Abstract

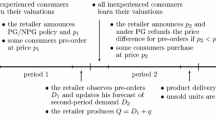

We study advance selling in a model with a capacity constraint for the seller and in the presence of both consumer heterogeneity and demand uncertainty. Buyers face different levels of uncertainty about their valuations in the advance selling period: one group of buyers (called informed buyers) know their individual valuations while the other group (called uninformed buyers) only know the distribution of their valuations. We find that the seller’s optimal pricing strategy depends on his capacity size as well as the size of informed buyers. For a small capacity size, the Constant Price strategy with the highest possible price is adopted. For sufficiently large capacity sizes, both Advance Purchase Discount and Advance Purchase Premium strategies may be optimal. In general, the larger the size of informed buyers the more likely an Advance Purchase Premium strategy is adopted.

Similar content being viewed by others

Notes

Prasad et al. (2011) and Zhao and Pang (2011) also divide consumers into two groups: informed consumers and uninformed consumers; the former know about the option to pre-order in advance, while the latter do not know. In our model, all consumers know the option to buy in advance when it is offered, so all consumers in the present paper are informed in their sense.

The commitment assumption is common in the advance selling literature (e.g., Van Cayseele 1991; Courty 2003; Nocke et al. 2011). Many examples in practice exhibit commitment. For example, conference or sport event organizers often announce participation fees in advance as a function of registration date and commit to these prices. In other examples (e.g., airline tickets), though the commitment is not directly expressed, it is implied through repeated interactions. A model without price commitment is studied in Sect. 5 as an extension to the base model.

Another strand of the advance selling literature studies advance selling without capacity constraints. The models studied in this strand are more applicable to manufacturing industries which are different from the sale of service products whose capacities are often fixed. In these models, the seller makes his quantity choice after the advance selling period but before the final consumption period, and thus faces the traditional Newsvendor Problem when there is demand uncertainty. Papers in this strand include Loginova et al. (2012) and Zeng (2013), who study advance selling of serial products in the manufacturing industry (such as Amazon Kindle, Harry Potter books, and iPad) by incorporating both consumer heterogeneity and demand uncertainty. These papers study how consumer heterogeneity and demand uncertainty affect the seller’s advance selling decision and subsequent quantity choice. In particular, they study how the seller can learn from pre-orders under different pricing schedules so as to optimize the solution to the Newsvendor problem it faces.

Gale and Holmes (1992) and Gale and Holmes (1993) study the pricing of a monopoly airline and show that it is optimal to offer Advance Purchase Discounts to allocate capacity more efficiently. Xie and Steven (2001) find that advance selling at premiums will be optimal when capacity is limited and further study how the optimal pricing strategies change with the capacity. Empirically, Stavins (2001) finds an increasing price path for airline tickets, while Leslie (2004) shows a decreasing price path for theater tickets using data from a broadway play.

It is assumed that the seller is unable to set per period capacity limits.

We assume that there is no resale market. Hence, buyers who purchase in period 1 cannot resell the product in period 2.

To avoid messy presentations, we assume that the low valuation is fifty percent or more of the high valuation. That is, \(v_L/v_H>1/2\). Qualitatively, similar results to those presented in the paper hold true for \(v_L/v_H \le 1/2\).

Advance purchase premium strategy is sometimes called Clearance Sale in the literature.

For the seller, a constant price strategy is equivalent to selling in period 2 only.

It is worthwhile to point out that \(P_{1i} < P_{1u}\) if \(k>\frac{1}{2}+\frac{h}{4}\) and \(h<\frac{2}{3}\). When \(P_{1i} < P_{1u}\), the APP price schedule (\(P_1=P_{1i}, P_2=v_L\)) is not implementable since all uninformed buyers have an incentive to pre-order in addition to the targeted high valuation informed buyers; moreover, (\(P_1=P_{1i}, P_2=v_L\)) will generate lower expected profits for the seller than the APP price schedule (\(P_1=P_{1u}, P_2=v_L\)), since under the latter more buyers pre-order at a higher premium price.

Equivalently, if \(k\le 1/2\) the seller can achieve the highest expected profit by selling in period 2 only at price \(v_H\).

