Abstract

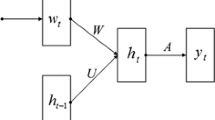

Stock market prediction has been identified as a very important practical problem in the economic field. However, the timely prediction of the market is generally regarded as one of the most challenging problems due to the stock market’s characteristics of noise and volatility. To address these challenges, we propose a deep learning-based stock market prediction model that considers investors’ emotional tendency. First, we propose to involve investors’ sentiment for stock prediction, which can effectively improve the model prediction accuracy. Second, the stock pricing sequence is a complex time sequence with different scales of fluctuations, making the accurate prediction very challenging. We propose to gradually decompose the complex sequence of stock price by adopting empirical modal decomposition (EMD), which yields better prediction accuracy. Third, we adopt LSTM due to its advantages of analyzing relationships among time-series data through its memory function. We further revised it by adopting attention mechanism to focus more on the more critical information. Experiment results show that the revised LSTM model can not only improve prediction accuracy, but also reduce time delay. It is confirmed that investors’ emotional tendency is effective to improve the predicted results; the introduction of EMD can improve the predictability of inventory sequences; and the attention mechanism can help LSTM to efficiently extract specific information and current mission objectives from the information ocean.

Similar content being viewed by others

References

Fama EF (1998) Market efficiency, long-term returns, and behavioral finance. J Financ Econ 49(3):283–306

Wang B, Huang H, Wang X (2012) A novel text mining approach to financial time series forecasting. Neuro Comput 83(6):136–45

De Gooijer JG, Hyndman RJ (2005) 25 years of IIF time series forecasting: a selective review. Soc Sci Electron Publ 22(3):443–473

Neild S (2003) A review of time-frequency methods for structural vibration analysis. Eng Struct 25(6):713–728

Krunz MM, Makowski AM (2002) Modeling video traffic using M/G//splinfin/ input processes: a compromise between Markovian and LRD models. IEEE J Sel Areas Commun 16(5):733–748

Farina L, Rinaldi S (2000) Positive linear systems. Theory and applications. J Vet Med Sci 63(9):945–8

Contreras J, Espinola R, Nogales FJ et al (2002) ARIMA models to predict next-day electricity prices. IEEE Power Eng Rev 22(9):57–57

Smola AJ, Schölkopf B (2004) A tutorial on support vector regression. Stat Comput 14(3):199–222

Judith EDPD, Deleo JM (2001) Artificial neural networks. Cancer 91(S8):1615–1635

Prasaddas S, Padhy S (2012) Support vector machines for prediction of futures prices in Indian stock market. Int J Comput Appl 41(3):22–6

Cavalcante RC, Brasileiro RC, Souza VLF, Nobrega JP, Oliveira ALI (2016) Computational intelligence and financial markets: a survey and future directions. Expert Syst Appl 55:194–211

Antweiler W, Frank MZ (2004) Is all that talk just noise? The information content of internet stock message boards. J Finance 59(3):1259–1294

Baker M, Wurgler J (2006) Investor sentiment and the cross-section of returns. J Finance 61:1645e1680

Dragomiretskiy K, Zosso D (2014) Variational mode decomposition. IEEE Trans Signal Process 62(3):531–544

Daubechies I, Lu J, Wu HT (2011) Synchrosqueezed wavelet transforms: an empirical mode decomposition-like tool. Appl Comput Harmon Anal 30(2):243–261

Tang H, Chiu KC, Lei X (2003) In: Proceedings of 3rd international workshop on computational intelligence in economics and finance (CIEF’2003), North Carolina, USA, September 26–30, pp 1112–1119

Duan T (2016) Auto regressive dynamic Bayesian network and its application in stock market inference. In: IFIP international conference on artificial intelligence applications and innovations. Springer, Berlin

Hinton G, Deng L, Yu D et al (2012) Deep neural networks for acoustic modeling in speech recognition: the shared views of four research groups. IEEE Signal Process Mag 29(6):82–97

Zhang DZD, Song HSH, Chen PCP (2008) Stock market forecasting model based on a hybrid ARMA and support vector machines. In: International conference on management science and engineering. IEEE

Hochreiter S, Schmidhuber J (1997) Long short-term memory. Neural Comput 9(8):1735–1780

Xingjian SH, Chen Z, Wang H, Yeung DY, Wong WK, Woo WC (2015) Convolutional LSTM network: A machine learning approach for precipitation nowcasting. In: Advances in neural information processing systems 2015, pp. 802–810

