). Computationally, it can be efficiently found by bisection. We denote the solutions by \(\ell_{i}\), \(u_{i}\) and \(k\). We note that in this application, the barriers for the subOU process are time-dependent, even though the barriers for the futures price are time-independent. This arises through the time dependence of the futures price. The put payoff at option expiration is \(f(x)=(K-F(x,t,t^{*}))^{+}\). Define \(\tilde{\ell}_{i}=\min(\ell_{i},k)\), \(\tilde{u}_{i}=\min(u_{i},k)\). By a calculation similar to [51, Theorem 3.4], the coefficients \(f_{n}^{i}(\ell_{i},u_{i})\) are given by

where \(\pi_{m,n}(\ell,u)=(\mathbf{1}_{(\ell,u)}\varphi_{m},\varphi_{n})\) have already been calculated for the OU eigenfunctions. The single barrier result is obtained by setting \(L=0\) or \(U=\infty\). The result for the call option is derived similarly.

Table 2 gives the prices of up-and-out puts under the asubOU commodity model of [52] with time-dependent mean-reverting jumps. In this example, the additive subordinator \(A\) is taken to be the inverse Gaussian Sato subordinator (see [52]). Its Laplace transform is given by \({\mathbb{E}}[e^{-\lambda(A_{t}-A_{s})}]=e^{-(\phi(\lambda t^{\rho})-\phi(\lambda s^{\rho}))}\), where \(\phi(\lambda)=\gamma\lambda+\frac{\mu^{2}}{\nu}(\sqrt {1+2\frac{\nu}{\mu}\lambda}-1)\). Results for monthly, weekly, daily and four times per day monitoring are given. The column marked “1” gives the price of a European call where the barrier at \(U\) is only checked at maturity. The four times per day monitoring result is given as an approximation for the continuous barrier monitoring since continuous monitoring results are not available for asubOU processes (in contrast to OU diffusions). The percentage value listed under each option price gives the percentage difference between that option and the option with the monitoring four times per day. We observe that in this example, the difference between daily monitoring and monitoring four times per day is sizable at nearly two percent of the option price. The difference between the daily and the continuous barrier option is even greater.

4.2 Equity barrier options under CEV, JDCEV and subJDCEV models

Cox’ [20] constant elasticity of variance (CEV) diffusion model captures the negative relationship between the stock price and volatility (the leverage effect—the volatility of the stock increases as the stock price falls) by specifying the stock price volatility as a negative power of the stock price. Carr and Linetsky [17] extended the CEV model by introducing a killing rate (default intensity) specified to be a negative power of the stock price (the default intensity increases as the stock price falls). The resulting model is called the jump-to-default extended CEV (JDCEV), as the stock price jumps to zero from a positive value at the time of default. Mendoza-Arriaga et al. [59] time-changed JDCEV with a Lévy subordinator (subJDCEV) to introduce jumps into the diffusive stock price dynamics of the (JD)CEV in addition to the terminal jump to default in the JDCEV model. This model parsimoniously captures many empirical observations in both equity and credit markets, including the well-known positive relationship between credit default swap (CDS) spreads and corporate bond yields and implied volatilities of equity options, the leverage effect, the volatility skew, and jumps in the stock price with the leverage effect (arrival rates of large jumps increase as the stock price falls). Carr and Linetsky [17] derived analytical formulas for European options and CDS under the JDCEV model via the theory of Bessel processes. Mendoza-Arriaga et al. [59] derived option pricing formulas for European options under the subJDCEV model via eigenfunction expansions. The continuous first passage problem for the JDCEV process was solved in [60] (no solution to the continuous first passage problem for subJDCEV is known at present). Here we consider the pricing of discretely monitored barrier options under the (sub)JDCEV model.