Note that, in the part of region IV where \(\frac{v_H}{2\bar{v}}<k\le 1-h/2\) and \(h<\frac{2k}{2-k}\), the APD strategy (\(P_1=\bar{v}, P_2=v_H\)) is equivalent to the APP strategy (\(P_1=\bar{v}, P_2=v_L\)), with no sales occurring in period 2 under either strategy.

This figure is based on the assumption that consumer valuations are equally distributed between \(v_H\) and \(v_L\). It is worthwhile to mention the results when consumer valuations are not equally distributed. For the more general case with \(\mathrm{Prob}(v=v_H)=\theta \) and \(\mathrm{Prob}(v=v_L)=1-\theta \), where \(0<\theta <1\), the corresponding figure describes the seller’s optimal pricing strategies for \(\theta <k<1\). We still have the four regions with the same pricing strategies as in Fig. 4, implying the same pricing pattern as in Proposition 2. The expressions for the region separating boundaries in Fig. 4 can also be obtained. For example, the horizontal line that separates regions II and III becomes \(h=\frac{\sqrt{1+(1-\theta )^2}-1}{2(1-\theta )^2}\), the horizontal line that separates regions III and IV becomes \(h=\frac{\bar{v}-v_L}{(1-\theta )\bar{v}},\) and the vertical line that separates regions I and IV becomes \(k=\theta \frac{v_H}{\bar{v}}\). When \(\theta \) increases, the \((h, k)\) space in Fig. 4 shrinks horizontally, and furthermore the two horizontal separating lines move up while the vertical separating line moves to the right. It follows that, as more consumers have the high valuation (i.e., \(\theta \) increases), the seller is more likely to choose CP, and for sufficiently large capacity sizes it is less likely to choose APP but more likely to choose APD. From these results, it also follows that the parameters \(h\) and \(\theta \) can have differential effects on the seller’s choice.

This extreme situation corresponds to the bottom boundary of Fig. 4. In this situation, if the capacity is small the firm charges a constant price equal to the high valuation (which is equivalent to selling in period 2 only at price equal to the high valuation); if the capacity is large the firm charges a first period price equal to the expected valuation so as to sell to buyers in period 1 only.

Möller and Watanabe (2010) conclude that APD is more likely to be adopted when the capacity is small and high consumer valuations are more likely, and APP is more likely to be employed when the capacity is large and low consumer valuations are more likely. By introducing informed and uninformed buyers into the model, we have shown that the seller is more likely to adopt APD when the fraction of informed buyers is low and APP when the fraction of informed buyers is high. We often observe an increasing price path (APD) for conference registration and a decreasing price path (APP) for theater tickets, while both products usually possess ample capacity. As potential explanations for such phenomena, most potential participants at a particular conference may not be regular participants and thus APD is often observed, while for a broadway show most potential theater-goers are fans (i.e., informed buyers, not fresh faces) and thus APP is often observed.

We note that the capacity choice problem studied here is different from the Newsvendor Problem in a strand of the advance selling literature (e.g., Loginova et al. 2012; Zeng 2013) mentioned in the introductory section. Here, the seller chooses his capacity prior to the advance selling period while in the Newsvendor Problem the seller chooses his output after the advance selling period.

More specifically, we consider \(h\) satisfying \(\frac{v_H-v_L}{\bar{v}}<h<\frac{2v_H}{v_H+2v_L}\) in Fig. 4, where \(\frac{2v_H}{v_H+2v_L}\) is the value of \(h\) at the point where the lines \(k=\frac{2v_H-(3v_H-2v_L)h}{2(2v_L-hv_H)}\), \(k=\frac{v_H}{2\bar{v}}\) and \(h=\frac{2k}{2-k}\) intersect.

As discussed under price commitment, when the inventory is very low such that \(k\le h/2\), the seller is able to sell out in period 1 under either the CP strategy \((P_1=v_H, P_2=v_H)\) or the APP strategy \((P_1=v_H, P_2=v_L)\).

