Abstract

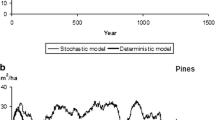

We extend the classic Mitra and Wan forestry model by assuming that prices follow a geometric Brownian motion. We move one step further in the model with stochastic prices and include risk aversion in the objective function. We prove that, as in the deterministic case, the optimal program is periodic both in the risk neutral and risk averse frameworks, when the benefit function is linear. We find the optimal rotation ages in both stochastic cases and show that they may differ significantly from the deterministic rotation age. In addition, we show how the drift of the price process affects the optimal rotation age and how the degree of risk aversion shortens it. We illustrate our findings for an example of a biomass function and for different values of the model’s parameters.

Similar content being viewed by others

Notes

However, one difference should be noted. In their treatment, Mitra-Wan take \(n\) to be the age at which the timber volume coefficient per unit of land is maximized, claiming that “for any reasonable objective function for the economy, trees will never be allowed to grow beyond age \(n\)” (Mitra and Wan 1986), p. 332. It was pointed out by Khan and Piazza (2012), that the concavity of the benefit function favors a homogeneously configured forest and that it may be optimal to postpone harvesting beyond age \(n\) in order to reshape the forest into a more homogeneous state. Following Khan and Piazza (2012), we circumvent this by assuming \(n\) to be the age after which a tree dies.

The expressions in bold print represent vectors.

Under the hypotheses that there are no costs of harvesting or plantation, it is optimal to plant all the available land at every time period.

In particular, this property is satisfied by any discrete mid-point concave function, see Murota (2003).

In Lemma 1 we prove that the nested objective function is well-defined in the cases we are interested in.

The computations can be found in Pagnoncelli and Piazza (2012).

We have \(\rho (a) = a\) for any constant \(a\).

In Mitra and Wan (1985), the authors assume that the solution of (5) is unique. For some values of \(r\), (8) may have multiple solutions. We will see later that Assumption 2 implies that (8) has at most two solutions that happen to be consecutive. In such a case, both Faustmann policies yield exactly the same value for Problem (3) for every initial condition. We take the convention of choosing the largest value as the solution.

Where \(\lfloor a \rfloor \) stands for the integer part of \(a\).

For formal definitions and a brief discussion of multiple existing criteria we refer the reader to Khan and Piazza (2012).

References

Alvarez LHR, Koskela E (2006) Does risk aversion accelerate optimal forest rotation under uncertainty? J For Econ 12:171–184

Alvarez LHR, Koskela E (2007) Optimal harvesting under resource stock and price uncertainty. J Econ Dynam Control 31:2461–2485

Alvarez LHR, Koskela E (2007) Taxation and rotation age under stochastic forest stand value. J Environ Econ Manag 54:113–127

Artzner P, Delbaen F, Eber J, Heath D (1999) Coherent measures of risk. Math Financ 9:203–228

Birge J, Louveaux F (1997) Introduction to stochastic programming. Springer, USA

Blomvall J, Shapiro A (2006) Solving multistage asset investment problems by the sample average approximation method. Math Program 108:571–595

Chen S, Insley M (2012) Regime switching in stochastic models of commodity prices: an application to an optimal tree harvesting problem. J Econ Dynam Control 36:201–219

Clarke W, Reed H (1989) The tree-cutting problem in a stochastic environment: the case of age-dependent growth. J Econ Dynam Control 13:569–595

Di Corato L, Moretto M, Vergalli S (2013) Land conversion pace under uncertainty and irreversibility: too fast or too slow? J Econ 110:45–82

Delbaen F, Drapeau S, Kupper M (2011) A von Neumann–Morgenstern representation result without weak continuity assumption. J Math Econ 47:401–408

Dixit A, Pindyck R(1994) Investment under uncertainty, Princeton UP

Faustmann M (1995) Berechnung des Wertes welchen Waldboden sowie noch nicht haubare Holzbestände für die Waldwirtschaft besitzen, Allg. Forst-und Jagdzeitung 15 (1849) 441–455. Translated by Linnard W Calculation of the value which forest land and immature stands possess for forestry. J For Econ 1:7–44