Under the risk-neutral measure chosen by the market, the stock price \(S\) is modelled as

Here \(X\) is a JDCEV diffusion (see [17]) with drift \(\mu (x)=(\mu+h(x))x\), local volatility \(\sigma(x)=a x^{\beta+1}\), and killing rate \(k(x)=h(x)\) with \(h(x)=b+ca^{2}x^{2\beta}\), where \(a>0\), \(b\geq0\), \(c\geq0\), \(\beta<0\), and \(X_{0}=S_{0}\). The case \(b=c=0\) corresponds to Cox’ CEV model. \(T\) is a Lévy subordinator with Laplace exponent \(\phi\) and assumed to be independent of \(X\). The subordinate process \(X^{\phi}_{t}=X_{T_{t}}\) is a jump-diffusion (if the subordinator has drift \(\gamma>0\)) or a pure jump process (if \(\gamma=0\)) with killing, called a subJDCEV process (see [59]) (when \(T=t\), the model reduces to the JDCEV model of [17]). The lifetime \(\tau_{d}=\inf\{t\geq0:X^{\phi}_{t}=\varDelta \}=\inf\{t\geq0: X_{T_{t}}=\varDelta \}\) of \(X^{\phi}\) is the bankruptcy time. The cemetery state \(\varDelta \) is identified with 0, so that the stock price jumps to zero at the bankruptcy time (the assumption is that strict priority rules are followed in bankruptcy and equity becomes worthless). The remaining model parameter \(\rho\) is a constant that is required to satisfy the martingale condition \(\rho=r-q+\phi(-\mu)\), where \(r\) is the risk-free interest rate and \(q\) is the dividend yield (the drift parameter \(-\mu\) is required to be such that \(\phi(\cdot)<\infty\)). The martingale condition ensures that the stock price process with dividends reinvested and taken relative to the money market account is a martingale.

A detailed spectral analysis of JDCEV processes is given in [59] and [61]. Define \(\varepsilon=\mathrm{sign}(\mu+b)\), \(\nu=\frac{1+2c}{2|\beta|}\), \(w=2|\beta (\mu+b)|\), \(A=\frac{|\mu+b|}{a^{2}|\beta|}\), and

The speed density of the JDCEV diffusion is

We assume \(\mu+b\neq0\). In this case, the spectrum is purely discrete with

for \(n=0,1,\dots\), where \(L^{(\alpha)}_{n}(\cdot)\) are generalized Laguerre polynomials (see, e.g. [41, Sect. 9.12]) and \(\varGamma (\cdot)\) is the gamma function. It is clear that the JDCEV transition semigroup is trace-class, \(\sum_{n=0}^{\infty}e^{-\lambda^{d}_{n}t}<\infty\), so Assumption 2.6 holds.

If \(\gamma=0\), we assume the Laplace exponent \(\phi\) of the subordinator satisfies

Also note that for the JDCEV eigenfunctions, on every compact subset \(J\subseteq I\), there exists a constant \(C_{J}\) such that \(\max_{x\in J}|\varphi_{n}(x)|\leq C_{J}/n^{\frac{1}{4}}\) for all \(n\) (cf. [64, Eq. (27a)]). Therefore, Assumption 2.6 holds for the subJDCEV semigroup.

To efficiently calculate the eigenfunctions, it is convenient to introduce the scaled Laguerre polynomial

Then \(\varphi_{n}(x)=A^{\frac{\nu}{2}}\sqrt{|\mu+b|}xe^{-\frac {1}{2}(1+\epsilon)Ax^{-2\beta}}\ell^{(\nu)}_{n}(Ax^{-2\beta})\). We also express other things in terms of \(\ell_{n}^{(\nu)}(x)\). Based on the recursion for generalized Laguerre polynomials, \(\ell_{n}^{(\nu)}(x)\) can be computed recursively as

We now consider pricing barrier options on the stock under the subJDCEV model. We first point out the following result. Let \(p_{t}(x,y)=\sum _{n=0}^{\infty}e^{-\lambda_{n}t}\varphi_{n}(x)\varphi_{n}(y)\) be the symmetric transition density with respect to the speed measure for either the JDCEV (\(\lambda_{n}=\lambda^{d}_{n}\)) or the subJDCEV (\(\lambda_{n}=\phi(\lambda ^{d}_{n})\)) transition semigroup. All proofs for this section are in the Appendix.

