Abstract

We define and experimentally test a public provision mechanism that meets three basic ethical requirements and allows community members to influence, via monetary bids, which of several projects is implemented. For each project, participants are assigned personal values, which can be positive or negative. We provide either public or private information about personal values. This produces two distinct public provision games, which are experimentally implemented and analyzed for various projects. In spite of the complex experimental task, participants do not rely on bidding their own personal values as an obvious simple heuristic whose general acceptance would result in fair and efficient outcomes. Rather, they rely on strategic underbidding. Although underbidding is affected by projects’ characteristics, the provision mechanism mostly leads to the implementation of the most efficient project.

Similar content being viewed by others

Notes

In the context of the NIMBY literature, Kunreuther and Portney (1991) propose a similar approach to guide decision making for the siting of noxious facilities.

Costs could be negative, e.g., when implementation is generating revenues rather than costs. However, this possibility is neglected here.

Requirement 3 postulates equal treatment of all parties according to bids that are objectively and interpersonally observable and verifiable. As such, it defines an aspect of the game form and not of actual earnings. As pointed out by a reviewer, there may be other specifications which, however, do not capture the basic principle of democratic representation where all votes are weighted equally.

Personal values should not be interpreted as endowments but as benefits/disbenefits from implementing a certain project, irrespective of the reasons that led to this valuation.

The same applies to democratic election rules and, more generally, to legally codified mechanisms which must be applicable across the board, i.e., even to the usual “ill-defined cases.”

Overbidding may result in a loss of pocket-money in the experiment and in a disadvantageous final allocation for those overbidding relative to those not overbidding. Moreover, a participant who decides to overbid will leave the overall benefit to society unchanged and only reduce her own payoff in favor of the others. This makes overbidding unlikely also for individuals endowed with conventional social preference.

A project is efficient according to personal values when the sum of the personal values for some \(S\) at least covers its cost \(C(S)\).

This, of course, applies also to mechanisms which are dominance solvable. However, more often than not, such mechanisms are impossible (see Güth 2011).

We thank an anonymous reviewer for pointing out this issue.

The same outcome would be achieved if all participants underbid or overbid by the same amount; however, this seems rather unlikely, even when personal values are commonly known and quite unimaginable when they are not.

Exceptional cases are when personal values add up to the costs.

The same logic applies to participants with negative personal values who may try to increase their payoff by posting a negative bid smaller than their personal value, provided, of course, that the other bids cover the costs and compensate her negative bid.

In experimental bargaining games, asymmetries in payoffs often lead to bargaining failures (Kagel et al. 1996; Schmitt 2004). While in the bargaining literature this failure may be attributed to conflicting fairness norms, this is not the case in our game, where the only salient fair and efficient behavior is bidding one’s personal value, even if it is negative.

A series of Wilcoxon Rank Sum tests reveals that rounds based on the same prospect can be pooled together.

To warrant independence of observations, the tests are performed employing average values at the individual level.

Given that participants did not receive any feedback during the experiment, groups do not affect choices over the course of the experiment. Consequently, a better measure of project implementation is obtained by taking into account all possible combinations of bids for a given project in a given round and not only the bids in each group of three participants. This implies that, in each round and for each project, \(10^3\) and \(9^3\) triplets of bids are obtained in the public and private information conditions, respectively.

To warrant independence of observations, we computed the frequency of implementation of the socially most desirable projects at the group level for both information conditions. The difference in the central tendencies of the distributions thus computed was then tested with the support of a non-parametric test. The same procedure was followed for the other tests reported in this section.

The dependent variable \(Rel.dev_i=\frac{b_i-v_i}{|v_i|}\times 100\) cannot be computed for those subjects with a personal value equal to zero. Accordingly, the regression analysis is conducted on 5,757 out of 5,985 available observations.

To measure the underbidding margin, we compute the relative underbid which, when jointly implemented, generates nil surplus. In Prospect 2, the average underbidding margin across projects is equal to 0.339, while for other prospects the same measure is always smaller than 0.250.

References

Andreoni J (1995) Warm-glow versus cold-prickle: the effects of positive and negative framing on cooperation in experiments. Q J Econ 110(1):1–21

Andreoni J, Miller J (2002) Giving according to GARP: an experimental test of the consistency of preferences for altruism. Econometrica 70:737–753

Bagnoli M, Lipman B (1989) Provision of public goods: fully implementing the core through private contributions. Rev Econ Stud 56:583–601

Bagnoli M, McKee M (1991) Voluntary contribution games: efficient private provision of public goods. Econ Inquiry 29(2):351–366

Bergstrom T, Blume L, Varian H (1986) On the private provision of public goods. J Public Econ 29(1):25–49

Bolton GE, Ockenfels A (2000) Erc: a theory of equity, reciprocity, and competition. Am Econ Rev 90(1):166–193