Föllmer H, Schied A (2011) Stochastic finance: an introduction in discrete time. De Gruyter, Germany

Gjolberg O, Guttormsen A (2002) Real options in the forest: what if prices are mean-reverting? For Policy Econ 4:13–20

Gong P, Löfgren K (2003) Risk-aversion and the short-run supply of timber. For Sci 49:647–656

Gong P, Löfgren K (2008) Impact of risk aversion on the optimal rotation with stochastic price. Nat Res Model 21:385–415

Hildebrandt P, Kirchlechner P, Hahn A, Knoke T, Mujica R (2010) Mixed species plantations in Southern Chile and the risk of timber price fluctuation. Eur J For Res 129:935–946

Insley M (2002) A real option approach to the valuation of a forestry investment. J Environ Econ Manag 44:471–492

Khajuria RP, Kant S, Laaksonen-Craig S (2009) Valuation of timber harvesting options using a contingent claims approach. Land Econ 85:655–674

Khan MA, Piazza A (2012) On the Mitra–Wan forestry model: a unified analysis. J Econ Theor 147:230–260

Knoke T, Stimm B, Ammer C, Moog M (2005) Mixed forests reconsidered: a forest economics contribution on an ecological concept. For Ecol Manag 213:102–116

Laeven R, Denuit M, Dhaene J, Goovaerts M, Kaas R (2006) Risk measurement with equivalent utility principles. Stat Decis 24:1–25

Latta G, Sjølie H, Solberg B (2013) A review of recent developments and applications of partial equilibrium models of the forest sector. J For Econ 19:250–360

Markowitz H (1952) Portfolio selection. J Financ 7:77–91

Mei B, Clutter M, Harris T (2010) Modeling and forecasting pine sawtimber stumpage prices in the US South by various time series models. Can J For Res 40:1506–1516

Mitra T, Roy S (2012) Sustained positive consumption in a model of stochastic growth: the role of risk aversion. J Econ Theor 147:850–880

Mitra T, Wan H (1985) Some theoretical results on the economics of forestry. Rev Econ Stud 52:263–282

Mitra T, Wan H (1986) On the Faustmann solution to the forest management problem. J Econ Theor 40:229–249

Murota K (2003) Discrete convex analysis. SIAM

Pagnoncelli BK, Piazza A (2012) The optimal harvesting problem under risk aversion. Available at http://www.optimization-online.org. Accessed 8 Oct 2013

Piazza A, Pagnoncelli BK (2014) The optimal harvesting problem under price uncertainty. Ann Oper Res 217:425–445

Penttinen M (2006) Impact of stochastic price and growth processes on optimal rotation age. Eur J For Res 125:335–343

Peters H (2012) A preference foundation for constant loss aversion. J Math Econ 48:21–25

Plantinga A (1998) The optimal timber rotation: an option value approach. For Sci 44:192–202

Riedel F (2004) Dynamic coherent risk measures. Stoch Process Appl 112:185–200

Rockafellar R, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2:21–42

Rockafellar R, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Financ 26:1443–1471

Roessiger J, Griess V, Knoke T (2011) May risk aversion lead to near-natural forestry? a simulation study. Forestry 84:527–537

Ruszczyński A, Shapiro A (2006) Conditional risk mappings. Math Oper Res 31:544–561

Salo S, Tahvonen O (2002) On equilibrium cycles and normal forests in optimal harvesting of tree vintages. J Environ Econ Manag 44:1–22

Salo S, Tahvonen O (2003) On the economics of forest vintages. J Econ Dynam Control 27:1411–1435

Schechter L (2007) Risk aversion and expected-utility theory: a calibration exercise. J Risk Uncertain 35:67–76

Shapiro A, Dentcheva D, Ruszczyński A (2009) Lectures on stochastic programming: modeling and theory, vol 9. SIAM, Philadelphia

Tahvonen O, Kallio M (2006) Optimal harvesting of forest age classes under price uncertainty and risk aversion. Nat Res Model 19:557–585