Proposition 4.1

Suppose

For \(\mu+b<0\), we have \(\int_{(0,\infty)}\sqrt{p_{t}(x,x)}m(dx)<\infty\). For \(\mu+b>0\), we have \(\int_{S}\sqrt{p_{t}(x,x)}m(dx)<\infty\) for any \(S\subset(0,\infty)\) bounded above.

From (4.2) and (2.2), (4.4) is satisfied for JDCEV and for any subordinator with \(\gamma>0\). When \(\gamma=0\), (4.4) is satisfied for all subordinators in the tempered stable family with \(p>0\) (\(p=\frac{1}{2}\) corresponds to the inverse Gaussian subordinator in [6]). Hereafter we assume that condition ( 4.4 ) holds.

Based on Proposition 4.1, it is straightforward to verify for \(\mathbf{1}_{(\ell_{N},u_{N})}(\cdot )f(\cdot)\) the following, where \(f(\cdot)\) is either the call or the put payoff. When \(\mu+b<0\), the function \(\mathbf{1}_{(\ell_{N},u_{N})}(\cdot)f(\cdot)\) satisfies Assumption 3.1 for all of the following options: down-and-out (DO), up-and-out (UO) and double barrier (DB) calls and puts. When \(\mu+b>0\), \(\mathbf{1}_{(\ell_{N},u_{N})}(\cdot)f(\cdot)\) satisfies Assumption 3.1 in all cases except DO calls. To price a DO call, we first need to approximate it with a truncated call payoff \((S_{t}-K)^{+}\mathbf{1}_{\{S_{t}\leq M\}}\), where the truncation level \(M\) is chosen large enough.

Remark 4.2

We note that the assumption that the option payoff is in \(L^{2}((0,\infty ),m)\) is generally too strong for the JDCEV model and excludes some practically relevant cases. Consider the up-and-out put. If we require \(\mathbf{1}_{(0,u_{N})}(\cdot)f(\cdot)\in L^{2}((0,\infty),m)\), then \(c-\beta >1/2\) must be satisfied. Thanks to Theorem 2.7 which extends the eigenfunction expansion approach to bounded payoffs that are not necessarily in \(L^{2}\), this restriction can be removed.

Next we calculate \(f_{n}(\ell,u)\) for the DB call. We are in the setting of Sect. 3.1, and \(L\) and \(U\) are the lower and upper barriers for the stock price. The single barrier case is obtained by setting \(L=0\) or \(U=\infty\) (when \(\mu+b>0\) and \(U=\infty\), we approximate \(f(x)\) by a truncated call payoff). The result for puts can be derived similarly. The call payoff as a function of the underlying subJDCEV state variable is \(f(x)=(e^{\rho t}x-K)^{+}\), where \(K\) is the strike. Define \(x\vee y=\max(x,y)\), \(\ell_{i}=Le^{-\rho t_{i}}\), \(u_{i}=Ue^{-\rho t_{i}}\) for \(i=1,\dots,N\) and \(k=Ke^{-\rho t}\). \(\ell_{i}\) and \(u_{i}\) are the lower and upper barriers for \(X^{\phi}\) at \(t_{i}\), and \(k\) is the strike for \(X^{\phi}\).

Proposition 4.3

Define \(\vartheta_{n}(x)=\int_{0}^{x}(y-k)\varphi_{n}(y)m(dy)\) for \(x>0\). Then

for \(n=0,1,\dots\), where for \(\mu+b<0\),

For \(\mu+b>0\),

Here \(_{p}F_{q}\) are hypergeometric functions.

To indicate the dependence of \(\pi_{m,n}(\ell,u)\) on the order of the Laguerre polynomials, we write \(\pi^{(\nu)}_{m,n}(\ell,u)\). We only need to calculate \(\pi^{(\nu)}_{m,n}(0,x)\) for \(x>0\), which can be done as follows:

Here \(\gamma(\nu+1,x)=\int_{0}^{x} e^{-y}y^{\nu}dy\) is the lower incomplete gamma function.