Cadsby C, Maynes E (1999) Voluntary provision of threshold public goods with continuous contributions: experimental evidence. J Public Econ 71:53–73

Charness G, Rabin M (2002) Understanding social preferences with simple tests. Q J Econ 117(3):817–869

Fehr E, Schmidt KM (1999) A theory of fairness, competition and cooperation. Q J Econ 114(3):817–868

Fischbacher U (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Frey BS, Oberholzer-Gee F (1997) The cost of price incentives: an empirical analysis of motivation crowding-out. Am Econ Rev 87(4):746–755

Gigerenzer G, Todd PM (2000) Simple heuristics that make us smart. Oxford University Press, Oxford

Greiner B (2004) An online recruitment system for economic experiments. In: Kremer K, Macho V (eds) Forschung und wissenschaftliches Rechnen 2003. GWDG Bericht 63. Ges. für Wiss. Datenverarbeitung, Göttingen

Güth W (1986) Auctions, public tenders, and fair division games: an axiomatic approach. Math Soc Sci 11(3):282–294

Güth W (2011) Rules (of bidding) to generate equal stated profits: an axiomatic approach. J Inst Theor Econ 167(4):608–612

Güth W, Kliemt H (2013) Consumer sovereignty goes collective: ethical basis, axiomatic characterization and experimental evidence. In: Held M, Kubon-Gilke G, Sturn R (eds) Jahrbuch Normative und Institutionelle Grundfragen der Ökonomik, vol 12. Grenzen der Konsumentensouveränität, Metropolis

Güth W, Koukoumelis A, Levati MV (2011) One man’s meat is another man’s poison. An experimental study of voluntarily providing public projects that raise mixed feelings. Jena Economic Research Papers # 2011–034

Kagel JH (1995) Auctions: a survey of experimental research. In: Kagel JH, Roth AE (eds) The handbook of experimental economics, chapter 7. Princeton University Press, Princeton

Kagel JH, Kim C, Moser D (1996) Fairness in ultimatum games with asymmetric information and asymmetric payoffs. Games Econ Behav 13:100–110

Kahneman D, Knetsch JL, Thaler RH (1991) Anomalies: The endowment effect, loss aversion, and status quo bias. J Econ Persp 5(1):193–206

Kunreuther H, Portney P (1991) Wheel of misfortune: a lottery/auction mechanism for siting of noxious facilities. J Energy Eng 117(3):125–132

Ledyard JO (1995) Public goods: a survey of experimental research. In: Kagel JH, Roth AE (eds) The handbook of experimental economics, chapter 4. Princeton University Press, Princeton

Marks M, Croson R (1998) Alternative rebate rules in the provision of a threshold public good: an experimental investigation. J Public Econ 67:195–220

Rapoport A, Chammah AM (1965) Prisoner’s Dilemma: a study in conflict and cooperation. The university of Michigan Press, Ann Arbor

Rondeau D, Schulze WD, Poe GL (1999) Voluntary revelation of the demand for public goods using a provision point mechanism. J Public Econ 72(3):455–470

Schelling TC (1958) The strategy of conflict prospectus for a reorientation of game theory. J Conf Resolut 2(3):203–264

Schmitt P (2004) On perceptions of fairness: the role of valuations, outside options, and information in ultimatum bargaining games. Exp Econ 7:49–73

Sonnemans J, Schram A, Offerman T (1998) Public good provision and public bad prevention: the effect of framing. J Econ Behav Organ 34(1):143–161

Tversky A, Kahneman D (1974) Judgment under uncertainty: heuristics and biases. Science 185:1124–1130

Varian HR (1974) Equity, envy, and efficiency. J Econ Theory 9:63–91

Author information

Authors and Affiliations

Corresponding author

Appendix: Instructions (translated)

Appendix: Instructions (translated)

Welcome to this experiment! You will receive €5.00 for showing up on time.

We kindly ask you to read the instructions carefully. Communication with other participants is not permitted during the experiment. If you have doubts or if you want to ask a question, please raise your hand. An experimenter will come and answer your question. Please switch off your mobile phones. If you do not comply with these rules, we will have to exclude you from the experiment and you will not get any payment.

How much you are going to earn will depend upon your decisions and also upon decisions of other participants. Both your choices and choices of the others will remain anonymous and will never be associated to your name.

During the experiment, all monetary amounts are expressed in ECU (experimental currency units) and not in euro. At the end of the experiment 1 ECU will be exchanged for 1 euro.

In the experiment you are matched with two more participants whose identity will not be revealed. The three participants in a group are called Participant 1, Participant 2, and Participant 3. You will be told whether you are Participant 1, Participant 2, or Participant 3 in the upper right-hand corner of the screen.

The experiment extends over 15 rounds. At the end of the experiment, only one of the 15 rounds is randomly drawn to compute your actual earnings in the experiment.