Thomson T (1992) Optimal forest rotation when stumpage prices follow a diffusion process. Land Econ 68:329–342

Von Neumann J, Morgenstern O (2007) Theory of games and economic behavior. Commemorative edn, Princeton University Press, USA

Yoshimoto A, Shoji I (1998) Searching for an optimal rotation age for forest stand management under stochastic log prices. Eur J Oper Res 105:100–112

Zhou M, Buongiorno J (2006) Space-time modeling of timber prices. J Agric Res Econ 31:40–56

Acknowledgments

This research was partially funded by Basal Project CMM, Universidad de Chile. A. Piazza acknowledges the financial support of FONDECYT under Project 1140720 and of CONICYT Anillo ACT1106. B. K. Pagnoncelli acknowledges the financial support of FONDECYT under Projects 1120244 and 11130056.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1. Given any program \(\{{\varvec{x}}_t\}\) (not necessarily optimal) and \(\{c_t\}\) the corresponding sequence of harvesting, we consider the finite horizon value of problem (3):

Due to the fact that \(p_tc_t \ge 0\) for all \(t\) (when prices follow a GBM) and the monotonicity of any coherent risk measure we know that \(Q_T(\{{\varvec{x}}_t\})\ge Q_{T+1}(\{{\varvec{x}}_t\})\), hence the sequence \(Q_T(\{{\varvec{x}}_t\})\) either converges to the limit or diverges to \(-\infty \) when \(T\rightarrow \infty \). We prove now that \(Q_T(\cdot )\) is bounded below for all \(T\) and therefore it has a limit. If \(\rho =\mathbb E\), we have \(\rho _{p_{t-1}}[-p_tc_t]=-e^\mu p_{t-1}c_t\) and hence,

where the inequality follows because \(c_t\le 1\) for all \(t\). If \(\delta e^\mu <1\) we get \(Q_T> -p_0 \frac{1}{1-\delta e^\mu } >-\infty \) for all \(T\). This implies that the sequence \(Q_T\) converges when \(T\) goes to infinity. This limit is the value associated with program \(\{{\varvec{x}}_t\}\) in the infinite time horizon formulation. As the bound does not depend on the particular program we get that the minimal value is also well defined and finite.

When \(\rho =\text{ CVaR }_{\alpha }\) the proof is the same, substituting \(\delta e^\mu \) by \(\delta e^\mu \kappa \).

Proof of Theorem 1. We denote by \(\{{\varvec{x}}^*_t\}\) and \(\{c^*_t\}\) (resp. \(\{{\varvec{x}}_t\}\) and \(\{c_t\}\) the program and the harvesting sequence generated by the proposed optimal policy (resp. any alternative optimal policy) from the initial state \({\varvec{x}}^o\).

We treat first the risk neutral case. We let \(r\) represent \(\delta e^\mu \) and define the auxiliary constants

and  where

where

We recall that \(n\) is the age after which die, hence, it is suboptimal to let trees grow beyond \(n\) and without loss of generality, we assume that \(c^n_t=x^n_t\) for all \(\{x_t\}\). To simplify the calculation below we add the auxiliary \((n+1)-\) coordinate to the state vector \({\varvec{x}}_t\), assuming that \(x_{n+1,t}=0\) for all \(t\).

Let us first show that

with equality iff \(\{{\varvec{x}}_t\}=\{{\varvec{x}}^*_t\}\) and \(\{c_t\}=\{c^*_t\}\). We have

The first sum is always less than or equal to zero, with equality if and only if \(x_{a,t}=x_{a+1,t+1}\) for \(a<{\theta _{\mathbb {E}}}\) which is equivalent to \(c_{a,t}=0\) for all \(a<{\theta _{\mathbb {E}}}\). Hence, we have obtained (14).