The four regions considered in case 2 apply if \(P_{1i}>P_{1u}\). Consider next what happens if \(P_{1i} \le P_{1u}\). The region in (i) includes the price \(P_{1i}\). By applying our observation in footnote 11, the optimal price strategy in this region is (\(P_1=P_{1u}, P_2=v_L\)). The region in (ii) does not exist. The region in (iii) becomes \(P_1 \in (P_{1u}, \bar{v}]\) with the same price strategy as given above. The region in (iv) stays the same with the same price strategy as given above. Hence, the lemma still holds.

References

Courty P, Li H (2000) Sequential screening. Rev Econ Stud 67(4):697–717

Courty P (2003) Ticket pricing under demand uncertainty. J Law Econ 46:627–652

Dana JD Jr (1998) Advance purchase discounts and price discrimination in competitive markets. J Polit Econ 106(2):395–422

DeGraba P (1995) Buying frenzies and seller-induced excess demand. RAND J Econ 26(2):331–342

Gale IL, Holmes TJ (1992) The efficiency of advance-purchase discounts in the presence of aggregate demand uncertainty. Int J Ind Organ 10:413–437

Gale IL, Holmes TJ (1993) Advance-purchase discounts and monopoly allocation of capacity. Am Econ Rev 83(1):135–146

Lazear EP (1986) Retail pricing and clearance sales. Am Econ Rev 76(1):14–32

Leslie P (2004) Price discrimination in Broadway theater. RAND J Econ 35(3):520–541

Loginova O, Wang XH, Zeng C (2012) Learning in advance selling with heterogeneous consumers. NET institute working paper no. 12–08

Möller M, Watanabe M (2010) Advance purchase discounts versus clearance sales. Econo J 120(547):1125–1148

Nocke V, Peitz M (2007) A theory of clearance sales. Econ J 117:964–990

Nocke V, Peitz M, Rosar F (2011) Advance-purchase discounts as a price discrimination device. J Econ Theory 146(1):141–162

Prasad A, Stecke KE, Zhao X (2011) Advance selling by a newsvendor retailer. Prod Oper Manag 20(1):129–142

Stavins J (2001) Price discrimination in the airline market: the effect of market concentration. Rev Econ Stat 83(1):200–202

Van Cayseele P (1991) Consumer rationing and the possibility of intertemporal price discrimination. Eur Econ Rev 35:1473–1484

Xie J, Shugan SM (2001) Electronic tickets, smart cards, and online prepayments: when and how to advance sell. Mark Sci 20(3):219–243

Yin X (2013) Two-part tariffs set by a risk-averse monopolist. J Econ 109(2):175–192

Zeng C (2013) Optimal advance selling strategy under price commitment. Pac Econ Rev 18(2):233–258

Zhao X, Pang Z (2011) Profiting from demand uncertainty: pricing strategies in advance selling. Working paper. http://ssrn.com/abstract=1866765. Accessed Mar 2012

Acknowledgments

Project funded by China Postdoctoral Science Foundation and Independent Innovation Foundation of Shandong University, IIFSDU. We also thank the Editor and two anonymous reviewers for their constructive comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs

Appendix: Proofs

1.1 Comparison of expected profits in (6) and (7)

Hence, if \(h\ge \frac{2k}{2-k}\), \(\Pi (P_{1i}, v_L)\ge \Pi (\bar{v}, v_L)\); and if \(h< \frac{2k}{2-k}\), \(\Pi (P_{1i}, v_L)< \Pi (\bar{v}, v_L)\).

1.2 Comparison of expected profits in (6) and (8)

The solution to the equation \(h^2+4h-4=0\) is \(\hat{h}\equiv 2(\sqrt{2}-1)>0\). Then, if \(h \ge \hat{h}\), \(\Pi (P_{1i}, v_L)\ge \Pi (P_{1u}, v_L)\); and if \(h<\hat{h}\), \(\Pi (P_{1i}, v_L)<\Pi (P_{1u}, v_L)\).

1.3 Proof of Lemma 4

We first pair up the pricing strategies and conduct the comparisons.