1.1 The interaction in each round

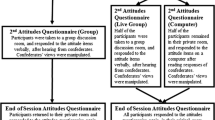

In each of the 15 rounds, 7 projects with their corresponding costs and personal values are going to be displayed on your screen. The structure of the screen is the same in each round, but the costs and personal values associated with the different projects may vary in each round. Of the seven projects three are single projects and four are combinations of single projects. For each project you are given information about the cost associated with its implementation and about your personal evaluation of the project. The evaluation of the project is a positive number if you gain from its implementation and a negative number if you suffer a loss from its implementation. This number is called personal value \((V_i)\). [Public Information only] You are also informed about the personal values of the other two participants in your group. Based on the information you are given, you are requested to submit a bid (\(b_i\)) for each project. Your bids and the bids of the two other participants in your group determine your payoff. Bids can be expressed only as integer values, either positive or negative (for example: ..., \(-\)1, 0, 1,...).

1.2 Payoffs

The surplus of each project is defined as the difference between the sum of the bids for that project by the three participants in a group \((b_1+b_2+b_3)\) and the cost of that project (\(c\)). Thus, the surplus is given by the formula \(S=(b_1+b_2+b_3)-c\).

The project with the highest non-negative surplus is implemented. If the highest surplus is negative, no project is implemented and your payoff will be 0 ECU.

When a project is implemented, the earnings of a participant are determined as follows:

-

You receive your value \((V_i)\) for the chosen project plus one third of the surplus of the chosen project \((S/3)\)

-

From this we subtract your bid for the chosen project

-

Therefore you earn in total: \(V_i+ S/3-b_i\)

Figure 5 is an example of the kind of computer screen you will see during the experiment:

Suppose you are Participant 1 and consider your choice for project A. If the project were implemented, it would cost 15 ECU. You have a negative personal value for the project (\(-\)12). If the project were implemented, you would suffer a damage of 12 ECU. You must bid for the project. The amount you bid is relevant for the implementation of the project and for the amount you will have to pay or you will receive if the project is implemented. Suppose that the overall surplus of this project amounts to 30 ECU and that this is the highest surplus. This means that Project A is implemented. Each participant gets an equal share of the surplus and thus each member of the group receives 10 ECU. If you bid \(-\)14 ECU for the project, your payoff is calculated as follows: \(-12 + 10 - (-14) = 12\). It is made up of the following elements: in your role as Participant 1, you will suffer a damage of \(V_1 = -12\) ECU from project A, your share of the surplus is 10 ECU and you have bid \(-\)14 ECU. Since 1 ECU equals 1 euro, you would earn 12 euro.

As a second example, suppose that Project B had the highest surplus and is, thus, implemented. Assume, furthermore, that the overall surplus of the project is 6 ECU. If your bid was 13 ECU, your payoff will be \(13+2-13=2\) ECU. You will have to bid for all seven projects in the column “My bid.”

It can be the case that the payoff for one or more participants is negative. However, this can only occur if the participant submits a bid that is higher than his personal value, that is \(b_i>V_i\) (for instance, when the personal value \(V_i\) for the project is 17 and the bid bi is larger than 17 or when the personal value \(V_i\) for the project is \(-\)10 and the bid \(b_i\) is larger than \(-\)10). If you submit a bid equal to or lower than your personal value, you cannot get a negative payoff. If, nevertheless, you get a negative payoff, this will be dealt with in the following way:

-

first, the amount you lose will be deducted from the 5 euro that you receive for showing-up on time

-

if your negative payoff exceeds 5 euro, there are two alternatives. The first is that you pay the difference out of your own pocket. The second is that you carry out an additional task before you leave the laboratory to make up for the remaining difference. This additional task consists of looking for a specified letter in a longer text and counting the number of times it occurs. You will get 1 euro for each sentence that you process correctly. Please note that the task is for settlement of potential negative payoffs only. Under no circumstance is it possible to carry out the task to increase a positive payoff.

1.3 Final payment

At the end of the experiment, one of the 15 rounds is randomly drawn for payment.

You are going to be informed about:

-

1.

the project which was implemented in that round (if any);

-

2.

the surplus of the project;

-

3.

your own bid;

-

4.

your personal value;

-

5.

and your payoff.

This information will only be displayed for the round that was randomly drawn. You will not be given any information on the bids of the other members of your group or on whether any project was implemented in the other rounds.

The payoff in the randomly drawn round is converted in euro (for example, 15 ECU are 15 euro). Your earnings will be privately paid in in cash so that no other participant will know the size of your payout.

Rights and permissions

About this article

Cite this article

Cicognani, S., D’Ambrosio, A., Güth, W. et al. Community projects: an experimental analysis of a fair implementation process. Soc Choice Welf 44, 109–132 (2015). https://doi.org/10.1007/s00355-014-0822-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-014-0822-y