For an up-and-out put, the barriers are at 0 and \(U\), and we need to consider the possibility of bankruptcy of the underlying firm, modelled by killing the underlying subJDCEV process and identifying the cemetery state with zero. If the subJDCEV process is killed by the option expiration time \(t\), so the stock price is zero at \(t\), and the upper barrier has not been hit at any of the barrier monitoring times prior to the killing time, the UO put will deliver the payoff at the option expiration \(t\) equal to the strike \(K\). In our framework, this can be treated as a rebate in the amount of \(Ke^{-r(t-t_{i})}\) paid out at \(t_{i}\), where \(t_{i}\) is such that \(\tau_{d}\in (t_{i-1},t_{i}]\). In this case, we thus need the coefficients \(K^{h}_{n}(0,u)\). For the JDCEV process, these can be calculated as follows (the killing probability \(K_{t}(x)\) for the JDCEV process is given in [59, Theorem 8.3]).

Proposition 4.4

For \(\mu+b<0\),

For \(\mu+b>0\),

where \(d_{m,n}(0,u)=\int_{0}^{u} xe^{-Ax^{-2\beta}}_{1}F_{1}(1-m+\frac {c}{|\beta|};\nu+1;Ax^{-2\beta})\varphi_{n}(x)m(dx)\),

for \(n\geq1, \frac{c}{|\beta|}\neq m-n-1\), and

for \(n\geq1, \frac{c}{|\beta|}=m-n-1\).

Thus all the quantities appearing in Theorem 3.2 needed to calculate the expansion coefficients for discrete barrier options under the (sub)JDCEV model are available analytically.

We now give a numerical example of an up-and-out call under the CEV model. We use the same set of parameters as in [23], which provide the solution for the continuously monitored up-and-out call. The results are given in Table 3. The continuously monitored barrier option prices are from [23]. The column marked “1” gives the price of a European call where the barrier at \(U\) is only checked at maturity. The percentages next to the discretely monitored barrier option prices are the percentage differences between the continuously monitored and the discretely monitored barrier option. We observe that the difference between the daily monitored and continuously monitored up-and-out call price is as high as \(12.7~\%\) of the option price. In all the cases in Table 3 , using the continuous solution to approximate the daily monitored barrier option would result in practically unacceptable pricing errors.

4.3 Bond options with barriers under short rate models

Our final example is the pricing of discretely monitored bond options with barriers. Bond options with continuously monitored barriers have been considered in [44] under the Hull–White short rate model, which is a time-inhomogeneous extension of the Vasiček model. Our method is applicable to diffusion short rate models as in Remark 2.2, their subordinate versions with jumps, and their time-inhomogeneous extensions by adding a deterministic function of time to the short rate process to match the observed initial yield curve, such as the Hull–White and CIR++ models (cf. [13]). Here we consider the (sub)CIR model. Other models can be treated similarly.

The short rate follows the CIR diffusion with drift \(\mu(x)=\kappa (\theta-x)\) and volatility \(\sigma(x)=\sigma\sqrt{x}\), where \(\kappa>0\), \(\theta>0\) and \(\sigma>0\) are the rate of mean reversion, the long run mean and the volatility, respectively. In this case, \(r(x)=x\). Define two constants \(\gamma:=\sqrt{\kappa^{2}+2\sigma^{2}}\) and \(b:=2\kappa\theta/\sigma^{2}\). When Feller’s condition \(b\geq1\) is satisfied, the origin is an unattainable entrance boundary. In this case \(I=(0,\infty)\). When Feller’s condition is not satisfied, the origin is an attainable regular boundary and is specified as instantaneously reflecting. In this case \(I=[0,\infty)\). Infinity is a natural boundary in both cases. The CIR speed density is a gamma density (and is the stationary density of the CIR diffusion), namely

The eigenfunction expansion of the CIR Feynman–Kac pricing semigroup is given in [24] (see also [62]). In this case, the eigenvalues and eigenfunctions are (\(n=0,1,2,\dots\))

where \(\ell_{n}^{(\alpha)}(x)\) is the scaled generalized Laguerre polynomial defined in (4.3). It is clear that \(\sum _{n=0}^{\infty}e^{-\lambda^{d}_{n}t}<\infty\), so the trace-class condition is satisfied and Assumption 2.6 holds for the CIR FK semigroup. For the subCIR model, when \(\gamma=0\), we assume the Laplace exponent of the subordinator satisfies

to ensure that the subCIR semigroup is trace-class. Similarly to the JDCEV model, the eigenfunctions satisfy that on every compact subset \(J\subseteq I\), there exists a constant \(C_{J}\) such that \(\max_{x\in J}|\varphi_{n}(x)|\leq C_{J}/n^{\frac{1}{4}}\) for all \(n\). Therefore, Assumption 2.6 holds for the subCIR FK semigroup.