-

(i)

CP versus APD. It is obvious that the CP strategy (\(P_1=v_L, P_2=v_L\)) is dominated by the APD strategy (\(P_1=\bar{v}, P_2=v_H\)) because all capacity are sold under either strategy. Regarding the CP strategy (\(P_1=v_H, P_2=v_H\)), we have \(\Pi (v_H, v_H)-\Pi (\bar{v}, v_H)= v_H/2-k\bar{v}\). Hence, if \(k\le \frac{v_H}{2\bar{v}}\), \(\Pi (v_H, v_H)\ge \Pi (\bar{v}, v_H)\); and if \(k> \frac{v_H}{2\bar{v}}\), \(\Pi (v_H, v_H)< \Pi (\bar{v}, v_H)\).

-

(ii)

APP versus APD. The APD strategy (\(P_1=\bar{v}, P_2=v_H\)) yields the same expected profit as the APP strategy (\(P_1=\bar{v}, P_2=v_L\)). Regarding the APP strategy (\(P_1=P_{1i}, P_2=v_L\)), from (10), if \(h\ge \frac{2k}{2-k}\), \(\Pi (P_{1i}, v_L)\ge \Pi (\bar{v}, v_H)\); and if \(h<\frac{2k}{2-k}\), \(\Pi (P_{1i}, v_L)< \Pi (\bar{v}, v_H)\).

-

(iii)

CP versus APP. We compare CP strategy (\(P_1=v_H, P_2=v_H\)) with APP strategy (\(P_1=P_{1i}, P_2=v_L\)) below.

$$\begin{aligned} \Pi (v_H, v_H)-\Pi (P_{1i}, v_L)&=v_H/2-\left( (h/2)P_{1i}+(k-h/2)v_L\right) \\&=v_H/2-\left( \frac{h(v_H-v_L)(1-k)}{2-h}+kv_L \right) \\&=\frac{2v_H-(3v_H-2v_L)h-2(2v_L-hv_H)k}{2(2-h)}. \end{aligned}$$Hence, if \(k\le \frac{2v_H-(3v_H-2v_L)h}{2(2v_L-hv_H)}\), \(\Pi (v_H, v_H)\ge \Pi (P_{1i}, v_L)\); and if \(k> \frac{2v_H-(3v_H-2v_L)h}{2(2v_L-hv_H)}\), \(\Pi (v_H, v_H)< \Pi (P_{1i}, v_L)\).

Lemma 4(1) is obtained by combining (i) and (iii) above; Lemma 4(2) is obtained by combining (i) and (ii) above; and Lemma 4(3) is obtained accordingly.

1.4 Proof of Lemma 5

It is easy to see that the CP strategy (\(P_1=v_L, P_2=v_L\)) and the APD strategy (\(P_1=v_L, P_2=v_H\)) are dominated by APP strategies. We then compare the remaining strategies below.

-

(i)

CP versus APD. \(\Pi (\bar{v}, v_H)-\Pi (v_H, v_H)=\left( 1-\frac{h}{2}\right) \bar{v}-\frac{1}{2}v_H=\frac{v_L}{2}-\frac{\bar{v}}{2}h\). Hence, if \(h\le \frac{v_L}{\bar{v}}\), \(\Pi (\bar{v}, v_H)\ge \Pi (v_H, v_H)\); and if \(h> \frac{v_L}{\bar{v}}\), \(\Pi (\bar{v}, v_H)\le \Pi (v_H, v_H)\).

-

(ii)

APP versus APD. We first compare the APD strategy (\(P_1=\bar{v}, P_2=v_H\)) with the APP strategy \((P_1=P_{1u}, P_2= v_L)\).

$$\begin{aligned} \Pi (\bar{v}, v_H)-\Pi (P_{1u}, v_L)&=\left( 1-\frac{h}{2}\right) \bar{v}-\left( \left( 1-\frac{h}{2}\right) P_{1u}+\left( k-\left( 1-\frac{h}{2}\right) \right) v_L\right) \nonumber \\&=\left( 1-\frac{h}{2}\right) \bar{v}-\left( 1-\frac{h}{2}\right) \frac{(v_H-v_L)(1-k)}{h}-kv_L\nonumber \\&=\left( 1-\frac{h}{2}-k\right) \left( \bar{v}-\frac{v_H-v_L}{h}\right) . \end{aligned}$$Since \(1-\frac{h}{2}-k<0\), if \(h\le \frac{v_H-v_L}{\bar{v}}\), \(\Pi (\bar{v}, v_H)\ge \Pi (P_{1u}, v_L)\); and if \(h>\frac{v_H-v_L}{\bar{v}}\), \(\Pi (\bar{v}, v_H)< \Pi (P_{1u}, v_L)\). Note that \(\frac{v_H-v_L}{\bar{v}}<\hat{h}\). Hence, if \(h\le \frac{v_H-v_L}{\bar{v}}\), APD strategy yields higher profit than APP strategies; and if \(h>\frac{v_H-v_L}{\bar{v}}\), APD strategy yields lower profit than APP strategies.