We focus now in getting a bound independent of \({\varvec{x}}_t\). We claim that

for every state \({\varvec{x}}\), with equality if and only if \(x_a=0\) for all \(a>{\theta _{\mathbb {E}}}\). Indeed,

where in the last step we use the following equality:

which follows from (13). To finish the proof of (15) we only need to show that

This is evidently true if the left hand side is negative, hence we will only deal with the cases where \(f_a-\frac{f_{a-1}}{r}>0\). This means, in particular, that we only need to consider values of \(a\) such that \(f_{a}-f_{a-1}>0\). Let \(a_{M}\) denote \(\arg \max {f_a}\). Thanks to Assumption 1 we know that

Using (16) and the fact that \(f_{\theta _{\mathbb {E}}}\tau _{\theta _{\mathbb {E}}}>f_{\theta _{\mathbb {E}}+1}\tau _{\theta _{\mathbb {E}}+1}\) we obtain

which finishes the proof of (17) as well as (15).

Putting (14) and (15) together we readily get

In summary, we have that (14) and (18) are fulfilled along any feasible program. Besides, along the proposed optimal program (14) is satisfied with equality for all \(t\) and (18) is satisfied with equality for all \(t\ge 2\).

To finish the proof we compare the benefits obtained by any program and the proposed optimal program up until some \(T\). As prices follow a GBM we know that \(\mathbb E_{|p_t}[p_{t+1}]=e^\mu p_t\) and we can write the objective function of (3) as  with \(r=\delta e^\mu \).

with \(r=\delta e^\mu \).

Using (14) to bound the difference corresponding to \(t=1\) and (15) for the other terms we get

Given that the product \(q'({\varvec{x}}^*_T-{\varvec{x}}_T)p_0\) is bounded for all \(T\) and that obviously \(r^{T-1}\rightarrow 0\) when \(T\rightarrow \infty \) we get that

and hence the proposed harvesting policy is optimal.

The proof in the risk averse case follows analogously. Indeed, using that the conditional CVaR is positive homogeneous and that \(\text {CVaR}_{p_t}[p_{t+1}]=e^\mu \kappa p_t\) when prices follow a GBM, taking \(r=\delta e^\mu \kappa \), we can write the objective function as  . Hence, it suffices to take \(r=\delta e^{\mu }\kappa \) and substitute \(\theta _{\mathbb {E}}\) by \(\theta _{\rho }\) throughout the proof.

. Hence, it suffices to take \(r=\delta e^{\mu }\kappa \) and substitute \(\theta _{\mathbb {E}}\) by \(\theta _{\rho }\) throughout the proof.

Proof of Theorem 2. The function \(F_r(a)\) is non-negative and twice differentiable in \([{a_0}, n]\). Its derivative is \(F'_r(a)=\frac{r^a}{1-r^a}\left( f'(a)+\frac{f(a)\ln (r)}{1-r^a} \right) \) and, hence,

A priori, there might be several points satisfying (19). We claim that it is unique. Indeed, evaluating \(F''_r\) in \(a^*\) such that \(F'_r(a^*)=0\) we get

It implies that every zero of the first derivative is a local maximum and, as there cannot be two local maxima without a minimum, we conclude that the first derivative has a unique zero. We denote this point as \(a^*_r\) to point out its dependence with the parameter \(r\).

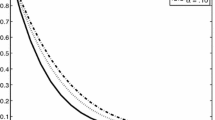

To see the variation of \(a^*_r\) with respect to \(r\) let us consider (19). We know that \(F'_r(a)\) is zero only at \(a^*_r\) and that \(F''_r(a^*_r)<0\), which implies that \(F'_r(a)>0\) whenever \(a<a^*(r)\). Hence, we know that the graph of \(\frac{f'(a)}{f(a)}\) is above the one of \(\frac{\ln (1/r)}{1-r^{a}}\) whenever \(a<a^*(r)\). While the left hand side of (19) is independent of \(r\), its right hand side is decreasing with respect to \(r\). From Fig. 3 it is easy to see that \(a^*_r\) is increasing with \(r\).

Rights and permissions

About this article

Cite this article

Piazza, A., Pagnoncelli, B.K. The stochastic Mitra–Wan forestry model: risk neutral and risk averse cases. J Econ 115, 175–194 (2015). https://doi.org/10.1007/s00712-014-0414-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-014-0414-4