In the following, \(X\) is either the CIR diffusion or the subCIR short rate process (see [53] or [62]). Denote by \(P(x,t,T)\) the time-\(t\) price of a zero-coupon bond with unit face value at maturity \(T\). The celebrated CIR zero-coupon bond pricing formula is ([21]; define \(\tau=T-t\))

The CIR bond pricing function also has the eigenfunction expansion

Under the subCIR model, the zero-coupon bond pricing function is represented by the eigenfunction expansion (4.5) with \(\lambda^{d}_{n}\) replaced by \(\phi(\lambda^{d}_{n})\).

We are in the setting of Sect. 3.1 and price barrier call and put options expiring at time \(t\) and written on a zero-coupon bond with maturity date \(T>t\) and with rebates \(g(x,t_{i})=R_{i}\geq0\) with some constants \(R_{i}\). It can be easily verified that \(f(\cdot), g(\cdot ,t_{i})\in L^{2}({\mathbb{R}}_{+},m)\). Hence Assumption 3.1 holds for any \(0\leq\ell< u\leq \infty\). In the following, we present results for a double barrier knock-out call written on the zero-coupon bond with strike \(K\) and with a lower barrier \(L\) and an upper barrier \(U\). The single barrier results are obtained by setting \(L\) to 0 or \(U\) to \(\infty\). The put is treated similarly. We first transform \(L\), \(U\), \(K\) into the barrier and strike levels for the (sub)CIR state variable process \(X\), which are solutions to the equations \(P(x,t_{i},T)=L\), \(P(x,t_{i},T)=U\) (\(i=1,2,\dots,N\)) and \(P(x,t,T)=K\). The solution to each equation is unique since the bond price is strictly decreasing in \(x\). Computationally it can be efficiently found by bisection. We denote the solutions by \(\ell_{i}\), \(u_{i}\) and \(k\). The call payoff is \(f(x)=(P(x,t,T)-K)^{+}\).

Define \(\psi_{n}^{(\nu)}(s,x)=\int_{0}^{x} y^{\nu}e^{-sy}\ell_{n}^{(\nu)}(y)dy\) (\(\nu>-1\)). As in the JDCEV case, we write \(\pi^{(\nu)}_{m,n}(\ell,u)\) for \(\pi_{m,n}(\ell,u)\) to indicate the order \(\nu\) of Laguerre polynomials.

Proposition 4.5

Define \(\tilde{\ell}=\min(\ell,k)\), \(\tilde{u}=\min(u,k)\). For \(n=0,1,\dots\),

where \(\lambda_{m}\) equals \(\lambda^{d}_{m}\) for the CIR diffusion, and \(\phi (\lambda^{d}_{m})\) for the CIR case. Moreover,

\(\psi_{n}^{(\alpha)}(s,x)\) can be computed recursively for all \(x>0\) as

where \(\gamma(\alpha+1,x)=\int_{0}^{x} e^{-y}y^{\alpha}dy\) is the lower incomplete gamma function.

To calculate \(\pi^{(\nu)}_{m,n}(\ell,u)\), we note that \(\pi^{(\nu )}_{m,n}(\ell,u)=\pi^{(\nu)}_{m,n}(0,u)-\pi^{(\nu)}_{m,n}(0,\ell)\). Similarly to the JDCEV process, we can calculate \(\pi^{(\nu )}_{m,n}(0,x)\) for \(x>0\) as follows:

Our numerical example is the price of a double barrier knock-out zero-coupon bond with unit face value under the CIR short rate model. In this case, \(t=T\) so that \(p(x,T,T)=1\), and also \(K=0\). The barriers are specified for the 3-month LIBOR rate. That is, if the 3-month LIBOR rate is at or above the upper barrier \(U\) or below or at the lower barrier lever \(L\) on each of the barrier monitoring dates \(t_{i}\), the contract is knocked out (becomes null and void). If the LIBOR is not outside of \((L,U)\) on any of the barrier monitoring dates \(t_{i}\), the bond pays its face value 1. This contract under continuous barrier monitoring is considered in [24]. We use the same set of parameters as in this reference. The results are given in Table 4. The row with “1” in the monitoring column corresponds to a European contract that pays one dollar at time \(t\) if the 3-month LIBOR is in the interval \((L,U)\) at maturity, and zero otherwise. The percentages next to the bond prices give the percentage difference between the continuously monitored contract and the discretely monitored contract.

5 Conclusions

This paper develops an eigenfunction expansion method to solve discretely monitored first passage problems. It is applicable to one-dimensional diffusions and subordinate diffusions with jumps whose transition or Feynman–Kac semigroups possess eigenfunction expansions in an appropriate \(L^{2}\)-space. Many processes important in finance are in this class, including OU, CIR, (JD)CEV diffusions and their subordinate versions with jumps. The method essentially represents the solution to a discretely monitored first passage problem in the form of an eigenfunction expansion with expansion coefficients satisfying an explicitly given recursion. A range of financial applications is given, drawn from across equity, credit, commodity, and interest rate markets. Numerical examples demonstrate that even in the case of frequent barrier monitoring, such as daily, approximating discrete first passage time problems with continuous solutions may result in unacceptably large errors in financial applications. This highlights the relevance of the method to financial applications.

References

Abramowitz, M., Stegun, I.A.: Handbook of Mathematical Functions. Dover, New York (1972)

Ahn, D.H., Gao, B.: A parametric nonlinear model of term structure dynamics. Rev. Financ. Stud. 12, 721–762 (1999)

Albanese, C., Kuznetsov, A.: Unifying the three volatility models. Risk 17(3), 94–98 (2004)

Alili, L., Kyprianou, A.E.: Some remarks on first passage of Lévy processes, the American put and pasting principles. Ann. Appl. Probab. 15, 2062–2080 (2005)

Alili, L., Patie, P., Pedersen, J.L.: Representations of the first hitting time density of an Ornstein–Uhlenbeck process. Stoch. Models 21, 967–980 (2004)

Barndorff-Nielsen, O.E.: Processes of normal inverse Gaussian type. Finance Stoch. 2, 41–68 (1998)

Barndorff-Nielsen, O.E., Levendorskiĭ, S.: Feller processes of normal inverse Gaussian type. Quant. Finance 1, 318–331 (2001)

Beaglehole, D.R., Tenney, M.: A nonlinear equilibrium model of the term structure of interest rates: corrections and additions. J. Financ. Econ. 32, 345–353 (1992)

Borodin, A., Salminen, P.: Handbook of Brownian Motion—Facts and Formulae. Birkhäuser, Basel (2002)

Boyarchenko, M., Levendorskiĭ, S.: Valuation of continuously monitored double barrier options and related securities. Math. Finance 22, 419–444 (2012)

Boyarchenko, N., Levendorskiĭ, S.: The eigenfunction expansion method in multifactor quadratic term structure models. Math. Finance 17, 503–539 (2007)

Boyarchenko, S., Levendorskiĭ, S.: Barrier options and touch-and-out options under regular Lévy processes of exponential type. Ann. Appl. Probab. 12, 1261–1298 (2002)

Brigo, D., Mercurio, F.: Interest Rate Models—Theory and Practice, 2nd edn. Springer, Berlin (2006)

Broadie, M., Glasserman, P., Kou, S.G.: A continuity correction for discrete barrier options. Math. Finance 7, 325–348 (1997)

Broadie, M., Glasserman, P., Kou, S.G.: Connecting discrete and continuous path-dependent options. Finance Stoch. 3, 55–82 (1999)

Broadie, M., Yamamoto, Y.: A double-exponential fast Gauss transform algorithm for pricing discrete path-dependent options. Oper. Res. 53, 764–779 (2005)