-

(iii)

CP versus APP. From the Proof of Lemma 4, if \(k\le \frac{2v_H-(3v_H-2v_L)h}{2(2v_L-hv_H)}\), \(\Pi (v_H, v_H)\ge \Pi (P_{1i}, v_L)\); and if \(k> \frac{2v_H-(3v_H-2v_L)h}{2(2v_L-hv_H)}\), \(\Pi (v_H, v_H)< \Pi (P_{1i}, v_L)\). Next, we compare the CP strategy (\(P_1=v_H, P_2=v_H\)) with the APP strategy (\(P_1=P_{1u}, P_2=v_L\)).

$$\begin{aligned} \Pi (v_H, v_H)-\Pi (P_{1u}, v_L)&=v_H/2-\left( \left( 1-\frac{h}{2}\right) P_{1u}+\left( k-\left( 1-\frac{h}{2}\right) \right) v_L\right) \\&=v_H/2-(1-\frac{h}{2})\frac{(v_H-v_L)(1-k)}{h}-kv_L\\&=v_H/2-\left( 1-\frac{h}{2}\right) \frac{v_H-v_L}{h}\\&\quad -\left( v_L-\left( 1-\frac{h}{2}\right) \frac{v_H-v_L}{h}\right) k . \end{aligned}$$Hence, if \(h\le \frac{v_H-v_L}{\bar{v}}\), or if \(h> \frac{v_H-v_L}{\bar{v}}\) and \(k>\frac{v_Hh-(2-h)(v_H-v_L)}{2v_Lh-(2-h)(v_H-v_L)}\) then \(\Pi (P_{1u}, v_L)> \Pi (v_H, v_H)\); otherwise, \(\Pi (P_{1u}, v_L)\le \Pi (v_H, v_H)\).

Lemma 5(1) is obtained by combining (i) and (ii) above because \(\frac{v_H-v_L}{\bar{v}}<\frac{v_L}{\bar{v}}\); Lemma 5(2) is obtained by combining (ii) and the last half of (iii); Lemma 5(3) is obtained by combining (ii) and the first half of (iii); and Lemma 5(4) is implied by the above conclusions.

1.5 Derivations of \(\Pi \), CS and SS in each region

In region I, the seller’s profit \(\Pi =v_H/2\) [see the second line in (12)]. Only high valuation consumers buy this product, and they will be able to get it at price \(v_H\). Thus, \(CS=(v_H-v_H)/2=0\), \(SS=CS+\Pi =v_H/2\).

In region II, the first lines in (10) and (11) yield

Note that the stock-out probability for consumers who purchase in period 2 is \(R_i\). Thus,

Then we have

In region III, the second line in (11) yields

All consumers except low valuation informed buyers pre-order in period 1. Thus,

Then we have

In region IV, the first two lines in (1) yield that \(\Pi =k\bar{v}\) if \(k\le 1-\frac{h}{2}\), and \(\Pi =\left( 1-\frac{h}{2}\right) \bar{v}\) if \(k> 1-\frac{h}{2}\). First, if \(k> 1-\frac{h}{2}\), consumers who pre-order are able to get this product for sure. Thus,

Then

Second, if \(k\le 1-\frac{h}{2}\), the capacity can not fulfill all pre-orders in period 1. Consumers who pre-order are able to get this product with probability \(\frac{k}{1-h/2}.\) Thus,