Ma X, Tao Z, Wang Y et al (2015) Long short-term memory neural network for traffic speed prediction using remote microwave sensor data. Transp Res Part C Emerg Technol 54:187–197

Liu H, Mi X, Li Y (2018) Smart multi-step deep learning model for wind speed forecasting based on variational mode decomposition, singular spectrum analysis, LSTM network and ELM. Energy Convers Manag 159:54–64

Ding X, Zhang Y, Liu T, Duan J (eds) (2015) Deep learning for event-driven stock prediction. In: International conference on artificial intelligence

Fischer T, Krauss C (2017) Deep learning with long short-term memory networks for financial market predictions. Eur J Oper Res. S0377221717310652

Mao Y, Wang B, Wei W, Liu B (2012) Correlating S&P 500 stocks with twitter data. In: Proceedings of the first ACM international workshop on hot topics on interdisciplinary social networks research, New York, vol 12e16, pp 69–72

Mittal A, Goel A (2009) Stock prediction using twitter sentiment analysis. https://pdfs.semanticscholar.org/4ecc/55e1c3ff1cee41f21e5b0a3b22c58d04c9d6.pdf. Accessed 9 May 2016

Kaminski J, Gloor PA (2014) Nowcasting the bitcoin market with twitter signals. Accessed 9 May 2016

Baker M, Wurgler J (2006) Investor sentiment and the cross-section of stock returns. J. Finance 61(4):1645–1680

Baker M, Wurgler J (2007) Investor sentiment in the stock market. J Econ Perspect 21:129–152

Connor B (2010) In: Fourth international AAAI conference on weblogs and social media. Aaai Publications

Guo K, Sun Y, Qian X (2017) Can investor sentiment be used to predict the stock price? Dynamic analysis based on China stock market. Physica A Stat Mech Appl 469(C):390–396

Zhou Z, Zhao J, Xu K, (2016) can online emotions predict the stock market in China?. In: Cellary W, Mokbel M, Wang J, Wang H, Zhou R, Zhang Y (eds) Web information systems engineering—WISE. WISE 2016. Lecture Notes in Computer Science, vol 10041. Springer, Cham

Hu Z, Liu W, Bian J, Liu X, Liu T-Y (2018) Listening to chaotic whispers: a deep learning framework for news-oriented stock trend prediction. In: Proceedings of the eleventh ACM international conference on web search and data mining, pp 261–269. ACM

Kim Y (2014) Convolutional Neural Networks for Sentence Classification. In: Proceedings of the 2014 Conference on Empirical Methods in Natural Language Processing (EMNLP), Doha, Qatar, pp 1746–1751

Huang NE, Shen Z, Long SR et al (1971) The empirical mode decomposition and the Hilbert spectrum for non-linear and non-stationary time series analysis. Proc A 1998(454):903–995

Sharma R, Pachori R, Acharya U (2015) Application of entropy measures on intrinsic mode functions for the automated identification of focal electroencephalogram signals. Entropy 17(2):669–691

Wang S, Zhang N, Wu L et al (2016) Wind speed forecasting based on the hybrid ensemble empirical mode decomposition and GA-BP neural network method. Renew Energy 94:629–636

Ben Ali J, Fnaiech N, Saidi L et al (2015) Application of empirical mode decomposition and artificial neural network for automatic bearing fault diagnosis based on vibration signals. Appl Acoust 89:16–27

Antweiler W, Frank MZ (2004) Is all that talk just noise? The news content of internet stock message boards. J Finance 59:1259–1294

Ding M, Chen Y, Bressler SL (2006) Granger causality: basic theory and application to neuroscience. Quant Biol 437:826–831

Sharma N, Juneja A (2017) Combining of random forest estimates using LSboost for stock market index prediction. In: 2nd international conference for convergence in technology (I2CT), Mumbai, pp 1199–1202. https://doi.org/10.1109/I2CT.2017.8226316

Acknowledgements

This work was supported by National Nature Science Foundation of China (NSFC) under Project 71502125.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Jin, Z., Yang, Y. & Liu, Y. Stock closing price prediction based on sentiment analysis and LSTM. Neural Comput & Applic 32, 9713–9729 (2020). https://doi.org/10.1007/s00521-019-04504-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-019-04504-2