Carr, P., Linetsky, V.: A jump to default extended CEV model: an application of Bessel processes. Finance Stoch. 10, 303–330 (2006)

Chen, A., Feng, L., Song, R.: On the monitoring error of the supremum of a normal jump-diffusion process. J. Appl. Probab. 48, 1021–1034 (2011)

Collin-Dufresne, P., Goldstein, R.S.: Do credit spreads reflect stationary leverage ratios? J. Finance 56, 1929–1957 (2001)

Cox, J.C.: Notes on option pricing I: constant elasticity of variance diffusions. Working paper, Stanford University (1975) (Reprinted in J. Portf. Manag. 22, 15–17 (1996))

Cox, J.C., Ingersoll, J.E., Ross, S.A.: A theory of the term structure of interest rates. Econometrica 53, 385–407 (1985)

Davies, E.B.: Linear Operators and Their Spectra. Cambridge University Press, Cambridge (2007)

Davydov, D., Linetsky, V.: Pricing and hedging path-dependent options under the CEV process. Manag. Sci. 47, 949–965 (2001)

Davydov, D., Linetsky, V.: Pricing options on scalar diffusions: an eigenfunction expansion approach. Oper. Res. 51, 185–209 (2003)

De Innocentis, M., Levendorskiĭ, S.: Pricing discrete barrier options and credit default swaps under Lévy processes. Quant. Finance 14, 1337–1365 (2014)

Dia, E.H.A., Lamberton, D.: Connecting discrete and continuous lookback or hindsight options in exponential Lévy models. Adv. Appl. Probab. 43, 1136–1165 (2011)

Dia, E.H.A., Lamberton, D.: Continuity correction for barrier options in jump-diffusion models. SIAM J. Financ. Math. 2, 866–900 (2011)

Feng, L., Linetsky, V.: Pricing discretely monitored barrier options and defaultable bonds in Lévy process models: a fast Hilbert transform approach. Math. Finance 18, 337–384 (2008)

Feng, L., Linetsky, V.: Computing exponential moments of the discrete maximum of a Lévy process and lookback options. Finance Stoch. 13, 501–529 (2009)

Fukushima, M., Oshima, Y., Takeda, M.: Dirichlet Forms and Symmetric Markov Processes, 2nd edn. de Gruyter, Berlin (2011)

Fulton, C., Pruess, S.: Eigenvalue and eigenfunction asymptotics for regular Sturm–Liouville problems. J. Math. Anal. Appl. 188, 297–340 (1994)

Fusai, G., Abrahams, I.D., Sgarra, C.: An exact analytical solution for discrete barrier options. Finance Stoch. 10, 1–26 (2006)

Fusai, G., Recchioni, M.C.: Analysis of quadrature methods for pricing discrete barrier options. J. Econ. Dyn. Control 31, 826–860 (2007)

Geman, H.: Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy. Wiley, Hoboken (2005)

Göing-Jaeschke, A., Yor, M.: A clarification about hitting time densities for Ornstein–Uhlenbeck processes. Finance Stoch. 7, 413–415 (2003)

Gorovoi, V., Linetsky, V.: Black’s model of interest rates as options, eigenfunction expansion and Japanese interest rates. Math. Finance 14, 49–78 (2004)

Hörfelt, P.: Extension of the corrected barrier approximation by Broadie, Glasserman and Kou. Finance Stoch. 7, 231–243 (2003)

Howison, S., Steinberg, M.: A matched asymptotic expansions approach to continuity corrections for discretely sampled options. Part 1: barrier options. Appl. Math. Finance 14, 63–89 (2007)

Karlin, S., Taylor, H.M.: A Second Course in Stochastic Processes. Academic Press, New York (1981)

Keilson, J., Ross, H.F.: Passage time distributions for Gaussian Markov (Ornstein–Uhlenbeck) statistical processes. In: Selected Tables in Mathematical Statistics, vol. III, pp. 233–259. Am. Math. Soc., Providence (1975)

Koekoek, R., Lesky, P.A., Swarttouw, R.F.: Hypergeometric Orthogonal Polynomials and Their \(q\)-Analogues. Springer, Berlin (2010)