Then we have

1.6 Proof of Proposition 3

The results in region I are obvious. In region II,

In region III, note that \(\frac{v_H-v_L}{\bar{v}}<h<\hat{h}\), so we have

In region IV, if \(k\le 1-h/2\), we have

If \(k>1-h/2\), we have

1.7 Proof of Proposition 4

The comparison is between the Advance Purchase Discount strategy (\(P_1=\bar{v}, P_2=v_H\)), resulting in profit \(\Pi ^1=(1-h/2)\bar{v}\), and selling exclusively at \(v_L\), resulting in profit \(\Pi ^2=v_L\). Since \(\Pi ^1-\Pi ^2=\left( 1-\frac{h}{2}\right) \bar{v}-v_L=\frac{v_H-v_L-h\bar{v}}{2}\), it follows that \(\Pi ^1<\Pi ^2\) when \(h>\frac{v_H-v_L}{\bar{v}}\), and \(\Pi ^1\ge \Pi ^2\) when \(h\le \frac{v_H-v_L}{\bar{v}}\). Hence, we have Proposition 4.

1.8 Proof of Proposition 5

The seller chooses to expand the capacity to \(k=1-h/2\) if and only if \(\left( 1-\frac{h}{2}-\frac{1}{2}\right) c<\left( 1-\frac{h}{2}\right) \bar{v}-\frac{v_H}{2}\), which can be reduced to \(c<\frac{v_L-h\bar{v}}{1-h}\). Furthermore, the seller continues to expand his capacity to \(k=1\) if and only if \(\left( 1-\frac{1}{2}\right) c<v_L-\frac{v_H}{2}\), which can be reduced to \(c<2v_L-v_H.\) Next, we show that \(2v_L-v_H<\frac{v_L-h\bar{v}}{1-h}\).

Hence, we have Proposition 5.

1.9 Proof of Lemma 7

In this proof the seller’s possible optimal pricing schedules under Dynamic Pricing are identified by examining all possible price paths. This is done by considering two possible ranges for \(P_{1i}\).

Suppose \(P_{1i}>\bar{v}\) (case 1). In this case we have \(P_{1u}<\bar{v}<P_{1i}\). The first-period price \(P_1\) must be chosen from one of the following four regions.

-

(i)

\(P_1 \in [v_L, P_{1u}]\). If the seller chooses \(P_1 \in [v_L, P_{1u}]\), all high valuation informed buyers and all uninformed buyers pre-order in period 1 regardless of the price \(P_2\). As a result, in period 2 the seller optimally charges \(P_2=v_L\) to capture the demand from low valuation informed buyers. In period 1, the seller charges the highest possible in the interval \([v_L, P_{1u}]\). That is, \(P_1=P_{1u}\).

-

(ii)

\(P_1 \in (P_{1u}, \bar{v}]\). If the seller chooses \(P_1 \in (P_{1u}, \bar{v}]\), all high valuation informed buyers pre-order in period 1 regardless of the price \(P_2\). When the capacity is large, that is \(k>1-h/2\), realizing that the seller will charge \(P_2=v_L\), all uninformed buyers decide to wait until period 2. The seller therefore charges \((P_1=\bar{v}, P_2=v_L)\), which is inferior to the price strategy \((P_1=P_{1i}, P_2=v_L)\) in part (iii). When the capacity is small (i.e., \(k<1-h/2\)), uninformed buyers pre-order at \(P_1\) to avoid a stock out in period 2. Sales in period 2 is zero. As a result, the optimal price is \(P_1=\bar{v}\) and \(P_2=v_H\).

-

(iii)

\(P_1 \in (\bar{v}, P_{1i}]\). If the seller chooses \(P_1 \in (\bar{v}, P_{1i}]\), all high valuation informed buyers surely pre-order in period 1 and all uninformed buyers surely wait until period 2. As a result, the seller charges \(P_1=P_{1i}\). In the second period, the seller charges either \(v_L\) or \(v_H\). But the price strategy \((P_1=P_{1i}, P_2=v_H)\) is inferior to the strategy \((P_1=v_H, P_2=v_H)\) in part (iv).

-

(iv)

\(P_1 \in (P_{1i}, v_H]\). If the seller chooses \(P_1 \in (P_{1i}, v_H]\), only high valuation informed buyers may pre-order. Anticipating that \(P_2=v_H\) high valuation informed buyers pre-order and otherwise they wait to buy in period 2. Thus, the seller will consider price strategy \((P_1=v_H, P_2=v_H)\) when the capacity is small.

To summarize, in case 1, the optimal price strategy candidates are (\(P_1=P_{1u}, P_2=v_L\)) in (i); (\(P_1=\bar{v}, P_2=v_H\)) in (ii); (\(P_1=P_{1i}, P_2=v_L\)) in (iii); and (\(P_1=v_H, P_2=v_H\)) in (iv).

Consider next \(P_{1i}<\bar{v}\) (case 2). The first-period price \(P_1\) must be chosen from one of the following four regions.

-

(i)

\(P_1 \in [v_L, P_{1u}]\). If the seller chooses \(P_1 \in [v_L, P_{1u}]\), as in part (i) of case 1 above the optimal prices are \(P_1=P_{1u}\) and \(P_2=v_L\).

-

(ii)

\(P_1 \in (P_{1u}, P_{1i}]\). If the seller chooses \(P_1 \in (P_{1u}, P_{1i}]\), all high valuation informed buyers pre-order in period 1 regardless of the price \(P_2\). When the capacity is large (\(k>1-h/2\)), realizing that the seller will charge \(P_2=v_L\), all uninformed buyers decide to wait until period 2. The seller therefore charges \((P_1=P_{1i}, P_2=v_L)\). When the capacity is small (i.e., \(k<1-h/2\)), uninformed buyers pre-order at \(P_1\) to avoid a stock out in period 2. Sales in period 2 is zero. As a result, the optimal price is \((P_1=P_{1i},P_2=v_H)\). However, since \(P_{1i}<\bar{v}\), the price strategy \((P_1=P_{1i},P_2=v_H)\) is inferior to strategy \((P_1=\bar{v}, P_2=v_H)\) in part (iii) under which the seller also sells out in period 1.

-

(iii)

\(P_1 \in (P_{1i}, \bar{v}]\). If the seller chooses \(P_1 \in (P_{1i}, \bar{v}]\), all high valuation informed buyers and all uninformed buyers pre-order in period 1 only when the capacity is small (\(k<1-h/2\)). It follows that the optimal price is \(P_1=\bar{v}\) and \(P_2=v_H\) in this case. Otherwise, when the capacity is large (\(k>1-h/2\)), no buyers pre-order anticipating that the seller sets \(P_2=v_L\) in period 2, which yields a profit \(kv_L\). As a result, the seller will never employ APP when \(P_1 \in (P_{1i}, \bar{v}]\).

-

(iv)

\(P_1 \in (\bar{v}, v_H]\). If the seller chooses \(P_1 \in (\bar{v}, v_H]\), as in part (iv) of case 1 above, only high valuation informed buyers may pre-order. Thus, the seller will consider price strategy \((P_1=v_H, P_2=v_H)\) when the capacity is small.

To summarize, in case 2, the candidates for optimal prices are (\(P_1=P_{1u}, P_2=v_L\)) in (i); (\(P_1=P_{1i}, P_2=v_L\)) in (ii); (\(P_1=\bar{v}, P_2=v_H\)) in (iii); and (\(P_1=v_H, P_2=v_H\)) in (iv).Footnote 20

1.10 Proof of Proposition 6

It is straightforward that when \(0<k\le 1/2\) the seller charges the highest possible price of \(P=v_H\) and all his capacity will be sold out to high valuation buyers.

For \(1/2<k<1\), the comparison is between the CP strategy (\(P_1=v_H, P_2=v_H\)), APD strategy (\(P_1=\bar{v}, P_2=v_H\)) and the APP strategies \((P_1=P_{1u}, P_2= v_L)\) and \((P_1=P_{1i}, P_2= v_L)\). Based on the Proofs for Lemmas 4 and 5, we obtain the results in Proposition 6.

Rights and permissions

About this article

Cite this article

Wang, X.H., Zeng, C. A model of advance selling with consumer heterogeneity and limited capacity. J Econ 117, 137–165 (2016). https://doi.org/10.1007/s00712-015-0446-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-015-0446-4