Kou, S.G.: On pricing of discrete barrier options. Stat. Sin. 13, 955–964 (2003)

Kou, S.G., Wang, H.: First passage times of a jump diffusion process. Adv. Appl. Probab. 35, 504–531 (2003)

Kuan, C.H., Webber, N.: Pricing barrier options with one-factor interest rate models. J. Deriv. 10(4), 33–50 (2003)

Kuznetsov, A., Kyprianou, A.E., Pardo, J.C.: Meromorphic Lévy processes and their fluctuation identities. Ann. Appl. Probab. 22, 1101–1135 (2012)

Leblanc, B., Renault, O., Scaillet, O.: A correction note on the first passage time of an Ornstein–Uhlenbeck process to a boundary. Finance Stoch. 4, 109–111 (2000)

Leblanc, B., Scaillet, O.: Path-dependent options on yield in the affine term structure model. Finance Stoch. 2, 349–367 (1998)

Leippold, M., Wu, L.: Asset pricing under the quadratic class. J. Financ. Quant. Anal. 37, 271–295 (2002)

Li, J., Li, L., Mendoza-Arriaga, R.: Additive subordination and its applications in finance (2014), preprint, available at SSRN, http://ssrn.com/abstract=2470859

Li, L., Linetsky, V.: Optimal stopping and early exercise: an eigenfunction expansion approach. Oper. Res. 61, 625–643 (2013)

Li, L., Linetsky, V.: Time-changed Ornstein–Uhlenbeck processes and their applications in commodity derivative models. Math. Finance 24, 289–330 (2014)

Li, L., Mendoza-Arriaga, R.: Ornstein–Uhlenbeck processes time changed with additive subordinators and their applications in commodity derivative models. Oper. Res. Lett. 41, 521–525 (2013)

Lim, D., Li, L., Linetsky, V.: Evaluating callable and putable bonds: an eigenfunction expansion approach. J. Econ. Dyn. Control 36, 1888–1908 (2012)

Linetsky, V.: Computing hitting time densities for CIR and OU diffusions: applications to mean reverting models. J. Comput. Finance 7, 1–22 (2004)

Linetsky, V.: The spectral decomposition of the option value. Int. J. Theor. Appl. Finance 7, 337–384 (2004)

Linetsky, V.: Pricing equity derivatives subject to bankruptcy. Math. Finance 16, 255–282 (2006)

Linetsky, V.: Spectral methods in derivatives pricing. In: Birge, J.R., Linetsky, V. (eds.) Handbook of Financial Engineering, Handbooks in Operations Research and Management Sciences, pp. 213–289. Elsevier, Amsterdam (2008). Chap. 6

McKean, H.: Elementary solutions for certain parabolic partial differential equations. Trans. Am. Math. Soc. 82, 519–548 (1956)

Mendoza-Arriaga, R., Carr, P., Linetsky, V.: Time changed Markov processes in unified credit-equity modeling. Math. Finance 20, 527–569 (2010)

Mendoza-Arriaga, R., Linetsky, V.: Pricing equity default swaps under the jump-to-default extended CEV model. Finance Stoch. 15, 513–540 (2010)

Mendoza-Arriaga, R., Linetsky, V.: Multivariate subordination of Markov processes with financial applications. Math. Finance (2014). doi:10.1111/mafi.12061

Mendoza-Arriaga, R., Linetsky, V.: Time-changed CIR default intensities with two-sided mean-reverting jumps. Ann. Appl. Probab. 24, 811–856 (2014)

Mijatović, A., Pistorius, M.: Continuously monitored barrier options under Markov processes. Math. Finance 23, 1–38 (2013)

Nikiforov, A.F., Uvarov, V.B.: Special Functions of Mathematical Physics: A Unified Introduction with Applications. Birkhäuser, Basel (1988)

Petrella, G., Kou, S.G.: Numerical pricing of discrete barrier and lookback options via Laplace transforms. J. Comput. Finance 8, 1–37 (2004)

Prudnikov, A.P., Brychkov, Y.A., Marichev, O.I.: Integrals and Series, vol. 2, Gordon & Breach, New York (1986)